Understanding Amazon Fees for Selling: How to Calculate and Minimize Amazon Selling Fees for Your Business

The Amazon marketplace presently hosts 9.7 million merchants, with a remarkable 89% of them taking advantage of Fulfillment by Amazon (FBA) to fulfill their orders. This sounds exciting and would make anyone desire to become an Amazon Seller.

However, before starting out, it's important to understand the various fees associated with selling on the platform. Amazon charges several types of fees, including referral fees, fulfillment fees, storage fees, and more. These fees can add up quickly and eat into your profits if you're not careful.

With this in mind, it's essential for Amazon sellers to have a clear understanding of how these fees are calculated and how they can be minimized to maximize profits. This article will provide an overview of Amazon's selling fees, how to calculate them, and strategies to minimize them.

Contents

Amazon Global Selling Charges

Amazon vs eBay Selling Fees for Individual

What Are The Monthly Selling Fees And Charges For A Individual Selling Account On Amazon

How to Calculate and Minimize Amazon Selling Fees for Your Business

Final Thoughts

FAQs

Amazon Global Selling Charges

If you are selling on Amazon's global marketplaces, there may be additional fees and charges to consider. Here are some of the common fees associated with Amazon Global Selling:

International Referral Fee: Amazon charges a referral fee on each item sold on its marketplace. The referral fee ranges from 6% to 45% of the item's sale price, depending on the category.

For example, Amazon charges a 15% referral fee for most categories, while the fee for jewelry is 20%. The fee covers Amazon's cost of processing the order, payment processing, and customer service.Currency conversion fees: Amazon will convert the currency of your sales into your preferred currency at a competitive exchange rate. However, there may be additional fees associated with the currency conversion.

The fees vary depending on the currency, and it's important to check with Amazon for the most up-to-date rates.Fulfillment fees: If you choose to use Amazon's global fulfillment services, you'll need to pay additional fees for shipping and handling, as well as any customs fees and taxes associated with the shipment.

Fulfillment fees are based on the size and weight of the item, and the destination country. You can use Amazon's Fulfillment by Amazon (FBA) service to store your products in their warehouses and take care of shipping and handling for you.Subscription fees: If you have a Professional selling plan, you'll be charged a monthly subscription fee for each marketplace you sell in. The Amazon subscription fee is $39.99 per month in the United States, but it varies by country.

A Professional selling plan offers additional features such as the ability to sell in more categories, access to bulk listing and reporting tools, and more.Other fees: There may be other fees associated with selling on Amazon's global marketplaces. For example, Amazon charges an advertising fee for products sold through Sponsored Products, which is a pay-per-click advertising program.

The advertising fee is calculated as a percentage of the item's sale price, and the percentage varies by category. Additionally, there may be category-specific fees for certain products, such as media products, which require an additional fee for Amazon to store and ship them.

It's important to review the fees associated with your product category and marketplace to understand the total cost of selling on Amazon.

All Fees for Selling on Amazon

Amazon charges fees for selling on their platform, and the specific fees can vary depending on several factors, such as the type of selling plan you choose, the product category, and whether you use Amazon's fulfillment services. Here are some of the common fees and charges for selling on Amazon:

Selling plan fees: Amazon offers two selling plans - Individual and Professional. The Individual plan charges a fee of $0.99 per item sold, in addition to referral fees and other applicable fees.

The Professional plan charges a monthly subscription fee of $39.99, but waives the per-item fee. The Professional plan also offers additional features such as the ability to sell in more categories, access to bulk listing and reporting tools, and more.Closing fees: If you sell in certain categories (such as media or video game consoles), you may be charged a closing fee. The closing fee is a fixed fee that is charged in addition to the referral fee and other applicable fees. The amount of the closing fee varies depending on the category and the item's price.

Amazon subscription fees: In addition to the Professional selling plan, Amazon also offers several other subscription services that come with additional fees. For example, Amazon Business charges a yearly fee of $179, and provides features such as quantity discounts, tax exemptions, and more.

In addition, Amazon Prime charges a yearly fee of $139 and provides members with benefits such as free two-day shipping, access to streaming of movies and TV shows, and more.Advertising fees: Amazon offers various advertising services to help you promote your products. These services come with fees based on the type of ad and how many clicks or impressions it generates.

For example, Sponsored Products is a pay-per-click advertising program that charges a fee for each click on your ad. The fee is based on the bid you set for your ad, and can vary depending on the competition for the keywords you're targeting.

Amazon vs eBay Selling Fees for Individual

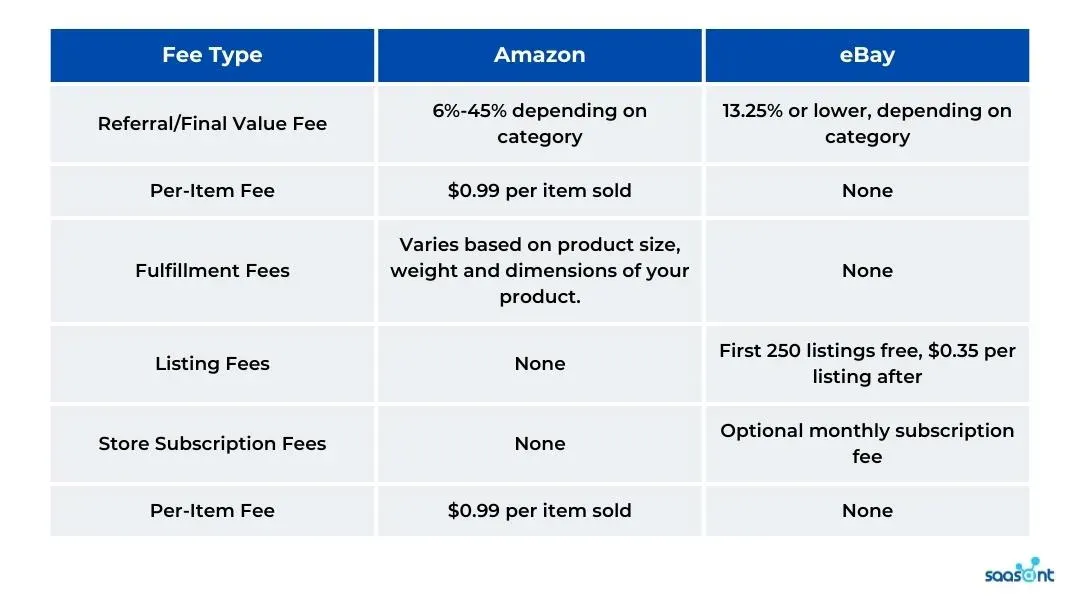

Both Amazon and eBay are popular online marketplaces for individuals and businesses to sell products. However, the fees and charges associated with selling on each platform differ.

Amazon charges a referral fee, which is a percentage of the item's sale price, and may also charge additional fees for using their fulfillment services or advertising options. On the other hand, eBay charges a final value fee, which is a percentage of the total amount of the sale, including shipping and handling costs.

eBay may also charge fees for listing enhancements, such as listing in multiple categories or setting a reserve price.

Here is a table summarizing the fees for selling as an individual on Amazon and eBay:

What Are The Monthly Selling Fees And Charges For A Individual Selling Account On Amazon

What are Amazon monthly fees for selling

For individual sellers on Amazon, there are no monthly fees or subscription charges. However, individual sellers are charged a per-item fee of $0.99 for each item sold on the platform, in addition to referral fees that are charged on each sale. Referral fees vary depending on the category of the item being sold, but typically range from 6% to 45% of the item's sale price.

For professional sellers, who pay a monthly subscription fee of $39.99, there are no per-item fees, but referral fees still apply. In addition, professional sellers may have access to additional features and tools, such as the ability to create new product listings in certain categories, access to inventory management tools, and more.

How does Amazon charge sellers?

Amazon charges sellers in two ways: a referral fee and, in some cases, a variable closing fee.

The referral fee is a percentage of the item's sale price and varies by category. For example, in the electronics category, the referral fee is typically 8% of the item's sale price, while in the jewelry category, the referral fee is typically 20% of the item's sale price. The referral fee is usually between 6% and 45% of the item's sale price, depending on the category.

The variable closing fee applies to media items such as books, DVDs, and music. This fee is $1.80 per item sold, plus a percentage of the item's sale price, which varies by category.

In addition to these fees, Amazon charges sellers a per-item fee of $0.99 for each item sold, but this fee is waived for sellers with a professional selling account.

How to Calculate and Minimize Amazon Selling Fees for Your Business

When selling on Amazon, it's important to understand the fees associated with each sale and how to minimize them to maximize your profits. Here's a step-by-step guide on how to calculate and minimize Amazon selling fees for your business:

1. Determine the category of the product you're selling

Amazon charges a referral fee based on the category of the product you're selling. Referral fees range from 6% to 45% of the item's sale price, depending on the category. For example, the referral fee for electronics is typically 8%, while the referral fee for jewelry is typically 20%.

2. Determine the sale price of your product

The sale price is the amount you're charging for your product. For example, if you're selling a book for $10, the sale price is $10.

3. Calculate the referral fee

To calculate the referral fee, multiply the sale price by the referral fee percentage for your product's category. For example, if you're selling an electronic item for $100 and the referral fee for electronics is 8%, the referral fee would be $8 (100 x 0.08).

4. Determine if a variable closing fee applies

Variable closing fees apply to media items such as books, DVDs, and music. If you're selling a media item, check the Amazon fee schedule to determine if a variable closing fee applies.

5. Calculate the variable closing fee (if applicable)

If a variable closing fee applies, add it to the referral fee. For example, if you're selling a book for $10 and the variable closing fee is $1.80 plus 15% of the sale price, the variable closing fee would be $2.70 ($1.80 + 0.15 x 10).

6. Determine if a per-item fee applies

Amazon charges a per-item fee of $0.99 for each item sold, but this fee is waived for sellers with a professional selling account. If you have an individual selling account, add this fee to your total fees.

7. Add up all fees

To calculate the total fees, add the referral fee, variable closing fee (if applicable), and per-item fee (if applicable). For example, if you're selling an electronic item for $100 with an 8% referral fee, the total fees would be $9.99 ($8 referral fee + $1.80 variable closing fee + $0.99 per-item fee).

Selling on Amazon can be a great way to reach millions of customers and grow your business, but it's important to understand and minimize the fees associated with each sale. Here are some tips on how to minimize Amazon selling fees for your business:

1. Choose the right category

Amazon charges a referral fee based on the category of the product you're selling, so choosing the right category is key to minimizing your fees. Do your research and compare referral fees across categories to find the one that's most cost-effective for your products.

2. Price your products competitively

Lowering your sale price can decrease your referral fee and increase sales volume, ultimately resulting in higher profits. Be sure to research your competitors' pricing and adjust your prices accordingly to stay competitive.

3. Consider a professional selling account

With a professional selling account, you won't be charged the $0.99 per-item fee, and you'll have access to additional features and tools that can help you optimize your listings and increase sales. While there is a monthly subscription fee for a professional account, it may be worth it if you plan on selling a large volume of products.

4. Use Fulfillment by Amazon (FBA)

With FBA, Amazon handles the storage, shipping, and customer service for your products, allowing you to focus on growing your business. While FBA does come with fees, they're often offset by the increased sales volume and reduced shipping costs. Additionally, FBA can help you win the Buy Box, which can increase your sales and visibility.

5. Keep an eye on your inventory

Amazon charges long-term storage fees for items that have been in their fulfillment centers for more than 365 days. To avoid these fees, keep track of your inventory and remove any items that aren't selling well or have been sitting in the fulfillment center for too long.

Accounting for Amazon selling fees QuickBooks Online

Using accounting software like QuickBooks Online can help you track inventory and monitor sales, enabling you to minimize Amazon selling fees. Here are some tips on how to use QuickBooks Online for this purpose:

Set up your QuickBooks Online account: Sign up for QuickBooks Online and set up your company profile. You will need to enter your business information and connect your Amazon seller account to QuickBooks Online.

Track inventory: QuickBooks Online allows you to track inventory by setting up product and service items. When you sell an item on Amazon, the corresponding inventory quantity will be adjusted in QuickBooks Online automatically.

This helps you monitor inventory levels in real-time and avoid overselling, which can result in Amazon fees.Monitor sales: QuickBooks Online allows you to track sales by setting up sales receipts or invoices. When you receive payment for an Amazon sale, you can record it in QuickBooks Online and link it to the corresponding inventory item. This helps you keep track of your revenue and profit margins and monitor your Amazon fees.

Generate reports: QuickBooks Online offers various reports that can help you analyze your sales and expenses, monitor your inventory levels, and track your Amazon fees. For example, you can run a profit and loss report to see your revenue, cost of goods sold, and net income, or a sales by item report to see which products are selling the most.

6. Optimize your product listings

Optimizing your product listings can increase your sales and visibility, ultimately reducing your fees as a percentage of sales. Use high-quality images and detailed product descriptions to make your products stand out, and optimize your listings for search engines to increase your visibility.

7. Monitor your metrics

Amazon measures seller performance metrics such as order defect rate, cancellation rate, and late shipment rate, and can suspend or terminate your selling account if your metrics fall below a certain threshold.

By monitoring your metrics and addressing any issues quickly, you can avoid suspension or termination and keep your fees under control.

8. Using Amazon fee calculator

Using an Amazon fees calculator can be a helpful tool to estimate your costs and optimize your pricing strategy, which can ultimately help you minimize Amazon selling fees.

An Amazon fees calculator can help you determine the various fees associated with selling a particular product on Amazon, including referral fees, fulfillment fees, and storage fees.

By inputting the relevant information such as the product category, shipping weight, and price, the calculator can provide you with an estimate of your total costs and potential profits.

With this information, you can adjust your pricing strategy to ensure that you are covering your costs and maximizing your profits. For example, you might decide to increase your product price to account for higher fees or reduce your shipping weight to minimize fulfillment fees.

Amazon selling fees calculator

An Amazon selling fees calculator is a tool that helps Amazon sellers estimate the fees they will incur when selling products on Amazon. It can be used to determine the total cost of selling an item on Amazon.

For example, let's say you want to sell a t-shirt on Amazon. You would input details such as the product category (apparel), the price you plan to sell it for, and the weight of the item. The calculator would then provide an estimate of the referral fee, fulfillment fee, and storage fee for that item, as well as the total cost of selling the item on Amazon.

Amazon offers a free calculator on their website for sellers to use, and there are also third-party calculators available online. It's important to keep in mind that these calculators are only estimates, and the actual fees may vary based on a variety of factors, such as the product's size and weight, the time of year, and changes in Amazon's fee structure.

Amazon shipping charges calculator

Amazon offers a shipping charges calculator to help sellers estimate the cost of shipping their products to customers. This tool can be accessed through the seller central dashboard and is available to all Amazon sellers.

The shipping charges calculator takes into account the weight and dimensions of the package, the destination address, and the shipping service chosen by the seller. It provides an estimate of the shipping cost based on this information, which can help sellers determine the appropriate shipping fee to charge their customers.

When using the shipping charges calculator, sellers should ensure that they have accurate and up-to-date information about the weight and dimensions of their products. They should also be familiar with the different shipping services offered by Amazon and choose the one that is most appropriate for their needs and budget.

Amazon selling price calculator excel

An Amazon selling price calculator in Excel is a tool that helps Amazon sellers calculate the ideal selling price for their products based on various costs and fees associated with selling on Amazon. This calculator can be created in Microsoft Excel by inputting relevant data and using formulas to calculate the desired selling price.

To create an Amazon selling price calculator in Excel, sellers will need to input data such as the product cost, Amazon referral fee, fulfillment fee, shipping cost, and desired profit margin. The formulas can then be set up to automatically calculate the desired selling price based on this information.

For example, let's say a seller wants to sell a product that costs $10 and has a referral fee of 15% and a fulfillment fee of $3. They also estimate that the shipping cost will be $2 per unit and want to achieve a profit margin of 20%.

To calculate the ideal selling price for this product, the seller can create an Excel spreadsheet and input the relevant data into the appropriate cells. They can then use formulas such as:

Referral fee = (Product cost + Shipping cost) x Referral fee percentage

Fulfillment fee = Fixed fee + (Product weight x per-unit fulfillment fee)

Total cost = Product cost + Referral fee + Fulfillment fee + Shipping cost

Desired profit margin = Total cost / (1 - Profit margin percentage)

By inputting these formulas into the Excel spreadsheet and adjusting the variables as necessary, the seller can calculate the ideal selling price for their product.

Using an Amazon selling price calculator in Excel can help sellers ensure that they are pricing their products competitively while still covering their costs and maintaining their profitability. It can also help sellers make more informed decisions about their inventory and pricing strategies, and make adjustments as needed based on changes in Amazon's fee structure or market conditions.

Amazon referral fee calculator

An Amazon referral fee calculator is a tool that helps sellers estimate the referral fees they will need to pay to Amazon for each product sold on the platform. Referral fees are a percentage of the total price of the product, and they vary depending on the category in which the product is listed.

To use an Amazon referral fee calculator, sellers will need to input the selling price of their product and the category in which it is listed. The calculator will then estimate the referral fee percentage and the total referral fee for that product.

For example, let's say a seller wants to sell a product in the "Home & Kitchen" category for $50. Using an Amazon referral fee calculator, they can determine that the referral fee percentage for this category is 15%. Therefore, the referral fee for this product would be $7.50 (15% of $50).

Final Thoughts

Selling on Amazon can be a profitable venture, but it's important for sellers to understand the various fees and charges associated with the platform. By using tools such as the Amazon Fee Calculator, sellers can get a clear picture of the costs involved in selling their products on Amazon and make informed decisions about pricing and profitability.

Additionally, by optimizing their product listings, leveraging Amazon's advertising tools, and utilizing Amazon's FBA program, sellers can potentially reduce their overall costs and increase their sales.

It's crucial for sellers to keep track of their expenses and revenue, whether through manual bookkeeping or software like QuickBooks Online, to ensure they are making a profit and not overspending on fees.

To take your cost-saving efforts to the next level, there's PayTraQer and SaasAnt Transactions, two powerful software tools integrated with QuickBooks that can automate the process of importing, tracking, and analyzing Amazon sales data, therefore making bookkeeping easy.

FAQs

Is Amazon Seller profitable?

Whether selling on Amazon as a third-party seller is profitable depends on a variety of factors, including the product category, the level of competition, the pricing strategy, the fulfillment method, and the overall cost structure of the business.

Sellers who are able to source products at low cost, offer competitive pricing, and maintain high levels of customer satisfaction can generate significant profits on Amazon. However, sellers who struggle to differentiate themselves from competitors or who have high operating costs may find it more difficult to achieve profitability.

Additionally, it is important for sellers to consider the fees associated with selling on Amazon, including referral fees, fulfillment fees, and storage fees, as these can impact profitability. Sellers who are able to optimize their pricing and fulfillment strategies to minimize these fees may be more likely to achieve profitability.

Does Amazon Charge Fees for Selling?

Yes, Amazon charges fees for selling on their platform. The fees vary depending on the product category, the selling plan you choose, and other factors.

For individual sellers, Amazon charges a per-item fee of $0.99 per item sold, plus referral fees, which are a percentage of the item's sale price. Referral fees can range from 6% to 45%, depending on the product category. There may also be additional fees for optional services, such as Fulfillment by Amazon (FBA) or advertising.

For professional sellers, there is a monthly subscription fee of $39.99, but the per-item fee is waived. Referral fees still apply, and there may be additional fees for optional services.

Does Amazon charge if you don't sell?

Amazon charges various fees to sellers who use their platform, regardless of whether or not they make a sale. These fees can include monthly subscription fees, referral fees, and storage fees, among others.

For example, Amazon charges a monthly subscription fee for professional sellers who want to access additional selling tools and features. This fee is charged regardless of whether or not the seller makes a sale during the month.

In addition, sellers who use Amazon's FBA (Fulfillment by Amazon) service may be charged storage fees for keeping their inventory in Amazon's warehouses, regardless of whether or not the inventory sells.

What is the minimum quantity to sell on Amazon?

There is no specific minimum quantity requirement to sell on Amazon. Whether you are a professional seller or an individual seller, you can list and sell as few or as many items as you want.

However, it is important to keep in mind that some product categories may have specific quantity requirements or restrictions. For example, certain categories such as grocery or health and personal care may have minimum order quantity requirements, while others such as hazardous materials may have quantity limits or shipping restrictions.

In general, sellers should check Amazon's guidelines and policies for their specific product category to ensure compliance with any quantity requirements or restrictions.

How do Amazon sellers get paid?

Amazon sellers can receive payment for their sales through several different methods, depending on the payment and fulfillment options they choose.

Here are some of the most common payment methods for Amazon sellers:

Direct Deposit: This is the most common payment method for Amazon sellers. Sellers can set up a bank account to receive direct deposit payments from Amazon.

Amazon Pay: Amazon Pay is a payment service that allows customers to use the payment methods stored in their Amazon accounts to make purchases on external websites. Sellers who use Amazon Pay can receive payments directly into their Amazon Pay account.

Check: Sellers can choose to receive payments by check, which Amazon sends by mail.

Gift Cards: Some sellers may choose to receive payments in the form of Amazon gift cards, which can be used to make purchases on Amazon's website.

It's worth noting that Amazon typically disburses payments to sellers every two weeks, with a delay of several days between the sale and the payment. Additionally, Amazon may withhold a portion of the payment as a reserve to cover any potential chargebacks or other issues that may arise with the sale.

Is GST mandatory for Amazon Sellers?

The requirement for GST registration and compliance on Amazon can vary depending on the country in which the seller is located and where they are selling their products.

In India, for example, it is mandatory for Amazon sellers to register for GST (Goods and Services Tax) if their annual turnover exceeds a certain threshold, which is currently set at INR 20 lakh (approximately USD 27,000) for most states. Failure to comply with GST regulations can result in penalties and legal consequences.

In the United States, GST is not applicable, but sellers may be required to collect and remit state and local sales taxes on their sales, depending on the state and the nature of the products being sold.