Decoding QuickBooks Invoice Fees: What You Need to Know to Save Money

user

author

QuickBooks is a lifesaver for small businesses needing to manage invoices and payments efficiently. But like most platforms, QuickBooks comes with fees. Understanding these fees is key to making smart financial decisions for your business. This article breaks down the fees associated with QuickBooks invoicing and equips you with strategies to minimize costs.

QuickBooks Invoice Fees: Two Main Categories

Transaction Fees: These are charged by QuickBooks Payments, the platform's integrated payment processing service, each time a customer pays an invoice online.

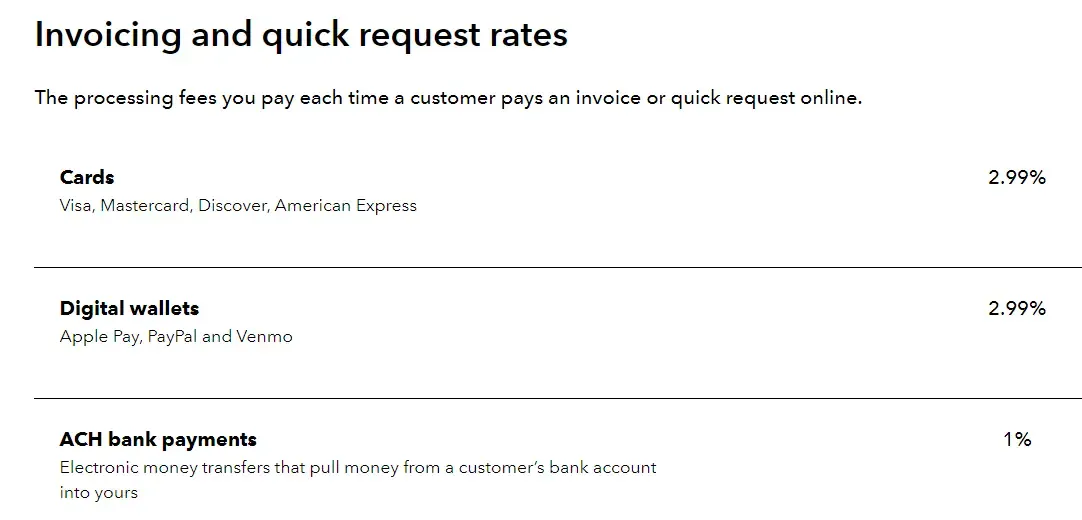

Credit/Debit Cards & Digital Wallets: A 2.99% fee applies to payments made via Visa, Mastercard, Discover, American Express, Apple Pay, PayPal, and Venmo.

ACH Bank Transfers: A 1% fee (with a $1 minimum) is charged for payments made directly from a customer’s bank account.

Monthly Subscription Fees: These cover the core QuickBooks software and its features, including invoicing. Prices as of June 2024 are:

Self-Employed: $15

Simple Start: $30

Essentials: $55

Plus: $85

Advanced: $200

Important: Subscription fees do not include transaction fees. Always factor in both when calculating your total QuickBooks invoicing expenses.

FAQ: Common Questions About QuickBooks Invoice Fees

Here are answers to some frequently asked questions about QuickBooks invoice fees:

Does QuickBooks Charge Fees for Invoices?

Yes, QuickBooks charges fees for processing invoice payments through its QuickBooks Payments platform. These fees consist of transaction fees (a percentage of each payment) and monthly subscription fees for using the QuickBooks software.

How to Avoid QuickBooks Payment Fees?

While you can't completely avoid fees for using QuickBooks and its payment processing features, you can minimize them:

Manually Record Payments: Accept payments outside of QuickBooks (cash, checks, external processors) and manually enter the details into your QuickBooks account.

Use Alternative Payment Processors: Research other payment processors that may offer lower fees, particularly for ACH bank transfers.

Negotiate with QuickBooks: High-volume businesses might be eligible for discounted transaction fees from QuickBooks Payments.

Smart Strategies to Minimize QuickBooks Invoice Fees

1. Manually Record Payments: Process payments outside of QuickBooks, but diligently enter the payment details into QuickBooks to maintain accurate financial records.

2. Explore Alternative Payment Processors: Compare pricing from different payment processors, especially for ACH bank transfers, where some offer lower fees or even free transactions for B2B payments.

3. Negotiate with QuickBooks: If you process a high volume of transactions, contact QuickBooks directly to inquire about volume discounts or custom pricing plans.

4. Maintain an Up-to-Date Account: Regularly review and update your QuickBooks account information to avoid potential discrepancies or late fees.

5. Be Mindful of Third-Party Processors: Integrating with third-party payment processors within QuickBooks might lead to additional fees from both QuickBooks and the third-party provider.

Making Informed Decisions for Your Business

The best approach to QuickBooks fees depends on your business needs and priorities:

Convenience vs. Cost Savings: QuickBooks Payments offers seamless integration and streamlined accounting, but manual recording of payments, while more time-consuming, can save on fees.

Transaction Volume: Businesses with many online transactions might benefit from negotiating lower rates with QuickBooks or exploring alternative processors.

Payment Preferences: Consider how your customers prefer to pay. If they primarily use credit cards, QuickBooks Payments offers a convenient solution.

Stay Informed: QuickBooks' pricing and features can change. Regularly check their website or contact customer support for the latest fees and potential cost-saving options.

Simplify Your Invoicing with SaasAnt Transactions

Beyond managing QuickBooks fees, you can streamline your entire invoicing process by using SaasAnt Transactions. This powerful tool allows you to import invoices from various sources directly into QuickBooks, eliminating manual data entry and reducing the risk of errors. By automating this crucial step, you can free up time to focus on growing your business while ensuring your financial records are accurate and up-to-date.

By understanding the nuances of QuickBooks invoicing fees and implementing these strategies, you can optimize your business finances, enhance your bottom line, and streamline your accounting processes for greater efficiency.

You can check out this guide import invoices into QuickBooks, for a seamless import of bulk invoices into QuickBooks.

Read also

Import Invoices into QuickBooks Online: Step-by-Step Guide

PDF Invoices Importation into QuickBooks Online: Step-by-Step Guide

How to Create an Invoice in QuickBooks Online

How to Import Invoices into QuickBooks Enterprise?

How to import Sales Invoices into QuickBooks Online?