Comprehensive Guide on Accounting for Shopify Dropshipping: Tools, Tips, and Techniques

Have you been keeping up with the impressive growth rates of the Shopify platform? Gross Merchandise Volume rose by a remarkable 15%, totaling an incredible $49.6 billion - over $6.4 billion higher than the first quarter of 2022. Not to mention, total revenue also experienced an extraordinary surge of 25%, reaching an impressive $1.5 billion on a constant currency basis.

However, with the increasing number of transactions that take place daily on the platform, some ecommerce business owners still struggle to manage their finances within the Shopify platform. It's easy to feel overwhelmed and lose track of your financial data amidst the hustle and bustle of e-commerce.

This is where Shopify Accounting comes in - it's the solution for seamlessly managing your financial transactions within the Shopify platform. The process streamlines all financial activities and tracks each transaction with pinpoint accuracy, giving you clear insights and control over your business's financial health.

The right accounting software can help you automate tasks such as invoicing, payment processing, and tax reporting, allowing you to focus on other aspects of the business. In this article, we'll delve deeper into Shopify Accounting and the importance of using accounting software for Shopify.

We'll also provide tips and tricks for getting started. By the end of this article, you'll have the knowledge and tools you need to take control of your finances and drive your ecommerce business to success.

Contents

Accounting for Shopify Dropshipping

Setting Up Accounting for Shopify

Managing Accounting for Shopify

Accounting Software for Shopify

Hiring a Shopify Bookkeeper

Conclusion

FAQs

Accounting for Shopify Dropshipping

Accounting for Shopify dropshipping involves managing financial transactions for an ecommerce business that uses the dropshipping model within the Shopify platform. In dropshipping, the merchant doesn't keep inventory in stock but instead purchases products from a supplier who ships them directly to the customer.

To properly manage accounting for Shopify dropshipping, it's essential to have a clear understanding of revenue, expenses, and profit margins. Dropshipping can be a profitable business model, but it also comes with unique challenges such as fluctuating product costs and shipping fees.

Accounting software can be a valuable tool for managing accounting for Shopify dropshipping. It can automate tasks such as tracking revenue, expenses, and profit margins, as well as creating and sending invoices to customers. Additionally, many accounting software options integrate with Shopify, allowing for seamless financial management within the platform.

By properly managing accounting for Shopify dropshipping, ecommerce business owners can make informed decisions about their business's financial health, optimize profit margins, and reduce the risk of errors or financial mismanagement.

Shopify dropshipping accounting software

Shopify dropshipping accounting software refers to a type of software designed to help Shopify dropshipping business owners manage their finances and accounting processes. This software allows ecommerce owners to track sales, expenses, profits, and other financial metrics, all in one place.

The software automates several accounting processes, such as invoicing, tax calculations, and inventory management. It also generates financial reports, which helps businesses understand their financial position, identify trends, and make informed decisions.

The software is especially important for businesses that operate online, as they deal with a high volume of transactions that can be difficult to manage manually. With accounting software, ecommerce owners can save time, reduce the risk of errors, and improve the accuracy of their financial records.

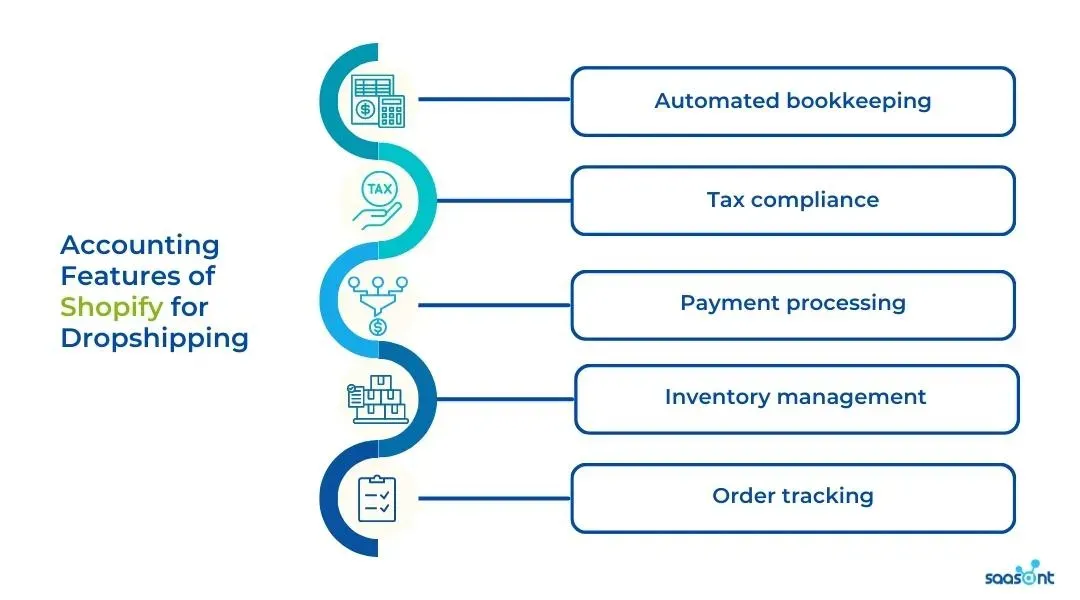

Accounting features of Shopify for dropshipping

One of the key advantages of Shopify for dropshipping is its integrated accounting system, which helps you keep track of your financial transactions and manage your business finances. Here are some of the accounting services that Shopify offers for dropshipping businesses:

1. Automated bookkeeping: With Shopify, you can automatically record your sales, expenses, and tax data, which can save you a lot of time and effort. The platform also generates financial reports, such as profit and loss statements, balance sheets, and cash flow statements, to give you a clear picture of your financial performance.

2. Tax compliance: Shopify automatically calculates and collects taxes based on your business location and customer location, which helps you comply with tax laws and regulations. You can also set up tax overrides and exemptions for specific products or regions.

3. Payment processing: Shopify offers multiple payment processing options, such as credit cards, PayPal, and Apple Pay, which simplify the payment collection process. The platform also integrates with accounting software like QuickBooks and Xero, so you can seamlessly transfer your financial data.

4. Inventory management: Shopify's inventory management system tracks your product stock levels, sales, and shipments, and updates your financial records accordingly. This helps you avoid overselling or underselling, which can cause accounting errors and customer dissatisfaction.

5. Order tracking: With Shopify's order tracking system, you can see the status of your orders, including pending, shipped, and delivered orders. This helps you reconcile your sales and revenue figures and keep track of your customer satisfaction levels.

Setting Up Accounting for Shopify

How to set up accounting for Shopify

Setting up accounting for your Shopify store is a crucial step to effectively manage your finances and track your sales. With the right accounting software and tools in place, you can easily keep track of your expenses, revenue, and profits. In this guide, we will take you through the steps to set up accounting for your Shopify store:

1. Choose the right accounting software: The first step is to select the right accounting software that suits your needs. Look for an accounting software that integrates with Shopify and provides features like automatic syncing of sales data, tracking expenses, generating financial statements, and tax compliance.

2. Connect Shopify to your accounting software: Once you have selected the right accounting software, connect your Shopify store to it. You can do this by navigating to the "Apps" section in your Shopify dashboard, searching for your accounting software, and then installing and configuring it.

3. Set up your chart of accounts: Your chart of accounts is the list of all your business's accounts, which include assets, liabilities, income, and expenses. Set up your chart of accounts to categorize your transactions accurately.

4. Create tax rates and rules: Ensure you set up tax rates and rules that apply to your business and the locations you operate. This helps you automatically calculate taxes on your sales.

5. Set up payment gateways: Set up your payment gateways to receive payments from your customers. Ensure your accounting software is synced to these payment gateways so that all transactions are recorded automatically.

6. Create invoices and receipts: Create customized invoices and receipts to provide to your customers when they make a purchase. Ensure your accounting software is configured to automatically generate invoices and receipts.

7. Track your expenses: Record all your business expenses, including product costs, shipping costs, and other expenses like rent and utilities. Make sure you categorize each expense correctly.

8. Review your financial reports: Regularly review your financial reports, such as your balance sheet, income statement, and cash flow statement. These reports help you monitor your business's financial performance and identify areas for improvement.

What account type should Shopify fees go into

Shopify fees should be recorded as an expense in your accounting records. Specifically, they should be recorded under the "Cost of Goods Sold" (COGS) account. COGS is a category of expenses that includes all the costs incurred in the production of goods sold by your business. Shopify fees are a necessary cost of selling products through the Shopify platform, and as such, they should be included in this category.

It's important to note that the COGS account should only include direct costs associated with the production or sale of goods, such as the cost of the product, packaging, and shipping. Indirect costs, such as Shopify's monthly subscription fee, should not be included in the COGS account but rather in a separate expense account.

By correctly categorizing Shopify fees under COGS, you can accurately calculate the gross profit of your business. Gross profit is the amount of revenue you generate after accounting for the direct costs of producing and selling your products. This information is crucial for evaluating the profitability of your business and making informed financial decisions.

Managing Accounting for Shopify

Shopify accounting system

Shopify provides its users with an easy-to-use and comprehensive accounting system that simplifies financial tracking and bookkeeping for your online store. The Shopify accounting system automates financial management and integrates easily with other apps, making it easy to track and manage your business's finances in one place.

The accounting system in Shopify includes a variety of tools to make managing your finances simple and straightforward. These tools include order management, payment processing, and inventory tracking. With these features, you can easily track and monitor your business's cash flow, expenses, and profits.

Shopify's accounting system also integrates with popular accounting software like QuickBooks and Xero, which can help streamline your bookkeeping processes even further. By integrating your Shopify store with your accounting software, you can easily keep track of your financial data and avoid any manual data entry errors.

In addition to these features, Shopify's accounting system also provides users with customizable financial reports, which can be used to analyze business performance and make informed decisions. With these reports, you can quickly assess the health of your business and identify areas for improvement.

Shopify accounting reports

Shopify accounting reports provide ecommerce businesses with essential financial data to help them make informed decisions about their operations. These reports are generated using accounting software and can be customized to fit the specific needs of the business.

Shopify accounting reports can provide valuable insights into the company's financial health, including revenue, expenses, profits, and losses. By analyzing these reports, businesses can identify areas where they can cut costs or invest more resources to increase profits.

Some of the most common Shopify accounting reports include the income statement, balance sheet, cash flow statement, and sales reports. The income statement provides a snapshot of the business's revenue and expenses over a specific period, while the balance sheet shows the business's assets, liabilities, and equity.

The cash flow statement shows the inflow and outflow of cash in the business, while sales reports provide information on sales trends and customer behavior. Shopify accounting reports can also be used to track inventory levels, monitor tax obligations, and prepare financial statements for external stakeholders such as investors and creditors.

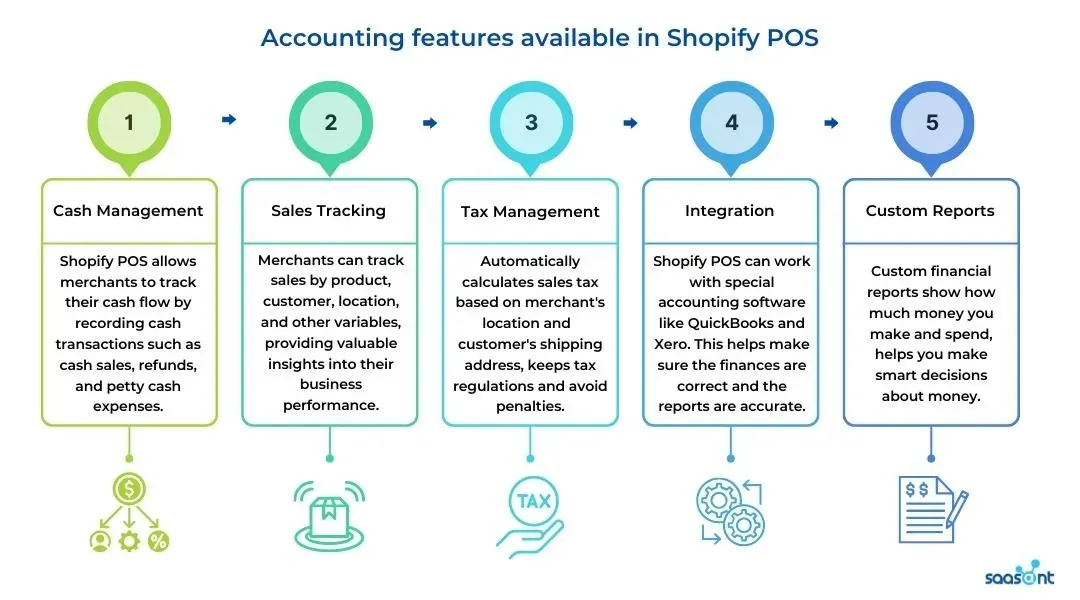

Accounting features available in Shopify POS

Shopify POS (Point of Sale) is a popular retail solution that allows merchants to sell their products in-person. Shopify POS comes with several accounting features that enable merchants to manage their financial data, track sales, and create financial reports. Here are some of the accounting features available in Shopify POS:

1. Cash management: Shopify POS allows merchants to track their cash flow by recording cash transactions such as cash sales, refunds, and petty cash expenses.

2. Sales tracking: Merchants can track sales by product, customer, location, and other variables, providing valuable insights into their business performance.

3. Tax management: It automatically calculates sales tax based on the merchant's location and the customer's shipping address. This helps merchants stay compliant with tax regulations and avoid penalties.

4. Integration with accounting software: Shopify POS integrates with several popular accounting software solutions, including QuickBooks and Xero. This enables merchants to seamlessly transfer their financial data and generate accurate financial reports.

5. Custom financial reports: Lastly, it allows merchants to generate custom financial reports such as profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into business performance and help merchants make informed financial decisions.

Accounting Software for Shopify

Best accounting software for Shopify

There are several factors to consider when selecting the best accounting software for your Shopify store. Some of the most important factors to consider include:

1. Integration with Shopify: The accounting software should be able to integrate seamlessly with Shopify to automate the process of tracking and recording transactions.

2. User-friendly interface: The accounting software should have a user-friendly interface that is easy to navigate and understand. This will help you to easily manage your accounting tasks without having to spend too much time learning how to use the software.

3. Automation: Look for accounting software that automates tasks such as data entry and invoicing. This will help to save time and reduce the risk of errors.

4. Reporting: The accounting software should be able to generate comprehensive reports that give you a clear picture of your financial status.

5. Cost: Consider the cost of the accounting software, including any monthly or annual fees, to ensure that it fits within your budget.

6. Scalability: The accounting software should be scalable, meaning that it can grow with your business and accommodate an increasing number of transactions.

7. Security: Look for accounting software that has robust security features to protect your financial data.

By considering these factors, you can choose the best accounting software for your Shopify store that meets your business needs and budget.

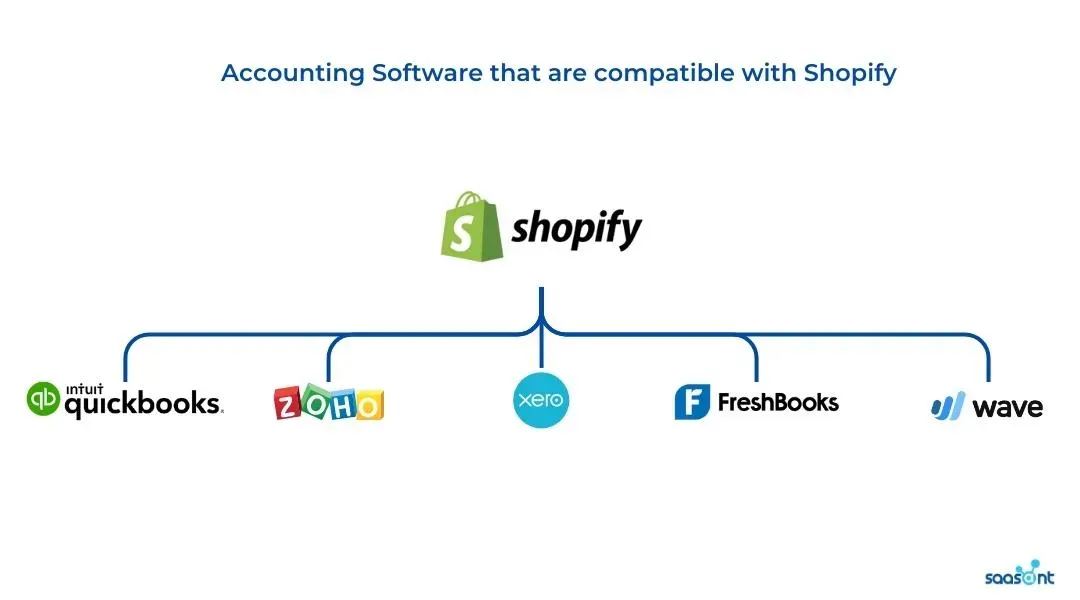

What accounting software is compatible with Shopify

There are several accounting software options that are compatible with Shopify. Some of the popular ones include:

1. Xero: Xero is cloud-based accounting software that integrates seamlessly with Shopify. It offers features like bank reconciliation, invoicing, inventory management, and financial reporting.

2. QuickBooks: QuickBooks is another popular accounting software that works well with Shopify. It offers features like invoicing, expense tracking, inventory management, and financial reporting.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers features like invoicing, expense tracking, inventory management, and financial reporting. It integrates with Shopify to automatically sync orders and inventory data.

4. Wave: Wave is a free accounting software that is ideal for small businesses. There are no subscription fees for using it, only transaction fees are charged for using Wave. It offers features like invoicing, expense tracking, and financial reporting. It integrates with Shopify to automatically import orders and payment data.

5. FreshBooks: FreshBooks is a cloud-based accounting software that offers features like invoicing, expense tracking, time tracking, and financial reporting. It integrates with Shopify to automatically import orders and customer data.

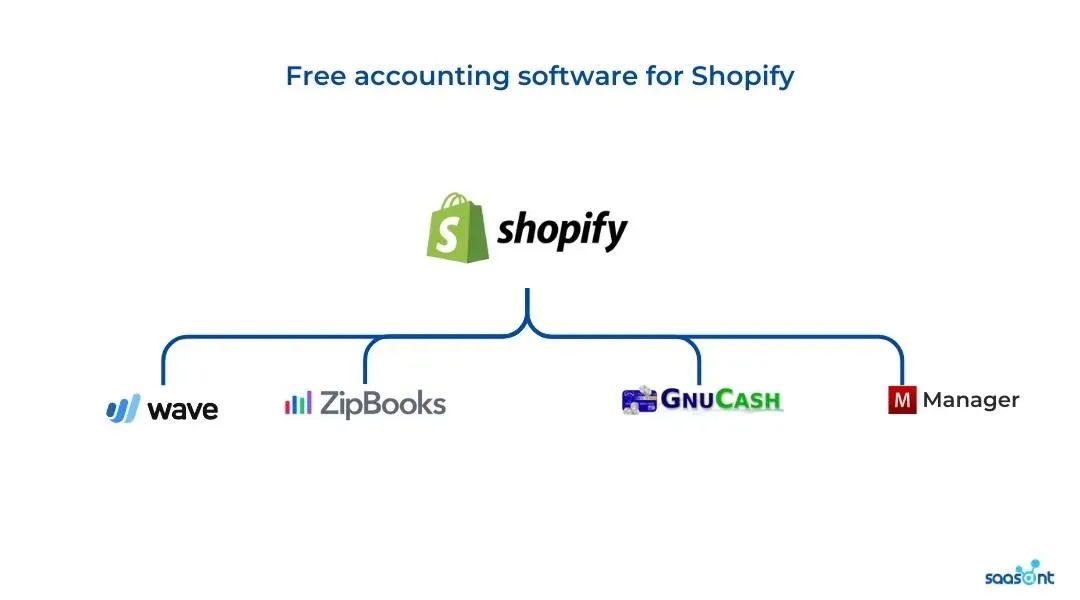

Free accounting software for Shopify

There are several free accounting software options available for Shopify, each with their own features and limitations. Here are a few examples:

1. Wave: Wave is a free accounting software that is popular with small business owners. It offers features such as invoicing, receipt tracking, and bank account and credit card syncing. Wave also integrates with Shopify to automatically import sales data and track inventory.

2. ZipBooks: ZipBooks is another free accounting software that offers features such as invoicing, time tracking, and project management. It should be noted that only the starter pack of this application is free. It integrates with Shopify to import sales data and track inventory.

3. GnuCash: GnuCash is a free, open-source accounting software that offers features such as invoicing, expense tracking, and budgeting. While it doesn't have a direct integration with Shopify, sales data can be manually imported.

4. Manager: Manager is a free accounting software that offers features such as invoicing, inventory tracking, and bank account syncing. It also has a direct integration with Shopify to automatically import sales data.

Hiring a Shopify Bookkeeper

What does a Shopify bookkeeper do?

Sometimes you are worried and unsure about the technicality involved in using an accounting software. That’s where a bookkeeper comes in. A Shopify bookkeeper is responsible for managing the financial records and transactions of a business that uses the Shopify platform for their e-commerce operations.

Their main responsibilities include recording sales, expenses, and other financial transactions, reconciling bank and credit card statements, preparing financial reports, and ensuring compliance with tax and regulatory requirements.

In addition, they may also assist in the budgeting process, inventory management, and cash flow forecasting. They may also collaborate with other members of the finance team, such as accountants or financial analysts, to ensure accurate and timely reporting of financial information.

Benefits of hiring a bookkeeper for Shopify

Hiring a bookkeeper for Shopify can provide numerous benefits to your business. Here are some of the advantages:

1. Accuracy: A bookkeeper can ensure that all financial records are accurate and up-to-date, reducing the risk of errors in financial statements.

2. Time-saving: By outsourcing bookkeeping tasks to a professional, you can free up time to focus on other important aspects of your business.

3. Financial insights: Bookkeepers can provide you with valuable insights into your business’s financial health and offer suggestions for improvements.

4. Compliance: The bookkeeper can ensure that your business stays in compliance with tax laws and regulations.

5. Organization: They help keep your financial records organized and easily accessible, saving you time and stress when it comes to tax season.

6. Cost-effective: Hiring a bookkeeper can be more cost-effective than hiring an in-house accountant or trying to manage your finances on your own.

7. Expertise: With specialized knowledge and expertise in financial management, a bookkeeper can benefit your business in the long run.

What to look for in a Shopify bookkeeper

When hiring a bookkeeper for your Shopify store, there are several things to look for to ensure that you are choosing the right person for the job. Here are some important factors to consider:

1. Experience: Look for a bookkeeper with experience working with Shopify stores or similar businesses. They should be familiar with Shopify's accounting features and be able to navigate the platform with ease.

2. Attention to detail: Bookkeeping requires a high level of attention to detail to ensure accuracy in financial records. Look for a bookkeeper who is detail-oriented and has a track record of producing accurate financial reports.

3. Communication skills: Your bookkeeper should be able to communicate financial information clearly and effectively. They should be able to explain complex financial data in a way that is easy to understand for non-financial professionals.

4. Availability: Make sure your bookkeeper is available when you need them. Consider whether you need someone who can work full-time, part-time, or on a project basis.

5. Education and credentials: While not always necessary, a bookkeeper with a degree in accounting or a relevant certification, such as a Certified Bookkeeper (CB) or Certified Public Accountant (CPA), can provide added assurance of their skills and expertise.

6. Technology skills: Your bookkeeper should be comfortable using accounting software, such as QuickBooks or Xero, and be familiar with the Shopify platform.

Conclusion

Managing your Shopify accounting is crucial to the success of your business. Utilizing accounting software such as QuickBooks, Xero, Zoho, Wave, or Freshbooks can help streamline your accounting process and provide accurate financial reports, especially when you integrate them with PayTraQer and SaasAnt Transactions.

PayTraQer offers an affordable and comprehensive solution for Shopify accounting with features such as automated data entry, inventory management, and financial reporting. SaasAnt Transactions, on the other hand, provides easy import and export of financial data between Shopify and QuickBooks, saving time and reducing the risk of errors.

As a business owner, it is important to consider the benefits of these software options and choose the one that best suits your needs. Investing in quality accounting software and potentially hiring a Shopify bookkeeper can ultimately help you make informed financial decisions and drive the success of your Shopify business.

FAQs

What accounting system works best with Shopify?

The accounting system that works best with Shopify depends on various factors, such as the size of the business, the complexity of the transactions, and the specific accounting needs. However, popular options that are known to integrate well with Shopify include Xero, QuickBooks, Zoho Books, Wave, and FreshBooks.

These software options allow businesses to manage their sales, expenses, inventory, and financial statements with ease, giving them a comprehensive view of their financials. When choosing an accounting system for Shopify, it is important to consider the specific features and functions required, such as invoicing, inventory tracking, and multi-currency support.

It is also essential to ensure that the accounting software is compatible with Shopify and can be integrated seamlessly. With the right accounting system in place, businesses can manage their finances more efficiently, make informed decisions, and grow their business effectively.

Can Shopify be used for accounting?

Shopify is primarily an e-commerce platform and does not have all the features of a full-fledged accounting software. However, Shopify does offer some basic accounting features such as sales tracking, tax management, and profit and loss reports.

These features can help with managing the financial side of the business, but may not be sufficient for more complex accounting needs. To fully manage the accounting for a Shopify store, it is recommended to integrate with a dedicated accounting software that is compatible with Shopify.

This allows for more robust accounting features such as accounts payable, accounts receivable, inventory management, and more. By integrating with a dedicated accounting software, businesses can streamline their financial management and get a clearer picture of their financial health.

How does Shopify help ecommerce business?

Shopify helps eCommerce businesses in various ways. Here are some of the ways Shopify helps eCommerce businesses:

1. Easy to use platform: Shopify is a user-friendly platform that allows eCommerce businesses to set up an online store quickly and easily.

2. Customizable: It allows businesses to customize their online store to reflect their brand image and showcase their products effectively.

3. Multiple payment options: The ecommerce platform offers a wide range of payment options, making it easier for customers to make purchases.

4. Marketing tools: Also, it provides various marketing tools to help eCommerce businesses reach their target audience and increase sales. These tools include email marketing, social media integration, and search engine optimization.

5. Order management: Shopify offers a powerful order management system that helps eCommerce businesses track orders, manage inventory, and fulfill orders efficiently.

6. Mobile-friendly: With more people using mobile devices to make purchases online, Shopify offers a mobile-friendly platform that allows eCommerce businesses to reach customers on-the-go.

How do I run a successful business on Shopify?

Running a successful business on Shopify involves several key steps. Here are some tips to help you get started:

1. Choose a profitable niche: To run a successful business, you need to choose a profitable niche that aligns with your interests, skills, and passions.

2. Create a professional-looking store: Invest time and resources to create a visually appealing and easy-to-navigate online store that is user-friendly and mobile responsive.

3. Optimize your products: Ensure that your products are high-quality, competitively priced, and optimized for search engines.

4. Promote your store: Utilize a variety of marketing tactics, including social media, email marketing, and paid advertising to promote your store and drive traffic to your site.

5. Offer exceptional customer service: Provide timely and helpful responses to customer inquiries, offer easy returns and refunds, and strive to exceed customer expectations.

6. Utilize analytics: Utilize analytics tools to track your store's performance, identify areas for improvement, and make data-driven decisions.

7. Stay up-to-date with trends: Stay up-to-date with industry trends, keep an eye on your competition, and continuously innovate to stay ahead.