Accounts Payable vs Accounts Receivable: Key Differences

Both accounts payable and accounts receivable help you manage your financial stability. Although they are often confused, they are total opposites. Accounts Receivable (AR) represents the money owed to your business by customers, while Accounts Payable (AP) signifies the money your company owes to suppliers. In the balance sheet, Accounts Receivable are represented as an asset account, and Accounts Payable are defined as a liability account.

Both accounts payable and accounts receivable help you manage your financial stability. Although they are often confused, they are total opposites. Accounts Receivable (AR) represents the money owed to your business by customers, while Accounts Payable (AP) signifies the money your company owes to suppliers. In the balance sheet, Accounts Receivable are represented as an asset account, and Accounts Payable are defined as a liability account.

This blog will walk you through everything you need about accounts payable vs. accounts receivable.

Key Takeaways

Accounts Payable (AP): Money your business owes to suppliers or creditors, recorded as a current liability.

Accounts Receivable (AR): Money customers owe your business for goods or services, recorded as a current asset.

Impact on Cash Flow: AP reduces cash flow, while AR increases it.

Importance: Proper management of both AP and AR is crucial for maintaining a steady cash flow, enhancing profitability, and ensuring financial stability.

Contents

What is Accounts Payable?

What is Accounts Receivable?

What Is the Difference between Accounts Payable and Accounts Receivable?

Importance of Managing Accounts Receivable and Accounts Payable

Best Practices for Managing Accounts Payable

Best Practices for Managing Accounts Receivable

How Accounts Payable and Accounts Receivable Affect Cash Flow

Common Challenges and Solutions

Integrating Accounts Payable and Accounts Receivable Processes

Wrapping Up

FAQ

What is Accounts Payable?

Accounts Payable (AP) refers to a business's obligation to pay off its short-term debts to third-party suppliers or creditors. It represents the outflow of money and is mentioned as a current liability on the balance sheet.

Example: A company purchases office supplies worth $1,000 on credit. This $1,000 is accounts payable, representing the company's obligation to pay the supplier within a specified period.

The primary role of accounts payable in business accounting is to ensure that all debts to third parties are tracked and managed correctly. Accounts Payable (AP) also helps plan and manage cash outflow and maintain liquidity.

What is Accounts Receivable?

Accounts Receivable (AR) represents the amount of money customers owe a business for goods or services provided on credit. These amounts are considered current assets on the balance sheet because they are expected to be converted into cash within a short period, typically under terms such as "net 30." The role of AR is crucial as it signifies the inflow of money from third parties, contributing to the company's liquidity and financial health. Also, you could use dunning, a process used to collect overdue accounts receivable, ensuring timely payment and maintaining cash flow.

Example:

A software company sells a $5,000 software license to a client with payment terms of net 30 days. Until the client pays the invoice, the $5,000 is recorded as accounts receivable, indicating the amount the customers owe the company. This amount is expected to be an inflow of cash within the specified period.

The primary role of accounts receivable in business accounting is tracking inflows from third parties and ensuring that the business has enough liquidity. Accounts receivable also helps manage credit terms and conditions, ensuring timely collection of payments through dunning and other methods.

What Is the Difference between Accounts Payable and Accounts Receivable?

Comparison Table

Aspect | Accounts Payable (AP) | Accounts Receivable (AR) |

Definition | Money that a business owes to suppliers or creditors | Money that customers owe to the business |

Classification | Current Liability | Current Asset |

Role | Represents an obligation to pay debts | Represents an inflow of cash |

Nature of Transactions | Outflow of funds to third parties | Inflow of funds from third parties |

Purpose | To track and manage debts owed by the business | To track and manage debts owed to the business |

Example | Business owes $5,000 to a supplier for inventory received | The customer owes $3,000 for services rendered |

Impact on Cash Flow | Reduces cash flow | Increases cash flow |

Management | Ensures timely payments to maintain good supplier relationships | Ensures timely collection to maintain cash flow |

Process | Involves reviewing invoices and making payments | Involves invoicing customers and managing collections |

Dunning | Not applicable | Involves dunning for overdue payments |

Accounting Entry | Credit | Debit |

Balance Sheet Impact | Decreases equity when paid | Increases equity when collected |

Impact on Financial Statements | Recorded as a liability, affects net income due to interest on late payments. | Recorded as an asset, increases revenue when collected. |

Impact on Financial Statements:

Accounts Payable: Appears under liabilities on the balance sheet and can affect the income statement if interest or late fees are incurred. Impacts cash flow negatively.

Accounts Receivable: Appears under assets on the balance sheet and directly contributes to revenue on the income statement upon collection. Impacts cash flow positively.

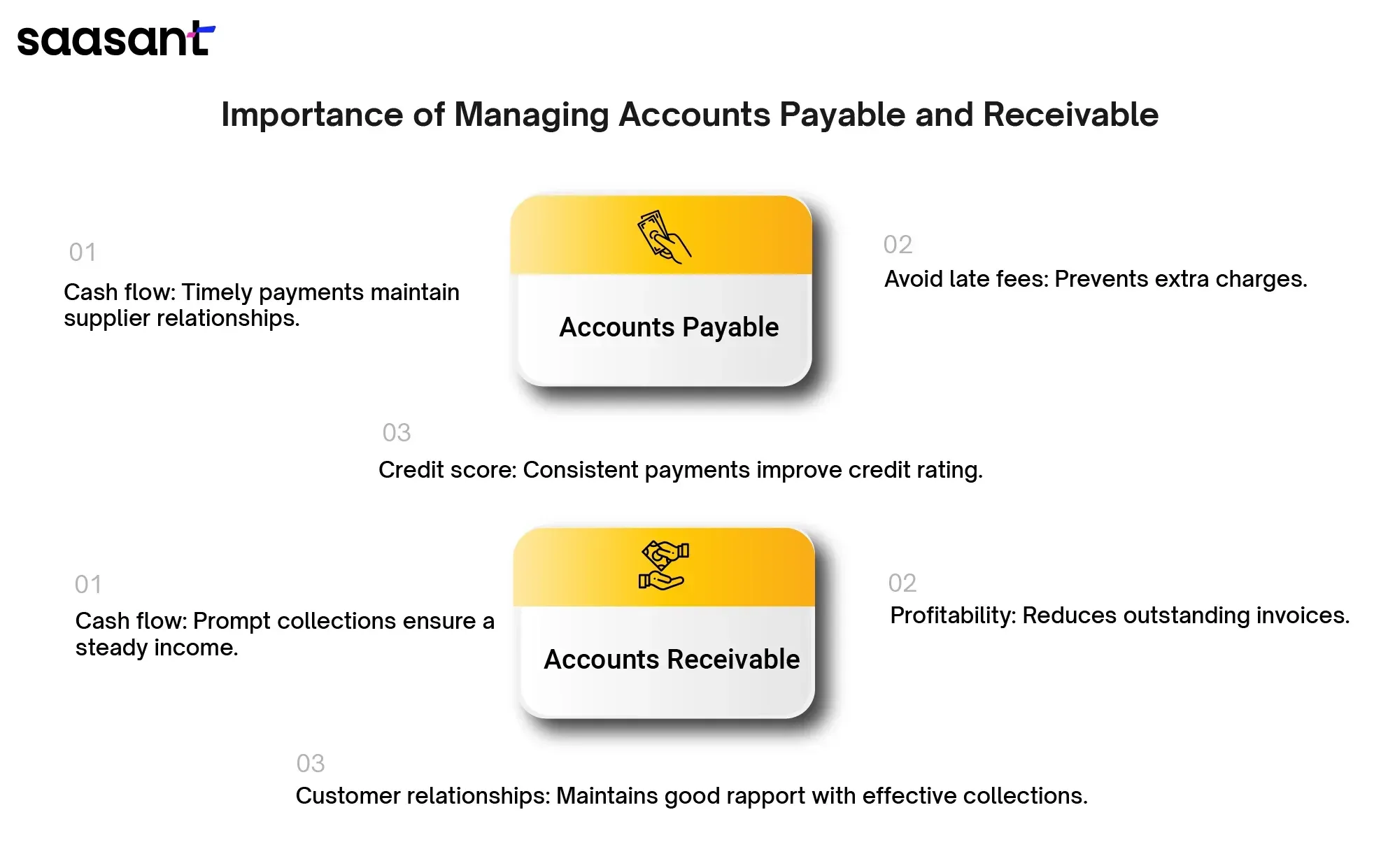

Importance of Managing Accounts Receivable and Accounts Payable

Accounts Payable

Cash flow management: Paying bills on time helps maintain a good supplier relationship, leading to better deals and discounts.

Avoiding late fees: Paying bills late can incur additional charges, impacting your profit margins.

Credit score: Consistent payments can improve your business's credit score, making it easier to borrow money in the future.

Accounts Receivable

Cash flow: Collecting payments ensures a steady income stream for your business.

Profitability: Outstanding invoices reduce your available cash, impacting your ability to pay bills and grow.

Customer relationships: Effective collection practices maintain good customer relationships.

How Effective Management Impacts Business Health

Managing accounts payable and receivable effectively maintains your business’s health. Here's why it matters:

More robust Cash Flow: When you manage your accounts well, money flows in and out steadily, keeping your business from running out of cash at critical moments.

Improved Profitability: By taking advantage of early payment discounts and reducing bad debts, your profit margins can see a healthy boost.

Enhanced Financial Planning: With accurate, up-to-date info on what you owe and what's owed to you, you can create reliable financial forecasts and budgets.

Better Creditworthiness: A solid track record in managing accounts payable and accounts receivable can improve your business's credit score, making it easier to secure loans and financing.

Risk Mitigation: Effective management helps you spot issues early, like slow-paying customers, so you can take action before they become more significant problems.

Best Practices for Managing Accounts Payable

Timely Invoice Processing

Always process invoices promptly to keep your cash flow and supplier relationships healthy. If you delay, you might face late fees, strained relationships, and cash flow problems.

Maintaining Accurate Records

Accurate records are crucial for financial reporting, audits, and managing cash flow. A solid system to track and organize invoices, payments, and related documents is also essential.

Leveraging Technology

Accounting software like QuickBooks and Xero makes recording invoices, payments, and reconciliations easier. Platforms like Saasant Transactions simplify data upload, automating manual tasks and improving accuracy. This shift towards automation frees time for financial teams to focus on strategic analysis and decision-making, ultimately boosting efficiency and financial health. You can try SaasAnt Transactions free for 30 days.

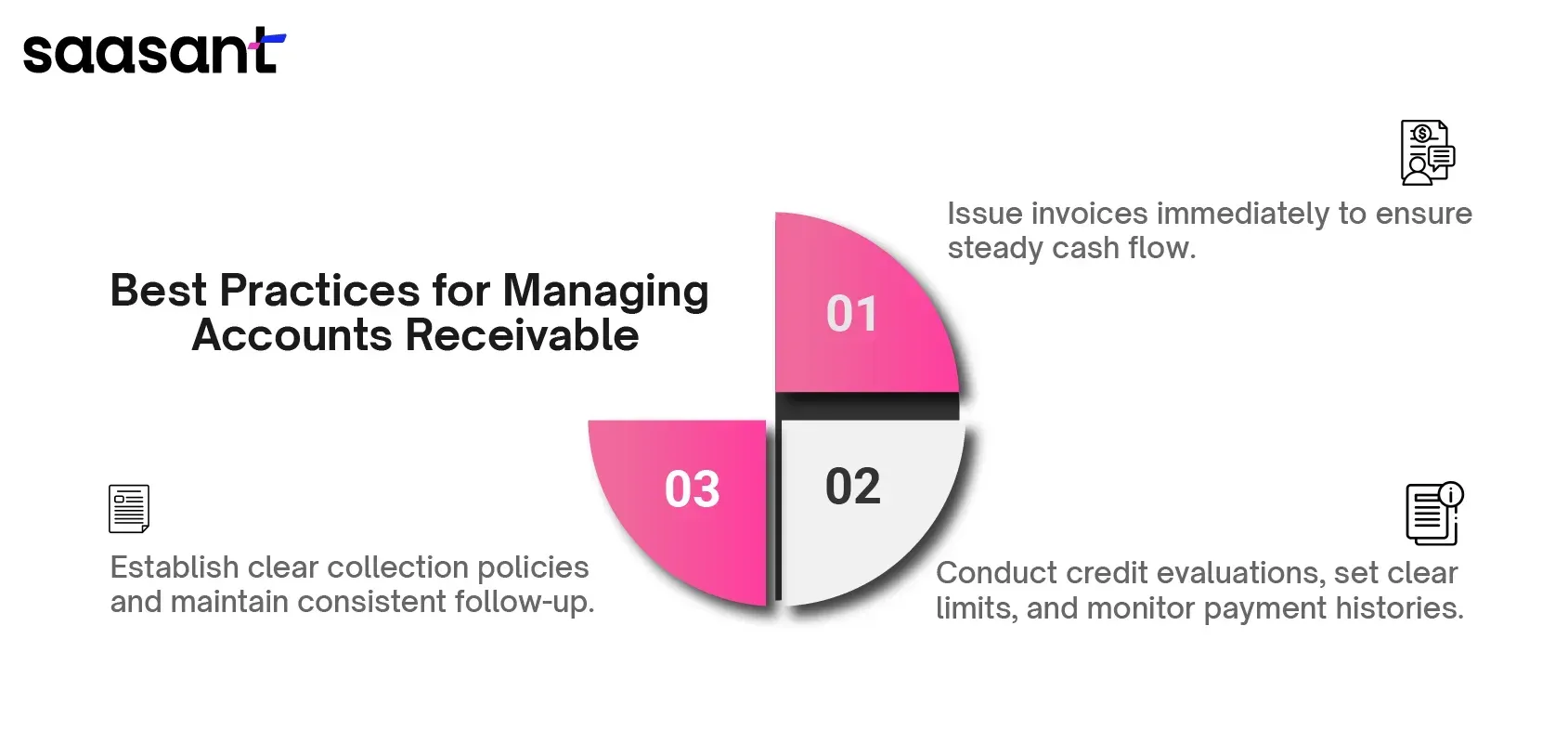

Best Practices for Managing Accounts Receivable

Invoicing Promptly and Accurately

Generating invoices promptly and accurately is the cornerstone of effective accounts receivable management—issue invoices when goods or services are delivered to keep your cash flow steady. Minimizing errors ensures regular cash flow and helps avoid disputes and delays in payment.

Credit Management

A robust credit management system is essential to reducing the risk of bad debts. Thorough credit evaluations, clear credit limits, and regular monitoring of customer payment histories are essential. These steps help identify potential risks early and manage credit efficiently.

Collections and Follow-Up

An organized collections process is crucial for recovering outstanding payments. Establish clear collection policies, use efficient communication channels, and take decisive action on overdue accounts. This helps maximize collections and minimize the impact of bad debt on your business. Regular follow-ups and consistent communication are essential to ensure timely customer payments. You can effectively track outstanding invoices and customer payment histories by maintaining detailed records in your ledger.

How Accounts Payable and Accounts Receivable Affect Cash Flow

Regarding your business's cash flow, accounts payable and receivable play crucial roles.

Accounts Payable and Cash Flow

Positive Impact: You can temporarily increase your cash on hand by delaying payments to your suppliers. This strategy, known as "stretching payables," gives you a buffer period to meet other financial obligations.

Negative Impact: Relying too much on credit can harm your supplier relationships, potentially leading to penalties or supply disruptions. If you can pay your bills on time, your creditworthiness may improve.

Accounts Receivable (AR) and Cash Flow

Positive Impact: Efficiently collecting customer payments boosts your cash inflow and improves liquidity. Faster collection times shorten your operating cycle, allowing for quicker reinvestment of funds.

Negative Impact: Slow-paying customers or bad debts can severely strain your cash flow. A high level of outstanding invoices can limit your ability to meet financial obligations.

Common Challenges and Solutions

Accounts Payable Challenges

You might need help managing accounts payable effectively.

Invoice processing delays: Slow invoice processing can lead to late payments, damaged supplier relationships, and cash flow issues.

Solution: Use automated invoice processing, set up clear approval workflows, and prioritize invoices based on payment terms.

Payment errors: Making incorrect or late payments can harm your supplier relationships and incur penalties.

Solution: Ensure rigorous data entry checks, use three-way matching and implement automated payment systems.

Vendor disputes: Disagreements over invoice amounts or terms can delay payments and create friction.

Solution: Establish clear communication with vendors, promptly address discrepancies, and document all interactions.

Fraud: Accounts payables are a common target for fraudulent activities.

Solution: Implement internal solid controls, regularly review vendor information, and use fraud prevention tools.

Accounts Receivable Challenges

Managing accounts receivables effectively means overcoming several obstacles.

Slow payment: Delayed customer payments can negatively impact your cash flow and profitability.

Solution: Offer early payment discounts, enforce strict credit policies, and use efficient collection strategies.

Bad debts: Unrecoverable debts can erode your revenue and profitability.

Solution: Conduct thorough credit checks, set clear limits, and employ effective collection efforts.

Discount abuse: Customers who take advantage of early payment discounts without honoring the terms can reduce your revenue.

Solution: Monitor discount usage, implement strict verification processes, and consider alternative discount structures.

Customer disputes: Disagreements over invoices or services can delay payments and harm customer relationships.

Solution: Provide clear, detailed invoices, maintain excellent customer service, and have a prompt process for resolving disputes.

Integrating Accounts Payable and Accounts Receivable Processes

When you integrate your accounts payables and accounts receivable processes, you can significantly improve your financial management. Connecting these two functions lets you gain valuable insights, enhance efficiency, and optimize cash flow.

Improved Cash Flow Forecasting: By combining data from accounts payable and receivables, you can create more accurate cash flow projections, which can help with better financial planning and decision-making.

Enhanced Efficiency: Automating processes like bulk import and payment reconciliation simplifies operations, reduces manual errors, and saves time.

Better Fraud Prevention: Integrating both processes allows for cross-checking data, which can help identify potential fraudulent activities.

Data-Driven Decision Making: A unified view of accounts payables and receivables provides valuable data for analysis, enabling informed decisions about credit terms, pricing, and discount strategies.

Strengthened Supplier Relationships: By optimizing payment processes, you can improve relationships with suppliers, potentially leading to better terms and discounts.

Wrapping Up

Understanding and managing both accounts payable and accounts receivable is like having two sides of the same coin. They're crucial for keeping your business financially healthy. By implementing our outlined best practices, you can improve your cash flow, reduce risks, and make better business decisions. You can also seek help from applications like SaasAnt Transactions for bulk data upload automation into QuickBooks and Xero and maintain data integrity for perfect accounts payable and receivable records. Remember, it's not just about numbers; it's about running a smoother, more profitable operation. So, take the time to understand these accounts, and you'll be well on your way to financial success!

FAQ

What is the difference between accounts payable and accounts receivable?

Accounts Payable (AP) refers to the money a business owes to its suppliers or creditors, representing an outflow of funds and recorded as a current liability. Accounts Receivable (AR) is the money owed to the business by its customers for goods or services, representing an inflow of funds and recorded as a current asset.

Is accounts receivable a debit or credit?

Accounts Receivable are recorded as debits. They represent the money customers owe to the business for goods or services provided, which is an asset on the balance sheet. Debits increase asset accounts, while credits decrease them.

Is accounts payable a debit or credit?

Accounts Payable are recorded as credits. They represent the money a business owes to suppliers for goods or services received, which is a liability on the balance sheet. Credits increase liability accounts, while debits decrease them.

What is an example of accounts payable?

An example of accounts payable is when a business purchases office supplies worth $1,000 on credit from a supplier. The $1,000 is recorded as accounts payable on the balance sheet, indicating the company's obligation to pay the supplier within the agreed-upon terms.

What is an example of accounts receivable?

An example of accounts receivable is when a company sells a $5,000 software license to a client with payment terms of net 30 days. The $5,000 is recorded as accounts receivable on the balance sheet, indicating the amount the client owes the company and is expected to be received within 30 days.

What are the best practices for managing accounts payable?

Best practices for managing accounts payable include:

Process invoices promptly to avoid late fees.

Maintain accurate records for financial reporting & audits.

Use automated systems for bulk import like SaasAnt Transactions

Establish clear communication with vendors to resolve discrepancies quickly.

What is Accounts Receivable in QuickBooks?

Accounts Receivable in QuickBooks tracks the money your customers owe you for sales made on credit. It's an asset account that QuickBooks manages through invoices and customer payments.

How do I write off Accounts Receivable in QuickBooks?

To write off bad debt in QuickBooks, use a journal entry: debit Bad Debt Expense and credit Accounts Receivable. Then, apply a "Receive Payment" to the uncollectible invoice, linking it to the journal entry to close it. (Alternative methods like credit memos or discounts may be used in older QuickBooks versions).

How do I print an Accounts Receivable report in QuickBooks?

To print an AR Aging report, go to QuickBooks "Reports," find "Accounts Receivable Aging," customize the report's date range and filters, and then select the "Print" icon.

How do I write off Bad Debt Accounts Receivable in QuickBooks?

This is a duplicate question; see "How do I write off Accounts Receivable in QuickBooks?" above. (Using "Bad Debt" in the question clarifies the intent).

QuickBooks says "Please choose a customer when using an accounts receivable account as a line item." Why?

QuickBooks requires a customer selection with Accounts Receivable because AR tracks customer-specific balances. This link ensures accurate reporting of who owes you money. You'll see this prompt in journal entries or direct transaction edits lacking customer assignment.

How do I create a Loan Receivable account in QuickBooks?

To create a Loan Receivable account: go to "Chart of Accounts," click "New," select "Other Current Assets" as the Account Type and "Loan Receivable" as the Detail Type. Name it clearly, for example, "Loans Receivable."

What account type is Accounts Receivable in QuickBooks?

Accounts Receivable in QuickBooks is a Current Asset account. It represents short-term assets – money expected to be received from customers within one year.

How do I change the Accounts Receivable account in QuickBooks Online?

Directly changing the main Accounts Receivable account in QuickBooks Online is generally not recommended and can cause errors. For specific needs like tracking by class, consider using sub-accounts or classes instead. Consult an accounting professional for complex AR account changes.

How do I record Accounts Receivable in QuickBooks?

You record Accounts Receivable in QuickBooks by creating and saving invoices for your sales to customers on credit. Each invoice automatically increases the Accounts Receivable balance for the specified customer.

How do I set up Accounts Receivable in QuickBooks?

Accounts Receivable is automatically part of QuickBooks' default Chart of Accounts. No manual setup is needed. Focus on using invoices and recording payments correctly to manage your AR effectively.

How do I clear a negative balance in Accounts Receivable in QuickBooks?

A negative Accounts Receivable balance usually indicates an overpayment or incorrect credit memo. Investigate the transactions. Correct it by applying the credit to open invoices, issuing a refund, or reclassifying incorrectly categorized transactions.

Read also:

QuickBooks Online Accounts Receivable: Your In-Depth, Practical Guide to Getting Paid