Government Grants for Small Businesses

Small businesses are the backbone of any economy, as they provide employment opportunities, promote innovation and entrepreneurship, and drive economic growth. However, starting and running a small business can be challenging, especially for those who lack access to sufficient capital. That’s where government grants come in.

In this article, we’ll explore the different government grants available for small businesses, who are eligible for these grants, and how to apply for those grants.

Contents

What Are Government Grants for Small Businesses?

What Are the Best Sources for Finding Government Grants?

How Do Government Grants Benefit Women Entrepreneurs?

How Do Government Grants Benefit Special Needs Entrepreneurs?

How Do Government Grants Benefit LGBTQ+ Entrepreneurs?

How to Apply for and Win a Government Grant?

What Are Government Grants for Small Businesses?

Government grants are financial awards given by the government to eligible recipients to fund specific projects or initiatives. Unlike loans, grants do not have to be repaid, making them an attractive option for small businesses that need funding but may need more resources to take on debt. Always remember that the grants are free only if you use them appropriately.

Government grants can be used for various purposes, including research and development, hiring and training employees, expanding operations, and purchasing equipment. There are different types of government grants available for small businesses, such as;

Federal Grants

The federal government provides grants to small businesses that meet specific eligibility criteria. These grants can be used for various purposes, including research and development, technology development, and exporting.

State Grants

Grants provided by individual states to small businesses that fulfill specific norms. These state grants can be utilized for job creation, infrastructure development, and business expansion.

Local Grants

Grants provided by local governments, such as city or country governments, to small businesses that satisfy certain conventions. These grants can be used for multiple purposes, including employment stimulation, architecture development, and business growth.

Note:

You can refer to the below link for more information about the eligibility criteria of various grants; https://www.grants.gov/learn-grants/grant-eligibility.html

What Are the Best Sources for Finding Government Grants?

If you are a small business owner looking for funding, you may wonder where to find government grants to develop your business performance. Let’s explore some of the best resources for finding government grants.

Grants.gov

Grants.gov is the leading website for finding and applying for federal government grants. This site allows you to search for grants based on various criteria, including the type of grant, the agency offering the grant, and the eligibility requirements. Once you find a grant that fits your needs, you can apply directly through this site.

Small Business Administration (SBA) Grants

The SBA offers various grants to small businesses operating in specific industries or regions. Some of the available grants include:

Small Business Innovation Research (SBIR) Grant

Small Business Technology Transfer (STTR) Grant

Small Business Development Centers (SBDC) Grant

Support of Competitive Research (SCORE) Grant

Veteran Business Outreach Center (VBOC) Grant

Small Business Innovation Research (SBIR) And Small Business Technology Transfer (STTR) Programs

The SBIR and STTR programs are federal government grants for small businesses engaged in research and development (R&D) activities. The SBIR program provides funding to small businesses to conduct R&D that has the potential for commercialization.

The STTR program fosters collaboration between small businesses and non-profit research institutions. These grants are awarded by 12 federal agencies, including the National Science Foundation, the Department of Defense, and the National Institutes of Health.

Eligible small businesses can apply for Phase I, II, and III grants, with each phase focusing on different aspects of R&D, from proof-of-concept to commercialization. On average, the SBA provided grants of up to $250,000 to small businesses that have received Phase I SBIR/STTR awards and have developed promising technologies or products.

To know more about SBIR and STTR programs, check SBIR portal

Small Business Development Centers (SBDC) Grant

SBA provides funding to SBDCs, which offer free business counseling and support services to small businesses within their local communities. These SBDCs are partnerships between the government and local universities, colleges, and economic development organizations.

They offer counseling, training, and technical assistance to small businesses to help them start, grow, and succeed. The grant is intended to support the development and growth of small businesses in underserved areas, including rural areas, women-owned firms, and minority-owned businesses.

You can find your nearby SBDC through the below link:

https://www.sba.gov/local-assistance/find?type=Small%20Business%20Development%20Center&pageNumber=1

Support of Competitive Research (SCORE) Grant

A federal grant provided by the Service Corps of Retired Executives (SCORE), a nonprofit organization involved in mentoring and coaching small business owners across the United States. SCORE comprises over 10,000 volunteers who are retired business executives, and entrepreneurs. They use their experience and expertise to help small businesses evolve.

The sole motto of the SCORE grants is to offer their services to small businesses free of cost, and it’s intended to support the development and growth of small businesses in deprived areas.

Veteran Business Outreach Center (VBOC) Grant

Federal grant provided to Veteran Business Outreach Centers (VBOCs) across the US. These centers offer counseling, and technical assistance to the veteran-owned businesses and assist them in all forms of business development.

Economic Development Administration (EDA) Grants

The EDA grant program provides funding to support economic development projects that create jobs and promote growth in communities. The program provides grants to businesses, nonprofits, and government agencies that are working to strengthen their local economies.

EDA grants can be used for a wide range of economic development activities, including infrastructure development, workforce development, and entrepreneurship support. The grants help communities create a favorable environment that stimulates economic growth.

Community Development Block Grants (CDBG)

CDBG is a form of federal assistance provided by the US Department of Housing and Urban Development (HUD) to support the development of communities nationwide. The CDBG program was established in 1974 to issue federal funding to support community development projects across the United States.

The program provides grants to state and local governments and non-profit organizations to support projects that meet the needs of low and moderate-income individuals and families. CDBG grants can be used for a wide range of activities, including

Housing development and rehabilitation

Economic development

Infrastructure improvements

Public facilities and services

Planning and Administration

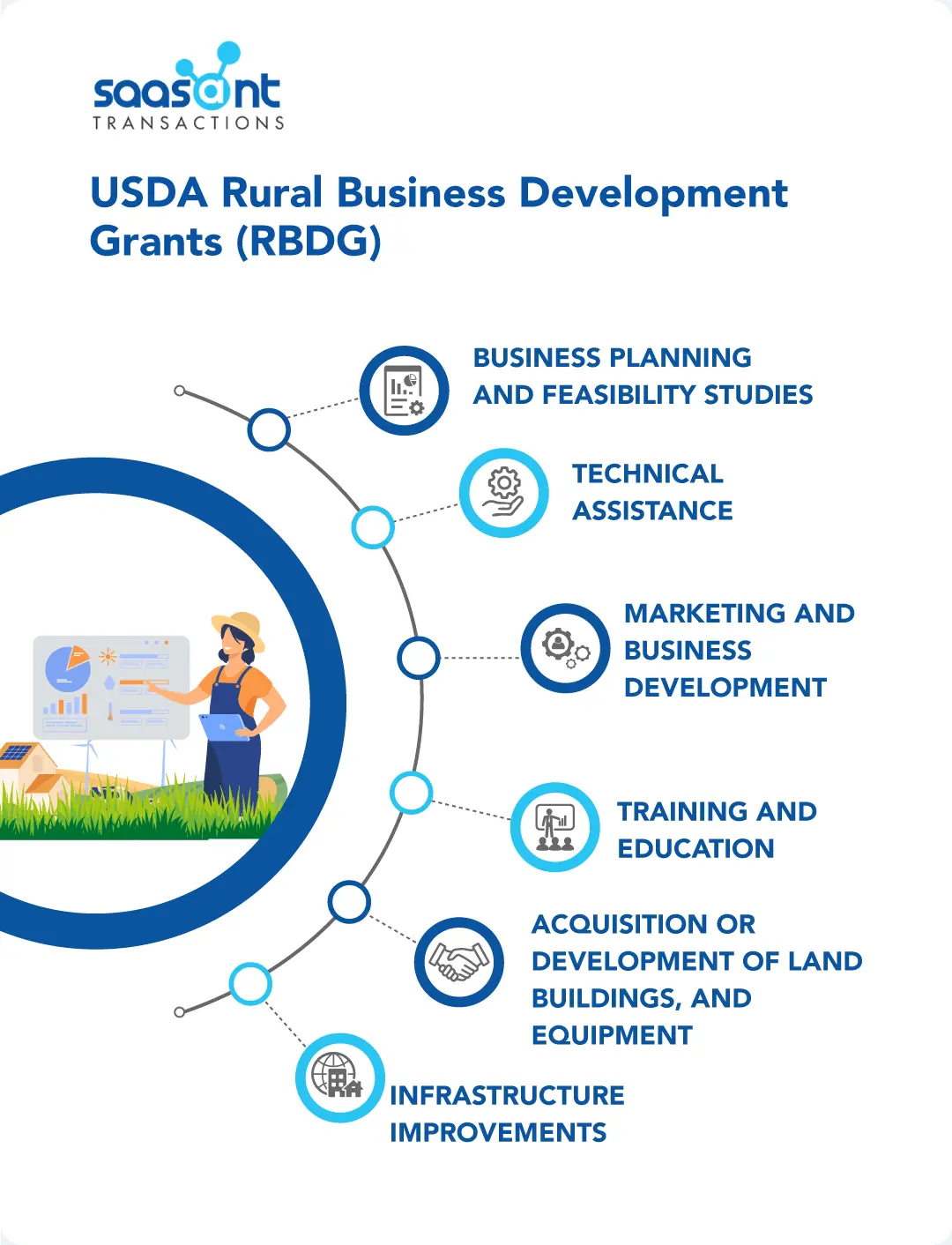

USDA Rural Business Development Grants (RBDG)

Rural Business Development Grants (RBDG) program by The United States Department of Agriculture is designed to provide financial assistance to rural communities to support economic development and employment creation. The program offers grants to rural small businesses, agricultural producers, and rural communities to help them develop, expand, or improve their businesses.

The program provides grants of up to $500,000 to eligible applicants. The grants can be used for a variety of activities, including:

Business planning and feasibility studies

Technical assistance

Marketing and business development

Training and Education

Acquisition or development of land, buildings, and equipment

Infrastructure improvements

National Institutes of Health (NH)

The National Institutes of Health is a government agency that supports medical research and innovation. The NH offers several grant programs designed to support small businesses engaged in biomedical research and development, including Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs.

Minority Business Development Agency (MBDA) Grants

The Minority Business Development Agency (MBDA) Grants program was developed to address the funding and resource availability issues faced by minority-owned small businesses. MBDA is an agency of the United States Department of Commerce dedicated to promoting the minority-owned businesses' growth and competitiveness.

The MBDA Grants program provides financial assistance to eligible minority-owned businesses to help them grow and expand. It also offers a range of services to help minority-owned businesses succeed, including business development, assistance, access to capital markets, advocacy, and policy support. There are two types of MBDA grants available, and they are:

Business Development Grants

Innovative Grants

Business Development Grants

These grants provide funding for activities that will help a business grow and become more competitive. Examples of eligible activities include marketing and advertising, market research, management, and technical assistance.

Innovative Grants

These grants provide funding for activities that will help a business develop and commercialize innovative technologies or products. Examples of eligible activities include product development, prototyping, and testing.

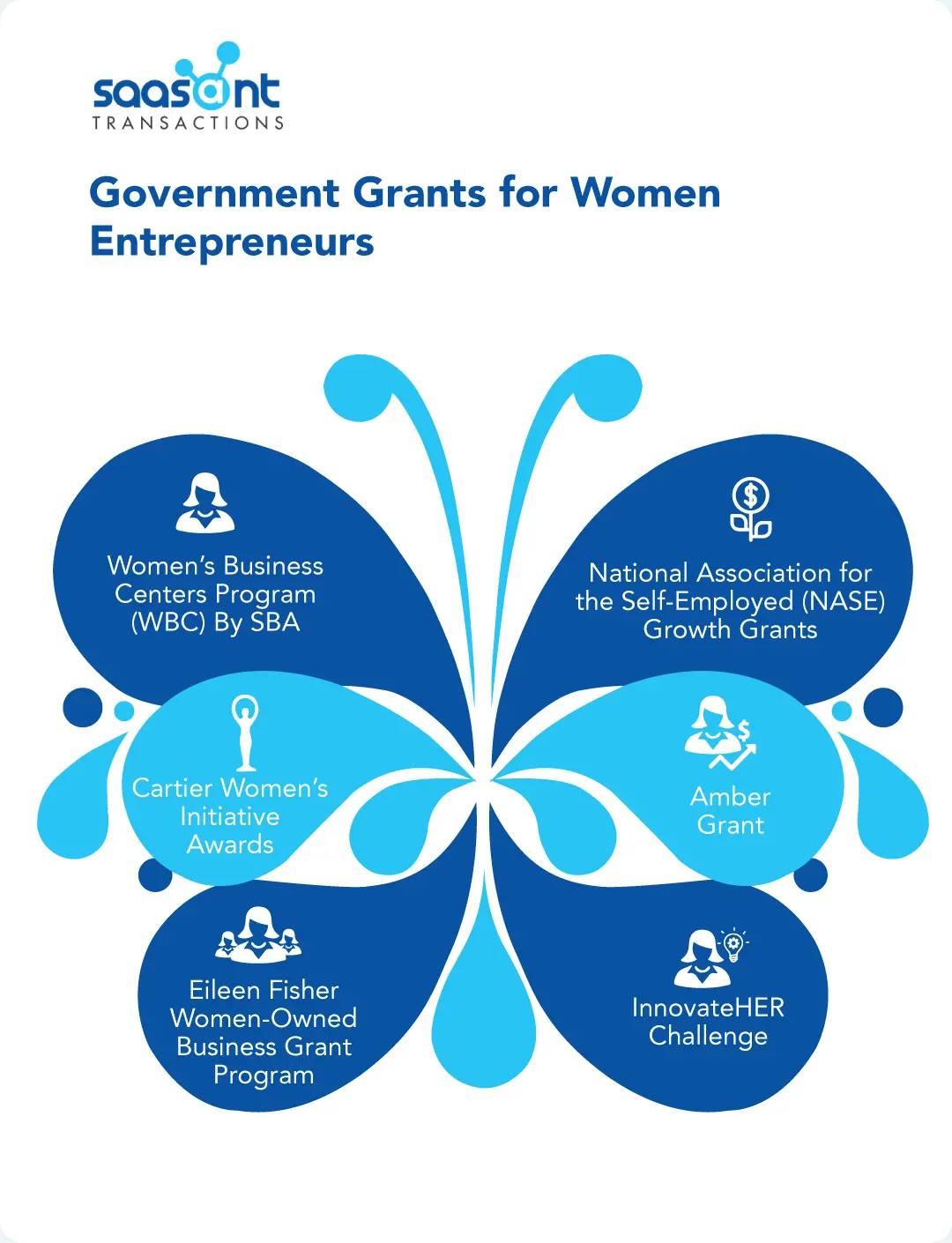

How Do Government Grants Benefit Women Entrepreneurs?

Women entrepreneurs are an integral part of the US economy, and the government provides various grants to help them start, grow, and prosper. Here are some of the Women’s Business Development grants available.

Women’s Business Centers Program (WBC) By SBA

This program provides counseling, training, and technical assistance to women-owned businesses. This program also offers access to funding opportunities and other resources to help women entrepreneurs succeed in their business endeavors.

National Association for the Self-Employed (NASE) Growth Grants

These grants provide funding to NASE members to help them expand their businesses. These grants can be used for advertising, purchasing equipment, hiring employees, or other expenses related to business growth.

Cartier Women’s Initiative Awards

This award provides funding and support to women entrepreneurs in the early stages of their businesses. The program also offers mentoring and networking opportunities to women entrepreneurs.

Amber Grant

This grant provides funding to women-owned businesses every month. The grant program awards a $10,000 grant to one women-owned business each month.

Eileen Fisher Women-Owned Business Grant Program

This program provides funding and support to women-owned businesses committed to environmental and social change. The program annually offers up to $100,000 in grants to women-owned businesses.

InnovateHER Challenge

This challenge is a national competition that funds women-owned businesses working to solve pressing social and economic issues. The Small Business Administration hosts the challenge, and the winners can receive up to $40,000 in funding to support their businesses.

How Do Government Grants Benefit Special Needs Entrepreneurs?

As a special needs entrepreneur, securing funding for your small business can be challenging. Fortunately, the US government offers grants and programs to support small businesses owned by special needs individuals. These grants can help you start, grow, and sustain your business, so you can focus on achieving your entrepreneurial dreams.

One of the primary sources of government grants for small business owners with physical disabilities is the Small Business Administration (SBA). The SBA offers loan programs and resources to help small businesses thrive. One of these programs is the 8(a) Business Development program, which supports small businesses owned by socially and economically disadvantaged individuals, including the special needs.

To be eligible for the 8(a) program, your business must be at least 51% owned and controlled by socially and economically disadvantaged individuals. You must also meet the SBA’s size standards for small businesses and demonstrate a potential for success.

Depart of Labor (DOL)

The DOL offers grant programs to support employment opportunities for people with disabilities, including those who want to start their own businesses. This Disability Employment Initiative provides funding to state and local governments to help people with disabilities find and retain employment, including self-employment opportunities.

National Institute on Disability, Independent Living, and Rehabilitation Research (NIDILRR)

NIDILRR is another source of government grants for special needs small business owners. NIDILRR offers grants to support research, development, and dissemination of knowledge to improve the lives of people with disabilities. These grants can help you develop and market products and services that address the unique needs of disabled individuals.

Veterans Affairs (VA)

VA offers several programs to assist disabled veterans in starting and growing their own businesses. These programs provide training, counseling, and financial assistance to help veterans become successful entrepreneurs.

How Do Government Grants Benefit LGBTQ+ Entrepreneurs?

Over the years, the US government has recognized the importance of supporting LGBTQ entrepreneurs, and several grant programs have been launched to help them grow and expand their businesses. Let’s explore the various government grants available to LGBTQ small business owners.

Small Business Administration (SBA) Grants

SBA supports small businesses nationwide, and the agency offers several grant programs to small businesses owned by the LGBTQ community. The SBA also provides resources and networking opportunities for LGBTQ small business owners through its LGBTQ Business Center.

This center provides assistance with financing, counseling, and training, as well as opportunities to connect with other LGBTQ business owners and potential investors.

State and Local Grants

Several states and local governments across the US have launched grant programs specifically for LGBTQ-owned small businesses. For example, the New York State Empire State Development Program through its Minority and Women-owned Business Enterprise (MWBE) program. Similarly, the city of Los Angeles has launched a Small Business Emergency Microloan Program for LGBTQ-owned businesses.

Non-government Grants

In addition to government grants, several non-governmental organizations offer grant programs for LGBTQ small business owners. For example, the National LGBTQ Chamber of Commerce (NGLCC) offers the LGBT Business Enterprise (LGBTBE) certification, which makes businesses eligible for a range of corporate and government contracting opportunities.

The organization also offers scholarships and grants to LGBTQ business owners through its National Business Inclusion Consortium (NBIC) program.

How to Apply for and Win a Government Grant?

Government grants can be a valuable source of funding for businesses, non-profits, and individuals. Winning a grant can support various projects, ranging from research and development to community programs and business expansion

However, applying for and winning government grants can be competitive, and knowing where to start can be challenging. Here are some tips to help you apply for and win government grants.

Identify the Right Grant Program

The first step in applying for a government grant is identifying the appropriate program for your project or business. Perform meticulous research on various grant programs offered by federal, state, and local government agencies and private foundations and non-profits. Read the eligibility requirements and guidelines precisely to determine if your project or business is a good fit for the grant program.

Create a Strong Proposal

Once you have identified the right grant program, it’s time to create a solid proposal. The proposal should clearly and concisely outline your project or business, the goals of the project, the expected outcomes, and how the grant funds will be utilized. Make sure to follow the grant program’s guidelines for proposal format, content, and submission requirements.

Gather the Necessary Information and Documents

Before you start the application process, gather all the necessary information and documents. This can include financial statements, tax returns, resumes, letters of support, and other supporting documents.

Follow the Application Process Carefully

The application process for government grants can be complex, and following the guidelines is essential. Read the instructions and requirements carefully, and provide all the necessary information and documents. Pay attention to deadlines, as applications must be considered on time.

Address the Evaluation Criteria

Grant applications are evaluated based on specific criteria, such as the project's feasibility and impact, the applicant's qualification and experience, and the potential for success. Ensure to address each evaluation criterion in your proposal and provide evidence to support your claims.

Seek Feedback and Revise Your Proposal

If your application isn't considered, don't give up. Seek feedback from the grant program administrators and revise your proposal based on the feedback received. Please take the opportunity to improve your submission and make it stronger for future grant applications.

In conclusion, government grants can be an excellent resource for small businesses in the US looking to grow, expand, or weather a challenging economic climate. Various federal, state, and local grant programs are available, each with significant eligibility criteria, application requirements, and award amounts.

Small business owners should research and carefully evaluate which grant programs align with their business goals and needs. They should also ensure they meet all eligibility criteria and have a well-crafted as well as compelling application highlighting their business's strengths and potential impact on the community.

While government grants can be highly competitive, they can substantially boost a small business's growth trajectory and offer vital financial support. Small business owners are encouraged to explore all their options and leverage available resources to help their businesses succeed.