How to Gain Your Own QuickBooks Certificate

Contents

What Is QuickBooks?

What Is a QuickBooks Certification?

Which Certification Program Should You Choose?

QuickBooks Certified User

QuickBooks Certified Proadvisor

QuickBooks Certified Advanced Proadvisor

Why Is a QuickBooks Certification Necessary?

How Can a QuickBooks Certified Personnel Help Business?

Expertise in Handling QuickBooks Software

Time and Cost Savings

Compliance with Tax and Accounting Regulations

Keeping Tabs on Your Financial Statements

Simplified Inventory Management

Effortless Taxation

What Are the Prerequisites?

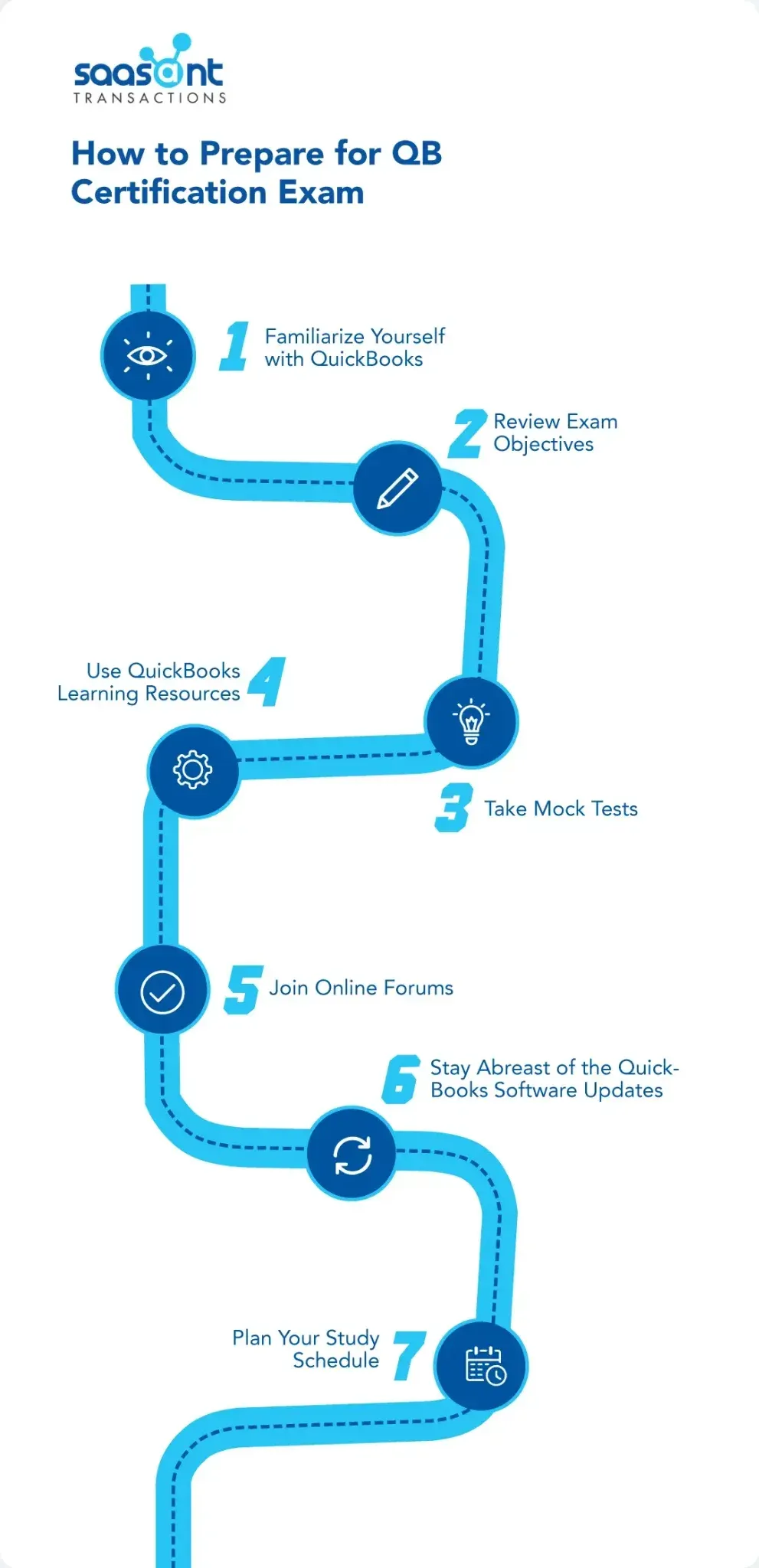

How to Prepare for the Exam?

Familiarize Yourself with QuickBooks

Review Exam Objectives

Take Mock Tests

Use QuickBooks Learning Resources

Join Online Forums

Stay Abreast of the QuickBooks Software Updates

Plan Your Study Schedule

When Can You Take the Exam?

How Can You Renew Your QuickBooks Certification?

Be Informed about QuickBooks’ Updates

Renew Your Certification Annually

Pursue Advanced Certification

Stay Engaged with the QuickBooks Community

Take Part in Proadvisor Programs

What Happens If You Don’t Clear the Exam on the First Attempt?

FAQs

What Is QuickBooks?

QuickBooks is an accounting software developed and marketed by Intuit since 1983 for both on-premises and cloud-based users. It's widely preferred by small and medium-sized businesses to manage their financial data easily.

QuickBooks offers comprehensive financial and accounting solutions, such as:

QuickBooks Payroll- Simplifies employee payroll processes and enhances HR access and benefits

QuickBooks Online - One-stop solution for cloud accounting

QuickBooks Desktop- Boosts confidence in handling general accounting and financial tasks

QuickBooks Live- You can correlate with a live bookkeeper who can update your financials and precisely manage books.

QuickBooks Payments- Facilitates payments made through all modes, such as online, debit/credit card, ACH (Automated Clearing House network) bank transfer, Apple Pay, PayPal, or Venmo.

QuickBooks Time- Employee time tracking software

The two significant features of QuickBooks' solutions are its user-friendly interface and the ability to streamline accounting efficiently.

What Is a QuickBooks Certification?

QuickBooks certification is an inclusive training program designed to inculcate the necessary skills and knowledge in individuals to use QuickBooks software effectively.

It is an industry-recognized credential demonstrating proficiency in using QuickBooks software for small businesses and individuals. The sole purpose of this certification is to provide end-users with a vast knowledge of how to simplify financial management, streamline bookkeeping, and make informed decisions.

This certification program covers all aspects of QuickBooks, including installation, setup, configuration, creating invoices and bills, managing expenses, customizing records, and flawlessly performing payroll tasks.

Which Certification Program Should You Choose?

There are several QuickBooks certification levels, depending on your experience and the expertise you want to demonstrate. The levels include:

QuickBooks Certified User

QuickBooks Certified ProAdvisor

QuickBooks Certified Advanced ProAdvisor

QuickBooks Certified User

It is designed for individuals new to QuickBooks who want to learn the basics of the software. The exam covers setting up a company file, managing customers and vendors, and creating invoices and bills.

QuickBooks Certified Proadvisor

It is designed for individuals who possess prior experience and knowledge about QuickBooks and wish to exhibit their proficiency in using the software. This exam covers managing inventory, handling payroll, and preparing financial statements.

By becoming a certified QuickBooks ProAdvisor, you can access exclusive benefits such as free listing on the Find-a-ProAdvisor directory, discounts on products and services, unlimited support, and much more.

QuickBooks Certified Advanced Proadvisor

This level is designed for individuals with extensive exposure to QuickBooks and has advanced knowledge of handling QuickBooks software. The exam covers advanced topics, including customizing QuickBooks, correlating with multiple users, and troubleshooting common issues.

Hence, choosing the appropriate one that best fits your needs and goals is imperative.

Why Is a QuickBooks Certification Necessary?

Employers recognize this certification, and many organizations demand it as a prerequisite for employment. Moreover, this will foster an individual's confidence in handling accounting and financial operations using QuickBooks.

A QuickBooks certification can enhance your career prospects in the accounting and financial management sector. It opens up new job opportunities as a bookkeeper, accountant, financial analyst, or QuickBooks consultant.

A QuickBooks certification can also optimize a person’s earning potential. According to PayScale, a QuickBooks Certified Proadvisor earns an average of $55,000 annually. The salary may vary depending on the person’s experience, qualifications, and job location. QuickBooks-certified individuals can access a dedicated support team to assist them with any issues.

How Can a QuickBooks Certified Personnel Help Business?

QuickBooks-certified personnel can aid business growth in numerous ways. As mentioned earlier, three different certifications are available, each with a unique feature.

In addition, a QuickBooks-certified individual can maximize QuickBooks using accounting automation software such as SaasAnt Transactions and PayTraQer. Let's look at how each certified expert benefits a business.

Expertise in Handling QuickBooks Software

A QuickBooks-certified individual possesses the virtuosity to manage accounting tasks using the software and can help businesses optimize their use of the software. This includes

Appropriately setting up the software

Customizing it to meet specific business needs

Ensuring the usage of the software to its full potential

Time and Cost Savings

Using QuickBooks effectively can save businesses significant amounts of time and money. As a QuickBooks certified professional, you can help companies streamline their accounting processes, downsize errors, and automate tasks, resulting in cost savings and increased productivity.

Compliance with Tax and Accounting Regulations

QuickBooks is designed to help businesses comply with tax and accounting regulations. A QuickBooks-certified professional can help enterprises to ensure the accuracy, amendment, and adherence of financial records to applicable laws.

Keeping Tabs on Your Financial Statements

QuickBooks can easily access all the common financial statements, such as balance sheets, profit and loss (P&L) statements, cash flow, and taxes filed. All you need to do is print the statement and send it to your accountant or share it with them during filing.

A QuickBooks Certified User who is adept at handling the software's basic functionalities, such as preparing financial statements, balance sheets, invoices, bills, P&L statements, cash flows, and tax filing documents, would be a perfect fit for managing these operations.

Simplified Inventory Management

Inventory management includes monitoring sold items, precisely entering appropriate data into expense accounts, calculating taxable incomes, and much more. However, performing all this manually requires a lot of work.

QuickBooks software can ease inventory management functionalities through automation. For example, whenever a payment is accepted for any item in the inventory, the accurate expense account will be revised and displayed automatically in taxable income.

Having a QuickBooks Certified ProAdvisor with abundant knowledge of know-how of the software by your side will be a value-add to your business.

Effortless Taxation

Taxation handling is one of the tedious processes in managing a business. But knowing QuickBooks and how to simplify the taxation process will be a game changer for your business's growth.

QuickBooks can easily manage colossal tax liability and estimate taxes automatically every cycle as a part of the payroll management functionalities. All you need to do is take a copy of the information from QuickBooks and share it with your accountant to prepare returns.

QuickBooks also allows you to scan and upload counterfoils in real-time through the QuickBooks mobile app. This will mitigate a chaotic situation during taxes. You can also share the same with the accountants for viewing and downloading the reports as and when required.

This certification also validates a person’s knowledge and skills, enabling them to take on more challenging tasks and responsibilities.

A QuickBooks Certified Advanced ProAdvisor with copious CPE credits and handling multiple accounting operations for various clients will be pertinent for spearheading effortless taxation functionalities.

If you're a small business owner or self-employed, QuickBooks certification can help you become more efficient in managing your finances. You'll be able to use the software to create invoices, manage expenses, and track your cash flow, among other things.

QuickBooks certification can provide businesses with a competitive advantage. By having QuickBooks-certified professionals, companies can differentiate themselves from their peers and demonstrate their expertise in financial management. This can be particularly promising for businesses that operate in the accounting or financial management sectors.

What Are the Prerequisites?

Before you can take the exam, you ought to meet specific simple prerequisites;

To earn a QuickBooks Online certification, you must have a QuickBooks Online/Online Plus account.

To earn a QuickBooks Desktop certification, your PC/Laptop must support QuickBooks Desktop 18 or later versions.

To earn a QuickBooks Point of Sale certification, install QuickBooks Point of Sale 18.0 on your PC/Laptop

How to Prepare for the Exam?

First and foremost, you should have a basic understanding of the software. Even if you have experience using QuickBooks, reviewing the material covered in the exam is an excellent idea to ensure that you're prepared.

Once you have met the prerequisites, it is time to prepare for the exam. Intuit, the company that developed QuickBooks, offers study guides and training resources to help you prepare for the exam. In addition, you can also refer to several reliable third-party resources.

Below mentioned are a few tips to prepare competently for the exam:

Familiarize Yourself with QuickBooks

Before starting to prepare for your certification exam, it is essential to understand the QuickBooks software, including its vital functions and features.

If you are new to QuickBooks, consider taking an introductory course or training program to familiarize yourself with the software.

Review Exam Objectives

The QuickBooks certification exam tests your knowledge and proficiency in using the software. Reviewing the exam objectives to ensure that you have covered all the topics that will be assessed is vital. You can find the exam objectives on the Intuit website.

Take Mock Tests

Taking mock tests is an eminent way to prepare for the QuickBooks certification program. Mock tests will aid you in identifying your "strengths and weaknesses” and provide you with an outline of what to expect on the actual exam. Intuit provides practice tests on its website that are similar to actual exams.

Use QuickBooks Learning Resources

Intuit offers various learning resources to help you prepare for the certification exam. These resources include online courses, webinars, and videos enclosing various aspects of QuickBooks. Use these resources to improve your understanding of the software and prepare for the exam.

Join Online Forums

Joining online forums can be a great way to interact with other QuickBooks users and learn from their experiences. You can ask questions, share your knowledge, and get advice from other users who have already cleared the exams.

Stay Abreast of the QuickBooks Software Updates

QuickBooks is continuously updated with new features and functions. Staying current and relevant is essential. Intuit provides regular updates and news on its website, and you can also sign up for its newsletter to receive updates frequently.

Plan Your Study Schedule

Planning your study schedule is decisive for ensuring you have enough time to prepare for the certification program. Set aside regular study time and create a study plan covering all the topics assessed in the exam.

When Can You Take the Exam?

When you feel ready, you can appear for the certification exam. The exam is administered online and consists of multiple-choice questions. You'll have two hours to pass the exam and must score at least 80%. The cost of the exam varies by program, but it typically ranges from $149 to $449.

On exam day, make sure you have a stable internet connection. As this exam is timed, ensure you manage your time well. Once you have cleared the exam, you will receive your QuickBooks certification. This credential will demonstrate your expertise in QuickBooks and advance your career.

How Can You Renew Your QuickBooks Certification?

Upgrading your QuickBooks certification requires ongoing effort and commitment, but it is not tedious. The following hints can help you keep your QuickBooks certification up-to-date.

Be Informed about QuickBooks’ Updates

QuickBooks releases software updates and introduces new features regularly. You must be aware of this information to maintain your QuickBooks certification.

QuickBooks provides free training courses to help you keep up with the latest features and modifications. Completing these courses lets you stay current and rewards you with continuing professional education (CPE) credits.

Renew Your Certification Annually

QuickBooks is valid for one year, after which you have to renew it. You must pass the current QuickBooks certification exam and complete the required CPE credits to restore your certification.

You can take the exam online or at a testing center. You can also earn CPE credits by attending QuickBooks training sessions or webinars, completing online courses, or participating in industrial conferences.

Pursue Advanced Certification

To upgrade your QuickBooks certification, you must pursue advanced QuickBooks certifications. QuickBooks offers several advanced certifications, including:

QuickBooks Online Advanced Certification

QuickBooks Enterprise Solutions Certification

QuickBooks Point of Sale Certification

These certifications demonstrate your expertise in specific areas of QuickBooks and can help you stand out from other accounting experts.

Stay Engaged with the QuickBooks Community

Joining the QuickBooks community is an eminent way to stay engaged with other accounting professionals and learn about the contemporary trends in accounting and QuickBooks.

QuickBooks community offers forums, webinars, blogs, and training resources to help you stay connected and informed. You'll also be able to share your knowledge and experiences with others in the community.

Take Part in Proadvisor Programs

QuickBooks ProAdvisor programs provide additional training and resources to help you enhance your skills and knowledge of QuickBooks. This program offers exclusive benefits such as:

Product discounts

Priority support

Access to QuickBooks software

By participating in this program, you can establish your commitment to excellence and client dedication.

What Happens If You Don’t Clear the Exam on the First Attempt?

If you can't attain your QuickBooks certification on the first attempt, don't worry! Depending on your chosen certificate, you can retake the exam after a certain period. For example, for the QuickBooks Certified User exam, you can retake the exam immediately if you fail. At the same time, for the QuickBooks Certified ProAdvisor exam, you must wait at least 60 days before you retake the exam.

Intuit allows you to take up to three attempts to pass the recertification exam, enabling you to retake only the failed sections. This is helpful as you can concentrate only on the areas you must clear.

If you fail to clear the exam in those three attempts, you'll be excluded from writing the test for the next 60 days. After the 60-day lock-out period, you'll be granted another three attempts to outperform the recertification exam.

Taking the QuickBooks certification exam can be a great way to expose your competence in QuickBooks and advance your accounting knowledge. Preparing for these certification programs would demand knowledge, practice, and dedication. Following the above tips and ideas gives you a coherent view of why a QuickBooks certification is essential.

Gaining your own QuickBook certification is a worthwhile investment that can help you stand out in financial management and exhibit your proficiency in using QuickBook software. You can also improve your workflow and productivity as a QuickBooks user through Saasant Transactions, an accounting automation tool that enables you to import, export, delete or modify bulk transactions.

What are you waiting for? Kick off the process of becoming a QuickBooks accredited expert!

FAQs

What Is QuickBooks?

QuickBooks is a versatile accounting software developed by Intuit in 1983 for both on-premises and cloud-based platforms. It is widely used by small and medium-sized businesses to manage their financial data efficiently. QuickBooks offers a wide array of financial and accounting solutions, including:

QuickBooks Payroll: Simplifies payroll processes and offers enhanced HR access.

QuickBooks Online: A cloud-based accounting solution.

QuickBooks Desktop: Assists with general accounting and financial tasks.

QuickBooks Live: Connects you with a live bookkeeper to manage your finances.

QuickBooks Payments: Facilitates payments via various methods such as debit/credit cards, ACH transfers, and PayPal.

QuickBooks Time: Employee time tracking software.

QuickBooks makes financial management more accessible for businesses with a user-friendly interface and streamlined accounting capabilities.

What Is a QuickBooks Certification?

QuickBooks certification is an industry-recognized credential that demonstrates proficiency in using QuickBooks software. It is designed to help individuals and businesses streamline financial management, bookkeeping, and decision-making. The certification program covers everything from software setup and configuration to managing invoices, payroll, and other financial tasks.

Which Certification Program Should You Choose?

There are several levels of QuickBooks certification based on your experience and goals:

QuickBooks Certified User: Ideal for beginners, covering basic software setup, managing customers and vendors, and creating invoices.

QuickBooks Certified ProAdvisor: This designation is for those with some experience who want to showcase their expertise in areas such as inventory management and payroll.

QuickBooks Certified Advanced ProAdvisor: Targeted at professionals with advanced knowledge of QuickBooks, including troubleshooting and multi-user capabilities.

Choosing the right program depends on your career goals and expertise.

Why Is a QuickBooks Certification Necessary?

QuickBooks certification is valuable for anyone looking to boost their accounting and financial management career. It is often a prerequisite for employment in many organizations, and certified individuals are typically more confident handling financial operations. A certified QuickBooks professional can access exclusive benefits such as free product listings, discounts, and ongoing support.

Moreover, it can increase earning potential. According to PayScale, a certified QuickBooks ProAdvisor earns an average of $55,000 annually. Certified professionals are also more likely to find jobs as bookkeepers, accountants, financial analysts, or QuickBooks consultants.

How Can a QuickBooks-Certified Personnel Help Businesses?

A certified QuickBooks expert can benefit businesses in several ways:

Expert Software Management: Certified personnel know how to customize QuickBooks to meet specific business needs and can ensure that the software is used to its full potential.

Time and Cost Savings: Certified professionals help businesses streamline accounting processes, reduce errors, and automate tasks, improving productivity and cost savings.

Regulatory Compliance: They ensure businesses comply with tax and accounting regulations, maintaining accurate and up-to-date records.

Simplified Inventory and Tax Management: QuickBooks can automate inventory tracking and tax calculations, reducing the burden of manual entry and increasing accuracy.

Access to Financial Statements: Certified users can generate balance sheets, profit and loss statements, and other reports, making financial analysis and tax filing more efficient.

What Are the Prerequisites?

Before taking the QuickBooks certification exam, ensure you meet the following prerequisites:

For QuickBooks Online Certification, you need a QuickBooks Online or Online Plus account.

For QuickBooks Desktop Certification, your computer must support QuickBooks Desktop version 18 or later.

For QuickBooks Point of Sale Certification, you should install QuickBooks Point of Sale 18.0.

How to Prepare for the Exam?

Familiarize Yourself with QuickBooks: Understand the software’s functions and features.

Review Exam Objectives: Check the exam objectives listed on the Intuit website to ensure you are covering all relevant topics.

Take Mock Tests: Use practice exams to identify strengths and weaknesses. Intuit offers practice tests that mimic the actual certification exam.

Use Learning Resources: Take advantage of Intuit’s study guides, webinars, and online courses to prepare.

Join Online Forums: Engage with other QuickBooks users for advice, tips, and shared experiences.

Stay Abreast of Updates: Keep up with new features and updates through Intuit’s newsletters and website.

Plan Your Study Schedule: Set aside regular study time and create a plan to cover all topics before the exam.

When Can You Take the Exam?

Once you feel prepared, you can register for the certification exam, which is administered online. The exam consists of multiple-choice questions; you must score at least 80% to pass. The cost typically ranges from $149 to $449, depending on the certification level.

How Can You Renew Your QuickBooks Certification?

To maintain your QuickBooks certification, follow these steps:

Stay Updated: Regularly complete training on new QuickBooks features and updates to earn Continuing Professional Education (CPE) credits.

Annual Renewal: QuickBooks certifications are valid for one year, after which you must pass the current exam and complete the required CPE credits.

Pursue Advanced Certifications: To demonstrate your expertise, consider pursuing advanced certifications, such as QuickBooks Online Advanced Certification or QuickBooks Enterprise Solutions Certification.

Engage with the QuickBooks Community: Join forums and participate in webinars to stay connected with other professionals and stay informed about trends.

Participate in ProAdvisor Programs: Join the QuickBooks ProAdvisor program to gain additional benefits, such as product discounts and priority support.