What Does Due Upon Receipt Mean? A Complete Guide to Invoicing and Payment Terms

Payment terms are vital to business transactions, directly influencing cash flow, financial planning, and client relationships. One of the most straightforward yet impactful payment terms is 'Payment Due Upon Receipt,' which asks customers to pay an invoice immediately upon receiving it. While this term can greatly benefit cash flow and minimize delays, it also comes with challenges.

In this blog, we'll explore what 'Payment Due Upon Receipt' means, when to use it, its advantages and disadvantages, and how to manage invoicing when adopting this payment term effectively.

Contents

What Does Due Upon Receipt Mean?

How Does It Work?

When to Use Due Upon Receipt on Invoices?

Advantages of Payment Due Upon Receipt

Disadvantages of Payment Due Upon Receipt

How Do You Politely Ask For an Invoice to Be Paid and Get Paid?

Conclusion

FAQs

What Does Due Upon Receipt Mean?

'Payment Due Upon Receipt' means the invoice must be paid as soon as the customer receives it. Unlike standard terms like net 30 or net 60, which give customers a set period to make the payment, 'Due Upon Receipt' requires immediate payment.

This payment term is frequently used by businesses that need to maintain a healthy cash flow, particularly in industries where work is completed quickly, such as freelancers, small business owners, and service providers.

How Does It Work?

Once an invoice marked as 'Due Upon Receipt' is issued, the client is expected to make payment immediately, usually within the same day. This reduces the delay between invoicing and payment, allowing businesses to move the funds into their working capital quickly.

When to Use Due Upon Receipt on Invoices?

Not all situations are suitable for 'Due Upon Receipt' invoices. Here are scenarios where it works best:

For Small and Growing Businesses

Startups or small businesses rely heavily on regular cash inflows to meet operating expenses, making this payment term ideal. Getting paid immediately helps you manage finances more efficiently without the worry of chasing late payments.

Freelancers and Consultants

Independent contractors who don’t have long-term contracts or recurring income streams can benefit from this term. It ensures they receive compensation immediately after completing a project, keeping their income consistent.

Emergency Services or On-Demand Work

Businesses providing urgent services—such as repairs, medical aid, or rush deliveries—often require immediate payment upon service completion, making 'Due Upon Receipt' ideal.

One-Time Purchases or Deliveries

Companies dealing with one-off transactions or direct deliveries, like wholesalers or retailers selling physical products, may use this term to ensure payment during product delivery.

New Clients or Risky Clients

'Due Upon Receipt' provides security against non-payment for new or higher-risk clients. You can minimize the risk of overdue invoices or bad debts by requiring immediate payment.

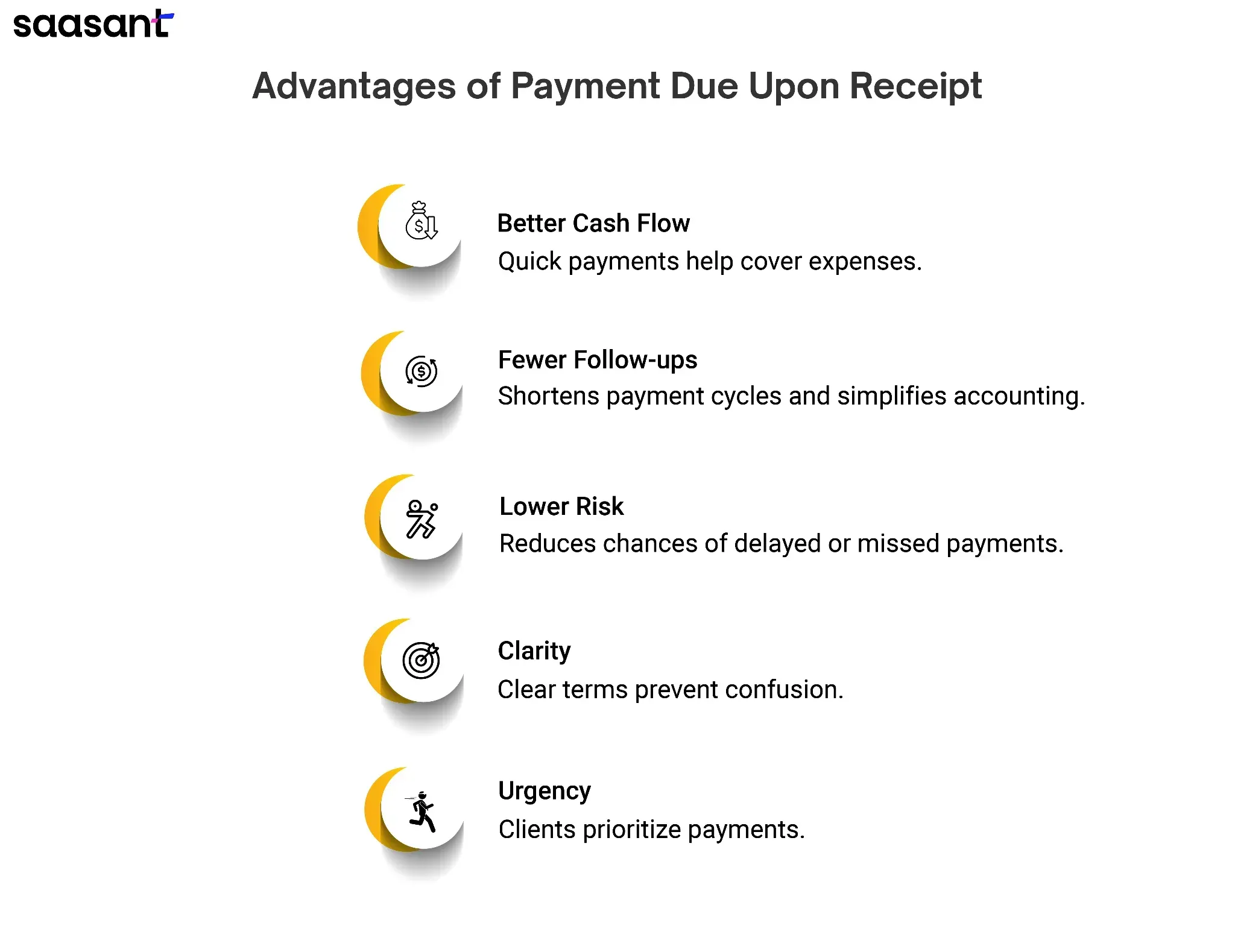

Advantages of Payment Due Upon Receipt

Using 'Due Upon Receipt' can offer a range of benefits for businesses, let's look into it:

Enhanced Cash Flow

With faster payments, businesses can maintain a stable cash flow, enabling them to reinvest in operations or cover expenses without delay. This is particularly useful for businesses with tight operating margins.

Reduced Accounts Receivable

This payment term significantly cuts down the accounts receivable cycle, reducing the need for follow-ups and reminders. It simplifies accounting and allows for more accurate financial tracking.

Lower Risk of Non-Payment

Immediate payment upon receipt minimizes the risk of clients forgetting to pay or defaulting on payments. This is especially important when dealing with customers with a history of delayed payments.

Simplified Payment Process

By clearly stating 'Due Upon Receipt,' there’s little room for confusion about when payment is expected. You and your client know exactly when payment is due, making the process straightforward.

Encourages Prompt Client Action

Clients tend to prioritize invoices with this term as it signals urgency. Their immediate attention ensures that the payment process moves forward without being pushed aside or forgotten.

Disadvantages of Payment Due Upon Receipt

While 'Due Upon Receipt' has its advantages, there are some downsides to consider:

Client Resistance

Some customers, particularly more significant businesses or those with stricter financial processes, may push back against this term. They may expect more lenient payment periods, and demanding immediate payment could discourage them from doing business with you.

Strained Client Relationships

Pushing too hard for immediate payments can come off as aggressive, which might harm your relationship with clients, mainly if they are used to longer payment terms like net 30 or net 60.

Not Suitable for Large Orders

For customers making large purchases, immediate payment may not be practical. Larger companies often have internal processes and approvals that take time, making 'Due Upon Receipt' an impractical term.

Limited Flexibility

By insisting on immediate payment, you limit your flexibility in offering clients different payment options, which could lead to lost opportunities, particularly with long-term or high-value customers.

Industry-Specific Restrictions

Payment terms are traditionally more extended in specific industries, such as manufacturing or large-scale B2B transactions, making 'Due Upon Receipt' less common and possibly unappealing to clients.

How Do You Politely Ask For an Invoice to Be Paid and Get Paid?

1. Send a Friendly Initial Reminder

Keep your tone polite and professional. Assume it was an oversight and gently remind them about the due invoice.

Example:

"Hi [Client Name],

I hope you’re doing well. This is a quick reminder that invoice [Invoice Number], dated [Date], is due for payment. Feel free to reach out if you need further information or clarification. Thanks for your attention to this!"

2. Reattach the Invoice

Always include a copy of the invoice to facilitate the client's review and payment without the need to search for previous emails.

Example:

"For your convenience, I’ve attached the invoice again. Please let me know if there’s anything else I can provide."

3. Offer Support

Express willingness to help with any issues related to the invoice or payment to prevent unnecessary delays.

Example:

"If there’s any issue or question about the invoice, please don’t hesitate to reach out. I’m happy to assist."

4. Gently Reinforce Payment Terms

Politely and non-confrontationally remind the client of any payment terms, such as deadlines or late fees.

Example:

"As per the agreed terms, we kindly ask that the payment be completed by [specific date]. A late fee of [amount/percentage] may apply for overdue payments."

5. Thank Them and Show Appreciation

End your message positively by thanking them for their attention and expressing appreciation for their business.

Example:

"Thank you so much for your prompt attention to this matter. We truly appreciate your business and look forward to continuing our collaboration!"

Conclusion

'Payment Due Upon Receipt' can be a highly effective payment term for maintaining consistent cash flow and minimizing late payments. However, balancing your business's needs with your clients' preferences is essential.

You can implement' Due Upon Receipt' without compromising customer relationships by clearly communicating your payment terms, using professional invoicing practices, and offering convenient payment methods. This strategy will help ensure your business remains financially stable and efficient when used appropriately.

FAQs

1. What is the difference between 'Due Upon Receipt' and other payment terms like 'Net 30'?

'Due Upon Receipt' means payment is expected immediately after the invoice is received, while 'Net 30' gives the customer 30 days to make the payment.

2. Can I apply 'Due Upon Receipt' to every customer?

While possible, it's only sometimes advisable. Some customers, huge companies, may expect more flexible payment terms due to their internal processes.

3. What should I do if a client ignores a 'Due Upon Receipt' invoice?

You can follow up with polite reminders and phone calls or even implement late payment fees if agreed upon beforehand in your contract.

4. How can I encourage clients to pay upon receipt?

Offering incentives like small discounts for immediate payments or providing multiple payment methods can motivate clients to pay faster.

5. Is 'Due Upon Receipt' ideal for freelancers?

Yes, freelancers and small business owners can benefit greatly from this payment term to ensure consistent cash flow and avoid chasing clients for payments.