How to Record Personal Expenses in QuickBooks Online

As an entrepreneur or business owner, you know the importance of maintaining a clear line of demarcation between personal and business finances. Separating these two aspects ensures accurate financial reporting, streamlined tax preparation and safeguards your company's integrity. Despite meticulous financial management efforts, accidental mix-ups can sometimes lead to personal expenses charged to your business credit card or bank account.

If you've ever found yourself in such a predicament, fret not! QuickBooks Online, the cutting-edge accounting software, offers a straightforward and effective solution to rectify these accidental transactions while upholding the financial health of your business. Following a few simple steps, you can seamlessly record personal expenses in your business account and proceed with proper reimbursement, ensuring that your financial records remain impeccable.

This comprehensive guide will help you navigate the process of handling personal expenses in your QuickBooks Online business account, from identifying inadvertent charges to accurately categorizing and tracking expenses, ensuring financial clarity and transparency.

Step-By-Step Guide: How to Record a Personal Expense from a Business Account in QuickBooks Online

Step 1: Access the Create New Transaction Menu

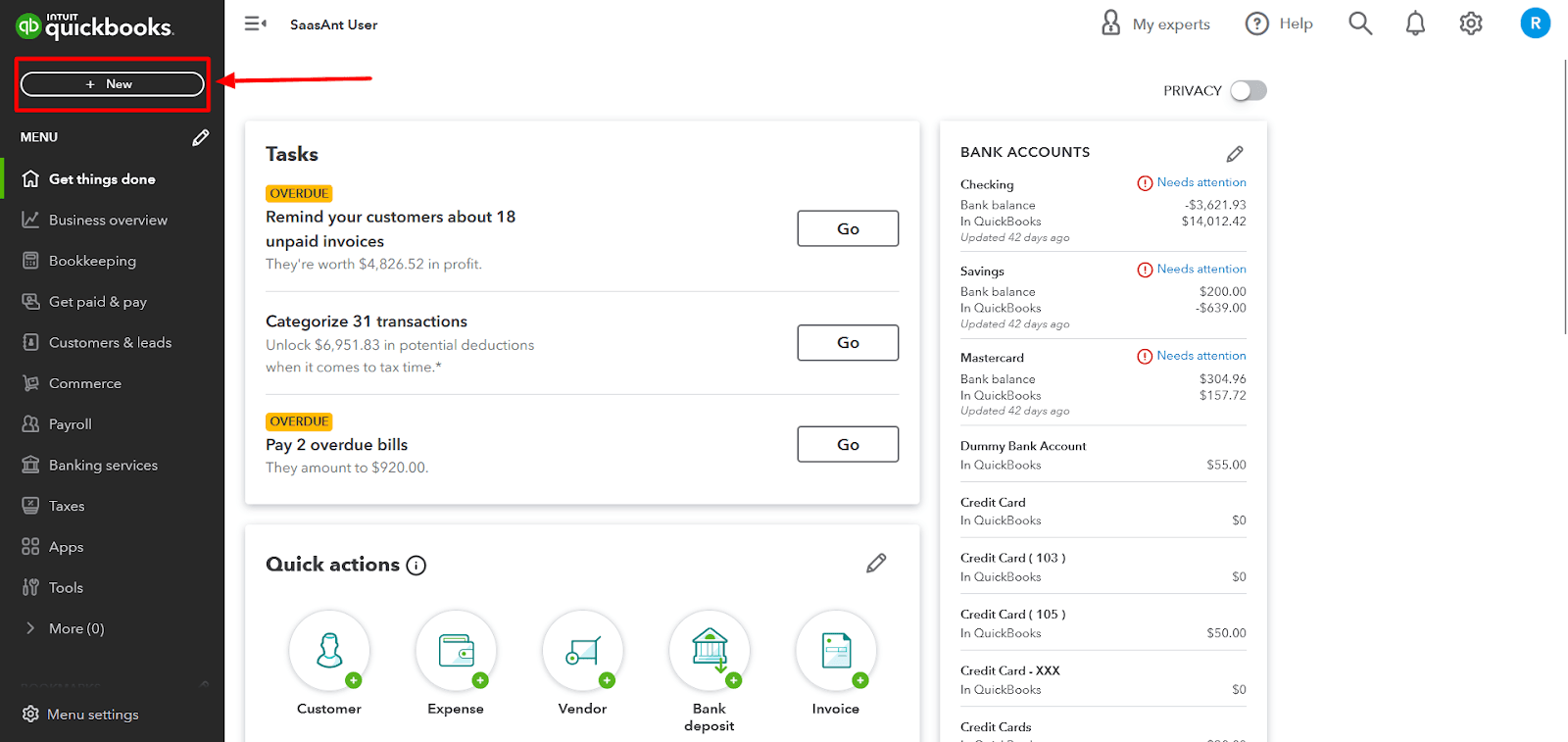

Log in to your QuickBooks Online account.

In the top navigation bar, click the '+ New' button, which opens the 'Create New' transaction menu.

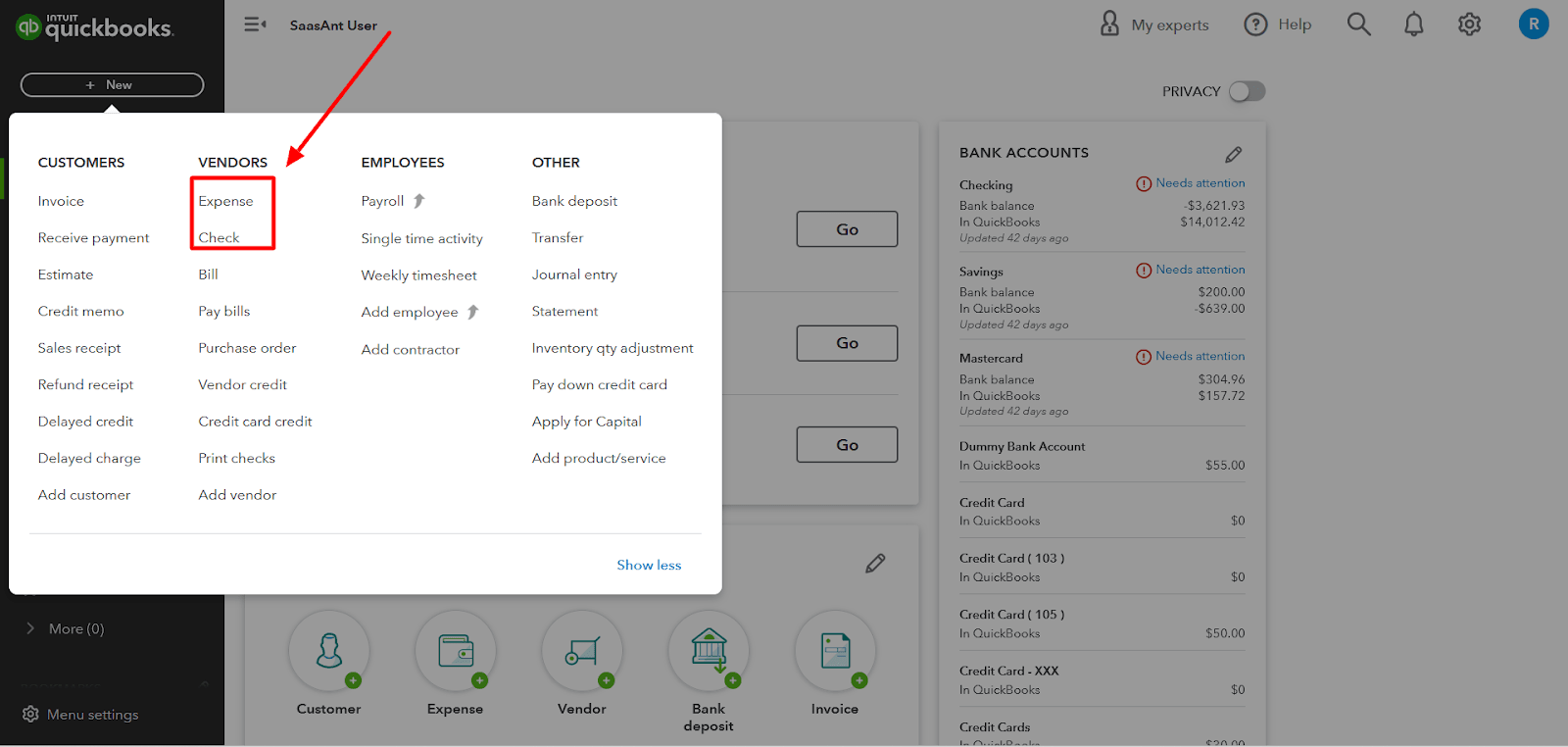

Step 2: Choose the Type of Transaction

From the ‘Create New’ menu, select either ‘Check’ or ‘Expense,’ depending on the transaction type you want to record.

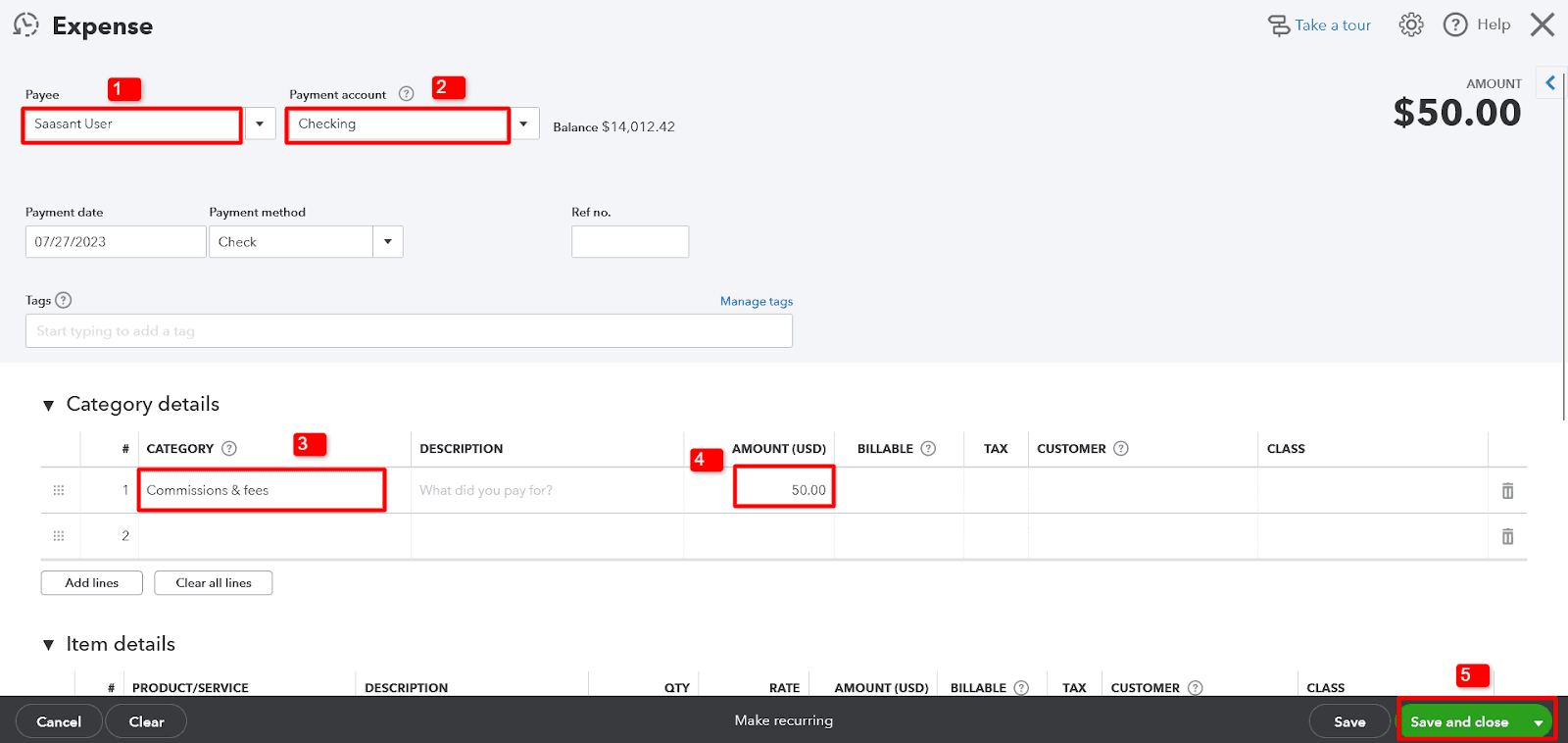

Step 3: Specify the Payee

In the transaction form, locate the 'Payee' field and choose the appropriate recipient from the dropdown ▼ menu. It could be an individual or a business from whom you purchased.

Step 4: Select the Funding Account

In the same transaction form, find the section for selecting the account used for payment (e.g., Bank Account, Cash Account, or Credit Card).

Select the business account from the dropdown menu to pay the personal expense.

Step 5: Categorize the Expense

Look for the ‘Category details’ section in the transaction form.

Select the dropdown menu to access the list of expense categories available in QuickBooks Online.

Choose the appropriate expense category that best fits the nature of the personal expense you incurred.

Step 6: Enter the Expense Amount

Locate the ‘Amount’ field in the transaction form.

Input the total amount of the personal expense you wish to record.

Step 7: Save the Transaction

Once you have filled in all the necessary information in the transaction form, review it for accuracy. If everything appears correct, click the 'Save and Close' button if you don't need to record another transaction immediately, or select 'Save and New' to continue entering more transactions.

Step-By-Step Guide: How to Reimburse the Company for a Personal Expense in QuickBooks Online

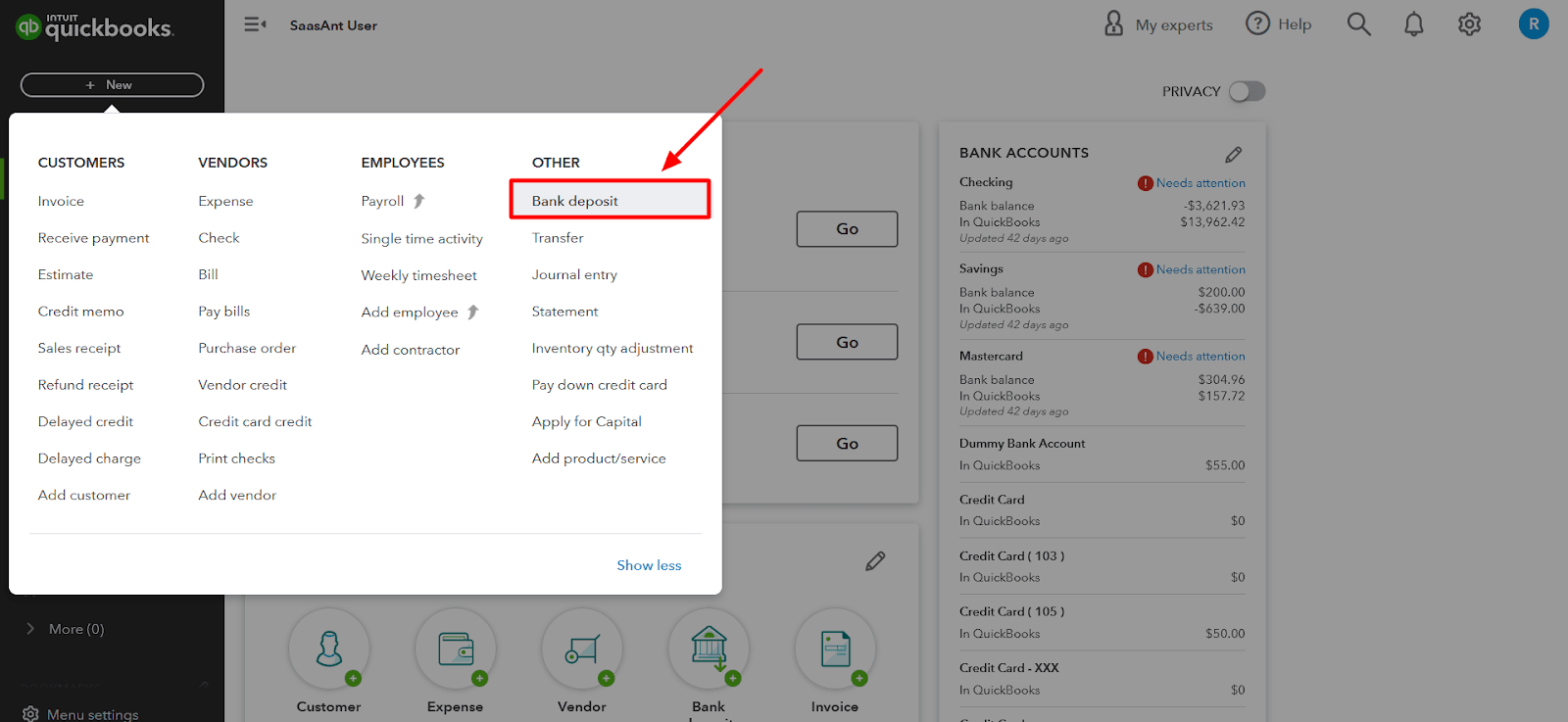

Step 1: Access the Create New Transaction Menu

Log in to your QuickBooks Online account.

Click the ‘+ New’ button in the top navigation bar to open the ‘Create New’ transaction menu.

Step 2: Choose the Type of Transaction

From the ‘Create New’ menu, select ‘Bank Deposit’ as the transaction type.

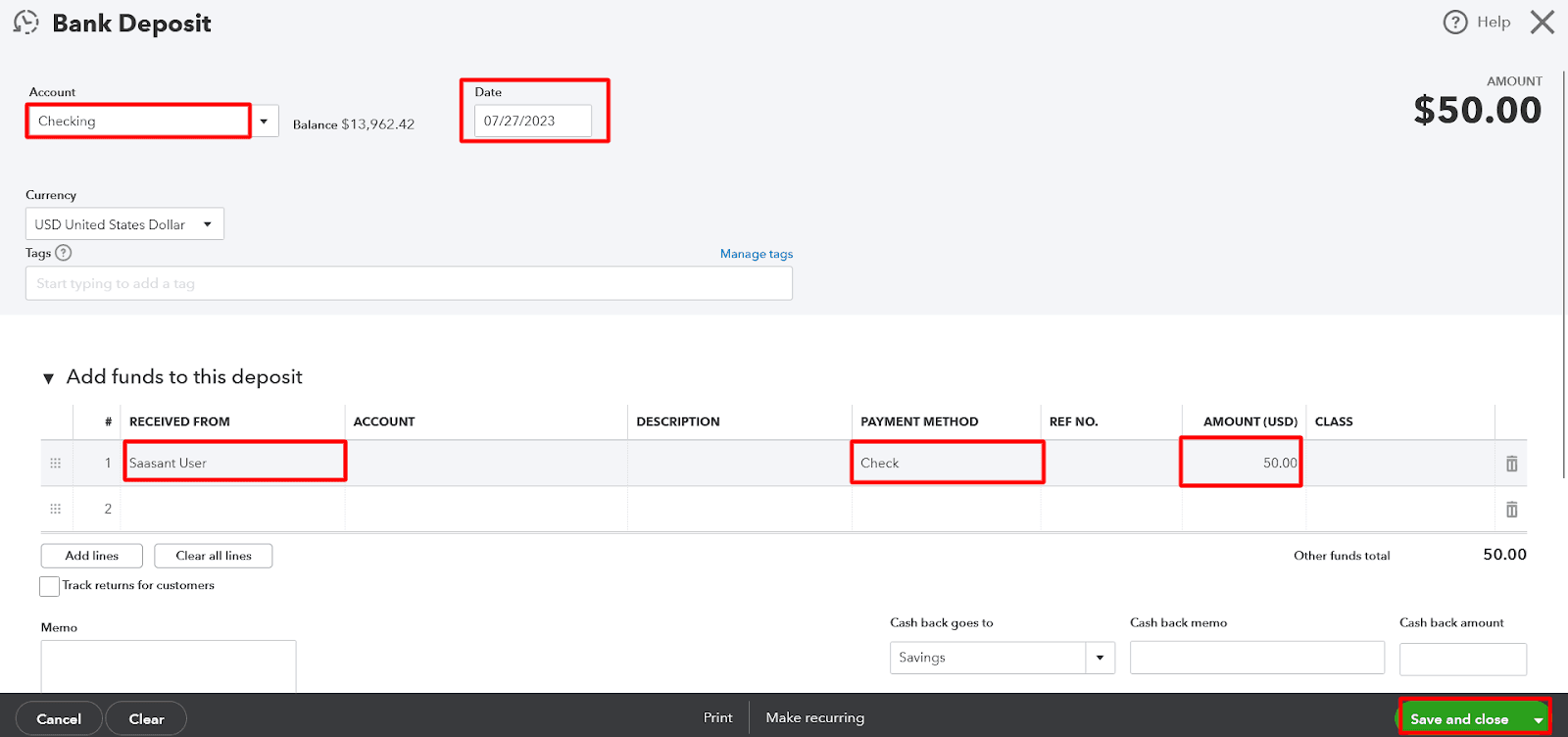

Step 3: Specify the Reimbursement Account and Date

In the 'Bank Deposit' form, select the appropriate account for recording the reimbursement.

Enter the date of the reimbursement.

Step 4: Add the Reimbursement Details

In the ‘Add funds to this deposit’ section, enter the name of the person who made the personal expense in the ‘Received From’ field.

From the ‘Account’ dropdown, select the appropriate account representing the person (e.g., add the person as a 'Customer' if they are not already in your books, even if they are not an actual customer).

Step 5: Specify the Payment Method and Reimbursement Amount

Choose the payment method for the reimbursement (e.g., cash, check, or bank transfer).

Enter the amount of the reimbursement.

Step 6: Save the Transaction

Review the details in the 'Bank Deposit' form for accuracy. If all information is correct, click on the 'Save and Close' button if you don't need to create another deposit, or select 'Save and New' if you want to record additional deposits.

FAQs

Q1: What Is the Process of Recording Personal Expenses in QuickBooks Online from a Business Account?

To record personal expenses in QuickBooks Online from a business account, follow these steps:

Select '+ New.'

Choose either 'Check' or 'Expense.'

Pick the Payee from the dropdown.

Select the Bank Account, Cash Account, or Credit Card used for the purchase.

Choose the appropriate account category for personal expenses in the Category details section.

Enter the amount of the purchase.

Click 'Save and Close' or 'Save and New' to save the transaction.

Q2: Can I Categorize Personal Expenses Directly under an Existing Business Account in QuickBooks Online?

Categorizing personal expenses directly under an existing business account is not recommended. Instead, creating a separate "Personal Expenses" account is considered best practice. Doing so helps maintain accurate financial records and enables a clear distinction between personal and business transactions.

Q3: How Can I Reimburse the Company for a Personal Expense Paid from a Business Account in QuickBooks Online?

To reimburse the company for a personal expense, use the ‘Bank Deposit’ form in QuickBooks Online:

Click the ‘+ New’ button on the home screen, then ‘Bank Deposit.’

Choose the appropriate account for the reimbursement, enter the date, and specify the person who made the personal expense in the ‘Received From’ field.

Enter the reimbursement amount and save the transaction.

Q4: Is It Necessary to Add the Person Who Made the Personal Expense as a Customer in QuickBooks Online?

Adding the person who made the personal expense as a customer in QuickBooks Online is recommended, even if they are not customers. This practice allows you to categorize the reimbursement and maintain accurate records properly.