Cash Flow Basics: Steps to Perform Cash Flow Analysis with Examples

Getting the cash flow analysis right is the first step in financial management for every small business. But every small business owner might not be a finance expert, and this guide is designed specifically for busy entrepreneurs like you. Before we get into the specifics, let’s get the basics right about cash flow in business. Cash flow simply means the movement of cash in and out of your business, but hidden insights within this flow can reveal your company's financial health.

We'll explain the basics of cash flow clearly and concisely. This guide will empower you to do cash flow analysis, starting from analyzing cash flow statements, managing cash flow, identifying areas for improvement, and ultimately making informed financial decisions that drive your small business forward.

Key Takeaways

Cash flow statement, where does it come from, and how to analyze it (with examples)

Types of cash flow and their importance in business decision-making

How to create cash flow statements using QuickBooks and Xero

Contents

What Is Cash Flow Analysis?

Why Is Cash Flow Analysis Important for Small Businesses?

What Is a Cash Flow Statement?

Cash Flow Analysis Examples

Why Do You Need Cash Flow Statements?

Where Do Cash Flow Statements Come From?

How Cash Flow Is Calculated?

How to Do Cash Flow Analysis?

How to Create a Cashflow Statement Using Quickbooks Online?

How to Create a Cashflow Statement in Xero?

How to Improve Cash Flow?

Wrapping up

FAQs

What Is Cash Flow Analysis?

Cash flow analysis examines the cash flow statement to evaluate a company's liquidity, solvency, and financial stability. It involves addressing the cash movement in and out of the business over time. This analysis focuses on understanding how effectively the company manages its cash resources to meet short-term obligations (liquidity) and long-term financial commitments (solvency).

During cash flow analysis, businesses evaluate their cash sources, such as operating activities, investments, and financing. They also identify areas where cash is utilized, such as operating expenses, asset investments, and debt repayments. By conducting a thorough cash flow analysis, companies can assess their ability to generate and maintain adequate cash reserves, make timely payments, and sustain financial stability over time.

Why Is Cash Flow Analysis Important for Small Businesses?

Cash flow analysis is essential in a sound financial plan because it provides a clear picture of the company's financial performance, ability to manage cash effectively, and overall financial health. Investors also assess business cash flow before making investment decisions, as it provides insights into the company's financial stability, ability to repay debts, and potential for generating returns.

It allows businesses to track their finances by monitoring the cash movement in and out of the company. When you analyze cash flow margins, businesses can assess their ability to generate cash from operations, investments, and financing activities.

Also, cash flow analysis helps distinguish between different types of cash flow.

What Is a Cash Flow Statement?

A cash flow statement is a crucial financial document that tracks the inflow and outflow of cash within a business over a specific period, usually monthly, quarterly, or annually. It clearly explains how cash moves in and out of the company, aiding in financial analysis and decision-making for business needs.

Cash inflows include sales revenue, accounts receivable, investment income, loans and financing, asset sales, royalties and licensing fees, grants, and subsidies. Cash outflows include operating expenses, accounts payable, loan repayments, asset purchases, salaries and wages, rent and utilities, taxes, interest payments, dividends, raw materials, and inventory purchases.

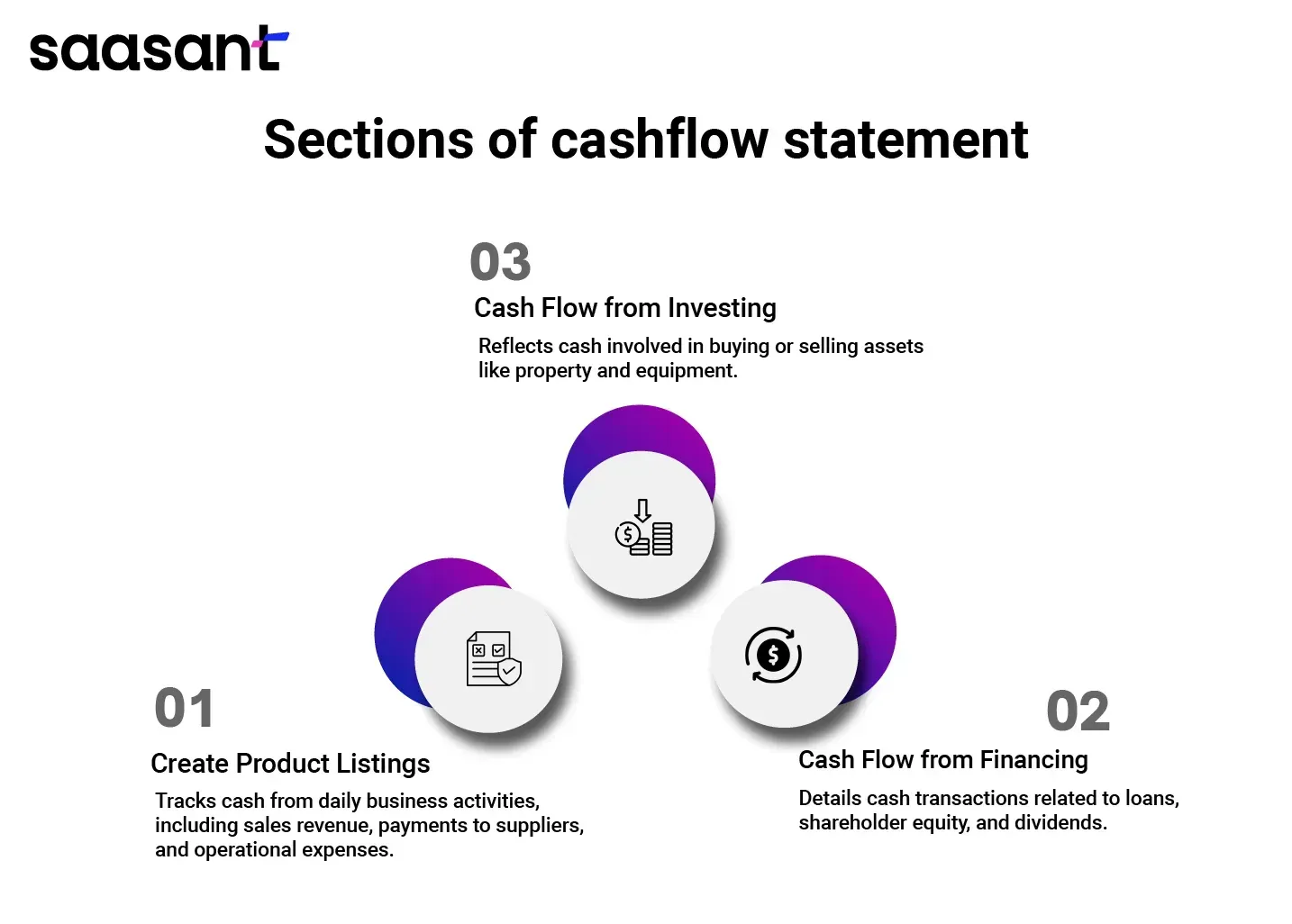

Now, let's learn how to read and understand a cash flow statement. First, we need to know what it contains. It typically indicates the type of cash flow and includes three sections: Cash Flows From Operations (CFO), Cash Flows From Investing (CFI), and Cash Flows From Financing (CFF).

The statement of cash flows typically includes three main sections.

Sections in the Cash Flow Statement

Cash Flow From Operations: It focuses on the cash generated or used in the business's day-to-day operations. It includes cash from sales, supplier payments, salaries, and operating expenses.

Cash Flow From Investing: This covers cash flows related to asset investments, such as property, equipment, or securities. It includes cash from asset sales and cash spent on acquiring new assets.

Cash Flow From Financing: This details cash flows related to financing activities, such as loans, equity financing, and dividends paid to shareholders. It includes cash from issuing or repaying debt and cash from issuing or buying back company shares.

Types of Cash Flow

Cash flow analysis evaluates a company's cash inflows and outflows, including different types of cash flow. It's used by both investors and management. Investors use it to assess a company's financial health, liquidity, and investment potential. While positive cash flow is generally preferred, it's essential to consider the overall cash flow picture and the reasons behind any negative cash flows. Management utilizes cash flow analysis to make informed decisions about operations, budgeting, and resource allocation.

Positive Cash Flow

Positive cash flow indicates that the business generates more cash than it spends. This surplus allows for reinvestment, debt repayment, or other strategic initiatives, showcasing financial health and stability.

Negative Cash Flow

Negative cash flow shows potential financial challenges. It highlights areas that may require attention or adjustments in the economic strategy, signaling the need for improved financial management.

Free Cash Flow

Free cash flow represents the surplus cash generated after accounting for operating expenses and capital expenditures. It is a key metric for evaluating a company's ability to invest in growth opportunities, repay debt, or distribute dividends to shareholders.

Cash Flow Analysis Examples

Cash Flow from Operations

A small consulting firm generates $80,000 in cash monthly from consulting services. It pays $30,000 to contractors for project work, $20,000 for employee salaries, and $10,000 for office rent and utilities. The net cash flow from operations is calculated as follows:

Cash inflows from consulting services: $80,000.

Cash outflows for contractor payments: -$30,000.

Cash outflows for salaries: -$20,000.

Cash outflows for rent and utilities: -$10,000.

Net Cash Flow from Operations: $20,000 ($80,000 - $30,000 - $20,000 - $10,000).

Cash Flow from Investing

The consulting firm decides to purchase new office equipment for $15,000 and sell old furniture for $5,000 monthly. The cash flow from investing activities is calculated as follows:

Cash inflow from furniture of sale: $5,000.

Cash outflow for new equipment: -$15,000.

Net Cash Flow from Investing: -$10,000 ($5,000 - $15,000).

Cash Flow from Financing

The consulting firm secures a bank loan of $50,000 to expand its operations and pays $10,000 towards the loan principal during the month. The cash flow from financing activities is calculated as follows:

Cash inflow from bank loan: $50,000.

Cash outflow for loan repayment: -$10,000.

Net Cash Flow from Financing: $40,000 ($50,000 - $10,000).

Summary:

Net Cash Flow from Operating Activities: $20,000

Net Cash Flow from Investing Activities: -$10,000

Net Cash Flow from Financing Activities: $40,000

Net Increase in Cash: $50,000

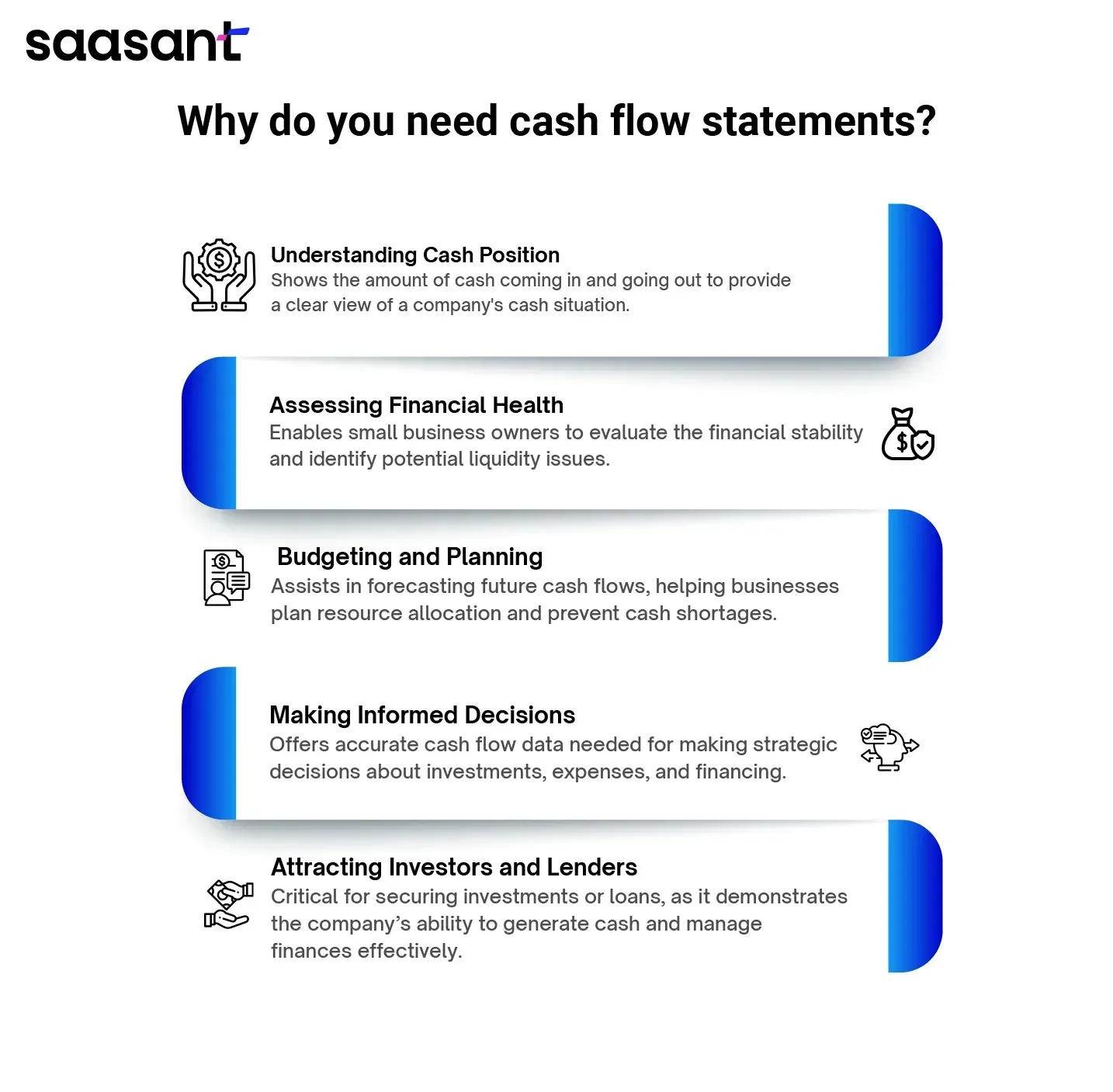

Why Do You Need Cash Flow Statements?

Cash flow statements are crucial for small business owners in cash flow basics and management. Here are five key reasons why small business owners need them.

Understanding Cash Position: The purpose of the statement of cash flows is to provide a clear picture of a company's cash position, including how much cash is coming in and going out.

Assessing Financial Health: Small business owners use cash flow statements to evaluate their financial health, identifying areas of strength or potential liquidity challenges.

Budgeting and Planning: Cash flow statements help in budgeting and planning by forecasting future cash flows, enabling businesses to allocate resources effectively to avoid cash shortages and maintain cash reserves.

Making Informed Decisions: Accurate cash flow information allows business owners to make informed decisions regarding investments, expenses, and financing options.

Attracting Investors and Lenders: Investors and lenders often assess cash flow statements before making investment or lending decisions, as they provide insights into the company's ability to generate cash and manage its finances effectively.

Where Do Cash Flow Statements Come From?

Cash flow statements typically originate from a company's financial records, including transactions in accounting software like QuickBooks and Xero. Businesses can manually create cash flow statements in Excel by organizing and categorizing cash inflows and outflows. However, accounting applications like SaasAnt Transactions can be utilized for more efficient management. SaasAnt Transactions allows small business owners to bulk import and export data seamlessly between QuickBooks, Xero, and Excel, streamlining the process of generating accurate cash flow statements and providing insights into cash on hand.

How Cash Flow Is Calculated?

There are two primary methods for calculating cash flow: direct and indirect cash flow.

Direct Cash Flow Method: This method calculates cash flow by directly recording cash inflows and outflows from operating activities. It involves listing cash receipts from sales, payments to suppliers, salaries, and other operating expenses in a simple cash flow statement format.

Example:

Cash inflows from operating activities:

Sales revenue: $50,000

Cash received from customers: $45,000

Total cash inflows: $95,000

Cash outflows from operating activities:

Payments to suppliers: $30,000

Salaries and wages: $15,000

Other operating expenses: $5,000

Total cash outflows: $50,000

Net cash flow from operating activities (inflow - outflow): $95,000 - $50,000 = $45,000

Indirect Cash Flow Method: Unlike the direct method, the indirect method starts with net income from the income statement and adjusts it for non-cash items and changes in working capital. This method is often used when creating more detailed cash flow statements, providing a comprehensive view of cash flow activities beyond the basics.

Example:

Start with net income from the income statement: $40,000

Adjust for non-cash expenses:

Depreciation expense: $5,000

Amortization expense: $2,000

Non-cash total expenditures: $7,000

Adjust for changes in working capital:

Increase in accounts receivable: $3,000

Decrease in accounts payable: $2,000

Total change in working capital: $3,000 - $2,000 = $1,000

Net cash flow from operating activities (net income + non-cash expenses + change in working capital): $40,000 + $7,000 + $1,000 = $48,000

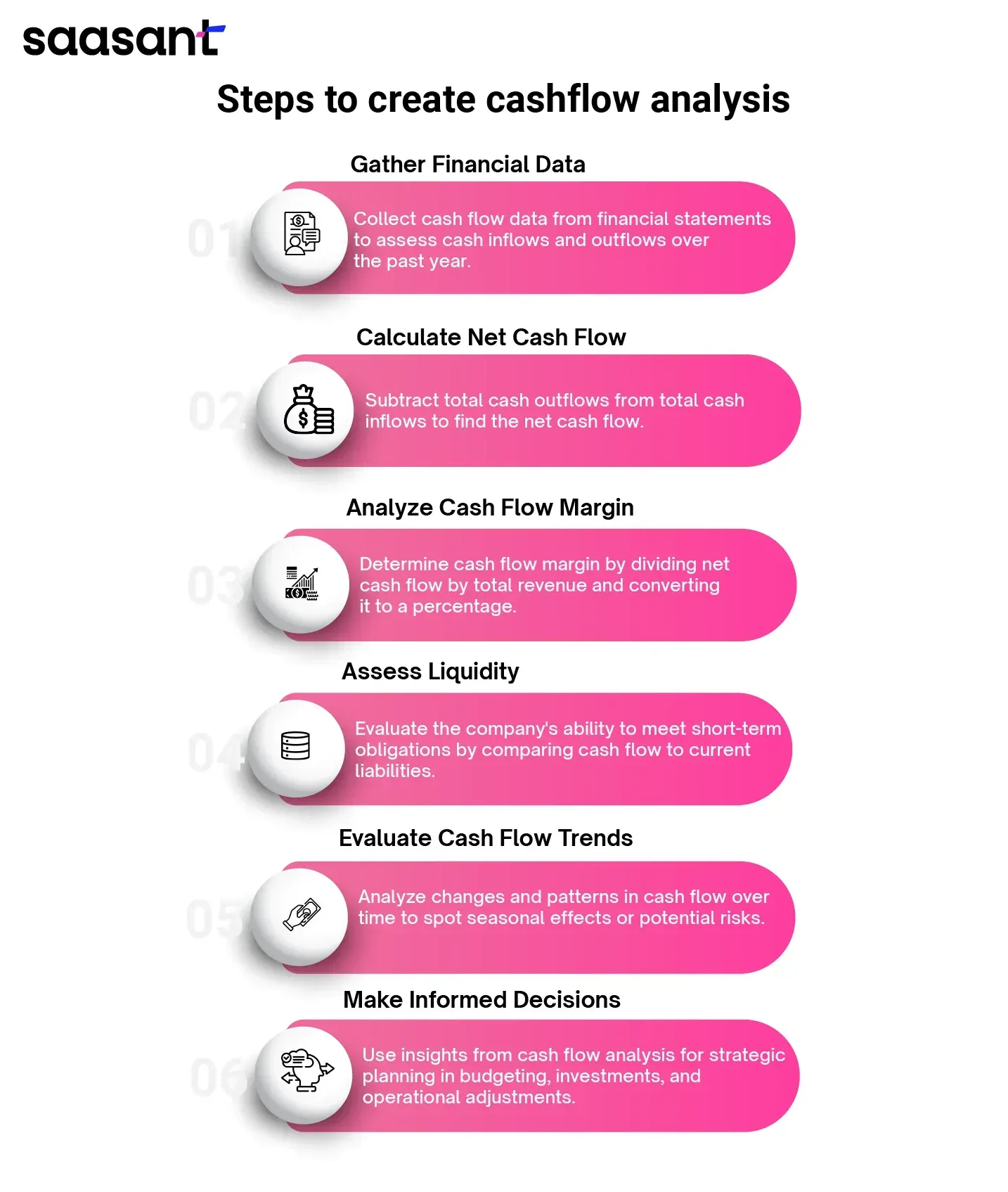

How to Do Cash Flow Analysis?

Here are 5 easy steps to do cash flow analysis.

Gather Financial Data:

Collect cash flow data from financial statements like cash flow, income, and balance sheets.

Example: Gather data on cash inflows and outflows for the past year from financial records.

Calculate Net Cash Flow: Calculate the net cash flow by subtracting total cash outflows from total cash inflows.

Example (Positive Cash Flow): Total cash inflows of $100,000 minus total cash outflows of $80,000 result in a net cash flow of $20,000.

Example (Negative Cash Flow): Total cash inflows of $80,000 minus total cash outflows of $100,000 result in a net cash flow of -$20,000.

Analyze Cash Flow Margin: Calculate the cash flow margin by dividing net cash flow by total revenue and multiplying by 100 to get a percentage.

Example (Positive Cash Flow Margin): Net cash flow of $20,000 divided by total revenue of $200,000, multiplied by 100, gives a cash flow margin of 10%.

Example (Negative Cash Flow Margin): Net cash flow of -$20,000 divided by total revenue of $150,000, multiplied by 100, gives a cash flow margin of -13.33%.

Assess Liquidity: Evaluate liquidity by comparing cash flow to current liabilities and short-term obligations.

Example: A positive cash flow greater than current liabilities indicates good liquidity for meeting short-term obligations.

Evaluate Cash Flow Trends: Analyze cash flow trends over time to identify patterns, fluctuations, and potential financial risks.

Example: Compare monthly or quarterly cash flow data to identify seasonal trends or irregularities.

Make Informed Decisions: Use cash flow analysis insights to make informed decisions regarding budgeting, investments, debt management, and operational improvements.

Example: Increase marketing budget during periods of positive cash flow to fuel business growth.

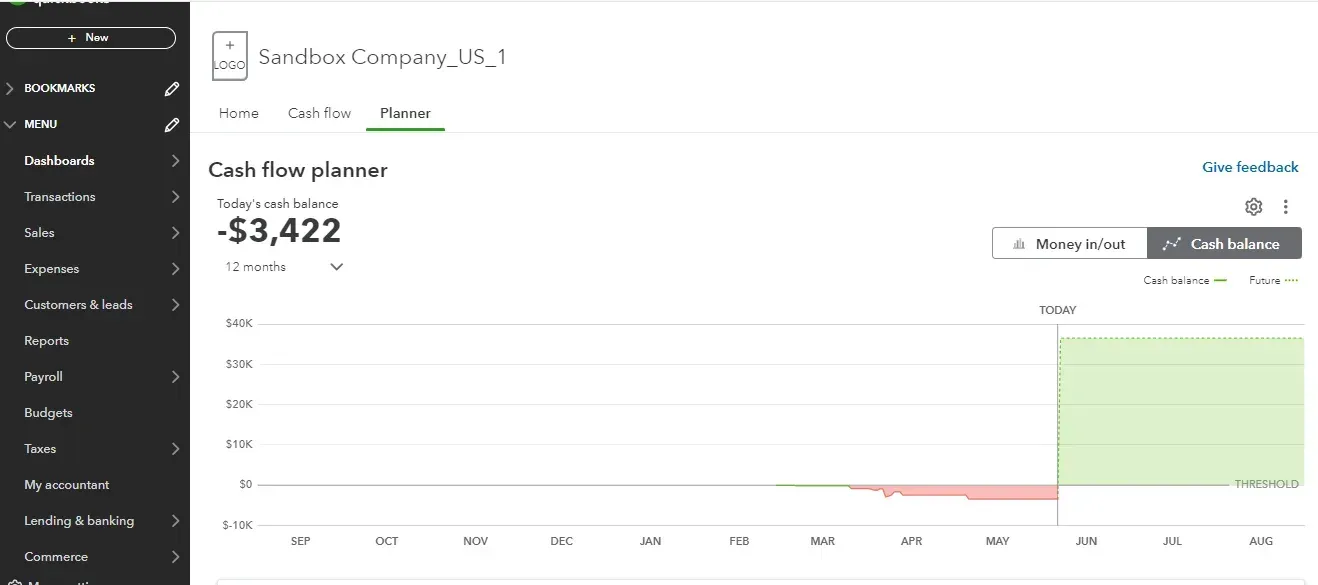

How to Create a Cashflow Statement Using Quickbooks Online?

Here are the steps to prepare a cash flow statement in Xero.

QuickBooks simplifies creating cashflow statements by automatically categorizing your chart of accounts into three sections: cash flow operations, cash flow from investing, and cash flow from financing.

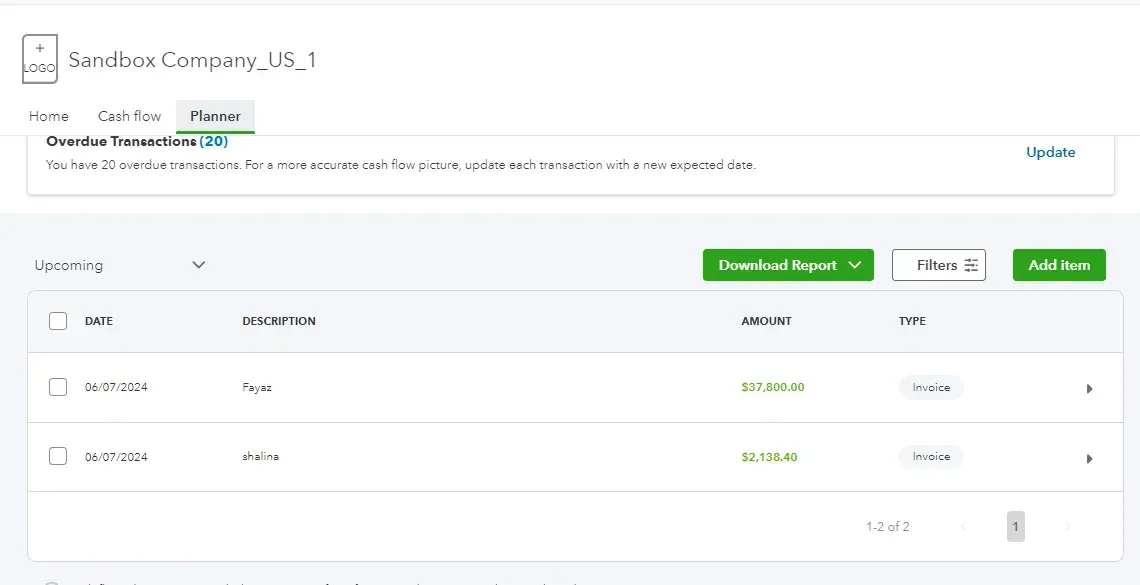

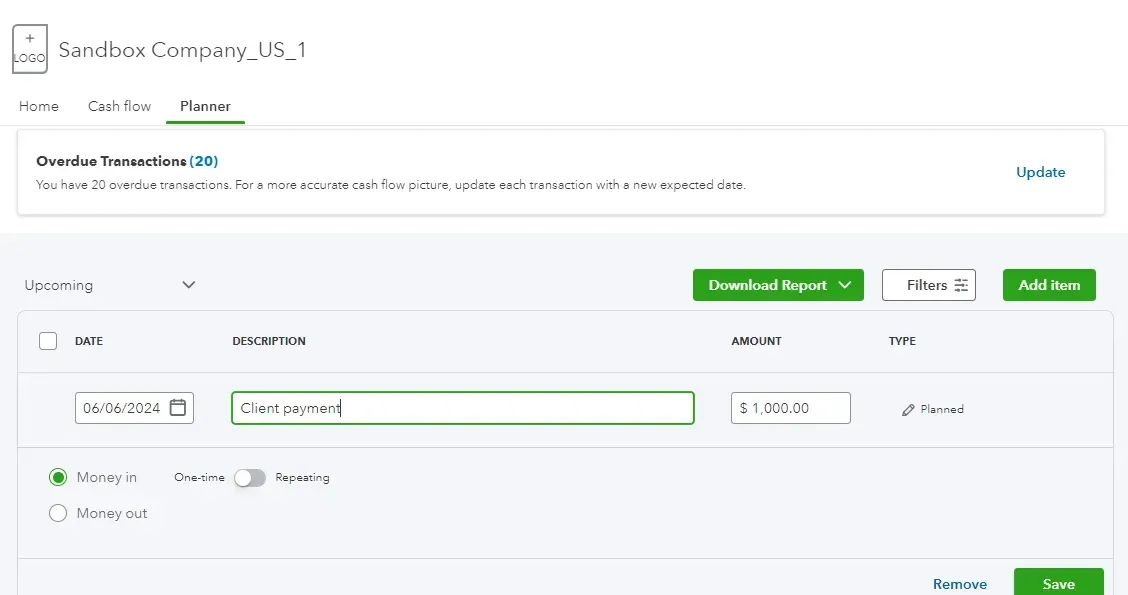

Step 1: Access the Cash Flow Planner in QuickBooks by selecting Dashboard -> Cashflow -> Planner.

Step 2: Upon entering the Cash Flow Planner, you will see a historical view of your cash flow. This view reflects the total cash that has flowed in and out of your connected bank accounts, including your QuickBooks cash account.

Step 3: You can change the view from cash balance to money in or out and adjust the time as needed. This flexibility allows you to analyze your cash flow in different contexts.

Step 4: Scroll down to explore the projected cash flow for the future. This projection includes all the events entered into QuickBooks, such as future invoices and expenses.

Step 5: QuickBooks uses your financial history to predict future events. You can edit these predictions to see how they impact your future cash flow. This feature helps in forecasting and planning ahead.

Step 6: You can manually add future events, such as purchasing equipment or upcoming investments. Doing so lets you see how these events affect your cash flow chart and make informed decisions accordingly.

Step 7: Finalize your cash flow projection after adjusting predictions and adding future events. This comprehensive view provides insights into your expected cash flow, helping you manage finances effectively and plan for potential scenarios.

How to Create a Cashflow Statement in Xero?

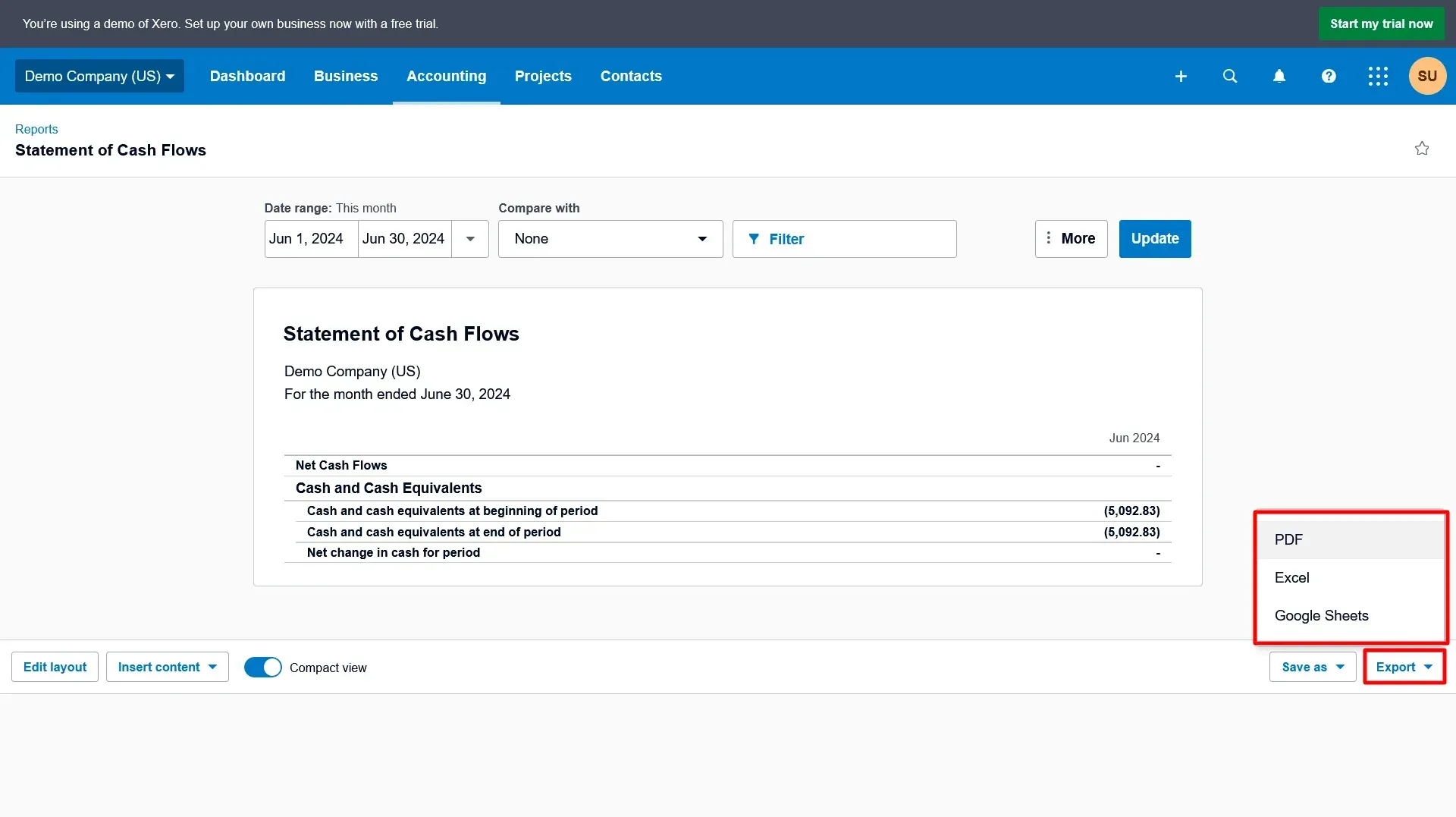

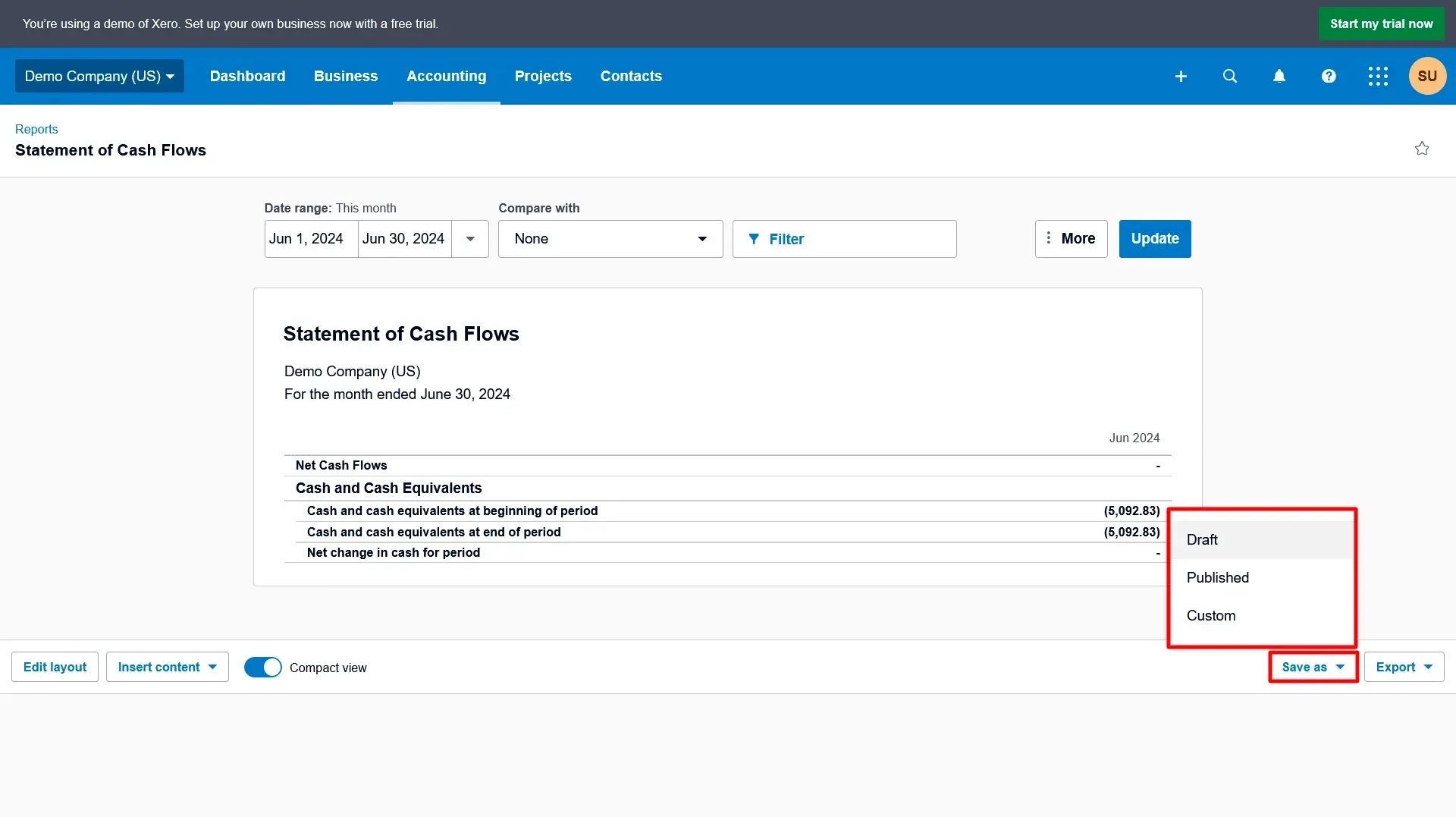

Here are the steps to prepare a cash flow statement in Xero.

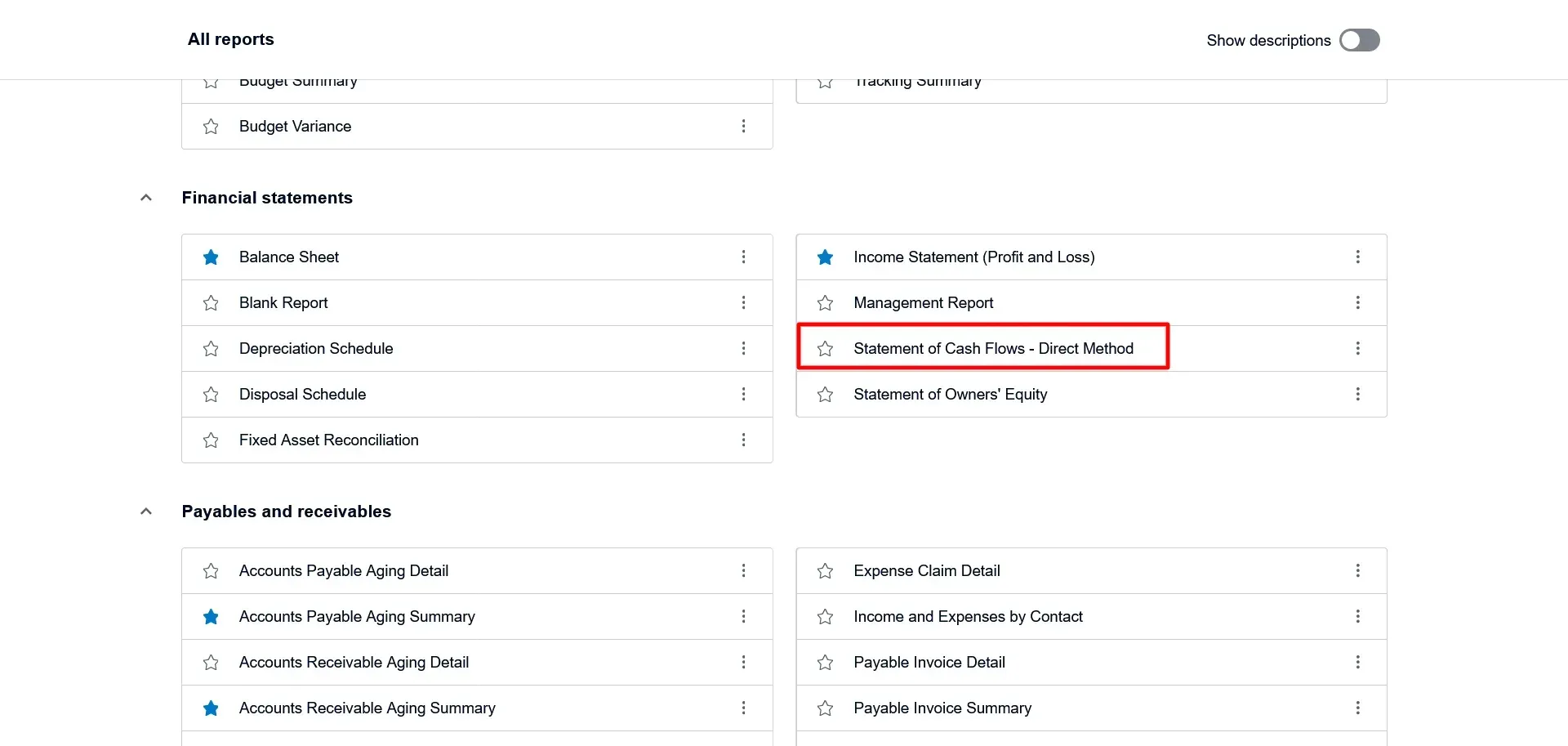

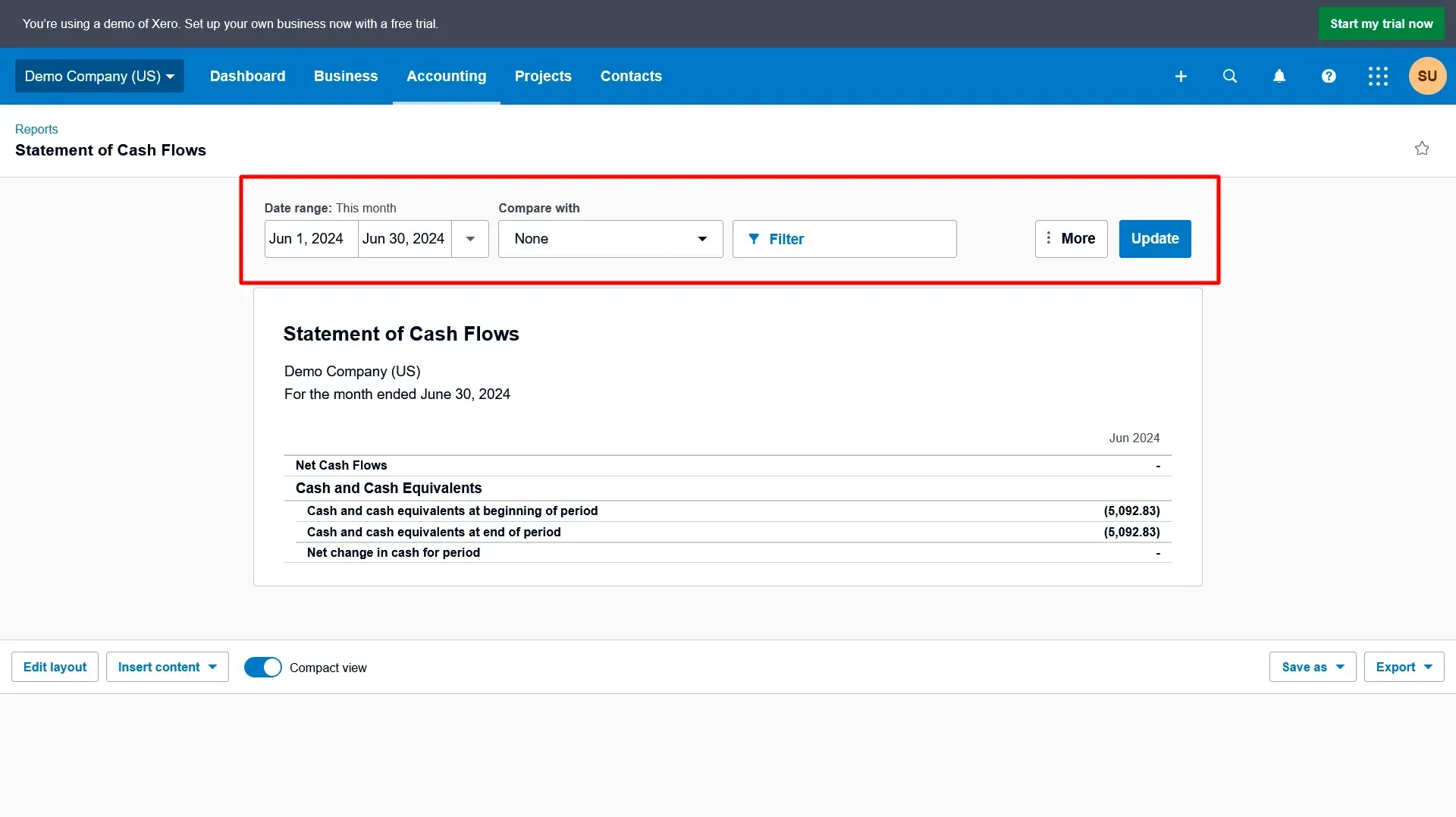

Step 1: To access the cash flow statement in Xero, go to the "Reports" tab, then select "All Reports." Under the financial section, choose "Statement of Cashflows."

Step 2: The first field allows you to choose the date range. You can either select a predefined period or enter custom dates. After selecting the desired dates, click the "Update" button to generate the cash flow statement with three sections for the specified period.

Step 3: Once the cash flow statement is displayed, save it in different formats, such as PDF, Excel, or Google Sheets. At the bottom of the report, click on the "Export" button and choose the format you want to save the statement.

Step 4: Xero offers options to save the cash flow statement according to your needs:

Draft: Save the report as a draft if you or someone else may need to make changes later.

Published: Use this option when finalizing the books for a specific period. A published report remains unchanged even if the system updates, ensuring consistency.

Custom: Select this option to save the report format for future use, eliminating the need to recreate it every time you run the report.

How to Improve Cash Flow?

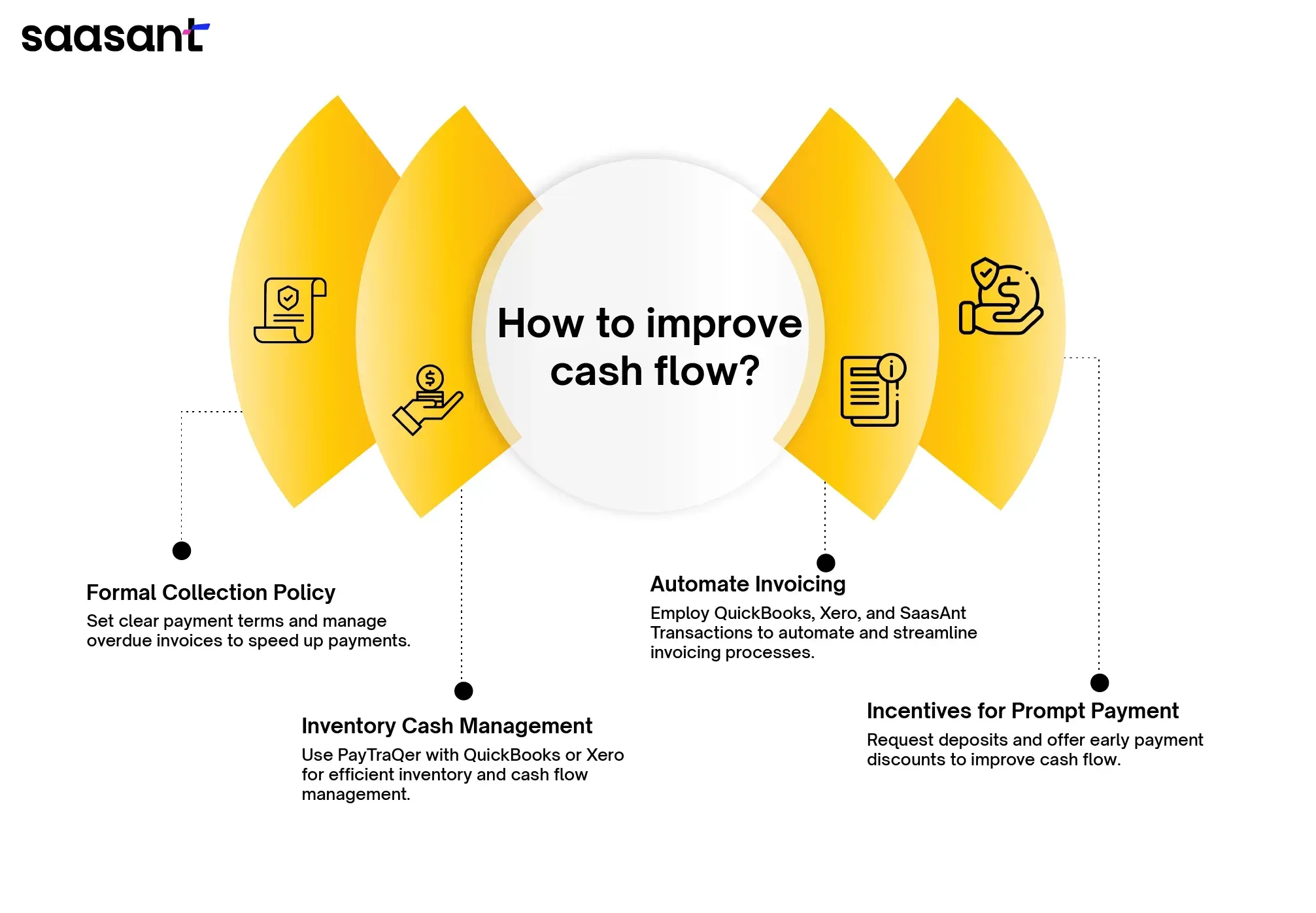

Here are 4 ways to improve cash flow.

Create a formal collection policy:

Set clear payment terms and monitor overdue invoices to get paid faster and boost your cash flow.

Manage cash for inventory purchases:

Strategies like accurate demand forecasting, just-in-time inventory management, and negotiating better supplier payment terms can significantly improve cash flow. PayTraQer integrates with eCommerce platforms such as Amazon, eBay, Shopify, etc., and payment applications like PayPal, Stripe, and Square. It tracks sales, expenses, and fees and reconciles them in QuickBooks and Xero. It also calculates the Cost of Goods Sold (COGS) to gain clear insights into margins and profitability. This helps you make informed decisions, prevent overstocking, and optimize cash flow by ensuring that your inventory purchases align with customer demand.

Automate invoice process:

Utilize accounting platforms like QuickBooks and Xero to automate invoicing processes, reducing manual tasks and ensuring billing accuracy. Additionally, accounting software like SaasAnt Transactions is used for bulk invoice import/export, improving invoicing efficiency and data management.

Ask for a deposit and offer discounts:

Implementing deposit requests for orders and offering early payment discounts can incentivize prompt payments and enhance overall cash flow.

Wrapping up

The Cash flow analysis aids in proactive decision-making for sustainable success. Always aim for positive cash flow, as it indicates financial strength, supporting growth, dividends, and resilience during challenges. Free cash flow also mirrors operational success and prudent capital use.

When you’ve got positive cash flow and accurate cash flow statements, investors are more likely to perceive your company as financially stable and capable of generating returns, increasing their confidence and interest in investing in your business.

Lastly, invest in applications like QuickBooks, Xero, SaasAnt Transactions, and PayTraQer to streamline cash flow management, ensuring accurate cash flow forecasting and transforming decision-making.

FAQs

What are the basic principles of cash flow?

The primary cash flow principles revolve around monitoring cash inflows and outflows, managing liquidity, and ensuring financial stability for business operations.

What are the three types of cash flow?

The three types of cash flow are cash flow from operations, cash flow from investing, and cash flow from financing, each representing different aspects of a company's financial activities.

How do you explain cash flow?

Cash flow is the movement of cash in and out of a business, reflecting its ability to generate and manage money effectively.

What is the cash flow formula?

The cash flow formula is typically represented as Cash Flow = Cash Inflows-Cash Outflows, providing a simple equation to assess a company's cash position.

What tools do you currently use to manage cash flows?

QuickBooks, Xero, SaasAnt Transactions, and PayTraqer, are essential tools for managing cash flows, ensuring accurate financial records and streamlined cash flow management.