QuickBooks for Small Business: Tips & Tricks

Whether you’re a new entrepreneur or a seasoned business owner, mastering QuickBooks can transform your accounting processes and give you the tools to manage your finances more effectively. This blog will further walk you through the tips and tricks on using QuickBooks for small businesses.

Contents

QuickBooks for Small Business

QuickBooks for Small Business: Tips & Tricks

Common QuickBooks Mistakes to Avoid

Conclusion

FAQs

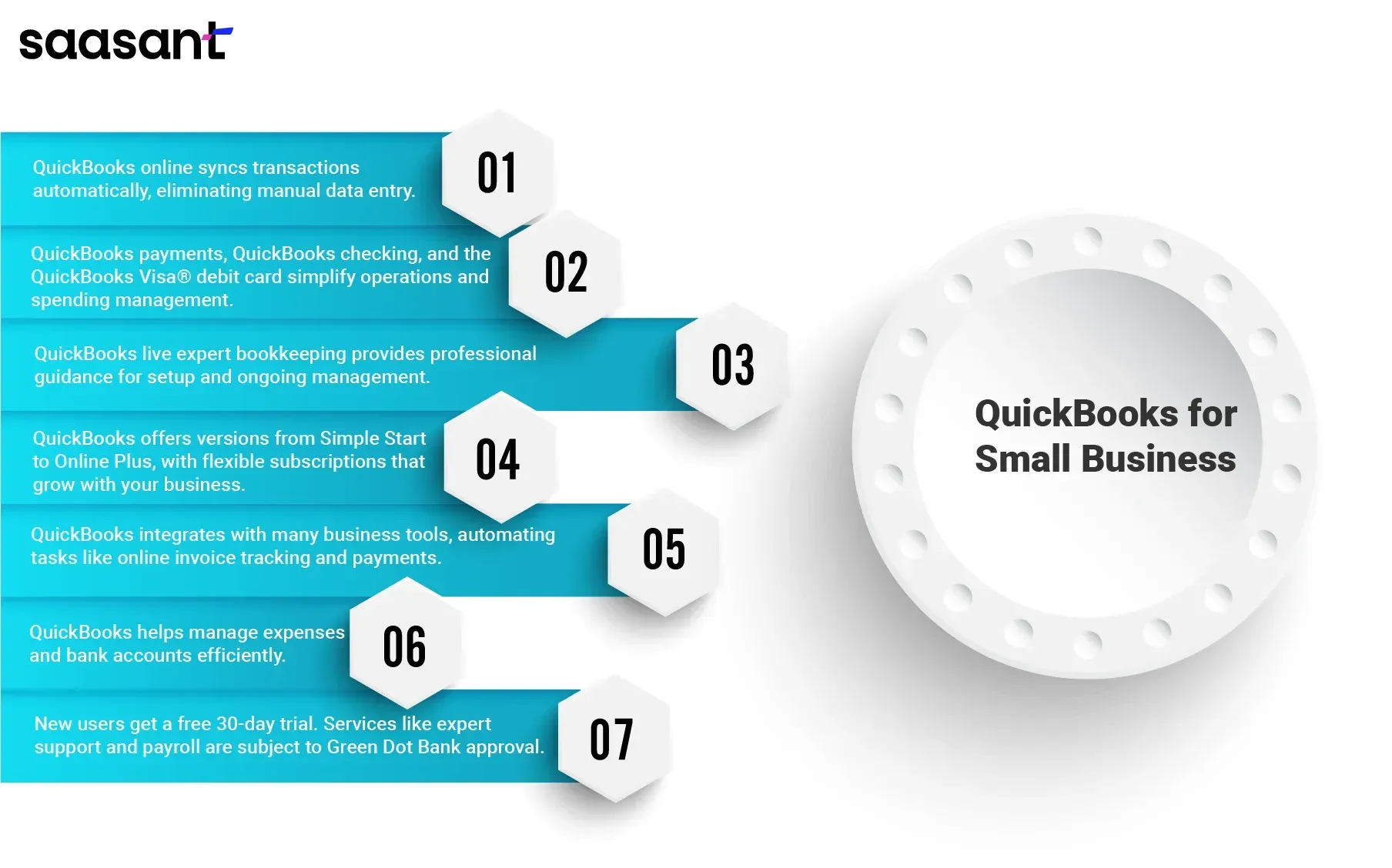

QuickBooks for Small Business

QuickBooks is the best accounting software for small businesses. It offers a comprehensive suite of tools to manage finances effectively, from tracking expenses to handling payroll. QuickBooks helps small business owners run their businesses with confidence.

Simplify Financial Management

Using QuickBooks online, transactions automatically sync to your QuickBooks account, making it easy to manage your business without the hassle of manual data entry. With QuickBooks live expert guided setup, even those new to accounting can get started quickly.

Essential Features for Business Owners

QuickBooks includes powerful features like QuickBooks payments and QuickBooks checking, which makes business operations easy. With the QuickBooks Visa® debit card, managing business spending becomes straightforward. Plus, all deposits with Green Dot Bank are aggregated within your primary QuickBooks checking account.

Expert Support

QuickBooks live expert full-service bookkeeping ensures you have professional guidance when you need it. This service is ideal for small businesses using QuickBooks online, providing access to QuickBooks experts who can help with everything from setup to ongoing management.

Flexible and Comprehensive Solutions

QuickBooks offers various versions tailored to different business needs. Whether you need QuickBooks Online Simple Start for basic needs or QuickBooks Online Plus for more advanced features, there's an option to suit every business. QuickBooks Online subscription plans are flexible, and subscriptions can be changed as your business grows.

Integration and Automation

QuickBooks integrates with many business tools and automates routine tasks. This includes online invoice tracking and payment solutions, which help streamline invoicing and ensure timely customer payments. Using QuickBooks online in the U.S., business owners can manage invoices, track payments, and keep their business running smoothly.

Competitive Advantage

Choosing QuickBooks means selecting the best accounting software for small businesses. Recommended by PCMag, QuickBooks helps small business owners easily manage their business expenses and bank accounts. It’s an essential tool for any business aiming to operate smartly and efficiently.

Special Offers and Trials

QuickBooks offers new users a free 30-day trial to explore the software's features. QuickBooks services, including live expert support and online payroll premium, are also subject to eligibility and approval by Green Dot Bank.

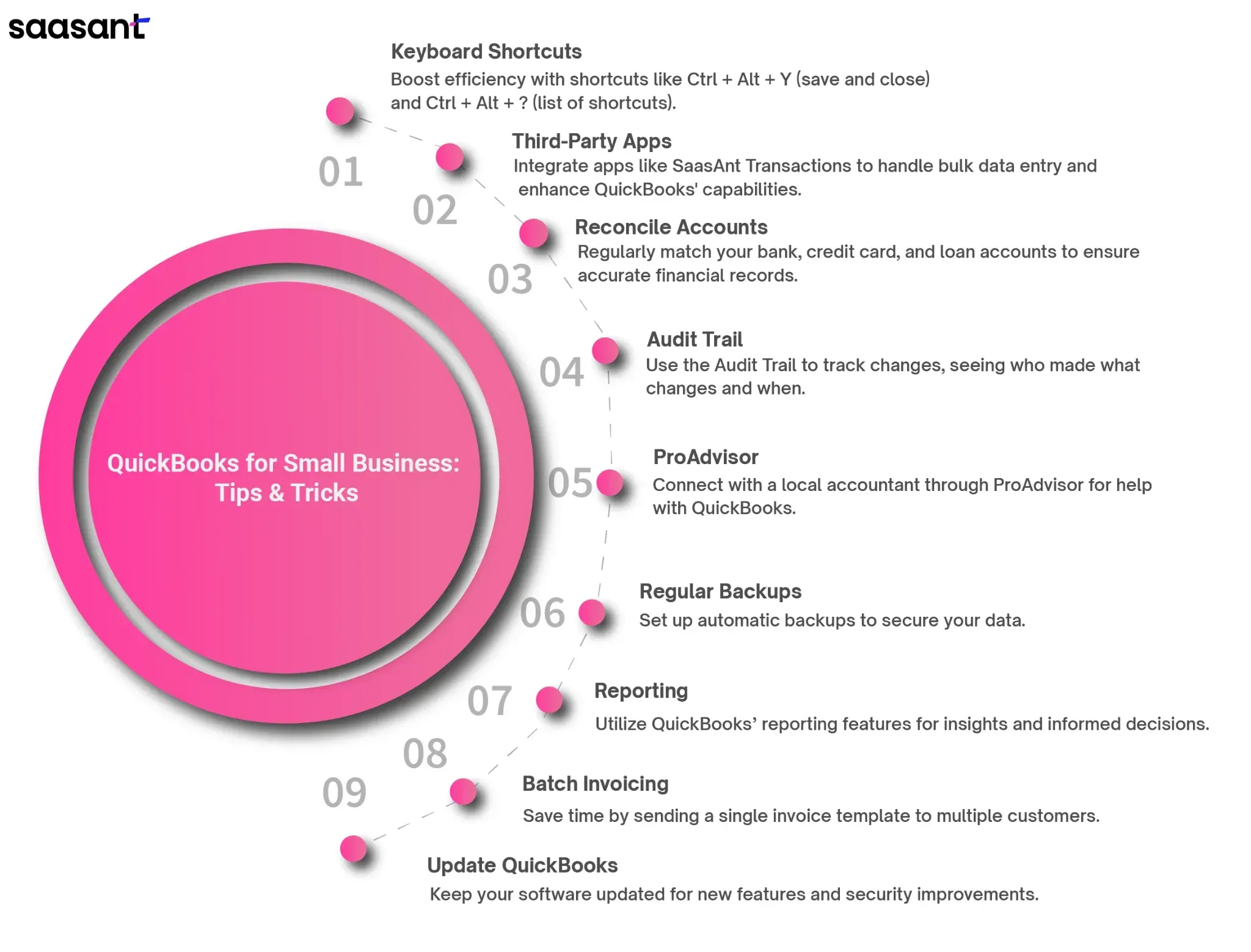

QuickBooks for Small Business: Tips & Tricks

Whether you aim to excel in QuickBooks bookkeeping or QuickBooks accounting services, various effective strategies are available to simplify your tasks. Some of the most valuable and popular QuickBooks tips include:

Use keyboard shortcuts to boost efficiency

Use keyboard shortcuts to enhance your QuickBooks experience and save time. Learning a few essential shortcuts can accelerate your workflow. For example, hitting Ctrl + Alt + Y allows you to save and close a transaction window. Similarly, using Ctrl + Alt + ? brings up a comprehensive list of all the keyboard shortcuts available in QuickBooks. Becoming proficient with these shortcuts can significantly improve your productivity while using the software.

Use Third-Party Applications

While QuickBooks offers robust features tailored for small business accounting, integrating third-party applications can significantly expand its capabilities and streamline your operations. Third-party applications are often scalable, providing features and services that grow with your business.

For example, SaasAnt Transactions is a powerful QuickBooks automation application for users who need to handle bulk data entry such as invoices, bills, customers, journal entries etc., and accounting tasks within QuickBooks. It's particularly beneficial for small to medium-sized businesses that regularly deal with large volumes of transactions. It allows you to import, export, and delete transactions in bulk, saving significant time compared to manual entry.

Regularly Reconcile Accounts

Reconciling your accounts regularly, not just your bank accounts but also credit cards and loans ensures that your financial data in QuickBooks matches the actual account statements. This habit can help catch discrepancies early and maintain accurate financial records.

Use the Audit Trail

The Audit Trail feature is handy for tracking changes within your QuickBooks files. It helps you monitor who made changes, what changes were made, and when, which is especially valuable, and where multiple users access the files.

Use ProAdvisor

If you’re new to QuickBooks accounting services, making the most of ProAdvisor is crucial. As a key component of the QuickBooks Intuit Package, ProAdvisor connects you with a local accountant who can help you operate the software. Depending on your location, you can discover professionals equipped to assist with various challenges, including tax preparation, outsourcing QuickBooks accounting, managing expenses, and much more.

Schedule Regular Backups

Protect your financial data by setting up automatic backups. QuickBooks can be configured to back up your data to a secure location automatically. This ensures that your business operations can resume quickly in case of hardware failure or data corruption.

Explore QuickBooks' Reporting Capabilities

QuickBooks offers reporting features that can provide deep insights into your business operations. Regularly review the financial reports available, like profit and loss statements, balance sheets, and cash flow statements, to make informed business decisions.

Streamline Invoicing with Batch Invoicing

If you often send invoices to multiple customers for the same service or product, use the batch invoicing feature. This allows you to create a single invoice template and send it to a selected group of customers, saving time and ensuring consistency across your invoicing.

Regularly Update QuickBooks

Ensure that you are running the latest version of QuickBooks. Intuit frequently updates the software to include new features and fix bugs. Keeping QuickBooks updated ensures you access the latest tools, improvements, and enhanced security.

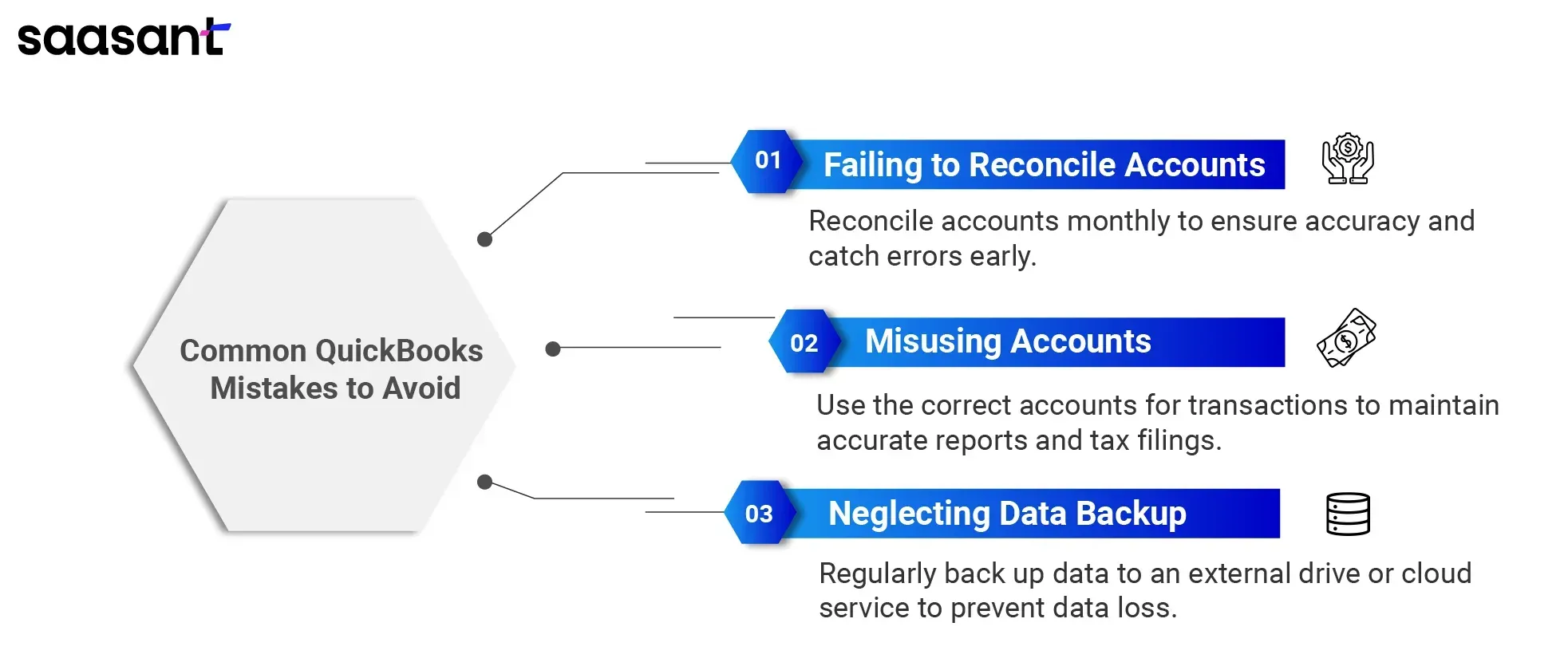

Common QuickBooks Mistakes to Avoid

There are some common QuickBooks mistakes that you should avoid as a QuickBooks user. Below are three major mistakes and solutions that you must know:

Failing to Reconcile Accounts

Refrain from regularly reconciling your QuickBooks accounts with your bank or credit card statements is one of the significant errors. Reconciliation ensures your financial records are accurate and current. Periodically reconcile your accounts, ideally monthly, to catch and rectify errors early, preventing more significant issues later.

Misusing Accounts

A common error in QuickBooks is using incorrect accounts for transactions, which can disrupt financial reports and affect tax filings. Ensure you use the appropriate account for each transaction. Familiarize yourself with QuickBooks' different accounts and consult a financial advisor if needed.

Neglecting Data Backup

Not backing up your QuickBooks data can lead to severe losses if you encounter a system failure. To prevent data loss, regularly back up your data to an external drive or cloud service, securing your information.

Conclusion

QuickBooks is one of the most influential and easy-to-use automated accounting software. But making the most of this software depends on your ability to learn its tips and tricks. All you need is a little time and experience to master it.

FAQs

How to become efficient in QuickBooks?

To become efficient in QuickBooks, it's essential to integrate all relevant financial tools with it. For instance, if you manage accounts for a B2B sales company, incorporating the order-to-cash process into QuickBooks is advisable. This integration boosts efficiency and lowers administrative expenses by minimizing order mistakes.

How does QuickBooks automation simplify accounting?

Automation in QuickBooks, using applications like SaasAnt Transactions, simplifies accounting by reducing manual data entry and errors. The application allows users to automatically handle bulk transactions, improving accuracy and efficiency in financial management.

What are the three benefits of using QuickBooks?

Efficient Financial Management: Automates tasks like invoicing and payroll, making financial operations smoother.

User-Friendly: Features an intuitive interface that simplifies accounting for all skill levels.

Real-Time Reporting: Offers instant financial reporting and analysis to aid quick decision-making.

Why is QuickBooks better than Excel?

QuickBooks is better suited for accounting as it automates processes, integrates seamlessly with various apps and banking systems, and ensures compliance and accuracy—features that Excel, a general spreadsheet tool, lacks.

What is QuickBooks primarily used for?

QuickBooks is primarily used for business accounting tasks, including bookkeeping, managing invoices and payments, payroll processing, generating financial reports, and simplifying tax preparation.