How Much Should You Pay Your Bookkeeper as a Small Business?

Running a small business is no easy feat, but knowing how much to invest in bookkeeping can save you headaches and keep your finances in check.

Accounting is the language of business.

- Warren Buffett, chairman and CEO of Berkshire Hathaway

Bookkeeping is the process of recording and organizing your financial transactions to keep track of your cash flow, prepare tax returns, and make smart business decisions.

At the same time, bookkeeping is time consuming, tedious, and complex. That’s why a lot of businesses like to outsource bookkeeping tasks. A professional bookkeeper can save you time, money and stress.

But how do you find a bookkeeper who suits your needs and budget? And how much should you pay for them?

In this blog, we’ll answer these questions and more. We’ll cover:

The average cost of bookkeeping services for small businesses

The benefits of hiring a professional bookkeeper for your small business

How to find and choose the right bookkeeper for your small business

Ready to take off the bookkeeper hat? Let’s get started!

Contents

How Much Does It Cost to Hire a Bookkeeper?

The Benefits of Hiring a Professional Bookkeeper for Your Small Business

How to Find and Choose the Right Bookkeeper for Your Small Business

The Bottom Line

How Much Does It Cost to Hire a Bookkeeper?

One of the first questions that probably pops into your mind is: how much does a bookkeeper cost?

The answer is: it depends.

The cost of bookkeeping services for a small business can vary depending on several factors, such as:

Location: Bookkeepers in different locations/regions may charge different rates based on the cost of living and the demand for their services.

The bookkeeper’s experience and credentials: Bookkeepers with more experience and higher qualifications may charge more.

The scope of work: Bookkeepers may charge you based on the number of transactions, the complexity of the work, or the type of service they provide. For example, some bookkeepers may offer only data entry and reconciliation, while others may offer more comprehensive services such as payroll, invoicing, reporting, and tax preparation.

Services Offered: Bookkeepers may charge you based on the frequency and duration of their service. For example, some bookkeepers may offer monthly or quarterly services, while others may offer hourly or project-based services. Additionally, some bookkeepers may work in-house or remotely, which may affect their rates.

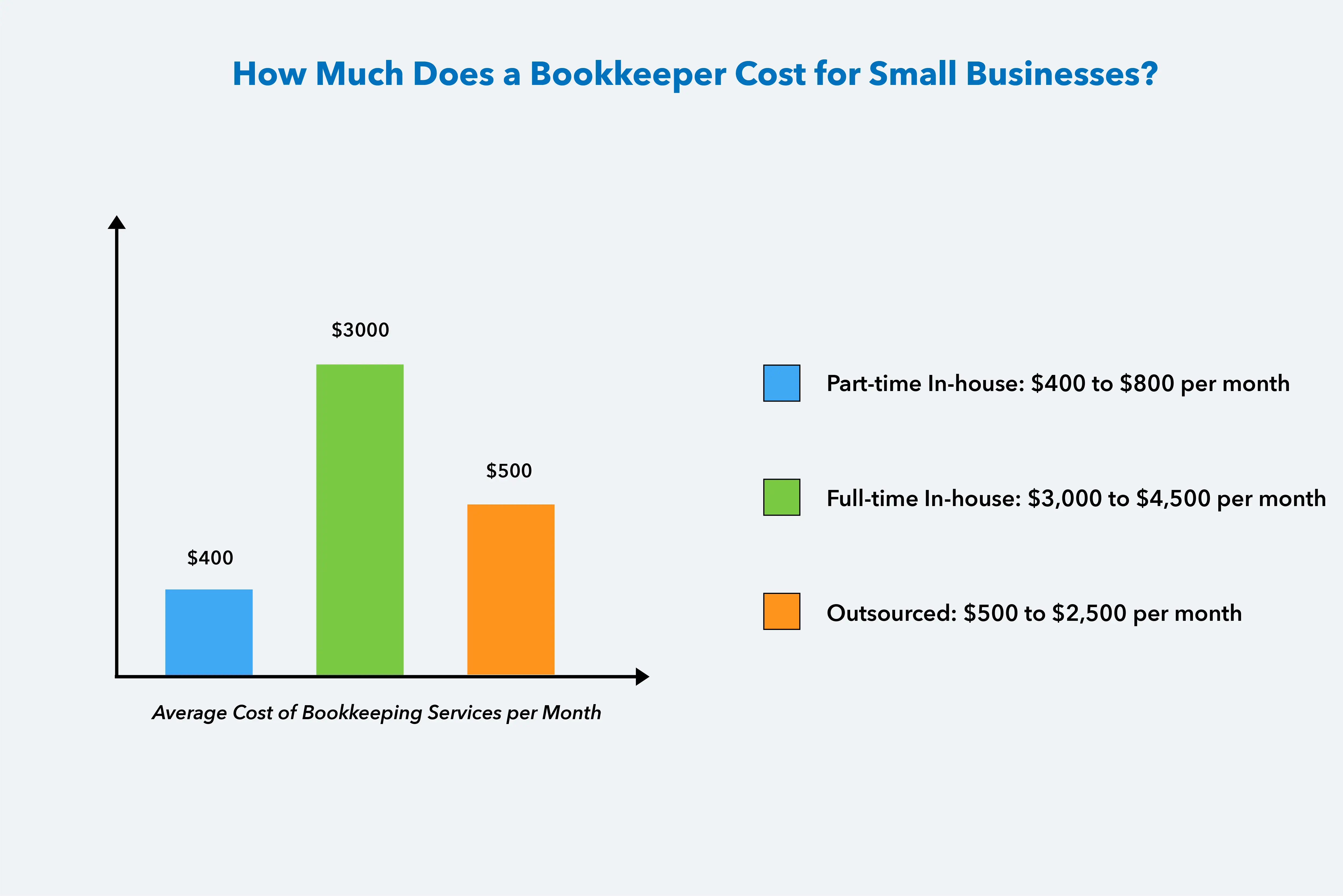

According to some sources, the average cost of bookkeeping services for a small business ranges from $500 to $3,520 per month. However, this is just a rough estimate and may not reflect your specific situation. To get a more accurate quote, you’ll need to contact several bookkeepers and compare their rates and services.

“Part time bookkeepers will charge between $400 and $800 per month for basic bookkeeping, excluding the benefits. For full time services, expect to pay from $3,000 to $4,500 per month without the benefits. For outsourced bookkeeping, the price is from $500 to $2,500 per month for basic bookkeeping tasks.(Source: Freshbooks)”

“The median annual wage for bookkeeping, accounting, and auditing clerks was $45,560 in May 2021. (Source: bls.gov)”

But don’t let these numbers scare you. Hiring a professional bookkeeper can actually save you money in the long run. As Mark Gandy , a CFO and bookkeeping expert says:

“Bookkeeping is not just about keeping track of numbers. It’s about telling the story of your business and helping you make better decisions.”

The Benefits of Hiring a Professional Bookkeeper for Your Small Business

You might be wondering, why should I hire a professional bookkeeper when I can do it myself?

Well, there are many reasons why outsourcing your bookkeeping tasks to a professional can be beneficial for your small business, such as:

Saving time: By outsourcing your bookkeeping tasks to a professional, you can free up your time to focus on other aspects of your business that you’re good at and enjoy doing.

According to a survey by The Alternative Board (TAB), entrepreneurs spend 68.1% of their time on day-to-day tasks and only 31.9% on long-term business goals. They work over 50 hours a week. Almost 40% say that they don’t have the time to create an annual plan or budget, and spend too much time on email (33%) and administrative tasks (24%).Saving money: By hiring a professional bookkeeper, you can avoid costly mistakes that could result in penalties, fines, or audits from the IRS. You can also save money on software, equipment, training, and payroll taxes that you would otherwise incur if you hired an in-house bookkeeper. Plus, you only pay for the services you need, rather than a fixed salary or benefits for a full-time employee.

Reducing stress: By trusting a professional bookkeeper with your financial records, you can reduce your stress levels and have peace of mind that your books are in order. You can also access timely and accurate financial reports that can help you monitor your business performance and make informed decisions.

“Having a bookkeeper has been a game-changer for me. It’s one less thing I have to worry about and it frees up mental space for me to focus on other things.” - Kaleigh Moore , a freelance writer and small business owner.Improving compliance: By working with a professional bookkeeper who is familiar with the latest tax laws and regulations, you can ensure that your business is compliant with all the relevant authorities. You can also avoid missing any deadlines or filing any incorrect forms that could result in penalties or audits.

How to Find and Choose the Right Bookkeeper for Your Small Business

Finding and choosing the right bookkeeper for your small business can be challenging. There are many bookkeepers out there, but they may not be qualified, reliable, or affordable.

Here are some tips and best practices to help you find and hire a bookkeeper that meets your needs and budget:

Ask for referrals: One of the best ways to find a reliable bookkeeper is to ask for referrals from other small business owners in your industry or network. You can also check online reviews or testimonials from previous clients to get an idea of their reputation and quality of work.

Check their portfolio: Another way to evaluate a bookkeeper’s skills and experience is to check their portfolio of previous work. You can ask them to show you some samples of their bookkeeping reports, statements, and software. You can also ask them about the types of clients and industries they have worked with and the challenges they have faced and solved.

Verify their credentials: It’s important to verify that the bookkeeper you’re considering has the necessary credentials to perform their duties. You can check if they have any certifications, licenses, degrees, or memberships in professional associations related to bookkeeping.

Some of the common credentials for bookkeepers are:

Certified Bookkeeper (CB): This credential is offered by the American Institute of Professional Bookkeepers (AIPB) and requires passing a four-part exam and having at least two years of bookkeeping experience.

Certified Public Bookkeeper (CPB): This credential is offered by the National Association of Certified Public Bookkeepers (NACPB) and requires passing a four-part exam and having at least one year of bookkeeping experience or education.

QuickBooks ProAdvisor: This credential is offered by Intuit and requires passing a series of exams on QuickBooks software and accounting principles.

Xero Certified Advisor: This credential is offered by Xero and requires passing an online course on Xero software and accounting principles.

Ask relevant questions: Before you hire a bookkeeper, you should ask them some relevant questions to assess their fit for your business. Some of the questions you can ask are:

How do you charge for your services? Do you charge by the hour, by the project, or by the month?

What are your payment terms and methods? Do you require a deposit, a retainer, or a contract?

How do you communicate with your clients? Do you prefer email, phone, or video calls? How often do you provide updates and reports?

What software and tools do you use for your bookkeeping tasks? Are you familiar with the software and tools that I use for my business?

How do you handle confidential and sensitive information? Do you have any security measures in place to protect my data?

How do you deal with errors or discrepancies in your bookkeeping records? Do you have any quality control procedures or policies?

How do you handle tax preparation and filing? Do you work with an accountant or a tax professional? Do you have any experience with tax laws and regulations in my industry and location?

Compare different options: Finally, you should compare different bookkeepers based on their rates, services, skills, experience, reputation, and personality. You should choose a bookkeeper who meets your needs and budget, who has relevant expertise and credentials, who has positive feedback from previous clients, and who is easy to work with and trustworthy.

Here is a blog that talks about hiring bookkeepers for your business.

The Bottom Line

While you may believe that you can manage your own finances with the help of accounting software like QuickBooks, you may be wasting your time and money.

Since most of us don’t have experience in bookkeeping, we may spend hours on managing books, tax deductions and even making mistakes that can lead to an IRS audit.

Hiring a professional bookkeeper can help you save time, money, and stress by keeping your financial records accurate and organized. It can also help you improve your compliance, cash flow management, financial reporting, and decision-making. You can also use tools like SaasAnt which can help you simplify your accounting tasks like importing, editing, and deleting transactions from Excel, CSV, IIF and other formats into QuickBooks & Xero.