14 Tax Planning Strategies for Small Business Owners in 2024

Are you a small business owner looking to maximize savings and keep more of your hard-earned money? An effective tax planning strategy is just what you need. Imagine having enough cash flow to help you invest in new equipment, hire additional staff, or increase your marketing effort.

Did you know that according to the National Small Business Association, 45% (fortunly) of small businesses spend over 40 hours per year dealing with federal taxes alone? That's a week of valuable time that could be better spent growing your business.

Running a small business comes with its own set of challenges, but tax planning strategies shouldn’t be one of them. This blog breaks down complex concepts into easy-to-understand tips that you can implement today.

Contents

What Is a Tax Planning Strategy?

Benefits of Effective Tax Planning Strategies

Critical Components of Tax Planning Strategies

Essential Tax Planning Strategies for Small Businesses

1. Understanding Tax Brackets and Income Management

2. Optimizing Business Structure (Tax Status Change)

3. Understanding Capital Gains and Losses for Tax Planning

4. Charitable Contributions Deductions

5. Home Office Deduction

6. Medicare and Asset Location

7. QBI Deductions

8. Business Vehicle Deduction

9. Marketing and Advertising Deductions

10. Employee Benefit Deduction

11. Tax-Advantaged Accounts

12. Tax Law Changes

13. 1099K for Online Business Owners

14. Work Opportunity Tax Credit

2024 Tax Deadlines for Small Business Owners: Key Dates to Remember

Ready to Plan Your Tax Strategies?

FAQs

What Is a Tax Planning Strategy?

A tax planning strategy organizes your finances to legally minimize the amount of taxes you owe. It involves making informed decisions about income, investments, and expenditures to take advantage of all available tax benefits, such as deductions, credits, and exemptions.

Benefits of Effective Tax Planning Strategies

Tax planning might not sound like the most exciting topic, but it can be a game-changer for your business. Here are some of the fantastic benefits of tax planning.

Increased Savings: Tax planning helps lower your tax burden and credits while reducing your tax bill, allowing you to keep more of your hard-earned money.

Improved Cash Flow Management: Business tax planning strategies can help you manage your cash flow better. They ensure that you have funds when you need them most.

Informed Financial Decisions: This information helps you make smart financial decisions, such as when to make major purchases or how to structure your business.

Reduced Stress During Tax Season: A solid tax plan ensures a smoother process by keeping you organized and prepared for the tax season.

Long-Term Financial Planning: Tax planning is not just about the present; it's about securing your future. By setting up retirement accounts and planning for significant expenses, you ensure long-term success for your business.

Avoidance of Costly Mistakes: Tax mistakes can lead to penalties, interest, and audits. Tax planning helps you avoid these issues, ensuring everything is accurate and compliant.

Support for Business Growth: The money that you save on taxes can be reinvested in your business, whether it's hiring new staff, expanding services, or upgrading technology, fueling your growth.

Compliance with Legal Requirements: A good tax strategy ensures you take advantage of every benefit while staying within legal boundaries, keeping you safe from potential legal issues.

Critical Components of Tax Planning Strategies

Understanding the key components of business tax planning strategies is essential for effectively using them. Knowing these elements helps you minimize taxes and maximize your business's financial benefits.

Deducting: Deducting means subtracting business expenses from your income to reduce your taxable income. Keep track of all business expenses, such as office supplies, travel, and utilities.

Deferring: Deferring is about postponing income to the next year and speeding up expenses for the current year.

Dividing: Dividing involves sharing your income with family members by paying them a salary or giving them dividends. This can reduce the overall tax you pay as a family.

Disguising: Disguising income means changing its type to benefit from lower tax rates. For example, converting some of your business income into capital gains can lower your taxes.

Dodging: Avoid dodging as it means illegal ways to avoid taxes. Instead, focus on legal methods like using tax credits and deductions and structuring your business correctly to save on taxes.

Essential Tax Planning Strategies for Small Businesses

Tax planning strategies don’t have to be a headache. You just have to know the right strategy to turn into opportunities for savings and financial growth. Here are the most essential strategies.

1. Understanding Tax Brackets and Income Management

A tax bracket determines the rate at which your income is taxed, and understanding it is crucial for small business owners. As your income increases, you move into higher tax brackets, meaning the additional income is taxed at a higher rate. Knowing which bracket you fall into helps you predict your tax liability and plan accordingly. Effective tax planning for small businesses includes using this knowledge to make informed decisions and optimize tax strategies.

Here are some practical tips to keep you in a lower tax bracket

Defer Income: If you’re close to moving into a higher bracket, consider deferring income to the next tax year. This can keep you in a lower bracket and reduce your overall tax rate.

Example: If you expect to receive a large payment from a client in December and you're close to moving into a higher tax bracket, ask if they can pay you in January instead. This defers the income to the next tax year, keeping you in a lower bracket for the current year.

Accelerate Deductions: On the flip side, accelerating deductible expenses into the current year can lower your taxable income, potentially keeping you in a lower bracket.

Example: If you're purchasing new office equipment or supplies, do it before the end of the year. The expense will reduce your taxable income for the current year, helping you stay in a lower bracket.

Bonus Timing: If you control when you receive bonuses or other forms of variable income, plan them for years when your overall income might be lower to avoid higher taxes.

Example: If your business had an exceptionally profitable year, consider delaying employee bonuses until the start of the next fiscal year. This way, the bonuses are counted as expenses in the next year, reducing your taxable income for the current year and potentially keeping you in a lower tax bracket.

Retirement Contributions: Contributing to retirement accounts like 401(k)s or IRAs can reduce your taxable income, helping you stay within a lower tax bracket.

Example: Contribute to your retirement account before the year-end. For instance, adding to your 401(k) or IRA can lower your annual taxable income, helping you stay within a lower bracket.

Leverage Software: Use accounting software like QuickBooks or Xero to track your yearly income and expenses. These platforms can provide insights and reports to help you manage your tax brackets. SaasAnt Transactions simplifies bulk data import and export in QuickBooks, making keeping your financial records up-to-date easier. PayTraQer synchronizes your e-commerce transactions with QuickBooks, ensuring accurate and timely records.

2. Optimizing Business Structure (Tax Status Change)

Optimizing business structure is a critical tax planning strategy for business owners because the structure of your business determines your tax obligations. When optimizing your business structure, you can take advantage of tax benefits, reduce liability, and set your business up for long-term success.

Types of Business Structures

Sole Proprietorship

A sole proprietorship is the simplest and most common type of business structure. It is owned and operated by one individual. It is not legally separate from its owner, meaning the owner is responsible for all the business's debts and liabilities.

Scenario:

As a sole proprietor of your small business, you report your income and expenses on your tax return. Your company has been growing steadily, attracting more customers and generating higher revenues, but this growth could come with potential risks associated with personal liability.

You can switch from a sole proprietorship to a Limited Liability Company (LLC) because it offers limited liability protection, meaning your assets would be shielded from business liabilities.

Partnership

A partnership is a business structure in which two or more individuals share ownership and management responsibilities. Each partner contributes capital, labor, skills, or other resources to the business and shares in its profits and losses.

Scenario:

The business you have been running in partnership business structure has grown, and you have taken on larger projects and more clients. However, you and your partner are concerned about your liability. In a partnership, all partners are personally liable for the business’s debts and legal obligations, which puts their assets at risk.

You can convert your partnership to a Limited Liability Company (LLC). An LLC provides limited liability protection, meaning your assets would be protected from business liabilities. Also, an LLC can offer more flexible management and tax options, which could be advantageous as their business expands.

Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a flexible business structure that blends aspects of partnerships and corporations. It provides limited liability protection to its owners (called members) and allows business income to be reported on their tax returns, avoiding double taxation.

Scenario:

Your LLC is growing fast, and you need outside investment to expand further. However, investors prefer corporations because they can issue shares and have a clear structure.

You might switch your LLC to a C Corporation (C Corp) for your needed investment. This change allows you to sell stock to investors, giving your business more credibility and stability.

S Corporation

An S Corporation (S Corp) is a particular type of corporation that allows income, losses, deductions, and credits to pass through to its shareholders' tax returns, avoiding double taxation. The primary tax advantage of an S Corp is that it combines a corporation's liability protection with a partnership's tax benefits.

Scenario: Your consulting business has been thriving, and you’re now considering expanding internationally and attracting a diverse group of investors. However, the S Corporation's restrictions on the number and type of shareholders and the requirement that all shareholders be U.S. citizens or residents limit your growth potential.

Consider converting your S Corporation to a C Corporation (C Corp) to facilitate international expansion and attract more investors. A C Corp has no restrictions on the number or nationality of shareholders, making it easier to attract foreign investors and expand globally.

C corporation

A C Corporation (C Corp) is a legal business entity separate from its owners. This structure provides limited liability protection to its shareholders, meaning their personal assets are protected from the company’s liabilities. A C corporation can have an unlimited number of shareholders, which makes it an attractive option for businesses looking to raise capital through the sale of stock.

Scenario: Tech Innovators Inc. decides to switch to an S Corporation. This change means the company’s profits are no longer taxed at the corporate level. Instead, profits are distributed directly to shareholders and taxed at their income tax rates. This conversion helps the company save money on taxes, making it a more tax-efficient structure for its current business stage.

By switching to an S Corp, Tech Innovators Inc. can benefit from a more straightforward tax structure, reduce its overall tax burden, and maintain the liability protection that its shareholders value. This strategic decision aligns better with the company’s financial goals and growth plans.

Practical tips

Review your current structure to evaluate if switching to an LLC or corporation could offer better tax benefits and liability protection.

Consult with a tax professional to understand the tax implications of different business structures.

Consider future growth and choose a structure that supports expansion and can attract investors, like a corporation.

Form an LLC or corporation to shield your assets from business liabilities.

Opt for structures like an S Corporation to avoid double taxation and enjoy flexible profit distribution.

3. Understanding Capital Gains and Losses for Tax Planning

Capital gains are profits from selling assets such as stocks, bonds, or real estate. They are categorized into:

Short-term capital gains: Gains on assets held for one year or less are taxed at ordinary income tax rates.

Long-term capital gains: Gains on assets held for more than one year are taxed at reduced rates, which can be significantly lower than ordinary income tax rates.

Capital losses occur when you sell assets for less than their purchase price. These losses can offset capital gains, reducing your overall tax liability.

Example: Imagine you bought a piece of equipment for your business for $10,000. After a few years, you sell it for $7,000. You have a capital loss of $3,000. If you also sold another piece of equipment for a $3,000 profit, you can use the $3,000 loss to cancel out the $3,000 profit, meaning you don’t have to pay taxes.

Why It Matters?

Properly managing capital gains and losses helps you reduce the taxes you owe on profits and maximize your losses. By timing when you sell assets and using losses to balance out gains, you can lower your taxable income and keep more money in your business.

Practical Tips with Examples

Offset Gains with Losses:

Example: If you have $10,000 in capital gains from selling stocks and $6,000 in losses from other investments, you can offset the gains with the losses, resulting in a taxable gain of only $4,000.

Tax Losses Harvesting

Example: If your investments lose value, you can sell them to create a loss. This loss can reduce the taxes on your other investment gains.

Timing is Key:

Example: If you expect to get a big contract next year, you might sell some equipment this year while your income is lower to take advantage of a lower tax rate. Conversely, if you plan to retire next year and expect a lower income, you could wait until next year to sell your equipment to benefit from a lower tax rate.

Utilize the $3,000 Deduction:

Example: If your capital losses exceed your capital gains, you can use up to $3,000 of the excess loss to offset other types of income, such as wages or business income. Any remaining loss can be carried forward to future years.

4. Charitable Contributions Deductions

Donating to charity is a generous act and a wise tax planning strategy. Charitable contributions, including cash donations and the fair market value of donated goods and property, can be deducted from your taxable income, reducing your overall tax liability.

Requirements:

Qualified Organizations: Contributions must be made to IRS-recognized charitable organizations.

Documentation: Keep records of all donations, including receipts for cash contributions and written acknowledgment from the charity for donations over $250.

How It Works:

Cash Donations: Deduct the amount of cash donated to qualified charities.

Non-Cash Donations: Deduct the fair market value of donated items such as clothing, furniture, or equipment.

Example:

Suppose you donate $500 to a local charity and give away used office equipment valued at $1,000. With the necessary documentation, you can deduct $1,500 from your taxable income.

5. Home Office Deduction

You might be eligible for the home office deduction if you run your business from home. This tax strategy allows you to write off a portion of your home expenses, such as rent, mortgage interest, utilities, and insurance, based on the square footage used exclusively for business.

Requirements:

Exclusive Use: The space must be used solely for your business activities.

Principal Place of Business: The home office must be your primary place of business, where you conduct administrative or management tasks.

How It Works:

Simplified Method: You can deduct $5 per square foot of your home used for business, up to 300 square feet.

Regular Method: Determine what percentage of your home is used for business. Calculate your deduction by applying that percentage to your home expenses (like rent, utilities, and mortgage interest).

Example: If your home office is 10% of your home's total square footage and your total home expenses are $10,000, you can deduct $1,000 (10% of $10,000) for your home office.

6. Medicare and Asset Location

Managing medicare premiums and asset location is crucial when planning your tax strategies. These tactics can help you keep more money in your pocket and make your retirement years more financially comfortable.

Medicare Considerations

Medicare, the federal health insurance program for people 65 and older, has premiums based on your income. If your income is too high, you could pay more premiums, known as Income-Related Monthly Adjustment Amounts (IRMAA). But with some strategic planning, you can avoid these extra costs.

Strategy: Keep your income below IRMAA thresholds. This can involve spreading out withdrawals from retirement accounts, managing the timing of your income, and employing tax-efficient investment strategies.

Example: Let’s say you’re retiring and have a lot of money in your 401(k). Instead of taking out a big chunk at once, which would push you into a higher tax bracket and increase your income and Medicare premiums, you take out smaller amounts over several years. This keeps your income lower and your Medicare premiums manageable.

Asset Location

Asset location means strategically placing your investments in different types of accounts—taxable, tax-deferred, and tax-exempt—to minimize your taxes and maximize your returns.

Types of Accounts:

Taxable Accounts: Investments here are subject to capital gains tax on profits.

Tax-Deferred Accounts: Examples include traditional IRAs and 401(k)s, which require you to pay taxes when you withdraw the money.

Tax-Exempt Accounts: Examples include Roth IRAs and Roth 401(k)s, where withdrawals are tax-free if certain conditions are met.

Strategy: Place tax-efficient investments (like index funds) in taxable accounts and less tax-efficient investments (like bonds) in tax-deferred or tax-exempt accounts.

Example: You have $100,000 to invest. You put investments that don’t get taxed much, like index funds, in a regular investment account. Then, you put bonds, which pay interest, in your IRA. This way, you won’t pay taxes on the interest until you retire, when you might pay less in taxes.

7. QBI Deductions

QBI is Qualified Business Income, which is the net profit of your business from day-to-day operations, i.e., income, gains, deductions, and losses. It applies only to a few business structures such as sole proprietorship, LLC, partnership, and S corporation. It doesn’t include items like investment income, capital gains or losses, certain dividends, and interest income. Including QBI in your business tax planning strategy can help you maximize deductions and reduce your overall tax liability.

The Tax Cuts and Jobs Act introduced the QBI deduction, allowing eligible businesses to deduct up to 20% of their qualified business income. This provision significantly benefits small business owners by reducing their taxable income.

Eligibility: Your business must be a pass-through entity, meaning its income is reported on your tax return, to qualify.

Deduction Amount: You can deduct up to 20% of your QBI from your taxable income. For example, if your total taxable income is less than $191,950 for single taxpayers (or $383,900 for married couples filing jointly) in 2024, you can take the full deduction. If you make more than this, the deduction might be smaller, depending on your business type and how much you pay in wages.

Limitations:

If your income is higher than the threshold, your QBI deduction will be the smaller amount between:

20% of your QBI, or

The more significant amount of either 50% of what you pay your employees or 25% of what you pay your employees plus 2.5% of the value of your business property.

Example:

Your business made $200,000 in QBI, and your taxable income is above the threshold. You also paid $60,000 in wages to your employees, and your business property is valued at $100,000.

20% of QBI is $40,000.

50% of Wages is $30,000.

25% of Wages + 2.5% of Business Property: $15,000 + $2,500 = $17,500.

Now, compare the amounts:

20% of QBI: $40,000

The greater of 50% of wages ($30,000) or 25% of wages plus 2.5% of property ($17,500): $30,000.

Since $30,000 (50% of wages) is less than $40,000 (20% of QBI), your QBI deduction is limited to $30,000, the lesser amount.

8. Business Vehicle Deduction

Using a business vehicle is an effective tax strategy for small business owners. You just have to document and deduct vehicle expenses that can reduce your taxable income. There are two main methods for calculating these deductions:

Standard Mileage Rate: Deduct a fixed amount for each mile you drive for business. As of 2023, the rate is 65.5 cents per mile.

Actual Expense Method: Deduct actual expenses such as gas, oil, maintenance, repairs, insurance, and depreciation based on the percentage of miles driven for business.

Example:

Imagine you run a small catering business. You use your vehicle to transport food and equipment to events. Over the year, you drive 10,000 miles, 7,000 of which are for business purposes. Using the standard mileage rate, you could deduct $4,585 (7,000 miles x 65.5 cents per mile).

Keep a detailed log of business miles driven, including dates, destinations, and the purpose of each trip. Accurate records are crucial for substantiating your deductions during an audit. Also, Evaluate whether leasing or purchasing a vehicle offers better tax advantages for your business. Leasing payments can be deducted as business expenses, while purchased vehicles can be depreciated over time.

9. Marketing and Advertising Deductions

Investing in marketing and advertising is essential for business growth and a smart tax planning strategy for small business owners. According to IRS Publication 535, "Business Expenses," advertising and marketing costs are fully deductible if they are directly related to your business activities. This includes expenses related to online advertising, print media, business cards, promotional materials, and even sponsoring local events.

Example:

Consider you own a local bakery and decide to invest in a new advertising campaign to attract more customers. You spend $10,000 on various advertising channels, including social media ads, flyers, and a local radio spot. You can deduct the entire $10,000 from your taxable income by documenting these business expenses.

As part of your overall tax strategy, plan and allocate a budget for marketing and advertising at the beginning of the year. Use a mix of online and offline advertising to reach a broader audience while maximizing your deductions.

10. Employee Benefit Deduction

Offering employee benefits is a good tax planning strategy that helps attract and retain top talent and provides significant tax advantages for small business owners. Employee benefits such as health insurance, retirement plans, and other perks are typically fully deductible as business expenses. These deductions lower your taxable income, resulting in tax savings for your business.

Example:

Imagine you own a small tech company and decide to offer health insurance and a 401(k) retirement plan to your employees. You spend $20,000 annually on these benefits. By documenting these expenses, you can deduct the entire $20,000 from your taxable income, lowering your overall tax bill. Also, properly managing payroll tax obligations alongside these benefits ensures compliance and maximizes your tax efficiency.

To prove your deductions, you just have to maintain accurate records of all employee benefit expenses. Consider working with a tax professional to design a benefits package that maximizes tax savings, meets the needs of your employees, and effectively manages your corporate income tax responsibilities.

11. Tax-Advantaged Accounts

Tax-advantaged accounts offer significant tax benefits that can help you save for the future while reducing your current tax liability. When tax planning for small businesses, incorporate tax-advantaged accounts to enhance your financial security and optimize your tax savings. These accounts include retirement accounts like Individual Retirement Accounts (IRAs) and 401(k) plans, Health Savings Accounts (HSAs), and 529 college savings plans.

Example:

Imagine you own a small consulting business and decide to contribute to a Simplified Employee Pension (SEP) IRA for yourself and your employees. You contribute $15,000 to your SEP IRA, which is tax-deductible and reduces your taxable income by $15,000 for the year. Additionally, the funds in the SEP IRA grow tax-deferred until you withdraw them in retirement, potentially when you are in a lower tax bracket.

When you contribute to IRAs, 401(k) plans, or SEP IRAs, you enjoy tax deductions now and tax-deferred growth for the future. If you have a high-deductible health plan, an HSA is a great option. Your contributions are tax-deductible, and you can make tax-free withdrawals for medical expenses. For your children's education, 529 plans are ideal. Contributions grow tax-free, and withdrawals for qualified education expenses are also tax-free.

12. Tax Law Changes

Tax law changes can impact your business in many ways, such as how you report income, what business expenses you can deduct, and the credits you can claim. Be aware of these changes when planning tax strategies, as these might offer new tax-saving opportunities or mean you need to adjust your current practices to stay compliant.

Example:

Imagine you own a small retail business. Recently, the government introduced a new green energy tax credit for energy-efficient upgrades. By staying informed, you learn about this change and invest in energy-efficient lighting and HVAC systems for your store. This investment reduces energy costs and qualifies you for a significant tax credit, lowering your overall tax bill.

Regularly meet with a tax advisor to stay informed about the latest tax law changes and how they affect your business. Sign up for newsletters from reputable tax advisory firms to receive updates on these changes. Each year, reevaluate your tax planning strategies to incorporate new laws and optimize your tax savings.

13. 1099K for Online Business Owners

Form 1099-K reports payments received through third-party networks and payment card transactions. This form is crucial for small business owners accepting credit cards, debit cards, or payments through payments like PayPal and Stripe. If you receive over $600 in a calendar year through these methods, you will receive a 1099-K from each payment processor.

Example

Suppose you own an online craft store and receive payments via PayPal and credit cards. You receive $20,000 annually via PayPal and $15,000 through credit card payments. At the end of the year, you receive two 1099-K forms, one from PayPal and one from your credit card processor, showing these amounts. You can use PayTraQer to integrate and reconcile these transactions with QuickBooks or Xero. It ensures accurate income reporting, helping you stay compliant with tax regulations and avoid potential penalties. This streamlined process saves time and enhances your overall tax planning strategy.

Reconcile your 1099-K forms with your internal records to catch any inconsistencies early and maintain accurate financial records. Work with a tax advisor to understand the implications of your 1099-K forms and to develop a comprehensive tax strategy that optimizes your tax outcomes.

14. Work Opportunity Tax Credit

Employers can claim the WOTC for hiring individuals from target groups such as veterans, individuals receiving Supplemental Nutrition Assistance Program (SNAP) benefits, ex-felons, and others. The credit amount varies based on the target group and the number of hours the new employee works. Generally, the credit is calculated as a percentage of the employee's wages up to a maximum amount.

Example:

Imagine you own a small retail business. You hire a veteran who qualifies for the WOTC. The veteran works at least 400 hours annually, making them eligible for a maximum credit. If you pay this employee $10,000 in wages, you could receive a tax credit of up to $2,400 (24% of the wages). This reduces your overall tax liability while supporting a veteran's employment.

Steps to claim WOTC

Just verify that the new hire belongs to one of the target groups.

Complete and submit IRS Form 8850 to your state workforce agency within 28 days of the employee's start date.

Your state workforce agency will certify the employee's eligibility for the WOTC.

Calculate the credit based on the employee's wages and include it when filing your business's federal tax return.

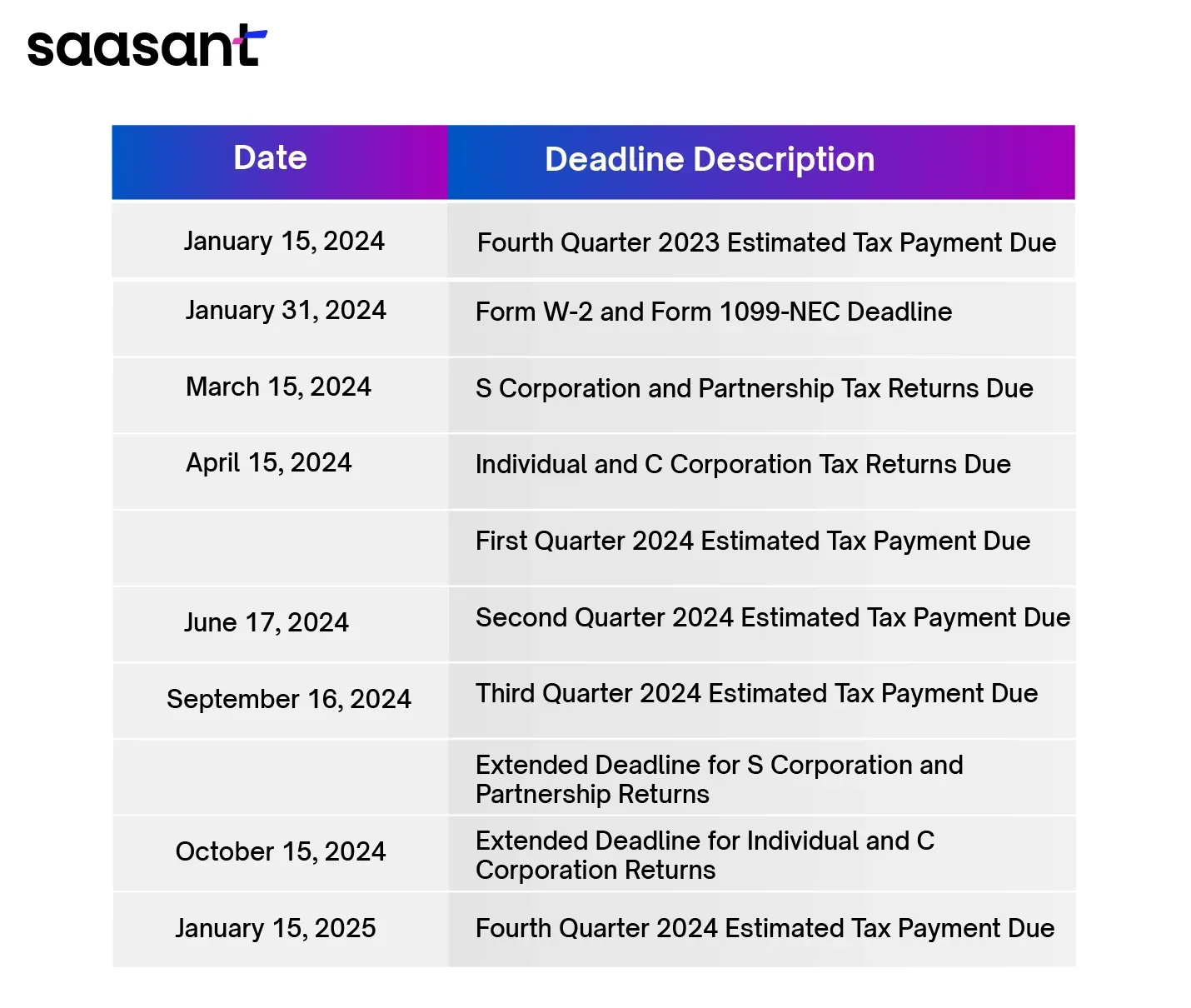

2024 Tax Deadlines for Small Business Owners: Key Dates to Remember

Staying on top of tax deadlines is crucial for small business owners to avoid penalties and ensure compliance. Here are the important tax dates to mark on your calendar for 2024.

January 15, 2024: Fourth Quarter 2023 Estimated Tax Payment Due.

January 31, 2024: Form W-2 and Form 1099-NEC Deadline.

March 15, 2024: S Corporation and Partnership Tax Returns Due.

April 15, 2024: Individual and C Corporation Tax Returns Are Due, and the Estimated Tax Payment for the First Quarter of 2024 Is Due.

June 17, 2024: Second Quarter 2024 Estimated Tax Payment Due.

September 16, 2024: Third Quarter 2024 Estimated Tax Payment Due, Extended Deadline for S Corporation and Partnership Returns.

October 15, 2024: Extended Deadline for Individual and C Corporation Returns.

January 15, 2025: Fourth Quarter 2024 Estimated Tax Payment Due.

Ready to Plan Your Tax Strategies?

Effective tax planning strategies can significantly improve your business's financial health. By staying informed and proactive, you can maximize savings, reduce tax liability, and ensure compliance with tax laws. Applications like SaasAnt Transactions and PayTraQer can significantly aid in this process.

SaasAnt Transactions streamlines bulk import and export of invoices, expenses, and sales receipts into Xero and QuickBooks, simplifying financial data tracking and management. PayTraQer simplifies tracking sales tax from different ecommerce platforms like amazon, Shopify, Walmart, etc., and payment gateways such as stripe, PayPal, and square, etc., It also syncs your tax data seamlessly to QuickBooks or Xero, which streamlines reconciliation. This makes tax compliance easier by ensuring accurate records and simplifying the overall process.

You can keep more of your earnings and ensure long-term business growth by leveraging these applications alongside strategies such as understanding tax brackets, optimizing business structure, and utilizing tax-advantaged accounts.

FAQs

What are the three basic strategies to use in planning for taxes?

Defer income to future years.

Accelerate deductions into the current year.

Utilize tax credits and deductions to lower taxable income.

What is effective tax planning?

Effective tax planning minimizes tax liability.

Stay updated on tax laws.

Time income and business expenses strategically.

Maximize deductions and credits.

Contribute to retirement accounts.

Choose a tax-efficient business structure.

Consult tax professionals.

What is an example of a tax-saving strategy?

Contributing to a retirement account like a 401(k) or IRA is a tax-saving strategy that reduces your taxable income while saving for the future.

What are three ways you can prepare for taxes?

You can prepare for taxes in 3 simple steps.

Keep accurate and detailed records of all financial transactions.

Regularly review and update your tax strategies.

Consult with a tax professional to stay informed about tax law changes.

How to pay the least amount of taxes as a small business owner?

Choose the proper business structure.

Maximize deductions (office supplies, travel, meals).

Utilize tax credits (Small Business Health Care, R&D).

Contribute to retirement plans (SEP IRA, Solo 401(k)).

Keep detailed records.

Hire a tax professional.