How to Create a Cash Flow Forecast? Essential Tips and Tools

Understanding cash flow forecasting is vital to maintaining a business's fiscal health. Assuming you are a business owner or financial manager looking to manage their cash flow effectively. Maybe you aim to predict future cash inflows and outflows to avoid liquidity issues, but you often face challenges like inaccurate financial records or unexpected expenses.

This could be due to limited or inaccurate data or an overwhelming amount of data. What you need is a cash flow forecasting tool, a tool to maintain data accuracy for accurate forecasts, and easy steps to create cash flow forecasts.

This blog will walk you through the ins and outs of cash flow forecasting, from creating a basic one with Excel to using advanced tools for accuracy with minimal effort, examples, and cash flow forecast templates.

Feel free to skip to the section you need using the Table of Contents below.

Contents

What Are the Components of a Cash Flow Forecast?

How to Create a Cash Flow Forecast in 9 Easy Steps?

Cash Flow Forecasting Template

Cash Flow Forecasting Tools

Setting up Accurate Data for Cash Flow Forecasting

Step-by-Step Guide to View Cash Flow Forecast in QuickBooks Online (5 Easy Steps)

Step-by-Step Guide to View Cash Flow Forecast in QuickBooks Desktop (5 Easy Steps)

10 Tips for Improving Your Cashflow Forecasting

Conclusion

FAQ

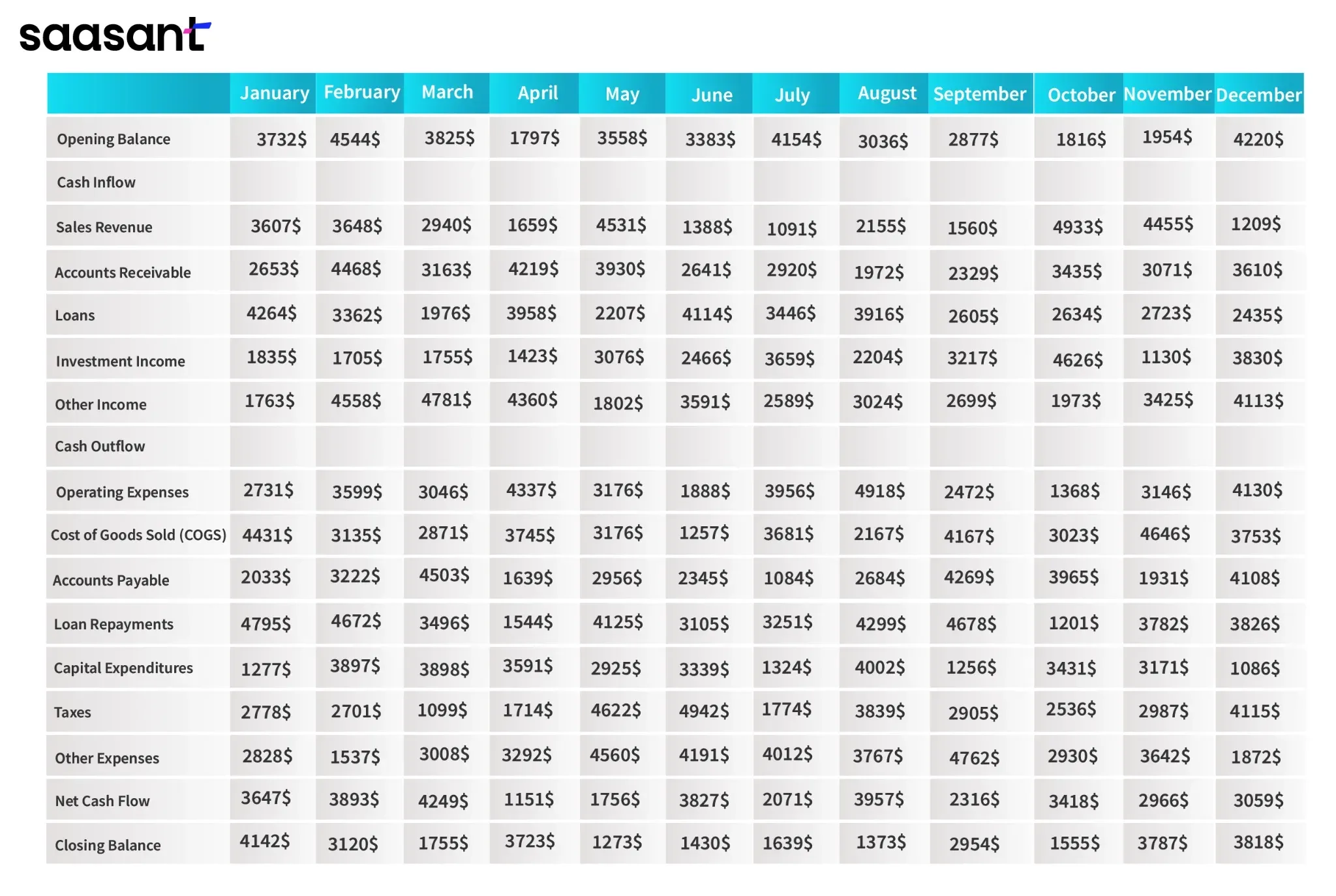

What Are the Components of a Cash Flow Forecast?

Before we get into the steps of how to create a cash flow forecast, let’s get to know the basic components of cash flow forecasting.

Opening Balance: The cash available at the beginning of the forecast period.

Cash Inflows:

Sales Revenue: Money received from selling goods or services.

Accounts Receivable: Expected payments from customers who bought on credit.

Loans: Funds received from borrowing.

Investment Income: Earnings from investments like interest or dividends.

Other Income: Any other cash receipts, such as grants or asset sales.

Cash Outflows:

Operating Expenses: Regular expenses for running the business, like rent, utilities, and wages.

Cost of Goods Sold (COGS): Money spent on producing goods or services sold.

Accounts Payable: Payments to suppliers and creditors.

Loan Repayments: Scheduled payments on borrowed funds.

Capital Expenditures: Money spent on buying or maintaining fixed assets like equipment or property.

Taxes: Payments for income tax, sales tax, or other taxes.

Other Expenses: Any other cash payments, such as insurance or subscriptions.

Net Cash Flow: The difference between total cash inflows and outflows for the period.

Closing Balance: The amount of cash available at the end of the forecast period, carried forward to the next period's opening balance.

How to Create a Cash Flow Forecast in 9 Easy Steps?

Here is a step-by-step guide on how to make a cash flow forecast. Follow these 9 easy steps to gain a clear view of your cash inflows and outflows, enabling you to make informed financial decisions and ensure liquidity.

Step 1: Define the Forecasting Objective

Determine why you are creating the cash flow forecast. This could be to ensure you have enough cash to pay bills, plan for future investments, or manage seasonal fluctuations in your business.

Example: A small retail store wants to create a cash flow forecast to cover rent and inventory purchases over the next three months.

Step 2: Choose the Forecasting Period

Decide the time frame for your forecast. It could be short-term (weekly/monthly), medium-term (quarterly), or long-term (annually).

Example: The retail store chooses a three-month period to cover the upcoming quarter.

Step 3: Select the Forecasting Method

Direct Method: Uses actual cash inflows and outflows to create the forecast.

Indirect Method: Uses financial statements to estimate cash flows.

Example: The retail store chooses the direct method for a more detailed view of daily cash transactions.

Step 4: Gather Financial Data

Collect all necessary financial information, such as sales forecasts, expected customer payments, regular expenses (rent, utilities, wages), and planned investments.

Example: The store gathers data on expected daily sales, monthly rent, utility bills, and payroll expenses.

Step 5: Estimate Cash Inflows

Identify all sources of cash inflow, including sales revenue, accounts receivable, loans, and other income.

Example: The store estimates it will receive $30,000 in sales revenue, $5,000 from accounts receivable, and $2,000 from a small loan over the next three months.

Step 6: Estimate Cash Outflows

Identify all cash outflows, including operating expenses, cost of goods sold (COGS), accounts payable, loan repayments, and other expenses.

Example: The store estimates $10,000 for rent, $3,000 for utilities, $12,000 for wages, and $8,000 for inventory purchases over the next three months.

Step 7: Calculate Net Cash Flow

Subtract total cash outflows from total cash inflows for each period.

Example: For the first month, the store expects $10,000 in inflows and $9,000 in outflows, resulting in a net cash flow of $1,000.

Step 8: Prepare the Cash Flow Forecast

Create a table or spreadsheet to organize your data. Include columns for each period (e.g., weeks or months) and rows for each cash inflow and outflow type.

Example: The store creates a spreadsheet with January, February, and March columns and rows for each inflow and outflow category.

Step 9: Review and Adjust

Regularly review your forecast against actual cash flow and make adjustments as needed.

Example: At the end of January, the store compares actual sales and expenses to the forecast and adjusts February and March projections accordingly.

Cash Flow Forecasting Template

Here is a cashflow forecasting template with a detailed 12-month cash flow forecast table with specific columns for different types of cash inflows and outflows

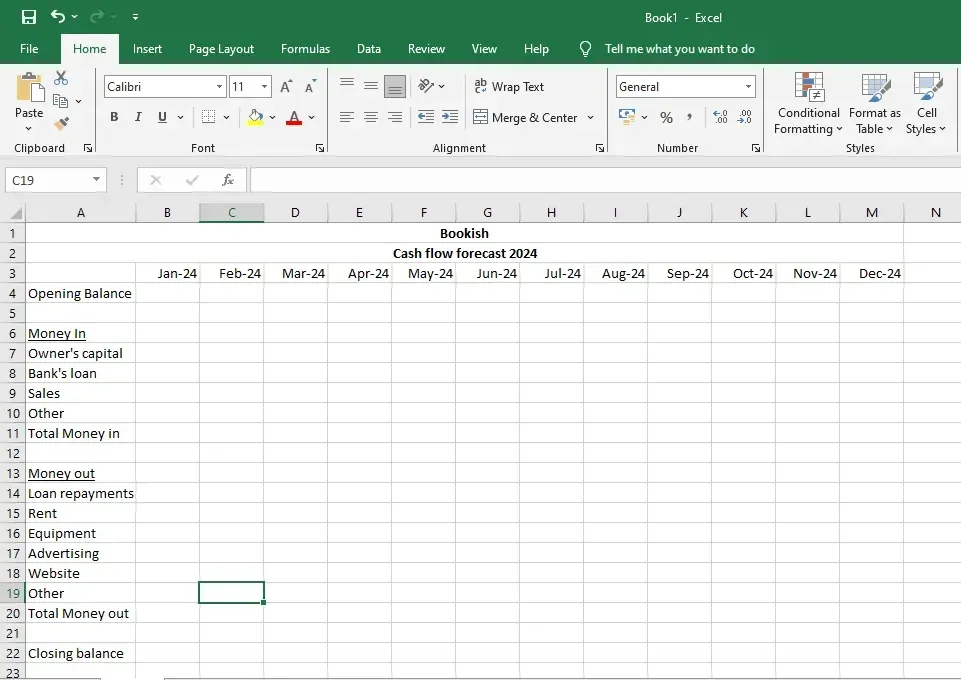

How to Create Cash Flow Forecasting in Microsoft Excel? (With Example)

How to Create Cash Flow Forecasting in Microsoft Excel? (With Example)

Here is a simple guide to creating your cash flow forecast using a Microsoft Excel spreadsheet.

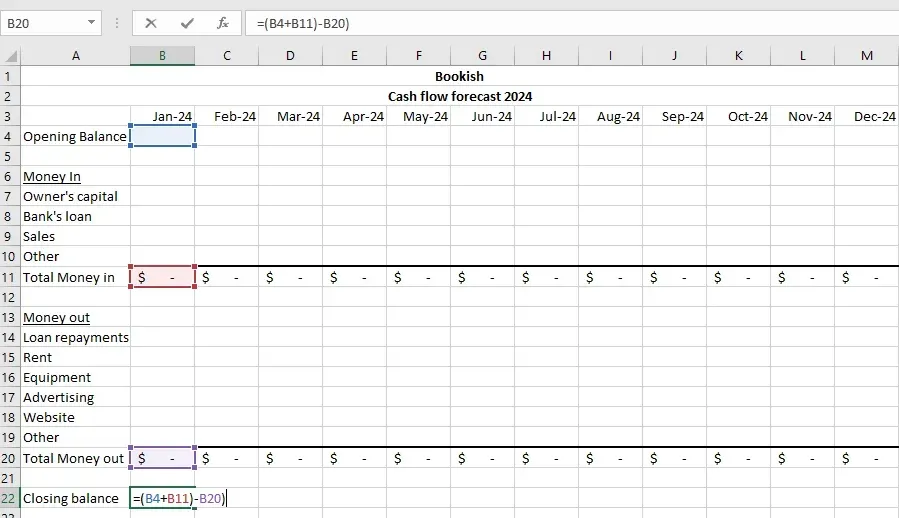

Step 1: Decide the time frame. It could be a week, a month, a quarter, or a year. Add the months to the columns and name the first row as the opening balance. You can also add the months to the rows. It depends on your convenience.

Step 2: Add the components of cash flow in and out. Make it as detailed as possible.

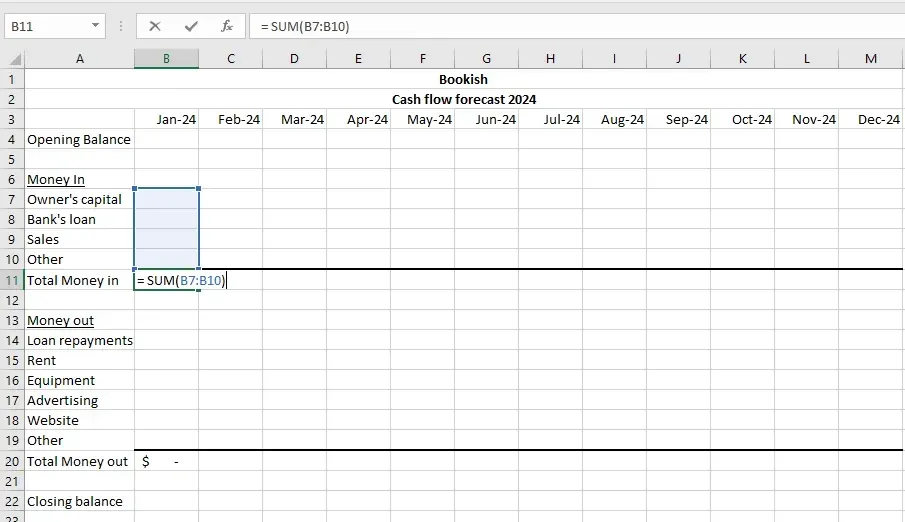

Step 3: Go to the first total money in the cell, enter = sum (select all the cells in cash in), or enter the cell number directly, e.g., =sum(B7:B10). Drag it across the months to apply the formula to the rest of the months, and repeat the same for the total money out.

Step 4: Add a formula for the closing balance. This formula should calculate the sum of the opening balance and total inflows and subtract the total outflows. For example, it could be =(opening balance cell+total cash cell)-total cash out cell. Drag it across the months to apply the formula to the rest of the months.

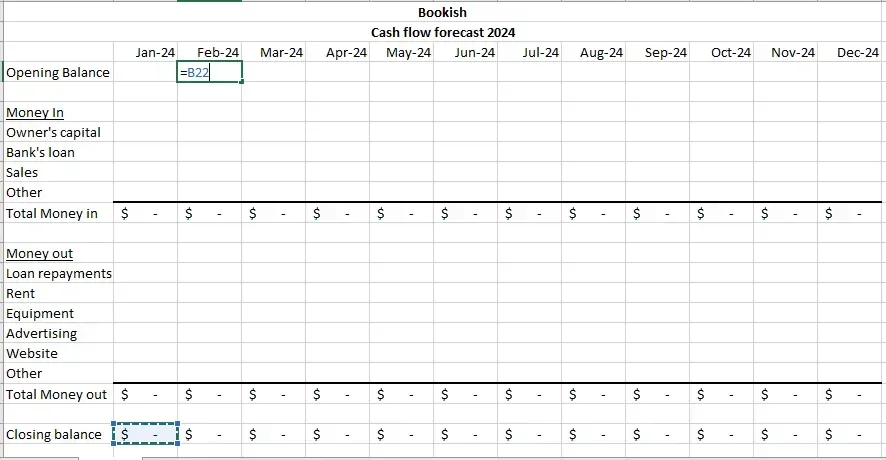

Step 5: Select the opening balance cell of the second month in your sheet and enter the formula =cell number of the previous month's closing balance, e.g., = B22. Drag it across the rest of the months to apply the formula to them.

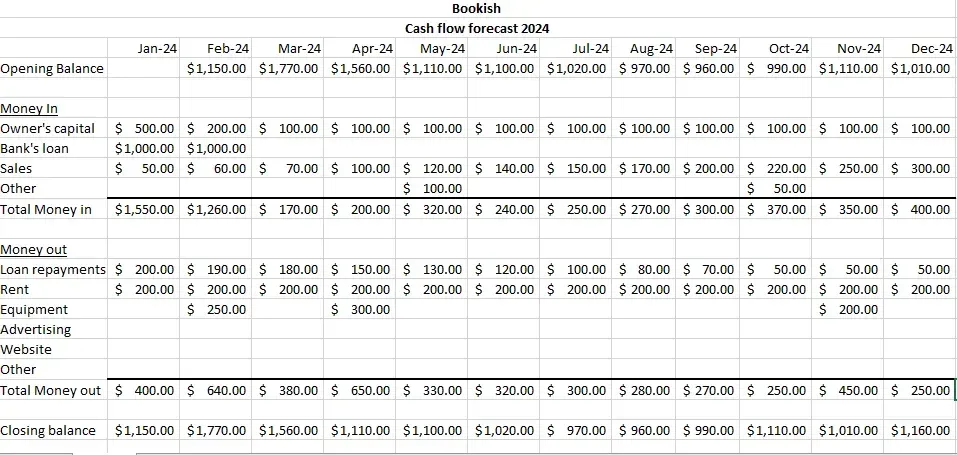

Step 6: Enter the amount in the columns. Predict your sales reasonably and enter the amount. For instance, sales might increase by 10 units each month. Similarly, your loan balance could decrease by 10% each month as repayments are made. Here’s an example of a cash flow forecast for a year. You can right-click the cells and insert a comment to refer to it later.

Step 7: Your opening and closing balances should be positive if you have sufficient cash. If not, they will be negative.

Cash Flow Forecasting Tools

Cash flow forecasting tools are vital for businesses to stay financially healthy and plan. These tools help predict money coming in and going out so companies can see potential shortfalls and make intelligent decisions. One popular cash flow forecasting software is QuickBooks, known for its ease of use and robust analysis features.

When you combine QuickBooks with SaasAnt Transactions, businesses can automate the import and export of large batches of data, reducing the errors that come with manual data entry. This automation makes cash flow forecasting more accurate, helps companies manage their finances better, avoids financial problems, and improves financial planning.

Setting up Accurate Data for Cash Flow Forecasting

Step 1: Log in to QuickBooks, find SaasAnt Transactions in the QuickBooks App Store, and connect it to your QuickBooks account. This certified, secure app has a 4.9-star rating from around 4000 users.

Step 2: Go to SaasAnt Transactions dashboard -> Import -> select the entity you want to import for accuracy. E.g., purchase orders

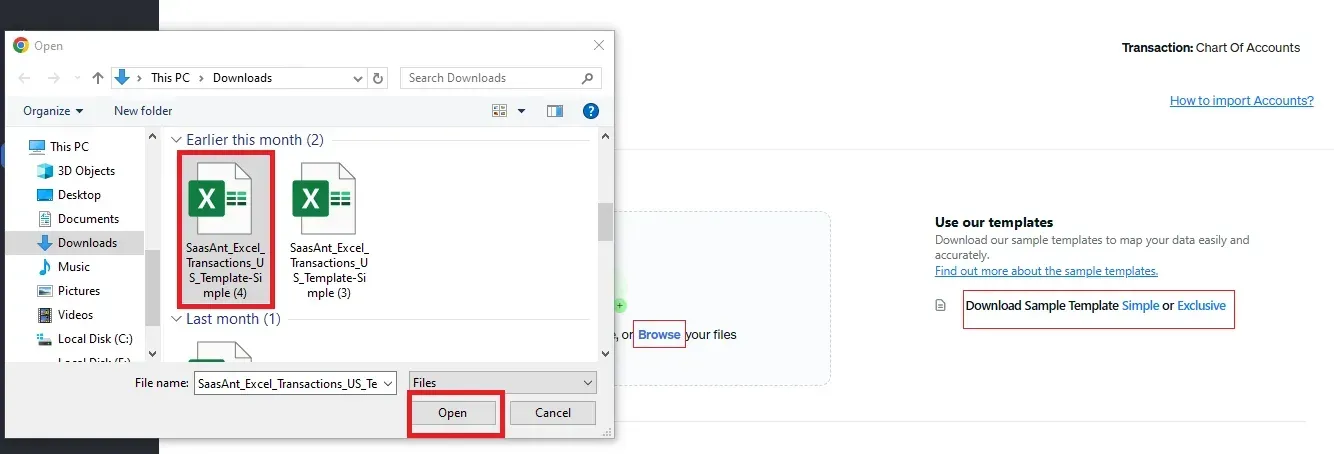

Step 3: Browse and select the file you want to import. You can upload any file format, such as XlS, XLSX, CSV, or IIF. Additionally, if you have a PDF file, you can convert it to Excel within the application.

Step 4: Map the fields in your file to the QuickBooks fields, e.g., If your file lists the purchase order number as a serial number, you must map it correctly to the appropriate QuickBooks fields.

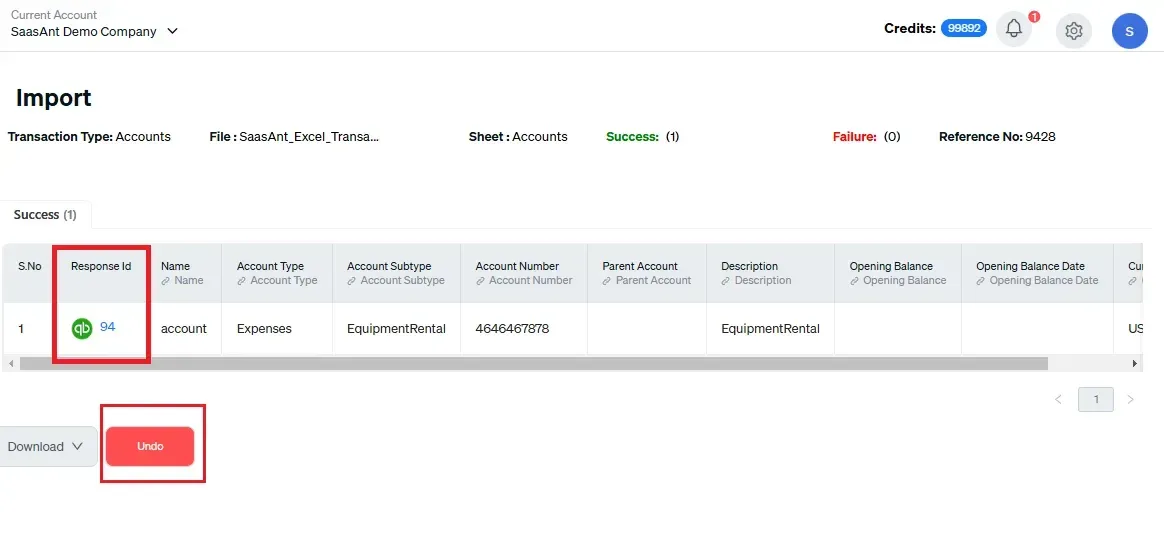

Step 5: Review the data once and click “Upload” to start the import process. Once the file is successfully uploaded, the imported data will appear with their reference number. You can click the reference number to verify if it is imported correctly. You can also reverse the import using the “Undo” button. In case of any errors, the application will give you easy-to-understand instructions to fix them.

Step-by-Step Guide to View Cash Flow Forecast in QuickBooks Online (5 Easy Steps)

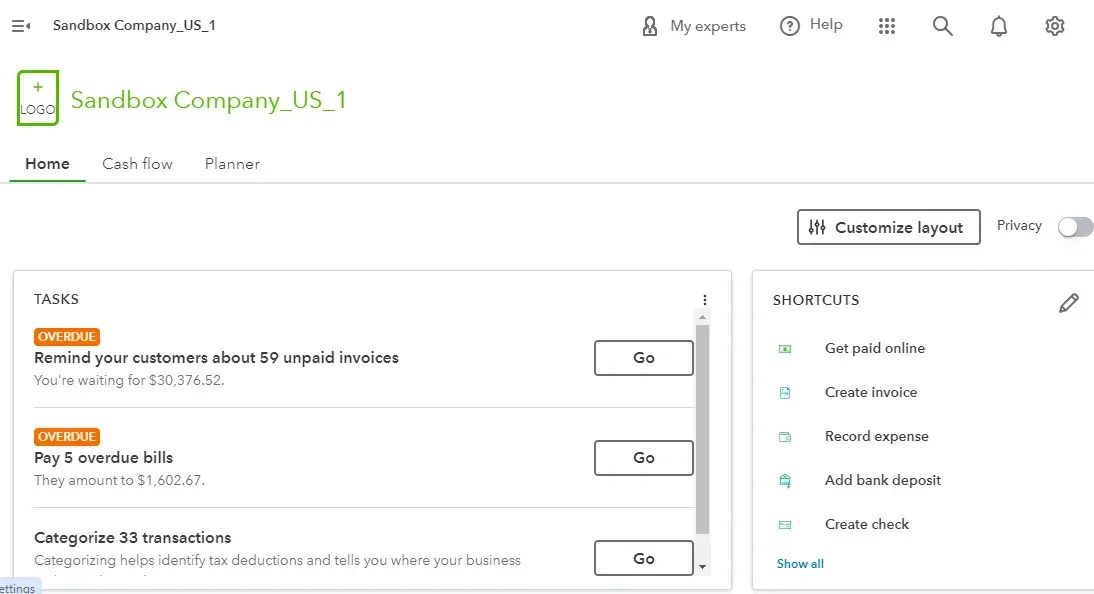

Step 1: Log in to your QuickBooks Online account. Select the Cash Flow menu from the left sidebar to open the Cash Flow Planner or directly access it from your home page.

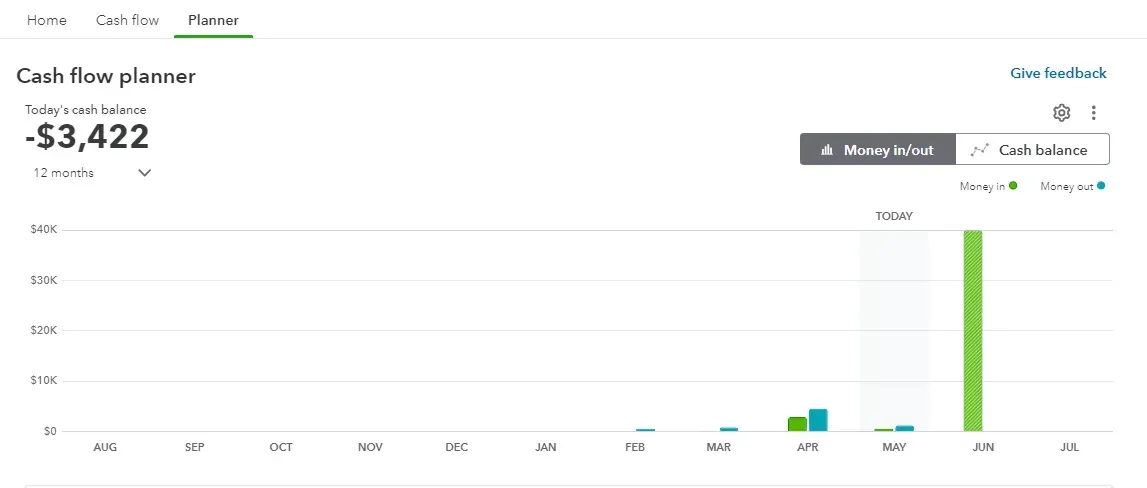

Step 2: If it’s your first time using the planner, QuickBooks might guide you through a brief setup to synchronize all relevant financial data. Click on the “money in/out” option.

Step 3: QuickBooks generates an automatic cash flow forecast based on your financial data, including invoices, bills, and transactions. Examine this forecast to get an overview of expected cash inflows and outflows.

Step 4: Review the graphs and other visual representations detailing the cash flow in and out of your business.

Step 5: Frequently update your cash flow forecast to reflect new financial activities and any changes in your business operations to keep the estimates accurate and valuable.

Step-by-Step Guide to View Cash Flow Forecast in QuickBooks Desktop (5 Easy Steps)

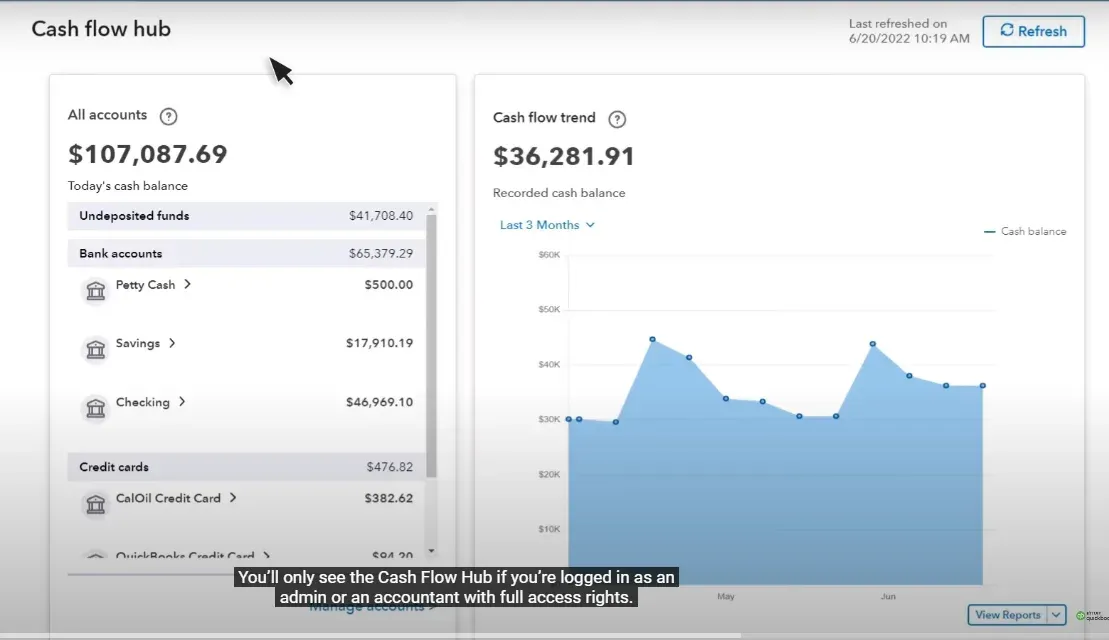

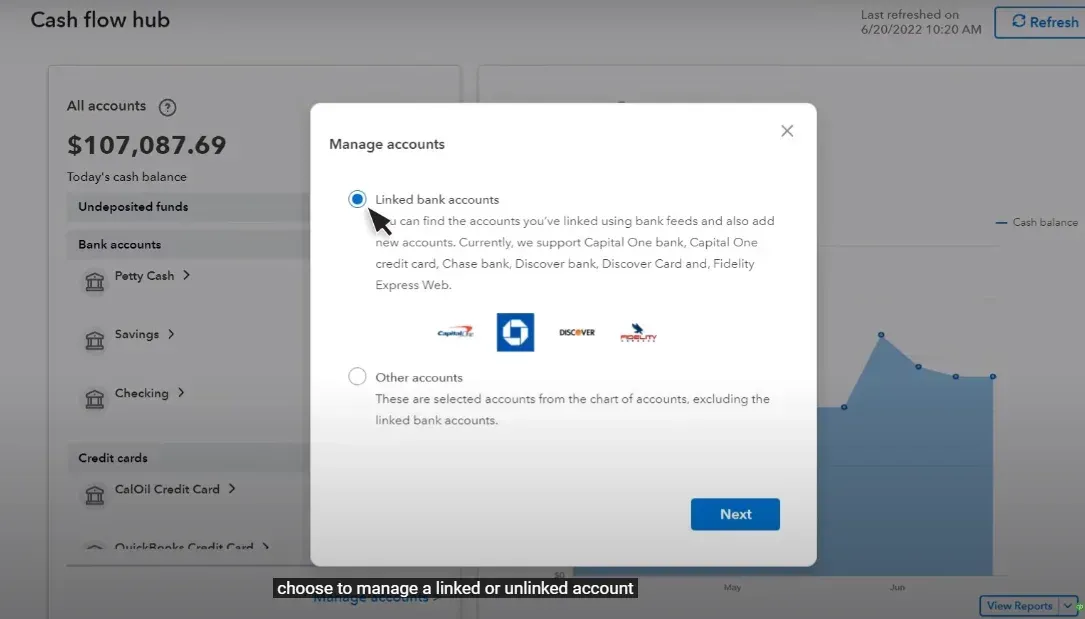

Step 1: Log in to QuickBooks Desktop and navigate to the reports menu -> cash flow hub. If you are an admin or accountant, you’ll have full access to the cash flow hub, where you’ll find your business's bank and credit card accounts.

Step 2: Select manage account -> linked bank account or other account and click next.

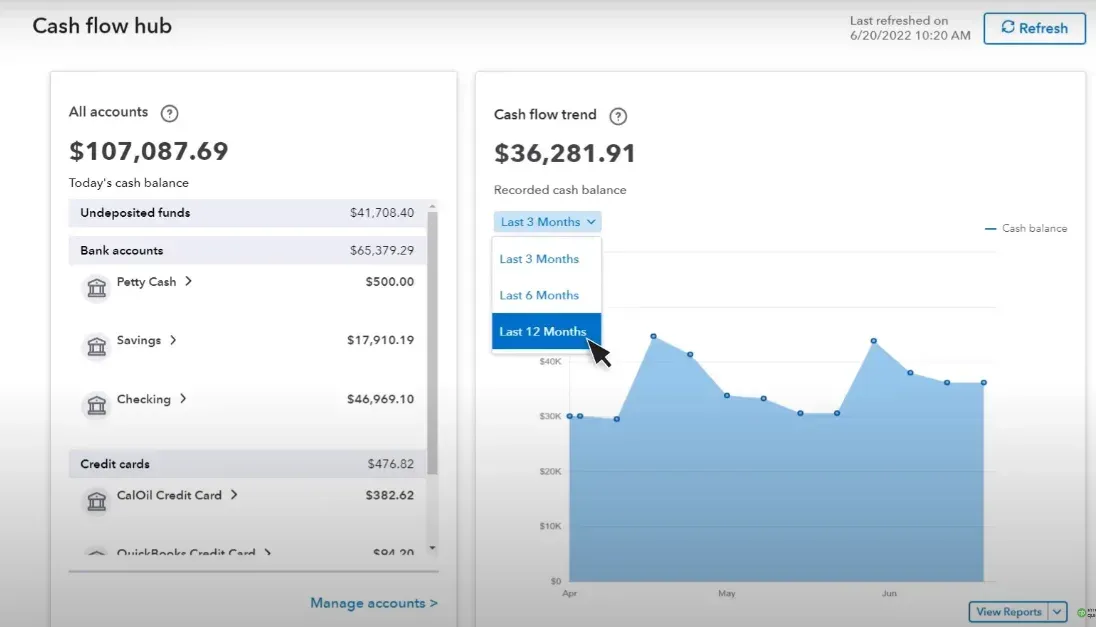

Step 3: QuickBooks builds the cash flow trend based on your transactions and displays your cash balance history.

Step 4: To adjust the view, select the drop-down arrow to change the date range for the graph. You can place your cursor on the graph to see specific cash balance details and the total money in and out for the selected period.

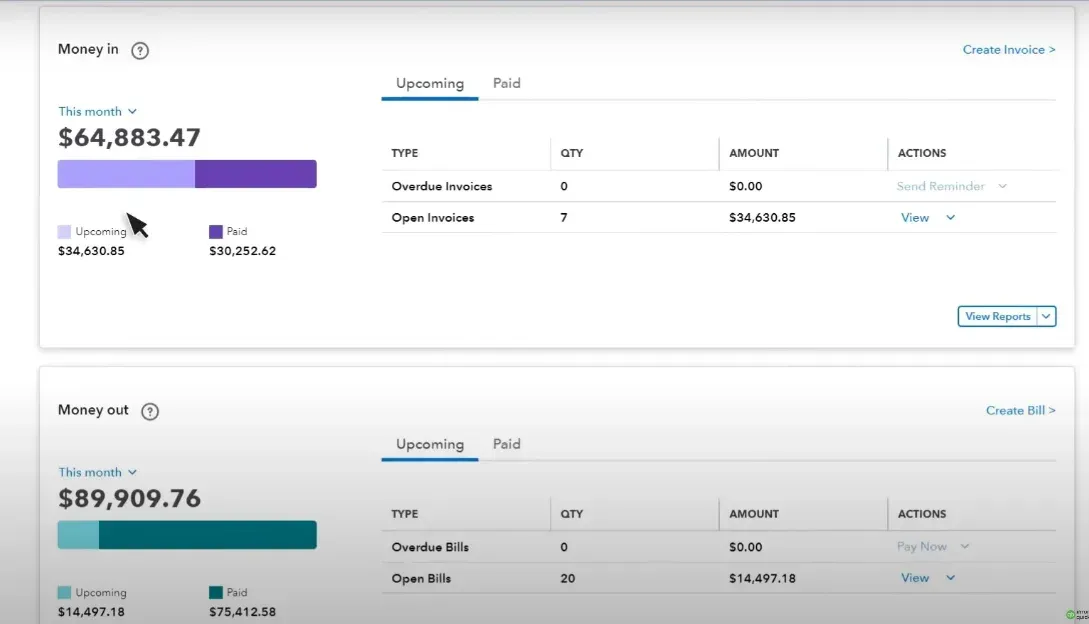

Step 5: Scroll down to access a detailed view of money in and out. The Money In section summarizes income, including invoices, credit memos, and sales receipts. The Money Out section summarizes expenses like bills, checks, and credit card charges. You can switch between Upcoming and Paid views across different time ranges to obtain a comprehensive cash flow overview.

10 Tips for Improving Your Cashflow Forecasting

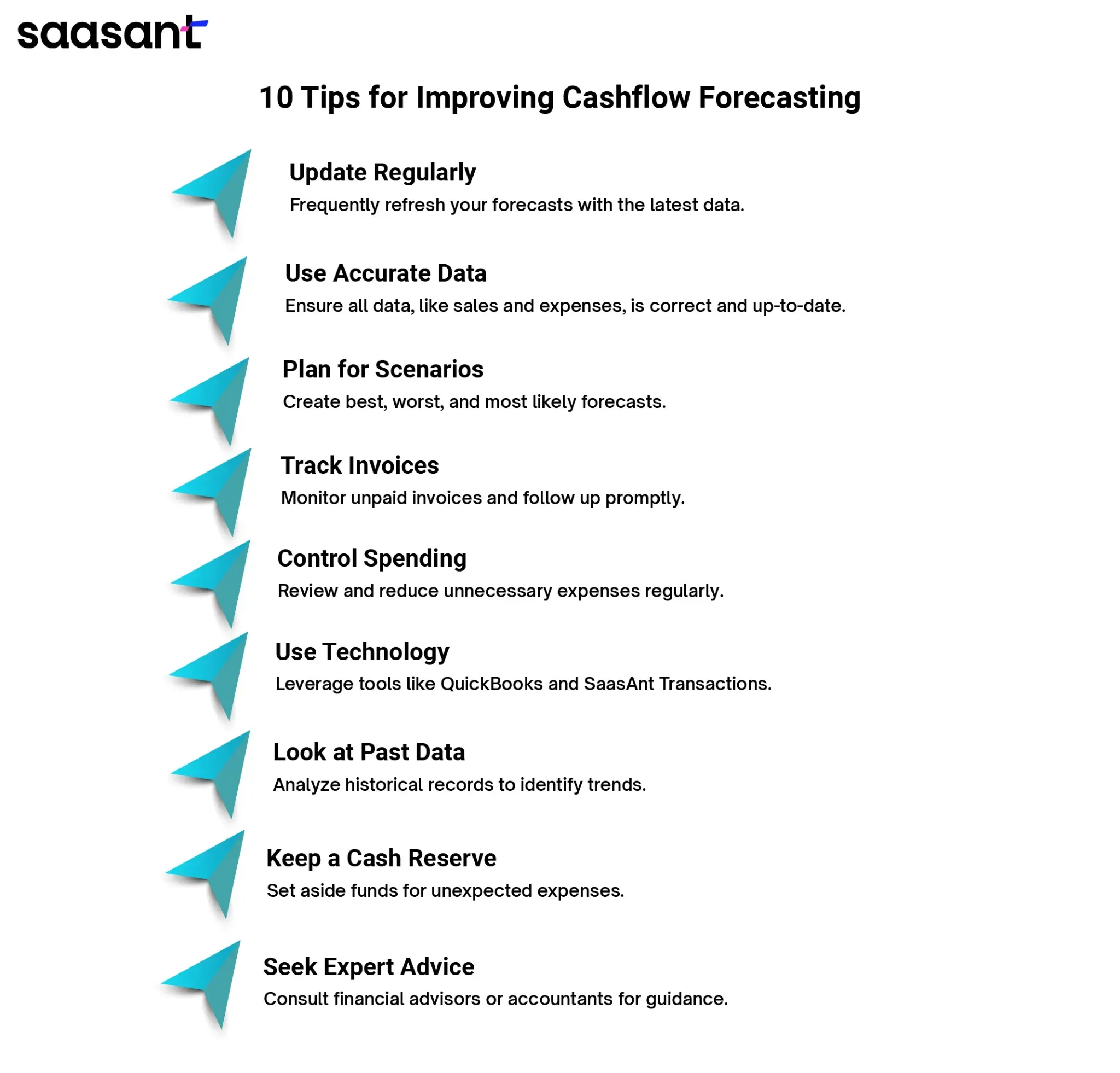

Cash flow forecasting requires constant updating to maintain accuracy. It’s a process, not a one-step solution. Here are 10 practical tips to help you refine your cash forecasting process and achieve greater financial clarity.

1. Update Regularly: Frequently update your forecasts with the latest financial information.

2. Use Accurate Data: Ensure that all your data, such as sales and expenses, is correct and current.

3. Plan for Different Scenarios: Create forecasts for best, worst, and most likely situations to prepare for any outcome. For example, a retailer might forecast revenue for high sales during the holiday season (best case), average sales (most likely case), and lower-than-expected sales due to supply chain issues (worst case).

4. Track Invoices: Monitor unpaid invoices and follow up to ensure timely payment.

5. Control Spending: Regularly check your expenses and reduce unnecessary costs.

6. Use Technology: Utilize accounting software like QuickBooks and applications like SaasAnt Transactions to automate your accounting and bookkeeping processes for accurate cash flow forecasting. Further, PayTraQer helps you automate your e-commerce accounting and bookkeeping with accurate income and expense data from various ecommerce platforms (Amazon, Walmart, Shopify, eBay, etc.) and payment gateways(PayPal, Stripe, Square, Braintree, etc.)to QuickBooks for more accurate cashflow forecasting.

7. Involve Your Team: Get input from different departments to have a complete view of your finances.

8. Look at Past Data: Review previous financial records to spot trends and make better predictions.

9. Keep a Cash Reserve: Set aside money to handle unexpected expenses and smooth out cashflow ups and downs.

10. Seek Expert Advice: Consult with a financial advisor or accountant to improve your forecasting techniques and strategies.

Conclusion

In conclusion, mastering cash flow forecasting is essential for maintaining your business's financial health and growth. By regularly updating your forecasts with accurate data, planning for different scenarios, and using accounting software like QuickBooks with accounting automation applications such as SaasAnt Transactions, you can clearly understand your cash inflows and outflows.

This helps you make informed financial decisions, manage expenses wisely, and always have enough cash to meet your obligations. Investing time in accurate cash flow forecasting ultimately leads to better financial stability and more growth opportunities.

FAQ

How to develop a cash flow forecast?

Collect the necessary data. Use SaasAnt Transactions to import the data into QuickBooks. Use the cash flow planner feature and check the money and out to see expected cash inflows and outflows.

How do I create a cash flow forecast in Excel?

To create a cash flow forecast in Excel, list each month in columns and different cash inflows and outflows in rows. Enter your estimated amounts for each category, calculate the difference between inflows and outflows, and track each month's opening and closing balances.

What is the formula for the cash flow forecast?

The formula for a cash flow forecast typically involves calculating the closing balance for each period. It can be expressed as:

Closing Balance = Opening Balance + Total Inflows - Total Outflows

To forecast cash flow, update the opening balance for the next period using the previous period's closing balance. Repeat this for each period in your forecast.

What are the three main components of the cash flow forecast?

The three main components of a cash flow forecast are cash inflows (money received), cash outflows (money spent), and the net cash flow (difference between inflows and outflows). This helps businesses predict their future financial position and plan accordingly.

Read also

How to Import Budget into QuickBooks Online

Import Journal Entries into QuickBooks Online: Step by Step Guide

Workflow Automation for Bookkeeping and Accounting Professionals

How to Import General Ledger into QuickBooks Online