Key Considerations Before Merging Sub-Accounts in QuickBooks

Efficient bookkeeping and accurate financial reporting are essential pillars of any successful business. QuickBooks, a popular accounting software, has become a go-to solution for countless entrepreneurs and finance professionals seeking to manage their financial data seamlessly. Among the many powerful features offered by QuickBooks, merging sub-accounts is an effective way to streamline the chart of accounts and simplify financial tracking.

However, while merging sub-accounts in QuickBooks can be a beneficial step towards improved accounting practices, it is not without complexities. Without proper consideration and planning, merging sub-accounts could lead to unintended consequences that may disrupt financial reporting accuracy and cause headaches.

This article will explore the vital checkpoints to address before executing sub-account mergers in QuickBooks. By the end, you'll have gained the knowledge and confidence to optimize your chart of accounts and elevate your financial management to new heights.

Contents

Considerations Before Merging Sub-Accounts

Step-By-Step Guide to Merge Sub-Accounts in QuickBooks Online

Step-By-Step Guide to Merge Sub-Accounts in QuickBooks Desktop

FAQs

Considerations Before Merging Sub-Accounts

Backup Your Company File

Before making any significant changes to your chart of accounts, always create a backup of your QuickBooks company file. This precautionary step ensures that you have a restore point in case anything goes wrong during the merging process.

Review Your Data

Conduct a thorough review of your existing sub-accounts. Ensure there are no transactions, open balances, or links to other accounts that merging could disrupt. As you conduct the study, look for duplicate or unnecessary sub-accounts that can be merged or consolidated.

Understand the Impact

Merging sub-accounts will consolidate data, which can impact financial reports, tax filing, and budgeting. Understand the consequences of combining each sub-account and how it will affect your financial structure.

Unique Account Types

Ensure that you merge accounts of the same type. For example, asset accounts can only be merged with other asset accounts, liability accounts with liabilities, etc. Merging accounts of different types may result in errors in your financial statements.

Check User Permissions

In multi-user environments, ensure you have the necessary permissions to merge accounts. Only users with appropriate access rights should be allowed to perform this task.

Communicate with Stakeholders

If you use QuickBooks in a team or organization, communicate with relevant stakeholders, such as accountants, managers, or financial advisors, about your intention to merge sub-accounts. Collaboration and consensus can help avoid potential issues later on.

Adjust Account Balances

Before merging, ensure that the sub-account balances accurately reflect the financial position. If there are discrepancies, reconcile the accounts or make adjusting entries.

Note: Once the merging process is complete, it becomes irreversible. Therefore, thoroughly reviewing and validating your data before merging is paramount. Take the time to ensure that the selected accounts are correct and that you have considered all potential implications to avoid any irreversible errors.

Step-By-Step Guide to Merge Sub-Accounts in QuickBooks Online

Step 1: Access Your Chart of Accounts

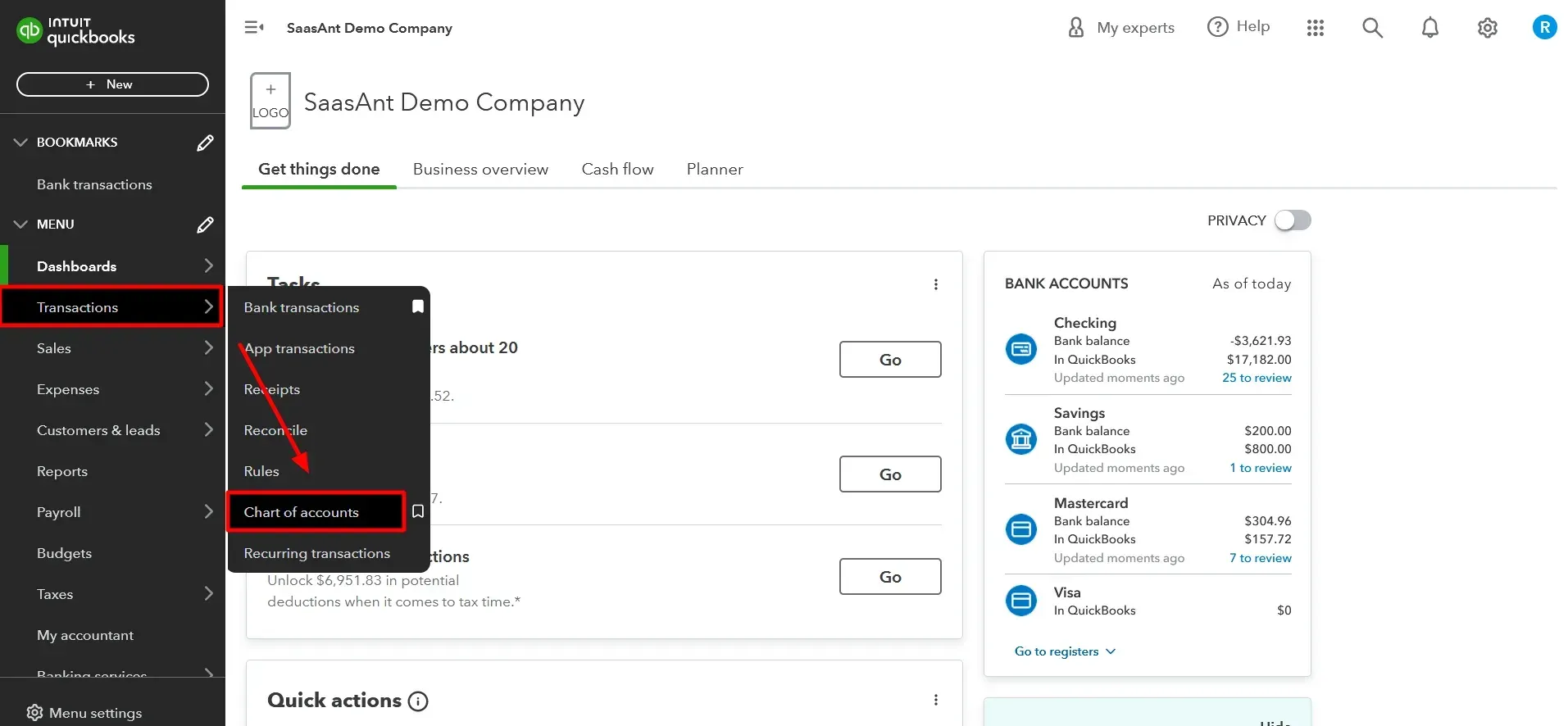

Log in to your QuickBooks Online account and navigate to the Chart of Accounts by navigating to the ‘Transactions’ menu and selecting ‘Chart of Accounts.’

(Transaction -> Chart of accounts)

Step 2: Identify the Accounts to Merge

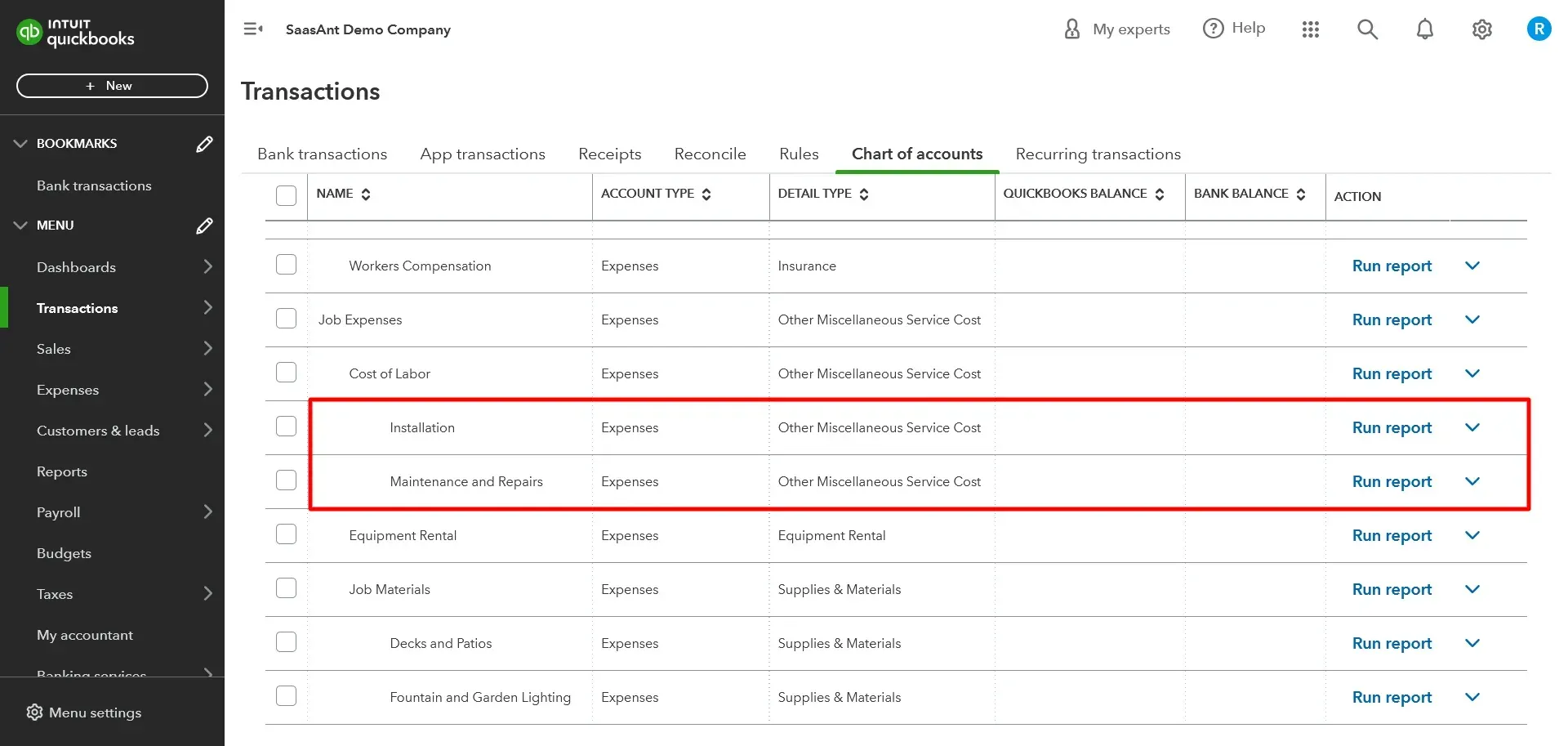

Locate the sub-accounts you wish to merge and make a note of their names, as well as the account to retain after the merge.

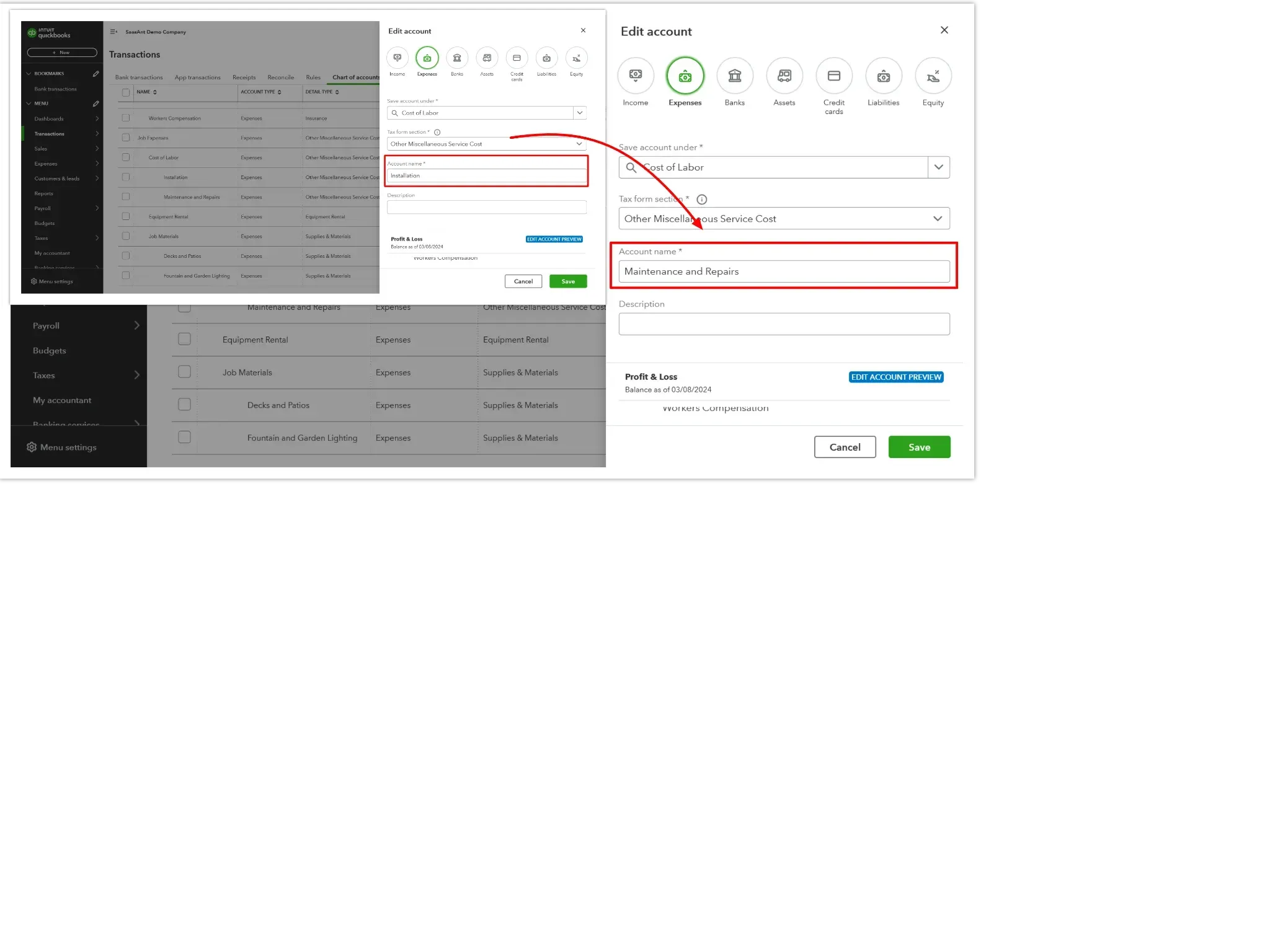

Step 3: Edit Account Details

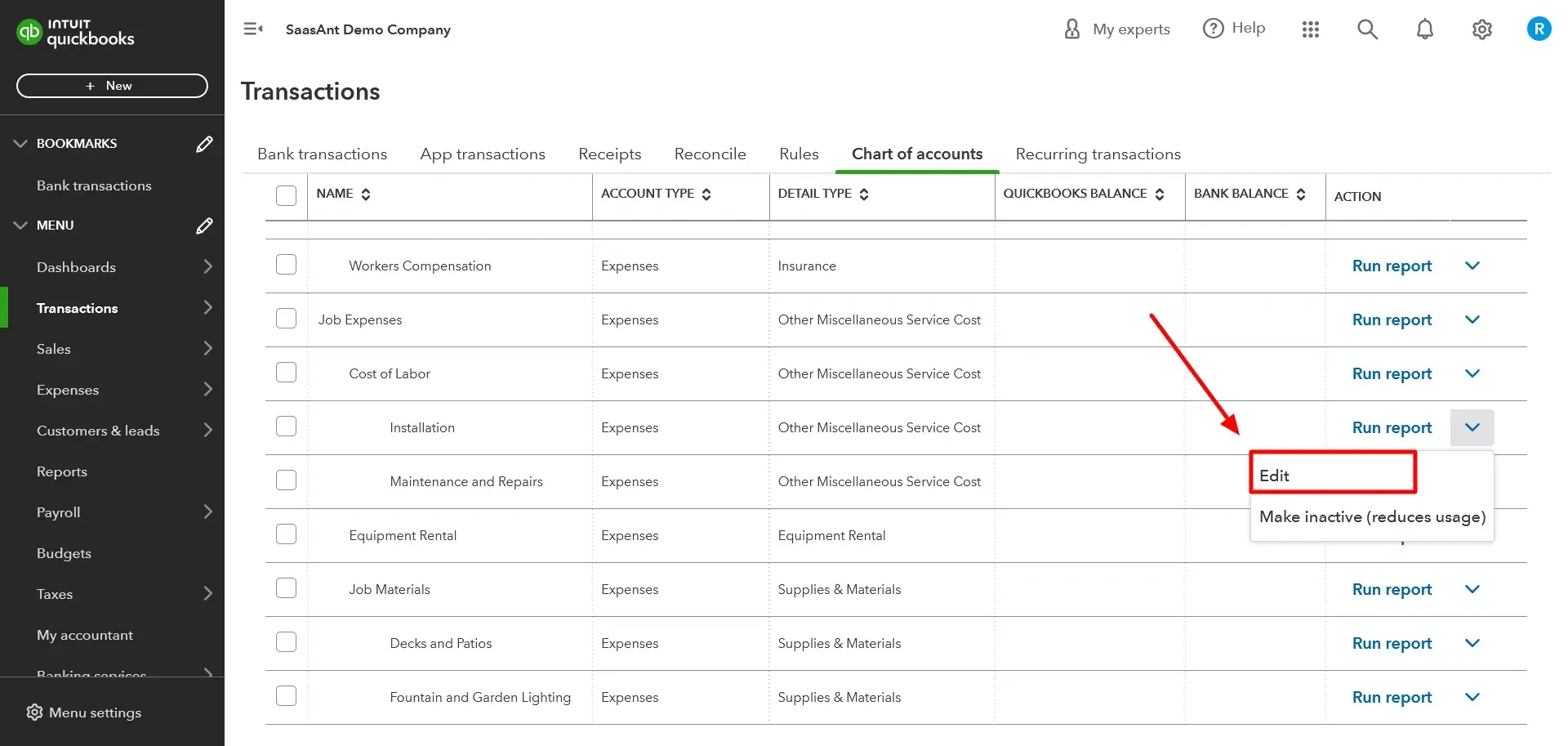

Click on the first sub-account that you want to merge. In the account window, click on the ‘Edit’ button.

Step 4: Change the Account Name

Modify the account name to match the name of the selected sub-account that will be retained after the merger.

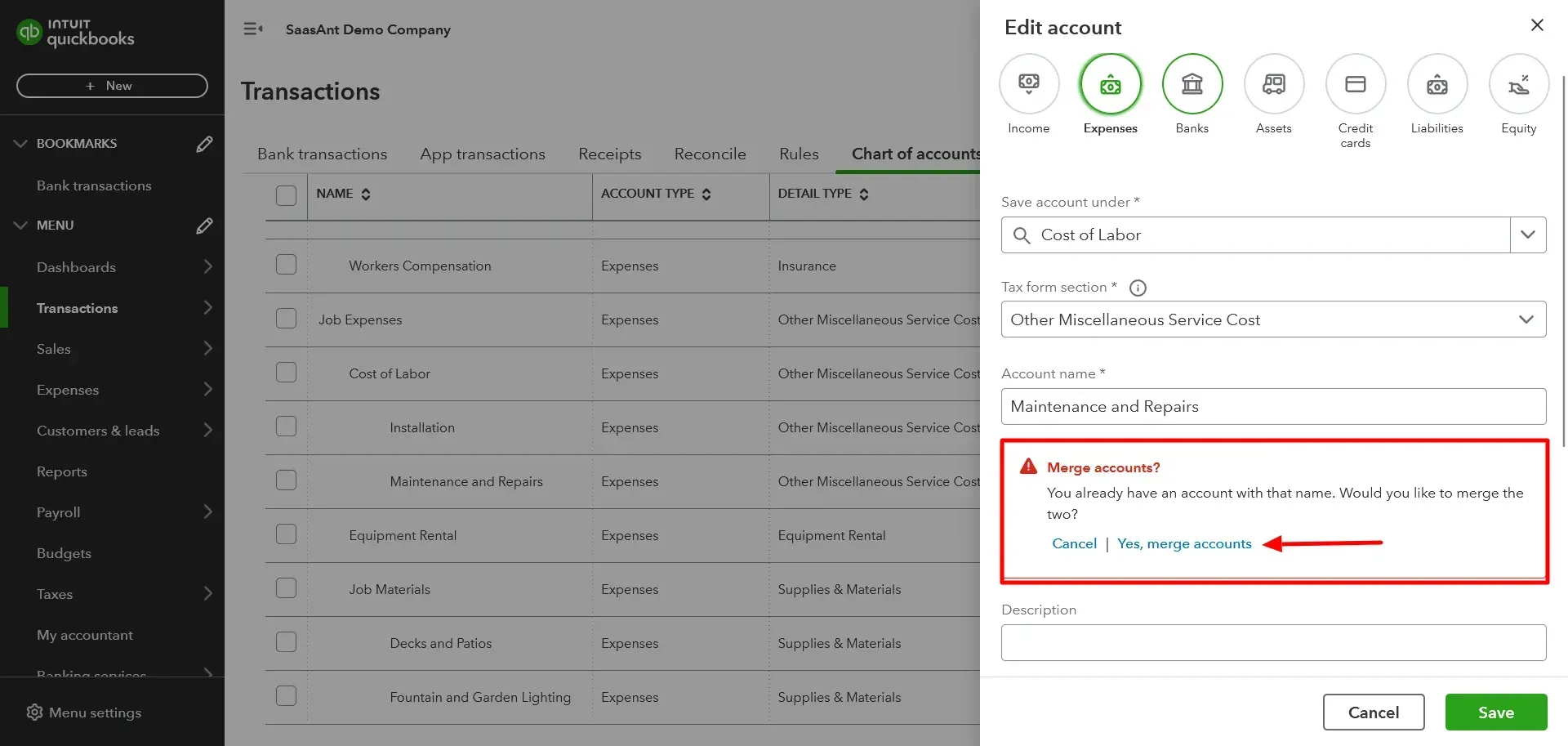

Step 5: Confirm Changes

Save the changes, and QuickBooks Online will prompt you to confirm the merge. Click ‘Yes’ to proceed.

Step 6: Review Reports

Run financial reports to verify that the merger was successful and that the data is accurate.

Step-By-Step Guide to Merge Sub-Accounts in QuickBooks Desktop

Step 1: Backup Company File

Open your QuickBooks Desktop software and create a backup of your company file.

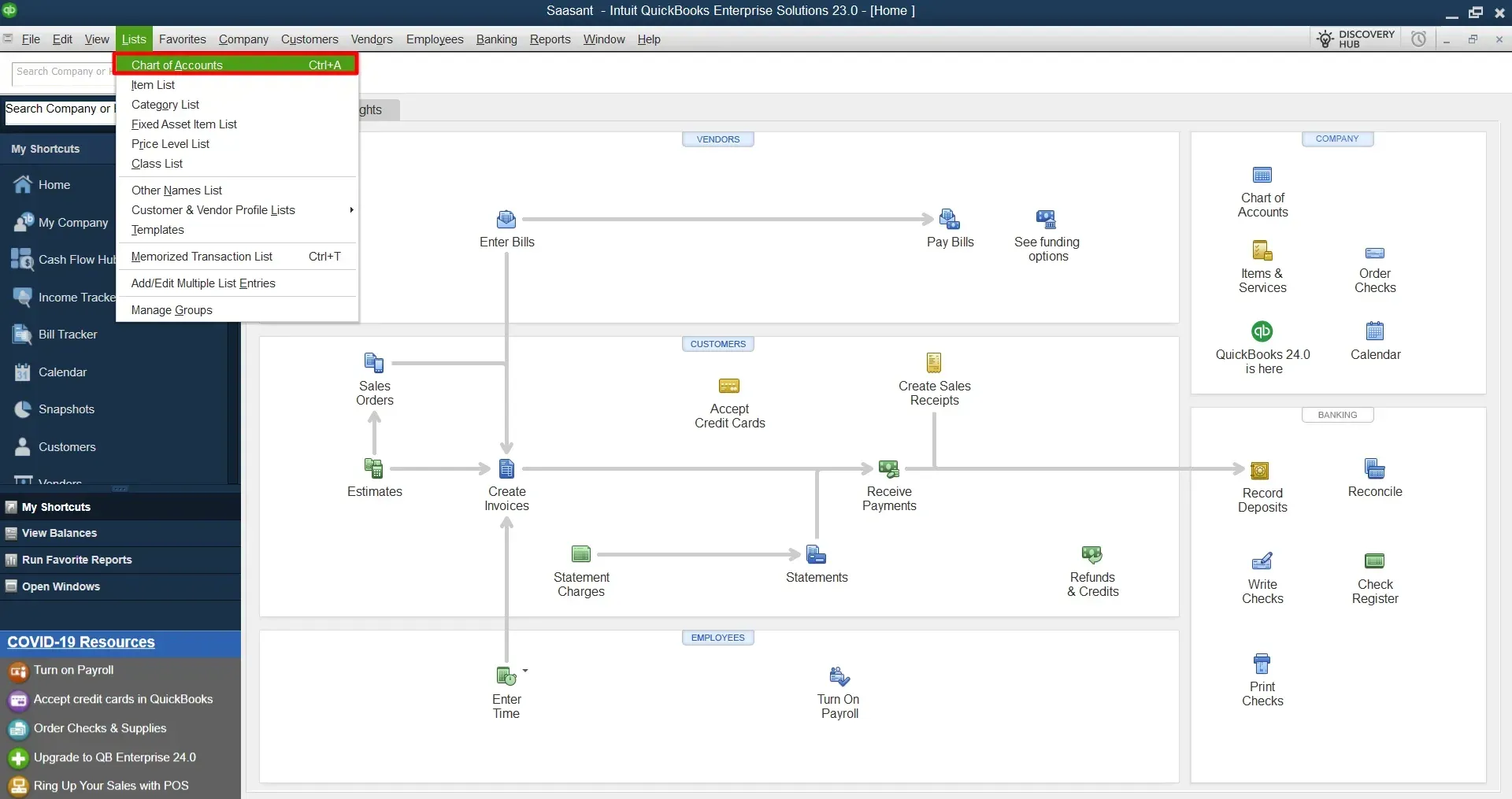

Step 2: Access the Chart of Accounts

From the ‘Lists’ menu, select ‘Chart of Accounts’ to open the chart.

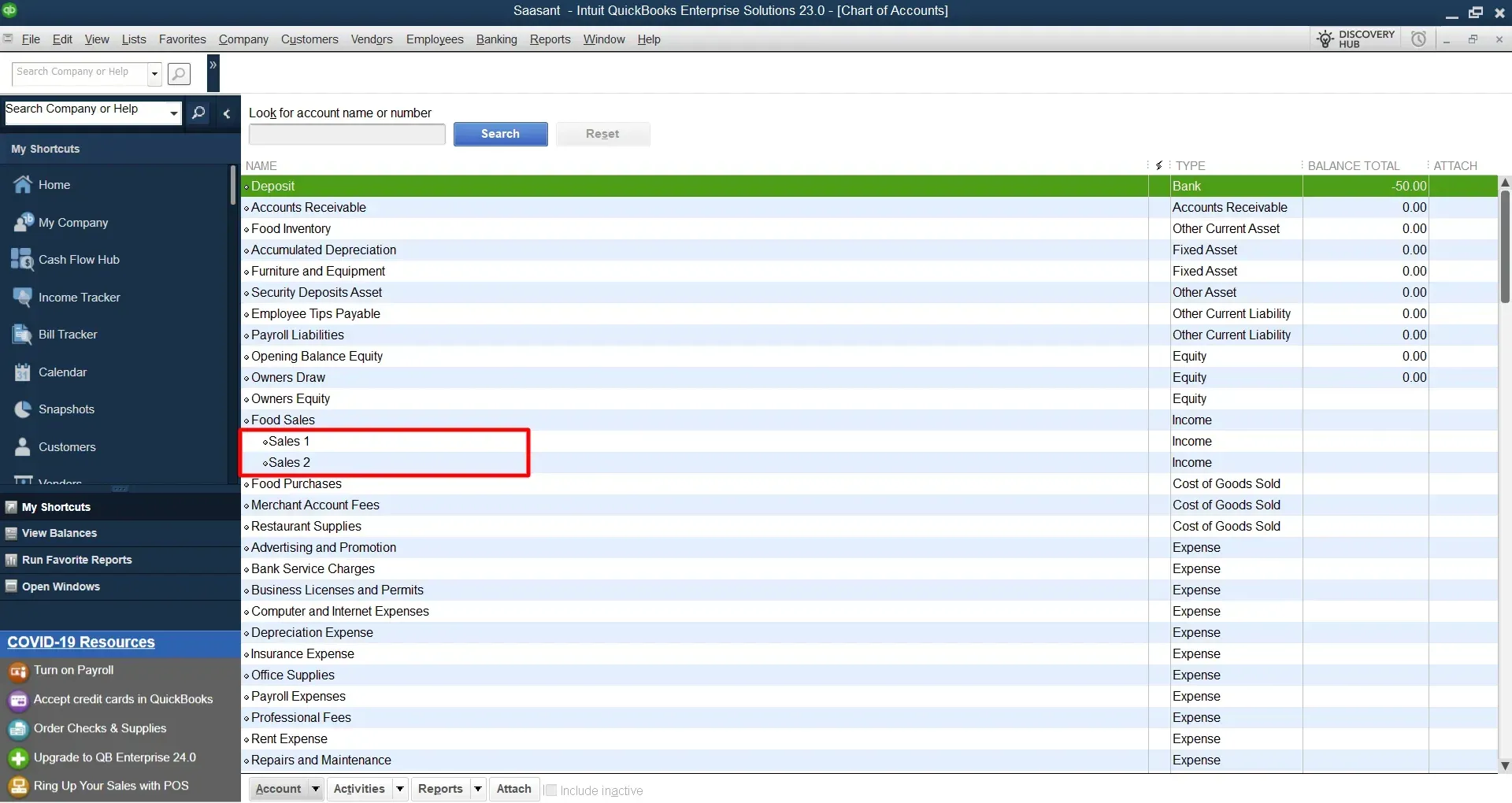

Step 3: Identify the Accounts to Merge

Locate the sub-accounts you want to merge and take note of their names and the ones to retain.

Step 4: Edit Account Details

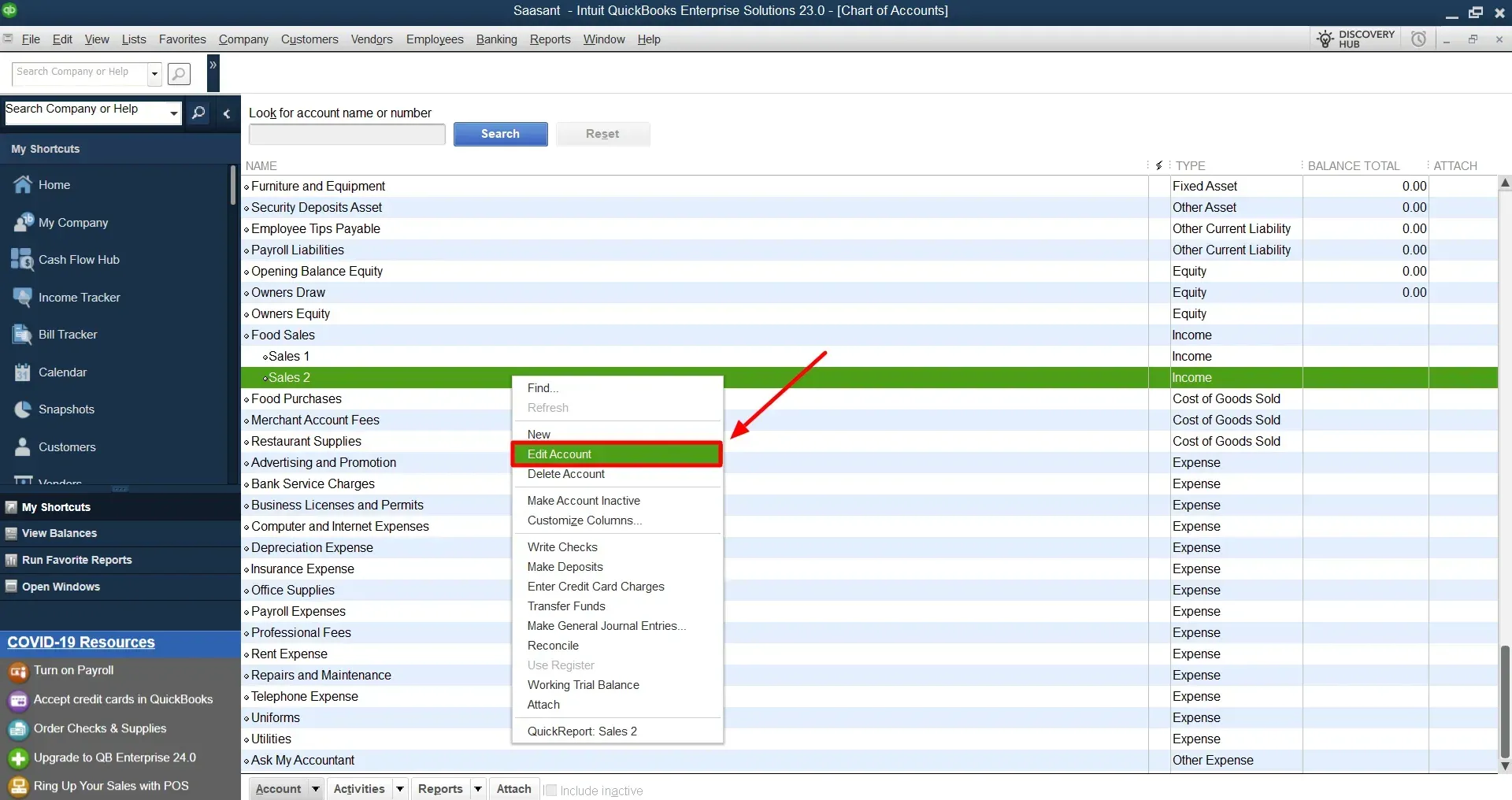

Right-click on the sub-account you want to merge and select ‘Edit Account’ from the dropdown.

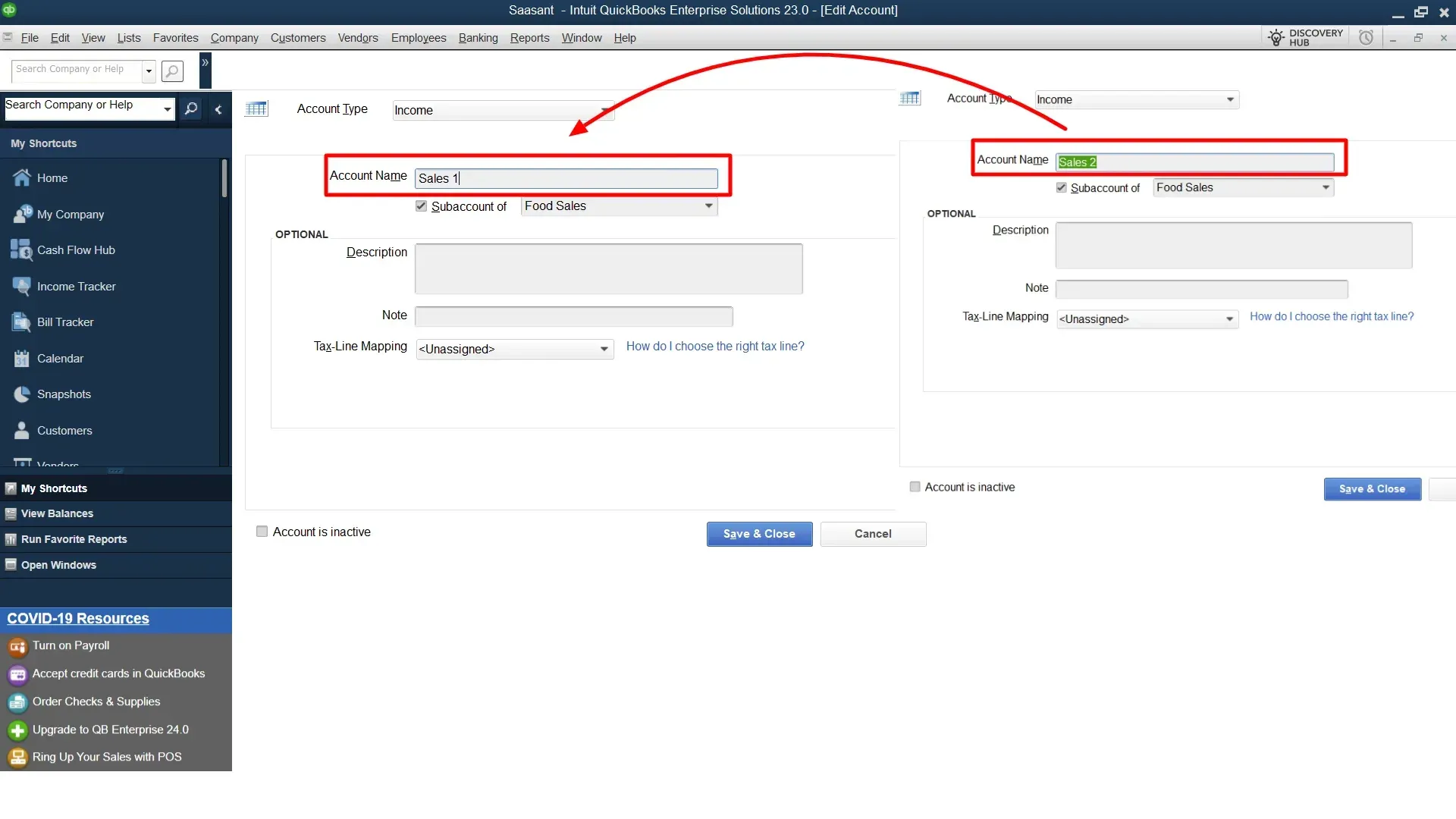

Step 5: Change the Account Name

Navigate to the 'Edit Account' window and modify the account name to align with the sub-account retained post-merger. Ensure you select the sub-account you wish to merge into, as it will remain after the merger.

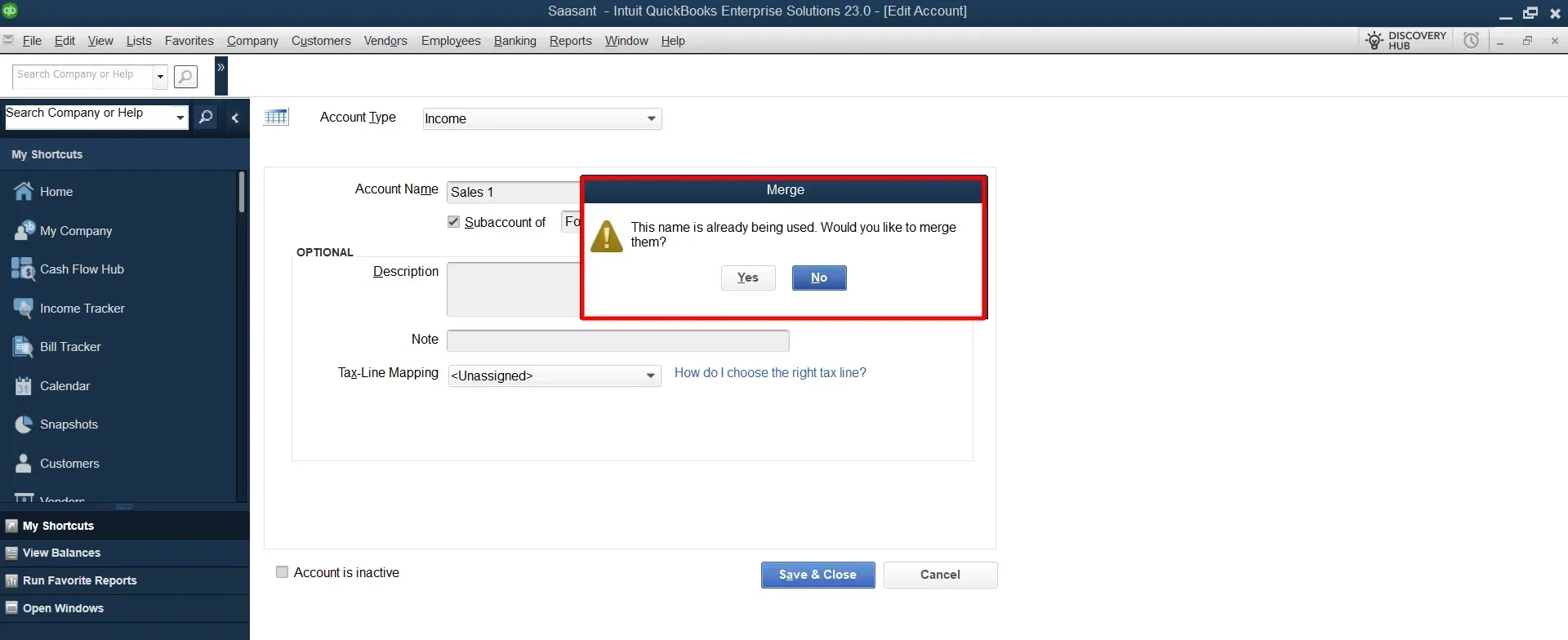

Step 6: Confirm Changes

After you save the changes, QuickBooks Desktop will ask if you want to merge the accounts. Click ‘Yes’ to proceed.

Step 7: Review Reports

Run financial reports to ensure the merger was successful and that your data is accurate.

FAQs

What Are Sub-Accounts in QuickBooks?

Sub-accounts in QuickBooks organize and categorize specific transactions within main parent accounts. They allow for a more detailed breakdown of financial data without cluttering the chart of accounts.

Why Would I Want to Merge Sub-Accounts in QuickBooks?

Merging sub-accounts can help simplify your chart of accounts, reduce redundancy, and streamline financial reporting. It allows you to consolidate data and improve the accuracy of your financial records.

Is It Necessary to Backup My QuickBooks Company File before Merging Sub-Accounts?

Yes, creating a company file backup is essential before merging sub-accounts. If anything goes wrong during the merging process, the backup is a safety net that allows you to revert to a previous state.

Can I Merge Sub-Accounts of Different Types, Such as Assets and Liabilities?

QuickBooks does not recommend merging sub-accounts of different types. It allows merging accounts of the same type to avoid potential errors in your financial statements.

Which Two accounts Cannot be merged in QuickBooks Online?

In QuickBooks, certain default accounts are designated for specific functions. These accounts, particularly those linked with online banking, are non-mergeable and undeletable. If you plan on merging accounts with reconciliation reports, backing up these reports is crucial.

Tags

Read also

How to Edit Chart of Accounts in QuickBooks Online

Import Chart of Accounts in QuickBooks Online: How to

How to Delete Chart of Accounts in QuickBooks Online

The Ultimate Guide to QuickBooks Chart of Accounts