Detailed Guide for Accountants and Bookkeepers Handling Bench Client Migration

With the sudden closure of Bench Accounting, accountants and bookkeepers face the critical task of assisting clients in transitioning to alternative platforms like QuickBooks or Xero. This guide provides detailed steps, tools like SaasAnt Transactions, and answers to common questions to streamline the migration process. If you need further assistance, reach out to us at support@saasant.com for expert help.

What Was Bench?

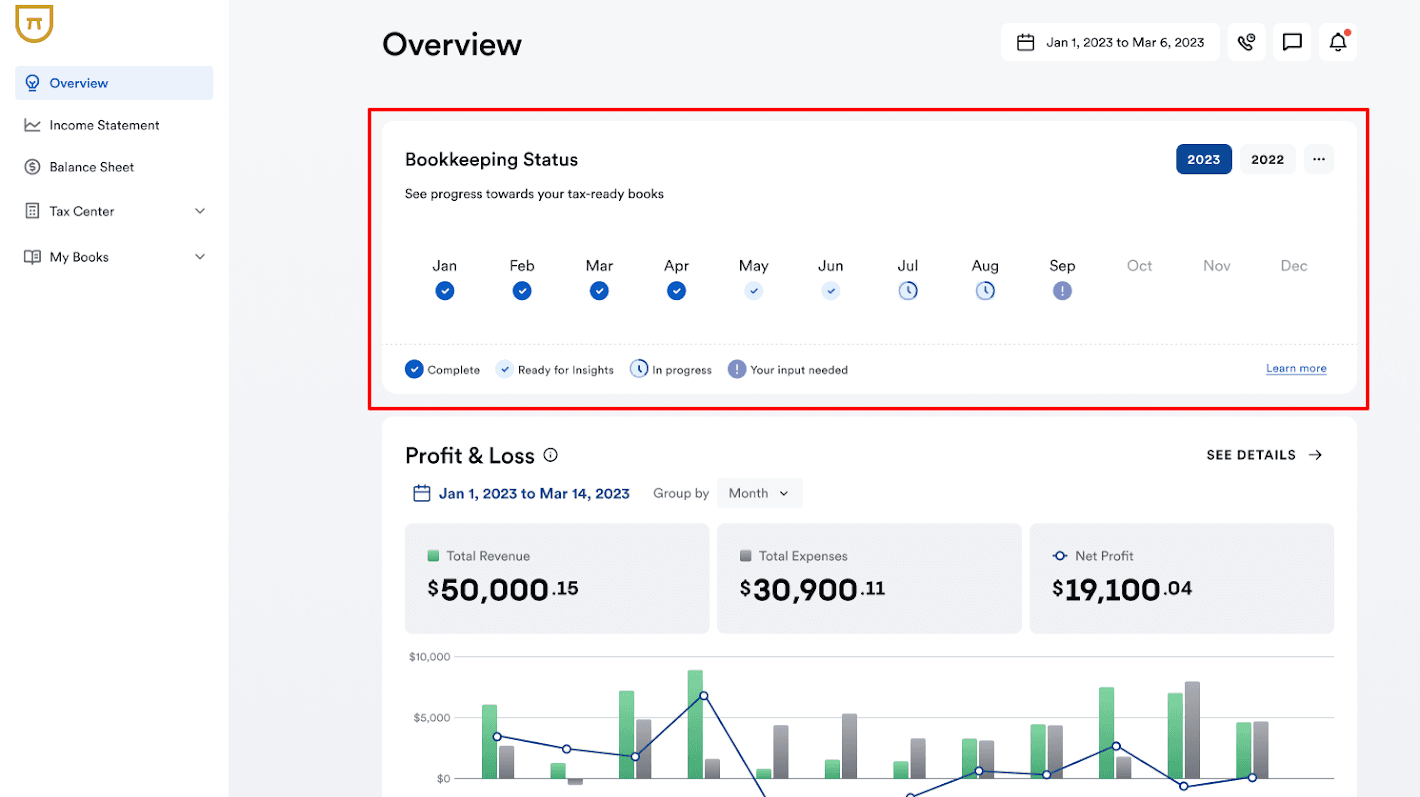

Bench was an online bookkeeping service combining software and human bookkeepers to manage finances for small businesses. Its offerings included monthly bookkeeping, tax preparation support, and financial reporting. It was widely used by small businesses, freelancers, and startups, particularly in industries like e-commerce, professional services, and retail.

Why Did Bench Close?

Bench Accounting announced its shutdown on December 27, 2024, citing strategic and operational challenges. Clients have until March 7, 2025, to download their financial data through the dedicated portal (data.bench.co). Bench’s closure has left thousands of businesses searching for alternatives, making timely migration crucial.

Acquisition Update: Bench Accounting’s intellectual property and technology assets were recently acquired by Employer.com Inc. This acquisition aims to mitigate the disruption caused by Bench's sudden closure and potentially offer new solutions for affected clients. However, the closure remains effective, and clients must transition their data immediately.

Common Questions from Accounting Professionals

Data Access and Security

How can I download my client’s data? Log in to Bench’s portal (data.bench.co) using client credentials. Export all financial reports, transaction histories, and tax documents in CSV or Excel formats.

Will the data format be compatible with other platforms? Bench provides data in CSV and Excel formats, which are widely compatible with accounting software like QuickBooks and Xero.

Migration Support

What tools can simplify the migration? Tools like SaasAnt Transactions enable bulk data import to QuickBooks and Xero, ensuring a smooth transition.

Who can help with the migration? Our team at SaasAnt is here to assist. Contact us at support@saasant.com for guidance on using SaasAnt Transactions and handling complex migrations.

Tax and Compliance

Will Bench’s closure impact tax filing? Ensure all tax-related documents are downloaded before the portal’s closure. These include 1099s, year-end summaries, and categorized transaction records.

How can I handle clients behind on their books? Use catch-up bookkeeping services in QuickBooks or Xero to bring records up to date before filing deadlines.

Detailed Migration Plan

Phase 1: Planning

Assess Client Needs:

Identify the client’s accounting requirements (e.g., invoicing, payroll).

Recommend a platform based on their business size and complexity.

Communicate the Plan:

Inform clients about the transition timeline and the March 7, 2025, data retrieval deadline.

Phase 2: Data Extraction

1. Log in to Bench

Use your client’s credentials to log in to data.bench.co.

If clients have lost credentials, assist them in resetting their passwords.

2. Download Data

Export all financial data:

Income Statements

Balance Sheets

Cash Flow Statements

Detailed Transaction Histories

Tax Reports (W-9, 1099, etc.)

Formats: Download files in CSV or Excel for compatibility.

3. Organize Data

Create separate folders for each client.

Categorize files by type:

Reports (financial statements, tax documents).

Transactions (income, expenses, bank statements).

Verify data completeness.

Phase 3: Preparing Data for Migration

1. Clean Data

Review transactions for errors, missing information, or duplicates.

Check for uncategorized expenses and categorize them appropriately.

2. Standardize Data

Ensure all transaction data is formatted consistently:

Date: YYYY-MM-DD

Amount: Decimal with two places

Categories: Align with the chart of accounts in the new system.

3. Map Accounts

Create a mapping table to align Bench categories with the new system’s chart of accounts.

Example:

"Supplies" in Bench → "Office Expenses" in QuickBooks/Xero.

Phase 4: Migration Using SaasAnt Transactions

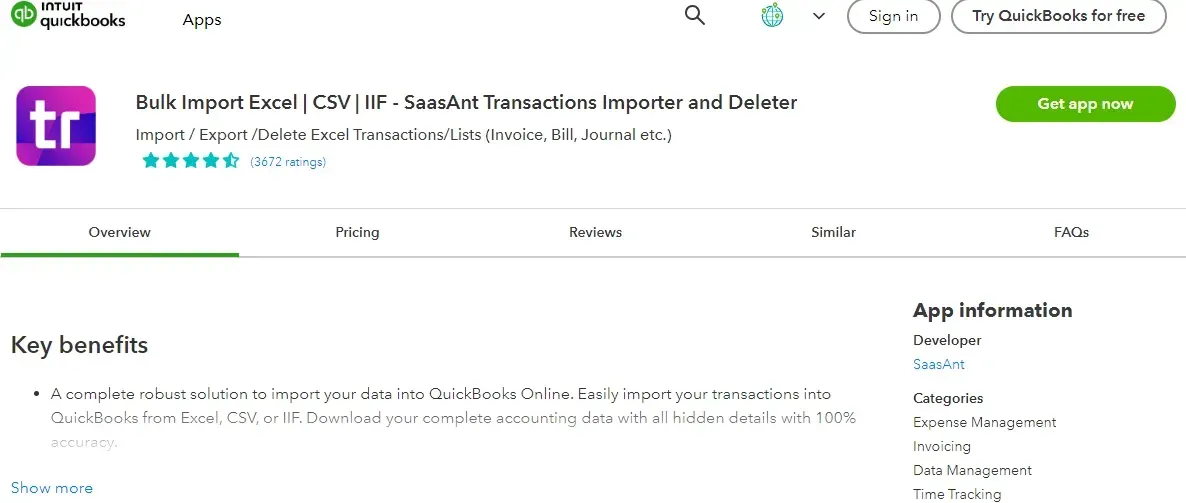

SaasAnt Transactions simplifies bulk imports of financial data to platforms like QuickBooks and Xero.

1. Set Up SaasAnt Transactions

Download SaasAnt Transactions:

Visit SaasAnt and install the application for your chosen platform (QuickBooks Online or Xero).

Create an Account:

Sign up and connect your QuickBooks Online or Xero account to SaasAnt.

2. Prepare Data for SaasAnt

Review and ensure your data meets SaasAnt's requirements:

Use their import templates for formatting.

SaasAnt provides pre-built templates for QuickBooks and Xero (available on their website).

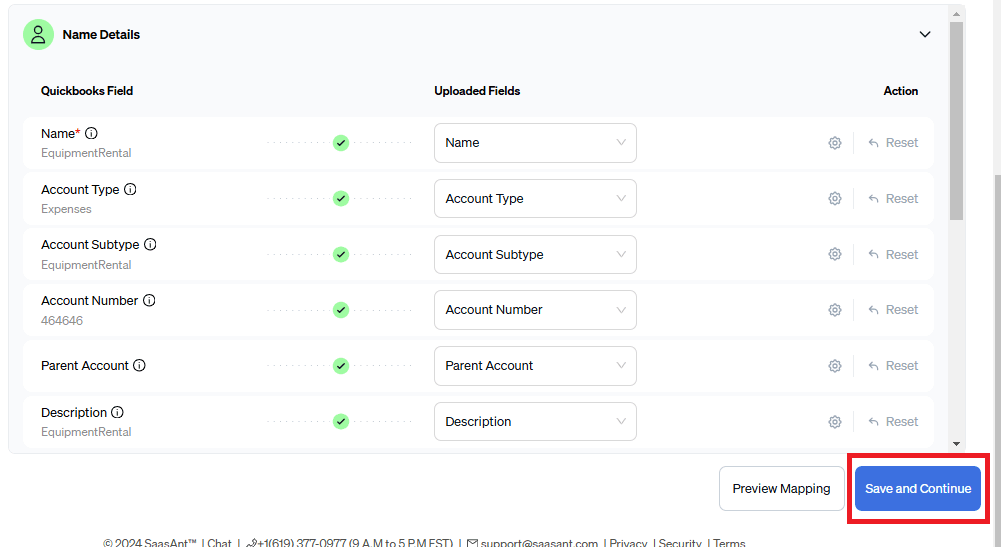

3. Importing Data

Step-by-Step:

Open SaasAnt Transactions.

Choose the type of data to import:

Transactions (Expenses, Invoices, Payments).

Journal Entries (for adjustments).

Customers, Vendors, or Products.

Upload the CSV or Excel file.

Map columns in the file to corresponding fields in the accounting platform:

Example: “Date” → Transaction Date, “Amount” → Total Amount.

Validate the data using SaasAnt’s built-in tools to identify errors or missing information.

Execute the import.

Automated Features:

Bulk import multiple transaction types.

Custom mapping for unique data fields.

Error logs for troubleshooting.

4. Verify Imported Data

Cross-check imported data with Bench’s reports:

Account balances.

Total income and expenses.

Individual transaction accuracy.

Phase 5: Post-Migration Setup

1. Reconcile Accounts

Compare opening balances in the new system with Bench’s final Balance Sheet.

Perform a bank reconciliation to ensure all transactions are accounted for.

2. Set Up Automations

Bank Feeds:

Connect bank accounts to QuickBooks/Xero for real-time transaction syncing.

Recurring Transactions:

Configure recurring invoices, bills, and journal entries.

Integrations:

Reconnect essential tools like Stripe, Shopify, or Amazon.

3. Train Clients

Provide clients with a walkthrough of the new system.

Highlight key features:

Generating reports.

Categorizing expenses.

Syncing transactions.

Key Considerations for Professionals

Tax Filing Support: Ensure all tax documents are migrated and accessible.

Compliance: Verify data integrity to maintain compliance with regulatory requirements.

Ongoing Support: Offer periodic reviews to ensure clients adapt smoothly to their new systems.

Detailed Workflow for Multiple Clients

Workflow Checklist

Phase 1: Initial Assessment

Evaluate client needs and recommend an accounting platform.

Phase 2: Data Retrieval

Log in to Bench, download, and organize data.

Phase 3: Data Preparation

Clean, categorize, and map data.

Phase 4: Migration

Use SaasAnt Transactions for bulk imports.

Phase 5: Finalization

Reconcile accounts, set up automations, and train clients.

Need Help with Migration?

For personalized support with data migration and to ensure a seamless transition to a new accounting platform, please contact us at support@saasant.com. Let’s make the transition seamless for your clients.

Why SaasAnt Transactions?

Bulk Import Efficiency: Handle hundreds of transactions at once.

Error Handling: Easily identify and correct issues before importing.

Custom Mapping: Flexible mapping for different data structures.

Platform Compatibility: Works with QuickBooks Online, Xero, and other popular tools.

Data Accuracy: Ensures clean and accurate data transfer, minimizing discrepancies and reducing manual corrections.

By following this guide, you can ensure a smooth, accurate, and efficient migration for your clients, reducing stress and maintaining continuity in their financial operations.