Expert Insights on Setting up a Chart of Accounts in QuickBooks for Ecommerce Owners

Are you tired of feeling overwhelmed and stressed about managing your ecommerce business's finances? As an ecommerce business owner, it can be challenging to keep track of your finances, but a well-organized Chart of Accounts in QuickBooks can be the solution you need.

By implementing a detailed Chart of Accounts, you can categorize your financial data, allowing you to make informed decisions about your business's financial health. A poorly organized Chart of Accounts can lead to missed revenue opportunities, uncontrolled expenses, and an inability to understand your business's true financial performance.

With a clear and accurate Chart of Accounts, you can track your revenue and expenses, manage inventory, analyze cash flow, create a budget, and generate financial reports. By gaining a better understanding of your business's financials, you can make confident decisions that will drive your ecommerce business's growth and success.

Contents

What is a Chart of Accounts?

Setting up a Chart of Accounts in QuickBooks

Understanding Account Types in the Chart of Accounts

Editing and Customizing the Chart of Accounts

Chart of Accounts for Ecommerce Businesses

Conclusion

What is a Chart of Accounts?

A Chart of Accounts is a comprehensive listing of all the accounts used by an organization to record financial transactions. In essence, it's a systematic way of organizing and categorizing a company's financial data.

Each account in a Chart of Accounts represents a specific financial aspect of the business, such as revenue, expenses, assets, liabilities, and equity. A well-organized Chart of Accounts is essential for ecommerce business owners, as it helps them keep track of their financial transactions and categorize them according to specific criteria.

For example, an ecommerce business might categorize revenue accounts by sales channels, such as online sales or sales from a physical store. By doing this, they can get a better understanding of where their revenue is coming from and make informed decisions about future business strategies.

Similarly, expenses can be categorized by different departments, such as marketing or operations, to help identify areas where the business might be overspending.

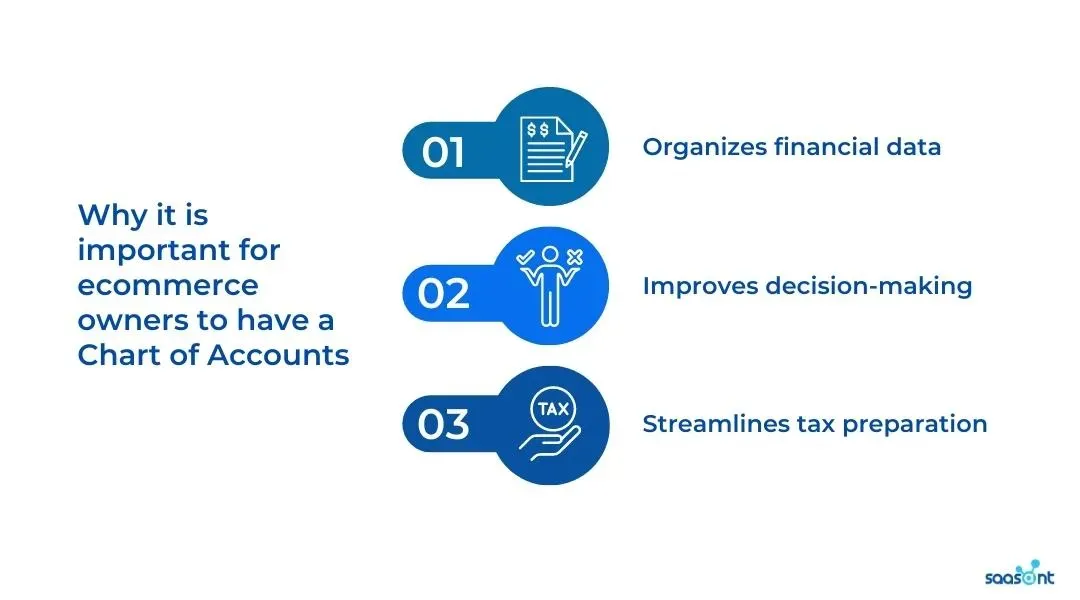

Why it is important for ecommerce owners to have a Chart of Accounts

As an ecommerce owner, you know that managing your finances can be a challenging task. With so many different revenue streams, expenses, and payment methods to keep track of, it can be challenging to know where your business stands financially. That's why having a Chart of Accounts is crucial for ecommerce owners. Here's why:

1. Organizes financial data: A Chart of Accounts helps ecommerce owners organize their financial data, making it easier to track revenue, expenses, and inventory levels. By creating categories for different types of revenue and expenses, ecommerce owners can quickly see where their money is coming from and where it's going.

For example, imagine you run an ecommerce store that sells beauty products. Your Chart of Accounts might include categories for revenue streams such as:

Online Sales

In-Store Sales

Subscription Sales

As well as categories for expenses such as:

Marketing

Inventory Costs

Shipping and Handling

2. Improves decision-making: With a well-organized Chart of Accounts, ecommerce owners can make more informed decisions about their businesses. For example, they can analyze their revenue streams to determine which channels are the most profitable and allocate resources accordingly.

They can also identify areas where they might be overspending and adjust their budgets accordingly.

3. Streamlines tax preparation: A Chart of Accounts makes tax preparation more manageable, as it provides a clear breakdown of revenue and expenses. By having a detailed Chart of Accounts, ecommerce owners can more easily identify deductions and credits and ensure that they're not missing any critical information come tax time.

Setting up a Chart of Accounts in QuickBooks

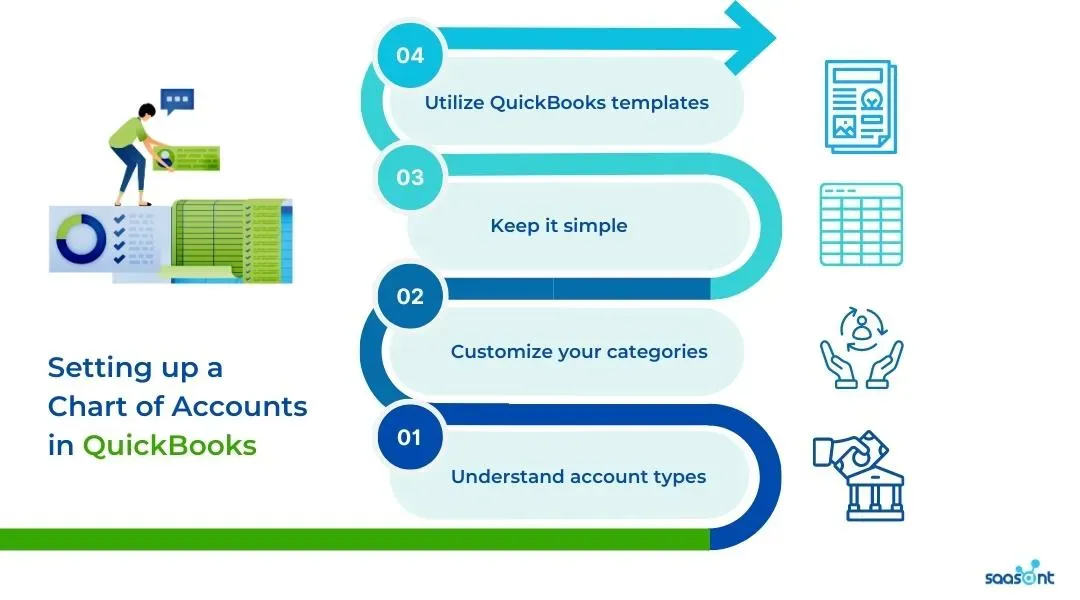

Tips for setting up a Chart of Accounts in QuickBooks

Setting up a Chart of Accounts in QuickBooks may seem daunting at first, but it's essential for managing your ecommerce business's finances effectively. Here's a step-by-step guide to get you started:

1. Understand account types: QuickBooks allows you to create various account types, including income, expense, asset, liability, and equity accounts. Understanding these different account types is crucial when setting up your Chart of Accounts. For example, income accounts track the money you’re making, while expense accounts track the money going out.

2. Customize your categories: When setting up your Chart of Accounts, it's essential to customize your categories to fit your ecommerce business's specific needs.

For example, instead of having a general "Advertising" category, consider breaking it down into subcategories such as "Social Media Advertising," "Google Ads," and "Influencer Marketing."

3. Keep it simple: While it's essential to have a well-organized Chart of Accounts, it's also important not to overcomplicate things. Keep your categories and subcategories as simple as possible to avoid confusion and ensure that you and your team can easily understand and use your Chart of Accounts.

4. Utilize QuickBooks templates: QuickBooks provides various templates that you can use to set up your Chart of Accounts quickly. These templates are designed for different industries and can help ensure that you're setting up your Chart of Accounts correctly.

By setting up a customized Chart of Accounts in QuickBooks, ecommerce owners can benefit from better revenue and expense tracking, more detailed financial reporting, and easier tax reporting and compliance.

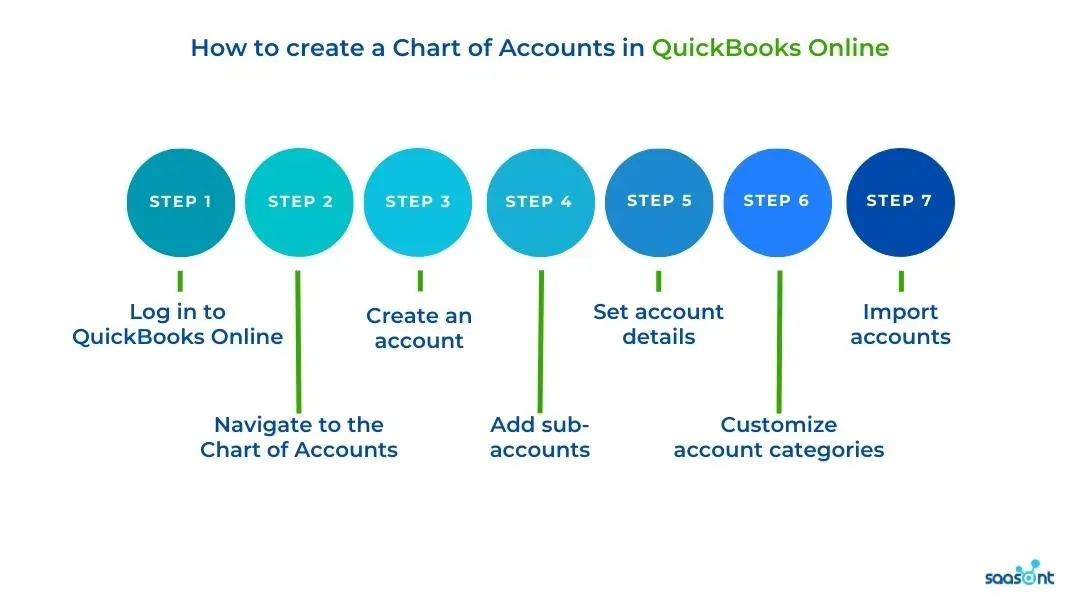

How to create a Chart of Accounts in QuickBooks Online

Creating a Chart of Accounts in QuickBooks Online is a crucial step for any ecommerce business owner. It helps to keep track of financial transactions and to generate accurate financial reports. Here is a detailed guide on how to create a Chart of Accounts in QuickBooks Online:

1. Log in to QuickBooks Online:

To begin, log in to your QuickBooks Online account. If you do not have an account, you will need to create one.

2. Navigate to the Chart of Accounts:

Once logged in, click on the "Accounting" tab in the navigation bar at the left side of the screen. From the dropdown menu, select "Chart of Accounts."

3. Create an account:

To create a new account, click on the "New" button at the top right corner of the screen. Select the appropriate account type from the dropdown menu, such as "Bank," "Credit Card," or "Expense." Fill in the required fields, such as the account name and description.

4. Add sub-accounts:

To add sub-accounts, click on the account name in the Chart of Accounts list. Select the "New sub-account" button at the top right corner of the screen. Enter the sub-account name and description.

5. Set account details:

After creating the account and sub-accounts, click on the account name to set the account details. Here, you can add the account number, adjust the opening balance, and set the tax code.

6. Customize account categories:

To customize the account categories, click on the "Settings" icon at the top right corner of the screen. Select "Account and Settings," then click on the "Advanced" tab. Here, you can customize the categories to fit the unique needs of your ecommerce business.

7. Import accounts:

If you have an existing Chart of Accounts, you can import it into QuickBooks Online. To do so, click on the "Settings" icon, select "Import Data," and follow the prompts to upload the file.

By following these steps, you can easily create a Chart of Accounts in QuickBooks Online for your ecommerce business. The process may seem overwhelming at first, but taking the time to set up a customized Chart of Accounts will ultimately save you time and effort in the long run.

How many Chart of Accounts can you have in QuickBooks Online?

QuickBooks Online offers users the flexibility to create and customize their Chart of Accounts according to their business needs. However, there are some limitations on the number of accounts you can create.

As of 2023, QuickBooks Online users are allowed to create up to 250 accounts per company file, however for QuickBooks Online Advanced, you can open unlimited accounts. This number includes all account types, such as income, expense, asset, liability, and equity accounts. This limit should be sufficient for most small and medium-sized businesses.

However, it's worth noting that there are some instances where you may need more than 250 accounts. For example, if your business has multiple locations or products, you may need to create separate accounts to track revenue and expenses for each location or product.

In this case, you may need to consider using sub-accounts to stay within the 250 account limit. Another thing to keep in mind is that having too many accounts can also make your Chart of Accounts difficult to manage.

It's important to keep your Chart of Accounts organized and streamlined to make it easy to understand for you and your team. In addition, QuickBooks Online offers features such as classes and tags that can help you categorize and track transactions without needing to create additional accounts.

While there is a limit of 250 accounts in QuickBooks Online Simple Start, Essentials, and Plus; most businesses find this sufficient for their needs. It's important to focus on creating a well-organized and customized Chart of Accounts that meets your business needs and is easy to understand and manage.

Understanding Account Types in the Chart of Accounts

5 main account types in the Chart of Accounts

The Chart of Accounts is an essential tool for financial management in any business. It allows business owners to categorize and track financial transactions accurately and easily.

Understanding the different account types in the Chart of Accounts is crucial to creating a well-organized and effective financial management system. In QuickBooks, there are five main account types:

1. Assets: Assets are resources that a business owns, such as cash, inventory, and equipment. These accounts are typically used to track items that have a financial value and can be used to generate revenue for the business.

2. Liabilities: Liabilities are debts that a business owes to others, such as loans, credit card balances, and accounts payable. These accounts are used to track money owed by the business to outside parties.

3. Equity: Equity represents the owner's investment in the business. It includes items such as capital, retained earnings, and dividends. These accounts are used to track the ownership interest in the business.

4. Income: Income accounts are used to track revenue generated by the business, such as sales and services rendered. These accounts are typically used to track sources of income and help business owners identify the most profitable aspects of their business.

5. Expenses: Expense accounts are used to track costs associated with running the business, such as rent, utilities, and employee wages. These accounts are used to help business owners understand where their money is going and identify areas where they can cut costs.

Note that each account type has sub-accounts, which allow for greater customization and specificity in tracking transactions. For example, under the "Expense" account type, you may have sub-accounts for rent, utilities, and employee wages.

How to determine which account types are needed for an ecommerce business

Determining the account types needed for an ecommerce business requires a thorough understanding of the business operations and financial transactions. Each ecommerce business is unique in terms of its products or services, revenue streams, and expenses.

As such, the Chart of Accounts must be customized to fit the specific needs of the business. To begin the process of determining which account types are needed, it is important to start by identifying the different revenue streams and types of expenses associated with the ecommerce business.

Revenue streams can include product sales and shipping fees, while expenses can include inventory costs, payment processing fees, and marketing expenses. Once the different revenue streams and expenses have been identified, they can be grouped into relevant account types.

For example, revenue from product sales can be categorized under the "Income" account type, while payment processing fees can be categorized under the "Expense" account type. It is important to consider the specific sub-accounts within each account type to ensure that the Chart of Accounts is tailored to the unique needs of the ecommerce business.

Another important consideration when determining which account types are needed for an ecommerce business is compliance with tax laws and regulations. Certain types of revenue streams and expenses may be subject to different tax rates or deductions, and the Chart of Accounts must reflect these variations to ensure accurate tax reporting.

Editing and Customizing the Chart of Accounts

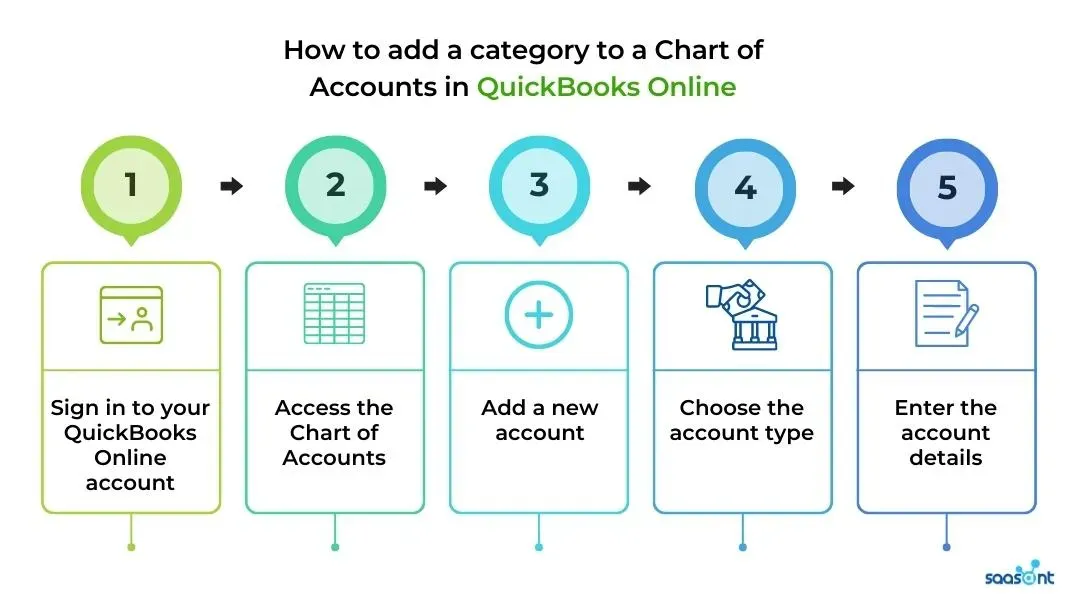

How to add a category to a Chart of Accounts in QuickBooks Online

A category is a grouping or classification of similar accounts in the chart of accounts. Adding a category to a Chart of Accounts in QuickBooks Online is a straightforward process that helps you organize your financial transactions. Here are the steps to add a category to your Chart of Accounts:

1. Sign in to your QuickBooks Online account

To add a category to your Chart of Accounts, you first need to sign in to your QuickBooks Online account. Open your web browser and navigate to the QuickBooks Online login page. Enter your login credentials and click on the 'Sign In' button.

2. Access the Chart of Accounts

Once you have logged in to your account, navigate to the Chart of Accounts. You can do this by clicking on the 'Accounting' menu on the left-hand side of the screen and selecting 'Chart of Accounts'.

3. Add a new account

You need to add a new account. To do this, click on the 'New Account' button located in the top right-hand corner of the screen.

4. Choose the account type

When adding a new account, you need to choose the account type that matches the category you want to add. You can choose from a range of account types, including bank, credit card, income, expense, and other current assets or liabilities. Once you have selected the appropriate account type, click on the 'Continue' button.

5. Enter the account details

The final step is to enter the account details. This includes the account name, the description, and the opening balance. You can also choose to link the account to a bank or credit card account.

Once you have entered all the details, click on the 'Save and Close' button to save the new account and add it to your Chart of Accounts.

QuickBooks Chart of Accounts Template

QuickBooks Online provides a Chart of Accounts template to help businesses get started with their financial management. This template includes a pre-built list of accounts that are commonly used by businesses.

However, it may not be suitable for all businesses, especially ecommerce businesses with unique revenue streams and expense categories. Customizing the Chart of Accounts template in QuickBooks Online is crucial to accurately reflect the financial transactions of an ecommerce business.

To customize the Chart of Accounts template in QuickBooks Online, follow these steps:

1. Navigate to the Chart of Accounts section in QuickBooks Online and click on "New" to add a new account.

2. Select the account type that best fits the new account you want to create. For example, if you want to add a new revenue account for your ecommerce store, select "Income" as the account type.

3. Enter the account name and description. Be as specific as possible to accurately reflect the type of transaction that will be recorded in the account.

4. Assign the account to the appropriate account category and detail type. QuickBooks Online provides a list of categories and detail types to choose from.

5. Save the new account.

Chart of Accounts for Ecommerce Businesses

Accounting for Ecommerce

Accounting for ecommerce businesses is an essential aspect of financial management. It involves keeping track of all the financial transactions related to the business, such as sales, expenses, inventory, and taxes.

One of the most crucial elements of ecommerce accounting is the Chart of Accounts, which is used to organize and categorize financial transactions for easy tracking and reporting. The Chart of Accounts is a list of all the accounts used by a business to record its financial transactions.

Each account is assigned a unique account number and is classified under one of the five main account types: assets, liabilities, equity, income, and expenses. By categorizing transactions according to account types, businesses can create a financial statement that shows the company's financial health.

For ecommerce businesses, the Chart of Accounts should be customized to reflect the unique nature of their operations. This customization can include adding new accounts specific to ecommerce, such as shipping and handling, advertising costs, or payment processing fees.

Additionally, ecommerce businesses should ensure that their accounts are set up to reflect their sales channels, such as Amazon, eBay, or their own online store. It's also important for ecommerce businesses to properly account for inventory, which can be a significant asset on their balance sheet.

QuickBooks Online offers inventory management features that allow businesses to track inventory levels, costs, and sales. By accurately tracking inventory, businesses can ensure they have sufficient stock on hand to meet customer demand while avoiding overstocking and tying up valuable cash.

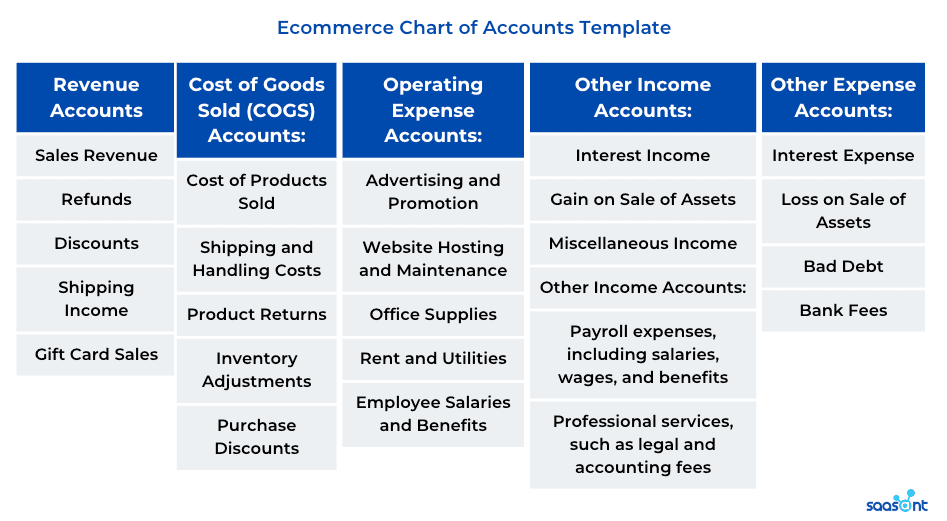

Ecommerce Chart of Accounts Template

This is a general guideline for creating a Chart of Accounts for ecommerce businesses.

These are just general categories, and ecommerce businesses can customize their Chart of Accounts based on their specific needs and financial reporting requirements. It is essential to consult with a financial expert or accountant to determine the appropriate accounts to set up in your Chart of Accounts.

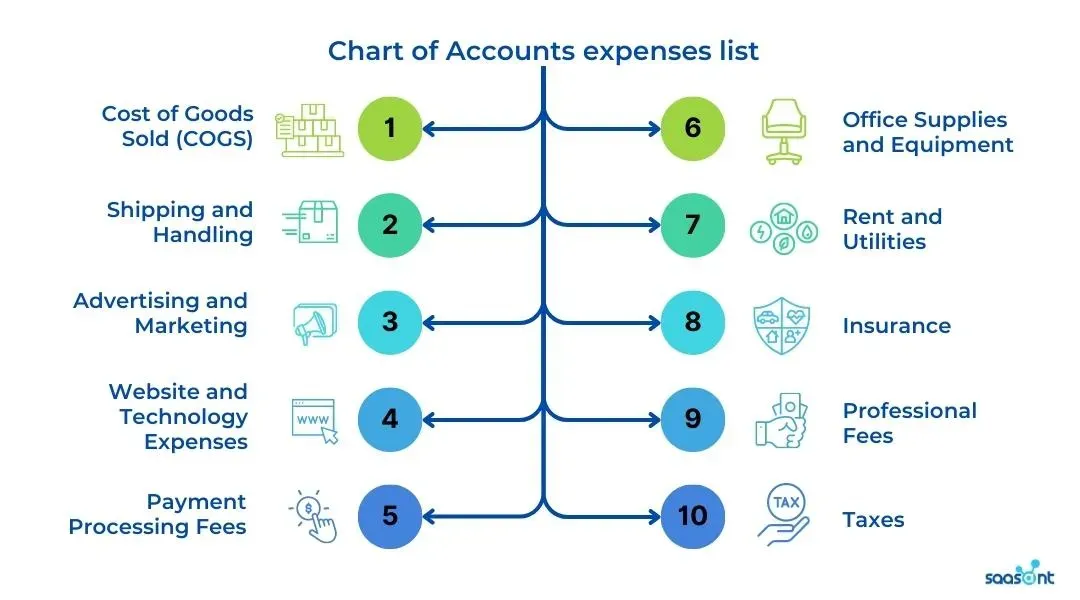

Chart of Accounts expenses list

Here are some common expenses for ecommerce businesses that can be added to a Chart of Accounts:

1. Cost of Goods Sold (COGS): This includes the cost of materials, labor, and other costs directly associated with producing or acquiring goods sold.

2. Shipping and Handling: This includes the cost of shipping and handling goods to customers, including packaging and postage.

3. Advertising and Marketing: This includes the cost of advertising and promoting the ecommerce business, such as online ads, social media ads, and email marketing campaigns.

4. Website and Technology Expenses: This includes expenses related to website hosting, design, maintenance, and development, as well as expenses for software, hardware, and other technology.

5. Payment Processing Fees: This includes the fees charged by payment processors, such as PayPal or Stripe, for processing online payments.

6. Office Supplies and Equipment: This includes expenses for office supplies, such as paper and ink, and equipment, such as computers and printers.

7. Rent and Utilities: This includes expenses for rent or mortgage payments, as well as utilities like electricity, water, and internet.

8. Insurance: This includes expenses for insurance policies, such as liability insurance and business property insurance.

9. Professional Fees: This includes expenses for professional services, such as legal and bookkeeping services.

10. Taxes: This includes expenses for federal, state, and local taxes, as well as sales tax and income tax.

Chart of Accounts for Amazon sellers

Amazon sellers can use a Chart of Accounts to track their revenue and expenses in QuickBooks by customizing their Chart of Accounts to match their business needs. Here are the steps to follow:

1. Customize the Chart of Accounts: Sellers can customize their Chart of Accounts to include specific accounts that match their business needs. They can create accounts for revenue, expenses, and other relevant categories that they want to track.

2. Map Amazon transactions: Use QuickBooks Online to import their transactions from Amazon using applications like PayTraQer and SaasAnt Transactions. They can map their Amazon transactions to the appropriate accounts in their Chart of Accounts, which will allow them to track their revenue and expenses more accurately.

3. Track Amazon fees: Amazon charges sellers various fees, including referral fees, fulfillment fees, and storage fees. These fees should be recorded as expenses in the Chart of Accounts. By tracking these fees, Amazon sellers can better understand their profit margins and make informed decisions about their business.

4. Reconcile accounts: It's important to reconcile accounts regularly to ensure that all transactions are recorded accurately in the Chart of Accounts. This involves comparing the transactions in QuickBooks to the transactions in Amazon to ensure that they match.

Conclusion

Having a well-organized Chart of Accounts is crucial for ecommerce business owners who want to effectively manage their finances in QuickBooks. It helps to keep track of revenue, expenses, assets, liabilities, and equity, and provides a clear and accurate picture of the financial health of the business.

By customizing the Chart of Accounts to fit the specific needs of their business, ecommerce owners can gain greater control and visibility over their finances, allowing them to make informed decisions and plan for the future.

Additionally, there are several third-party tools available, such as PayTraQer and SaasAnt Transactions, which can help streamline the process of managing and reconciling ecommerce transactions in QuickBooks.

By taking the time to set up and maintain a customized Chart of Accounts, ecommerce business owners can gain a better understanding of their finances, reduce errors, and save time and money in the long run. Don't wait any longer, start optimizing your Chart of Accounts today!