Can You Use Afterpay at Walmart? A Complete Guide

The shopping world is witnessing a revolution with the rise of Buy Now, Pay Later (BNPL) services. Offering a convenient way to manage finances, BNPL platforms like Afterpay have become a favorite among budget-savvy shoppers. Afterpay, in particular, has gained favor for its user-friendly interface and widespread acceptance across various retailers.

The shopping world is witnessing a revolution with the rise of Buy Now, Pay Later (BNPL) services. Offering a convenient way to manage finances, BNPL platforms like Afterpay have become a favorite among budget-savvy shoppers. Afterpay, in particular, has gained favor for its user-friendly interface and widespread acceptance across various retailers.

But what happens when you find that perfect item at Walmart and long to leverage the flexibility of Afterpay? This is where you might encounter a slight roadblock. Walmart doesn't directly integrate with Afterpay for in-store or online purchases.

However, before you abandon your split-payment dreams, there's a potential solution on the horizon! Afterpay offers a feature called Single-Use Cards that might be the key to unlocking Afterpay's payment plans for your Walmart purchases. This blog will explore the intricacies of using Afterpay Single-Use Cards and navigate the path towards a smoother shopping experience at Walmart, even with Afterpay in your wallet.

Contents

Navigating Payments at Walmart: A Guide to Afterpay and Beyond

Distilling the Facts: Afterpay Isn't Currently Accepted at Walmart

Unlocking Diverse Payment Options at Walmart: Your Guide to a Seamless Shopping Experience

Shopping at Walmart with Afterpay Single-Use Cards

FAQs

Navigating Payments at Walmart: A Guide to Afterpay and Beyond

The shopping world has undergone a significant transformation with the rise of ‘Buy Now, Pay Later’ (BNPL) services. Afterpay, a prominent player in this arena, allows users to split their purchases into manageable installments, making budgeting and managing finances a breeze. As a savvy shopper, you might be curious: can you leverage Afterpay's convenience when shopping at Walmart? The direct answer is ‘no’; you cannot use Afterpay at Walmart.

Distilling the Facts: Afterpay Isn't Currently Accepted at Walmart

Here's the bottom line: Walmart doesn't directly accept Afterpay as a payment method. This applies to both in-store and online transactions at Walmart. While this might be a setback for Afterpay enthusiasts, fret not! We'll delve into alternative payment options at Walmart later.

The Booming BNPL Trend and Its Significance

The BNPL market is witnessing phenomenal growth, with a projected valuation of a staggering $3.98 trillion by 2030, as per a report by Allied Market Research. This exponential rise can be attributed to the flourishing online shopping landscape and the growing demand for flexible payment solutions, especially among younger generations.

Potential Reasons Behind Walmart's Hesitation: Why Walmart Might Not Be on Board with Afterpay

The world of retail is a complex ecosystem, and decisions regarding payment integrations involve careful consideration of various factors. While the exact reasons behind Walmart's hesitation to embrace Afterpay remain undisclosed, here's a comprehensive analysis of some potential contributing factors:

Transaction Fees: As mentioned earlier, BNPL providers typically levy transaction fees on merchants for each purchase made using their service. These fees can eat into a retailer's profit margin. Considering Walmart's focus on maintaining competitive pricing, the additional cost associated with Afterpay might be a deterrent.

Risk Management and Late Payments: BNPL services offer convenience but also introduce the risk of late payments from customers. Late payments can lead to bad debt and potential losses for the retailer. Walmart might be cautious about integrating a payment method that could increase its exposure to such risks.

Integration Challenges: Implementing a new payment method requires technical adjustments and can be complex. Walmart's existing payment infrastructure might need to be more readily compatible with Afterpay's system, necessitating significant investments in technology and resources for a smooth integration.

Internal Competition: Walmart already offers its credit card, the Capital One Walmart Rewards Card, which provides benefits and rewards programs to loyal customers. Integrating Afterpay might be seen as introducing competition to their in-house credit card offering.

Focus on Existing Partnerships: Walmart has partnered with other BNPL providers like Affirm. They might prioritize promoting and strengthening these existing partnerships before exploring collaborations with additional BNPL services like Afterpay.

Data Security Concerns: The rise of BNPL services has also raised concerns about data security. Before integrating its system, Walmart should thoroughly assess Afterpay's data security practices to protect its customers' financial information.

Regulatory Landscape: The BNPL market is relatively new, and regulations are still evolving. Walmart might be waiting for a more straightforward regulatory framework to emerge before embracing BNPL services more broadly.

Note: It's important to remember that these are just potential reasons, and Walmart's actual decision-making process likely involves a combination of these factors or even others not mentioned here.

Unlocking Diverse Payment Options at Walmart: Your Guide to a Seamless Shopping Experience

Walmart, a household name synonymous with value and convenience, caters to a global audience with diverse needs and preferences. This extends to their payment options, ensuring a smooth checkout experience for every customer. Whether you're a tech-savvy millennial or prefer tried-and-true methods, Walmart offers a payment avenue to suit your style.

Traditional Payment Methods: Still Going Strong

Walmart understands that customer preferences vary. Whether you're a technology enthusiast or prefer a more traditional approach, Walmart offers a variety of established payment options to ensure a comfortable and familiar shopping experience.

Credit and Debit Cards: A Secure and Convenient Choice

Universally Accepted: Major credit card networks like Visa, Mastercard, American Express, and Discover cards are readily accepted at all Walmart locations, in-store and online. This widespread acceptance provides flexibility and ease of payment, regardless of the Walmart branch you visit.

Enhanced Security Measures: We recommend utilizing chip-enabled cards. Chip technology offers a significant security advancement compared to traditional magnetic stripe cards, minimizing the risk of fraudulent activity during transactions.

Streamlined Transactions: Chip-enabled cards also expedite processing times at checkout, ensuring a time-efficient shopping experience.

Cash: Maintaining Control

Undisputed Acceptance: Cash remains a universally accepted form of payment. It's readily accepted at all Walmart locations, offering security and control over spending.

Effective Budgeting Tool: Utilizing cash allows meticulous budgeting by allocating a specific amount for your shopping trip. This approach can help mitigate overspending and impulse purchases arising from digital transactions.

Privacy-Focused Transactions: Cash transactions provide complete privacy, eliminating the need to share your financial information electronically.

Modern Wallet Solutions for a Contactless Future

Gone are overflowing wallets and frantic searches for the right card. The way we pay is undergoing a digital revolution driven by innovative technologies prioritizing convenience and security. Here's a breakdown of modern wallet solutions that are transforming the shopping experience:

Embrace the Power of Mobile Payments: Walmart Pay

This game-changing app by Walmart empowers you to streamline your in-store purchases. Simply download the app, securely link your preferred debit, credit, or Walmart gift card, and you're ready to go. Scan your purchases through the app and pay instantly at checkout, eliminating the need to fumble with physical cards or cash. Enjoy a faster, more contactless experience that keeps your shopping trip moving smoothly.

Leverage the Speed and Security of Contactless Payments: The Future is Here

Many debit and credit cards issued today are equipped with contactless payment technology. Look for your card's contactless symbol (often consisting of four curved radio waves). Tap your card on the designated reader at the payment terminal during checkout. This eliminates the need to insert your card into the reader or swipe it, offering a significantly faster and more secure payment method.

Benefits of Modern Wallet Solutions

Enhanced Convenience: Imagine breezing through checkout lanes without rummaging through your wallet. Mobile payment apps empower you to streamline in-store purchases. Download a reputable app like Apple Pay, Google Pay, or Samsung Pay, and securely link your preferred debit, credit, or store loyalty cards. At checkout, simply scan your purchases through the app for instant payment, eliminating the need to fumble with physical cards or cash. Enjoy a faster, more contactless experience that keeps your shopping trip moving smoothly.

Increased Security: Contactless payments utilize advanced encryption techniques to safeguard your financial information. Additionally, mobile payment apps often require fingerprint or PIN verification for added security, minimizing the risk of fraud compared to traditional methods.

Improved Hygiene: In today's hygiene-conscious world, contactless payments minimize contact with surfaces. By eliminating the need to touch a keypad or hand your card to a cashier, you can enjoy a more hygienic shopping experience.

Modern wallet solutions are gaining traction worldwide, offering a universally convenient and secure payment method. Whether shopping in your local grocery store or exploring a new market on the other side of the globe, these innovative technologies are redefining how we interact with our finances.

Ready to Make the Switch?

If you want to simplify your shopping experience and embrace the future of payments, consider exploring mobile payment apps like Walmart Pay, Apple Pay, Samsung Pay, and Google Pay, or inquire about contactless options with your bank. With these modern wallet solutions, you can shop confidently, conveniently, and with peace of mind.

Alternative Payment Solutions: Catering to Specific Needs

In today's dynamic world, consumers have varied preferences regarding managing their finances. Recognizing this diversity, Walmart offers many payment solutions to ensure a smooth and convenient shopping experience.

Flexibility and Gifting: The Power of Walmart Gift Cards

Walmart gift cards are perfect for those seeking versatility and budgeting control. These cards can be used in-store and online for personal shopping sprees or thoughtful gifts. The wide range of redeemable products makes them a universally appreciated present, while the recipient can enjoy the freedom to choose exactly what they need.

Note: You cannot use a Walmart gift card to purchase another gift card. Treat your gift card like cash! The remaining balance can only be replaced if it's recovered or stolen.

Ensuring Essential Access: Acceptance of EBT Cards

Walmart understands the importance of providing access to essential goods. For those receiving government benefits through EBT (Electronic Benefits Transfer) cards (program participation varies by location), Walmart facilitates authorized purchases, ensuring everyone can acquire necessary items.

Note: EBT cards offer a convenient way to purchase a variety of fruits, vegetables, dairy products, meat, poultry, fish, bakery items, cereals, and non-alcoholic beverages. You can also use your EBT card to purchase seeds and plants that will eventually produce food you can eat.

Buy Now, Pay Later at Walmart: A Comprehensive Guide to Affirm and PayPal Pay in 4

Walmart recognizes this growing trend and offers its customers a variety of BNPL options. However, with multiple providers available, choosing the right one can feel overwhelming. This section explores the two main BNPL options at Walmart—Affirm and PayPal Pay in 4—to help you make an informed decision.

Note: Before using any BNPL service, thoroughly review the terms and conditions to ensure they align with your financial situation.

Understanding BNPL at Walmart

BNPL services function by partnering with retailers like Walmart to provide an alternative payment method. Instead of paying the total upfront, you split your purchase into smaller installments, typically spread over several weeks or months, depending on the provider. This can be particularly helpful for managing larger purchases or unexpected expenses.

Here's a breakdown of the two main BNPL options at Walmart:

Affirm

Affirm is a reputable ‘Buy Now, Pay Later’ (BNPL) financing option that is seamlessly integrated into the Walmart checkout process (subject to eligibility). This service allows customers to split their total bill into manageable monthly installments, offering greater flexibility in budgeting and facilitating the acquisition of necessary or desired items that might otherwise strain finances.

Key Benefits of Financing with Affirm at Walmart

Transparency and Predictability: Affirm prioritizes clarity by displaying the exact loan terms upfront, including the total interest paid and the specific monthly payment amount. This empowers customers to make informed decisions without hidden fees or surprises.

Budget-Friendly Flexibility: Dividing a more significant purchase into fixed monthly installments allows for better budgeting and financial planning. Customers gain control over their cash flow and can prioritize other financial obligations while acquiring the products they need or desire.

Responsible Credit Building: On-time payments made through Affirm can improve a customer's credit score, unlocking better loan terms and interest rates in the future. However, it's crucial to remember that responsible repayment is vital to reap these benefits and avoid potential negative impacts on creditworthiness.

How to Utilize Affirm Financing at Walmart?

Eligibility Check: Customers can initiate a quick eligibility check with Affirm during checkout, either online or in-store, at participating Walmart locations. When you begin the eligibility check at Walmart checkout (online or in-store), Affirm typically performs a ‘soft credit check.’ This check doesn't leave a footprint on your credit report or affect your credit score. These soft checks are quick and provide you with a real-time decision within minutes.

Transparent Terms: Once approved, Affirm presents clear loan terms outlining the total loan amount, interest rate, and specific monthly payment schedule. Customers can review these details and make an informed decision before finalizing the purchase.

Convenient Repayment: Affirm offers multiple convenient repayment options, including automatic deductions from a designated bank account. Customers can also manage their loans and make payments directly through the Affirm app or website.

By providing various payment solutions, Walmart caters to a global audience with diverse financial needs. Whether you're seeking a thoughtful gift, require access to essentials through EBT cards, or wish to manage a more significant purchase through financing options like Affirm, Walmart offers a convenient and secure way to complete your transaction.

Key Points To Remember

Plan Your Payment Method: Decide your preferred payment method beforehand to expedite checkout.

Take Advantage of Mobile Wallets: If you haven't already, consider downloading the Walmart Pay app for a contactless and convenient shopping experience.

Review Online Order Payment Options: Double-check the available payment methods at online checkout to ensure you have selected the necessary payment method before finalizing your order.

With a clear understanding of Walmart's payment options and a little planning, you can turn your next shopping trip into a smooth and efficient experience. Happy Shopping!

Considerations

Interest rates can vary depending on your creditworthiness and purchase amount.

Late fees may apply for missed payments.

PayPal Pay in 4

Known for: Convenience for existing PayPal users, promotes budgeting.

How It Works

Link PayPal Account: Ensure your account is linked to your Walmart online or app checkout.

Select Pay in 4: Choose PayPal Pay in 4 as your payment method during checkout.

Split Payments: Similar to Afterpay (though not currently offered at Walmart), PayPal Pay in 4 splits your purchase into four bi-weekly installments, with no interest charged if on time.

Benefits

Interest-free if payments are made on time.

Convenient for existing PayPal users, eliminating the need for additional account creation.

Promotes budgeting by dividing payments into smaller chunks.

Considerations

Late fees apply for missed payments.

There is a potential for overspending due to the ease of multiple smaller payments. Be mindful of your budget and avoid impulsive purchases.

Choosing the Right BNPL Option:

The ideal BNPL option hinges on your individual needs and financial situation. Here are some key factors to consider:

Interest Rates: Compare interest rates offered by each provider (in this case, Affirm).

Fees: Be aware of any late fees or other charges associated with using the service (late fees apply for both Affirm and PayPal Pay in 4).

Repayment Terms: Choose a repayment plan that fits comfortably within your budget. Consider the number of installments and due dates each provider offers (Affirm offers a broader range of repayment terms).

Responsible BNPL Usage:

BNPL services can be valuable for managing finances, but responsible usage is crucial. Always make payments on time to avoid late fees and interest charges. Only borrow what you can afford to repay within the specified timeframe. Remember, BNPL is not a free loan - be mindful of your budget and avoid impulse purchases.

International Payment Options: A Glimpse Across the Globe

While Walmart strives to offer a consistent shopping experience worldwide, payment options can vary slightly depending on location. This section delves into the nuances of international payments at Walmart, ensuring a smooth checkout experience no matter where you are.

The good news for international shoppers is that major credit cards with logos like Visa, Mastercard, and sometimes Discover and American Express are generally accepted at Walmart stores across the globe. These cards offer a reliable and convenient way to pay for your purchases.

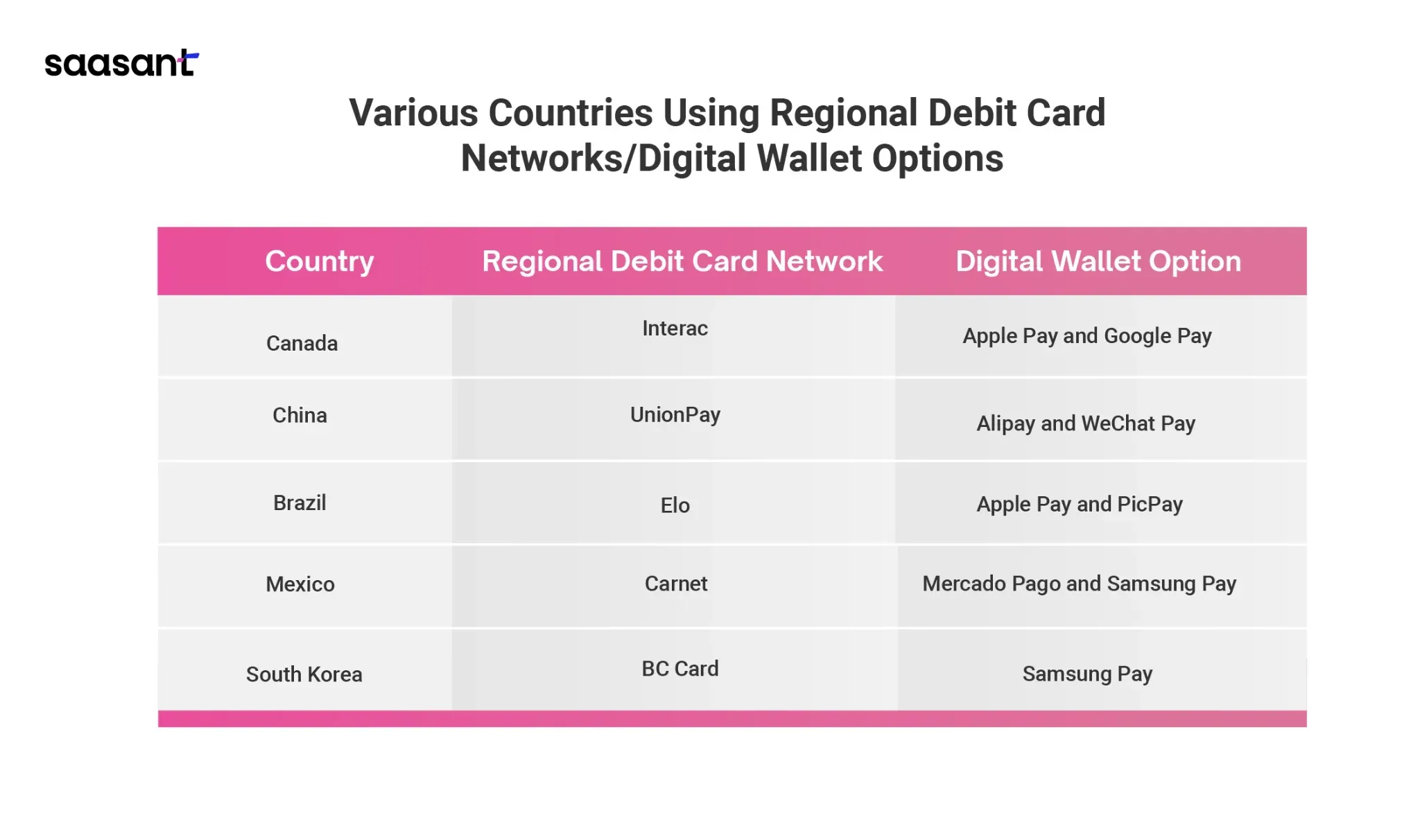

While major credit cards offer a widely accepted solution, some countries might have popular regional debit card networks or digital wallet options that are also accepted at Walmart. However, some countries also have regional debit card networks or digital wallet options:

To ensure you're utilizing the most convenient payment method, consider these options:

Check with Your Local Walmart Store: The best way to get the most up-to-date information on accepted international payment methods is to contact your local store directly. They can provide specific details on what payment options are available in your region.

Explore the Walmart Website: The official website often has a section dedicated to international shoppers. This section might provide details on accepted payment methods for your specific country. Look for a section titled ‘International’ or ‘Global Information’ on the website.

Consider Currency Exchange Rates: It's important to remember that using a credit or debit card issued in a different currency than the one used at Walmart incurs foreign transaction fees and potentially less favorable exchange rates. Checking with your bank about these fees beforehand can help you plan your shopping trip accordingly.

Here are some additional tips for a seamless international shopping experience at Walmart:

Contact your bank: Inform your bank that you'll use your card internationally to avoid any potential issues with blocked transactions due to suspected fraudulent activity.

Carry some local currency: Having some local cash on hand can be helpful for situations where card payments might not be accepted, such as for tipping or at self-checkout kiosks that might not be set up for international cards.

Understanding the potential variations in international payment options at Walmart and taking a few proactive steps can ensure a stress-free and enjoyable shopping experience on your next Walmart adventure!

Shopping at Walmart with Afterpay Single-Use Cards

Have you ever browsed the aisles at Walmart, filled your cart with treasures, then reached the checkout only to discover your beloved Afterpay wasn't an accepted payment option? We've all been there. But fear not, budget-conscious shoppers! Afterpay's ingenious Single-Use Cards come to the rescue, allowing you to split your Walmart purchases into manageable installments, even if Walmart doesn't directly integrate with Afterpay.

What are Afterpay Single-Use Cards?

Imagine a magic credit card generator specifically for each Afterpay purchase! These virtual cards, unique to each transaction, offer the flexibility of Afterpay's split-payment system at stores that wouldn't traditionally support it. Here's the breakdown:

One-Time Wonders: Unlike traditional credit cards, Afterpay Single-Use Cards are explicitly generated for a single purchase. You set your spending limit within the Afterpay app, and they create a unique card number with an expiry date tied to that specific transaction. This ensures you only spend what you intended and don't risk carrying a balance on the virtual card.

Enhanced Security: Since these cards are single-use, the risk of unauthorized charges is significantly reduced. Even if someone were to obtain your card information somehow, it wouldn't be usable for future purchases.

How to Use Afterpay Single-Use Cards for Your Walmart Shopping?

Ready to conquer Walmart with the power of Afterpay? Here's a step-by-step guide:

Step 1: Finding Your Single-Use Card

Open your Afterpay app and navigate to the ‘Single-Use Cards’ section.

This might vary slightly depending on your app version.

Don't worry; it's usually quite intuitive to find.

Decide on a responsible spending limit for your Walmart purchases.

Note: Afterpay typically breaks down your purchase into four interest-free installments, so factor that in when setting your limit.

Step 2: Using the Single-Use Card at Walmart

When you're ready to check out at Walmart's online store, look for the ‘Single-Use Payment’ option.

Select this option and enter the exact purchase amount, including applicable taxes and shipping costs.

The beauty of Afterpay Single-Use Cards is that the app will auto-fill the payment details with your unique card information.

Simply confirm the details and complete your order.

That's it! Your Walmart goodies are coming, and your payments are conveniently split into manageable installments.

In-Store Availability (Limited)

While the online experience is seamless, in-store functionality might be trickier. Walmart locations might allow single-use cards through their point-of-sale (POS) systems. This feature is still rolling out, so it's always best to check with your local store beforehand to avoid any checkout surprises. Contact your local Walmart by phone or browse their website for store-specific information.

Benefits of Using Afterpay Single-Use Cards at Walmart

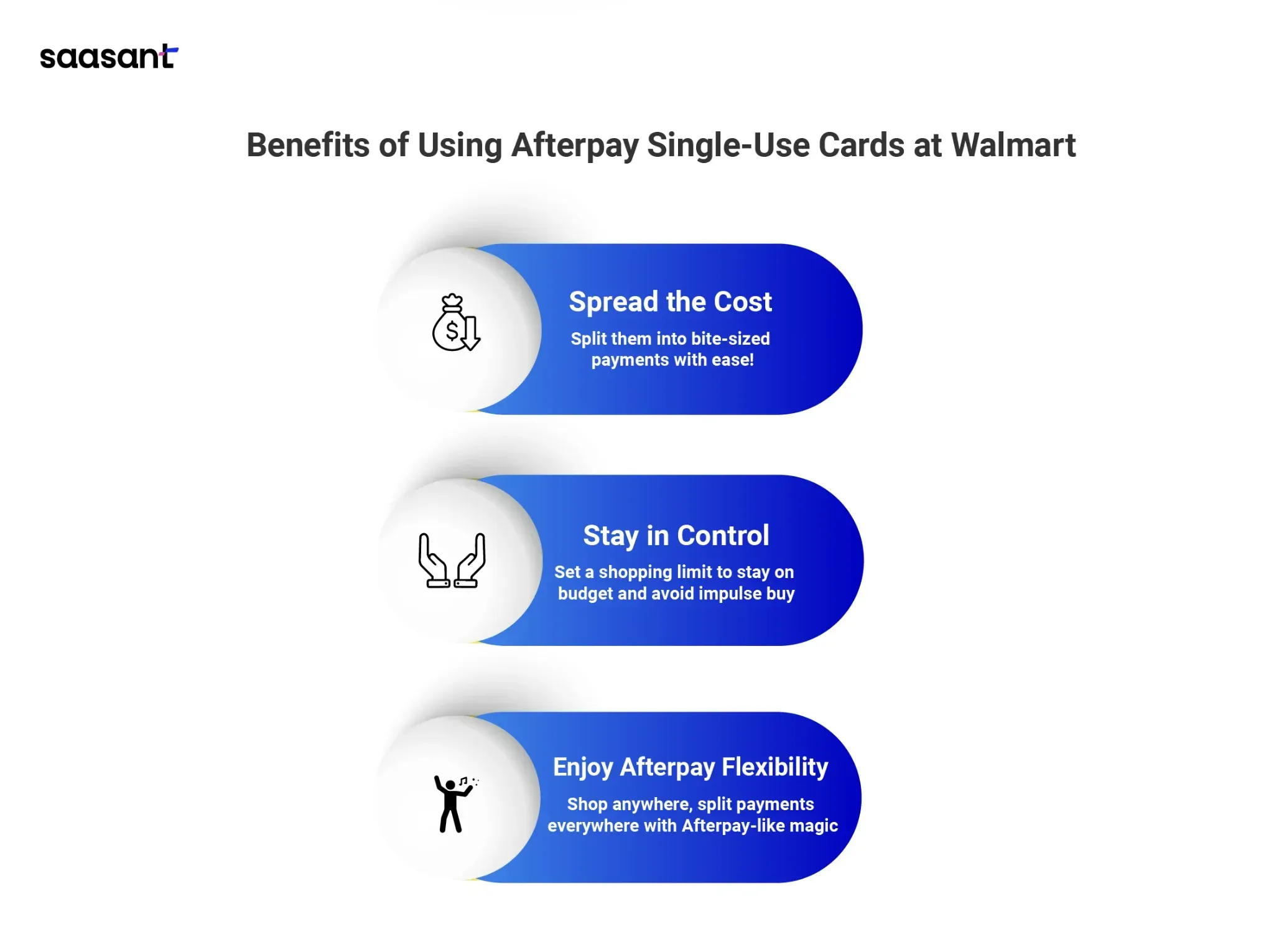

Spread the Cost: Break down those larger Walmart purchases into bite-sized payments, making them easier to manage and budget. No more straining your wallet with a single large payment!

Stay in Control: Setting a spending limit beforehand ensures you don't overspend on your shopping trip. This promotes responsible shopping habits and prevents impulse purchases from derailing your budget.

Enjoy Afterpay Flexibility: Experience the familiar split-payment system of Afterpay, even at stores that don't traditionally offer it. This opens up a world of flexibility and responsible shopping opportunities!

Important Reminders

One-Time Use Only: Remember, Afterpay Single-Use Cards are for a single purchase only. Once you've used them for that specific transaction, they become invalid. Don't try to reuse them for future purchases!

Reliable Internet Connection: Since the checkout process often involves the Afterpay app auto-filling information, a good internet connection is crucial for a smooth experience. Ensure a stable connection before heading to checkout.

Afterpay Single-Use Cards are a game-changer for budget-conscious shoppers who frequent Walmart. They offer the convenience of Afterpay's split-payment system at a store that wouldn't traditionally provide it. So next time you're at Walmart, and budgeting is on your mind, consider Afterpay Single-Use Cards! They are a secure, responsible, and flexible way to conquer your shopping list without breaking the bank.

Wrap Up

Do you ever wish to split your Walmart shopping bills into more manageable chunks? While Walmart doesn't integrate directly with Afterpay, a clever workaround allows you to enjoy similar benefits.

Although you can't use your Afterpay account directly at Walmart checkout, Afterpay offers virtual single-use cards with specific spending limits. These cards enable you to make online purchases at Walmart, bringing Afterpay's convenience to your shopping experience.

But what if Afterpay isn't your preferred option? Don't worry! There are other ‘buy now, pay later’ (BNPL) services that Walmart does accept:

Affirm: This well-known BNPL service allows you to split your Walmart purchases into installments over a defined period, making it easier to manage your payments.

Pay in 4: This widely accepted BNPL option allows you to divide your Walmart purchases into four interest-free payments over six weeks.

Before you sign up for any BNPL service, it's crucial to research and compare the terms. Depending on the provider, interest rates, late fees, and repayment timelines can vary significantly. Your choice should align with your specific financial needs and situation.

By exploring these alternatives, you can still enjoy the flexibility of spreading your Walmart purchases over time, making your shopping experience more budget-friendly and convenient.

FAQs

Can I Use Afterpay Directly at Walmart?

Walmart doesn't directly integrate with Afterpay for in-store or online purchases, so you cannot use your Afterpay account at checkout.

Are There Any Workarounds To Use Afterpay For Walmart Purchases?

Yes! Afterpay offers virtual Single-Use Cards with specific spending limits. These cards can be used to make online purchases at Walmart. Essentially, they bring the convenience of Afterpay's split-payment system to your Walmart shopping experience.

How Do Afterpay Single-Use Cards Work For Walmart Online Shopping?

Open the Afterpay app and navigate to the ‘Single-Use Cards’ section (This might vary slightly depending on your app version).

Decide on a responsible spending limit for your Walmart purchases (Afterpay typically breaks down your purchase into four interest-free installments, so factor that in).

When checking out at Walmart's online store, select the ‘Single-Use Payment’ option.

Enter the exact purchase amount, including any applicable taxes and shipping costs.

The Afterpay app will auto-fill the payment details with your unique card information.

Confirm the details and complete your order.

Can I Use Afterpay Single-Use Cards at Walmart Stores?

Currently, Walmart's in-store functionality for Afterpay Single-Use Cards is limited. While some stores might allow them, it's not a guaranteed option. To avoid surprises, it's always best to check with your local Walmart beforehand.

Are There Alternative BNPL Options Accepted at Walmart?

Yes! Walmart offers other "Buy Now, Pay Later" (BNPL) payment solutions:

Affirm: This service allows you to split your Walmart purchases into installments over a defined period.

PayPal Pay in 4: This option lets you divide your Walmart purchases into four interest-free payments spread over six weeks.

Before Using a BNPL Service at Walmart, What Should I Consider?

It's crucial to research and compare the terms of each BNPL service offered by Walmart. Here are some key factors to consider:

Interest rates: These can vary depending on your creditworthiness and purchase amount, with some BNPL options having interest charges.

Late fees: Both Affirm and PayPal Pay in 4 have late fees for missed payments.

Repayment Terms: Choose a repayment plan that fits comfortably within your budget. Consider the number of installments and due dates offered by each provider.

Are There Any Other Payment Methods Accepted at Walmart?

Absolutely! Walmart offers a variety of payment options to cater to diverse customer needs. Here are some examples:

Traditional credit and debit cards (significant networks like Visa, Mastercard, American Express, and Discover are accepted).

Cash.

Walmart gift cards.

EBT cards (electronic benefits transfer cards) for government benefits recipients (program participation varies by location).

Mobile payment apps like Walmart Pay, Apple Pay, Google Pay, and Samsung Pay (depending on your device).

I'm Shopping at Walmart From Outside the US. What Payment Methods Can I Use?

Generally, major credit cards with logos like Visa, Mastercard, and sometimes Discover and American Express are accepted at Walmart stores worldwide. However, some countries might have popular regional debit card networks or digital wallet options also accepted at Walmart. Here are some tips for a smooth international shopping experience:

Contact your local Walmart store for the most up-to-date information on accepted payment methods in your region.

Explore the Walmart website's international section for details on payment methods specific to your country.

Consider currency exchange rates, as you incur foreign transaction fees and potentially less favorable rates when using a card issued in a different currency.

Inform your bank about international travel to avoid blocked transactions due to suspected fraudulent activity.

Carry some local currency for situations where card payments might not be accepted.

Also read: