Mastering Xero Bank Feeds: Automate Your Finances Like a Pro

Are you drowning in paperwork? Do you need help maintaining accurate financial records across multiple bank accounts and credit cards? This time-consuming burden plagues countless business owners and bookkeepers worldwide. Xero bank feeds are designed to liberate you from this data entry drudgery, ushering in a new era of streamlined financial management.

Contents

Importance of Bank Feeds

Level Up Your Financial Management: A Deep Dive into Xero Bank Feeds

Xero Bank Feeds: A Global Guide to Streamlined Accounting and Financial Management (2024 Update)

Unleash the Power of Automation: A Comprehensive Guide to Setting Up Bank Feeds in Xero

Mastering Your Bank Feed Workflow in Xero: A Guide to Effortless Financial Management

Conquering Bank Feed Challenges in Xero: A Streamlined Guide to Financial Management

Wrap Up

FAQs

Importance of Bank Feeds

Xero bank feeds deliver a transformative solution by integrating seamless, real-time data exchange between your bank accounts and Xero's user-friendly accounting software. Eliminate the tedious tasks of manual data entry and reconciliation errors. Embrace the power of effortlessly synchronised financial data, empowering you to make informed decisions backed by up-to-date insights, regardless of location.

Whether you're a solopreneur navigating the complexities of managing a business or a seasoned bookkeeper seeking to optimise workflow across international borders, Xero bank feeds offer a multitude of advantages:

Enhanced Efficiency: Free yourself from hours of manual data entry. Bank feeds automate the import of your financial data, granting you precious time to focus on core business activities and strategic growth initiatives.

Unparalleled Accuracy: Human error is an undeniable reality. Bank feeds minimise these inaccuracies, ensuring the integrity and reliability of your financial records. Transactions are automatically captured, eliminating the risk of missed entries or reconciliation discrepancies.

Global Accessibility: Access your financial data anytime, anywhere, on any device. Xero's secure cloud-based platform allows you to manage your finances remotely, fostering peace of mind and complete control over your business's financial health, irrespective of geographical limitations.

Xero bank feeds represent a paradigm shift for businesses of all sizes and locations. Experience the unparalleled convenience, precision, and efficiency they bring to financial management. Bid farewell to the woes of manual data entry and embrace the future of streamlined accounting with Xero bank feeds.

Level Up Your Financial Management: A Deep Dive into Xero Bank Feeds

In the age of digital transformation, streamlining financial processes is no longer a luxury; it's a necessity. Xero, a frontrunner in cloud-based accounting software, acknowledges this reality. Their innovative Xero Bank Feeds feature seamlessly integrates your bank accounts with Xero, revolutionising how you manage your finances. Say goodbye to manual data entry struggles and embrace a world of automation and real-time financial insights.

Effortless Automation: Conquer Busywork and Save Time

Imagine reclaiming precious hours currently spent on tedious manual data entry. Xero Bank Feeds automates the import of bank transactions directly into your Xero account. This translates to:

Reduced workload: Eliminate the time-consuming task of manually entering transactions.

Enhanced accuracy: Minimise the possibility of errors associated with manual data input.

Improved efficiency: Focus on core business strategies while Xero handles bookkeeping.

Real-Time Visibility: Make Informed Decisions with Up-to-Date Data

Xero Bank Feeds go beyond automation. They boast real-time data synchronisation, ensuring your Xero account instantaneously reflects your bank activity. This empowers you with the following:

Unparalleled cash flow tracking: Monitor your cash flow accurately, allowing for proactive financial management.

Data-driven expense control: Identify areas for cost optimisation by tracking expenses in real-time.

Informed financial decision-making: Make strategic choices based on the most up-to-date economic data.

Accurate financial reporting: Generate reports that accurately depict your current financial health.

Unleash the Power of Automation: Streamline Your Workflow

Xero Bank Feeds unlock the true potential of automation within your Xero account. Here's how they elevate your financial management:

Automated transaction categorisation: Establish bank rules to automatically categorise transactions based on predefined criteria, saving time and ensuring consistency in your financial records.

Seamless reconciliation: Effortlessly matches imported bank transactions with existing records in Xero, streamlining the reconciliation process and guaranteeing data accuracy.

Beyond Reconciliation: Unlock the Power of Data-Driven Decisions

Xero Bank Feeds offer a plethora of benefits that extend far beyond reconciliation:

Enhanced cash flow forecasting: Gain real-time visibility into your cash flow, allowing you to anticipate potential shortfalls or surpluses and proactively manage your finances.

Effortless budgeting: Track your income and expenses against your budget in real-time. Identify variances and make adjustments as needed to maintain optimal financial control.

A Global Solution for Financial Efficiency

Whether you're a small business owner, accountant, or entrepreneur operating anywhere in the world, Xero Bank Feeds offer a secure and efficient way to manage your finances. By leveraging this powerful feature, you can:

Streamline your accounting processes on a global scale.

Reduce human error and ensure data accuracy across borders.

Gain valuable financial insights to make informed decisions that drive growth, regardless of your location.

Xero Bank Feeds: A Global Guide to Streamlined Accounting and Financial Management (2024 Update)

Maintaining meticulous and up-to-date financial records is paramount in today's dynamic global business environment. Manual data entry, a prevalent practice worldwide, can be a significant time drain and introduce errors, hindering your ability to make informed financial decisions. Xero Bank Feeds emerges as a transformative solution, offering a seamless path towards automated transaction recording and enhanced financial management.

Understanding Xero Bank Feeds

Xero Bank Feeds, a cornerstone feature within the Xero accounting software platform, bridges the gap between your bank accounts and your Xero account. This ingenious functionality facilitates automatically importing transactions (deposits, withdrawals, transfers) directly into your accounting system. By eliminating the need for manual data entry, Xero Bank Feeds empowers businesses of all sizes to save valuable time and minimise errors associated with manual processes.

Global Benefits of Xero Bank Feeds

Effortless Automation: Streamline your accounting processes worldwide. Xero Bank Feeds automates transaction recording, liberating your team from tedious manual data entry, regardless of location. This translates into significant time savings that can be directed towards core business activities.

Real-time Accuracy, Globally Accessible: Transactions are synchronised into Xero instantaneously upon occurring in your bank account, ensuring real-time data accuracy. This empowers you with a clear and up-to-date understanding of your global financial health, accessible from anywhere with an internet connection.

Enhanced Cash Flow Management Across Borders: Gain real-time visibility into your cash flow across all your international operations. Xero Bank Feeds empowers you to proactively forecast cash flow, identify potential shortfalls or surpluses in any geographical segment, and make informed financial decisions on a global scale.

Streamlined Reconciliation for a Globalised Business: Reconcile bank transactions effortlessly, irrespective of location. Xero Bank Feeds enables you to match imported transactions with existing records in Xero, streamlining the reconciliation process and saving your global accounting team valuable time.

Improved Budgeting and Forecasting on a Global Scale: Make data-driven budgeting decisions with the power of accurate and timely expense and income tracking across your global operations. Xero Bank Feeds provides valuable insights to compare your actual financial performance against your budget and forecasts, allowing you to identify variances and adjust your plans accordingly for each geographical segment.

Powerful Rule-Based Automation for Global Consistency: Ensure consistency in your financial record-keeping across international operations. Xero Bank Feeds empowers you to create bank rules, automating transaction categorisation and reconciliation. Set up rules to automatically categorise transactions based on predefined criteria (payee name, amount, etc.), ensuring consistency and saving time for your global accounting team.

Aligning with Recent Global Trends

Cloud-Based Accounting for a Globalised Workforce: As cloud-based accounting gains traction globally, Xero Bank Feeds perfectly complements this trend by offering seamless bank integration within the cloud-based Xero platform. This ensures easy accessibility and real-time data updates from anywhere worldwide, anytime.

Open Banking and Global Fintech Integration: Open Banking regulations foster collaboration between financial institutions and fintech companies like Xero on a global scale. This paves the way for even more powerful integrations between Xero Bank Feeds and various international bank accounts, offering businesses a more comprehensive range of functionalities and data insights, regardless of location.

Machine Learning and AI: The Future of Global Financial Management: Machine learning (ML) and Artificial Intelligence (AI) are revolutionising the accounting landscape globally. Xero Bank Feeds can leverage these advancements to offer features like automatic transaction matching, anomaly detection, and even predictive cash flow forecasting across your international operations, further streamlining financial management on a global scale.

Xero Bank Feeds is a powerful feature for businesses seeking to automate transaction recording, gain real-time financial insights across their global operations, and make informed decisions that drive financial success. By leveraging Xero Bank Feeds and staying informed about the latest trends like cloud integration, open banking, and AI, you can empower your business for financial success in the ever-evolving technological landscape, regardless of your geographical location.

Unleash the Power of Automation: A Comprehensive Guide to Setting Up Bank Feeds in Xero

Manual data entry tasks like bank reconciliations can waste valuable time that could be better spent on strategic initiatives. Xero's bank feed integration emerges as a game-changer, offering a seamless solution to automate financial management and empower you to focus on what matters most: growing your business.

This comprehensive section delves into Xero bank feeds, providing a step-by-step approach to setting them up and maximising their potential. Whether you're a seasoned accounting professional or a business owner just starting your automation journey, this tutorial will equip you with the knowledge to streamline your financial processes and unlock a new level of bookkeeping efficiency.

A Streamlined Journey: Setting Up Bank Feeds in Xero

Automate the daily import of your bank transactions into Xero. Quickly refresh your feed within Xero to access the latest transactions.

Key Points:

You must be registered for online banking to connect your bank with Xero.

Once connected, transactions will be seamlessly imported into Xero every business day without manual intervention. You can opt to share up to 12 months' worth of historical transactions initially.

Ensure your bank offers a compatible bank feed for your bank and account type.

Step-by-Step Guide for Setting up Bank Feeds in Xero

Step 1: Access Bank Accounts in Xero

Navigate to the Accounting menu and select Bank Accounts.

Step 2: Add Bank Account

Click on ‘Add Bank Account.’

Choose your bank from the list of popular banks or begin typing its name. You may need to import bank statements manually if your bank isn't listed.

If your bank isn't listed, click ‘Add without bank feed’ to proceed with manual import.

Step 3: Agree and Login

Click ‘Agree’ and log in to your bank.

Follow the prompts to log in, enter your online banking credentials, and use any required multi-factor authentication.

Step 4: Select Accounts to Share

Choose the accounts you wish to share with Xero and complete the sharing process.

Step 5: Verify Selected Accounts

Ensure the correct bank accounts are selected, each showing a green tick.

If necessary, choose different accounts or add new ones.

Step 6: Match Xero Accounts

Match your Xero accounts with your bank accounts.

Step 7: Set Transaction Start Date

Confirm the date from which you'd like transactions to start importing. You can import up to 12 months' worth of transactions.

Step 8: Finish Setup

Click ‘Finish’ to complete the process.

Step 9: Troubleshooting

If encountering issues, consider the following:

Reconfirm Bank Feed Consent

You can periodically renew your bank feed consent within Xero by navigating to Bank accounts, selecting the account, and clicking Manage Account and Renew Bank Connection.

Refresh Bank Feed

Suppose you need to import the latest transactions before the next automatic import. In that case, you can refresh the bank feed at any time within Xero by selecting the account and clicking Manage Account and Refresh Bank Feed.

Troubleshooting Common Hiccups: Ensuring a Smooth Journey

Even with the best-laid plans, occasional roadblocks may appear. Here's how to navigate some common hurdles you might encounter:

Credential Conundrums: Encountering error messages during login? Breathe easy! Simply verify that your username and password precisely match the credentials you use for your online banking portal. A typo or minor discrepancy can cause login failures.

Bank Not Currently Supported: If Xero still needs to support your bank, don't despair! Explore alternative solutions like manual bank statement import. This option lets you upload your bank statements directly into Xero for categorisation and reconciliation. Additionally, consider contacting Xero's exceptional support team for further guidance and explore any upcoming integrations with your bank.

Connection Calamities: Are you facing connection issues? First, ensure a stable internet connection. Occasionally, banks may undergo scheduled maintenance that can temporarily disrupt connectivity. If the problem persists, contact Xero's support team for further assistance.

Signature Issues: Ensure the application form bears a physical signature, as most banks do not accept digital signatures. Confirm that the signature on the form matches the bank's records. If no signature is on file, contact your bank to add signatories before reapplying. For accounts requiring multiple signatures, ensure all signatories sign the form.

Account Problems: Verify that the account number in Xero matches the one in online banking or bank statements. Refer to your bank's specific page to check if your account type is supported for bank feeds. Closed accounts cannot import historical transactions; manual import is necessary. Ensure the account name matches the bank's records. All accounts requiring bank feeds must be added to Xero.

Credit Card Issues: Confirm your credit card is activated before applying for a bank feed.

Bank feeds are typically provided for primary cards; confirm with the primary cardholder.

Include the cardholder's name and the first six digits of the credit card on the application form.

Bank feeds are not available for debit cards; apply for the bank feed for the connected bank account.

Other Common Problems: If a bank feed is already active within your organisation or another, the bank will reject the application. Ensure the application form is clear and all information is legible. Some banks may require the account holder to contact them directly to resolve specific issues.

A Global Reach: Xero Caters to the World

Xero understands the importance of serving a global audience. Their extensive list of supported banks encompasses major institutions across continents, including Australia, New Zealand, the United Kingdom, North America, and many other regions. This ensures a smooth and efficient experience for users worldwide, regardless of location.

By leveraging Xero's bank feed functionality, you can finally ditch the tedious task of manual data entry. Welcome to automated financial management, where accuracy and efficiency reign supreme. Focus on what truly matters: growing your business and achieving your financial goals, while Xero handles the heavy lifting of bookkeeping.

Mastering Your Bank Feed Workflow in Xero: A Guide to Effortless Financial Management

Xero, a popular cloud-based accounting software, offers a powerful solution for streamlining your finances with its bank feed functionality. This section dives deep into mastering your bank feed workflow in Xero, empowering you to achieve efficient transaction management and effortless reconciliation and ultimately gain valuable insights for data-driven decision-making.

Understanding the Power of Bank Feeds in Xero

Imagine eliminating tedious manual data entry and automating a significant portion of your bookkeeping tasks. Xero's bank feed functionality makes this a reality. Connecting your bank accounts to Xero allows you to automatically import your bank transactions, saving you precious time and resources. This real-time import ensures your financial data reflects your latest activity, allowing you to make informed business decisions confidently.

Streamlining Transaction Management: Matching, Creating, and Reconciling

Matching Transactions for Accuracy: Xero's bank feed functionality goes beyond simple import. It allows you to effortlessly match imported transactions with existing entries in your accounting system. This intuitive matching process ensures data accuracy and prevents duplicate entries that can skew financial health.

Creating Transactions for Unmatched Entries: For transactions that don't have a match, Xero empowers you to make them directly within the software. Simply provide relevant details such as date, amount, payee, and a clear description to maintain a comprehensive record of your financial activity.

Regular Reconciliation for Peace of Mind: Regularly reconciling your bank transactions with your accounting records is a cornerstone of accurate financial reporting. Xero streamlines this process by highlighting any discrepancies or errors that may arise. Addressing these discrepancies promptly ensures your financial data remains reliable and trustworthy.

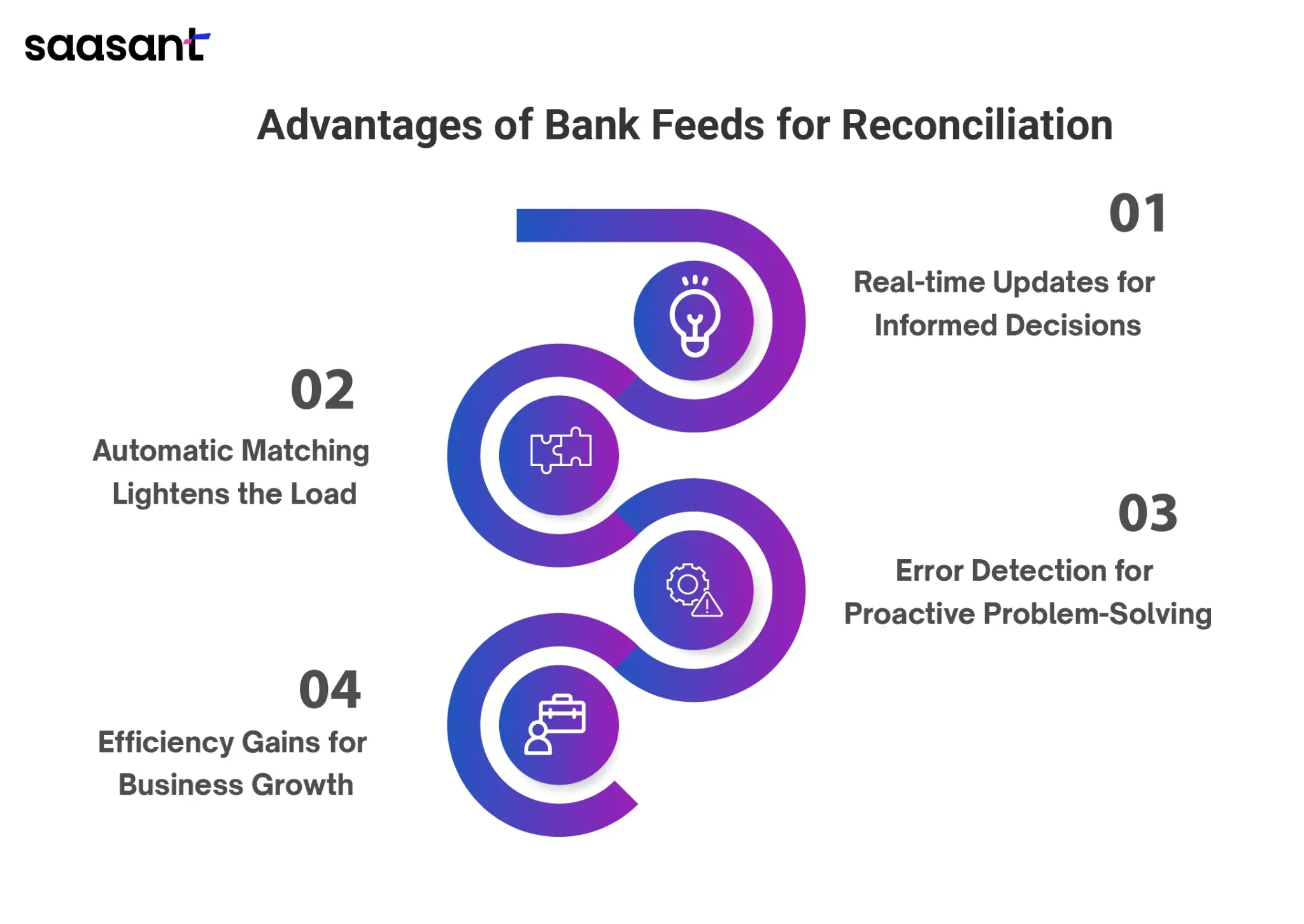

Beyond Automation: The Advantages of Bank Feeds for Reconciliation

Real-time Updates for Informed Decisions: Bank feeds provide a significant advantage by offering real-time updates on your transactions. This allows you to stay on top of your cash flow, identify spending patterns, and make informed financial decisions without delay.

Automatic Matching Lightens the Load: Say goodbye to tedious manual matching! Xero's intelligent reconciliation tool automatically matches imported transactions with existing ones, significantly reducing the time and effort needed to complete this process.

Error Detection for Proactive Problem-Solving: Bank feeds act as a watchdog, helping you detect discrepancies or errors between your bank statement and accounting records. This proactive approach allows you to identify and resolve issues promptly, ensuring the integrity of your financial data.

Efficiency Gains for Business Growth: Automating the reconciliation process through bank feeds frees up valuable time and resources. This lets you focus on core business activities, develop strategic plans, and drive growth.

Bank Rule Magic: Automating Transaction Categorization

With Xero's powerful bank rules, take your financial management to the next level. These rules allow you to set automated criteria based on transaction details such as description, amount, or payee. When a new transaction matches your criteria, Xero automatically categorises it, saving you significant time and effort.

Understanding Bank Rules for Smart Automation: Bank rules are predefined filters that tell Xero how to categorise specific types of transactions. Setting up these rules allows you to automate the categorisation process, ensuring consistency and accuracy in your financial data.

Creating Bank Rules for Streamlined Workflow: Creating bank rules is straightforward. Identify common transaction patterns, such as recurring payments to specific vendors or expenses, with consistent keywords in the description. Then, regulations based on these patterns will be set up to automate categorisation.

Automating Categorization for Effortless Management: Once your bank rules are in place, Xero automatically categorises imported transactions, saving countless hours of manual data entry and categorisation. This frees you up to focus on analysing your financial data and extracting valuable insights for business growth.

Customization and Review for Continued Accuracy: Even the best systems require occasional fine-tuning. Regularly review and update your bank rules to accurately reflect your evolving transaction patterns. This ongoing review process helps maintain the accuracy and reliability of your financial data.

Conquering Bank Feed Challenges in Xero: A Streamlined Guide to Financial Management

Navigating the intricacies of bank feeds is crucial for seamless financial management within Xero. However, encountering challenges is not uncommon. This section offers a comprehensive troubleshooting guide to help you overcome common issues, differentiates between when to seek assistance from your bank versus Xero support, and provides resources for advanced troubleshooting.

Troubleshooting Bank Feed Connection Issues in Xero

Verify Bank Connection Status: Regularly check Xero's bank feed status page for real-time updates on connectivity and any scheduled maintenance that might temporarily impact feed updates.

Scrutinise Login Credentials: Double-check the accuracy of your bank login credentials within Xero. Even minor typos in usernames or passwords can prevent successful bank feed synchronisation.

Initiate a Bank Feed Refresh: Manually refresh your bank feeds within Xero to trigger an immediate update. This can often resolve minor connectivity issues and import the latest transactions.

Review Bank Account Permissions: Ensure Xero has the necessary permissions to access your bank account information. Some banks require additional authorisation steps, such as multi-factor authentication or granting access to third-party applications like Xero.

Optimise Bank Feed Settings: Periodically review and update your bank feed settings within Xero. You can adjust settings like the import frequency or date range to optimise the performance and efficiency of your bank feeds.

When to Seek Help: Bank vs. Xero Support

The appropriate support channel depends on the nature of the bank feed issue you're facing:

Bank Contact: If the problem stems from bank-specific issues such as online banking access, security protocols, or transaction discrepancies, it's best to contact your bank's customer support team directly. They possess the expertise to address concerns specific to your bank account.

Xero Support: For technical difficulties related to Xero's platform, such as integration errors, feed synchronisation issues, or software functionalities, contacting Xero support is the recommended course of action. Xero's dedicated support team has the specialised knowledge to troubleshoot and resolve software-related challenges within Xero.

Troubleshooting Guide: Resolving Common Issues with Rejected Bank Feed Applications in Xero

If your bank feed application in Xero has been rejected, it’s essential to understand the common reasons behind it and how to rectify them. This guide outlines the typical problems encountered and provides step-by-step solutions to ensure a successful application process.

Signature Issues

For security reasons, most banks do not accept digital signatures. Ensure you physically sign the application form before scanning and uploading it to Xero.

If the signature on the application form doesn’t match the bank's records, verify with your bank and update the form accordingly.

If there's no signature on file, contact your bank to add signatories before reapplying for the bank feed.

For accounts requiring multiple signatures, ensure all signatories sign the form before uploading it.

Remember to include the signature name and physical signature in the provided box.

Account-Related Issues

Verify that the account number in Xero matches the one in your online banking or bank statement to avoid rejection due to an invalid account.

Refer to your bank's specific page to check if your account type is supported for direct feeds. Unsupported account types may require manual transaction imports.

If you are applying for a closed account, remember that direct feeds only import transactions from the activation date onwards. Manual import is necessary for historical transactions.

Ensure the account name on the application form matches the name registered with the bank to prevent discrepancies.

Add all bank accounts in Xero to receive bank feeds; missing accounts on Xero won't be recognised for feed connection.

Credit Card Issues

Confirm that your credit card is activated before applying for the bank feed.

Bank feeds are typically provided only for primary cards; sub-cards may not be eligible.

Include the cardholder's name and the first six digits of the credit card on the application form.

Miscellaneous Issues

Check if the bank feed is already active within your organisation or another; duplicate requests will be rejected.

Ensure the application form is clear, and all information is legible before scanning and uploading.

Some banks may require direct communication with the account holder or relationship manager to resolve issues; encourage contacting the bank if necessary.

Staying Informed and Advanced Troubleshooting

Monitor Bank Feed Status Updates: Stay informed about the status of bank feeds by regularly checking Xero's bank feed status page. This resource provides real-time updates on feed connectivity and any ongoing maintenance activities that might affect synchronisation.

Advanced Troubleshooting Resources: Xero offers a comprehensive knowledge base to assist users encountering persistent or complex bank feed issues. Explore Xero's help centre, community forums, and user guides for in-depth troubleshooting steps, best practices, and peer-to-peer assistance from the Xero community.

By following these guidelines and leveraging the available resources, you can effectively conquer bank feed challenges and ensure a smooth, uninterrupted financial data flow within Xero. This empowers you to confidently make informed financial decisions, streamline your accounting processes, and optimise your overall financial management experience.

Wrap Up

Xero Bank Feeds empowers businesses of all sizes and locations to streamline financial management and confidently make data-driven decisions. By leveraging automation, real-time data synchronisation, and powerful features like bank rule categorisation, Xero Bank Feeds facilitates an efficient and accurate financial management experience.

As cloud-based accounting gains traction globally and Open Banking regulations foster collaboration between financial institutions and fintech companies, Xero Bank Feeds positions itself at the forefront of innovation. Embrace the potential of Machine Learning (ML) and Artificial Intelligence (AI) to streamline financial processes further, automate tasks like transaction matching and anomaly detection, and unlock predictive cash flow forecasting capabilities.

Xero Bank Feeds caters to the needs of a globalised workforce, offering seamless bank integration regardless of geographical location. With the power of rule-based automation, ensure consistent and accurate record-keeping across international operations. Gain real-time visibility into your global cash flow, proactively manage finances and make informed decisions that drive growth across all your international segments.

By implementing Xero Bank Feeds and staying informed about the latest trends in cloud integration, open banking, and AI, you empower your business to thrive in the ever-evolving technological landscape. Xero Bank Feeds offer a world of benefits, including:

Effortless Automation: Streamline manual tasks like data entry and bank reconciliation, freeing valuable time for strategic growth initiatives. Consider leveraging SaasAnt Transactions to automate bulk uploads and downloads of your financial data across various file formats, reducing manual work.

Real-time Accuracy: With real-time data synchronisation, you can gain a clear and up-to-date understanding of your global financial health. For businesses managing payments through popular platforms like PayPal, Stripe, or Square, SaasAnt's PayTraQer seamlessly integrates with Xero and automates recording and syncing these transactions, ensuring all your financial data is captured accurately and reflected in real-time.

Enhanced Cash Flow Management: Proactively manage cash flow across international operations by gaining real-time visibility into your global finances. Xero Bank Feeds and PayTraQer's automated payment processing provide a holistic view of your cash flow, empowering you to make informed decisions about resource allocation and future investments.

Improved Budgeting and Forecasting: Make data-driven financial decisions based on accurate and timely insights from your global operations. Xero's robust budgeting and forecasting features and comprehensive financial data captured through Xero Bank Feeds allow you to create realistic and achievable financial plans for your business.

Powerful Rule-Based Automation: Ensure consistency and save time with automated transaction categorisation and reconciliation across all your international accounts. Xero Bank Feeds' rule-based automation and SaasAnt Transactions' bulk upload and download capabilities further streamline financial data management, saving you valuable time and resources.

Equipping yourself with the knowledge and tools to effectively leverage Xero Bank Feeds, SaasAnt Transactions, and PayTraQer is an investment in your business's future financial success. Whether you're a seasoned accounting professional or a business owner venturing into the exciting world of automation, this integrated suite empowers you to unlock a new level of financial management efficiency and propel your business towards economic prosperity.

Get started with Xero Bank Feeds and explore the complementary functionalities offered by SaasAnt Transactions and PayTraQer today. Experience the transformative power of automated financial management and unlock valuable insights to drive your business forward in the global marketplace. By leveraging automation and the power of real-time data, you can streamline your financial processes, gain valuable financial insights, and make data-driven decisions that drive your business forward.

FAQs

What Are Xero Bank Feeds?

Xero Bank Feeds automatically imports your bank transactions directly into your Xero accounting software, eliminating manual data entry and saving you time.

What Are the Benefits of Using Xero Bank Feeds?

Xero Bank Feeds offers several benefits, including:

Effortless automation: Streamline manual tasks like data entry and bank reconciliation.

Real-time accuracy: Gain a clear and up-to-date understanding of your finances with real-time data synchronisation.

Enhanced cash flow management: Proactively manage cash flow across your business.

Improved budgeting and forecasting: Make data-driven financial decisions based on accurate and timely insights.

Powerful rule-based automation: Ensure consistency and save time with automated transaction categorisation and reconciliation.

Are Xero Bank Feeds Secure?

Yes, Xero Bank Feeds uses industry-leading security measures to protect your financial data. Xero utilises secure encryption and data security techniques to ensure the safe transfer of your bank transactions.

How Do I Set up Xero Bank Feeds?

Setting up Xero Bank Feeds is a simple process. You'll need to be registered for online banking with a compatible bank. Here's a step-by-step guide from the blog:

Navigate to the Accounting menu in Xero and select Bank Accounts.

Click on ‘Add Bank Account.’

Choose your bank from the list or begin typing its name.

You may need to import statements manually if your bank isn't listed.

Follow the on-screen prompts to connect your bank account to Xero.

I’m Having Trouble Connecting My Bank Account to Xero. What Should I Do?

There can be a few reasons why you might face connection issues. Here are some troubleshooting tips:

Verify your login credentials: Ensure your username and password match precisely with your online banking login.

Check if your bank is supported: Not all banks are compatible with Xero Bank Feeds. Refer to Xero's list of supported banks.

Ensure a stable internet connection: A weak connection can disrupt the connection process.

Review Xero's bank feed status page: This page provides updates on any scheduled maintenance that might impact feed connectivity.

Contact Xero Support: If you've tried these troubleshooting steps and are still facing issues, contact Xero's support team for further assistance.

My Bank Transaction Isn’t Showing up in Xero. Why?

There are a few possible reasons why a transaction might not be showing up in Xero:

The transaction may still need to be imported: Allow some time for your bank transactions to import into Xero.

The transaction may not be within the import date range: Xero Bank Feeds can only import transactions from a specific date range.

There may be a discrepancy between Xero and your bank statement. Double-check the transaction details on your bank statement and ensure they match what you entered in Xero.

The transaction might need to be categorised correctly: You can try searching for the transaction by amount or description.

Does Xero Bank Feeds Work with International Banks?

Yes, Xero Bank Feeds supports a wide range of banks worldwide. You can check Xero's list of supported banks to see if your bank is included.

What Are Bank Rules in Xero?

Bank rules allow you to automate the categorisation of your bank transactions in Xero. You can set up rules based on criteria like payee name, amount, or transaction description.

How Can I Improve the Accuracy of My Bank Reconciliation in Xero?

Here are some tips to improve the accuracy of your bank reconciliation:

Use bank rules: Automate transaction categorisation to reduce manual errors.

Review your bank statements regularly: Look for any discrepancies between your bank statement and Xero.

Reconcile your accounts frequently: Regularly reconciling your accounts helps identify and fix any errors early on.