Guide to Choosing the Right QuickBooks Add-Ons for Your Business

QuickBooks has emerged as a trusted ally for small businesses. This robust accounting software has revolutionized how companies manage their finances, track sales, and organize their day-to-day operations. With the integration of add-ons, companies can unlock a new level of customization and functionality. These add-ons, essentially software extensions, seamlessly integrate with QuickBooks to provide specialized features for your business.

Contents

Understanding Your Business Needs

Factors to Consider When Choosing QuickBooks Add-Ons

Compatibility

Ease of Use

Cost-effectiveness

Customer Support and Reviews

Scalability

Choosing the Right QuickBooks Add-Ons for Different Business Functions

Accounting and Finance Add-Ons for QuickBooks

SaasAnt Transactions

Bill.com

Avalara AvaTax

Sales and Customer Management Add-Ons for QuickBooks

Pipeline CRM

Insightly CRM

HubSpot CRM

Inventory Management Add-Ons for QuickBooks

SkuVault

Cin7

Fishbowl Inventory

Payroll and Employees Add-Ons for QuickBooks

Rippling

Reporting and Analytics Add-Ons for QuickBooks

QCommission

Understanding Your Business Needs

Enhancing your QuickBooks experience begins with a comprehensive understanding of your business needs. This step is not merely about identifying areas of your business that need improvement; it's about delving deeper into the operational intricacies of your organization and pinpointing the specific challenges you face.

Each business is a unique entity characterized by its processes, goals, and challenges. For instance, a retail business might grapple with inventory management, needing a solution that offers real-time tracking and automated reordering. On the other hand, a service-based business might require a more sophisticated customer relationship management system to track interactions and improve customer service.

Understanding your business needs takes time and effort. It requires you to stay attuned to the changing dynamics of your business environment. Regularly reassessing your needs ensures you continue leveraging your QuickBooks add-ons.

This understanding extends beyond the operational aspects of your business. It's also about recognizing your financial capacity, technical prowess, and team readiness to adapt to new tools. A high-powered add-on might seem attractive, but there may be better choices if it's within your budget or too complex for your team to use.

Understanding your business needs is about gaining a holistic view of your organization. It's about identifying the gaps in your current processes and finding the QuickBooks add-ons to fill them effectively and efficiently. Doing so can ensure that your add-ons enhance your business operations and contribute to your overall business success.

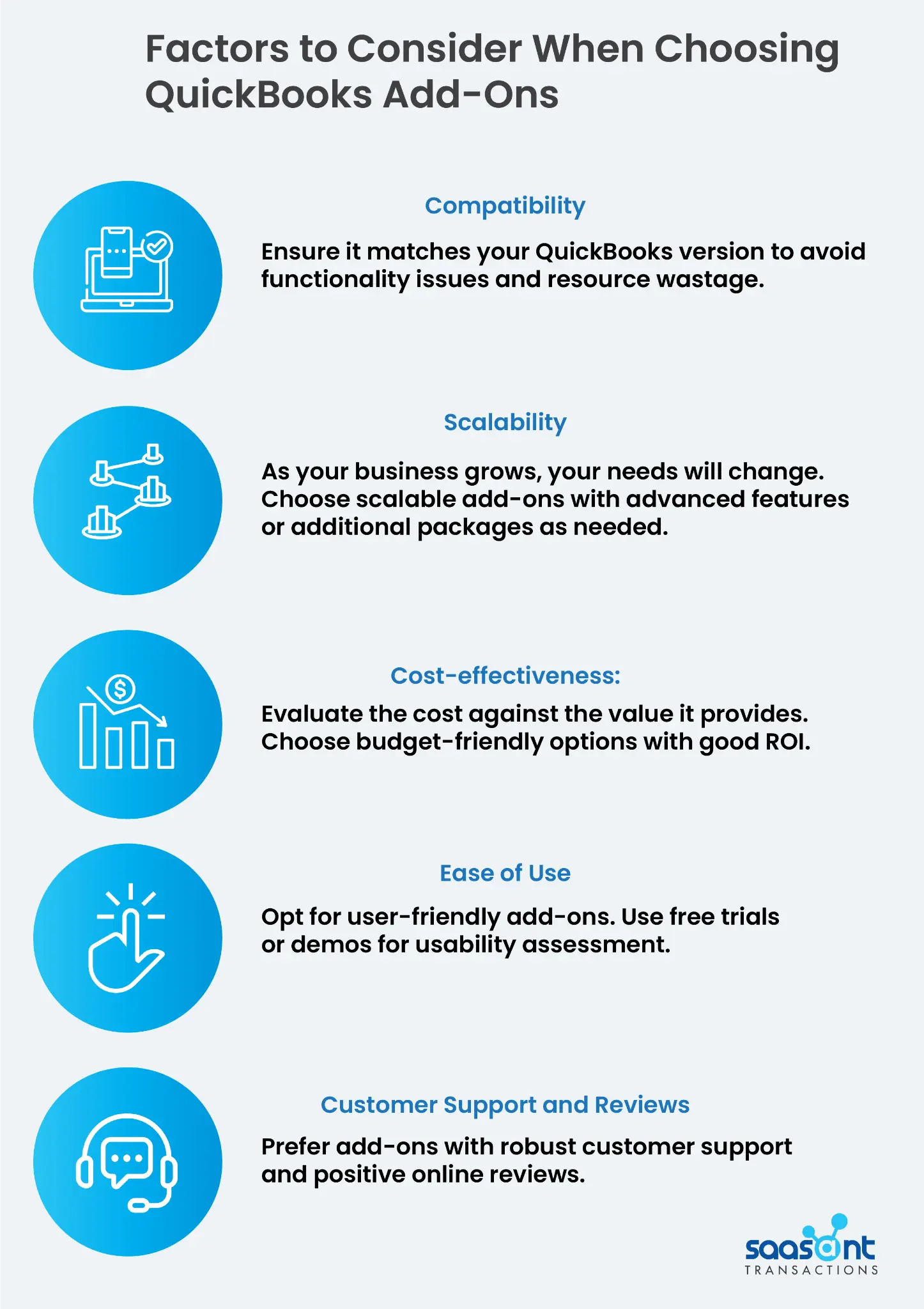

Factors to Consider When Choosing QuickBooks Add-Ons

Choosing the right QuickBooks add-ons involves more than just identifying your needs and picking a tool that addresses them. It requires a holistic approach considering compatibility, ease of use, cost-effectiveness, customer support, and scalability. Let's explore the key factors you should consider.

Compatibility

Imagine you're running a retail business using QuickBooks Online Plus. You decide to enhance your inventory management and choose an add-on that promises advanced features. However, after purchasing, you realize the add-on is only compatible with QuickBooks Desktop Enterprise, not your Online Plus version. This compatibility issue could lead to functionality problems, data discrepancies, and wasted resources. Therefore, always ensure the add-on you choose is compatible with your specific version of QuickBooks.

Ease of Use

You've found an add-on that perfectly matches your business needs. It's compatible with your QuickBooks version and falls within your budget. However, after implementation, the add-on is incredibly complex and unintuitive. Your team needs to work on using it effectively, leading to inefficiencies and frustration. An add-on should be user-friendly and easy to navigate. Many add-ons offer free trials or demos, which can be a great way to assess their ease of use before committing.

Cost-effectiveness

Consider a scenario where you invest in a high-end add-on with many features. However, you only end up using a fraction of these features, and the add-on's cost far exceeds the value it brings to your business. It's essential to weigh the cost of the add-on against the value it provides. An add-on that streamlines processes, saves time or provides valuable insights can be worth the investment. However, choosing an add-on that fits your budget and offers a good return on investment is crucial.

Customer Support and Reviews

Imagine you encounter a technical issue with your add-on. You reach out to customer support, but they take days to respond, and when they do, their assistance could be more helpful. Good customer support is crucial for resolving issues and ensuring smooth operation. Look for add-ons with robust customer support, including multiple communication channels and quick response times. Additionally, consider the experiences of other users. Online reviews and ratings can provide valuable insights into the reliability of the add-on and the quality of customer support.

Scalability

The customer base expands, the inventory increases, and the number of transactions multiplies. The add-on that served your needs now needs to be improved. Choose an add-on that can scale with your business.

Choosing the Right QuickBooks Add-Ons for Different Business Functions

This section will delve into choosing the right add-ons for different business functions. The right add-on can significantly enhance the functionality of QuickBooks and make it more tailored to your specific business needs. Let's explore some of the top add-ons for various business functions:

Accounting and Finance Add-Ons for QuickBooks

PayTraQer

Overview

PayTraQer is a powerful automation application that syncs your online payments from payment processors like PayPal, Stripe, and Square and ecommerce platforms like Amazon, eBay, and Shopify with QuickBooks. It robustly integrates with QuickBooks, ensuring your sales, fees, and expense data are up to date .

Key Features:

Robust Integration: PayTraQer enables efficient synchronization of your sales, fees, and expense data with QuickBooks.

Itemized Synchronization: It provides detailed information like products, services, discounts, customers, and vendors from the payment systems.

Instant Rollback: PayTraQer allows for an instant rollback of synced data, giving you complete control over your information.

Unlimited Historical Transactions Sync: It allows you to sync complete historical transactions with QuickBooks.

Advanced Analytics: PayTraQer provides advanced analytics for your business payments, giving you a comprehensive overview of your financial data.

Multi-Currency and Tax Ready: It can handle multiple currencies and tax rates, ensuring accurate data transfer into QuickBooks.

SaasAnt Transactions

Overview

SaasAnt Transactions allows you to import, export, and delete transactions from QuickBooks Online, providing a comprehensive solution for data management.

Key Features

Supports all QuickBooks transaction types, including customer & vendor transaction types.

It provides options for importing, exporting, and deleting transactions.

Includes data validation features to ensure the accuracy of your imports.

Allows for the mapping of fields to match your import file layout.

Supports batch operations for handling large volumes of data.

You can automate transaction entry using FTP, Email, SFTP, and Zapier.

EBizCharge

Overview

EBizCharge is a payment gateway that integrates with QuickBooks, processing credit, debit, and eCheck transactions directly within the software.

Key Features

Offers recurring billing, invoice payment, and a customer payment portal.

Includes robust security measures to protect transactions.

Provides detailed reports and analytics to track and manage payments.

Supports a variety of payment methods, including credit cards, debit cards, and eChecks.

Bill.com

Overview

Bill.com is a digital business payments platform that integrates with QuickBooks, automating your accounts payable and receivable processes.

Key Features

Allows you to pay bills, send invoices, and accept payments through various methods, including ACH, credit cards, and PayPal.

Includes features like approval workflows, document storage, and international payments.

It provides a clear audit trail, which can be helpful for compliance purposes.

It offers mobile access, allowing you to manage payments on the go.

Avalara AvaTax

Overview

Avalara AvaTax is a tax compliance software that integrates with QuickBooks, automating sales tax and VAT calculation and application.

Key Features

Calculates tax based on the details of the invoice and the applicable tax rules.

Automatically adds the tax as a line item on the invoice.

Updates tax rates in real-time, ensuring accurate calculations.

Supports tax calculations for multiple countries and regions.

Sales and Customer Management Add-Ons for QuickBooks

Nutshell CRM

Overview

Nutshell CRM is a platform that combines customer relationship management (CRM) and sales automation. It integrates with QuickBooks Online, ensuring your sales and financial data are aligned.

Key Features

Contact Management: Stores and organizes customer information for easy access and management.

Sales Pipeline Tracking: Monitors the progress of deals through the sales pipeline.

Reporting: Generates detailed reports on sales activities and performance.

Sales Automation: Automates routine sales tasks, reducing manual work.

Team Collaboration Tools: Includes task management and shared calendars to enhance team collaboration.

Email Marketing: Supports email marketing efforts with templates and bulk emailing capabilities.

Pipeline CRM

Overview

Pipeline CRM is a customer relationship management tool that integrates with QuickBooks Online, providing a unified platform for managing customer relationships and generating invoices.

Key Features

Contact Management: Organizes customer information for easy access and management.

Sales Pipeline Tracking: Monitors the progress of deals through the sales pipeline.

Task Management: Helps manage tasks related to sales and customer relationship management.

Invoicing: Allows for generating and managing invoices directly within the platform.

Insightly CRM

Overview

Insightly CRM is a customer relationship management tool that integrates with QuickBooks, providing a unified platform for managing customer relationships and project management.

Key Features

Contact Management: Organizes customer information for easy access and management.

Project Management: Helps manage tasks and projects related to sales and customer relationship management.

Business Intelligence: Provides insights into business performance through reporting and analytics.

Automation: Streamlines sales and project management processes, reducing manual work and improving efficiency.

HubSpot CRM

Overview

HubSpot CRM is a comprehensive customer relationship management tool that integrates with QuickBooks, providing a unified platform for managing customer relationships and viewing QuickBooks transactions.

Key Features:

Contact Management: Organizes customer information for easy access and management.

Sales Pipeline Tracking: Monitors the progress of deals through the sales pipeline.

Marketing Automation: Streamlines marketing processes, reducing manual work and improving efficiency.

QuickBooks Integration: Allows viewing and managing QuickBooks transactions directly within the CRM.

Inventory Management Add-Ons for QuickBooks

Zoho Inventory

Overview

Zoho Inventory is a comprehensive inventory management software that integrates seamlessly with QuickBooks, offering a range of functionalities to manage your inventory effectively.

Key Features

Multi-channel Selling: Allows you to manage your inventory across multiple sales channels.

Inventory Control: This helps you keep track of your inventory levels to prevent stockouts and overstocking.

Order Management: Manages your orders, from receipt to delivery, in one place.

Analytics: Provides insights into your inventory performance through detailed reports.

SkuVault

Overview

SkuVault is an inventory and warehouse management system that integrates with both online and desktop versions of QuickBooks, providing a unified platform for managing your inventory systems effectively.

Key Features

Real-time Inventory Updates: This provides real-time updates on your inventory levels, helping you prevent stockouts and overstocking.

Warehouse Management: Helps manage your warehouse operations, improving efficiency and reducing errors.

Order Management: Manages your orders, from receipt to delivery, in one place.

Product Kitting and Bundling: Allows for managing product kits and bundles, improving inventory accuracy.

Cin7

Overview

Cin7 is a sophisticated inventory management solution that integrates with QuickBooks, offering extensive functionalities for managing your inventory effectively.

Key Features

Multi-channel Inventory Control: You can manage your inventory across multiple sales channels.

Order Management: Manages your orders, from receipt to delivery, in one place.

Warehouse Management: Helps manage your warehouse operations, improving efficiency and reducing errors.

Product Kitting and Bundling: Allows for managing product kits and bundles, improving inventory accuracy.

SOS Inventory

Overview

SOS Inventory is an inventory management app that offers a complete solution for inventory management and order alignment. It integrates with QuickBooks Online, allowing you to track work-in-progress throughout the entire lifecycle and sync serial numbers and batches.

Key Features

Inventory Control: This allows you to manage your inventory levels effectively.

Order Management: Manages your orders, from receipt to delivery, in one place.

Work-in-Progress Tracking: Helps track work-in-progress items throughout their entire lifecycle.

Serial Number and Batch Management: Allows to manage serial numbers and batches, improving inventory accuracy.

Fishbowl Inventory

Overview

Fishbowl Inventory is a popular inventory management app tailor-made to function alongside QuickBooks. It specializes in manufacturing and warehouse management.

Key Features

Inventory Control: This allows you to manage your inventory levels effectively.

Order Management: Manages your orders, from receipt to delivery, in one place.

Manufacturing Management: Helps manage your manufacturing processes, improving efficiency and reducing errors.

Warehouse Management: Helps manage your warehouse operations, improving efficiency and reducing errors.

Asset Management: Allows for the management of assets, improving inventory accuracy.

Payroll and Employees Add-Ons for QuickBooks

Overview

TSheets, now known as QuickBooks Time, is a cloud-based time-tracking app that helps manage employee time effectively.

It suits businesses of all sizes and industries, including construction companies.

Features

Real-time time tracking: Allows employees to clock in and out digitally.

Employee scheduling: Assign shifts to employees and identify unassigned tasks.

Detailed reports and analytics: Provides insights on team performance, time spent on tasks, punctuality, and more.

Project management: Offers a 'Project Estimates vs. Actual Reporting' comparison to monitor project progress.

Payroll integration: Streamlines payroll management and invoicing.

GPS and Geofencing: Tracks employee location and sends notifications when employees enter or leave job sites.

Mobile app: Available on both Android and iOS devices, allowing employees to track time, select jobs and tasks, add notes, and clock out.

Image attachments: Employees can add image attachments to timesheets to document project progress or report issues at job sites.

Time Kiosk: Allows employees to clock in and out via mobiles, computers, text messages, and even Twitter.

Rippling

Overview

Rippling is a highly automated cloud-based software that allows organizations to manage their workforces’ payroll, benefits, expenses, devices, apps, and more.

It combines HR, IT, and finance in one unified workforce management platform.

It is used for fast onboarding, managing payrolls and benefits in the U.S. and globally, and running centralized employee databases.

Features

Global payroll management: Can manage thousands of remote workers, regardless of their location. It can track hourly work, PTO, compliance, wage and salary information reports, and tax computations.

Employee benefits administration and health insurance: Comprehensive and fully automated benefits management, including health insurance and 401k.

Global workforce management: Companies can hire, pay, and centralize their talent in one place. It can automate compliance to meet local laws and customize policy by country.

IT management: Can manage and integrate third-party apps, as well as seamlessly track and monitor employees’ apps, devices, data, and security.

Learning management program: Provides training to employees with a robust library of more than 1,000 pre-built courses.

Surveys: Allows organizations to run surveys to understand their talent better and gain insights into their teams.

Paychex Flex

Overview

Paychex Flex is a cloud-based payroll platform suitable for fast-growing businesses.

It offers four plans and a broad range of add-on services, making it scalable with a company's growth.

However, its high cost can be a drawback, especially for small businesses.

Features

Payroll management: Ability to pay employees and contractors via direct deposit, check, or prepaid pay card.

Tax filing and payments: Federal, state, and identified local payroll taxes are calculated, filed, and paid.

Employee benefits administration: For an additional cost, Paychex offers in-house retirement plans, health insurance, health savings accounts (HSAs), flexible spending accounts (FSAs), and other benefits.

Employee portal: Employees can view their paystubs and tax documents and get paid via direct deposit, check, or prepaid card.

HR services: Includes background checks, onboarding documents, and assistance with state unemployment insurance processes.

Reporting: Access to over 160 standard reports, custom reports, and additional reporting capabilities.

Training: Employee financial wellness program, training platform, and performance management.

Integration: Integrations for accounting software, including QuickBooks and Xero.

Gusto

Overview

Gusto is an online payroll software and HR administration platform for startups and small businesses.

It simplifies payroll processing and benefits administration.

Features

Payroll management: Allows for easy setup of a payroll schedule and runs payroll automatically based on the schedule.

Tax filing: Calculates and files payroll taxes for you and your employees and keeps a record of pay stubs accessible to employees through their online profiles.

Recruiting and Onboarding: Gusto has its native applicant tracking tool available for Gusto Plus and Premium customers. It also facilitates the onboarding process for new employees.

Benefits Administration: Gusto offers health, commuter, life insurance, and retirement plans. It also offers unique benefits like college savings, financial wellness, and charity matching benefits.

Time Tools: Gusto contains time off management and time-tracking tools. It suggests typical time off policies, including paid time off, sick leave, and holiday paid leave.

Reporting: Gusto includes a reports library for time tracking, contractors, payroll, etc.

Employee Self-Service: Gusto allows employees to access and manage their information by offering individual profile accounts.

Compliance: Gusto helps you stay compliant with local labor laws with its labor law poster store. It also has built-in ACA, COBRA, HIPAA, and ERISA compliance for benefits administration.

OnPay

Here are the main points about OnPay:

Overview

OnPay is a cloud-based, full-service payroll software solution that enables small and midsize businesses to manage payroll, tax filing, benefits administration, and other human resources processes.

It is particularly suitable for businesses new to payroll and HR software and offers industry-specific payroll services in farming, nonprofit, and restaurant services.

Features

Payroll management: OnPay offers various features to support business payroll workflows, including garnishment deductions, automated tax payments, and payroll reporting.

Tax filing: OnPay simplifies tax filing by withholding all payroll taxes each pay run. It automatically files all federal taxes, including quarterly 941s and annual Forms W-2, W-3, 1099, 940, and 943. It also files state payroll taxes and all applicable local payroll taxes.

HR features: OnPay includes various helpful HR features that support processes like employee benefits management, conducting traceable conversations within the platform, and onboarding new staff members.

Integration with third-party solutions: OnPay integrates with popular business software such as QuickBooks Online, QuickBooks Time, Xero, and Deputy.

Reporting and Analytics Add-Ons for QuickBooks

Reporting and analytics are crucial for making informed business decisions, and QuickBooks add-ons can significantly enhance the functionality of your software in this area. Let's delve deeper into each of these add-ons, exploring their features, benefits, and potential drawbacks:

Reach Reporting

Overview

Reach Reporting is a comprehensive package integrating QuickBooks Online, Xero, Gusto, and Google Sheets.

Designed to automate financial and non-financial data, making reporting, forecasting, and budgeting easier with powerful dashboards.

Features

Integration and automation: QuickBooks Online & Desktop, Xero, Gusto, CSV trial balance, and Datasheets & Google Sheets.

Intuitive customization: Offers a spreadsheet environment with Excel-like formulas, metric goals/targets, and trend lines.

Data storytelling features: Includes live text, conditional formatting, dynamic statements & interactive metrics, and custom themes for your branding and colors.

Template library: Provides pre-built report & dashboard templates that are fully customizable.

Budget & forecasting: Offers forecasting algorithms & custom formulas, datasheets for non-financial data, and planning trend visualizations.

Integrated 3-Way Forecasting: Provides a complete picture of a business trajectory with connected P&L, Balance Sheet & Cash Flow Statement.

Consolidations: Supports multi-currency consolidation and easy eliminations and allows filtering by company.

Client Portal: You can organize your reports and dashboards, determine access levels using folders, and upload files.

Zoho Analytics

Overview

Zoho Analytics is an online financial analytics software that integrates with QuickBooks, providing a platform for analyzing QuickBooks data and creating reports and KPI dashboards.

Features

Offers data analysis, reporting, and visualization features.

Allows creation of custom reports and dashboards.

Supports a wide range of charts for data analysis.

Provides collaboration features for team-based data analysis.

Includes the ability to pull quantitative data from qualitative information.

Supports integration with Zoho apps and other third-party tools.

CashFlowTool

Overview

CashFlowTool is a robust financial forecasting and cash flow management tool that integrates with QuickBooks, providing real-time cash flow forecasting, budgeting, and financial analytics.

Features

Offers cash flow forecasting, budgeting, and financial analysis features.

Allows creation of custom reports and dashboards.

Supports vendor management, invoicing, payments, receipts, and other transactions.

Provides notifications for financial numbers and receivables.

Helps in cash management and records all trades with related details.

ICAT

Overview

ICAT is a budgeting and financial reporting tool that integrates with QuickBooks, providing robust reporting and analytics capabilities, including budget-to-actual reporting, indirect rate calculation, and more.

Features

Offers budgeting, financial reporting, and indirect rate calculation features.

Allows creation of custom reports and dashboards.

Supports vendor management, invoicing, payments, receipts, and other transactions.

Provides notifications for financial numbers and receivables.

Helps in cash management and records all trades with related details.

QCommission

Overview

QCommission is a powerful, flexible sales commission software that integrates with QuickBooks to calculate salespeople's compensation accurately and reduce errors related to sales commission calculations.

Features

Automated Sales Commission: QCommission automates the calculation of total and partial payments, minimizing errors found in commissions and enabling the generation of plans.

Commission Plan Creation: Allows users to generate commission plans such as varying commission rates through attainment, splitting commissions for representatives, and varying commissions using products.

Transaction Adjustments: The software can process, credit, and calculate performance transactions as many times as needed in a single day. Transaction adjustments can be made and processed within the platform.

Reporting Templates: QCommission offers numerous report templates for sales commission data. An analytics module is available to interpret details into graphs and charts.

Data Preservation: The software preserves data involved in calculating commissions, allowing users to produce concise and transparent commission statements for their field.

Choosing the right QuickBooks add-ons is a strategic decision that can significantly enhance your business operations. This guide has provided an overview of various add-ons across crucial business functions, including accounting, sales, inventory management, payroll, and reporting.

The selection process requires profoundly understanding your business needs and carefully evaluating each add-on's compatibility, ease of use, cost-effectiveness, customer support, and scalability. We've highlighted the potential drawbacks of each add-on. Remember, the best QuickBooks add-ons depend on your specific needs and circumstances. Investing time in understanding your business needs and researching suitable add-ons is crucial.