eBay Taxes: A Complete Guide for Sellers

Selling on eBay can be a great way to earn extra income, clear some old stuff, or even start a full-time business. But as an eBay seller, you must also deal with the tax implications of your online activities. Depending on what you sell, where you sell, and how much you sell, you may have to pay different taxes on your eBay sales, such as income tax, sales tax, value-added tax, and more. This blog will cover everything you need to know about eBay taxes, including:

How do you determine if your eBay sales are taxable?

How do you report your eBay income and expenses on your tax return?

How do you deal with sales, value-added, and other taxes on your eBay transactions?

How do you find and access your eBay tax documents and forms?

How to avoid common tax mistakes and pitfalls as an eBay seller?

How do you save money and reduce tax liability with tax deductions and credits?

By the end of this blog, you will better understand how eBay taxes work and how to handle them properly. However, please remember that this blog post does not provide legal or tax advice, and you should always consult a qualified tax professional for your specific situation.

Contents

Are Your eBay Sales Taxable?

How Do You Report Your eBay Income and Expenses On Your Tax Return?

FAQs

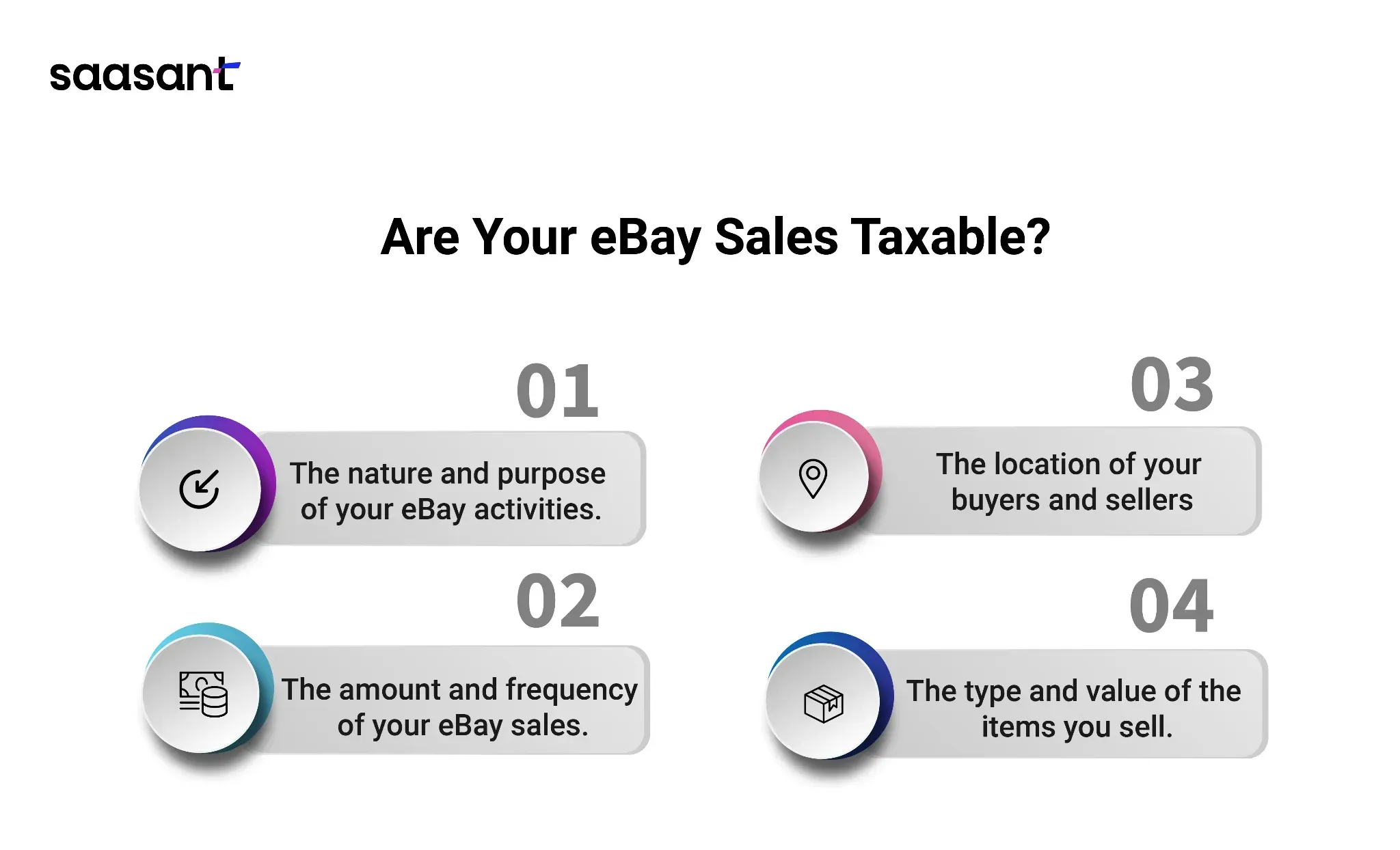

Are Your eBay Sales Taxable?

The first question you must ask yourself is whether your eBay sales are taxable. It depends on several factors, such as:

The nature and purpose of your eBay activities.

The amount and frequency of your eBay sales.

The type and value of the items you sell.

The location of your buyers and sellers

Generally speaking, if you sell items on eBay as a hobby or a personal activity and do not profit from your sales, you do not have to pay income tax on your eBay earnings. However, if you sell items on eBay as a business or a regular activity and profit from your sales, you must report your eBay income and pay income tax.

The IRS (Internal Revenue Service) has some guidelines to help you determine if your eBay activities are a hobby or a business based on factors such as:

The amount of time and effort you put into your eBay activities.

The level of expertise and knowledge you have about the items you sell.

The expectation and intention of making a profit from your eBay activities.

The history of income or losses from your eBay activities.

The amount of assets and resources you invest in your eBay activities.

The degree of dependence on your eBay income for your livelihood.

The market conditions and trends affecting your eBay activities

Note: If you are still determining whether your eBay activities are a hobby or a business, consult a tax professional for guidance.

How Do You Report Your eBay Income and Expenses On Your Tax Return?

If your eBay sales are taxable, you must report your income and expenses on your tax return. The way you do this depends on whether you are a sole proprietor, a partner, a corporation, or another type of business entity.

If you are a sole proprietor or a partner, you must report your eBay income and expenses on Schedule C (Form 1040), Profit or Loss from Business. You have to list all the income you received from your eBay sales, as well as all the expenses you incurred to run your eBay business, such as:

eBay fees and commissions.

PayPal fees and charges.

Shipping and handling costs.

Packaging and mailing supplies.

Advertising and marketing costs.

Internet and phone expenses.

Office supplies and equipment.

Travel and transportation expenses.

Insurance and legal fees.

Depreciation and amortization of assets.

Inventory and cost of goods sold.

Suppose you are a corporation or another type of business entity. In that case, you must report your eBay income and expenses on the appropriate business tax form, such as Form 1120, U.S. Corporation Income Tax Return, or Form 1065, U.S. Return of Partnership Income. You have to follow the same rules and principles as a sole proprietor or a partner, but you may have to use different accounting methods and reporting formats. You can find more information about the different business tax forms and their instructions on the IRS website.

How Do You Deal With Sales, Value-added, and Other Taxes On Your eBay Transactions?

As an eBay seller, you may have to deal with various types of taxes on your eBay transactions, depending on the location of your buyers and sellers, the type and value of the items you sell, and the exemptions and exceptions that apply. These taxes may include sales tax, value-added tax (VAT), goods and services tax (GST), and other taxes imposed by different jurisdictions on the sale of goods and services.

Sales tax is a tax imposed by most states and some local jurisdictions in the United States on the sale of tangible personal property and certain services. The sales tax rate varies by state and locality, ranging from 0% to 10.5%. Some states also have special sales tax rates for food, clothing, or gasoline.

A value-added tax is imposed by most countries in the European Union (EU) and some other countries on the sale of goods and services. The VAT rate varies by country and item, ranging from 0% to 27%. Some items, such as books, food, or medicine, are exempt from VAT or subject to reduced VAT rates.

GST is imposed by some countries, such as Australia, New Zealand, Canada, and others, on the sale of goods and services. The GST rate varies by country and item, ranging from 0% to 15%. Some items, such as basic food, health care, or education, are exempt from GST or subject to reduced GST rates.

To deal with these taxes on your eBay transactions, you must follow the rules and regulations of each jurisdiction where you sell or buy and collect and remit the taxes to the appropriate authorities when required. You also need to inform your buyers about the potential taxes and charges they may have to pay when they receive their items and keep track of your tax obligations and records.

However, manual management of taxes can take time and effort. You need PayTraQer, an integration management software that connects QuickBooks Online or Xero to your payment processors. PayTraQer automates your bookkeeping with a simple interface, intuitive workflow, and improved accuracy. With PayTraQer, you will always get perfectly balanced books, updated inventory, and better cash flow visibility.

Don’t let taxes overwhelm you. Try PayTraQer today and see how it can simplify your accounting and tax compliance. Click here to learn more about PayTraQer and get a free trial.

Tips and resources to help you deal with these taxes on your eBay transactions

Check the eBay website for the latest information and updates on the tax policies and requirements that apply to your eBay transactions, such as Internet Sales Tax in the United States, VAT in the European Union, and GST in other countries.

Use the eBay sales tax table to set up tax rates for the states where you must collect sales tax. You can also use the eBay sales tax calculator to estimate the sales tax amount of your transactions.

Register your eBay business with the relevant tax authorities and obtain a tax identification number, such as an Employer Identification Number (EIN) in the United States, a VAT identification number in the European Union, or a GST registration number in other countries.

Use the eBay tax exemption tool to verify and manage your tax-exempt buyers, such as resellers, non-profit organizations, or government entities. You can also upload your tax exemption certificates and documents to your eBay account.

Use the eBay tax settings tool to customize your tax preferences and settings, such as whether to include or exclude tax in your listing prices, charge tax on shipping and handling, and display tax information on your listings.

Use the eBay tax reports tool to download and view your tax reports, such as the sales tax, VAT, and GST reports. These reports show the tax amounts collected and remitted by eBay on your behalf and the tax amounts you need to collect and remit on your own.

How Do You Find and Access Your eBay Tax Documents and Forms?

Depending on your eBay sales and transactions, you may receive tax documents and forms from eBay, such as Form 1099-K, Form W-9, or Form W-8. These documents and forms help you comply with your tax obligations and report your eBay income and expenses to the IRS and other tax authorities.

Form 1099-K is an IRS form for reporting applicable payments received within a calendar year. Online marketplaces like eBay must issue a 1099-K to US sellers who’ve received payments from online sales that meet or exceed the minimum threshold set by the IRS and each applicable state.

Form W-9 is an IRS form requesting the taxpayer identification number and certification of a US person, such as a sole proprietor, a partnership, a corporation, or an individual. eBay may ask you to provide a Form W-9 if your tax details can’t be verified or if you need to update your tax information.

Form W-8 is an IRS form requesting a non-US person's foreign status and certification, such as a foreign individual, a foreign entity, or a foreign trust. eBay may ask you to provide a Form W-8 if you are not a US person and sell on eBay.com or other US-based eBay sites.

To find and access your eBay tax documents and forms, you need to follow these steps:

Navigate to eBay’s Seller Hub or My eBay, and click on the ‘Payments’ section.

Once in the ‘Payments’ tab, click on another tab titled ‘Taxes.��’

On this page, you will see ‘PDFs’ of all your tax documents and forms for previous years (if applicable).

To download a copy of your tax document or form, click on the Download button next to the document or form name.

You can also print or save the document or form to your computer or device.

To provide or update your tax information, click the ‘Provide Tax Information’ button and follow the instructions.

You may need to fill out and submit a ‘Form W-9’ or ‘Form W-8’ online or by mail.

To view your tax settings and preferences, click the ‘Tax Settings’ button and make any changes as required.

You can also contact eBay customer service with any questions or issues regarding your tax documents and forms.

How Do You Avoid Common Tax Mistakes and Pitfalls as an eBay Seller?

Selling on eBay can be rewarding and profitable but comes with tax challenges and risks. As an eBay seller, you are responsible for complying with all the applicable tax laws and regulations of your jurisdiction and the jurisdictions of your buyers. Failing to do so can result in penalties, fines, audits, or legal actions.

To avoid these unpleasant consequences, you must be aware of the common tax mistakes and pitfalls that eBay sellers often make and learn how to avoid them. Here are some of the most frequent eBay seller mistakes and how to prevent them:

Neglecting Proper Research

Before listing any item on eBay, you should do your homework and research the market demand, pricing trends, and tax implications of your product category and niche. You should also check eBay's tax policies and requirements and the jurisdictions where you sell or buy. It will help you avoid listing items with low demand, overpricing or underpricing your items, or violating any tax rules or regulations.

Setting Unrealistic Pricing

Pricing your items is crucial for your eBay success, as it affects your sales, profits, and taxes. You should avoid underpricing your items, as it can result in losses and lower tax deductions. You should also avoid overpricing your items, which can deter buyers and increase your tax liability. You should use eBay’s tools and features, such as the sales tax table, the sales tax calculator, and the completed listings, to set realistic and competitive prices for your items.

Failing to Report Your eBay Income and Expenses

As an eBay seller, you must report your income and expenses on your tax return, regardless of whether you sell as a hobby or a business. You must use the appropriate tax form and schedule depending on your business entity and accounting method. You have to list all the income you received from your eBay sales and all the expenses you incurred to run your eBay business, such as eBay fees, PayPal fees, shipping costs, packaging supplies, advertising costs, and more. You should keep accurate and organized records of your transactions and receipts and use eBay’s tax reports tool to download and view your tax reports.

However, preparing and filing your taxes can be daunting, especially if you have multiple sales channels and payment processors. It is where PayTraQer comes in with cutting-edge integration management software designed to seamlessly link your QuickBooks Online or Xero accounts with payment platforms like PayPal, Stripe, and Square and popular e-commerce platforms like Amazon, Shopify, and eBay.

Below mentioned are three use cases focusing specifically on tax compliance for eBay sellers, illustrating how PayTraQer can assist in managing and simplifying this aspect:

Use Case 1: eBay Seller with Multiple State Sales Tax Obligations

Scenario:

An eBay seller operates across multiple states in the United States. Each state has different sales tax rates and regulations, making it challenging to calculate and remit the correct sales tax amount.

How PayTraQer Helps:

Automated Sales Tax Calculation: PayTraQer automatically calculates the sales tax for each transaction based on the buyer's location.

Accurate Tax Reporting: Ensures accurate sales tax reporting for each state, simplifying the process of tax filing and remittance.

Integration with Accounting Software: By integrating eBay sales into QuickBooks or Xero, PayTraQer helps maintain accurate records for tax compliance.

Use Case 2: International eBay Seller Dealing with VAT

Scenario:

An eBay seller based in Europe sells products internationally and needs to comply with Value-Added Tax (VAT) regulations, which vary by country.

How PayTraQer Helps:

VAT Management: PayTraQer helps track and calculate VAT for sales in different countries.

Consolidates Financial Records: It integrates international sales data into the seller’s accounting software and ensures accurate reflection of VAT in financial records.

Simplified VAT Filing: Provides the necessary data for VAT filing, making it easier to comply with various international tax laws.

Use Case 3: High-Volume eBay Seller with Complex Tax Deductions

Scenario:

A high-volume eBay seller operates a dynamic business that involves frequent transactions and incurs various expenses. These expenses include eBay fees, shipping costs, and potentially deductible business expenses, adding complexity to their tax filings.

How PayTraQer Helps:

Expense Tracking: PayTraQer integrates seamlessly with eBay transactions, automating expense tracking. It categorizes various sales-related expenses, including listing fees, final value fees, promotional fees, and shipping costs. This automation eliminates manual effort, ensuring precise and complete financial records.

Deduction Optimization: PayTraQer utilizes advanced algorithms to analyze the seller's financial data, identifying potential tax deductions. It extends beyond standard eBay fees, exploring additional business expenses eligible for deduction. PayTraQer maximizes the seller's tax savings by optimizing deductions, ensuring they fully leverage all allowable deductions under tax regulations.

Streamlined Tax Preparation: Its intuitive interface organizes financial data into comprehensive reports, simplifying navigation for the seller or their tax professional through income and expense details. This streamlined process saves time and reduces the risk of errors during tax preparation.

Integration with Tax Filing Systems: PayTraQer seamlessly integrates with popular tax filing systems, streamlining the filing process. Users can directly export organized financial data into tax software, facilitating a smooth transition from expense tracking to tax filing. This integration minimizes the risk of data entry errors and improves overall efficiency in tax preparation.

Real-time Financial Insights: PayTraQer offers real-time financial insights for eBay sellers, enabling informed decisions year-round. This proactive approach keeps sellers aware of their financial standing, reducing the likelihood of surprises during tax season. The platform includes forecasting tools to assist sellers in planning for upcoming expenses and optimizing their overall business strategy.

Ignoring Sales Tax, Value-added Tax, and Other Taxes

In addition to income tax, you may also have to deal with sales tax, value-added tax (VAT), goods and services tax (GST), and other taxes on your eBay transactions. These taxes are imposed by different jurisdictions, such as states, counties, cities, and countries, on the sale of goods and services. The rules and rates of these taxes vary widely depending on the location of your buyers and sellers, the type and value of the items you sell, and the exemptions and exceptions that apply.

You should inform your buyers about the potential taxes and charges they may have to pay when they receive their items and collect and remit the taxes to the appropriate authorities when required. You should also register your eBay business with the relevant tax authorities and obtain a tax identification number, such as an EIN, a VAT number, or a GST number. You should use eBay’s tools and features, such as the tax exemption tool, the tax settings tool, and the tax reports tool, to manage your tax obligations and records.

Missing Tax Deadlines and Payments

As an eBay seller, you must meet specific tax deadlines and payments, such as filing your tax return, paying your estimated taxes, and remitting your sales tax, VAT, GST, and other taxes. Missing these deadlines and payments can result in penalties, interest, and late fees. You should use a tax calendar and software to track your tax due dates and amounts and pay your taxes on time and in full. You should also check your eBay account and email regularly for any tax notices or updates from eBay or the tax authorities.

How Do You Save Money and Reduce Tax Liability With Tax Deductions and Credits?

If you are an eBay seller, you may wonder how to deal with taxes on your online sales. While paying taxes is inevitable and unavoidable, there are ways you can save money and reduce your tax liability as an eBay seller. The Income Tax Act provides various tax deductions and credits for investments, savings, and expenses you can claim on your tax return.

These tax deductions and credits can lower your taxable income and tax bill and increase your tax refund. However, the tax rules and regulations may vary depending on your location and the nature of your eBay activities.

Hobby vs. Business on eBay

If you sell items on eBay, you may wonder whether you are running a hobby or a business. This distinction is important because it affects how you report your income and expenses and what tax deductions and credits you can claim.

Let’s delve into the difference between a hobby and a business on eBay and how to determine which one applies to your situation. We’ll also explore tips and resources to help you manage your taxes as an eBay seller.

What Is a Hobby on eBay?

A hobby is any activity that you do for fun or personal enjoyment without making a profit. People who sell items on eBay as a hobby occasionally or sporadically sell them for less than they paid.

For example, you may sell some old books, clothes, or collectibles you no longer need or want or sell items you make as a hobby, such as crafts or jewelry.

Tax Treatment of Hobby Income and Expenses

Income Reporting: If you earn money from a hobby, you must report that income on your tax return. It is true even if the activity is something you do for personal enjoyment rather than as a primary source of income.

Expense Deductions: Unlike a business, where you can often deduct various expenses related to the company, in the case of a hobby, you generally cannot deduct any expenses.

Expense Limitation: If you have expenses associated with your hobby, the deduction is limited to the income you generated from that hobby. In other words, you can only use expenses to offset the income; you can't use hobby-related expenses to create a loss or reduce income from other sources.

No Business Tax Breaks: Unlike businesses that may be eligible for various tax breaks and deductions to encourage economic activity, hobbies do not receive such preferential treatment. The tax treatment for hobbies is generally less favorable than that for businesses.

Non-Deductibility of Hobby Losses: If your hobby expenses exceed your hobby income, you cannot use the resulting loss to offset income from other sources.

What Is a Business on eBay?

A business is an activity you do to make a profit and conduct regularly and continuously, and people who sell items on eBay as a business frequently or systematically sell them for more than what they paid.

For example, you may buy items at a low price and resell them at a higher price, or you may create and sell your products or services, such as art, clothing, or consulting.

If you have a business, you must report the income and expenses related to it, and you can deduct business expenses that are ordinary and necessary for your activity, such as supplies, equipment, and advertising. You can also claim business tax deductions and credits that may reduce your tax liability.

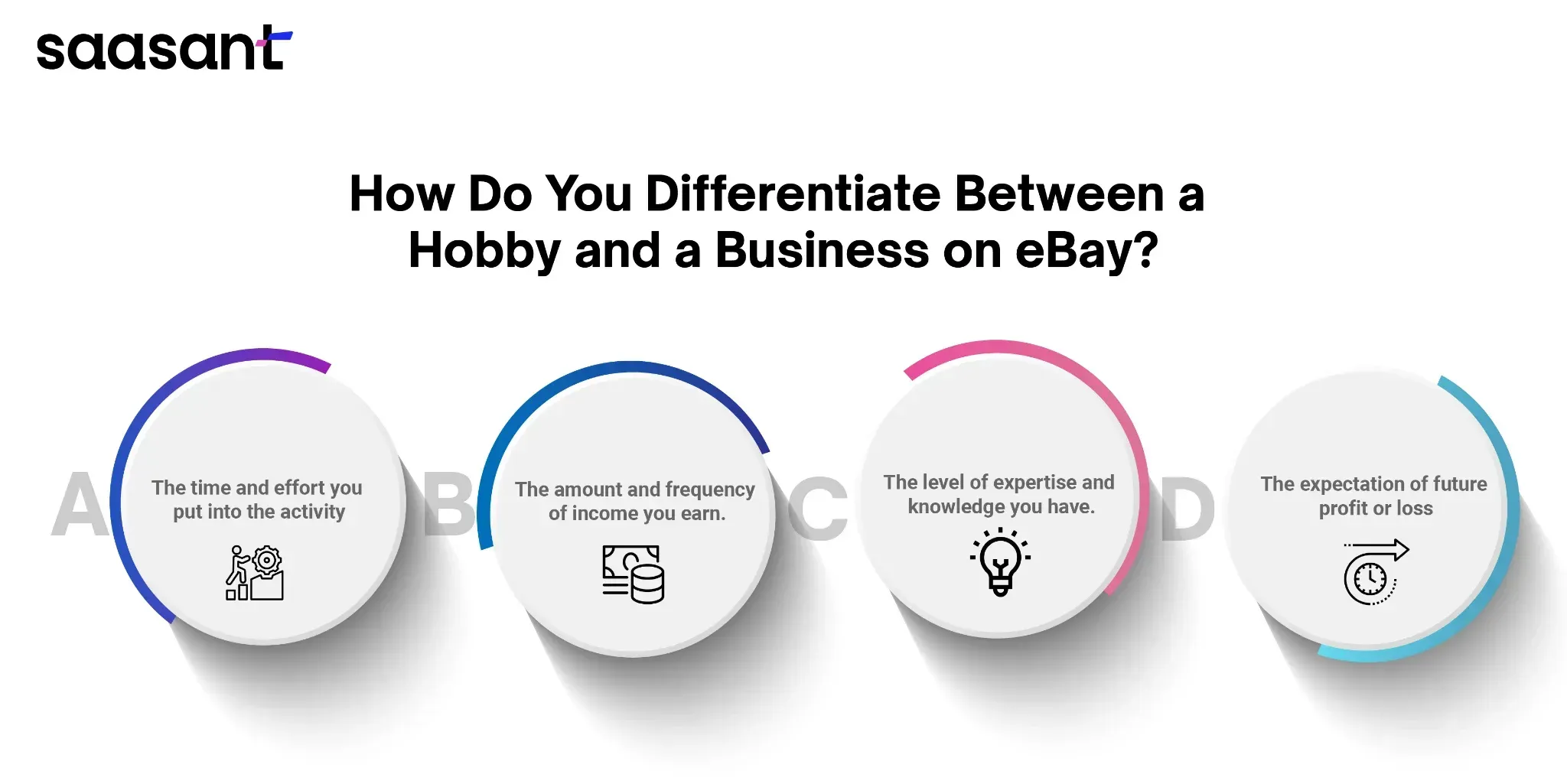

How Do You Differentiate Between a Hobby and a Business on eBay?

There is no clear-cut rule or threshold to distinguish a hobby from a business; each case depends on its facts and circumstances. However, as a general guideline, the IRS has established some factors that taxpayers must consider when determining whether their activity is a business or hobby, such as:

The time and effort you put into the activity.

The amount and frequency of income you earn.

The level of expertise and knowledge you have.

The expectation of future profit or loss

You can use these factors to evaluate your situation and assess your intentions and goals honestly. For clarification, consult a tax professional or local tax authority for guidance.

Tips and Resources for eBay Sellers

Whether you have a hobby or a business on eBay, you should keep track of your income and expenses and keep receipts and records of your transactions. It will help you report your taxes accurately and avoid penalties or audits.

You should also be aware of the tax rules and obligations that apply to your activity, such as:

Collect and remit sales tax from your customers, depending on state and local laws.

Paying self-employment tax on your net earnings from your business.

Filing Schedule C or C-EZ with your Form 1040 if you have a business.

Filing Form 1099-K if you receive over $20,000 in gross payments and more than 200 transactions through eBay in a calendar year.

Tax Deductions and Credits for eBay Sellers in the United States

If you are an eBay seller in the United States, you must report your income from your eBay sales on your federal tax return, regardless of whether you are running a hobby or a business. However, your status depends on how you report your income and expenses and the tax deductions and credits you can claim.

If you are running a hobby on eBay, you must report your income from your eBay sales as other income on Line 8 of Schedule 1 of Form 1040. You cannot deduct any expenses related to your hobby, such as eBay fees, shipping, or inventory costs, from your income. You must pay tax on your gross income from your eBay sales without deductions. However, you may be eligible for some tax credits that can reduce your tax liability, such as the earned income tax credit (EITC), the child tax credit (CTC), or the American Opportunity Tax Credit (AOTC), depending on your income level and personal situation.

If you are running an eBay business, you must report your income and expenses from your eBay sales on Schedule C of Form 1040. You can deduct any ordinary and necessary expenses related to your business, such as eBay fees, shipping, inventory, travel, software, office, and home office expenses (if you use a part of your home exclusively and regularly for your business).

These deductions can lower your taxable income and your tax liability. However, you may also have to pay self-employment tax on your net income from your eBay sales, 15.3% of your net income up to $142,800, and 2.9% above that amount for the 2023 tax year. You can deduct half of your self-employment tax from your income as an adjustment on Line 14 of Schedule 1 of Form 1040.

You may also be eligible for some tax credits that can reduce your tax liability, such as the EITC, the CTC, the AOTC, the lifetime learning credit (LLC), the child and dependent care credit (CDCC), the saver's credit, or the premium tax credit (PTC), depending on your income level and personal situation.

To claim tax deductions and credits as an eBay seller in the United States, you must keep accurate and complete records of your income and expenses and provide the necessary documentation to the IRS. You must also fill out the appropriate forms and schedules on your tax return. You can use online tax software or consult a tax professional to help you.

Tax Deductions and Credits for eBay Sellers in the European Union

If you are an eBay seller in the EU, you must report your income from your eBay sales on your local tax return and pay income tax and social security contributions according to your local tax rules and rates.

However, you may also have to deal with value-added tax (VAT), a tax on the EU's consumption of goods and services. VAT charges differ depending on the product type, country of origin, and country of destination.

As an eBay seller in the EU, you may have to register for VAT, charge VAT to your customers, and pay VAT to your local tax authority, depending on your location, turnover, and customers' location. You can also claim VAT refunds or deductions for the VAT you paid on your purchases or expenses related to your eBay sales.

The EU's VAT rules and regulations for eBay sellers are complex and vary from country to country. Therefore, you should consult a tax professional or local tax authority for guidance on your VAT obligations and entitlements.

Tax Deductions and Credits for eBay Sellers in Canada

Suppose you are an eBay seller in Canada. In that case, you must report your income from your eBay sales on your Canadian tax return and pay income tax and Canada Pension Plan (CPP) contributions according to the Canadian tax rules and rates. However, you may also have to deal with goods and services tax (GST) or harmonized sales tax (HST), taxes on the consumption of goods and services in Canada. GST is charged at a rate of 5% on most goods and services sold in Canada, while HST is a combination of GST and provincial sales tax (PST) charged in some provinces instead of GST and PST.

As an eBay seller in Canada, you may have to register for GST/HST, charge GST/HST to your customers, and remit GST/HST to the Canada Revenue Agency (CRA), depending on your location, your turnover, and your customers' location. You can also claim input tax credits (ITCs) for the GST/HST you paid on your purchases or expenses related to your eBay sales.

The GST/HST rules and regulations for eBay sellers in Canada are also complex and vary from province to province. Therefore, consulting a tax professional or the CRA for guidance on your GST/HST obligations and entitlements is advisable.

Wrap Up

In conclusion, understanding and managing taxes as an eBay seller is crucial for a successful and compliant online business. The tax implications can significantly impact your financial responsibilities, whether selling as a hobby or running a full-fledged business. This comprehensive guide has covered vital aspects, from determining the taxable nature of your eBay sales to reporting income, dealing with various taxes, and accessing essential tax documents.

Sellers can seamlessly navigate the complexities of sales tax, value-added tax, and other obligations by staying informed about tax policies, utilizing eBay tools, and following proper procedures. Conduct thorough research before listing items, set realistic prices, and stay organized with your income and expense records. Timely compliance with tax deadlines is essential to avoid penalties and ensure a smooth financial operation.

Understanding the distinction between a hobby and a business is pivotal for sellers in the United States, influencing income reporting and deductions or claiming credits. In the European Union and Canada, sellers must navigate local tax rules, including VAT and GST/HST, adding an extra layer of complexity.

Leveraging available resources on eBay, such as the tax exemption tool, tax settings tool, and tax reports tool, can streamline the tax management process. Regularly checking for updates on eBay's tax policies and collaborating with tax professionals when needed will contribute to a compliant and financially optimized eBay selling experience.

Successfully managing eBay taxes is about fulfilling legal obligations and maximizing savings through legitimate deductions and credits. Stay informed, stay organized, and consult with professionals to ensure your eBay venture remains profitable and tax-efficient.

FAQs

Do I Have To Pay Taxes On My eBay Sales?

Whether you have to pay taxes on your eBay sales depends on several factors, including:

Your location: Tax laws vary by country, state, and even locality.

The nature of your sales: Are you selling occasionally as a hobby or running a regular business?

The amount and frequency of your sales: There may be minimum thresholds for collecting sales tax.

The type and value of the items you sell: Certain items may be exempt from taxes.

How Do I Know If I'm Selling As a Hobby Or a Business on eBay?

The IRS uses several factors to determine if your eBay activity is a hobby or a business. These include:

The time and effort you put into it.

Your intention to make a profit.

The frequency and regularity of your sales.

Whether you keep detailed records of your income and expenses.

If you need more clarification, consult a tax professional for guidance.

What Taxes Might I Need To Pay on My eBay Sales?

Depending on your location and sales activity, you may need to pay:

Income tax: This is a tax on your net profits from your eBay sales.

Sales tax: This tax is collected when taxable goods are sold in certain jurisdictions.

Value-added tax (VAT): This tax is levied on the incremental value added at each stage of production and distribution of a product or service. It is common in the European Union.

Goods and services tax (GST): Similar to VAT, this tax applies in some countries like Canada.

How Do I Collect And Remit Sales Tax On My eBay Sales?

eBay can help you collect sales tax on your sales if required by law in your location. You can set up your sales tax table in your eBay seller settings. However, it's your responsibility to ensure you're complying with all relevant tax regulations.

How Do I Find And Access My eBay Tax Documents And Forms?

You can find your eBay tax documents and forms, such as Form 1099-K, in your eBay Seller Hub or My eBay under the "Payments" and then "Taxes" tab. These forms will help you report your income and expenses to the IRS or other tax authorities.

What Are Some Common Tax Mistakes eBay Sellers Make?

Some common mistakes include:

Neglecting to research tax laws applicable to their location and sales activity.

Setting unrealistic prices can affect profits and tax liability.

Failing to report income and expenses on their tax return.

Ignoring sales tax, VAT, or GST obligations.

Missing tax deadlines and payments.

How Can I Save Money On Taxes As An eBay Seller?

There are several ways to save money on taxes as an eBay seller, such as:

Keeping accurate records of your income and expenses.

Understanding and claiming all eligible tax deductions for business-related expenses.

Consult with a tax professional to ensure you comply with all tax laws and maximize your deductions.

By following these tips, you can minimize your tax liability and keep more of your hard-earned profits from your eBay sales.

Your eBay sales are taxable if you sell items on eBay as a business or a regular activity and profit from your sales. The IRS guidelines can help you determine whether your eBay activities are a hobby or a company.

What Are the IRS Guidelines for eBay Sellers?

The IRS guidelines for eBay sellers depend on factors such as:

The amount of time and effort you put into your eBay activities.

The level of expertise and knowledge you have about the items you sell.

The expectation and intention of making a profit from your eBay activities.

The history of income or losses from your eBay activities.

The amount of assets and resources you invest in your eBay activities.

The degree of dependence on your eBay income for your livelihood.

The market conditions and trends are affecting your eBay activities.

How Do I Report My eBay Income and Expenses On My Tax Return?

How you report your eBay income and expenses on your tax return depends on whether you are a sole proprietor, partner, corporation, or business entity. If you are a sole proprietor or a partner, you must report your eBay income and expenses on Schedule C (Form 1040), Profit or Loss from Business. Suppose you are a corporation or another type of business entity. In that case, you must report your eBay income and expenses on the appropriate business tax form, such as Form 1120, United States Corporation Income Tax Return, or Form 1065, United States Return of Partnership Income.

What Are the Common Expenses for eBay Sellers?

The common expenses for eBay sellers include eBay fees and commissions, PayPal fees, shipping and handling costs, packaging and mailing supplies, advertising and marketing costs, internet and phone expenses, office supplies and equipment, travel and transportation expenses, insurance and legal fees, depreciation and amortization of assets, and inventory and cost of goods sold.

What Are the Different Types of Taxes that eBay Sellers May Have to Deal With?

A: eBay sellers may have to deal with sales tax, value-added tax (VAT), goods and services tax (GST), and other taxes imposed by different jurisdictions on the sale of goods and services, depending on the location of their buyers and sellers, the type and value of the items they sell, and the exemptions and exceptions that apply.

What is Form 1099-K, And Why Did I Receive it From eBay?

Form 1099-K is an IRS form for reporting applicable payments received within a calendar year. Online marketplaces like eBay must issue a 1099-K to US sellers who’ve received payments from online sales that meet or exceed the minimum threshold set by the IRS and each applicable state. If you meet these criteria, you may receive a 1099-K from eBay, and you need to report your eBay income on your tax return accordingly.

What is Form W-9, And Why Did eBay Ask Me to Provide it?

Form W-9 is an IRS form requesting the taxpayer identification number and certification of a US person, such as a sole proprietor, a partnership, a corporation, or an individual. eBay may ask you to provide a Form W-9 if your tax details can’t be verified or if you need to update your tax information. You need to fill out and submit a Form W-9 online or by mail to eBay, and eBay will use it to issue your 1099-K and report your eBay income to the IRS.

What is Form W-8, And Why Did eBay Ask Me to Provide it?

Form W-8 is an IRS form requesting a non-US person's foreign status and certification, such as a foreign individual, entity, or trust. If you are not a US person and sell on eBay.com or other US-based eBay sites, eBay may ask you to provide a Form W-8. You need to fill out and submit a Form W-8 online or by mail to eBay, and eBay will use it to determine your tax obligations and withholdings on your eBay income.

How Do I Find And Access My eBay Tax Documents And Forms?

To find and access your eBay tax documents and forms, you need to follow these steps:

Navigate to eBay’s Seller Hub or My eBay, and click on the ‘Payments’ section.

Once in the ‘Payments’ tab, click on another tab titled ‘Taxes.’

On this page, you will see ‘PDFs’ of all your tax documents and forms for previous years (if applicable).

To download a copy of your tax document or form, click on the Download button next to the document or form name.

You can also print or save the document or form to your computer or device.