Can You Use Afterpay on Amazon? Learn How It Works

Have you ever craved the perfect Amazon find but hesitated due to the price tag? You're not alone! Many of us adore the budgeting power Afterpay offers, letting us "buy now, pay later" in manageable installments. But can this magic extend to Amazon's vast marketplace? Simply put, does Amazon take Afterpay? Buckle up because this guide will analyze the Afterpay and Amazon combination, explore clever workarounds, and equip you with responsible spending tips for a smooth online shopping spree!

What is Afterpay?

Afterpay is a buy now, pay later (BNPL) service. This means it allows you to split your purchases into installments you pay over a short period, typically without interest or fees, if you make your payments on time. Afterpay offers flexible payment options for online shopping, allowing purchases to be split into four interest-free installments over six weeks. The application process is quick, and online and in-store retailers widely accept it. However, there are spending limits, late fees for missed payments, and a risk of overspending if not managed carefully.

Benefits of Afterpay: Your Shopping Companion

Managing your finances is difficult in the world of instant gratification and online shopping splurges. Thankfully, services like Afterpay offer a helping hand. Let us know the key benefits of Afterpay that can improve your shopping experience:

1. Seamless Shopping and Checkout

Gone are the days of cart abandonment due to hefty price tags. Afterpay integrates seamlessly with the checkout process at partnered retailers. Simply choose Afterpay as your payment method, and you can split your purchase into manageable installments without leaving the online store.

2. Instant Approval Process

Forget lengthy credit card applications and waiting periods. Afterpay boasts a quick and easy approval process. After providing basic information, you'll receive an instant approval, allowing you to enjoy your purchase immediately.

3. Effortless Payment Splitting

Afterpay eliminates the burden of a large upfront payment. Instead, it automatically splits your purchase amount into smaller, equal installments, typically spread over four payments. This makes budgeting a breeze and allows you to spread the cost without breaking the bank.

4. Automated Deductions

Say goodbye to the stress of remembering due dates! Afterpay takes care of everything. Your scheduled payments are automatically deducted from your nominated debit or credit card at specific intervals, ensuring you avoid late fees and maintain a good credit score.

5. Interest-Free Advantage

One of the most attractive features of Afterpay is its zero-interest policy. You won't incur additional fees or interest charges if you make your payments on time. This allows you to enjoy your purchase without hidden costs eating into your budget.

Does Amazon Accept Afterpay Payments?

Amazon does not directly accept Afterpay as a payment method. However, the two workarounds, the Afterpay single-use payment card, and the gift card option, allow you to use Afterpay for purchases on Amazo.

Single-Use Payment Option

Afterpay provides a single-use payment credit card that can be utilized similarly to a regular debit or credit card for purchases on Amazon. Here's how to use it:

Open the Afterpay app and select Amazon in the 'Shop' tab.

Shop on Amazon as usual and add items to your cart.

When checking out, choose the option to add a new credit or debit card.

Afterpay will generate a single-use card number that you can use to complete your purchase on Amazon.

It’s important to remember that this card is for single use only, so it shouldn’t be saved as your default payment method on Amazon. Also, the availability of single-use cards might vary depending on the user's location and Afterpay account details.

Gift Card Option

Another workaround is purchasing an Amazon gift card via the Afterpay platform and then using this gift card to shop on Amazon. This method lets you indirectly benefit from Afterpay's installment plans when shopping on Amazon. However, you should know that some retailers might charge fees for gift cards purchased with Afterpay.

Key Points to Remember

The Afterpay app must be used to initiate purchases on Amazon using the single-use card.

These workarounds enable you to enjoy the flexibility of Afterpay’s payment plan without direct support on Amazon's platform.

These methods allow you to split your payment into more manageable installments, adhering to Afterpay's typical structure.

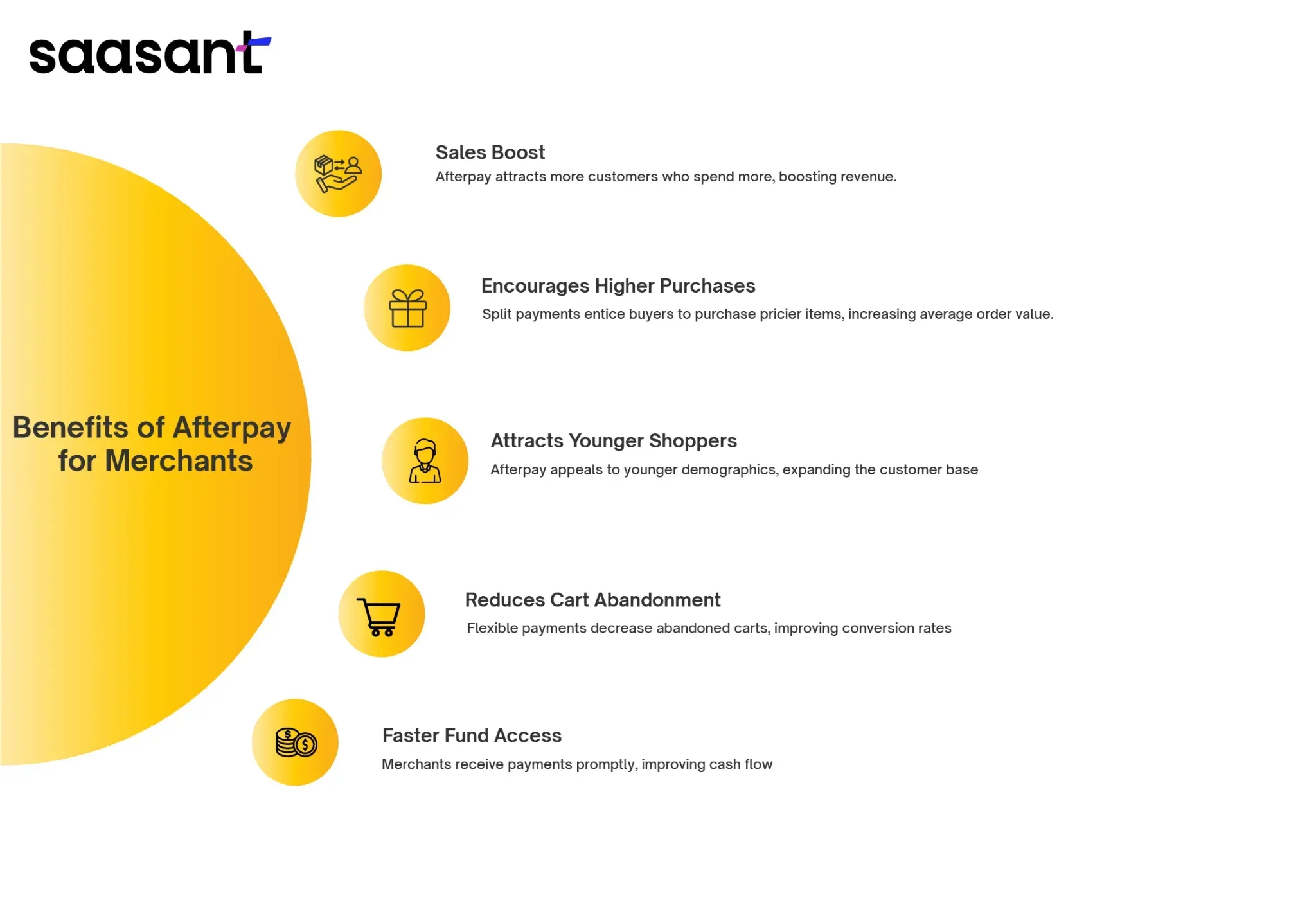

What are the Benefits of Afterpay for Merchants?

While Afterpay empowers customers with flexible payment options, it also offers a treasure trove of benefits for merchants:

1. Boosting Sales: Afterpay can be a powerful sales magnet. Afterpay users tend to spend more per transaction than traditional payment methods. This translates to increased revenue and a potential boost to your bottom line.

2. Encouraging Higher Purchases: Splitting payments into manageable installments can entice customers to consider pricier items they might otherwise hesitate to purchase. This opens doors to selling higher-value products and potentially increasing your average order value.

3. Attracting Younger Shoppers: Afterpay is particularly popular with younger demographics who value flexible payment options. By offering Afterpay, you can tap into this growing customer base and expand your reach to a generation comfortable with "buy now, pay later" services.

4. Reducing Cart Abandonment: One major hurdle for online retailers is cart abandonment, which occurs when customers add items to their cart but do not complete the purchase. Afterpay removes the barrier of a large upfront payment, potentially leading to fewer abandoned carts and a higher conversion rate (turning website visitors into paying customers).

5. Faster Access to Funds: Unlike traditional payment methods, which might require weeks or even months to receive payment, Afterpay ensures you are paid within days of the purchase. This improves your cash flow and simplifies your financial management.

How to Integrate Your Amazon and Payment Gateway Data?

Managing diverse payment options and keeping track of complex financial data can pose challenges when selling across multiple marketplaces. This is where PayTraQer, a bookkeeping automation software, comes to the fore. PayTraQer seamlessly syncs your e-commerce sales, fees, refunds, taxes, and Amazon with different payment gateways to your QuickBooks or Xero account. Paytraqer simplifies your bookkeeping process, allowing you to manage your business finances efficiently.

Running an online business requires juggling multiple tasks, and managing finances can quickly become overwhelming. PayTraQer aims to simplify this process with powerful features designed to save you time and streamline your bookkeeping. Here's a closer look at ten key features that make PayTraqer a valuable asset:

Automatic Data Extraction: Say goodbye to tedious manual data entry! PayTraQer automatically extracts transaction data from your connected e-commerce platforms and payment gateways. This eliminates the risk of errors and saves you countless hours that could be better spent growing your business.

Effortless Time Savings: The automated data extraction translates to significant time savings. No more manually copying and pasting data from different sources. PayTraqer seamlessly gathers the information, allowing you to focus on more strategic tasks.

Multi-Platform & Gateway Connectivity: Whether you sell on Shopify, Amazon, or another platform and accept payments through PayPal, Stripe, or other gateways, PayTraqer has you covered. It connects to various platforms and gateways, ensuring all your sales and payment data are consolidated in one place.

Real-Time Syncing for Up-to-Date Insights: With real-time transaction syncing, you can gain a clear and current picture of your finances. PayTraqer instantly reflects every sale and payment, providing you with the most up-to-date financial data for accurate decision-making.

Data-Driven Decisions with Powerful Reporting: PayTraqer goes beyond simply collecting data. It helps you analyze the information through insightful reports. Gain valuable insights into sales trends, payment patterns, and overall financial performance, allowing you to make data-driven business decisions.

Seamless Accounting Integration: Streamline your workflow further by integrating PayTraqer with popular accounting software like QuickBooks and Xero. This allows for effortless data transfer, saving time and ensuring consistency across your financial systems.

Customization for Your Needs: PayTraqer understands that every business has unique needs. You can customize sync settings to ensure the data you receive aligns perfectly with your accounting practices and preferences.

Global Reach with Multi-Currency Support: PayTraqer handles multiple currencies even if you sell internationally, allowing you to track sales and payments seamlessly regardless of your customer's location.

Unwavering Data Security: Protecting your financial data is paramount. PayTraqer prioritizes security with features like data encryption and read-only access. You can rest assured that your sensitive information is always secure.

Exceptional Customer Support: PayTraqer isn't just about software; it's about offering a complete solution. Their excellent customer support team can answer questions and ensure a smooth user experience.

“SaasAnt's PayTraqer Hits 3.46 Million QuickBooks Transactions in E-Commerce for 2023”

Expanding Your Shopping Horizons: Using Afterpay's Single-Use Card Beyond Amazon

While the single-use card from Afterpay might have initially caught your eye for Amazon purchases (thanks to the handy workaround!), its utility extends far beyond the world's largest online marketplace. Here's how you can leverage the flexibility of Afterpay's single-use cards for various shopping sprees:

Unlocking Possibilities

Retailers Accepting Afterpay: Many online and in-store retailers have partnered with Afterpay. Explore the "Shop" section within the Afterpay app to discover a wide range of stores where you can utilize your single-use card directly at checkout. From clothing brands and electronics stores to homeware and beauty retailers, the options might surprise you!

Maximizing Convenience: The process is straightforward, just like using your single-use card on Amazon. Locate the participating retailer within the Afterpay app, browse their selection, and add items to your cart. During checkout, choose the "Credit or Debit Card" option and enter the single-use card details provided by Afterpay.

Important Considerations

Availability and Limits: Remember, single-use card availability might vary depending on your location and Afterpay account details. Each single-use card has a specific spending limit based on your Afterpay approval amount.

Merchant Restrictions: Some retailers might restrict the use of single-use cards. It's always wise to double-check the retailer's payment policy before heading to checkout.

Responsible Spending: The convenience of Afterpay's single-use cards shouldn't overshadow responsible spending habits. Always ensure you can comfortably manage the repayment installments associated with each card.

Exploring Alternatives

Direct Afterpay Integration: While less widespread than credit cards, many retailers directly integrate with Afterpay. This eliminates the need for single-use cards and allows you to utilize Afterpay's payment plan options at checkout seamlessly.

Afterpay vs. Klarna vs. Affirm vs. Sezzle: Which One Should You Choose?

Afterpay has become a popular choice for "buy now, pay later" (BNPL) purchases, but it's not the only player in the game. Here's a breakdown of Afterpay compared to other leading BNPL services to help you choose the best fit for your needs:

Key features

Feature | Afterpay | Klarna | Affirm | Sezzle |

Payment Split | Four installments (every two weeks) | Three installments (pay in 30 days or split) | 3-36 months (varies by purchase) | Four installments (every two weeks) |

Interest | No interest if paid on time | No interest if paid on | Variable interest (0-30%) | No interest if paid on |

time | time | |||

Late Fees | Yes | Yes | Yes | Yes |

Minimum Purchase | Varies | Varies | Varies | Varies |

Spending Limits | Yes | Yes | Yes | Yes |

Credit Check | Soft check | Soft check | Hard credit check | Soft check |

Pros and Cons

Service | Pros | Cons |

Afterpay | Widely accepted, easy to use, transparent fee structure | Limited payment split options, shorter repayment period |

Klarna | Flexible options (pay later or split), longer repayment | It can be confusing to understand fees and may require a hard check |

Affirm | Larger purchase amounts possible, extended repayment terms | Hard credit check, higher potential interest rates |

Sezzle | Widely accepted, easy to use, multiple promotions available | Limited repayment period (4 installments) |

Choosing the Right Option:

Consider your purchase amount: If you're making a more minor purchase, Afterpay or Sezzle might be suitable due to their shorter repayment periods. Klarna or Affirm could be better options for larger purchases due to their higher spending limits and longer repayment terms.

Prioritize interest-free purchases: If interest-free payments are crucial, Afterpay, Sezzle, and Klarna (when paying in 30 days) are your best bets.

Value flexibility: Klarna offers the most flexibility with its "pay later" option alongside installment plans.

Credit score concerns: Afterpay and Sezzle only perform soft credit checks, while Klarna and Affirm might require hard checks, impacting your credit score.

How to Use Afterpay Safely?

Afterpay offers a convenient way to manage online purchases, but ensuring security is crucial. Here are some essential tips for using Afterpay safely, guarding personal information, managing accounts, safe shopping practices, and understanding terms and conditions.

Guard your information:

Create a robust and unique password.

Enable two-factor authentication (2FA).

Beware of phishing scams.

Manage your account:

Monitor account activity regularly.

Ensure linked cards have strong security.

Report any concerns to customer support.

Practice safe shopping:

Shop at reputable retailers.

Double-check order details before purchasing.

Understand the terms:

Read and understand Afterpay's terms and conditions.

Know your spending limits to avoid exceeding them.

How to Use Afterpay Responsibly?

Afterpay's "buy now, pay later" convenience can be a budgeting ally, but it's crucial to use it responsibly. Here are key strategies to ensure Afterpay empowers your shopping, not the other way around:

Budget Before You Buy

Refrain from letting Afterpay's ease entice you into impulse purchases. Always factor in your current budget and essential expenses before using Afterpay. Prioritizing needs over wants and sticking to a plan to avoid financial strain.

Understand Your Limits

Afterpay might have spending limits initially, but these can increase with responsible usage. Be aware of your limits and avoid exceeding them. Remember, exceeding your limits can lead to declined purchases and potentially impact your credit score.

Master the Art of Tracking

Don't rely solely on Afterpay's automated deductions. Keep track of your upcoming payments and ensure sufficient funds are available in your linked account. Missing payments can incur late fees and damage your credit score.

Prioritize On-Time Payments

Afterpay's beauty lies in its zero-interest policy. However, late payments can negate this benefit and result in additional fees. Set calendar reminders or utilize the app's notifications to ensure timely payments and avoid unnecessary charges.

Beware of Overspending

The convenience of Afterpay can be a double-edged sword. While it allows you to spread costs, it can also lead to overspending if not managed carefully. Stick to your budget and resist the urge to make multiple Afterpay purchases simultaneously.

Common Afterpay Issues and Troubleshooting Tips

While Afterpay offers a convenient way to shop, you might encounter some bumps on the road. Here's a breakdown of common Afterpay issues and troubleshooting tips:

Resolving Payment Declines on Afterpay

Reason: This could be due to insufficient funds in your linked account, exceeding your spending limit, or a technical glitch with Afterpay.

Solution:

Check your linked account balance and top it up if necessary.

Review your Afterpay spending limit and avoid exceeding it.

Contact Afterpay customer support to rule out any technical issues.

Managing Late Fees with Afterpay

Reason: Late payments incur late fees, which can add up quickly.

Solution:

Set calendar reminders or utilize the app's notifications to ensure timely payments.

Consider setting up automatic payments to avoid missing due dates.

Addressing Missing or Inaccurate Order Details on Afterpay

Reason: Discrepancies between your order and Afterpay information can occur.

Solution:

Contact the merchant directly to address any order-related issues.

If the issue pertains to Afterpay displaying incorrect information, contact Afterpay customer support.

Troubleshooting Account Linking Issues with Afterpay

Reason: Your bank or debit card might be incompatible, or you might need to enter the correct information.

Solution:

Double-check your bank details and ensure they match your card information exactly.

Verify if your bank or debit card issuer offers Afterpay integration.

Contact Afterpay customer support for further assistance.

Enhancing Account Security on Afterpay

Reason: If you suspect unauthorized activity on your account, it's crucial to act immediately.

Solution:

Change your Afterpay password immediately and enable two-factor authentication.

Report suspicious activity to Afterpay customer support to ensure your account security.

The Future of Afterpay and BNPL: Growth, Innovation, and Evolving Regulations

The "Buy Now, Pay Later" (BNPL) sector has seen explosive growth, with Afterpay being a significant player. But what does the future hold for Afterpay and BNPL services in general? Here's a glimpse into potential trends:

Continued Rise in Popularity

Market Expansion: BNPL is expected to continue its global expansion, reaching new markets and attracting a broader customer base. This growth will likely be driven by increasing consumer adoption, particularly among younger demographics that are comfortable with flexible payment options.

Retailer Integration: Expect even deeper integration between BNPL providers and retailers. Offering BNPL options at checkout will likely become standard practice for online and in-store retailers, further boosting BNPL usage.

Innovation and Feature Expansion

Beyond Traditional Split Payments: BNPL services might evolve beyond the standard split payment model. We might see features like extended repayment plans for larger purchases or integrations with budgeting and financial management tools.

Loyalty Programs and Rewards: BNPL providers might introduce loyalty programs and reward structures to incentivize customer engagement and brand loyalty.

Regulatory Landscape

Increased Scrutiny: Expect more regulatory scrutiny as the BNPL market matures. Governments will likely implement stricter regulations to ensure consumer protection, financial stability, and a level playing field with traditional financial institutions. This might involve data security measures, creditworthiness checks, and more transparent communication of fees and terms.

Collaboration with Regulators: Responsible BNPL providers will likely collaborate with regulators to develop fair and effective regulations that foster innovation while protecting consumers.

The Competitive Landscape

Market Consolidation: The BNPL market might consolidate, with established players like Afterpay acquiring smaller competitors or forming strategic partnerships.

Competition from Traditional Players: Traditional financial institutions like banks and credit card companies will likely step up their offerings in the BNPL space to compete with Afterpay and other BNPL providers.

The Afterpay Advantage

Building on Brand Recognition: Afterpay's strong brand recognition and established user base position it well to navigate future challenges.

Focus on User Experience: By prioritizing user experience with a seamless and user-friendly platform, Afterpay can solidify its position as a preferred BNPL option.

Adapting to Regulations: Afterpay's proactive approach towards working with regulators will be crucial in navigating the evolving regulatory landscape.

Conclusion

Afterpay offers a convenient and flexible solution for managing online purchases, empowering consumers to "buy now, pay later" in manageable installments. While Afterpay's direct integration with Amazon might be limited, savvy shoppers can leverage workarounds such as single-use payment cards or gift card options to enjoy the benefits of Afterpay while shopping on the platform. However, it is vital to use Afterpay responsibly by budgeting before buying, understanding spending limits, tracking payments, prioritizing on-time payments, and avoiding overspending. By adhering to these practices, consumers can maximize Afterpay's benefits without falling into pitfalls such as late fees or financial strain.

Moreover, Afterpay benefits consumers and offers many advantages for merchants, including increased sales, higher purchase encouragement, reduced cart abandonment, and faster access to funds. Integrating Afterpay with e-commerce platforms like Amazon can further enhance the shopping experience for consumers and merchants alike.

Looking ahead, the future of Afterpay and the broader "buy now, pay later" sector seems promising, with affirmations of continuous growth, innovation, and evolving regulations. As Afterpay gets past these challenges, its strong brand recognition, attention to user experience, and proactive approach toward regulatory compliance position it well for sustained success in the complex arena of online commerce.

FAQs

Can you pay with Afterpay on Amazon?

Amazon does not currently support Afterpay as a direct payment method. Customers interested in utilizing buy now, pay later services while shopping on Amazon may need to consider alternative payment options or explore other buy now, pay later services that are compatible with Amazon's platform.

Afterpay Single-Use Cards: The Afterpay app allows you to generate temporary virtual cards for specific purchases. Use this card at checkout on Amazon, but remember to remove it after to avoid unexpected charges.

Amazon Gift Cards: Some retailers allow gift cards to be bought with Afterpay. If this is available in your area, purchase an Amazon gift card with Afterpay and use the balance on Amazon.

Does Amazon take Afterpay?

No, Amazon does not accept Afterpay as a direct payment method. While Amazon provides a wide range of payment options such as credit and debit cards, Amazon gift cards, and Amazon Pay, Afterpay is not currently included among the payment methods directly supported by Amazon's checkout system. Customers looking to use buy now, pay later services on Amazon may explore alternative payment options or consider other platforms that support Afterpay for their shopping needs.

When will Amazon be back on Afterpay?

There has not been an official announcement or indication from Amazon or Afterpay about integrating Afterpay into Amazon’s list of accepted payment methods. It’s best to check both companies' official websites or announcements for the most current information regarding any future partnership.

What happens if I don't pay Afterpay?

If you fail to make a payment to Afterpay, several things can happen:

Late Fees: You may be charged a late fee for missed payments. The amount of the late fee can vary depending on your country and the terms of your agreement with Afterpay.

Suspended Account: Afterpay may suspend your account, preventing you from making further purchases using their service until your outstanding payments are settled.

Payment Schedule Adjustments: Afterpay may work with you to adjust your payment schedule, allowing you more time to pay off your balance. However, this is at their discretion.

Debt Collection: In severe cases, unpaid debts may be referred to a collection agency, impacting your credit score and history.

Is Clearpay the same as Afterpay?

Yes, Clearpay and Afterpay refer to the same service, but they are branded differently depending on the region. Afterpay is an Australian financial technology company that allows customers to make purchases immediately and pay interest-free in four installments. It is known as Afterpay in Australia, New Zealand, the United States, and Canada. However, in the United Kingdom and Europe, the service operates under Clearpay due to trademark issues. Despite the difference in names, the service and how it operates remain consistent across these regions. It provides a buy now, pay later platform that has become popular among shoppers for its flexibility and ease of use.

What payment methods does Amazon accept?

Amazon accepts several payment methods, including.

Credit and debit cards: Visa, Mastercard, American Express, Discover

Amazon Gift Cards

Amazon Pay,

Amazon Store Cards

What online stores use Afterpay?

Here are some popular online store categories that commonly use Afterpay:

Fashion and Clothing: Adidas, American Eagle, ASOS, Boohoo, Forever 21, Gymshark, Nike, Urban Outfitters

Beauty and Cosmetics: Anastasia Beverly Hills, Charlotte Tilbury, ColourPop, Fenty Beauty, Glossier, Sephora, Ulta Beauty

Electronics and Appliances: Best Buy, Dyson, GoPro, Samsung

Home and Furniture: Bed Bath & Beyond, Casper, Wayfair

Sporting Goods: Dick's Sporting Goods, Fanatics, JD Sports

How to use Apple Pay on Amazon?

Amazon does not directly support Apple Pay as a payment method on its website or app. To make purchases on Amazon, you would need to use one of Amazon's accepted payment methods, such as a credit or debit card, Amazon Pay, or an Amazon Gift Card.

However, if you're looking to use funds from your Apple Pay account to shop on Amazon, one workaround is to add your Apple Pay card as a payment method to your Amazon account. If Amazon accepts the debit or credit card you use with Apple Pay, you can manually enter this card's details into your Amazon account's payment options. Here's a simplified guide on how to do this:

Open Amazon: Log in to your Amazon account.

Go to Your Account: Navigate to the "Your Account" section.

Payment Options: Find the "Payment Options" or similar section where you can manage your payment methods.

Add a Payment Method: Select to add a new payment method.

Enter Card Details: Input the credit or debit card information associated with your Apple Pay.

Save and Confirm: Save the new payment method, which will be available for future purchases.

Why does Amazon indicate a payment issue even though my Afterpay payment was successful?

This can be frustrating, but there are a few things you can try:

Contact Afterpay: Confirm that the initial payment went through on their end and inquire if any additional steps are needed for your Amazon purchase.

Verify Payment Method on Amazon: Double-check the billing address and ensure it matches the information on your Afterpay account. If there's a discrepancy, update it on Amazon.

Try a Different Payment Method: Use a different credit or debit card on Amazon to complete the purchase.

Contact Amazon Customer Service: Explain the situation and see if they can manually process the Afterpay single-use card details.

How to get a one-time Afterpay card?

To obtain a one-time Afterpay card, you can follow these steps:

Visit the Afterpay website or mobile app.

Navigate to the section to create an account or log in if you already have one.

Look for options related to virtual cards or one-time-use cards within your account settings.

Follow the prompts to generate a one-time Afterpay card. This may involve providing some personal information and agreeing to terms and conditions.

Once generated, you can use the one-time Afterpay card to make your intended purchase.

Who should I contact for assistance: Afterpay or Amazon, if only half of my large Amazon order went through but Afterpay charged for the total amount?

Both! Contact Amazon to confirm processed items and potentially cancel the failed part. Then, reach out to Afterpay with the info from Amazon to address the incorrect charge on the total amount.

Why is Afterpay not accepting my order?

There could be a few reasons why Afterpay isn't accepting your order. Here are some of the most common culprits:

Insufficient Funds: Afterpay requires you to have a minimum amount available on your linked payment card to cover your initial payment. They may decline your order if the available balance doesn't meet their requirement.

Order Value Limits: Afterpay limits the total order value you can purchase using their service. If your order exceeds their maximum limit, it might be declined.

Late Payment History: If you have a history of late payments with Afterpay, they might temporarily restrict your account or limit your spending power.

Merchant Not Supported: While Afterpay is widely accepted, it's only available at some online stores. Check if the specific merchant you're trying to purchase from supports Afterpay as a payment option.

Does Amazon offer other ‘Buy Now, Pay Later’ payment methods?

While Amazon doesn't directly integrate Afterpay, it offers alternative ways to spread out payments:

Amazon Monthly Payments: Pay for select items in installments directly on Amazon.

Integrated Options: Choose "Buy Now, Pay Later" services like Affirm at checkout.

Third-Party Workarounds: Afterpay or Klarna might offer single-use virtual cards that work on Amazon.

Tags

Read also

Solving Common Issues: How to Fix Afterpay on Amazon Not Working?

Afterpay with Amazon: Understanding Limitations and Charges

Amazon and Afterpay Integration: Can You Use Afterpay on Amazon?

What Stores Accept Afterpay?