How to Calculate Net Income from Balance Sheet?

Net income is a critical metric in financial analysis, providing a clear picture of a company's profitability. It represents the money a company has earned after deducting all expenses, including taxes and interest, from its total revenue. Understanding net income is essential for investors, creditors, and analysts, as it helps assess a business's financial health and performance.

Net income is a critical metric in financial analysis, providing a clear picture of a company's profitability. It represents the money a company has earned after deducting all expenses, including taxes and interest, from its total revenue. Understanding net income is essential for investors, creditors, and analysts, as it helps assess a business's financial health and performance.

Net Income (profit) = Gross Profit - (Operating Expenses + Taxes)

Example: If you’re making a gross profit of $20,000 from your merchandise business, here is how to calculate the net income.

Gross Profit = $20,000; Operating Expenses = $8,000; Taxes = $4,000

Net Income = $20,000 - ($8,000 + $4,000) = $8,000

Contents

What is Net Income on a Balance Sheet?

Connecting Balance Sheets with Financial Statements: Unveiling Net Income

Understanding the Balance Sheet

Core Concepts Needed to Calculate Net Income

Step-by-Step Guide to Calculating Net Income

Understanding Retained Earnings

Analyzing the Impact of Net Income

Conclusion

FAQs

What is Net Income on a Balance Sheet?

Net income on a balance sheet remains after subtracting all the costs from a company's earnings. It's important because it shows whether the company is making a profit and affects things like how much money it keeps versus what it pays out to shareholders in retained earnings.

Connecting Balance Sheets with Financial Statements: Unveiling Net Income

Balance Sheet: The balance sheet is a snapshot of a company's financial position at a specific point in time. It consists of assets, liabilities, and shareholders' equity. Assets are what the company owns (e.g., cash, inventory, equipment), liabilities are what it owes (e.g., loans, accounts payable), and shareholders' equity represents the owners' stake in the company.

Income Statement: The income statement, also known as the profit and loss statement (P&L), shows a company's revenues, expenses, and net income over a period, usually a quarter or a year. It starts with total revenue and subtracts various expenses for net income. Expenses may include the cost of goods sold (COGS), operating expenses, taxes, and interest.

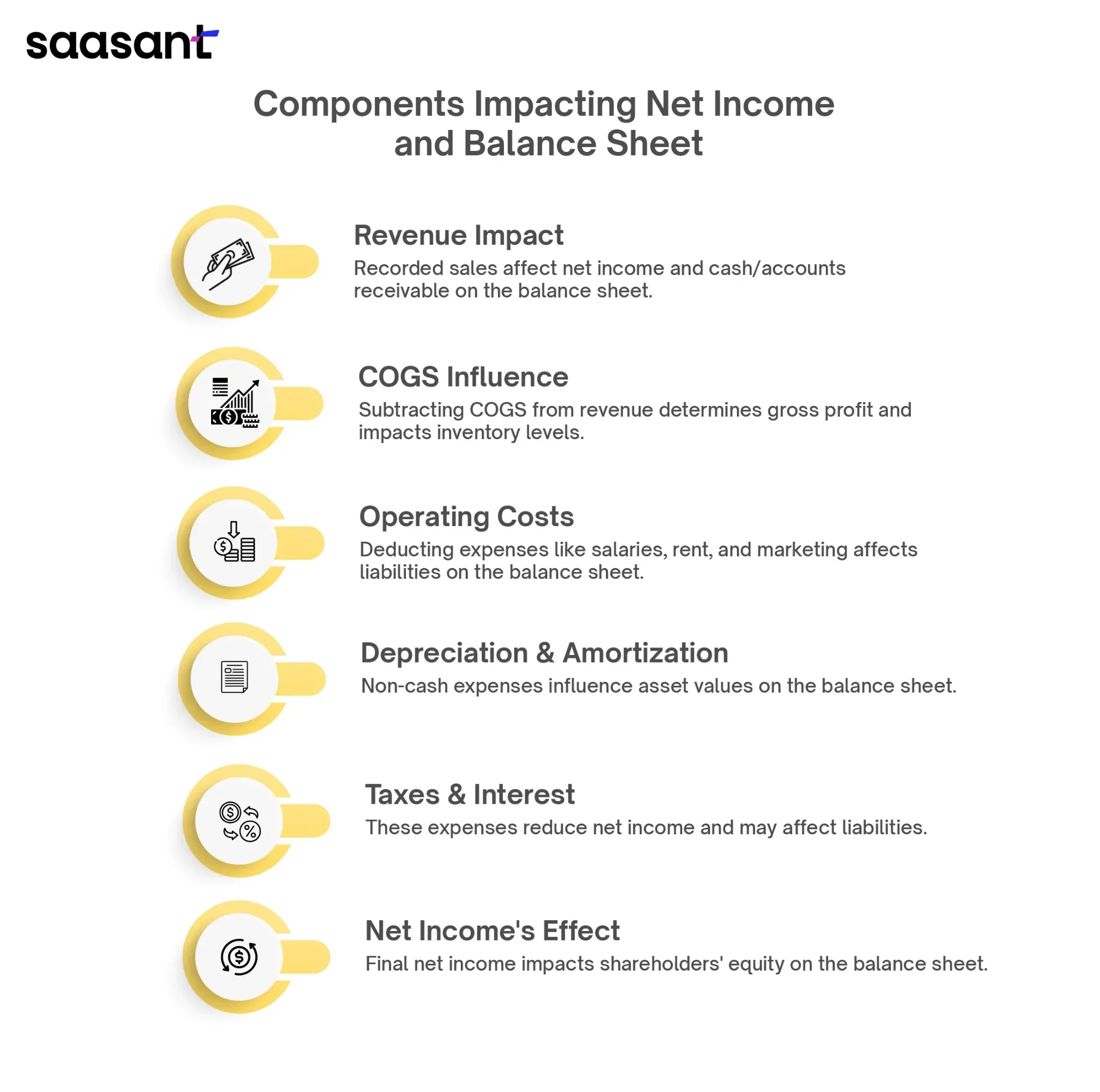

Interlinking Process: Net income is directly linked to the balance sheet and the income statement. Here's how they interconnect:

Revenue Recognition: Revenue from sales is recorded on the income statement, which affects net income. Simultaneously, this revenue increase can lead to increased cash or accounts receivable on the balance sheet.

Cost of Goods Sold (COGS): COGS is subtracted from revenue on the income statement to determine gross profit. COGS primarily impacts inventory levels on the balance sheet, reflecting the cost of products sold during the period.

Operating Expenses: Expenses such as salaries, rent, and marketing costs are deducted from gross profit on the income statement. These expenses are often reflected as liabilities or prepaid expenses on the balance sheet.

Depreciation and Amortization: Non-cash expenses like depreciation reduce net income but do not affect cash flow. However, they are reflected in the balance sheet as accumulated depreciation, impacting asset values.

Taxes and Interest: Taxes and interest expenses reduce net income. They are shown on the income statement and may also impact liabilities on the balance sheet.

Net Income Impact: The final net income figure from the income statement is carried over to the balance sheet, affecting shareholders' equity. Positive net income increases equity, while negative net income decreases it.

Understanding the Balance Sheet

The balance sheet is a fundamental financial statement that provides a snapshot of a company's financial position at a specific time. It's called a balance sheet because it must balance, meaning that the total assets must equal the sum of liabilities and shareholders' equity. Let's delve into each component of the balance sheet and explore how it relates to income generation:

Assets: Assets are resources owned by the company that hold economic value and can be used to generate future benefits. They are typically categorized into current assets (e.g., cash, accounts receivable, inventory) and non-current assets (e.g., property, plant, equipment, intangible assets). Assets are crucial in income generation as they are utilized in day-to-day operations and revenue-generating activities. For example, inventory is necessary to produce goods for sale, while equipment and machinery are essential for manufacturing processes.

Liabilities: Liabilities represent the company's obligations or debts to external parties. They can be categorized into current liabilities (e.g., accounts payable, short-term loans) and non-current liabilities (e.g., long-term loans, deferred tax liabilities). Liabilities impact income generation by influencing the company's financial obligations. For instance, interest payments on loans are expenses that reduce net income. However, liabilities can also be strategic, such as using debt to finance expansion projects that can lead to increased revenue in the future.

Shareholders' Equity: Shareholders' equity, also known as owners' equity or net assets, represents the residual interest in the company's assets after deducting liabilities. It consists of contributed capital (e.g., common stock) and retained earnings (profits reinvested in the business). Shareholders' equity is crucial for income generation as it reflects the company's financial health and the extent to which shareholders have a stake in its success. Higher shareholders' equity can give the company more economic leverage and flexibility to pursue growth opportunities and generate income.

Relationship to Income Generation

The balance sheet's components directly influence income generation in several ways:

Assets Utilization: Efficient utilization of assets, such as inventory and equipment, is essential for generating revenue. For example, a manufacturing company must manage its inventory effectively to meet customer demand and maximize sales.

Liability Management: Proper management of liabilities, including debt levels and interest payments, impacts the company's profitability. Too much debt can lead to higher interest expenses, reducing net income, while strategic debt usage can fuel growth and income generation.

Shareholders' Equity Impact: Shareholders' equity reflects the company's financial stability and ability to generate shareholder returns. A strong equity position can attract investors and provide the company with the resources needed for income-generating activities, such as research and development or marketing campaigns.

Core Concepts Needed to Calculate Net Income

To understand net income, it's essential to differentiate it from gross and operational income. Let's clarify these concepts and delve into critical terms related to calculating net income:

Gross Income vs. Net Income

Gross Income: It refers to the total revenue a company generates before deducting expenses. It includes all sources of income, such as sales, interest, and other operating revenues.

Net Income: Net income, or net profit or bottom line, is the amount of money left after deducting all expenses from gross income. These include COGS, operating expenses, taxes, interest, and depreciation.

Operational Income

Operational income, also called operating income or operating profit, focuses specifically on the profitability of core business operations. It excludes non-operating income and expenses, such as gains or losses from asset sales or interest income/expenses.

Operational income is calculated by subtracting operating expenses (including COGS) from gross income.

Key Terms for Calculating Net Income

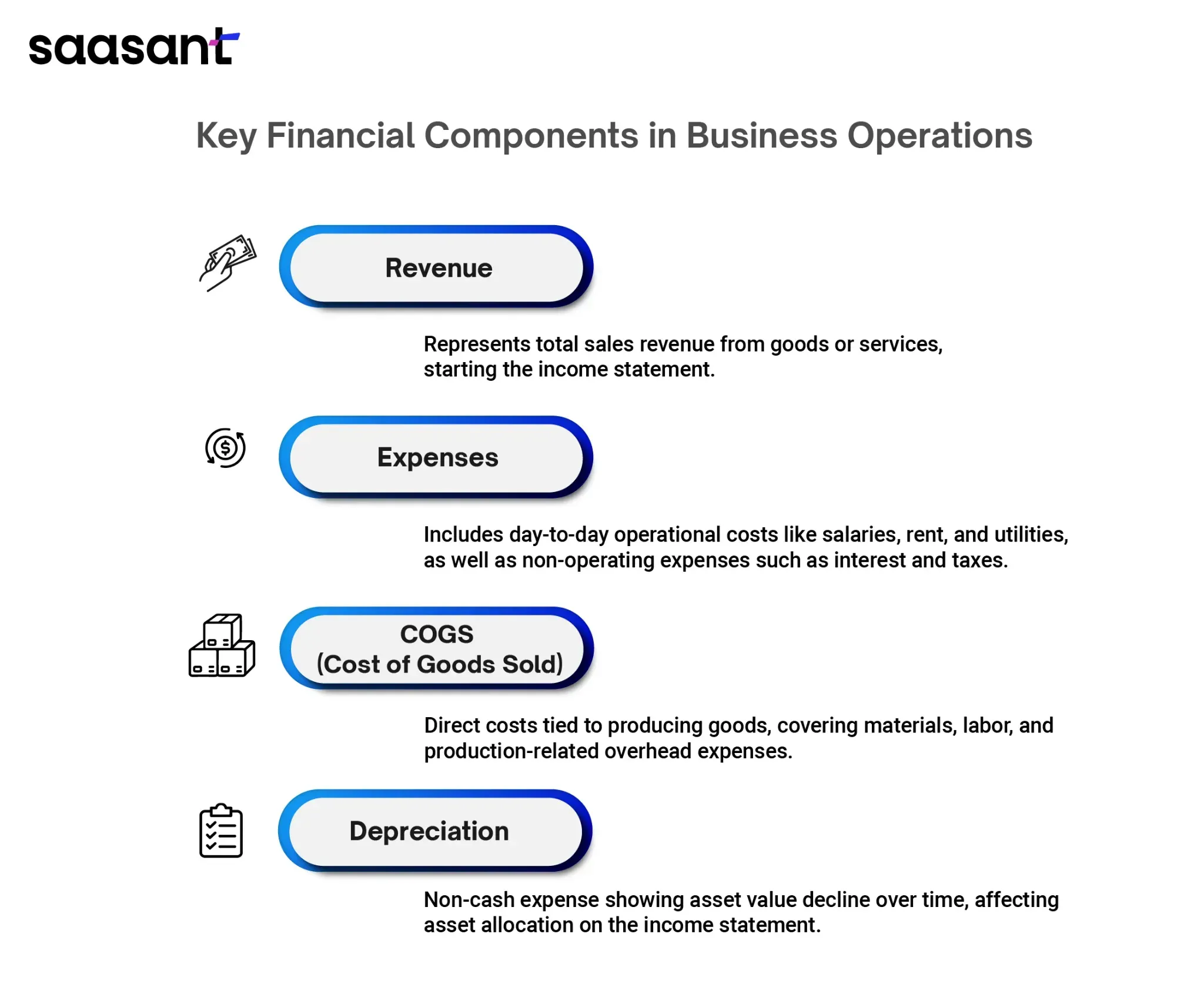

Revenue: Revenue, also known as sales or turnover, represents the total money generated from selling goods or services. It is the starting point in the income statement and contributes to gross income.

Expenses: Expenses are costs incurred by a company in its day-to-day operations. They can be categorized into operating expenses (e.g., salaries, rent, utilities) and non-operating expenses (e.g., interest, taxes).

COGS (Cost of Goods Sold): COGS refers to the direct costs associated with producing or purchasing a company's goods. It includes materials, labor, and overhead costs directly related to production.

Depreciation: Depreciation is a non-cash expense that reflects the gradual decrease in the value of tangible assets (e.g., buildings, equipment) over their useful life. It is recorded on the income statement to allocate the cost of assets over time.

Calculating Net Income

Net income is calculated using the following formula:

Net Income=Revenue−Expenses

Where:

Revenue includes all sources of income.

Expenses encompass operating expenses, COGS, depreciation, interest, and taxes.

Step-by-Step Guide to Calculating Net Income

Identifying Relevant Information:

Total Revenues:

Locate the total revenue figure on the income statement. It's typically listed as "Total Revenue," "Net Sales," or a similar term.

If there are multiple revenue streams, ensure all sources of revenue are included in the calculation.

Expenses:

Identify and gather all types of expenses incurred by the company. These can be found in different income statement sections, such as Cost of Goods Sold (COGS), operating expenses, interest expenses, taxes, and other relevant expenses.

Ensure that both operating and non-operating expenses are accounted for accurately.

Other Necessary Details:

Include any non-operating income or gains contributing to the company's total revenue.

Consider any extraordinary items, one-time charges, or adjustments impacting net income.

Review any relevant notes or disclosures accompanying the financial statements for additional details.

Using Formulas:

Direct Formula Approach:

Calculate net income directly using the formula:

Net Income = Total Revenues−Total Expenses

Subtract total expenses (including operating costs, COGS, interest, taxes, etc.) from total revenues to find the net income figure.

Indirect Approach via Gross Profit:

Calculate gross profit first using the formula:

Gross Profit = Total Revenues−COGS

Then, subtract operating expenses from gross profit to arrive at net income:

Net Income = Gross Profit−Operating Expenses

Conservative Calculation Method:

To adopt a conservative approach, consider incorporating allowances or reserves for unforeseen expenses or potential losses.

Deduct these allowances from total revenues before subtracting expenses for a more conservative net income calculation.

This method helps account for potential risks and uncertainties, providing a more cautious estimate of net income.

Understanding Retained Earnings

Retained earnings are a crucial component of a company's financial statement, representing the cumulative net income retained after distributing dividends to shareholders. Here's an explanation of retained earnings and their role in calculating net income, along with a method to extract net income figures from changes in retained earnings:

Retained Earnings Definition

Retained earnings are the portion of net income that a company retains and reinvests in its operations rather than distributing as dividends to shareholders.

They accumulate over time and contribute to the company's equity, reflecting its profitability and reinvestment strategies.

Calculation

Retained earnings at the beginning of a period (usually the fiscal year) are added to the net income generated.

Dividends paid to shareholders during the period are subtracted from this total to arrive at the retained earnings at the end of the period.

Role in Calculating Net Income

Retained earnings play a significant role in calculating net income as they represent the portion of profits reinvested into the company rather than distributed to shareholders.

Net income, dividends, and any company equity adjustments directly impact them.

Method to Extract Net Income from Changes in Retained Earnings

Start with Retained Earnings Changes

Calculate the change in retained earnings during a specific period. This change is typically reported in the statement of retained earnings or can be derived from the balance sheet by comparing retained earnings at the beginning and end of the period.

Adjust for Dividends

Subtract any dividends paid to shareholders during the period from the change in retained earnings. Dividends reduce retained earnings as they represent distributions of profits to shareholders.

Consider Other Equity Adjustments

Consider any other equity adjustments that impact retained earnings, such as stock issuances, share buybacks, or adjustments for accounting changes.

Adjustments that increase retained earnings, such as net income for the period, should be added back if not included in the change in retained earnings calculation.

Extract Net Income

The net result of the adjustments after considering dividends and other equity changes represents the period's net income.

This method provides a way to extract net income indirectly from changes in retained earnings and other equity-related transactions.

Analyzing the Impact of Net Income

Influence on Business Decisions and Investor Perspective

Business Decisions

Investment Decisions: Net income figures play a crucial role in investment decisions. Higher net income indicates strong profitability, which can attract investors and support fundraising efforts for business expansion or new projects.

Operational Decisions: Businesses use net income to evaluate the success of operational strategies. It helps assess the effectiveness of cost control measures, revenue generation efforts, and overall business performance.

Investor Perspective

Profitability Assessment: Investors use net income figures to assess a company's profitability and financial health. Consistent or growing net income signals a stable and potentially lucrative investment opportunity.

Dividend Potential: Net income influences dividend decisions. Companies with higher net income may be able to pay dividends to shareholders, which is attractive to income-seeking investors.

Implications of Net Income Trends Over Time

Positive Trends

Investor Confidence: Consistently increasing net income over time enhances investor confidence in the company's ability to generate profits and sustain growth.

Market Perception: Positive net income trends can positively impact the company's stock price and perception, attracting more investors and increasing market capitalization.

Negative Trends

Investor Concerns: Declining or negative net income trends raise investors' concerns about the company's financial stability and performance.

Risk Assessment: Investors may perceive companies with declining net income as riskier, leading to reduced investor interest and potential stock price declines.

Strategic Implications

Strategic Planning: Net income trends inform strategic planning. Companies experiencing positive trends may focus on expansion, while those facing challenges may prioritize cost-cutting or restructuring efforts.

Capital Allocation: Net income impacts capital allocation decisions. Companies with net solid income may allocate resources towards research and development, acquisitions, or debt repayment, while those with weak net income may prioritize debt management or operational improvements.

Long-Term Impact:

Sustainability: Sustainable net income growth reflects a company's ability to adapt to market changes, innovate, and maintain competitive advantages over the long term.

Investor Loyalty: Consistent positive net income trends can build investor loyalty and trust, leading to long-term partnerships and support.

Conclusion

Calculating net income from the balance sheet is crucial for businesses and financial stakeholders. It clearly explains profitability, economic health, and performance, influencing decision-making and strategic planning. This knowledge empowers better financial planning, informed decisions, investor attraction, and strategic growth. Prioritizing accuracy and transparency in financial reporting is vital to long-term success and value creation.

FAQs

Can you calculate net income directly from the balance sheet?

No, you cannot directly calculate net income from the balance sheet. The balance sheet provides a snapshot of a company's financial position at a specific time, showing assets, liabilities, and shareholders' equity. On the other hand, net income is a figure derived from the income statement, which reflects a company's performance over a period (usually a quarter or a year).

How does the balance sheet relate to calculating net income?

The balance sheet offers valuable context for interpreting net income. Here's how:

Changes in equity: Net income ultimately flows into the shareholders' equity section of the balance sheet, specifically retained earnings.

Expense impact: Expenses like depreciation (reflected in the balance sheet) reduce net income on the income statement.

What information from the income statement is needed to calculate net income?

To calculate net income, you need the following information from the income statement:

Total Revenue

Cost of Goods Sold (COGS)

Operating Expenses

Interest Expense (if applicable)

Taxes

Is there a formula to calculate net income using the income statement?

Yes, the formula for net income is:

Net Income = Total Revenue - Total Expenses

Total expenses include COGS, operating expenses, interest expense, and taxes.

How can I find the income statement to calculate net income?

The income statement is typically included in a company's annual report or financial filings, which can be found on the company's investor relations website or financial databases.