Opening Balance Equity in QuickBooks

The Opening Balance Equity (OBE) account in QuickBooks often perplexes users, especially beginners. QuickBooks creates This temporary account automatically to balance discrepancies during initial setup or adjustments. If left unresolved, it may lead to inaccurate financial records, resulting in an unprofessional-looking balance sheet.

This blog explores the concept of opening balance equity, its purpose, and how to effectively manage it to ensure professional and accurate financial statements.

What Is Opening Balance Equity in QuickBooks?

The Opening Balance Equity account is not included in regular financial statements like the balance sheet. It is generated automatically when setting up or adjusting your accounts in QuickBooks. You may encounter this account when creating a company file or adding opening balances.

Definition of Opening Balance Equity

The Opening Balance Equity account is a specialized equity account created by QuickBooks to ensure your books remain balanced when entering opening balances during the initial setup or while making adjustments. This account plays a crucial role in maintaining the fundamental accounting equation:

When setting up a company in QuickBooks, opening balances for assets, liabilities, and equity accounts may need to be added to reflect the starting point of the financial data. The Opening Balance Equity account acts as a clearing account to temporarily hold any difference arising from these entries, ensuring the equation remains intact until all balances are correctly allocated.

Key Features of Opening Balance Equity

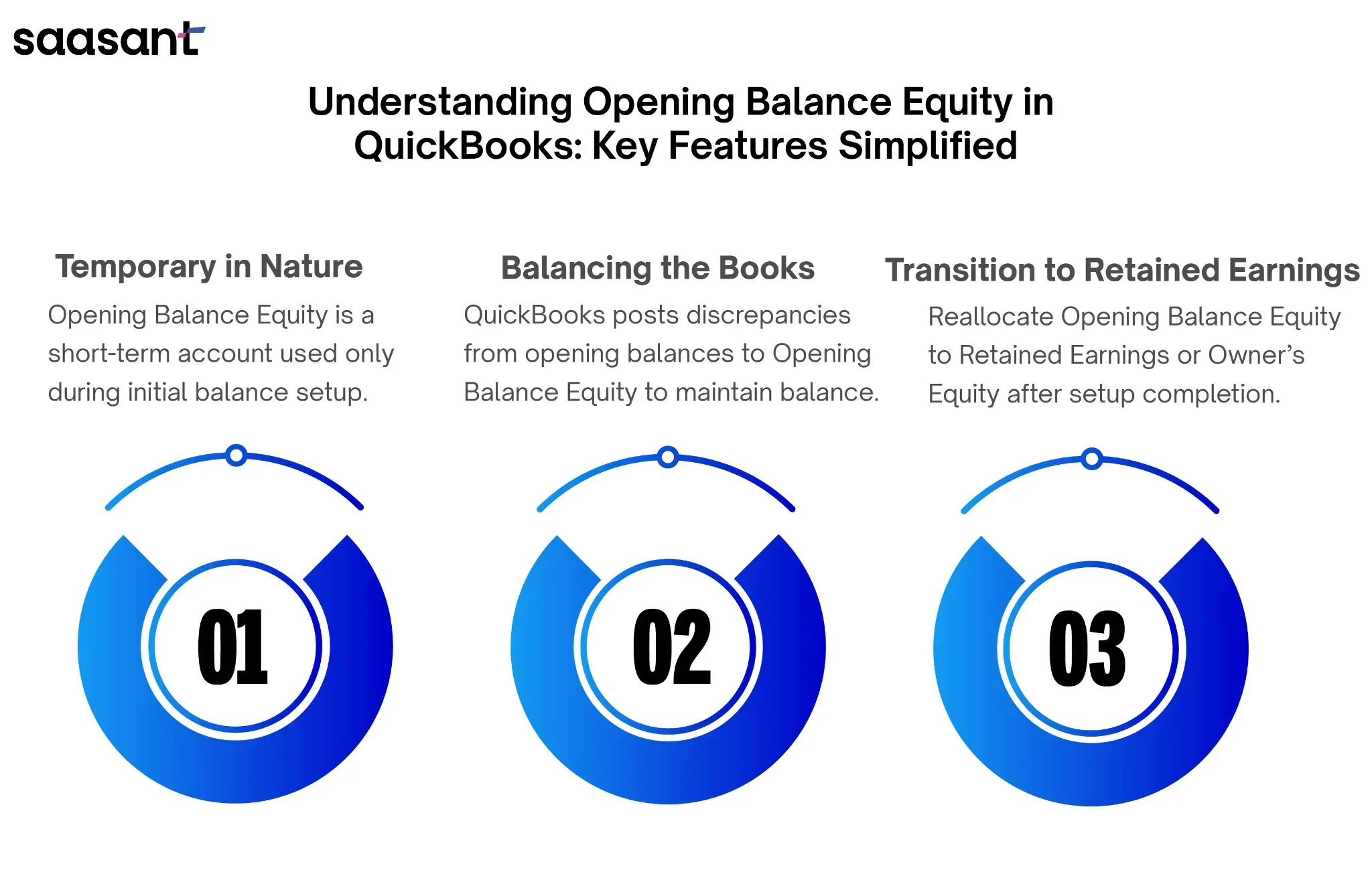

Temporary in Nature

Opening Balance Equity is not intended for long-term use. Its purpose is solely to accommodate initial discrepancies when entering opening balances. Once setup is complete, the balance in this account should be zero.

Balancing the Books

QuickBooks automatically posts the offset to the Opening Balance Equity account if you enter an opening balance for an asset or liability account. This approach keeps your books balanced even before all equity adjustments are finalized.

Transition to Retained Earnings

After ensuring the accuracy of all opening balances, the balance in the Opening Balance Equity account should be reallocated to appropriate equity accounts, such as Retained Earnings or Owner's Equity, as part of the account setup process.

How Does Opening Balance Equity Work?

The accounting equation drives QuickBooks’ functionality. QuickBooks assigns a corresponding amount to the OBE account when opening balances for assets are entered to balance the equation. The OBE account should ideally zero out as you add liabilities and equity balances. If it doesn’t, a discrepancy exists that must be resolved.

Why Do You Have an Opening Balance Equity Account?

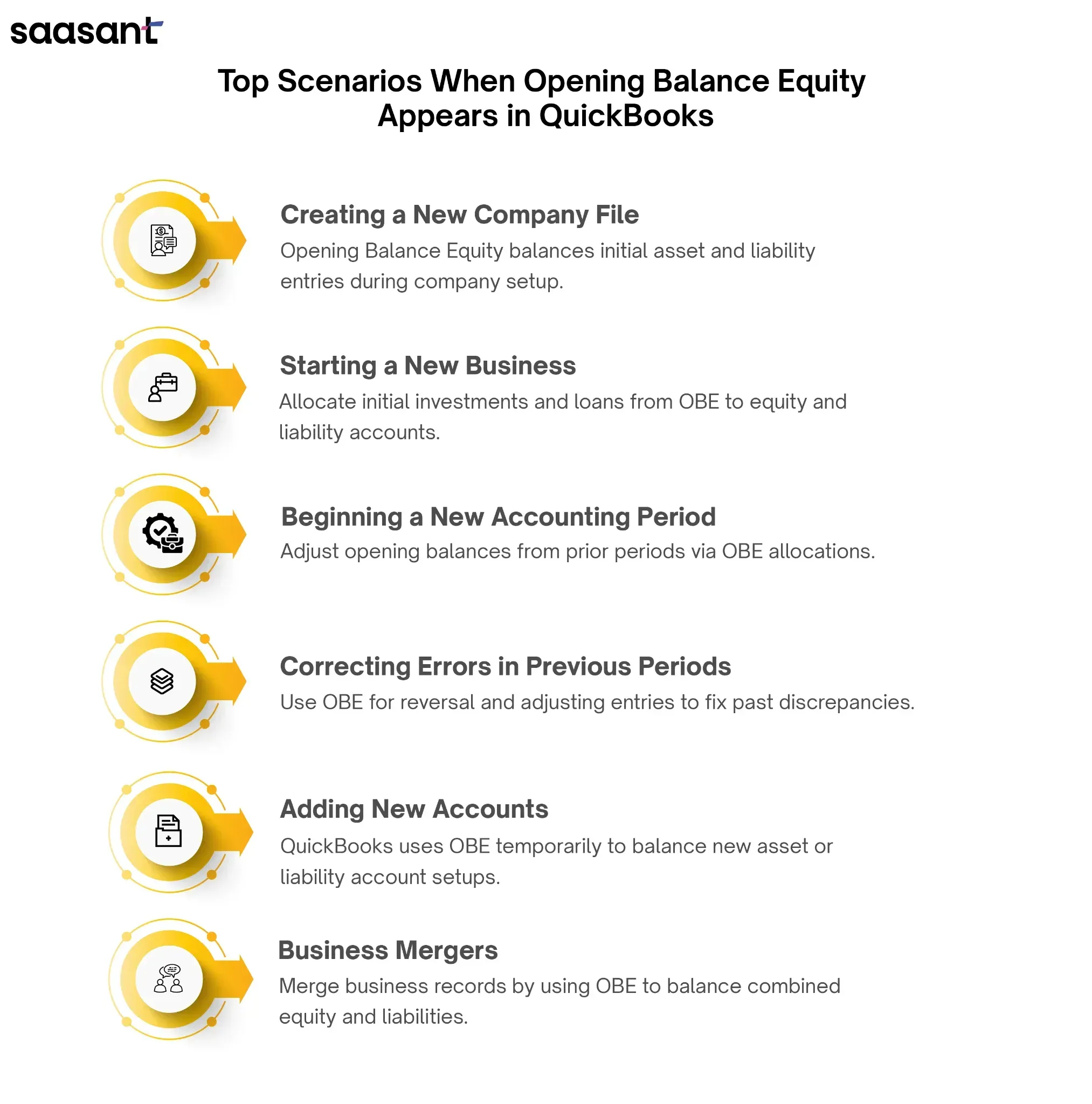

Here are the common scenarios where the Opening Balance Equity account appears:

1. Creating a New Company File

When setting up a new company in QuickBooks, OBE is used to balance the initial setup of accounts:

Step 1: Add opening balances for assets.

QuickBooks credits the OBE account to balance the equation.

Step 2: Add liabilities

QuickBooks debits OBE to reflect the liability balances.

Step 3: Allocate remaining funds from OBE to appropriate equity accounts (e.g., Owner’s Equity or Retained Earnings) through journal entries.

2. Starting a New Business

For new businesses, OBE is used to balance initial investments and liabilities. Funds in the OBE account may represent:

Initial investments: Allocate to the Owner’s Equity or Capital account.

Business loans: Assign to liabilities.

Other equity accounts: For multi-owner businesses, distribute funds among respective equity accounts.

3. Beginning a New Accounting Period

At the start of a new period, adjustments or accruals from the previous period may lead to an OBE balance. Allocate these funds appropriately based on their nature (e.g., revenues, expenses, or balance sheet accounts).

4. Correcting Errors in Previous Periods

Errors in past records may cause discrepancies reflected in the OBE account. To resolve:

Reversal entries: Undo incorrect transactions and reclassify them.

Adjusting entries: Correct balances in the affected accounts.

5. Adding New Accounts

When adding new accounts (e.g., a new asset or liability), QuickBooks may temporarily use the OBE account to balance transactions until allocations are completed.

6. Business Mergers

If merging businesses, QuickBooks may temporarily use OBE to balance the combined assets, liabilities, and equity.

Why Is It Important to Zero Out the Opening Balance Equity Account?

The Opening Balance Equity (OBE) account in QuickBooks is a transitional account used to facilitate the entry of opening balances during setup. While it is a helpful tool for maintaining the accounting equation (Assets = Liabilities + Equity) in the initial stages, it is not intended to hold balances permanently. Leaving funds in the OBE account can lead to several complications, including distorted financial statements, compliance challenges, and analytical confusion.

Clearing the OBE account and reallocating its balance to appropriate accounts is a best practice that ensures accurate and transparent financial reporting. Below, we explore why zeroing out this account is essential for maintaining clean and professional financial records.

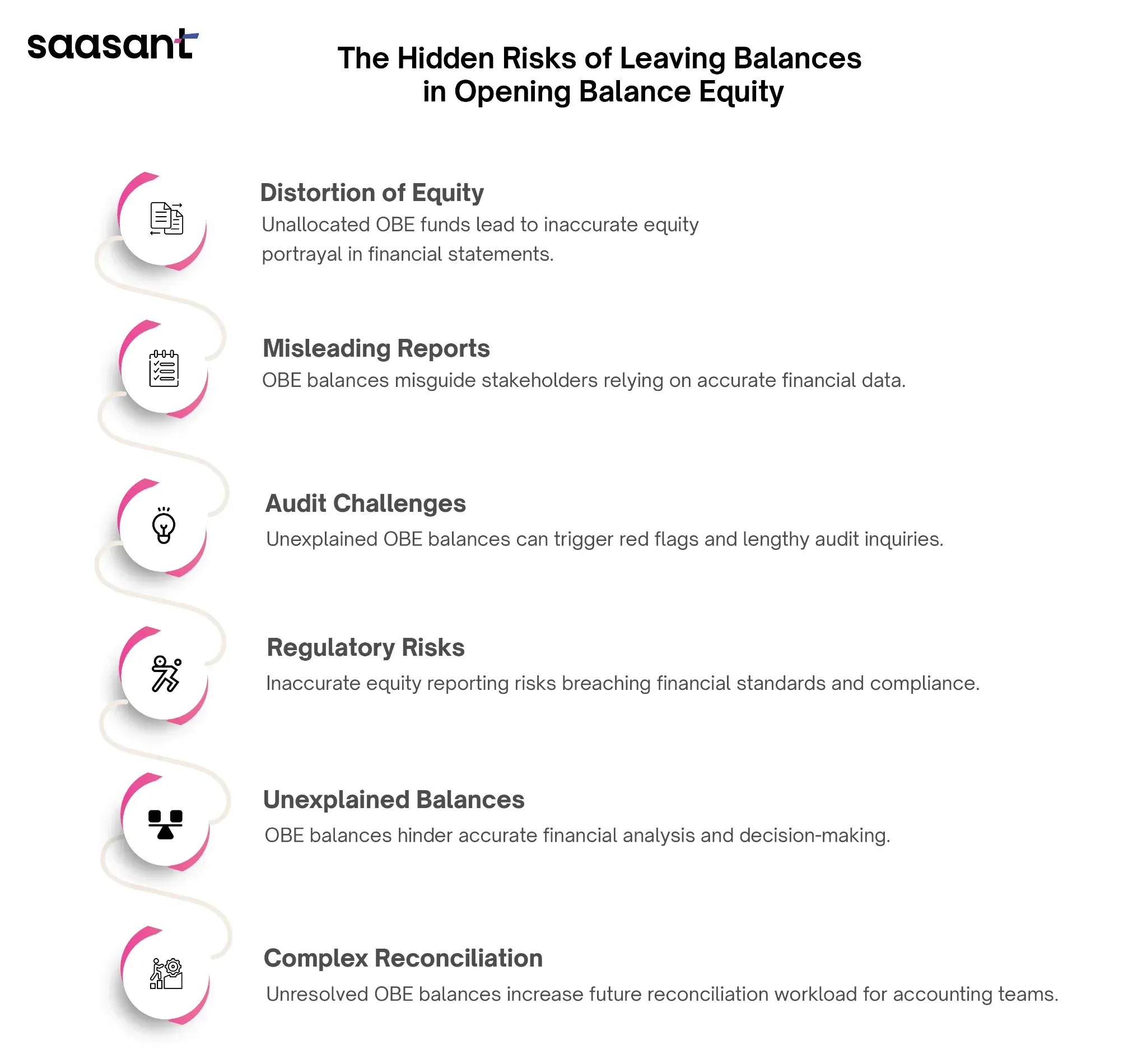

Consequences of Leaving Balances in the Opening Balance Equity Account

Misrepresentation of Financial Statements

Distortion of Equity: Any unallocated funds in the OBE account result in an inaccurate portrayal of a company’s equity. The equity section appears inflated or misaligned instead of reflecting the actual retained earnings or capital contributions.

Misleading Reports: This misrepresentation affects stakeholders who rely on accurate financial reports for decision-making, such as investors, creditors, and management.

Compliance Issues

Audit Challenges: Regulators and auditors often scrutinize financial records for accuracy. An unexplained balance in the OBE account can raise red flags during audits, leading to time-consuming inquiries or penalties for non-compliance.

Regulatory Risks: Inaccurate equity reporting may breach financial reporting standards, causing further complications for businesses operating in regulated industries.

Confusion in Financial Analysis

Unexplained Balances: An unaddressed OBE balance makes it challenging to accurately analyze the company’s financial position. It can obscure the actual equity sources, making it harder to identify trends or make informed decisions.

Complex Reconciliation: Balances left in OBE often require additional effort to trace and reallocate during future reconciliations, increasing the workload for accounting teams.

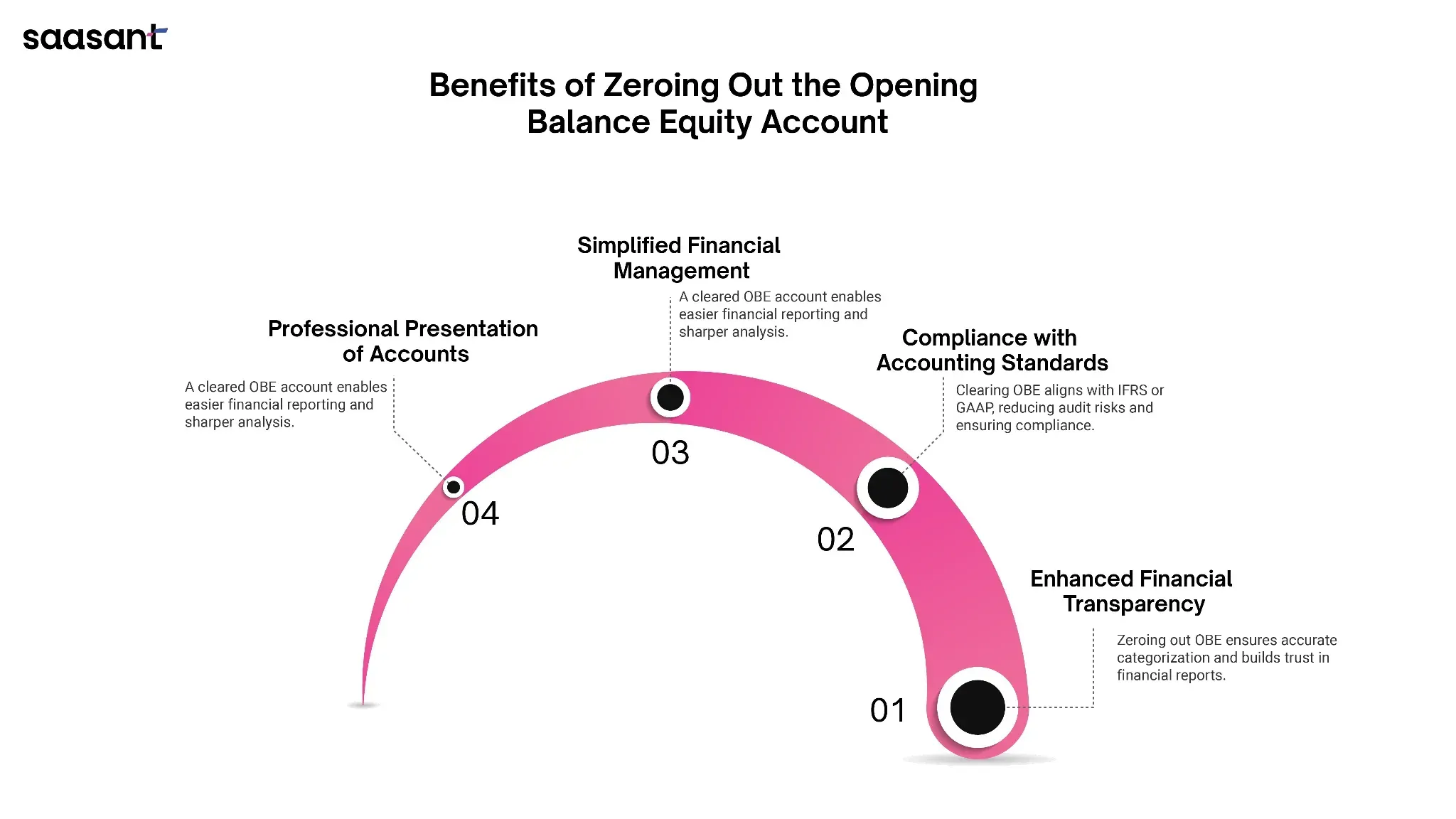

Benefits of Zeroing Out the Opening Balance Equity Account

Enhanced Financial Transparency

Clearing the OBE account ensures that all funds are correctly categorized under equity, liabilities, or retained earnings. This transparency builds trust among stakeholders and enhances the credibility of financial reports.

Compliance with Accounting Standards

Adhering to proper accounting practices by zeroing out the OBE account ensures compliance with international financial reporting standards (IFRS) or generally accepted accounting principles (GAAP). This step reduces the risk of audit issues and ensures regulatory compliance.

Simplified Financial Management

Removing unnecessary balances in the OBE account simplifies financial reporting and analysis. With clean records, decision-makers can focus on actionable insights without being distracted by unexplained discrepancies.

Professional Presentation of Accounts

Properly allocating funds from the OBE account to their respective accounts enhances the professionalism of your financial records, making them suitable for audits, presentations to investors, or use in tax filings.

How to Zero Out the Opening Balance Equity Account?

Identify Unallocated Balances

Review the OBE account to identify all transactions and balances needing reallocation.

Reallocate to Appropriate Accounts

For balances related to initial investments, transfer funds to the Owner’s Equity or Capital Accounts.

For retained earnings or previous profits, reallocate the balance to Retained Earnings.

Validate Adjustments

After reallocating the funds, verify that the OBE account shows a zero balance. Additionally, ensure that the adjustments are correctly reflected in the equity section of the balance sheet.

Document Changes

Maintain a record of the adjustments made for transparency and use during audits or future financial reviews.

Zeroing out the Opening Balance Equity account is critical in maintaining accurate and professional financial records. Allowing funds to remain in this account can distort financial statements, cause compliance challenges, and create confusion during analysis. By reallocating the balances to the appropriate accounts, businesses ensure financial transparency, regulatory compliance, and simplified management of their books.

Adopting this best practice strengthens the reliability of financial reporting and portrays a professional image to stakeholders, auditors, and regulators. Ensure that your financial processes prioritize clearing the OBE account for seamless, accurate, and credible accounting practices.

How to Clear Opening Balance Equity in QuickBooks?

The Opening Balance Equity (OBE) account in QuickBooks is a temporary placeholder that ensures the accounting equation remains balanced when initial account balances are entered during setup. While it is necessary during the initial stages, leaving funds in this account can lead to inaccurate financial statements, complicating audits and financial analyses.

Clearing the OBE account is essential for maintaining clean, transparent, and professional financial records. This section provides a detailed step-by-step approach to zero out the Opening Balance Equity account in QuickBooks and best practices to ensure accuracy.

Step-by-Step Guide to Clearing Opening Balance Equity in QuickBooks

Review Account Balances Linked to OBE

Before making any adjustments, carefully review the accounts contributing to the OBE balance. These accounts might include:

Assets: Bank accounts, inventory, or receivables.

Liabilities: Loans, payables, or credit card balances.

Equity: Retained earnings, capital contributions, or owner’s equity.

Understand the OBE balance's origin to ensure the adjustments are correctly allocated. This step is crucial for accuracy in financial reporting.

Create a Journal Entry to Reallocate Funds

A journal entry is the most effective way to reallocate the funds in the OBE account to their appropriate destinations. Follow these steps to create a journal entry in QuickBooks:

Open the Journal Entry Module

Log into QuickBooks and select the + New button.

From the drop-down menu, choose Journal Entry.

Input the Allocation Details

In the Debit column, specify the account(s) where the funds should be transferred, such as Owner’s Equity, Retained Earnings, or other relevant accounts.

Enter the equivalent amount to the Opening Balance Equity account in the Credit column to zero it out.

Example:

If the OBE balance represents initial capital contributions:

Debit: Owner’s Equity

Credit: Opening Balance Equity

Save the Journal Entry

Save the journal entry after verifying that the debit and credit amounts match. This step ensures that the OBE account is accurately cleared.

Verify the OBE Account Balance

After posting the journal entry, confirm that the OBE account has a zero balance. To do this:

Navigate to the Chart of Accounts in QuickBooks.

Locate the Opening Balance Equity account.

Ensure the account shows a balance of $0.00.

If the account still has a balance, revisit the journal entry to check for errors or omissions in the allocation.

Run Financial Reports to Confirm Accuracy

Verifying the changes through financial reports ensures the OBE account no longer impacts your financial statements.

Run a Balance Sheet Report

Navigate to the ‘Reports’ section and select ‘Balance Sheet.’

Check the equity section to ensure the OBE account no longer appears.

Examine the Equity Accounts

Confirm that the reallocated amounts are correctly reflected under accounts like Retained Earnings or Owner’s Equity.

Running these reports provides confidence in the adjustments and ensures accurate financial reporting.

Why Clearing Opening Balance Equity Matters?

Leaving funds in the OBE account can lead to several complications:

Distorted Financial Statements: An uncleared OBE balance can misrepresent equity, leading to inaccuracies in financial reporting.

Compliance Issues: Auditors and regulators may question unexplained balances, raising concerns about the integrity of your records.

Confusion in Analysis: An unexplained balance complicates financial analysis, making it difficult to interpret the company’s financial health.

By clearing the OBE account, you maintain professional, accurate, and transparent financial records, ensuring compliance and instilling stakeholder confidence.

Best Practices for Clearing OBE

Document Adjustments: Record all journal entries for future reference, audits, or financial reviews.

Consult an Accountant: If you’re unsure about reallocating the OBE balance, seek advice from a certified accountant to avoid errors.

Regular Reviews: Periodically review your financial accounts to ensure no unintentional balances are left in temporary accounts like OBE.

Clearing the Opening Balance Equity account is not merely a technical task but an integral step in maintaining clean, accurate, and compliant financial records. You can effectively zero out the OBE account by following the outlined steps, including reviewing account balances, creating journal entries, and running financial reports.

Taking the time to clear this account ensures professional financial reporting, minimizes confusion, and builds trust in your records. Addressing OBE balances should be a priority for businesses looking to maintain robust financial management practices.

Wrap Up

Mastering the process of recording credit card payments in QuickBooks is not just a fundamental task but a vital step toward ensuring accurate financial management. You can avoid common accounting pitfalls and make well-informed financial decisions by categorizing your expenses correctly, reconciling accounts, and maintaining clear records.

If you're looking for a seamless way to handle bulk credit card payments or complex financial transactions, SaasAnt Transactions can simplify the process significantly. Its robust automation features allow you to import, categorize, and reconcile data with unmatched precision, saving time and minimizing errors.

Additionally, for businesses managing extensive sales transactions, PayTraQer offers an ideal solution by automating the synchronization of payment data between QuickBooks and your payment platforms. This ensures your financial records remain updated in real-time, making tax compliance and financial reporting effortless.

Integrating these tools into your workflow can streamline your financial management processes and help your business achieve greater efficiency. Start exploring the possibilities today to elevate your QuickBooks experience.

FAQs

What Is the Opening Balance Equity Account in QuickBooks?

The Opening Balance Equity (OBE) account in QuickBooks is an automatically created equity account used to offset discrepancies when you enter opening balances for accounts such as bank accounts, loans, or assets. It ensures that the accounting equation, Assets = Liabilities + Equity, remains balanced while you input these initial balances.

Why Does QuickBooks Create the Opening Balance Equity Account?

QuickBooks creates the OBE account to temporarily hold the difference between the opening balances of assets and liabilities when you set up a new company file or add accounts with balances. For instance, if you enter an opening balance for a bank account without specifying the corresponding equity source, QuickBooks records the difference in the OBE account.

How Does Opening Balance Equity Appear in Financial Reports?

The OBE account is reflected in the equity section of your balance sheet. If the account has a balance, it means opening balances have not been fully allocated to the correct accounts (e.g., Retained Earnings, Owner’s Equity). This unresolved balance can distort your financial statements, making them appear unbalanced or inaccurate.

When Should the Opening Balance Equity Account Be Cleared?

The OBE account should be cleared immediately after all opening balances are set up. For example, if you input a $10,000 opening balance for a business bank account, you need to offset it by assigning the $10,000 to an equity account like Owner’s Equity. Once all balances are appropriately allocated, the OBE account should show a zero balance.

How Do I Clear the Opening Balance Equity Account in QuickBooks?

To clear the OBE account:

Review Transactions: Go to the Chart of Accounts, open the OBE account, and review all listed transactions.

Determine Allocation: Identify the appropriate accounts (e.g., Retained Earnings, Owner’s Equity, or Capital Accounts) where these balances should be transferred.

Create a Journal Entry: Use the journal entry feature in QuickBooks to transfer the balance. For example:

Debit the OBE account.

Credit the correct equity account.

Verify Balance: Confirm the OBE account balance is zero by checking the Chart of Accounts.

Run Reports: Generate a balance sheet to confirm the adjustment is reflected accurately.

What Happens If I Leave a Balance in the Opening Balance Equity Account?

Leaving a balance in the OBE account can misrepresent your company’s equity position. For example, if the account has a $5,000 balance, your equity section will show incorrect figures, which could lead to issues during audits, tax filings, or financial analysis. It is essential to reallocate the balance to avoid such complications.

Can the Opening Balance Equity Account Be Deleted in QuickBooks?

No, the OBE account cannot be deleted because it is a system-generated account integral to QuickBooks. However, its balance should always be zero after you have allocated the opening balances to appropriate accounts.

How Do I Check the Balance of the Opening Balance Equity Account in QuickBooks?

To check the OBE account balance:

Navigate to the Chart of Accounts.

Locate the Opening Balance Equity account.

Click on the account to open its register.

Review the list of transactions and the current balance displayed at the top.

What Are Common Scenarios Where the Opening Balance Equity Account Is Used?

The OBE account is typically used in the following scenarios:

Setting up a new QuickBooks company file: When entering opening balances for assets and liabilities.

Adding new accounts: For example, creating a new loan account and recording its balance without specifying an offset account.

Correcting prior-period errors: When adjustments to historical balances require temporary equity adjustments.

Business mergers or acquisitions: To record the opening balances of newly acquired assets and liabilities.

Why Is It Important to Zero Out the Opening Balance Equity Account?

Zeroing out the OBE account ensures that all balances are allocated to appropriate equity accounts, such as Retained Earnings or Owner’s Equity, accurately reflecting the company's financial standing. For example, if a $15,000 bank account opening balance is left in OBE, your financial reports will show an incorrect equity balance, potentially leading to audit discrepancies or tax filing errors.

Can I Consult an Accountant for Clearing the Opening Balance Equity Account?

Yes, if you are unsure how to allocate balances or make journal entries, consulting a certified accountant or QuickBooks expert is highly recommended. They can ensure the account is cleared accurately and prevent errors that could affect your financial statements.

How Does the Opening Balance Equity Account Interact with Retained Earnings?

When closing the OBE account, its balance is often transferred to retained earnings, particularly for balances representing prior-year profits or equity. For example, if you input historical data for a previous year, the final OBE balance should be transferred to Retained Earnings to maintain proper accounting continuity.