Is Cost of Goods Sold (COGS) an Asset? Methods, Calculations, and Examples

Dealing with physical goods is complicated. One of the critical complexities lies in understanding the relationship between assets, expenses, and the concept of Cost of Goods Sold (COGS). COGS represents the direct costs associated with producing and selling goods. It's a crucial income statement component, directly impacting a company's profitability.

Sales revenue, the income generated from selling goods, is directly linked to COGS. The higher the COGS, the lower the gross profit. Calculating COGS involves numerous factors, including the cost of inventory, labor, and manufacturing overhead.

This article is all about the Cost of Goods Sold (COGS) explained with methods to calculate it, its impact on a company's financial health, and how it differs from other expenses.

Contents

What is the Cost Of Goods Sold?

What is the Cost of Goods Sold formula?

The Role of Assets in Accounting

COGS and the Accounting Equation

The Expense Nature of COGS

Inventory vs Cost of Goods Sold

COGS and the Income Statement

Cost of Revenue vs. COGS

Operating Expenses vs. COGS

COGS and Financial Analysis

COGS and Taxes

Complexities and Things to Consider When Calculating COGS

Common Misconceptions About COGS

COGS Calculation Tool

Conclusion

FAQ

What is the Cost Of Goods Sold?

The cost of Goods Sold (COGS), or cost of sales, is a crucial accounting term representing the direct costs of producing and selling goods during an accounting period. It is an essential income statement component that directly affects a company's profitability. COGS includes materials, labor, and manufacturing overhead costs for creating the products sold.

What is the Cost of Goods Sold formula?

COGS = Beginning Inventory + Purchases - Ending Inventory

This formula measures the cost of inventory at the beginning of a period, adds the cost of purchases made during the period, and subtracts the cost of inventory remaining at the end.

The Role of Assets in Accounting

Assets are resources owned by a company expected to provide future economic benefits. Inventory is a common type of asset, representing goods held for sale or use in production.

Creating an asset involves acquiring or producing something that will be used or sold. An investment is considered when purchased or developed to generate revenue or provide future benefits.

COGS and the Accounting Equation

The accounting equation, a fundamental principle in accounting, states that a company's assets must always equal its liabilities plus equity. This equation ensures the financial health and accuracy of a company's records. But where does COGS go in the accounting equation? Let’s take a look.

COGS and the Equity Side of the Equation

COGS is an expense account, not an asset or a liability. It is reported on the income statement and directly impacts the company's profitability.

When COGS increases, it reduces net income, decreasing equity. Equity represents the residual interest in a company's assets after deducting liabilities.

COGS and the Assets Side of the Equation

While COGS itself is not an asset, it indirectly affects assets. When a company sells inventory, the cost of that inventory (COGS) is transferred from the asset account (inventory) to the expense account (COGS). This reduces the company's asset balance and increases its expenses.

The Expense Nature of COGS

Is the cost of goods sold an expense? The Cost of Goods Sold (COGS) is a crucial expense on a company's income statement. It represents the direct costs associated with producing and selling goods or services. These costs are incurred to generate revenue and are matched against the revenue earned during the same accounting period.

Matching Principle and COGS

The matching principle is a fundamental accounting concept that requires expenses to be recognized in the same period as the revenue they help generate. For example, the cost of units sold in COGS should be matched against the revenue earned.

For example, if a company sells 100 units of a product, the COGS associated with those 100 units should be expensed in the same period, regardless of when the inventory was purchased.

COGS and Profit Calculation

COGS is a significant factor in determining a company's profitability. It directly impacts the calculation of gross profit, which is the difference between revenue and COGS. A higher COGS reduces gross profit, while a lower COGS increases gross profit.

The formula for calculating gross profit is as follows:

Gross Profit = Revenue - COGS

Once gross profit is determined, other expenses, such as operating and taxes, are subtracted to arrive at net income. A company with a high gross profit margin efficiently manages its costs and generates revenue.

Inventory vs Cost of Goods Sold

Inventory is a current asset representing goods held for sale or use in production. It can include raw materials, work-in-progress, and finished goods. Inventory is a valuable asset for a company as it provides the foundation for generating revenue.

COGS and Inventory Reduction

When a company sells inventory, the cost of that inventory is transferred from the asset account (inventory) to the expense account (COGS). This reduces the company's inventory balance and increases its expenses. The specific cost assigned to each unit of inventory sold depends on the inventory valuation method used.

The Flow of Costs: FIFO, LIFO, and Average Cost

Let’s see what are different accounting methods for COGS.

FIFO (First-In, First-Out): This method assumes that the earliest goods purchased are sold first. In times of rising prices, FIFO results in lower costs of goods sold and higher net income.

LIFO (Last-In, First-Out): This method assumes that the most recently purchased goods are the first ones sold. In times of rising prices, LIFO results in higher costs of goods sold and lower net income.

Average Cost: This method assigns an average product cost to each inventory unit based on the total cost of all units available for sale. The average cost is calculated by dividing the total inventory cost by the total number of units.

The choice of inventory valuation method significantly impacts a company's financial statements, particularly during fluctuating prices.

COGS and the Income Statement

COGS is a separate line item on the income statement, appearing below revenue. It is an expense and is reported on the income statement. COGS does not appear on the balance sheet. However, the inventory used to calculate COGS is reported as a current asset on the balance sheet.

Gross Profit and COGS

Gross profit is the difference between revenue and COGS. It represents the remaining revenue after deducting the direct costs of producing and selling goods. A higher gross profit margin (gross profit as a percentage of revenue) indicates a company's ability to manage its costs and generate revenue efficiently.

Net Income and COGS

Net income is the company's final profit after deducting all expenses, including COGS, from revenue. A higher COGS reduces net income, while a lower COGS increases net income.

Cost of Revenue vs. COGS

The cost of revenue is often used interchangeably with COGS. However, there are subtle differences between the two.

COGS typically applies to companies that sell physical goods. It includes the direct costs of producing and selling those goods, such as materials, labor, and manufacturing overhead.

Cost of revenue can apply to both companies that sell goods and service providers. It includes the direct costs associated with providing services, such as labor, materials, and other expenses directly related to service delivery.

Examples of professions where cost of revenue is used:

Consulting firms: The cost of labor, travel, and other expenses directly related to providing consulting services.

Software companies: The cost of software development, testing, and maintenance.

Creative agencies: The labor, materials, and other expenses associated with creating advertising campaigns or designs.

Operating Expenses vs. COGS

Operating expenses are costs incurred in the day-to-day operations of a business, but they are not directly related to the production or sale of goods or services. Examples of operating expenses include:

Rent

Salaries and wages (for administrative staff)

Utilities

Insurance

Marketing and advertising

Legal fees

While COGS is a direct cost, operating expenses are indirect costs. COGS and operating expenses contribute to a company's overall expenses and affect its profitability.

COGS and Financial Analysis

Before we discuss the financial analysis of COGS, let’s first understand what is included in the Cost Of Goods Sold.

COGS typically includes:

Beginning Inventory: The inventory value is on hand at the accounting period's beginning.

Purchases: The cost of goods purchased during the period.

Production of the Period: The cost of goods produced during the period, including direct materials, direct labor, and manufacturing overhead.

Ending Inventory: The inventory value is at the year's end.

COGS as a Percentage of Sales

COGS as a percentage of sales is a financial ratio that measures the cost of goods sold as a proportion of total sales revenue. It is calculated using the following formula:

COGS as a percentage of sales = (COGS / Sales) * 100

Example:

If a company has a COGS of $50,000 and a total sales of $100,000, its COGS as a percentage of sales would be 50%. This indicates that 50% of the company's revenue is spent on producing and selling goods.

A lower COGS as a percentage of sales generally indicates a more efficient cost structure, while a higher rate may suggest areas for cost reduction.

Inventory Turnover and COGS

The inventory turnover ratio is a financial ratio that measures how efficiently a company manages its inventory. It is calculated using the following formula:

Inventory turnover ratio = Cost of Goods Sold / Average Inventory

Example:

If a company has a COGS of $100,000 and an average inventory of $25,000, its inventory turnover ratio would be 4. This means the company sold its average inventory four times during the year.

A higher inventory turnover ratio generally indicates that the company effectively manages its inventory and minimizes the costs associated with holding excess inventory.

COGS and Taxes

Accurate COGS calculation is crucial for US businesses to minimize their tax liability. COGS represents the direct costs of producing and selling goods, and it is deductible from taxable income. By correctly accounting for COGS, businesses can reduce their taxable income and potentially save on taxes.

Key considerations for COGS and taxes include inventory valuation, direct vs. indirect costs, and period costs. Maintaining detailed records of inventory purchases, sales, and production costs is essential for preparing for potential tax audits.

If this is all too much for you, better to consult with tax professionals to ensure compliance with GAAP (Generally Accepted Accounting Principles) and FRS (Financial Reporting Standards) regarding COGS and tax treatment. Understanding the specific COGS tax rules applicable in the US is vital for avoiding penalties.

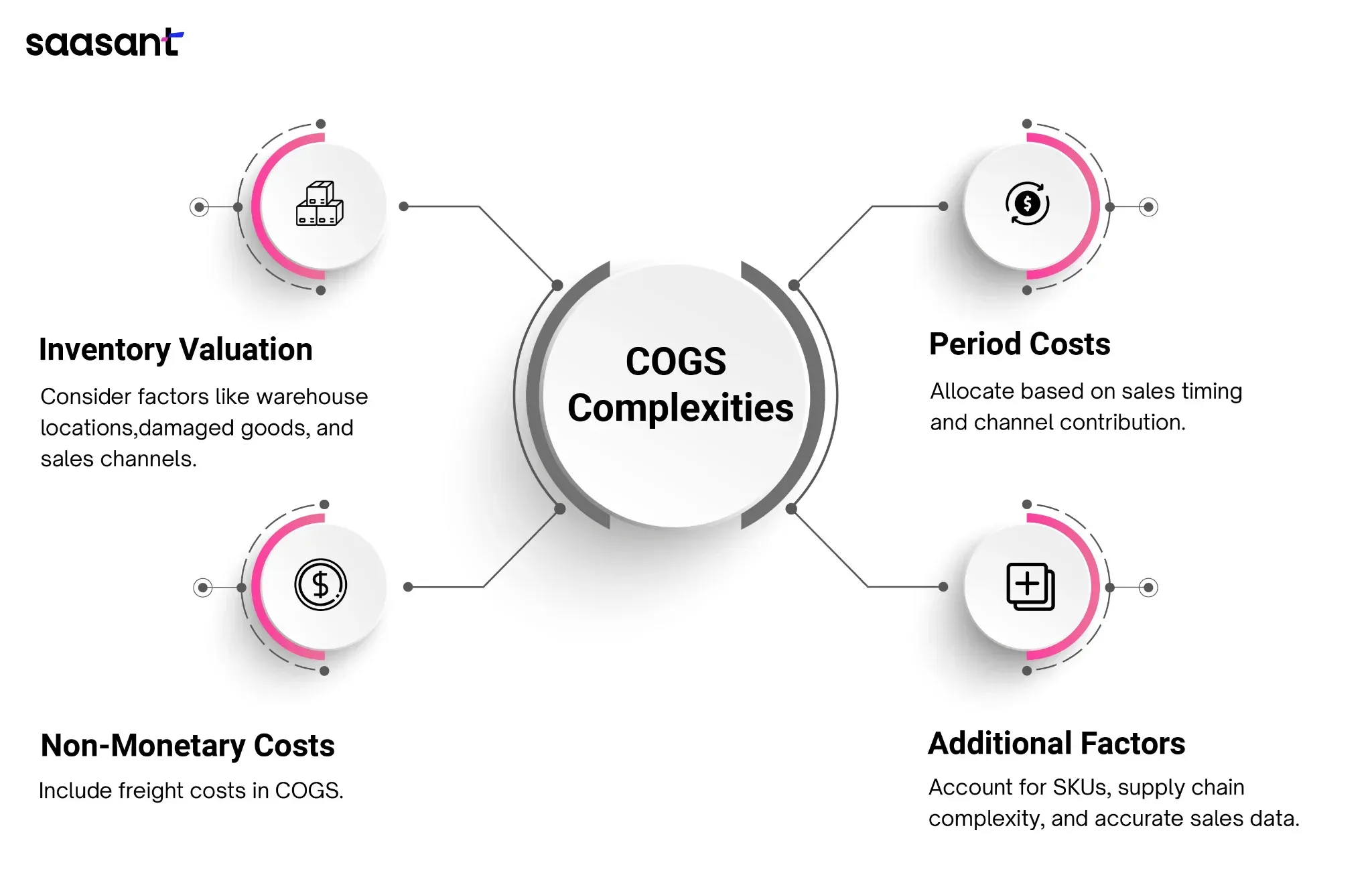

Complexities and Things to Consider When Calculating COGS

Inventory Valuation Methods

Warehouse Locations: A company may need to consider different inventory valuation methods for each location if it operates multiple warehouses.

Damaged Goods: Damaged or obsolete goods may require special treatment in inventory valuation.

Sales Channels: If a company sells products through multiple channels (e.g., online, retail stores, wholesale), it may need to allocate inventory costs to each channel.

Period Costs

Timing of Sales vs. Shipping: The timing of sales and shipping can impact the allocation of period costs (e.g., advertising, sales commissions) to COGS.

Sales Channels: Period costs may need to be allocated to different sales channels based on their contribution to revenue.

Non-Monetary Costs

Freight Costs: Freight costs associated with shipping inventory to warehouses or customers may need to be included in COGS.

Additional Considerations

Number of Accounts and SKUs: Companies with many accounts and stock-keeping units (SKUs) may need help tracking inventory and calculating COGS.

Supply Chain Complexity: A complex supply chain with multiple suppliers, manufacturers, and distributors can make it difficult to track inventory costs accurately.

Common Misconceptions About COGS

COGS is not a current asset. It is an expense.

Inventory is a current asset, but COGS is reported on the income statement.

Prepaid expenses are assets until the goods or services are received and used.

Capital expenditures are not included in COGS. They are capitalized and depreciated over the asset's useful life.

COGS Calculation Tool

COGS calculation can be complex and time-consuming, involving numerous factors and potential pitfalls. Miscalculations can lead to inaccurate financial statements, incorrect tax filings, and suboptimal business decisions.

To simplify the COGS calculation process and ensure accuracy, consider using a dedicated COGS calculation tool like PayTraQer. These tools automate many manual steps in COGS calculation, saving you time and effort.

PayTraQer can automatically sync your sales data into accounting platforms like QuickBooks and Xero.

Here's a quick tip to stay organized and efficient:

Use SaasAnt Transactions to upload accounting data directly into QuickBooks and Xero. This helps you reduce data entry errors and maintain accurate inventory records. You can also automate data uploading through email, FTP/SFTP, or Zapier.

Conclusion

So, the Cost of Goods Sold (COGS) is not an asset. It's an expense that directly impacts a company's profitability. Understanding COGS involves comprehending its relationship with inventory, revenue, and the accounting equation.

Key takeaways:

COGS is a direct expense related to producing and selling goods.

It affects profitability through its impact on gross profit and net income.

Inventory valuation methods influence COGS calculation.

Accurate COGS calculation is essential for financial reporting and tax purposes.

FAQ

What type of account is the COGS?

COGS is an expense account. It represents the direct costs of producing and selling goods during an accounting period. As an expense, COGS is reported on the income statement and directly impacts a company's profitability.

Where do COGS go on a balance sheet?

COGS does not appear on the balance sheet. It is an expense account reported on the income statement. The inventory used to calculate COGS is reported as a current asset on the balance sheet.

Is the cost of goods sold a fixed expense?

COGS is not a fixed expense. It is a variable expense that changes in direct proportion to changes in sales volume. As sales volume increases, COGS will also increase, and vice versa. This is because COGS represents the direct costs of producing and selling goods, which are directly tied to the number of units sold.

Is the cost of goods sold an expenditure?

Yes, the cost of goods sold (COGS) is an expenditure. It is a cost incurred by a business to generate revenue. While the term "expenditure" is often used interchangeably with "expense," "expenditure" can also refer to payments made for capital assets. Conversely, COGS is specifically related to the direct costs of producing and selling goods.