Mastering Ecommerce Accounting: Strategies and Tools for Online Businesses

As an online business owner, managing your business effectively requires attention to detail in many areas. From website development to digital marketing, many technical aspects must be considered.

Accurate and efficient financial management is critical to the success of any business, and this is even truer for eCommerce businesses. Understanding eCommerce accounting is essential if you're starting or looking to grow your existing business.

By the end of this blog, you'll understand the strategies and tools you need to manage your finances effectively and take your online business to the next level.

Contents

What is eCommerce Accounting?

How Important is Accounting to eCommerce Business?

eCommerce Accounting Strategies: Step-by-Step Guide

5 Best eCommerce Accounting Tools for Online Businesses

Conclusion

FAQs

What is eCommerce Accounting?

eCommerce accounting is a specialized field of accounting that applies accounting principles uniquely suited to online businesses. This area, crucial for anyone keen to understand eCommerce accounting, involves processes and systems required to meticulously track, manage, and analyze financial transactions and data associated with eCommerce operations.

eCommerce Accounting Helps You Build a Stable Business Model

-Rachel Phillips (COO, Fully Accountable)

eCommerce accounting typically employs specialized software and tools to handle transactions and data efficiently. It includes monitoring sales and revenue, expenses, inventory management, shipping and handling costs, and payment processing. It also extends to leveraging various financial reports and analyses, providing critical insights into an eCommerce business's financial health and performance.

Understanding the essentials of accounting for eCommerce is vital, as it requires a deep comprehension of the unique challenges and complexities online businesses face. These include managing large volumes of transactions, navigating multiple payment methods and currencies, adhering to tax laws and regulations, and effectively managing inventory levels and shipping costs.

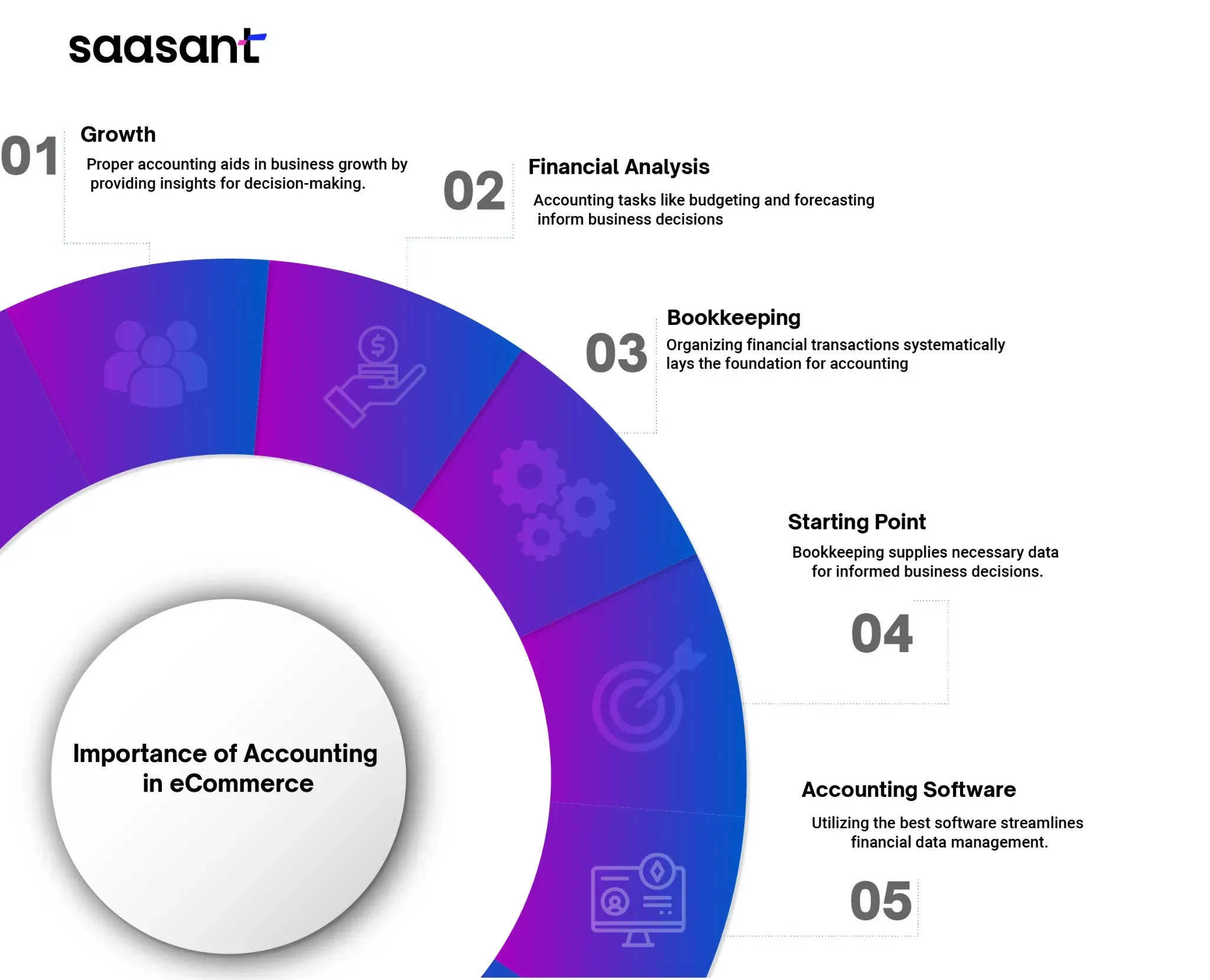

How Important is Accounting to eCommerce Business?

Your eCommerce business will only grow with proper accounting. Implementing a robust accounting system for eCommerce involves analyzing and interpreting financial data to provide meaningful insights into your business's future financial performance. Accounting tasks such as financial statement analysis, budgeting, and forecasting will also help you make informed business decisions.

As an eCommerce businessperson, you need to have a clear understanding of both bookkeeping and accounting. Bookkeeping involves systematically and comprehensively recording and organizing financial transactions, such as sales, purchases, and expenses.

It lays the foundation for accounting and financial reporting, providing accurate and up-to-date financial data for decision-making. Therefore, bookkeeping is the starting point for accounting, supplying the necessary financial data that accounting relies on to provide insights that help you make informed business decisions. Leveraging the best accounting software for eCommerce business can enhance this process significantly.

Accounting Methods for eCommerce

Using accounting services for eCommerce is crucial as they help implement accounting methods that are essential tools used by eCommerce businesses to accurately track and report financial data such as sales, expenses, inventory, and cash flow. Different eCommerce businesses may require either cash-based or accrual accounting methods, depending on the size and complexity of their operations.

Cash Basis Accounting

Cash basis accounting is a straightforward method that records financial transactions when cash is received or paid out. This cash accounting method is commonly used by small businesses, particularly those with straightforward operations.

Under cash-based accounting, revenue is recorded when cash is received, and expenses are recorded when money is paid out. This method does not consider accounts receivable or accounts payable, making it more straightforward to maintain.

Accrual Accounting eCommerce

Accrual accounting is a more complex accounting method that records financial transactions when they occur, regardless of when cash is received or paid out. Under accrual accounting, revenue is recognized when earned, and expenses are recorded when incurred. This method considers accounts receivable and payable, making it more accurate and complicated than cash-based accounting.

eCommerce Accounting Strategies: Step-by-Step Guide

Below are eCommerce accounting strategies that you must consider implementing for your online business.

Step 1: Choosing the Best Accounting Software for eCommerce

To effectively manage eCommerce accounting, selecting the right software is crucial. It's vital for tracking, analyzing, and managing financial transactions, ensuring up-to-date bookkeeping, spending monitoring, and tax compliance. The ideal software provides insights into your eCommerce business's financial health.

Selecting Your eCommerce Accounting Software

Identify your business needs, set a budget, research options, and test the software through trials or demos. Essential features include robust data security, inventory management, tax compliance support, comprehensive sales reporting, and seamless integrations with other eCommerce tools.

QuickBooks for eCommerce

QuickBooks stands out for its extensive features tailored to eCommerce businesses. It seamlessly integrates with major eCommerce platforms, automates financial management, and provides efficient inventory tracking. Its robust security measures ensure the safety of your financial data.

Integrations and Enhancements

QuickBooks supports integrations with eCommerce platforms like Amazon, Walmart, Shopify, eBay, BigCommerce, Woocommerce, etc., facilitating streamlined inventory management and financial reporting. Applications like PayTraQer enhance accounting efficiency by automating financial data handling by integrating various eCommerce systems and payment gateways.

Step 2: Track Sales and Expenses for Your eCommerce Business

Efficiently managing your eCommerce business's finances involves meticulous sales and expense tracking. QuickBooks offers integrated solutions for this, especially when combined with platforms like Shopify. PayTraQer makes it easy to sync e commerce sales, expenses, and refunds into QucikBooks or Xero.

Using QuickBooks for eCommerce Accounting:

Integration with eCommerce Platforms: Connect your eCommerce platform, like Shopify, to QuickBooks to import sales data automatically. It ensures all sales figures are accurately reflected in your accounting records.

Expense Categorization: Categorize and record various expenses directly in QuickBooks, such as shipping costs, website hosting, and advertising expenses. Input these as individual expense transactions and align them with the correct dates.

Account Reconciliation: Regularly reconcile your accounts in QuickBooks with your bank and credit card statements to maintain accurate financial records.

Detailed Tracking in QuickBooks:

Customizing Accounts: Set up and customize your chart of accounts in QuickBooks to reflect your business’s unique financial activities, accurately categorizing all expenses and incomes.

Recording Transactions: Log every financial transaction, from the rent payments for your physical location to sales receipts for customer purchases, assigning each to the appropriate account.

Revenue and Expense Management: Keep a detailed record of all sales and expenses, ensuring you can track your profitability and manage your cash flow effectively.

Monitoring eCommerce Specific Costs:

Platform Fees and Shipping Costs: Create specific expense accounts in QuickBooks for fees charged by your eCommerce platform and shipping costs. Record each expense accurately to monitor these recurring costs effectively.

Financial Oversight: Utilize QuickBooks reports to analyze the fees and shipping costs, aiding in strategic decision-making and financial planning.

By considering these steps, you can use QuickBooks to gain a comprehensive overview of your eCommerce business's financial health, helping in strategic decision-making and ensuring financial accuracy.

Step 3: Monitoring Inventory in eCommerce Accounting

Effective eCommerce accounting requires diligent inventory management. eCommerce businesses must maintain accurate inventory records to manage sales and purchases effectively. Software like QuickBooks offers specialized features for inventory management, streamlining the tracking of stock levels, purchase orders, receipts, and related transactions.

Implement an Inventory System: Use a tool like QuickBooks or an eCommerce platform with inventory features like Shopify to keep accurate inventory records.

Log New Stock: Record new inventory arrivals with SKU, quantity, and cost details.

Adjust Inventory Post-Sale: Deduct sold items from your stock count to maintain current inventory levels.

Establish Reorder Points: Set minimum stock levels that trigger the need to reorder, ensuring you never run out of critical products.

Regularly Audit Inventory: Periodically verify your inventory count for accuracy, helping to identify and correct any discrepancies.

For instance, if your store stocks 100 t-shirts and sells around ten daily, you might reorder when the count drops to 30. After receiving 50 new shirts, you update the system, continuously adjusting as sales are made, ensuring you always have sufficient stock.

This strategy ensures continuous monitoring and efficient inventory management, which is crucial for maintaining the operational flow of an eCommerce business.

Step 4: Reconcile Bank Accounts in eCommerce Accounting

Reconciling bank accounts is a crucial step in eCommerce bookkeeping, ensuring that your accounting records align with your bank statements. Here's a streamlined approach:

Collect Bank Statements: Gather your latest bank statements for the period you're reconciling.

Match Transactions: Compare your eCommerce system's recorded transactions against the bank statement.

Spot Discrepancies: Investigate any differences to pinpoint issues like timing lags, bank fees, or entry mistakes.

Adjust Records: Correct your eCommerce records to mirror your bank statement accurately, addressing any discrepancies.

Finalize Reconciliation: Ensure the adjusted eCommerce system balance matches your bank statement.

Document Everything: Record the reconciliation details and any adjustments made.

Regular Reconciliation: To keep your financial records accurate and reliable, perform this reconciliation routinely, such as monthly.

Step 5: Generate Financial Statements in eCommerce Accounting

After reconciliation, it's vital to produce financial statements that clearly show your eCommerce business's financial status. These statements include:

Income Statement: This document details your revenues, expenses, and net income over a certain period, showcasing the business’s profitability and operational performance.

Balance Sheet: It provides a snapshot of your assets, liabilities, and equity at a specific time, illustrating the company's financial condition and stability.

Cash Flow Statement: This statement tracks the cash inflows and outflows, assessing the organization’s ability to generate cash and manage its liquidity.

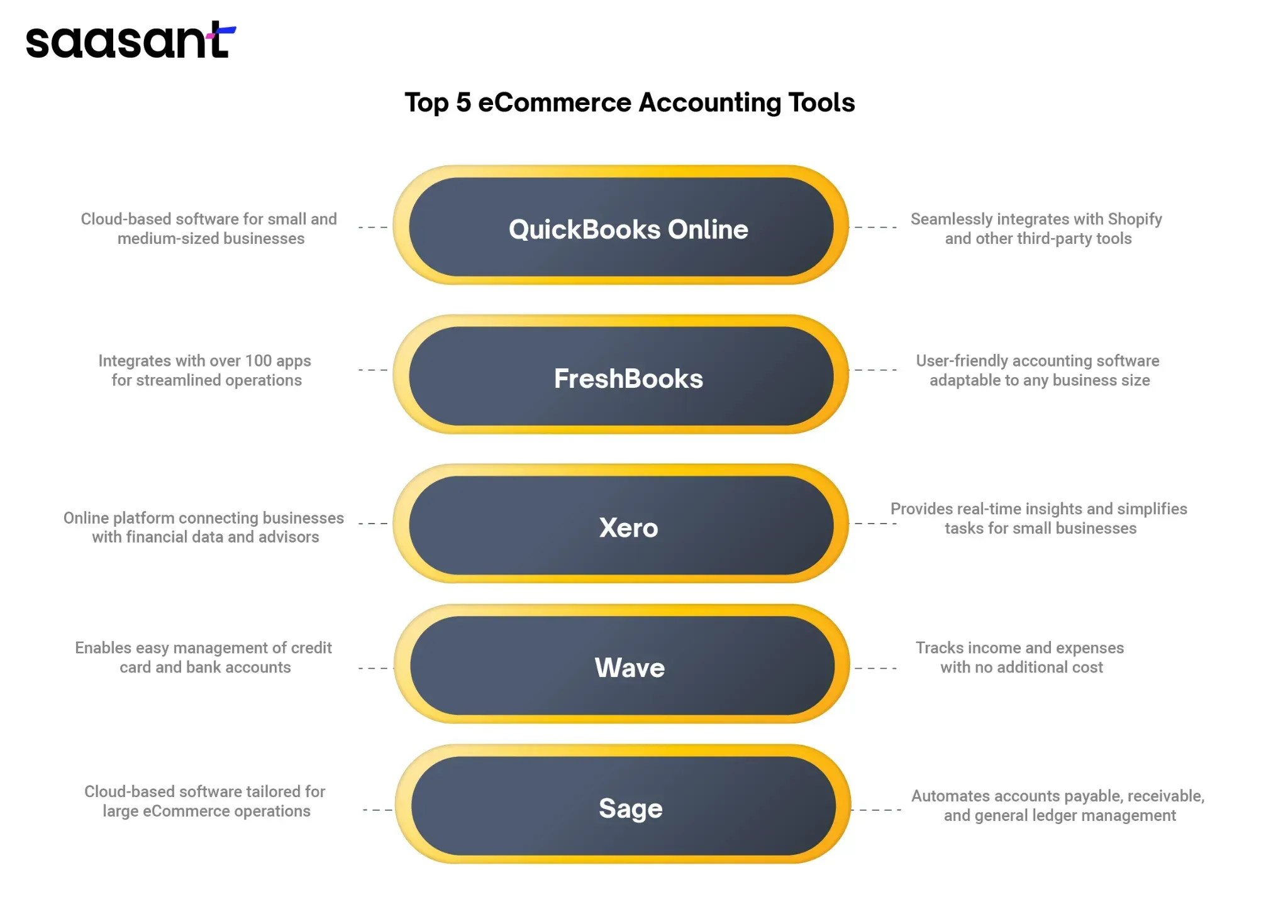

5 Best eCommerce Accounting Tools for Online Businesses

Choosing the ideal eCommerce accounting software is not just a matter of convenience; it's about ensuring smooth integration that is time-consuming and benefits your online business. Below are five best eCommerce accounting tools for online businesses:

QuickBooks Online:

QuickBooks is a cloud-based accounting software with user-friendly features for small and medium-sized businesses. To enhance the eCommerce experience, QuickBooks has seamlessly integrated with third-party tools. Specifically, QuickBooks has streamlined Shopify integration through an app, simplifying its use within your business.

Freshbooks

FreshBooks offers user-friendly accounting and bookkeeping software suitable for businesses of any size. FreshBooks is the ideal choice if your eCommerce business requires a comprehensive solution.

With integration capabilities extending to over 100 top-notch apps, FreshBooks streamlines your business operations, fosters collaboration with your team and clients, and provides invaluable insights into your business performance.

Xero

Xero's online accounting software seamlessly links small business owners to their financial data, banking institutions, and advisors around the clock. You can conveniently oversee all aspects of your business from a single platform.

Xero synchronizes bank and financial data effortlessly by connecting with your bank, providing real-time insights. Its features are tailored to simplify tasks for small businesses, ensuring accessibility and convenience regardless of location or time.

Wave

Wave accounting software enables you to seamlessly link numerous credit card and bank accounts, simplifying the management of your finances. Tracking income and expenses is effortless and cost-free, while features like invoicing and receipt scanning come at no additional charge.

However, if you opt for customers to pay directly through your invoices, a percentage fee applies. Similarly, utilizing Wave for payroll incurs an additional cost. Notably, Wave integrates seamlessly with Shopify, enhancing its functionality for eCommerce businesses.

Sage

If you manage a large eCommerce business, Sage could be highly beneficial. It's cloud-based accounting software designed for more advanced operations. Alongside accounting tools, it includes payroll and HR features to support businesses with many employees.

Sage allows you to automate accounts payable, accounts receivable, and general ledger management, helping streamline your accounting processes.

Conclusion

Mastering eCommerce accounting is essential for online businesses to ensure financial and business success and longevity in today's digital marketplace. By implementing the right strategies and tools, online businesses can streamline their accounting processes and make informed decisions based on accurate financial data.

With PayTraQer, online businesses can save time and reduce errors by automating bookkeeping tasks and reconciling their sales data with accounting software such as QuickBooks or Xero.

These applications reduce the risk of errors and ensure that financial data is always up-to-date. With the help of PayTraQer, online businesses can master eCommerce accounting and thrive in the competitive world of eCommerce.

FAQs

How do you maintain eCommerce accounting?

To maintain eCommerce accounting, keep accurate records of all financial transactions, including sales, expenses, and taxes. Use accounting software to track income and expenses, reconcile accounts regularly, and generate financial reports. Keep separate accounts for personal and business costs and ensure compliance with applicable tax laws and regulations.

What is the role of an accountant in eCommerce?

An accountant in eCommerce is responsible for managing and maintaining accurate financial records, ensuring compliance with tax laws and regulations, and providing insights into the business's financial health. They handle various bookkeeping tasks, such as tax preparation, financial analysis, and budgeting, and advise on financial strategy and cash flow management.

What does an eCommerce bookkeeper do?

An eCommerce bookkeeper is responsible for recording and categorizing transactions, reconciling financial transactions for an eCommerce business, managing accounts payable and receivable, tracking and managing inventory, and producing financial reports. They work to ensure the accuracy and completeness of financial records and provide insights into the business's financial health.

What is accounting in eCommerce?

Accounting in eCommerce involves the recording and analysis of financial transactions related to online sales. It includes bookkeeping, payroll processing, tax preparation, financial reporting, and analysis. Accounting provides valuable insights to eCommerce businesses to make informed pricing, marketing, and overall financial health decisions. Accurate accounting is essential for monitoring financial performance, making informed decisions, and complying with legal requirements.

Which is the best accounting course?

As a small business owner looking to improve your bookkeeping skills, consider courses that are time-efficient, affordable, and specifically geared towards small business accounting. Some recommended courses include QuickBooks online tutorials, Udemy's Small Business Accounting & Bookkeeping course, and Harvard Business School's online accounting course.

What is eCommerce maintenance?

eCommerce maintenance refers to regularly updating and managing an online store to ensure it functions correctly and meets customer needs. It includes updating product information, managing inventory, processing orders, monitoring website performance, and ensuring security measures are in place. Regular maintenance can improve the customer experience and increase sales.

How do you manage an eCommerce project?

To manage an eCommerce project, define project goals, scope, and budget. Create a project plan and timeline, and identify project team members and their roles. Develop an eCommerce platform that meets customer needs, and test and launch the site. Monitor performance against key metrics and make improvements as needed.

Is GST applicable for eCommerce?

Yes, GST (Goods and Services Tax) applies to eCommerce transactions in many countries, including Canada and Australia. eCommerce businesses are required to register for GST, collect GST on sales, and file regular GST returns. Failure to comply with GST regulations can result in penalties and legal action.