How to Turn off Sales Tax in QuickBooks Online

In the intricate accounting world, the ability to customize your software can be incredibly beneficial. QuickBooks Online, a robust accounting software, is designed to help businesses manage their finances. One of its key features is its ability to handle sales tax calculations. This capability is highly beneficial for precision calculations, mitigating the risk of errors. However, there may be situations where you need to turn off the sales tax feature.

Whether your business operates in a region where sales tax isn't applicable, deals with tax-exempt goods or services, or uses external systems for tax management, in such cases, knowing how to turn off this feature could significantly streamline your accounting processes.

It's crucial to emphasize the importance of thoroughly understanding applicable tax laws and regulations. Always consult a professional or a tax advisor before making significant changes to your tax settings. Join us as we walk you through the step-by-step process of turning off the sales tax feature, making your QuickBooks experience more tailored to your business needs.

Reasons to Turn off Sales Tax in QuickBooks

There are a few reasons why a business might want to turn off the sales tax feature in QuickBooks:

Tax-Exempt Sales

Certain types of sales transactions don't require the collection of sales tax. These typically involve specific types of customers or products. For instance:

Non-profit organizations: Non-profit organizations are typically tax-exempt, meaning they don't have to pay sales tax on their purchases. You may need to exclude sales tax from their invoices if you have non-profit customers.

Educational institutions: Similarly, sales to educational institutions are often tax-exempt.

Government agencies: Sales to government agencies also typically don't require sales tax collection.

Tax-Exempt Products or Services

Certain products or services might be exempt from sales tax, depending on the laws of the specific state. For instance, in some areas, groceries, prescription medications, and certain services may not be subject to sales tax.

Out-Of-State or International Sales

In some dominions, such as Alaska, Delaware, Montana, New Hampshire, and Oregon, businesses are exempt from sales tax on goods or services sold to customers in other states or countries. Therefore, if your business primarily operates in such a manner, you should turn off the sales tax feature in QuickBooks.

Manual Tax Calculation Preference

Some businesses prefer to calculate their sales tax manually or use different tax software. If you're more comfortable with this method or your tax situations are particularly complex, you should turn off QuickBooks's automatic sales tax calculation feature.

Note: Before deciding to turn off sales tax, businesses should consult with a tax advisor to understand the implications fully.

Step-By-Step Guide for Turning off Sales Tax in QuickBooks Online

Here's how to turn off sales tax in QuickBooks Online:

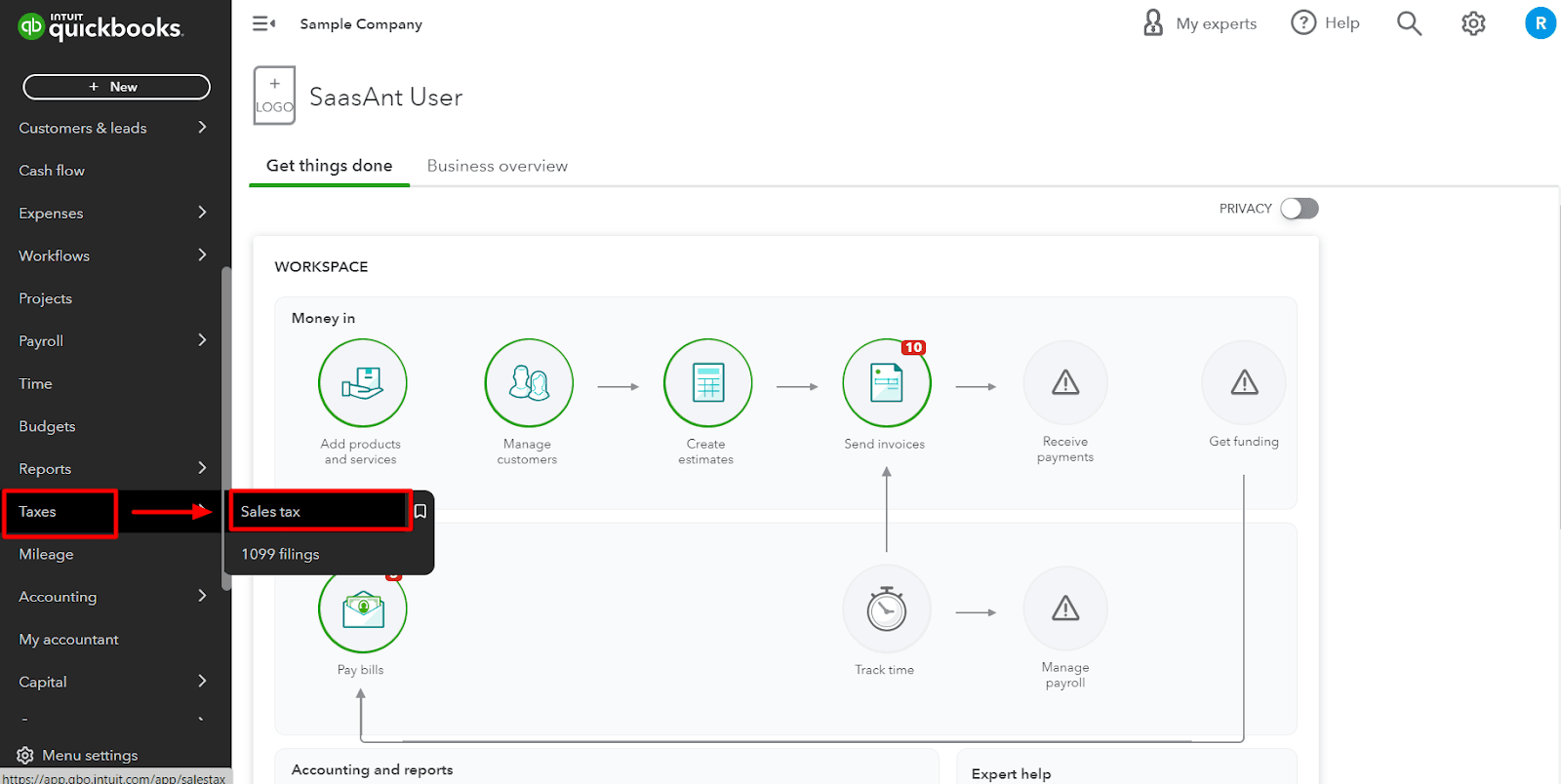

Step 1: Navigate to the Sales Tax Center

Sign in to QuickBooks Online. From the left menu, click on ‘Taxes.’ Then, select ‘Sales Tax.’

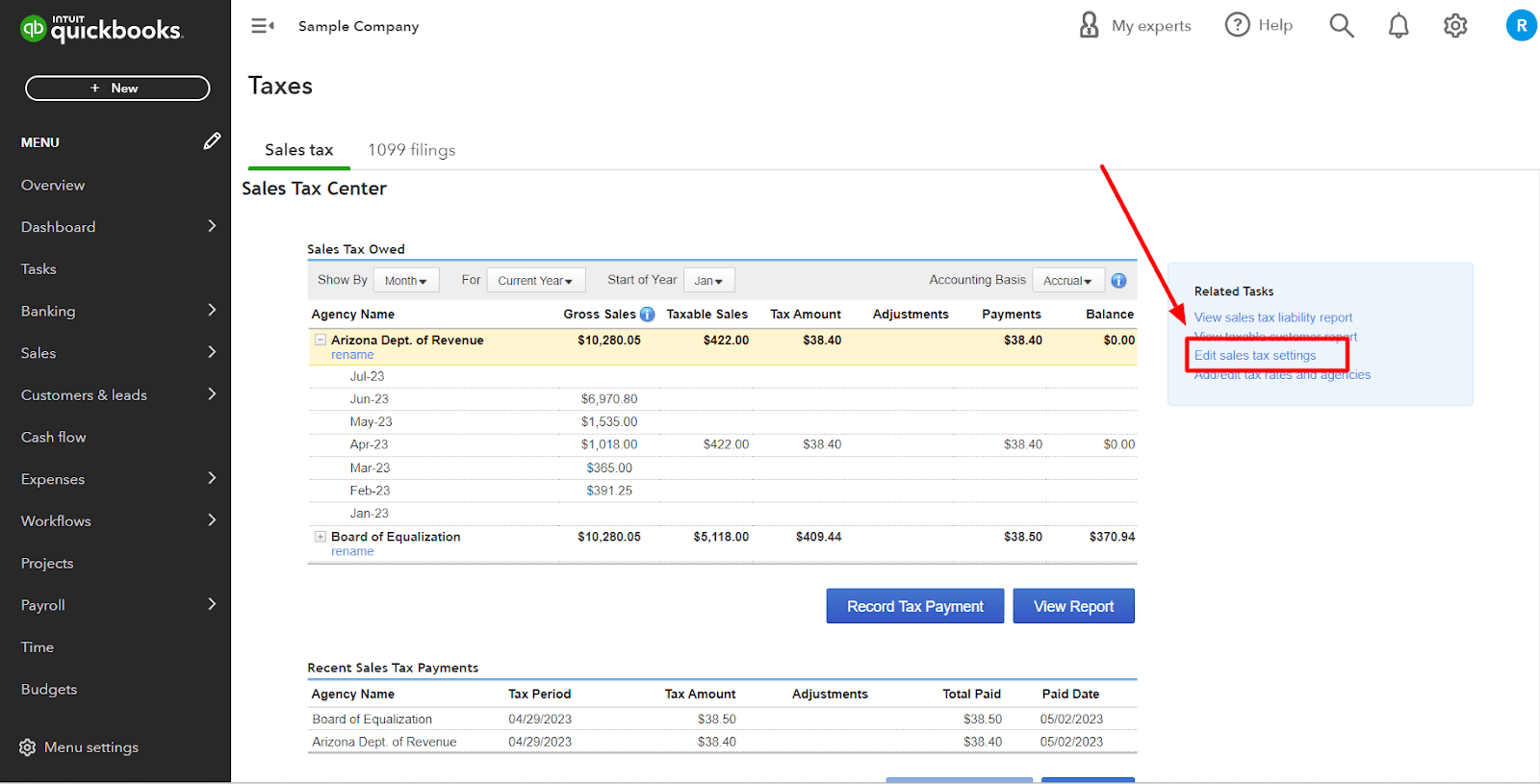

Step 2: Edit Your Sales Tax Settings

Within the ‘Sales Tax’ tab, you'll find the ‘Related Tasks’ on the right-hand side. Click on ‘Edit sales tax settings’ from the options available.

Step 3: Turn off the Sales Tax

In the ‘Edit Sales Tax Settings’ window, click ‘No’ under the ‘Do you charge sales tax’ option and then click ‘Save.’

Alternative Methods

If you want to turn off only some of the sales tax functionality but wish to exempt certain customers, QuickBooks Online allows that too.

Exempting a Customer

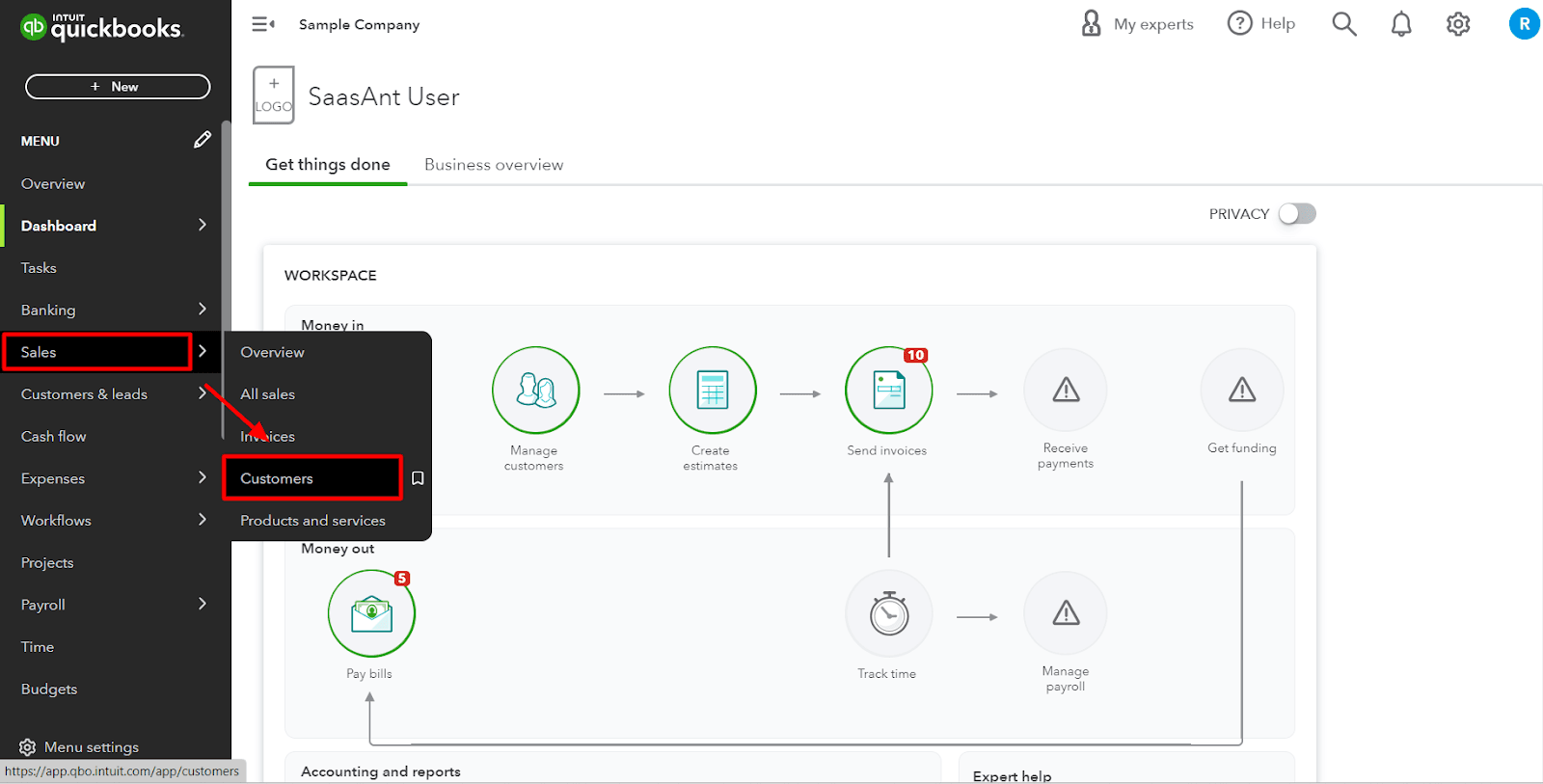

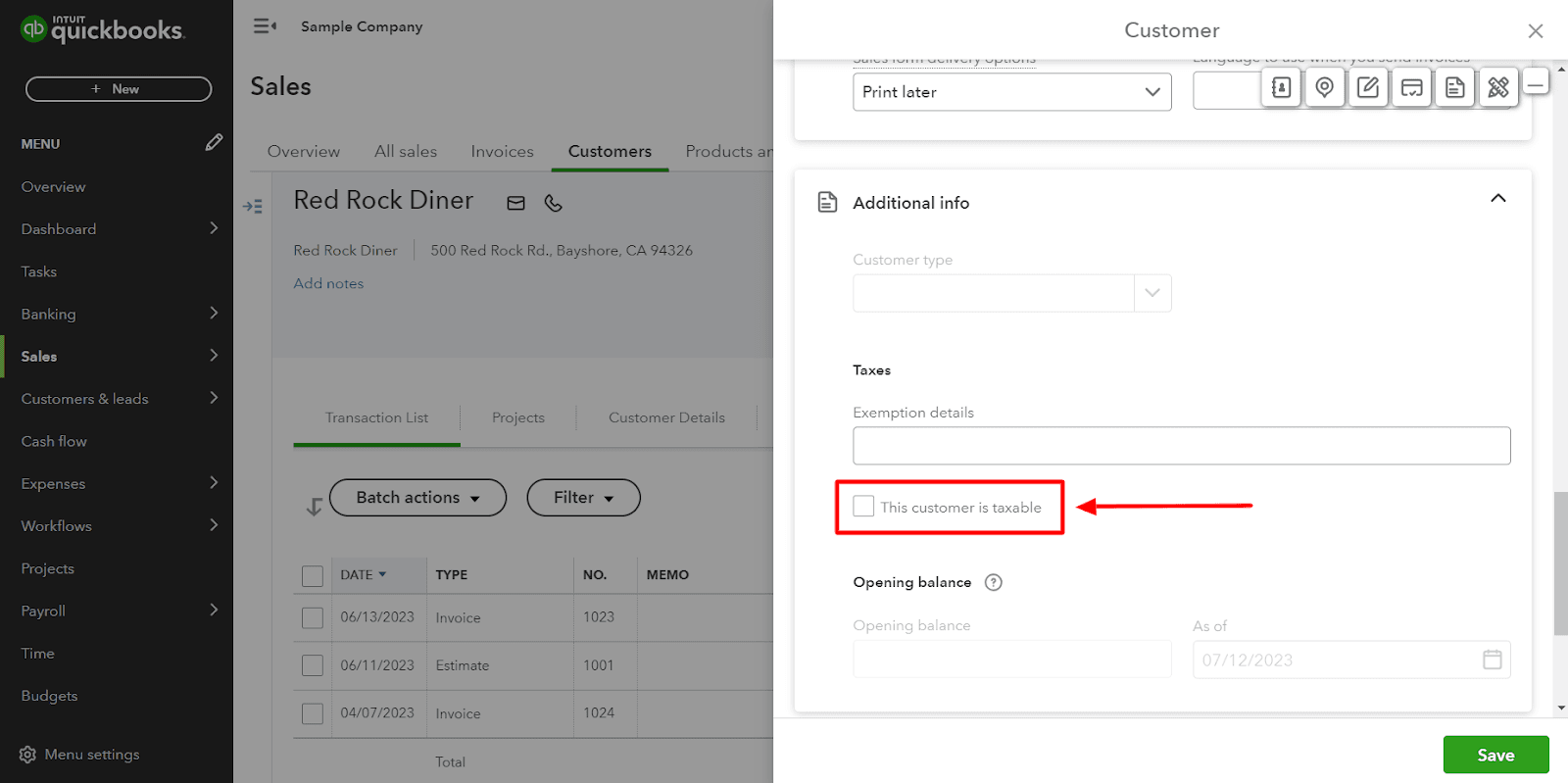

Step 1: Navigate to the ‘Sales’ menu and choose ‘Customers.’

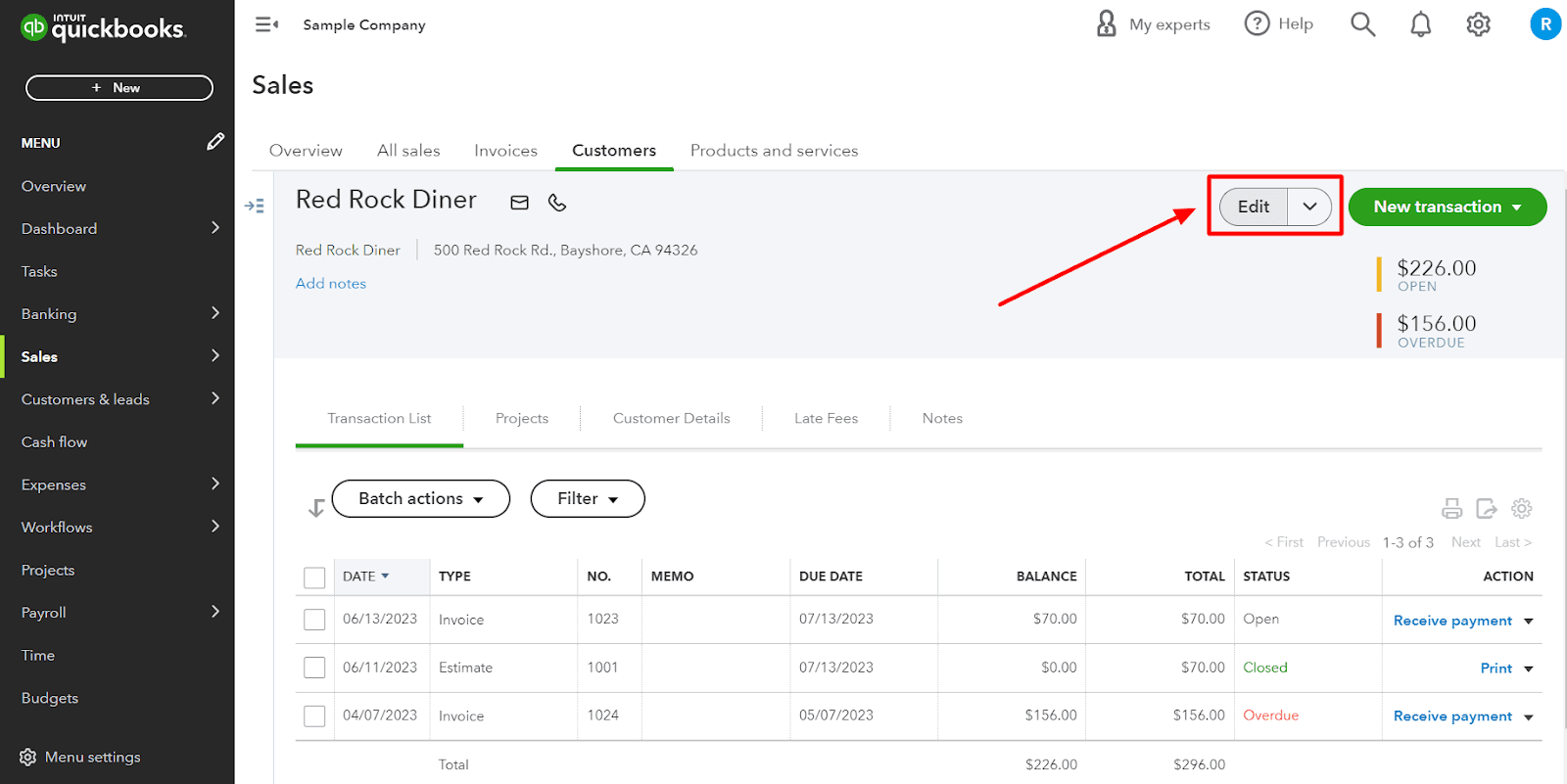

Step 2: Select the ‘Customer’ you wish to make tax-exempt and click ‘Edit.’

Step 3: Within the ‘Additional info’ tab, check the ‘This customer is taxable’ box and click ‘Save.’

FAQs

Q1: How Can I Turn off Sales Tax in QuickBooks Online?

The process of turning off the sales tax feature involves the following:

Sign in to QuickBooks Online

Navigate to the ‘Sales Tax Center.’

In the ‘Sales Tax Center,’ you'll find the ‘Sales tax settings’ on the right-hand side. Click on ‘Edit settings.’

In the ‘Edit Settings’ window, uncheck the box next to ‘Turn on sales tax’ and then click ‘Save.’

Q2: Why Would I Want to Turn off Sales Tax in QuickBooks Online?

There can be several reasons to turn off sales tax in QuickBooks Online. You might operate in a state that does not require sales tax, you might only sell non-taxable items, or you might have a tax exemption status.

Q3: Will Turning off Sales Tax Affect My Business’s Financial Reporting?

Yes, it can. Sales tax collected from customers usually gets reported as a liability because it's money owed to the government. If you stop tracking it in QuickBooks, it could impact your liability accounts and comprehensive financial reports.

Q4: Will Turning off Sales Tax Impact My Previous Transactions?

No, turning off the sales tax feature will not change any transactions that have already been recorded. It will only affect future transactions.

Q5: What Are the Consequences of Incorrectly Managing Sales Tax in Quickbooks Online?

Mismanagement of sales tax can lead to inaccurate financial statements, audit risks, and potential fines and penalties from tax authorities.

Q6: What Happens If I Turn off Sales Tax but Later Need to Turn It Back On?

You can turn the sales tax feature back on at any time, and any previous tax settings and rates will be saved, but you must reapply them to your products and services.

Q7: Are Any Alternative Methods for Managing Sales Tax in Quickbooks Online Rather than Turning It Off?

Yes, QuickBooks Online provides different ways to manage sales tax, including automatic sales tax calculation, manual sales tax entry for each transaction, or sales tax groups for multiple tax rates.

Q8: What Happens to the Sales Tax Information If I Switch It Off?

The previously collected and recorded sales tax data will remain in your account. Turning off the feature disables the automatic calculation and recording of sales tax in new transactions.

Q9: Will Turning off the Sales Tax Affect My Invoicing Process?

If you've previously included sales tax in your invoices, turning off the sales tax feature will remove this line item from future invoices. You'll need to include it if required manually.

Tags

Read also

Import Invoices into QuickBooks Online: Step-by-Step Guide

Import Bills into QuickBooks Online - Complete Guide

How to Manage Sales Tax in QuickBooks Online: A Complete Guide

Import Transactions with Sales Tax for U.S QuickBooks Online Companies