Getting Started with Xero UK: Setup, Navigation, & Essential Features

As a UK small business owner, freelancer, accountant, or bookkeeper, you need a reliable and efficient way to manage your finances. Xero is a popular cloud-based accounting software solution that simplifies the accounting process. It offers a range of tools to handle invoicing, bank reconciliation, expense tracking, financial reporting, and more.

As a UK small business owner, freelancer, accountant, or bookkeeper, you need a reliable and efficient way to manage your finances. Xero is a popular cloud-based accounting software solution that simplifies the accounting process. It offers a range of tools to handle invoicing, bank reconciliation, expense tracking, financial reporting, and more.

Xero's intuitive design aims to reduce accounting complexities, even for those with extensive bookkeeping experience. Automating repetitive tasks frees up time for business owners to focus on strategic growth. Additionally, Xero's compliance with UK tax regulations, specifically Making Tax Digital (MTD), ensures businesses stay on the right side of the law.

Accountants and bookkeepers also find Xero beneficial. It offers a streamlined platform for managing multiple clients, providing real-time visibility into their financial data. This allows them to offer timely and accurate financial advice.

Contents

Xero Login UK: Starting Your Journey

Xero Login - Step-by-Step Guide

Navigating the Xero UK Dashboard

Understanding Key Dashboard Features

Customising Your Dashboard:

Xero Pricing UK: Choosing the Right Subscription

Detailed Comparison of Xero UK Plans

How to Select the Best Plan for Your Business

Essential Accounting Features with Xero UK

Creating and Managing Invoices: A Guide for Small Businesses and Accountants

Bank Reconciliation: Connecting and Managing Bank Accounts Efficiently.

Xero Contact Number UK: Getting Support and Assistance

How to access Xero UK Support

Comprehensive Financial Management with Xero Accounting UK

Core Accounting Cornerstones

Advanced Capabilities

Xero's Value for UK Businesses and Accountants

Maximising Business Efficiency with Xero Integrations

How Xero Integrations Enhance Small Business Efficiency

How Xero Integrations Benefit Accountants

Discovering The Right Integrations

Tips for Bookkeepers and Accountants: Streamlining Workflows with Xero

Understanding Xero's Potential for UK Businesses

Xero Login UK: Starting Your Journey

Getting started with Xero in the UK is simple, but it's essential to begin by emphasising the importance of secure login practices to safeguard your business's financial health.

Xero Login - Step-by-Step Guide

Choosing Your Plan:

Begin your journey on the Xero UK website (https://www.xero.com/uk/). Carefully compare the available plans (Starter, Standard, Premium, Ultimate) to find the best fit for your business needs. Consider the number of transactions, your required features, and your budget.

Tip: Xero offers a free trial period, allowing you to explore the software's capabilities before committing to a subscription.

Setting Up Your Account:

Select the "Try Xero for free" option (or similar) and proceed to provide the following information:

Your email address

A strong, unique password

Basic details about your business

Tip: Craft a strong password with a mix of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like birthdays or your business name.

Verifying Your Email:

Xero will send a verification email to the address you provided. Follow the link in the email to confirm your account.

Accessing Your Xero Account

Visit the Xero login page ([invalid URL removed]) and enter your email address and password. You'll then be taken to your Xero dashboard, the central hub for managing your finances.

Secure Login Practices for Financial Management

Protecting your Xero login credentials is paramount for safeguarding your sensitive financial data. Implement these essential practices:

Robust Passwords: Your password is your first line of defense. Make it lengthy and complex, and never reuse passwords across different websites or services.

Multi-Factor Authentication (MFA): Xero offers MFA as an added security layer. Enable it to require an additional verification code (often sent to your mobile device) during login.

Cybersecurity Vigilance: Stay alert to potential phishing attempts or suspicious emails. Exercise caution before clicking links or opening attachments, even if they seemingly appear from Xero.

Password Manager: Consider a password manager tool to generate and store complex passwords for you securely.

Unauthorised access to your Xero account could expose you to financial loss, reputational damage, and even legal repercussions. Prioritising secure login habits is an essential investment in your business's well-being.

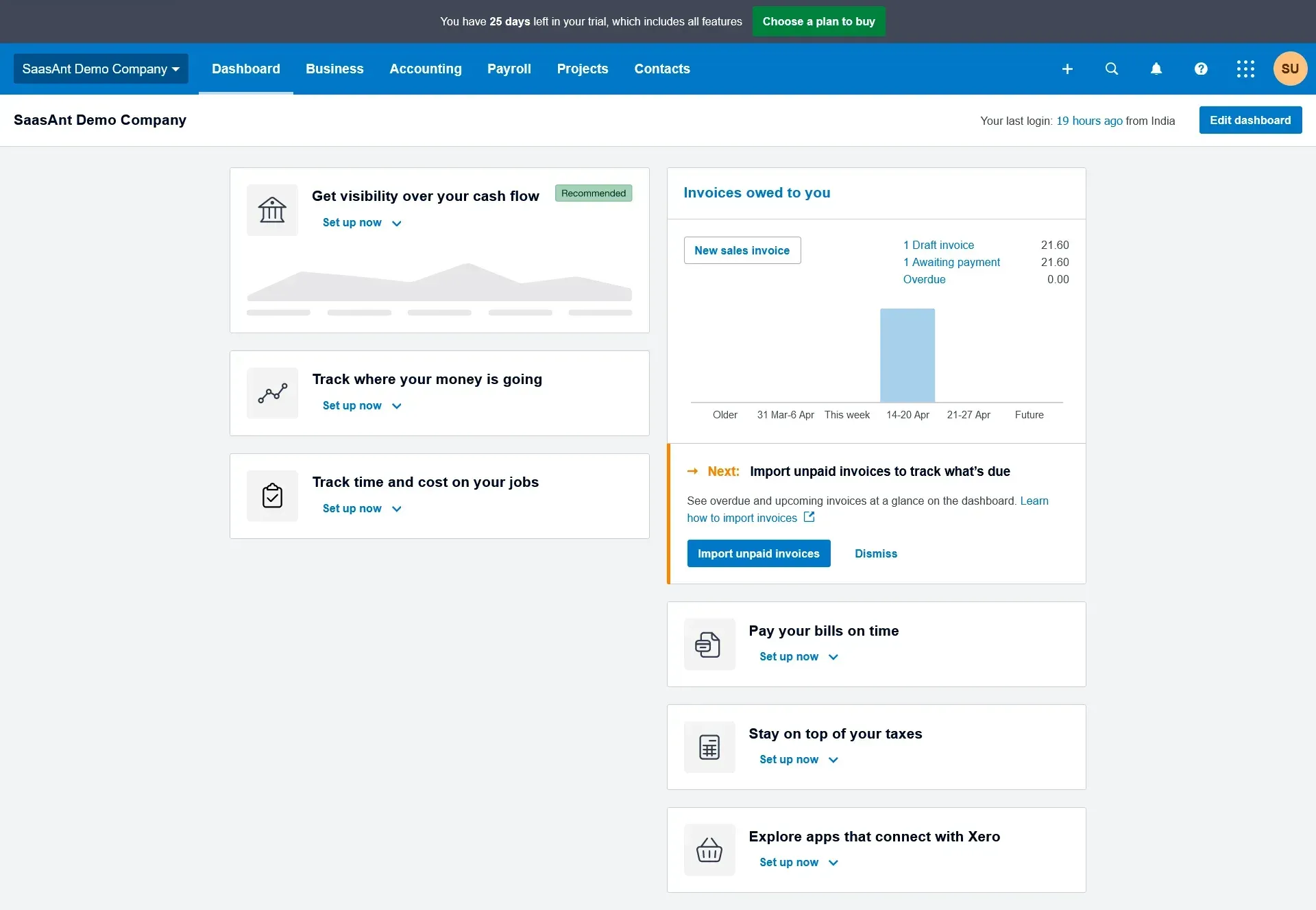

Navigating the Xero UK Dashboard

Xero's dashboard is designed to provide a clear snapshot of your business's financial health. Once you log in, you'll find a well-organized and intuitive interface that places key information at your fingertips.

Understanding Key Dashboard Features

Bank Accounts: Xero lets you link your business accounts to the platform. Your dashboard will display your current balances and a list of recent transactions. This is central to real-time cash flow visibility.

Tip: Xero's bank reconciliation feature is a lifesaver. It intelligently matches your bank statement lines with your Xero transactions, speeding up the reconciliation process.

Invoices: The dashboard provides a clear overview of your invoicing activity. You'll see:

Outstanding Invoices: Quickly monitor what's owed to you, including overdue amounts.

Draft invoices: Keep track of drafts that are ready for sending.

Paid Invoices: View recent payments and historical records.

Tip: Xero's invoice reminders help you get paid faster by automatically sending follow-ups to clients.

Bills to Pay: Similar to the invoices section, this section shows what you owe to suppliers, due dates, and payment records.

Business Snapshot: This customisable area provides critical financial metrics (e.g., profit and loss and cash flow trends). You can tailor it to focus on the insights that matter most to you.

Contacts: Access a quick view of your customers and suppliers.

Other Features: Depending on your Xero plan, the dashboard might display additional widgets for expenses, projects, tax, and more.

Ease of Monitoring Invoices & Bank Transactions

Xero significantly simplifies two core accounting tasks:

Invoice Monitoring: The clear layout allows you to see the status of each invoice at a glance. Filter by status (Draft, Awaiting Approval, Awaiting Payment, Paid) to focus on the necessary actions.

Bank Transaction Monitoring: Monitor your cash flow by instantly viewing up-to-date balances and spotting any unusual activity.

Customising Your Dashboard:

While Xero's default layout is intuitive, you can personalise it to suit your workflow:

Rearrange or remove widgets to prioritise the information most valuable to you.

Add specific widgets to enhance visibility in certain areas.

The Xero dashboard is your financial mission control centre. By understanding its features and customisation options, you'll gain better control over your business finances.

Xero Pricing UK: Choosing the Right Subscription

Xero's UK pricing aims to cater to businesses of varying sizes and complexities. Each subscription tier offers a different set of features and usage limits. Understanding the differences is critical to making an informed decision that supports your business growth.

Detailed Comparison of Xero UK Plans

Generally, Xero provides four main pricing plans in the UK:

Starter: Best for sole traders, new businesses, and those with minimal accounting needs.

Key features: Issue up to 20 invoices and quotes, reconcile bank transactions, capture bills, and submit VAT returns (MTD compliant).

Limitations: No multi-currency support, limited expense claims or project tracking.

Standard: Suitable for growing businesses or those needing more than the basics.

Includes everything in Starter, plus: Unlimited invoices & quotes, capture more bills, and bulk reconciliation.

Limitations: Still needs multi-currency, expense management, and project tracking features.

Premium: Designed for established businesses with more complex needs.

It includes all features from Standard and adds multi-currency support, expense claims management, and project tracking.

Ultimate: Best for larger or rapidly scaling businesses requiring the full range of Xero's functionality plus more advanced features.

It includes everything in Premium and adds Payroll support (for a limited number of employees).

Note: Prices for each plan vary slightly, so it's best to check the latest figures on the Xero UK website (https://www.xero.com/uk/).

How to Select the Best Plan for Your Business

Consider these factors when making your selection:

Transaction Volume: How many monthly invoices and bills do you typically process? Choose a plan that accommodates this volume with some headroom for growth.

Feature Requirements:

Do you need to operate in multiple currencies? (Premium or Ultimate)

Do you regularly manage expenses (employee reimbursements, etc.)? (Premium or Ultimate)

Do you track the profitability of projects? (Premium or Ultimate)

Do you need payroll functionality? (Ultimate – be mindful of employee limits within the plan)

Budget: While finding value within your budget is essential, avoid being too restrictive. Choosing a plan with the right features can boost efficiency and save you money in the long run.

Additional Considerations

Xero Add-ons: Some features (like in-depth Projects or robust Expenses) can be added to lower-tier plans for a monthly fee. Explore these if you need a specific function but don't require a complete plan upgrade.

Free Trial: Xero offers a trial period for all plans. It's a great way to test-drive the features of different tiers before committing.

Feel free to seek advice from a Xero-certified accountant or bookkeeper. They can help you assess your business needs in detail and determine the most cost-effective plan.

Essential Accounting Features with Xero UK

Creating and Managing Invoices: A Guide for Small Businesses and Accountants

Invoice Customization: Xero offers customisable invoice templates. You can include your logo and business details and tailor payment terms to suit your clients or projects.

Automated Invoice Reminders: This feature can significantly improve payment collection. Set up Xero to gently remind clients of overdue invoices, saving you time and awkward conversations.

Online Invoice Payments: Xero integrates with payment providers (e.g., Stripe, GoCardless), allowing customers to pay directly from their invoices. This speeds up the payment process and improves cash flow.

Recurring Invoices: Ideal for regular clients or subscription-based services. Create recurring invoice templates, automating the billing process.

Reporting: Generate detailed invoice reports to track income, understand payment trends, and identify outstanding issues.

Benefits for Small Businesses: Streamline invoicing, get paid faster, and maintain better cash flow visibility.

Benefits for Accountants: Easily collaborate with clients, simplify recurring invoicing tasks, and gain insights into client payment patterns.

Bank Reconciliation: Connecting and Managing Bank Accounts Efficiently.

Secure Bank Connections: Xero links to most major UK banks and financial institutions, enabling the automatic import of bank statement data.

Intelligent Matching: Xero's robust matching algorithm suggests how imported bank transactions align with existing Xero records (invoices, bills, etc.). This significantly speeds up reconciliation.

Reconciliation Rules: Streamline repetitive matching. Create rules to automatically categorise recurring transactions (e.g., monthly subscriptions to be matched to a specific expense account).

Real-time Financial View: With regular reconciliation, your Xero dashboard provides an accurate, up-to-date picture of your cash flow.

"Bank Explained" Transactions: Xero can categorise even unmatched transactions, helping you identify potential expenses or sources of income for further review.

Benefits for Small Businesses: Reduce bookkeeping time, catch errors early, and enjoy a real-time understanding of your cash position. Benefits for Accountants: Increased efficiency in bookkeeping tasks, easier identification of potential discrepancies, and timely financial advice for clients.

Additional Tips

Mobile App: Xero's app lets you create invoices, reconcile transactions, and monitor your finances on the go.

Xero Support: Access comprehensive guides and tutorials on using these features effectively.

Xero aims to revolutionise traditionally tedious accounting tasks. Its powerful invoice management and bank reconciliation tools allow small business owners and accountants to save time, improve accuracy, and unlock valuable financial insights.

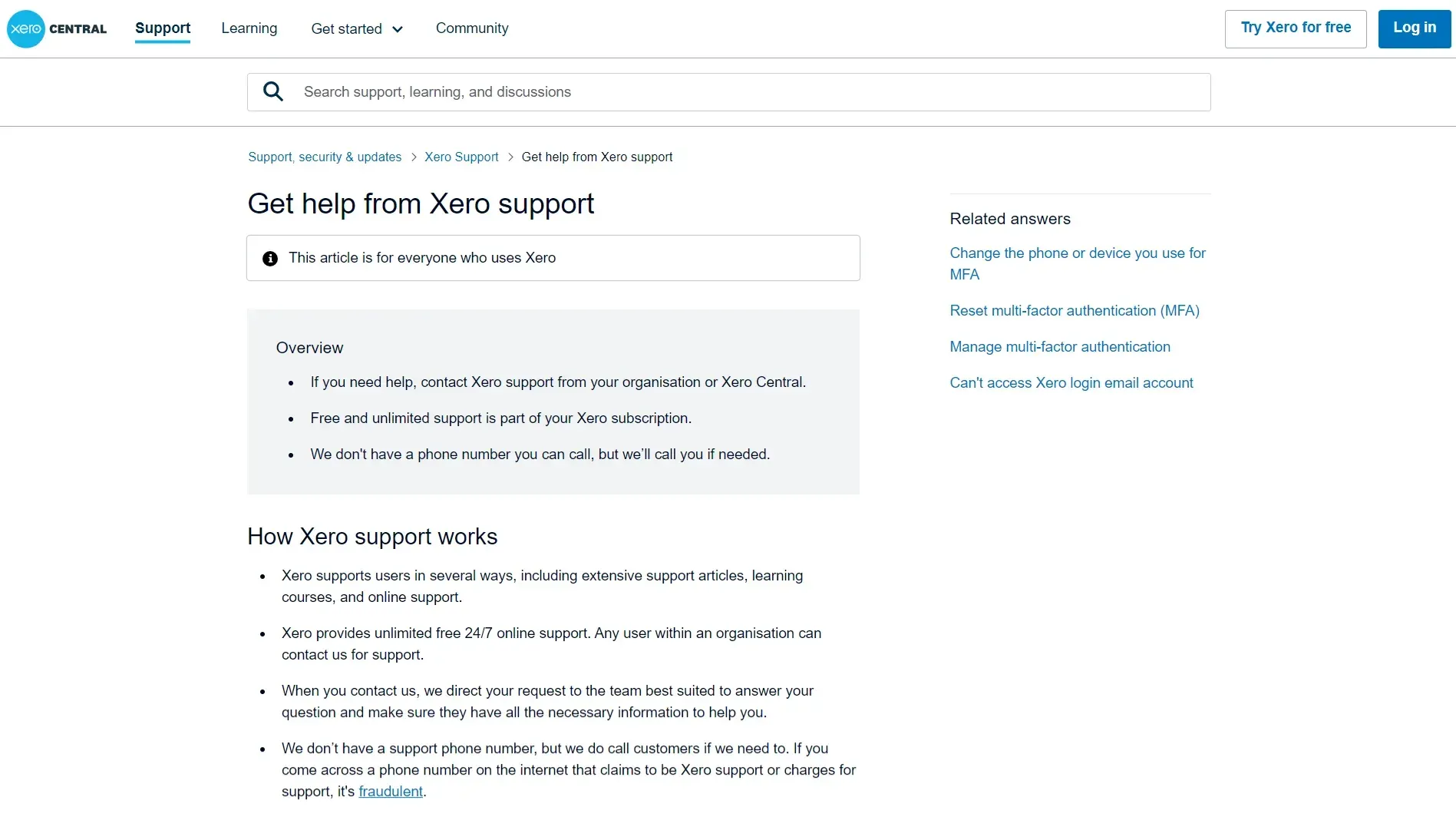

Xero Contact Number UK: Getting Support and Assistance

Xero's approach to customer support prioritises online resources and a callback system rather than a traditional inbound phone helpline. This model offers advantages for both users and the Xero support team.

How to access Xero UK Support

Xero Central: This is your first stop for support. Xero Central (https://central.xero.com/s/) is their extensive online help centre. Here's what you'll find:

Searchable knowledge base of articles, guides, and tutorials

Community forums where you can ask questions and get help from other Xero users and experts

Option to submit an online support request to get a callback from the Xero team

In-App Support: Xero includes a prominent '?' help icon within the software. This provides contextual help and links to relevant support resources.

Xero Callback Request: If you can't resolve the issue through Xero Central, you can request a callback from their support team. Provide your details and outline the issue you need help with. Xero aims to respond quickly to these requests.

When To Use Xero's UK Support Services

Technical Issues: If you encounter a software error, bug, or something that isn't working as expected, contact Xero Support for assistance.

Complex Queries: A callback provides tailored assistance if an issue requires an in-depth explanation or personalised guidance beyond what's available in Xero Central.

Urgent Matters: While there isn't a direct emergency phone line, using the callback system ensures your request is prioritised.

Benefits of Xero's Support Model

24/7 Availability: Xero Central provides an extensive database of resources you can access anytime, anywhere.

Efficient Resolution: By providing context about your issue upfront, the Xero support team can often resolve it faster when they call you back.

Scalability: This system allows Xero to support a large user base effectively.

Additional Tips

Before Seeking Support: Always try searching Xero Central first, as many joint issues may have readily available solutions.

Accountants & Bookkeepers: Xero has dedicated resources to serve accountants and bookkeepers. Check their partner-specific support channels.

Comprehensive Financial Management with Xero Accounting UK

Xero's suite of features goes beyond core accounting to facilitate a comprehensive financial management approach. It also ensures compliance with the UK's tax regulations and business practices.

Core Accounting Cornerstones

Invoicing & Accounts Receivable: Xero streamlines the invoicing process by creating customised templates, setting up online payments, automating reminders, and tracking what's due for improved cash flow.

Expense Management & Accounts Payable: Digitize bills and receipts, categorise expenses accurately, and monitor supplier payments.

Bank Reconciliation: Securely connect bank accounts to Xero for simplified bank statement reconciliation, using intelligent matching tools and custom rules to reduce manual work.

Financial Reporting: Xero generates crucial financial reports (e.g., profit and loss, balance sheet, cash flow statements) to provide insights into business performance.

Tax Compliance (VAT & MTD): Xero's built-in MTD features ensure compliance, simplifying VAT calculation and submission directly to HMRC.

Advanced Capabilities

Payroll Management: Xero's 'Ultimate' plan includes built-in payroll functionality (with limits on the number of employees). This allows businesses to manage payroll within Xero: calculate wages and taxes, generate payslips, and submit payroll data to HMRC.

Project Tracking: Monitor the profitability of individual projects, tracking time and expenses against income. It is ideal for service-based businesses or those managing client-specific work.

Multi-Currency Support: Operate seamlessly with international clients and suppliers. Xero manages multiple currencies with real-time exchange rate updates.

Expense Claims: Employees can easily submit expense claims with supporting documentation, which can then be categorised, approved, and reimbursed through Xero.

Advanced Reporting: Go beyond standard financial statements with customisable 'packs' designed to give in-depth financial analysis with visual charts and graphs.

Xero's Value for UK Businesses and Accountants

Centralised Platform: Xero is a single source of truth for your entire financial picture, replacing the disjointed use of spreadsheets and disparate software.

Automation: Reduction in manual tasks frees up time and reduces errors, allowing businesses to focus on growth.

Real-time Insights: Up-to-date financial data leads to informed decision-making.

Collaboration: Accountants and bookkeepers can serve clients more efficiently, accessing their data remotely and providing real-time advice.

Ecosystem of Integrations: Xero seamlessly connects with other essential business tools (e.g., payment gateways, CRM systems, sales platforms), optimising workflows.

Maximising Business Efficiency with Xero Integrations

One of Xero's greatest strengths is its open API, which enables it to connect to a vast ecosystem of third-party applications. These integrations create potent synergies, extending Xero's core accounting features to streamline various aspects of business operations.

How Xero Integrations Enhance Small Business Efficiency

Streamlined Sales & Payments:

Improved Expense Management:

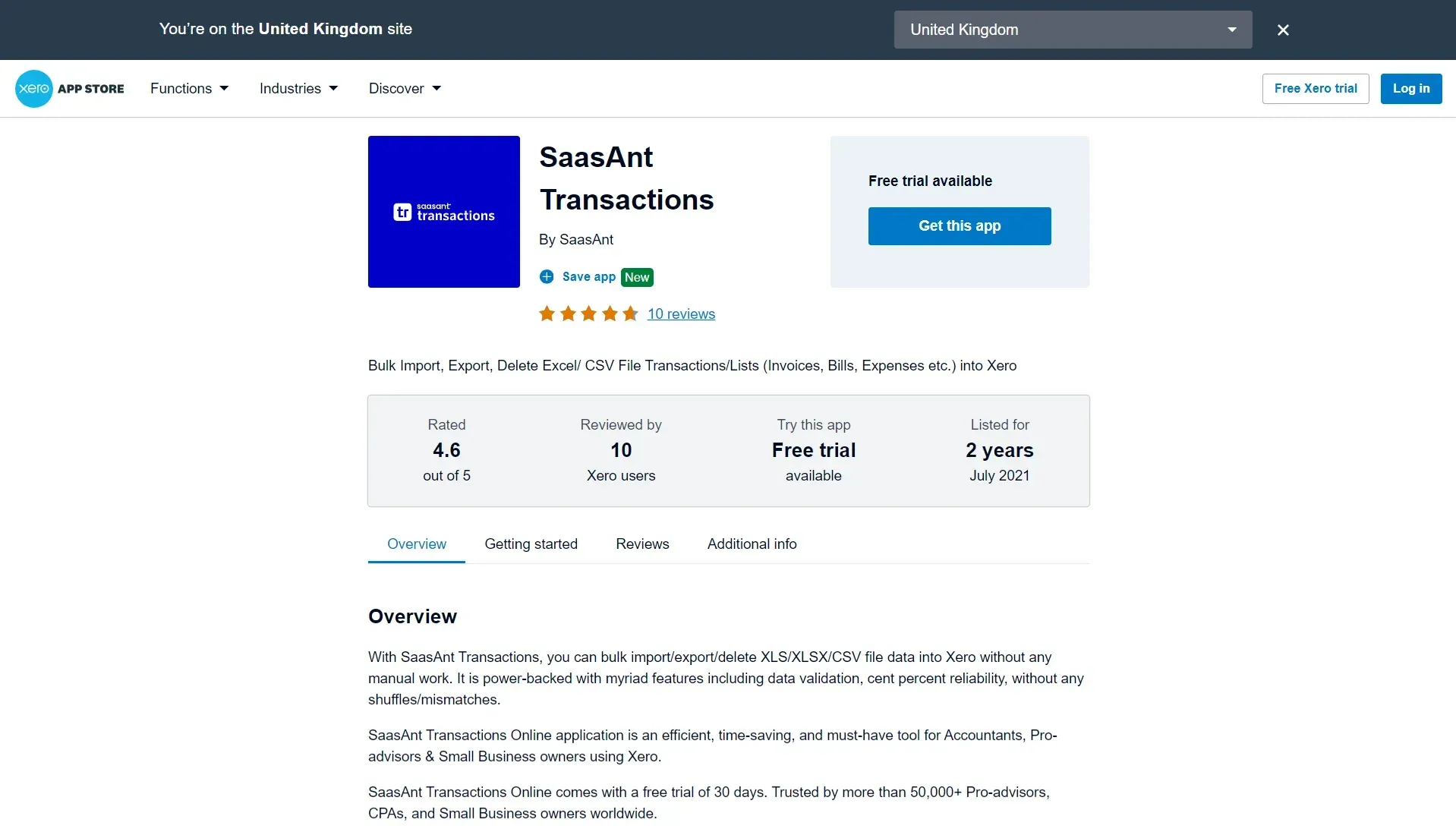

Connect with automation apps (e.g., Saasant Transactions) to import invoices and bills, and automatically pull the data into Xero.

Enhanced Customer Relationship Management (CRM): Connect with CRMs (e.g., Salesforce, HubSpot) to create a single, centralised view of customer interactions, sales, and financial data.

Project Management Simplification: Integrate with project management tools (e.g., Asana, Trello) to track project time, expenses, and profitability directly within Xero.

Streamlined Inventory Management: Connect to inventory management solutions to automatically adjust stock levels and update accounting records based on sales and purchases.

How Xero Integrations Benefit Accountants

Reduced Manual Data Entry: Integrations with clients' other systems minimise manual data entry tasks for accountants, improving accuracy and saving time.

Centralised Client Data: A single dashboard for all client financial data, regardless of the other systems they use, enhances efficiency and simplifies reporting.

Real-Time Advisory Services: Up-to-date financial data flowing through integrations enables accountants to provide proactive and timely advice to clients.

Practice Management Tools: Integrate with practice management software designed for accountants to track time, manage workflows, and automate client communications.

Discovering The Right Integrations

The Xero App Store ([invalid URL removed]) is your gateway to exploring this extensive ecosystem. Here's how to find the best integrations for your needs:

Identify Pain Points: What tasks are manual, repetitive, or time-consuming in your current workflow?

Search the Xero App Store: Filter by categories (e.g., CRM, Payments, Inventory) or search using relevant keywords.

Read Reviews & Ratings: Look at what other users say to understand the app's reliability and support.

Demos and Trials: Many apps offer demos or free trials so you can experience them before committing.

Tips for Bookkeepers and Accountants: Streamlining Workflows with Xero

Onboarding & Setup

Standardised Setup Processes: Develop onboarding checklists and procedures for clients that ensure Xero is configured to meet their unique business and tax requirements.

Custom Chart of Accounts: Create tailored charts of accounts that align with different industries or client needs, streamlining future bookkeeping.

Automation Rules: Preset customised bank reconciliation rules for recurring transactions, saving time on repetitive tasks.

Streamlining Client Work and Collaboration

Xero HQ & Client Access: Utilize Xero HQ to manage multiple client accounts from a single dashboard. Grant clients appropriate levels of access to Xero for better visibility and input.

Real-time Collaboration: Embrace Xero's cloud-based nature to work on clients' books simultaneously, enabling efficient communication and progress updates.

"Ask" Function: Use the "Ask" feature within Xero to ask clients clarifying questions about specific transactions quickly or to request missing documentation.

Efficiency & Productivity

Bulk Actions: Use bulk reconciliation to process similar bank transactions quickly. Process multiple invoices and bills simultaneously when appropriate.

Memorised Reports: Save sets of frequently used financial reports with predefined date ranges and filters for 1-click generation.

Shortcuts: Familiarize yourself with Xero's keyboard shortcuts (easily accessible within Xero) to speed up navigation and everyday tasks.

Xero Mobile App: Utilize the app for quick reconciliations, approvals, and client communication on the go

Proactive Advisory Services

Budgets: Use Xero's budgeting tool to help clients set forecasts and track progress against financial goals.

Financial Insights: Leverage Xero's visual dashboards and reporting tools to proactively identify trends and potential issues, providing valuable advice to clients.

Add-on Features: Explore Xero's add-ons, such as in-depth project tracking or advanced analytics, to tailor advisory services to specific client needs.

Additional Best Practices

Xero Certification: Become a Xero-certified advisor to demonstrate your expertise and attract new clients.

Xero Community: Stay updated on the latest features and engage with other accountants and bookkeepers on the Xero community forums.

Ongoing Training: Xero regularly releases new features and updates. Invest in continued training for yourself and any team members to maximise the platform's value.

By adopting these best practices, you empower yourself to deliver exceptional service to clients while simplifying your workflows, boosting productivity, and enhancing your bottom line.

Understanding Xero's Potential for UK Businesses

Xero provides UK businesses with comprehensive tools to streamline their financial management. Its key advantages lie in automation, insights, and adaptability.

Here's a summary of the potential benefits:

Time Savings: Automated features like bank reconciliation, invoice reminders, and reporting reduce the burden of manual bookkeeping.

Data-Driven Insights: Up-to-date financial dashboards and reporting capabilities empower businesses to understand their cash flow, profitability, and overall economic health.

Tax Compliance Xero's integration with HMRC and MTD features simplifies tax management and adherence to UK regulations.

Customizability: Xero's subscription plans and add-on options allow businesses to tailor the software to their specific scale and accounting needs.

Xero is worth careful consideration if you're a UK business owner, freelancer, accountant, or bookkeeper looking to improve your financial management processes. Its features have the potential to modernise and optimise your accounting workflows.