How to Apply for a UTR Number: Your Complete Guide

Navigating the UK's tax system can be complex, but understanding critical components like the Unique Taxpayer Reference (UTR) number is crucial for individuals and businesses. A UTR number is a ten-digit code issued by HMRC to identify taxpayers within the UK tax system. Whether you are self-employed, a contractor, or running a limited company, having a UTR number is essential for managing your tax affairs effectively.

Contents

Who Needs a UTR Number

When Do You Need a UTR Number? Understanding the Essentials

Preparing to Apply for a UTR Number: Your Comprehensive Guide

How to Apply for a UTR Number: Step-by-Step Guide

What to Expect After Applying for Your UTR Number

Using Your UTR Number

Common Issues and Troubleshooting: What to Do When Facing UTR Number Problems

Additional Resources and Support for UTR Number Issues

Conclusion

Frequently Asked Questions

What is a UTR Number?

A Unique Taxpayer Reference (UTR) number is a unique identifier HMRC assigns to every taxpayer in the UK. This number is used in all interactions with HMRC, from filing tax returns to making tax payments. You must complete essential tax-related tasks with a UTR number, making them critical to your financial and legal responsibilities.

Importance of a UTR Number for Individuals and Businesses

The importance of a UTR number cannot be overstated. Individuals, particularly the self-employed, must submit self-assessment tax returns with a UTR number. This ensures compliance with HMRC regulations and facilitates smooth financial operations for businesses, including contractors and limited companies. Managing tax obligations becomes easier with a UTR number, leading to potential fines and legal issues.

This guide aims to provide a comprehensive, step-by-step process for applying for a UTR number. Whether you need to apply for a UTR number online, find a lost UTR number, or understand UTR number requirements, this guide covers it all. Following the steps outlined here, you will learn how to get a UTR number efficiently, ensuring you meet all HMRC requirements.

Step-by-Step Process for Applying for a UTR Number

UTR Number Application: Understand the application process and what information you need to provide.

UTR Number for Self-Employed: Learn the specific requirements for self-employed individuals.

HMRC UTR Number Lookup: Find out how to locate your UTR number if you've misplaced it.

UTR Number for Tax Return: Ensure your UTR number is ready for tax return submissions.

Apply for UTR Number Online: A detailed guide on the online application process.

UTR Number for Contractors and Limited Companies: Specific steps for businesses and contractors.

By the end of this guide, you will be equipped with all the necessary knowledge to apply for, manage, and utilise your UTR number effectively. Let's dive in and simplify the process of obtaining your Unique Taxpayer Reference number.

Who Needs a UTR Number

In the complex world of taxation, a Unique Taxpayer Reference (UTR) number stands out as a crucial identifier for individuals and businesses within the UK. But who needs a UTR number, and how does it differ from other tax identification numbers? This guide will delve into these questions, shedding light on UTR number requirements, eligibility, and necessity for various types of taxpayers.

Differences Between UTR and Other Tax Identification Numbers

A UTR number is distinct from other tax identification numbers, such as National Insurance (NI) or VAT registration numbers. While an NI number is used primarily for social security and benefits purposes, and a VAT number is for businesses charging VAT, a UTR number uniquely identifies taxpayers in their dealings with HMRC, particularly for income tax purposes. Understanding these differences is critical to knowing why and when a UTR number is necessary.

Who Needs a UTR Number?

The necessity for a UTR number spans a wide range of individuals and entities. Here’s a breakdown of who must have a UTR number:

UTR Number for Self-Employed

If you are self-employed, you need a UTR number to file your self-assessment tax returns and manage your tax obligations. This includes freelancers and sole traders.

UTR Number for Contractors

Contractors, especially those in construction and other industries requiring subcontracting, need a UTR number to comply with HMRC’s tax regulations.

UTR Number for Limited Companies

Limited companies must have a UTR number to manage corporation tax and other related financial matters.

UTR Number for Businesses

Any business entity, whether a partnership, limited company or sole proprietorship, requires a UTR number for tax reporting and compliance.

UTR Number for Landlords

Landlords with rental income must register for a UTR number to correctly declare their income and manage their tax affairs.

Do I Need a UTR Number?

Consider your tax status and activities to determine if you need a UTR number. You likely need a UTR number if you earn income outside of traditional employment, operate a business, or have rental income. Here are specific scenarios:

Freelancers and Self-Employed Individuals: You must have a UTR number for self-assessment.

Contractors and Subcontractors: Required to ensure tax compliance.

New and Existing Businesses: Essential for corporation tax and other obligations.

Landlords and Property Owners: Necessary for declaring rental income.

Partnerships and Sole Traders: Must register to manage partnership tax returns and self-assessment.

Why You Need a UTR Number

The UTR number is essential for accurately reporting income, paying taxes, and avoiding penalties. It is a critical component for:

Ensuring compliance with HMRC regulations.

Facilitating smooth financial and tax operations.

Avoiding legal issues related to tax evasion.

Understanding who needs a UTR number and why it is essential can help you navigate the UK's tax system more effectively. Whether you are self-employed, a contractor, a business owner, or a landlord, having a UTR number is crucial for managing your tax obligations. Stay compliant and organised by ensuring you have your Unique Taxpayer Reference number ready and up to date.

When Do You Need a UTR Number? Understanding the Essentials

Navigating the UK's tax system can be daunting, especially when it comes to understanding when you need a Unique Taxpayer Reference (UTR) number. This unique identifier, issued by HM Revenue and Customs (HMRC), plays a crucial role in various tax-related scenarios. Let's explore when obtaining a UTR number is necessary and why it's essential for individuals and businesses.

Starting Self-Employment or a New Business

If you're venturing into self-employment or starting a new business, obtaining a UTR number is one of the first steps in your journey. Whether you're a freelancer, consultant, or entrepreneur, having a UTR number is essential for tax compliance and managing your financial affairs.

Registering for Self-Assessment with HMRC

Registering for Self-Assessment with HMRC is a common trigger for needing a UTR number. Self-assessment is the system HMRC uses to collect income tax from individuals who earn income outside of PAYE (Pay As You Earn). When you register for Self-Assessment, HMRC will assign you a UTR number to ensure accurate reporting and tax payments.

Submitting Tax Returns as a Sole Trader, Partnership, or Limited Company

Whether you operate as a sole trader, partnership, or limited company, submitting tax returns is a legal requirement in the UK. Your UTR number is your unique identifier in these tax returns, ensuring HMRC can track and process your tax obligations accurately.

Other Scenarios Requiring a UTR Number

Apart from the scenarios above, there are other situations where you may need a UTR number:

Contractors: If you work as a contractor, especially in industries like construction or IT, you'll likely need a UTR number to comply with HMRC regulations.

Landlords: If you earn rental income from properties you own, you must register for self-assessment and obtain a UTR number for tax reporting purposes.

Freelancers: Individuals offering freelance services, such as writers, designers, or photographers, need a UTR number for tax purposes.

New Businesses: Whether setting up a limited company, partnership, or sole proprietorship, obtaining a UTR number is essential for establishing your tax identity.

Understanding when you need a UTR number is crucial for staying compliant with HMRC regulations and managing your tax affairs effectively. Whether you're embarking on self-employment, starting a new business, or engaging in other income-generating activities, obtaining a UTR number is a fundamental step in your journey towards financial responsibility. Stay informed, stay compliant, and ensure your UTR number is ready when needed.

Preparing to Apply for a UTR Number: Your Comprehensive Guide

Applying for a Unique Taxpayer Reference (UTR) number is crucial in ensuring your tax affairs are in order, whether you're self-employed, starting a new business, or engaging in other taxable activities. Gathering the necessary information and documents is essential to streamline the application process and avoid delays. Here's what you need to know to prepare for your UTR number application:

Information and Documents Needed

Personal Details:

Full Name

Address

Date of Birth

National Insurance Number

Business Details (if applicable):

Business Name

Business Address

Nature of Business

Contact Details:

Phone Number

Email Address

Importance of Accuracy in the Application Process

Accuracy is paramount when applying for a UTR number. Any discrepancies or errors in your application could lead to delays in processing or even rejection. Ensure that all information provided is correct and up-to-date to avoid complications. Double-checking your application form and supporting documents can save you time and frustration in the long run.

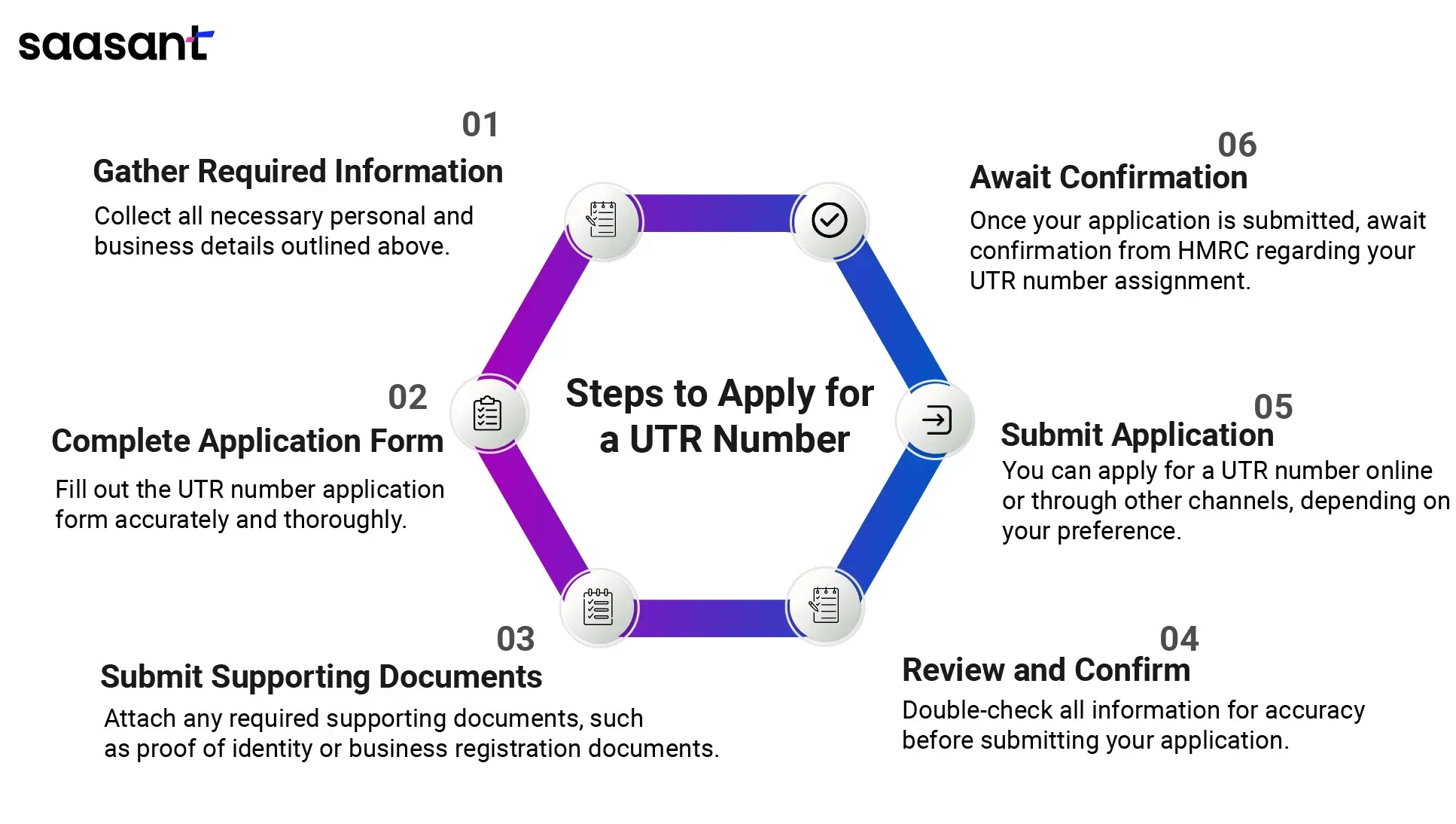

Steps to Apply for a UTR Number

Gather Required Information: Collect all necessary personal and business details outlined above.

Complete Application Form: Fill out the UTR number application form accurately and thoroughly.

Submit Supporting Documents: Attach any required supporting documents, such as proof of identity or business registration documents.

Review and Confirm: Double-check all information for accuracy before submitting your application.

Submit Application: You can apply for a UTR number online or through other channels, depending on your preference.

Await Confirmation: Once your application is submitted, await confirmation from HMRC regarding your UTR number assignment.

Applying for a UTR Number Online

Applying for a UTR number online offers a convenient and efficient way to complete the process. HMRC provides an online application portal where you can input your information, upload required documents, and track the progress of your application.

UTR Number Application Deadline

While there is no strict deadline for applying for a UTR number, it's advisable to do so as soon as you start your self-employment or business activities. Delaying your application could complicate fulfilling your tax obligations, so it's best to apply promptly.

Preparing for your UTR number application involves gathering the necessary information and documents, ensuring accuracy in your application, and following the steps outlined by HMRC. By preparing thoroughly and submitting your application accurately, you can streamline the process and avoid unnecessary delays. Remember, accuracy is vital to a successful UTR number application.

How to Apply for a UTR Number: Step-by-Step Guide

Applying for a Unique Taxpayer Reference (UTR) number is an essential step for individuals and businesses in the UK to ensure compliance with HM Revenue and Customs (HMRC) regulations. Whether you're self-employed, starting a new business, or need a UTR for other tax-related purposes, this comprehensive guide will walk you through the application process step by step.

Applying Online

1. Registering for Self-Assessment Online

Visit the HMRC website and register for Self Assessment if needed.

You will receive a Unique Taxpayer Reference (UTR) as part of the registration process.

2. Navigating the HMRC Website

Access the HMRC online services portal and select the option to apply for a UTR number.

Follow the prompts to begin the application process.

3. Completing the Online Form

Provide the required details, including personal information, business details (if applicable), and contact information.

Double-check all information for accuracy before proceeding.

4. Submitting the Application

Review your application to ensure all information is correct.

Apply electronically through the HMRC website.

5. Receiving Confirmation

Await confirmation from HMRC regarding your UTR number assignment.

You may receive a confirmation email or letter with your UTR details.

Applying by Phone

HMRC Helpline Contact Details

Contact the HMRC helpline at [HMRC contact number] to apply for a UTR number by phone.

Information to Have Ready Before Calling

Personal details (full name, address, date of birth)

National Insurance number

Business details (if applicable)

Steps and What to Expect During the Call

Dial the HMRC helpline and follow the prompts to speak with a representative.

Provide the necessary information as requested.

Note down any reference numbers or instructions provided during the call.

Applying by Post

1. Downloading and Completing the Form

Download the SA1 form (for individuals) or the relevant form for businesses from the HMRC website.

Complete the form with the required details, ensuring accuracy.

2. Mailing the Form to HMRC

Mail the completed form to the address on the form or the HMRC website.

Ensure you include any necessary supporting documents with your application.

3. Estimated Processing Times and Follow-Up

Wait for HMRC to process your application.

You may receive confirmation of your UTR number assignment by mail.

If you are still waiting to receive confirmation within the estimated processing time, follow up with HMRC using the contact information provided on their website.

Following these step-by-step instructions, you can apply for a UTR number online, by phone, or by post. Remember to provide accurate information and follow any additional instructions provided by HMRC to ensure a smooth application process. A UTR number is essential to fulfil your tax obligations and comply with HMRC regulations.

What to Expect After Applying for Your UTR Number

Congratulations on successfully submitting your application for a Unique Taxpayer Reference (UTR) number! Now that you've completed this crucial step, you may wonder what happens next. Here's what you can expect after applying for your UTR number:

Confirmation from HMRC and Receiving Your UTR Number

After processing your application, HM Revenue and Customs (HMRC) will confirm your UTR number assignment. This confirmation typically comes in the form of a letter or email sent to the address provided in your application. This correspondence will contain your UTR number and unique tax identifier.

Typical Processing Times

The processing time for UTR number applications can vary depending on various factors, including HMRC's workload and the application method. Typically, you can expect confirmation of your UTR number assignment within a few weeks of submitting your application. However, processing times may be longer during peak periods.

How the UTR Number Will Be Delivered

Your UTR number confirmation will be delivered via post or email, depending on the contact information you provided in your application. It will be sent to your specified address if you receive it by post. Ensure that you check your mailbox regularly to avoid missing any correspondence from HMRC.

Steps to Take If There Are Delays or Issues

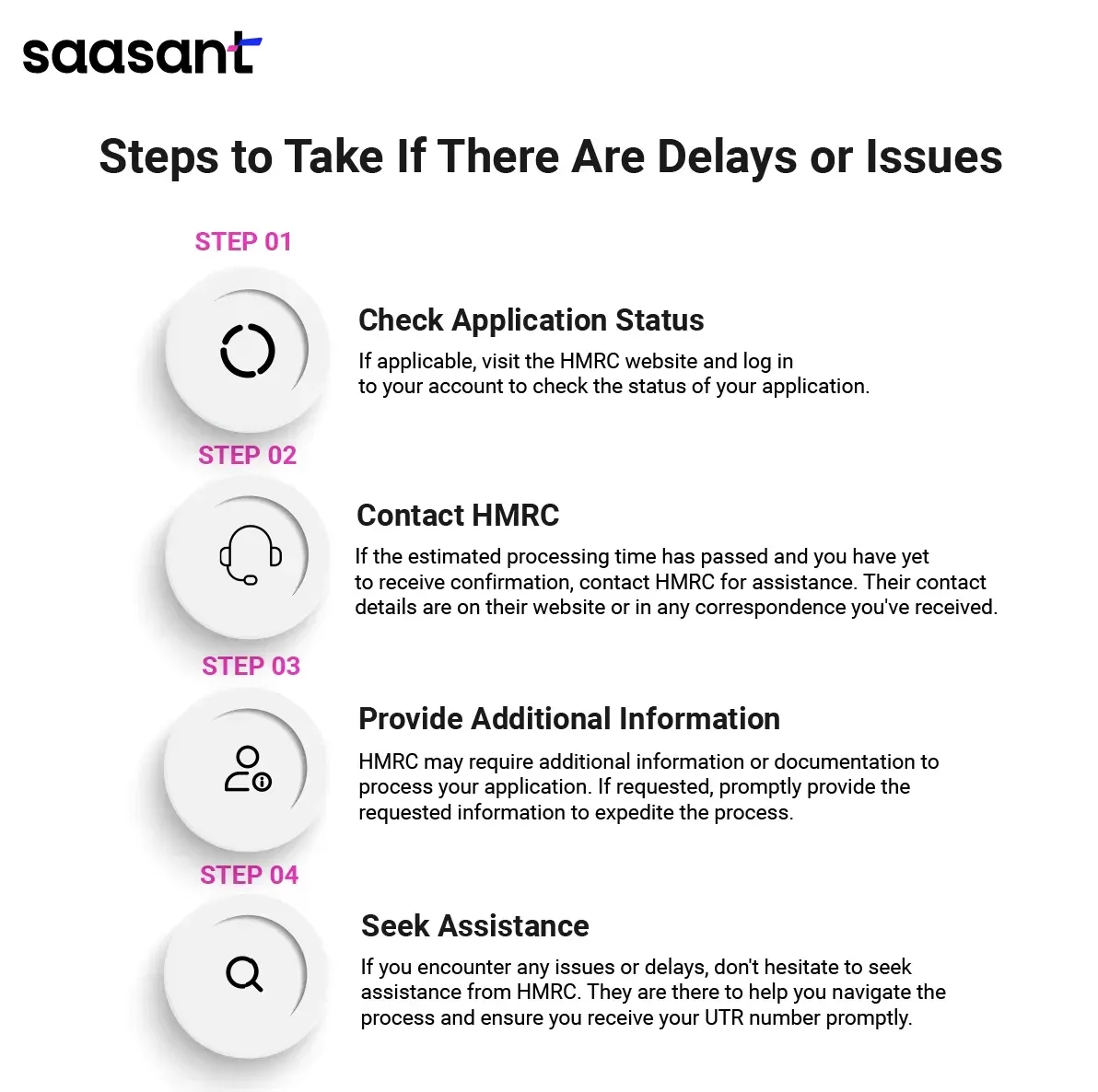

If you have yet to receive confirmation of your UTR number assignment within the expected timeframe, don't panic. Sometimes, processing times may be delayed due to various reasons. Here are the steps you can take:

Check Application Status: If applicable, visit the HMRC website and log in to your account to check the status of your application.

Contact HMRC: If the estimated processing time has passed and you have yet to receive confirmation, contact HMRC for assistance. Their contact details are on their website or in any correspondence you've received.

Provide Additional Information: HMRC may require additional information or documentation to process your application. If requested, promptly provide the requested information to expedite the process.

Seek Assistance: If you encounter any issues or delays, don't hesitate to seek assistance from HMRC. They are there to help you navigate the process and ensure you receive your UTR number promptly.

After applying for your UTR number, you can expect confirmation from HMRC containing your assigned UTR number. Keep an eye on your mailbox or email inbox for this correspondence. If there are any delays or issues, take proactive steps to follow up with HMRC and ensure the timely resolution of any concerns. Your UTR number is essential for fulfilling your tax obligations, so staying informed and proactive is crucial.

Using Your UTR Number

Your Unique Taxpayer Reference (UTR) number is more than just a string of digits; it's a vital identifier for managing your tax affairs effectively. Understanding when and where to use your UTR number, keeping it secure, and updating HMRC with any changes are essential to tax compliance. Here's a comprehensive guide on using your UTR number:

When and Where to Use Your UTR Number

Tax Purposes: Your UTR number is primarily used for tax-related activities, such as filing tax returns, making tax payments, and communicating with HM Revenue and Customs (HMRC).

Self-Assessment: If you're self-employed or have income from other sources, you'll need your UTR number to accurately complete your self-assessment tax return.

Business Transactions: When conducting business transactions, such as invoicing clients or receiving payments as a contractor, providing your UTR number may be necessary for tax purposes.

VAT Registration: If your business turnover exceeds the VAT threshold, you'll need to register for VAT with HMRC, and your UTR number will be required as part of the registration process.

HMRC Correspondence: Any correspondence with HMRC regarding your tax affairs will require your UTR number for identification and reference.

Importance of Keeping Your UTR Number Secure

Preventing Fraud: Your UTR number is sensitive information that should be kept secure to prevent identity theft and fraud. Avoid sharing it with unauthorised individuals or entities.

Tax Compliance: Protecting your UTR number helps ensure that only authorised individuals can access your tax information, reducing the risk of unauthorised changes or fraudulent activity.

Financial Security: Keeping your UTR number secure safeguards your financial security by minimising the risk of unauthorised access to your tax records and sensitive financial information.

Updating HMRC with Changes to Your Personal or Business Details

Personal Details: If your details, such as your address or name, change, you must inform HMRC promptly. You can update your information online through the HMRC website or by contacting HMRC directly.

Business Details: Similarly, if your business details change, such as your business name or address, you should notify HMRC to ensure that your records are current.

Maintaining Accuracy: Keeping HMRC informed of changes to your personal or business details helps ensure that your tax records are accurate and up to date, reducing the risk of errors or discrepancies in your tax filings.

Your UTR number is valuable in managing your tax affairs and ensuring compliance with HMRC regulations. By understanding when and where to use your UTR number, keeping it secure, and updating HMRC with any changes, you can maintain control over your tax obligations and safeguard your financial security effectively. Remember, protecting your UTR number is essential for maintaining the integrity of your tax records and financial information.

Common Issues and Troubleshooting: What to Do When Facing UTR Number Problems

Encountering issues with your Unique Taxpayer Reference (UTR) number can be frustrating, but solutions are available. Whether you've lost your UTR number, experienced delays in receiving it, or encountered errors, this guide will help you troubleshoot common issues effectively.

Losing Your UTR Number

What to Do:

Check Previous Correspondence: Your UTR number may be included in previous correspondence from HM Revenue and Customs (HMRC), such as tax returns or letters.

Contact HMRC: If you need help locating your UTR number, contact HMRC. They can provide you with it or guide you through the following steps.

Handling Delays or Non-Receipt of Your UTR Number

What to Do:

Check Processing Times: Processing times for UTR number applications can vary. If you have not received your UTR number within the estimated timeframe, check HMRC's website for any updates or delays.

Contact HMRC: If you've experienced significant delays or have yet to receive your UTR number, contact HMRC for assistance. They can provide you with an update on the status of your application and guide you on the next steps.

Contacting HMRC for Assistance

What to Do:

Use Official Channels: When contacting HMRC for assistance with UTR number issues, ensure you use official channels like the HMRC website or helpline. Avoid sharing sensitive information through unofficial channels to protect your privacy and security.

Provide Necessary Information: When contacting HMRC for assistance, be prepared to provide relevant information, such as your details and any documentation related to your UTR number application.

While encountering issues with your UTR number can be challenging, there are steps you can take to troubleshoot common problems effectively. Whether you've lost your UTR number, experienced delays in receiving it, or encountered errors, following the guidance provided in this article and contacting HMRC for assistance will help resolve your issues promptly. Remember, HMRC is there to help you navigate the process and ensure that you have access to the information and support you need.

Additional Resources and Support for UTR Number Issues

Having access to the right resources and support is essential when dealing with your unique taxpayer reference (UTR) number. Whether you need help with the application process, troubleshooting issues, or seeking professional advice, this guide will provide valuable information and links to additional resources.

HMRC Resources and Guides

Contact Information for HMRC Helpline

Contacting HMRC's customer service is the best action if you need direct assistance. Here are the details:

HMRC Contact Information: For general inquiries, you can reach HMRC by phone at 0300 200 3310. Ensure you have your details and relevant documentation ready for specific issues related to your UTR number.

Taxpayer Helpline: The HMRC helpline is available Monday through Friday, 8 a.m. to 8 p.m., and Saturday, 8 a.m. to 4 p.m. They can assist with UTR number issues, self-assessment queries, and more.

Access to the right resources and support is crucial for effectively managing your UTR number. Utilise the links to HMRC resources and guides, contact the HMRC helpline for direct assistance, and seek professional advice from accountants and tax advisors when needed. By leveraging these resources, you can ensure smooth handling of your UTR number and comply with your tax obligations.

Conclusion

Understanding and managing your Unique Taxpayer Reference (UTR) number is crucial for staying compliant with HMRC regulations and efficiently handling your tax affairs. This comprehensive guide has walked you through the importance of a UTR number, who needs it, the application process, and how to address common issues.

Applying for a UTR number, whether online, by phone, or by post, requires accuracy and thoroughness to avoid delays or complications. Once you have your UTR number, it is essential to know when and where to use it, keep it secure, and update HMRC with any changes to your personal or business details.

If you encounter any problems, from losing your UTR number to experiencing delays, this guide provides troubleshooting steps and valuable resources to ensure you get the assistance you need. Accessing additional support through HMRC’s resources and professional advice from accountants and tax advisors can further aid in effectively managing your tax obligations.

By following the steps and utilising the resources in this guide, you can ensure that your UTR number is effectively applied, managed, and utilized, paving the way for smooth financial and tax operations. Stay proactive and informed to maintain compliance and safeguard your financial integrity.

Frequently Asked Questions

What does UTR stand for?

UTR stands for Unique Taxpayer Reference. It is a ten-digit code issued by HM Revenue and Customs (HMRC) to identify taxpayers within the UK tax system.

Why do I need a UTR number?

A UTR number is essential for filing tax returns, making tax payments, and managing your tax obligations. It's required for self-employed individuals, contractors, businesses, and landlords.

Who needs a UTR number?

A: Self-employed individuals, contractors, limited companies, partnerships, landlords, and anyone required to file a self-assessment tax return need a UTR number.

How does a UTR number differ from other tax IDs like NI or VAT numbers?

While an NI number is for social security and benefits, and a VAT number is for businesses charging VAT, a UTR number uniquely identifies taxpayers in their dealings with HMRC, particularly for income tax purposes.

How can I apply for a UTR number?

You can apply for a UTR number online through the HMRC website, by phone, or by post. Our guide provides detailed steps for each method.

What information do I need to apply for a UTR number?

You’ll need your personal details (full name, address, date of birth, National Insurance number) and business details (business name, address, nature of business), if applicable.

Can I apply for a UTR number online?

Yes, you can apply for a UTR number online through the HMRC online services portal. This is the fastest and most convenient method.

How long does it take to receive my UTR number?

You should typically receive your UTR number within a few weeks. Processing times may vary, especially during peak periods.

What should I do if I haven’t received my UTR number?

If you haven’t received your UTR number within the expected timeframe, check your application status online or contact HMRC for assistance.

When should I use my UTR number?

Use your UTR number when filing tax returns, making tax payments, and in any correspondence with HMRC regarding your tax affairs.

How do I keep my UTR number secure?

Keep your UTR number confidential and only share it with authorised individuals or entities. Store it securely to prevent identity theft and fraud.

What should I do if I lose my UTR number?

Check previous correspondence from HMRC for your UTR number. If you still can’t find it, contact HMRC directly to retrieve it.

How do I handle delays in receiving my UTR number?

If you experience delays, check HMRC’s website for updates or contact their helpline. Ensure all your application details are correctly submitted.

Where can I find more information about UTR numbers?

Visit the HMRC website for detailed guides and resources. You can also contact the HMRC helpline for direct assistance with any issues.

Can I get professional help with my UTR number application?

Yes, consulting an accountant or tax advisor can provide expert guidance on applying for and managing your UTR number.