How to Check Klarna Spending Limit?

If you're new to Klarna, Klarna is nothing but the popular buy-now-pay-later service that allows you to split your purchases into installments. offers flexible payment options for online and in-store purchases. You can split your purchase into three interest-free installments or pay it off within 30 days.

But before you begin shopping on Klarna, it's essential to understand your Klarna spending limit, how to check it, ways to boost your credit limit on Klarna, and much more.

Contents

How to Check Your Spending Limit on Klarna

Understanding Klarna Credit and Spending Limits

Factors That Increase Your Klarna Spending Limit

Ways to Increase Your Klarna Limit

Tips for Boosting Your Klarna Limit: What to Follow and What to Avoid

What happens When You Fail to Pay Klarna?

Conclusion

FAQs

How to Check Your Spending Limit on Klarna

To verify your spending limit with Klarna, you must have a Klarna account. If you're not an existing user, you can register for an account via Klarna’s website or the Klarna app. After creating an account, follow the below steps to check your spending limit on Klarna:

Open the Klarna app

Click on ‘You’ section

Click on ‘Purchasing Power’ on the top left to check your limit

Note: If your spending limit isn't showing up, this might be because Klarna has not approved your account yet. Another reason your spending power is not shown is that Klarna is unavailable in certain locations.

In that case, there are alternative ways to check your spending limit. To check Klarna purchase power in the app,

Open the app and tap the ‘Wallet’ tab at the bottom

Choose one of the retailers from the list (Just choose one as we are not going to make a purchase)

Then, click on ‘Create Digital Card.’

Enter an amount like $3000 or higher, for example

Now, you can see the error message showing your maximum spending limit (e.g., $1500).

Understanding Klarna Credit and Spending Limits

The Klarna limit shows that the total credit Klarna offers to a user is influenced by various factors like credit and payment history, income, and employment status. A higher limit with Klarna enhances your buying power which allows you to purchase more or costlier products that are not affordable. With a greater Klarna limit, you gain the flexibility to shop on your terms and purchase your preferred products.

Factors That Increase Your Klarna Spending Limit

Several factors increase your Klarna credit limit, including:

Credit score is a crucial factor in setting your Klarna limit. A higher credit score can lead to a larger Klarna credit limit.

Paying your dues consistently is another important factor. Regular, on-time payments can boost your chances of receiving an increased Klarna limit.

Your earnings level is critical in determining your Klarna limit. Those with higher incomes tend to qualify for larger Klarna credit limits.

Your job stability and income level affect your Klarna limit, with stable employment or higher income improving your chances of a higher limit.

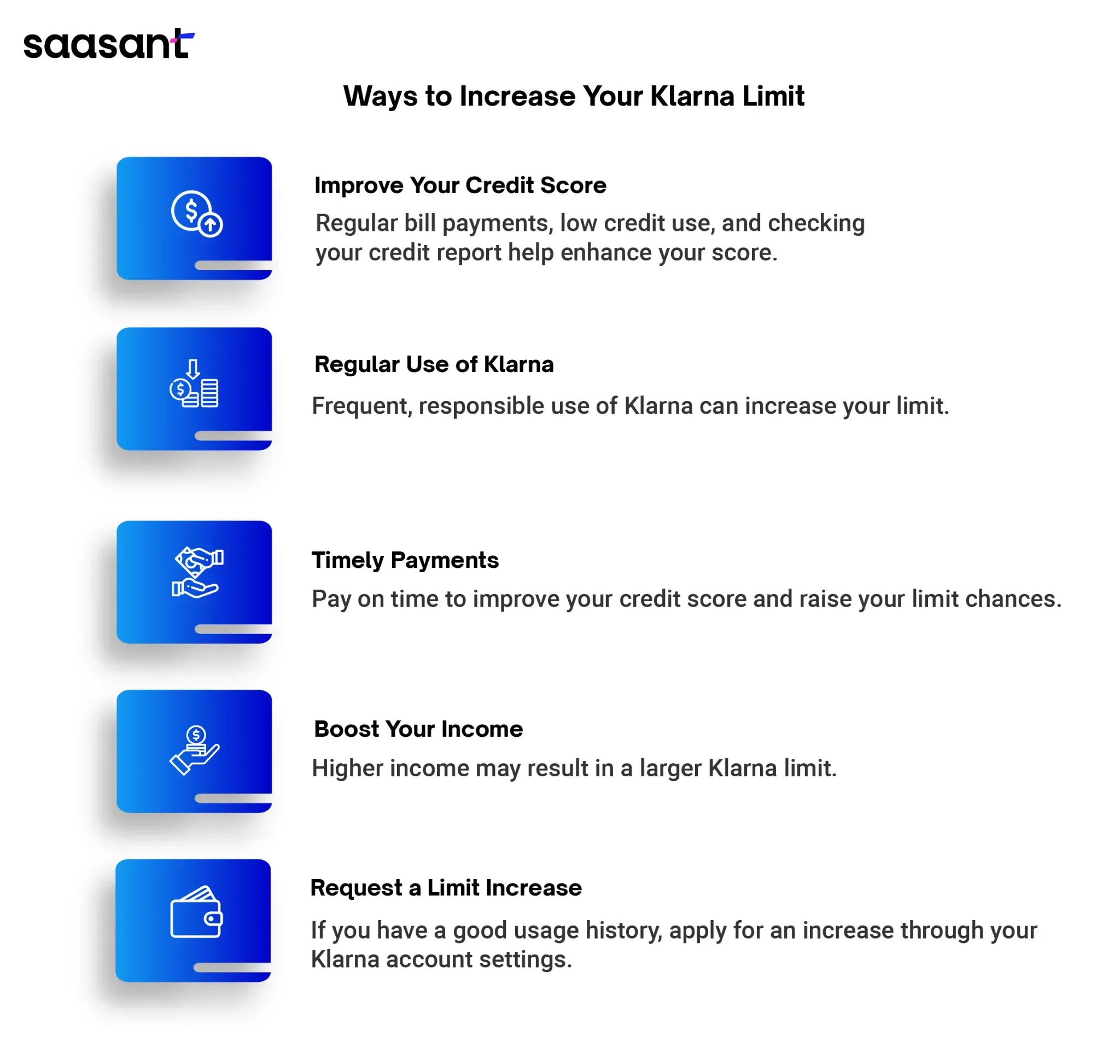

Ways to Increase Your Klarna Limit

Your Klarna limit isn't fixed and can be increased anytime with the right strategy. Below are some of the ways to increase your Klarna limit:

Improve Your Credit Score

Enhancing your credit score is vital for increasing your Klarna limit. Achieve this by paying bills regularly, maintaining low credit usage, and regularly reviewing your credit report for accuracy.

Regular Use of Klarna

Using Klarna often shows your reliability as a user which potentially leads to a higher limit. As a user ensure to use Klarna in a responsible way to avoid excessive spending.

Timely Payments

Consistent, on-time payments are another important factor in increasing your Klarna limit. Delayed payments can damage your credit score and reduce the likelihood of a limit increase.

Boost Your Income

A higher income can lead to a higher Klarna limit, as income is a crucial factor in its determination. Increasing your income through additional work or securing a higher-paying job could positively impact your Klarna limit.

Request a Limit Increase

If you've consistently used Klarna responsibly and have a solid payment history, consider requesting a limit increase. You can do this by logging into your Klarna account, navigating to account settings, and selecting “Increase Limit.” Klarna will then assess your account to decide if you're eligible for a higher limit.

Tips for Boosting Your Klarna Limit: What to Follow and What to Avoid

To boost your Klarna limit, following certain practices and avoiding others is essential. Here are some tips to follow and pitfalls to avoid to increase your Klarna limit:

To follow:

Since your credit score significantly impacts your Klarna limit, regularly checking it ensures it remains accurate and current.

Use Klarna consciously to keep your credit utilization low, which can positively affect your credit score and potentially raise your Klarna limit.

Consistent on-time payments contribute to a favorable payment history, enhancing the likelihood of a Klarna limit increase.

Avoid excessive spending with Klarna, particularly for unplanned or impulse purchases, to manage your financial obligations wisely.

To avoid:

Applying for excessive credit can negatively impact your credit score, and diminish your chances of a higher Klarna limit.

Late payments can damage your credit score and decrease the probability of increasing your Klarna limit.

Do not ignore Klarna's notifications as it can lead to overlooked payments. Also, it can affect your credit score and reduce your chances of a higher limit.

Using your Klarna limit to its fullest can negatively affect your credit score and lessen the opportunity for a limit increase.

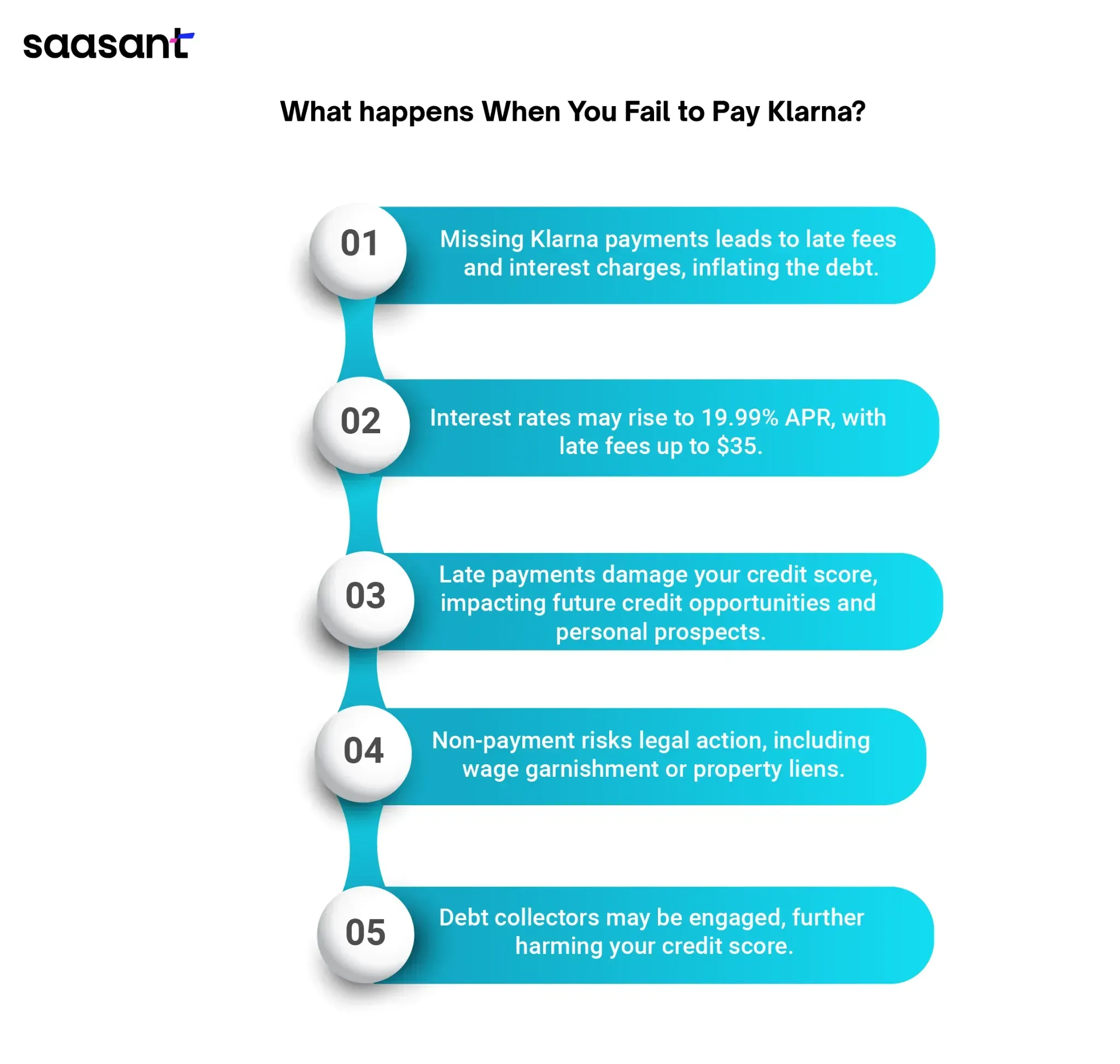

What happens When You Fail to Pay Klarna?

Paying Klarna on time is crucial to avoid late fees, interest charges, and a negative impact on your credit score. Delayed payments can lead to banning your account, damaging your credit further, and potentially leading to legal action.

Late Fees and Interest

Missing a Klarna payment causes late fees and interest charges. As a result, the total amount of money you owe to Klarna will increase beyond the original purchase amount. Interest can reach up to 19.99% APR, significantly increasing the debt over time, while late fees can be as much as $35, adding to the financial burden.

Credit Score Impact

Late payments are reported to credit bureaus, adversely affecting your credit score. This can hinder your future ability to secure credit, obtain favorable loan terms, or even impact your chances of renting an apartment, securing a job, or getting insurance.

Legal Consequences

If you do not pay your Klarna bills, the company has the right to initiate legal proceedings against you to recover the unpaid amount. This legal action can result in wage garnishment, where a portion of your salary is taken directly by the court to pay off the debt, or liens on your property, where a legal claim is placed on your assets until the debt is cleared.

Such actions can have lasting negative effects on your financial situation, making it difficult to manage your finances effectively over time.

Debt Collection

Failure to pay may result in Klarna involving debt collectors, who could contact you frequently and report your debt, further damaging your credit score.

To prevent these factors, ensure timely repayment to Klarna, which not only avoids negative consequences but also helps in building a positive relationship with Klarna, possibly leading to enhanced credit limits and terms in the future.

Conclusion

Understanding your Klarna spending limit is crucial to avoid unexpected problems during purchases and to enhance your buying capacity. Moreover, understanding how to use Klarna can significantly improve your ability to use its benefits. Knowing how to navigate Klarna's features and payment options allows for smoother transactions and potentially better financial management.

FAQs

Does Klarna have a spending limit?

Yes, Klarna sets a spending limit for each customer based on factors like credit score, income, and purchase history.

How do I raise my limit on Klarna?

To increase your Klarna limit, maintain a good payment history, use Klarna services regularly, improve your credit score, and increase your income if possible.

How many purchases can you make with Klarna at once?

The number of purchases you can make with Klarna at once depends on your spending limit and the cost of the products you’re purchasing.

Does Klarna allow 12-month payments?

Klarna offers various payment plans, including longer-term options that can extend up to 12 months, depending on the retailer and purchase amount.

What is the pay-in-4 limit on Klarna?

The pay-in-4 limit on Klarna varies based on your spending limit and financial standing with Klarna. This plan allows you to split your purchase into four equal payments.