Accounting Automation: What Is It & how will It Impact Small Business?

Automation is a trending topic in contemporary times. Automated cars, computerized cashiers in grocery stores, parcel delivery by robots are examples of the application of automation.

But, the next thing that may come into your mind must be, "will accounting be automated”? Well, it is indeed automated. Technology is rapidly making people more productive and efficient than ever before.

Is it all about bringing a change in an accountant's life only? Well, the answer is no. Automation in accounting can help small business owners and accounting professionals to manage their accounting process more efficiently.

The scope of manual data entry or managing ledger books is automated. So, a small business owner can easily develop the business instead of managing the credit and debit part.

Accounting automation has made it possible by offering an end-to-end solution for businesses. As a result, business owners are gradually zeroing in on the accounting automation system from large to small enterprises.

Accounting automation aims to manage the accounting process by reducing scopes of manual calculations to understand the finance of your organization.

According to a report, 59% of organizations use an automated accounting system to use their employees in some other tasks.

This article will talk about the accounting automation system and how it will add value to your business. So get ready to explore various aspects of accounting automation. You will learn how the deployment of this system can make your life smoother, faster and better.

Contents

What is Accounting Automation

Accounting Process Vs. Robotic Process Automation (RPA)

Why Accounting Automation is on the Rise?

The List of Accounting Tasks you Can Automate

Key Factors to Consider before Selecting Accounting Application for SME

The Impact of COVID-19 on Account Process Automation

Benefits of Accounting Automation

The List of Accounting Automation Software

The Secret of Successful Accounting Automation

Automation: The Ultimate Solutions for Business Growth

Wrapping Up

What is Accounting Automation

There are many articles doing rounds virtually that speak about how this accounting automation can be proven deadly for CPAs. Now, let us understand what this accounting automation process is. Simply put, accounting automation finds out the most manual element of an accountant's workday and automates the same.

This computerized accounting software does transaction tracking and number crunching, saving time and manual effort.

Gone are those days when CPAs had to build complex ledger files and enter countless rows of data. You can create a report within a minute with the help of a few clicks. All the fundamental formulae are built-in.

The primary purpose is to simplify this complex accounting process by switching to Automation.

Do you know that we have had different forms of accounting automation since the late 1800s? Of late, the tools and platforms have become entirely automatic for providing an end-to-end accounting solution.

In the modern era, accounting automation removes the scope of monotonous responsibilities. This process gives more time for analysis, human interaction, and strategy.

AI in the finance field strives to streamline the overall business operation by automating the accounting process. As a result, it will help to grow a business and generate more revenues by minimizing human involvement.

Accounting Process Vs. Robotic Process Automation (RPA)

Present-day accounting has reached beyond the stage when the application of chatbots becomes a must for accountants. Robotic Process Automation (RPA) can do wonders for small businesses.

Suppose you constantly make the same series of clicks; you can easily automate the process by switching to RPA. It efficiently saves your time and increases your overall productivity.

Automate your Current System

Most accounting software provides room for a bit of Automation, so be wise enough to pick the quick win at first. So, use your built-in accounting software capabilities optimally to automate your existing accounting system.

You must be thinking about how to begin with this automation process? Try automating your invoice system using the recurring invoice feature built into accounting software. Once you automate your accounting process, you can start analyzing the process.

Appoint an RPA Manager

Designate or appoint an RPA manager who will be responsible for the RPA management of your organization. RPA should be considered in a specific and linear way to be successful. Therefore, it is better to document each step in the process.

Restructure your Accounting Process

Sometimes, your current accounting process will not be automatable. A few owners and managers are a bit reluctant to understand the worth of accounting automation. Some of them even hesitate to automate their product to make it futuristic.

They can only get rid of their doubts and understand the worth of accounting automation is to read use cases. The final goal is to reduce the amount of time and finance a business spends on accounting.

So, those who are all not sure about going for accounting automation can take time. Ultimately, you need to get ready for selecting an automated accounting process to survive.

Document the Automation Process

Small businesses face a huge problem when it comes to documentation. This process allows a small business to be adaptive and agile in most cases. This documentation process lets people identify tasks that can be automated.

Moreover, without documentation, you can lose much productivity. Without documentation, the work process cannot be streamlined. So, new joiners will find it challenging to pick up the designated tasks where the outgoing employee left off.

Successful Implementation

Now comes the most crucial point of successfully implementing your accounting automation strategy. Implementation is always the most critical part for small businesses. You need to think carefully or else all your efforts will be vain.

Learning a new technology is always exciting, but implementing the same can be an uphill task. There will be failures and stumbling blocks along the way, but the benefits cannot be ignored.

Why Accounting Automation is on the Rise?

You must have learnt that the rise of accounting automation is nothing less than a revolution in the finance field. Futuristic technologies like artificial intelligence (AI), robotic process automation (RPA) and machine learning (ML) promise to transform the sector.

This accounting automation is a boon for SME owners and accounting professionals both.

Growth in fintech enhances various aspects of business accounting. Current benefits consist of fast access to valuable data for decision making, real-time cloud access, and automated data entry.

The scope of accounting automation is much beyond traditional accounting functions. Core accounting automation focuses on central tasks like:

Accounts payable

Accounts Receivable

Ledger Management

Invoice Management

There are a few ways in which anyone can deploy accounting functions for the ultimate business growth.

1) Scheduled Automation

This process ensures that you do not need to repeat the same process and get your job done within time. That means your accounting never falls behind for your customer.

This scheduled automation process reflects new changes to the billing or revenue cycles.

2) Event Automation

Traditional accounting is now getting more streamlined. Thanks to the application of accounting automation can completely automate the process of manual and repetitive data entries through event automation.

3) Batch Automation

Batch processing or batch automation is an automation process in which the system finishes batches of jobs at a go. In the old method, each task used to get finished manually and individually.

Accounting automation is diversified and equally effective for business owners, accounting professionals, or anyone associated with the Fintech domain. Accounting automation offers automated internal controls vital for compliance, data accuracy, and security.

The List of Accounting Tasks you Can Automate

The application of automated accounting systems has an enormous effect in the accounting field. SMEs are enjoying the benefits of Automation in all areas. This article focuses on accounting automation. Know more about the list of tasks before thinking about how will accounting be automated?

So, how should you start your journey of accounting automation?

Here is a list of tasks that can easily be automated and begin with the computerized accounting system

Accounts Receivable

Accounts Payable

Bank Reconciliation

Expense Management

Tax Compliance and Financial Reporting

Payroll

When to Apply Automation of accounting process

This may seem a bit confusing for a business owner or anyone new to accounting automation.

The aim behind opting for the accounting process is to stop repetition of the same works. Accounting automation is the best solution for areas where you can reduce the time by reducing the scope of repetitive work.

Expense Management

Imagine, you need to run after employees to collect receipts! This is high time you can save your time and effort by reducing paper receipts and tracking spending.

Automating expense management can help you in various ways. Creating an easy approval process, simplifying the portal's receipt upload process- are part of expense management.

Ways to automate the task

Select the best accounts payable automation solutions that cater to your business needs

You are minimizing the need for manual data entry to handle your money-related matters by yourself.

Explore and try out all automated accounting software by yourself. As a business owner, and no one knows your mission and vision better than you

Payroll Management

The most tedious yet most crucial part of any business is payroll management. Being a business owner,, you can understand that these automatable parts of bookkeeping keeps track of employee’s attendance and taxation.

to keep track of employees' working hours and income tax management are pretty draining.

Payroll Automating can help you in many ways:

Disbursing paychecks with a click

Inputting data to the accounting system

Calculating the net pay for each employee

How to Automate this task?

Some accounts payable automation solutions have built-in payroll automation tools. Those who are already running a business should always check whether their existing accounting software provides a payroll option or not.

We will always suggest that those who are going to start their business must apply accounts payable automation. They can select software that automates the payroll management.

Bank Reconciliation

Reconciliation is an integral part of accounting. It helps to match your accounting records with bank account statements. As a result, you can quickly find out if everything is okay or not! Anyone can easily spot errors and correct them quickly.

Like many other tasks, this task can easily be automated with the help of automated accounting software.

This automating bank reconciliation allows you to match your books and bank statements. Check any missing or double inputs, solve problems in cash records, and find out fraud by conducting periodic reconciliations.

How to Automate the Task?

Banking reconciliation is given as a primary feature in most automated accounting software. It helps you get transaction details from your accounts and NPCI to banks. In addition, this process allows you to generate bank reconciliation reports automatically.

Accounts Receivable

Accounts Receivable is probably the lifeline of small and medium-sized businesses. Every business owner can relate how it can directly affect your revenue generation.

This work can easily be automated. Please update yourself with the basic knowledge of accounting before starting your work.

Accounts receivable includes generating and tracking invoices collaborating with multiple finances, customer service, and sales teams.

Now, you must consider why this crucial system should get automated? Because numerous stakeholders' involvement and approval make this process lengthy and tedious for humans to manage efficiently.

Accounts receivable Automation helps you by:

Generating error-free invoices

Getting quick approvals

Reminding customers to send payment on time

How to automate the tasks

Accounting receivable automation offers many accounts receivable tools that can help you get paid faster without putting in any effort. Try to opt for tools that can help you automate your payment system.

Accounts Payable

Account payable (AP) is what you need to pay to others. It can be bills, rent, and so on. Delaying your payments can cost you additional late fees. Any business owner can easily relate to this point.

AP management requires various steps involving multiple business units. This is the primary reason behind implementing accounts payable automation software for SMEs. Modern-era owners are switching to the accounting automation system to enjoy a complete solution.

Automating AP can help you by:

Collecting bills in the principal repository

Automating approval process for invoices

Giving payments to suppliers

Generating auto-matching of deliveries received against bills

Recording transactions for accounts payable automation solutions

How can you Automate the Task?

Accounts Payable can be fully automated within the accounting software. In addition, a few tools can even assist you in gathering information from invoices and fastening up the entire payment system.

Key Factors to Consider before Selecting Accounting Application for SME

Everything is closely associated with accounting automation. From accepting payments from your clients on time to setting up long-term financial planning for your organization.

Finance is the backbone of your business. So, it is important to pay attention to the automated accounting system for your long-term business growth.

Like any other field, AI technology is replacing the traditional bookkeeping method. So, selecting the perfect automated accounting software is the ultimate game-changer. This switch helps you stay at the top of your business niche. Accounting software is designed to take end-to-end responsibility for the accounting of your business.

As a business owner, finding out the perfect automated accounting software for your small enterprise is tough. Unfortunately, each accounting software in the market has something different to offer.

Here are the key factors a business owner should consider before selecting the best software for accounting automation.

Always go for cloud-based accounting software that offers you many benefits like security and user-friendliness.

Choose the best-automated accounting software as per your business needs. A business owner needs to get the hang of the software thoroughly.

Focus on your allocated budget while picking the best accounting software. There are plenty of automated accounting solutions that are feature-rich yet affordable.

Features are add-ons but not an absolute necessity, but they are worth considering while finding the best-automated accounting software. Think about the bonuses you can get from each accounting application before selecting the best one for your concern.

Consult with an experienced accountant professional and take their opinions before finalizing the best-automated accounting software.

If you need a POS, make sure the accounting software you select should align with other aspects of your enterprise.

The Impact of COVID-19 on Account Process Automation

The global COVID-19 pandemic severely disturbed the way all organizations used to operate. Most of the small to medium-sized enterprises could not manage the tremendous loss they have faced due to the pandemic.

They have been forced to begin with disaster recovery programs to run their businesses. The most discussed topic, accounting will be automated, becomes the need of the hour! Remote work seemed difficult for many of them as they were not equipped with automated programs. Any business owner can understand the primary step of online business operations is accounting automation.

According to a survey, 45% of SME owners have stopped asking the evergreen question: will accounting be automated? Around 19% of the accountants described the influence of accounting automation in business growth.

Even if all the employees work remotely, that does not mean the accounting or finance cannot perform properly. This miracle has happened because of the implementation of an automated accounting system.

Business owners must acknowledge that financial data is critical for making business decisions. One thing business owners will agree on is that data helps to make businesses budget friendly.

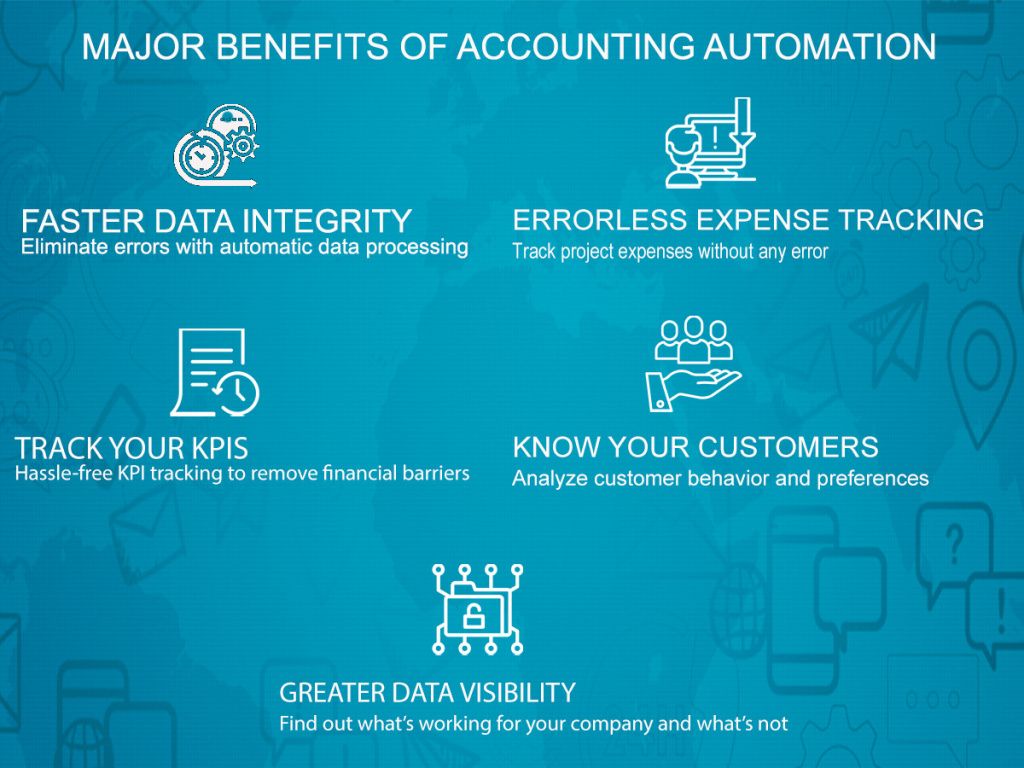

Benefits of Accounting Automation

Accounting is one of the first business processes that got automated to save time from manual entry. All businesses, small to medium-sized enterprises, reap the benefits of this accounting automation.

Here is an gist of the benefits of the Automation of the accounting process-

Financial processing gets faster and better.

It is easy to analyze and acquire the relevant data and use it in critical moments.

Time and expense tracking of projects in real-time.

Errorless accounting process to get the job done in time

Streamlined accounting process

Accounting automation eliminates uncertainties for ROI.

Easy tracking of KPIs and financial roadblocks

Accounting automation allows more effective and more accessible methods of monitoring fund related data

Financial issues and questions can be resolved quickly

Customer behavior and preferences can be identified easily

Regulations and compliance rules can be easily managed

The benefits of accounting automation are not limited to offering secure data or managing finance properly. The application of automated accounting software ensures that the entire business process runs smoothly. It is all about making a profit by switching to Automation. Deployment of computerized accounting software can be the first step towards Automation.

The List of Accounting Automation Software

Small to medium-sized business owners benefit from the automated accounting software. It helps them track accounts receivable and payable. These types of softwares give a crystal clear understanding of their revenue generation, and get ready for the tax filing process.

In the world of accounting software, a small business must use accounting software for end-to-end finance solutions. The main advantage of switching to Automation of accounting processes is that accounting software does not require extensive changes.

However, as a business grows, its accounting needs become more complex, and a custom enterprise resource planning system is needed.

There is a plethora of automated accounting software available for small businesses. The pricing and features depend upon the one you will select for your enterprise.

Small business owners choose the perfect accounting software based on the type of business and number of employees they have.

The Secret of Successful Accounting Automation

Use your automated accounting software to perform your regular business operations. Here are the quick and useful tips to manage and grow your business. Let’s take a quick look at the secrets of successful accounting automation.

Record each transaction

Check and reconcile regularly.

Keep track of the cash flow both incoming and outgoing regularly

Gather required tax-related information

Keep ledger entries updated

Cross-check the ledger book

Prepare reports regularly

Consult with a financial advisor as required

Keep receipts and invoices (records) properly

File IT returns on time

Monitor your business cash flow

Have an internal audit regularly

Never mix your personal and business accounts

So, now you have a far enough understanding of why your business finances require Automation must be clear. Automated accounting software saves time, avoids duplicate manual errors, and keeps business documents at your fingertips.

Let's have a look at the list of key factors how automation helps SMEs to grow their business

Automation: The Ultimate Solutions for Business Growth

Automate accounting tasks like bookkeeping, payroll, purchase order for generating more revenues

Automate your taxation related accounts and records under the federal taxation system

Automate your data to pay tax falls under state and local taxation scheme

Automatically verify data to maintain the quality and keep an eye on the redundancy

Deploy an automated accounting software to keep track of your financial modeling and business planning. It allows you to understand what’s adding value to your business process.

Select software that offers more accounting automation features and capabilities

A business owner can focus more time on other aspects of your business right after opting for the accounting automation

Switching to accounting automation helps a business owner to save the cost of appointing an accountant to keep track of finances

Wrapping Up

Technology allows business owners to manage their enterprises end-to-end properly. As a result of automation, the business now has an easy way to perform better data analysis and reporting.

Ideal accounting platforms allow entrepreneurs to watch the overall business performance. Opting for an automated accounting system can help you improve your business and be the best among the rest.

Automation enables you to keep abreast of your business techniques. You can quickly get your fingertips on the pulse of your business with the help of an automated accounting system. Deployment of accounting automation for SMEs to meet the ever-changing demands in the marketplace.

Any business owner wants to opt for the practical solution offered by accounting automation in the present era. This is the primary reason why this accounting automation has become so important for organizations to incorporate it into their process.

Integrating this modern technology into the business process allows businesses to stay updated with the latest trends. Still, at the same time, it will enable them to scale up the business and serve their clients better.

Small businesses always look for an affordable and efficient solution to increase their profitability and business growth. Accounting automation seems to be the most potent answer to address their challenges and help them to grow their business.

Switch to accounting automation and see the growth of your business.