A Comprehensive Guide to Handling Month-End Accruals in QuickBooks

Do you want to keep your business accounting accurate and compliant? If so, you must know how to add month-end accruals in QuickBooks. Month-end accruals are expenses or revenues you have incurred or earned in a month but haven’t paid or received yet. Adding them to QuickBooks ensures that your financial statements reflect your financial condition and follow the generally accepted accounting principles (GAAP).

Contents

What Are Month-End Accruals, and Why Are They Important?

How to Add Month-End Accruals in QuickBooks?

How to reverse month-end accruals in QuickBooks?

What Are Month-End Accruals, and Why Are They Important?

Accruals are accounting methods that record revenues and expenses when earned or incurred, regardless of when the cash exchange happened. This method provides a more accurate view of a company’s financial health by matching the revenues and expenses to the period they relate to.

Month-end accruals are expenses or revenues you have incurred or earned in a month but haven’t paid or received yet. For example, if you provided a service to a customer in January but they will pay you in February, you have an accrued revenue of the amount they owe you. Similarly, if you received an invoice for a utility bill in January but will pay it in February, you have an accrued expense of the amount you owe.

Month-end accruals are vital because they help you record your financial transactions in the period they occur rather than when the cash exchange happened. It will give you a more accurate picture of your business performance and financial health. Accrual accounting also helps you comply with the GAAP, the rules and standards governing financial reporting.

How to Add Month-End Accruals in QuickBooks?

QuickBooks is a popular accounting software allowing you to add month-end accruals easily. The process involves creating journal entries for each accrual and posting them to the appropriate accounts. Here are the steps to follow:

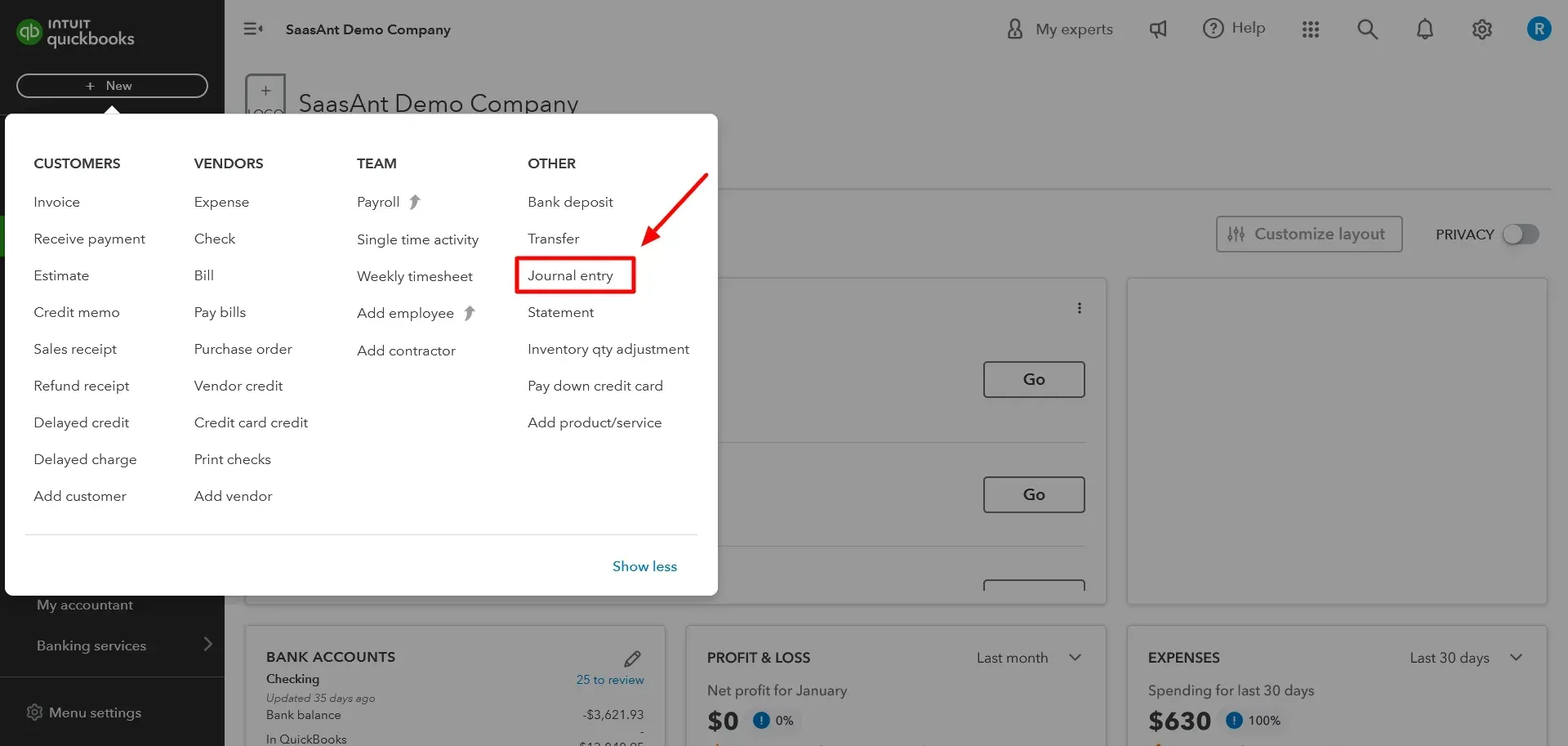

Click the ‘+ New’ button at the top left corner of the screen. It will open a menu with different options for creating transactions.

Click on ‘Journal entry’ under Other. It will open a form where you can enter the details of your journal entry.

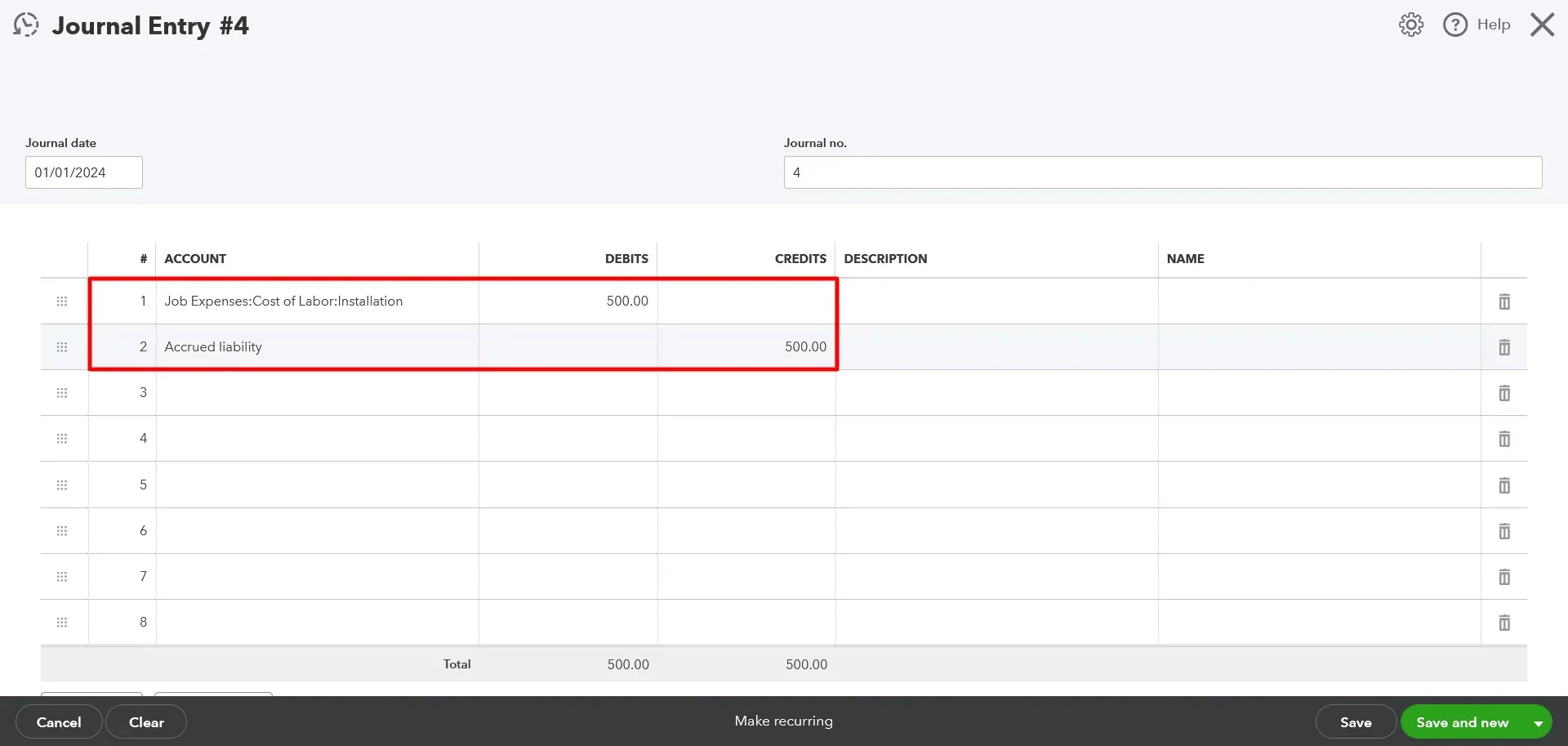

Enter the date and entry number for the journal entry. The date should be the last day of the month you record the accruals. The entry number should be sequential and unique for each journal entry.

Select the expense account for the accrual in the Account column on the first line. For example, select ‘Utilities Expense’ if you have an accrued utility bill.

Enter the accrual amount in the Debit column on the same line. For example, if your utility bill is $100, enter 100.

Select the Accrued Liabilities account in the Account column on the second line. This liability account tracks the amounts you owe but hasn’t paid yet. If you don’t have one, you can create one by clicking ‘Add New’ and choosing Other Current Liabilities as the account type.

Enter the same accrual amount in the Credit column on the same line. For example, enter 100.

Optionally, you can enter a description or memo for the journal entry in the Description or Memo fields. It can help you identify and explain the purpose of the journal entry later.

Click on ‘Save and close.’

You have successfully added a month-end accrual in QuickBooks. You can repeat these steps for each accrual you need to record.

How to reverse month-end accruals in QuickBooks?

When you receive or pay the amount, the next action step is to reverse the accruals created earlier in QuickBooks. It means you create a new journal entry that cancels the original one. This way, you avoid double-counting the revenue or expense in both periods. Here are the detailed instructions for reversing accruals in QuickBooks:

Click the ‘+ New’ button at the top left corner of the screen.

Click on Journal entry under Other.

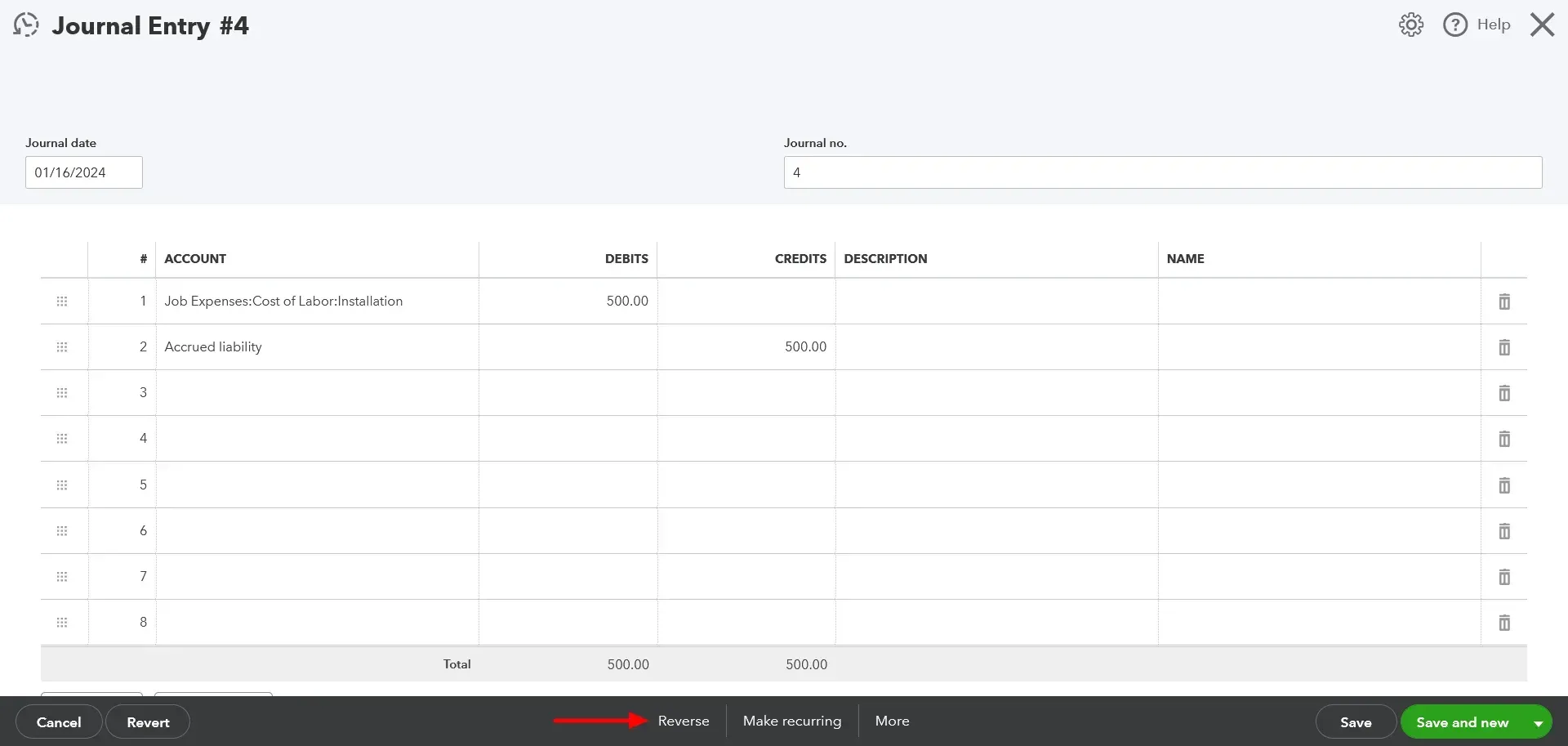

Find the journal entry you created for the accrual in the previous period. You can use the Journal no., Date, or Description fields to search for it.

Change the date to the first day of the current period. For example, if you created the accrual journal entry on January 31st, change the date to February 1st.

Click ‘Reverse’ at the bottom of the Journal Entry window. It will automatically swap the debits and credits of the original journal entry.

Click on ‘Save and close.’

You have successfully reversed an accrual in QuickBooks. You can repeat these steps for each accrual you need to reverse.

Common Types of Month-End Accruals

Accrued Expenses: Expenses incurred but still need to be paid. Examples:

Salaries and wages

Rent

Interest on loans

Utilities

Accrued Revenue: Revenue earned but has yet to be received or invoiced. Examples:

Services rendered but not yet billed

Interest earned on investments

Sales commissions earned but not yet paid

Tips for Identifying Month-End Accruals

Review Recurring Expenses: Examine your regular bills and invoices. Are any due for payment shortly after the month's end?

Check Contracts and Agreements: Look for agreements that outline payments or services that span month-ends.

Consult your Accountant: They can help identify potential accruals or clarify specific scenarios.

The Importance of Reversing Accruals

Avoid Double Counting: Reversing accruals ensures the recording of income and expenses only when received or paid.

Accurate Financial Reporting: Improves the reliability of income statements and balance sheets over time.

Automating Accruals in QuickBooks

Recurring Journal Entries: Explore this feature in QuickBooks to streamline the process for regular accruals.

Third-Party Apps: Consider apps like SaasAnt that integrate with QuickBooks and can automate some entries.