Stripe Vs PayPal: Which payment gateway to choose for your Small Business?

Choosing Stripe or PayPal can be pivotal for your online payment success. In this article, we will discuss “Stripe vs PayPal” by comparing fees, user experiences, and integration simplicity - to help you select the best platform for your business.

Contents

Key Takeaways

Dueling Titans of Payment Processing: Stripe vs PayPal

Analyzing Transaction Costs: Stripe Fees vs PayPal Fees

Seamless Integration and User Experience

Security Showdown: Protecting Your Business Finances

The Battle for Customer Support

Versatility in Payment Options and Accessibility

Exclusive Benefits and Limitations

Navigating International Waters: Currency Conversions and Global Sales

Summary

Frequently Asked Questions

Key Takeaways

Stripe and PayPal are top contenders in the online payment processing space, each with distinct features tailored to different business needs, such as Stripe’s robust API and PayPal’s user-friendly interface.

Both platforms charge similar basic transaction fees but differ in additional charges and fee structures. Stripe offers custom pricing for high-volume transactions, and PayPal adjusts fees based on transaction types.

Security protocols, integration capabilities, and customer support vary between Stripe and PayPal, offering strong fraud prevention measures. Stripe provides 24/7 support, while PayPal is time-restricted.

Dueling Titans of Payment Processing: Stripe vs PayPal

Stripe and PayPal are renowned payment service providers that significantly support online businesses. Both offer a robust platform for processing payments, from simple credit card payments to complex recurring payments. However, their distinct capabilities cater to different business needs, and choosing between them is critical.

Key Features of Stripe

Stripe's powerful and flexible API stands apart, enabling businesses to craft a comprehensive online payment processing ecosystem. Its inventory management system streamlines order management, while its support for over 135 currencies facilitates global transactions.

Furthermore, adherence to PCI DSS standards ensures secure processing and handling of credit card information.

Key Features of PayPal

On the other hand, PayPal simplifies the online payments process with:

An easy sign-up

Instant access to a digital wallet

The PayPal Payments Pro service, which offers a customizable checkout experience, a virtual terminal, and supports 25 currencies from over 200 countries

PayPal Payments Standard, which forms the core of PayPal’s payment gateway services.

Analyzing Transaction Costs: Stripe Fees vs PayPal Fees

A crucial factor in choosing a payment processor is understanding the fee structure, including monthly payment processing and transaction fees. Both Stripe and PayPal charge a 2.9% + USD .30 transaction fee for online transactions under $1 million in volume per year. However, their fees differ regarding other transaction types and additional charges.

Let’s examine the specifics for a more transparent understanding.

Understanding Stripe's Pricing Model

The variation in Stripe’s pricing is dependent on the type of transaction. For card transactions, it charges 1.4% plus €0.10 for European Economic Area (EEA) cards and 2.9% plus €0.10 for non-EEA cards. International card payments and transactions requiring currency conversion incur additional fees.

Businesses dealing with high-volume or high-value transactions can negotiate custom pricing arrangements.

Deciphering PayPal's Fee Structure

Depending on the transaction type, PayPal’s fees can range from 1.9% to 3.49%. International transactions and chargebacks incur additional fees.

PayPal imposes a fee of 4.99% plus a fixed fee for smaller transactions and an additional 1.50% fee for international micropayments.

Seamless Integration and User Experience

Integration and user experience form a critical component in evaluating a payment processor. While Stripe offers advanced customization options, PayPal prioritizes simplicity. It enables businesses to choose a platform that best aligns with their operational needs.

Stripe's Advanced Integration Options

With its API-based integration, Stripe allows businesses to create a customized checkout experience. It offers a pre-built payment form, Checkout, Elements, and modular UI components, which help design custom payment forms. The Stripe Dashboard is a centralized platform for managing Stripe data, processing refunds, handling disputes, and viewing real-time analytics.

Stripe Terminal and mobile SDKs support a unified commerce experience, allowing businesses to accept in-person transactions, mobile app payments, and online payments.

PayPal's User-Friendly Approach

PayPal offers a simple setup process that caters to users who prioritize ease of use. As a payment processing tool, merchants can use PayPal’s virtual terminal to manually enter card information for phone payments, while compatibility with mobile devices enables app or website-based transactions.

The PayPal app facilitates digital wallet management, providing cashback offers, package tracking, and early fraud alerts for a secure shopping experience.

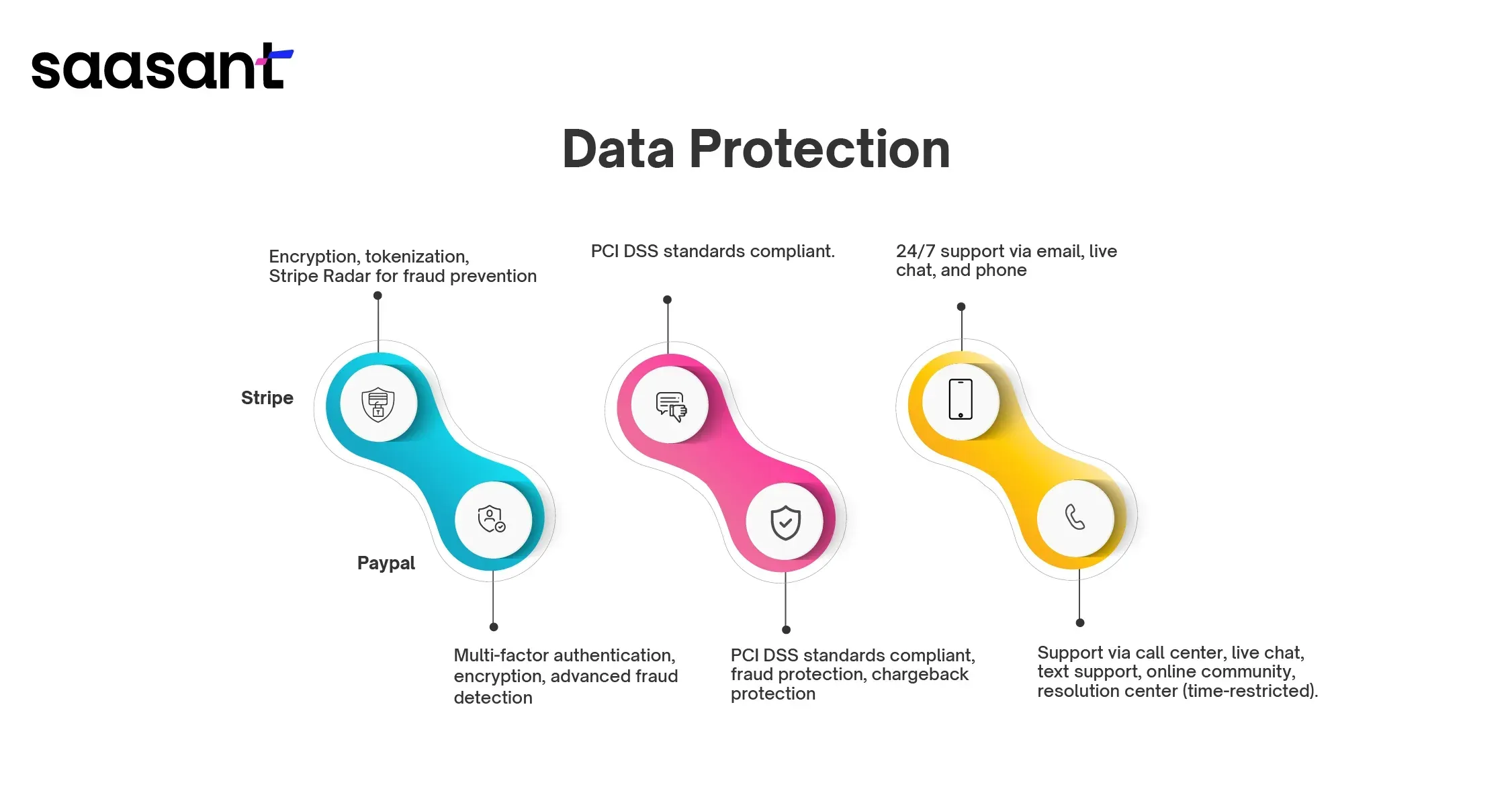

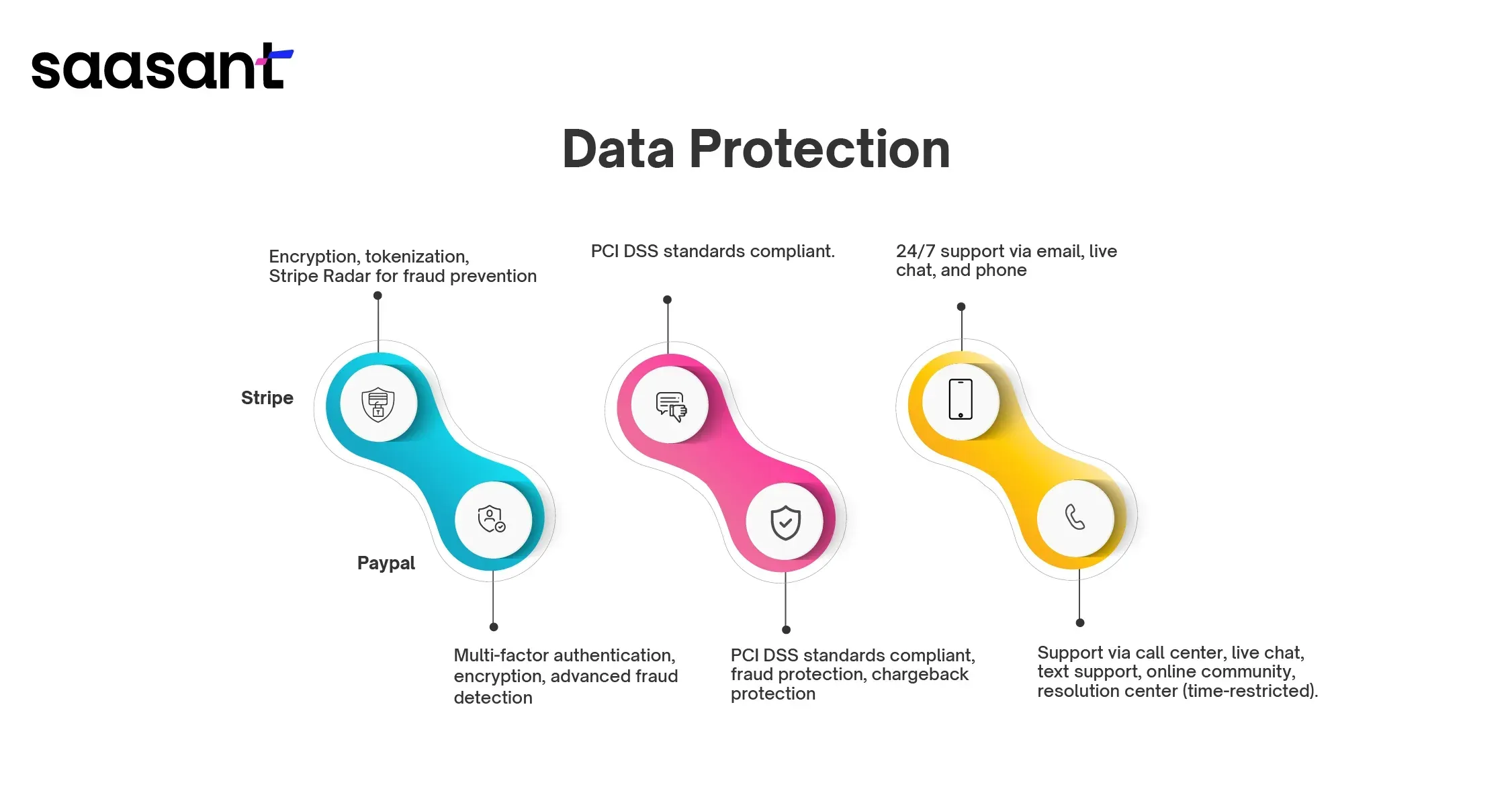

Security Showdown: Protecting Your Business Finances

Security is paramount when it comes to online transactions. Stripe and PayPal adhere to high-security standards and PCI compliance, ensuring your business finances are well-protected.

Let’s examine how each platform ensures the security of your transactions.

Stripe's Security Protocols

Stripe ensures data protection through encryption and replaces sensitive data with non-sensitive equivalents, or ‘tokens,’ using tokenization. Stripe Radar, an integrated fraud prevention system, uses machine learning to help identify and prevent fraudulent transactions. Collectively, these features ensure a secure transaction environment.

PayPal's Trustworthy Measures

PayPal ensures the security of user accounts and transactions through multi-factor authentication and encryption protocols. It utilizes advanced fraud detection systems and meets PCI DSS standards to protect financial information. Furthermore, PayPal provides comprehensive protection against financial risks through fraud protection, chargeback protection, and seller protection for eligible transactions.

The Battle for Customer Support

Good customer support can define the user experience with a payment processor. Stripe offers round-the-clock support, whereas PayPal provides a range of channels for assistance.

Let’s examine the specifics of their customer support offerings.

Stripe's 24/7 Support Channels

Stripe offers round-the-clock customer support, providing accessible assistance at all times. It gives various support channels, including email support with a guaranteed response within a day, live chat, and phone support.

The average waiting time for Stripe’s live chat and phone support is approximately 3 minutes, showcasing its commitment to efficient customer service.

PayPal's Assistance Network

PayPal’s aid network comprises:

A call center

Live chat

Text support

An online community

Resolution center

Phone support is available from 8 a.m. to 8 p.m. Central Time, Monday through Friday. However, other support options may be available outside of these hours. It is different from Stripe’s 24/7 availability. This difference might be a critical factor for businesses that require round-the-clock support.

Versatility in Payment Options and Accessibility

Stripe and PayPal provide various payment options, supporting all major credit and debit cards and digital wallet payments. However, their offerings differ regarding additional payment methods, which can be a decisive factor for businesses catering to diverse customer preferences.

Stripe's Array of Payment Methods

Stripe offers various payment options, including:

Major debit and credit cards

Multiple wallet payment methods include Alipay, Apple Pay, Google Pay, Click to Pay, WeChat Pay, and Cash App Pay.

Direct debits and bank transfers for recurring charges

‘Buy Now, Pay Later’ options

Innovative real-time payment methods

Stripe offers a comprehensive suite of payment options to cater to diverse business needs.

PayPal's Diverse Payment Solutions

PayPal offers user-friendly features like the ability to request money, settle up or split bills, and quickly pay friends and family through the PayPal app. It allows businesses to accept payments through various options, including ACH bank transfers and debit and credit cards, and integrates with platforms like Venmo for payment processing.

PayPal’s integration with Apple Pay facilitates the sale of physical and digital goods and professional services, enriching customer checkout options.

Exclusive Benefits and Limitations

While both Stripe and PayPal offer compelling features, they have unique benefits and limitations, making one more suitable than the other based on specific business needs.

Let’s scrutinize the unique benefits associated with each platform.

The Perks of Picking Stripe

Stripe offers a comprehensive array of payment processing tools, including:

Billing

Invoicing

Identity protection

Inventory-management tools

Users can enjoy these features without any extra charges. Stripe also offers tailored invoicing for businesses and customizable solutions, such as Stripe Connect, to cater to small businesses’ unique needs.

The Advantages of Adopting PayPal

With user-friendly features, an uncomplicated setup process, custom integration options, and transparent pricing, PayPal becomes a favored choice for businesses that prefer simplicity. Its features include:

User-friendly interface

Easy setup process

Custom integration options

Transparent pricing

In addition, PayPal offers flexibility in cross-country transactions, which can be integral for expanding global reach. Its transparent processing costs also aid in effective cash flow management.

Navigating International Waters: Currency Conversions and Global Sales

In the era of global e-commerce, the ability to handle international transactions and currency conversions becomes critical. Both Stripe and PayPal offer extensive support for global sales, but their capabilities differ in certain aspects.

Let’s examine their performance in the global marketplace.

Stripe's International Reach

Catering to a global customer base, Stripe facilitates the processing of charges and the display of prices in over 135 different currencies. It automatically converts payments to a business’s default settlement currency while charging an additional fee for the currency conversion.

Its multi-currency payout feature enables businesses to send payouts to third parties in their local currencies, enhancing international dealings.

PayPal's Global Presence

PayPal, accessible in over 200 markets, permits users to maintain balances in 25 different currencies. It facilitates international payments and can handle transactions in multiple currencies, aiding businesses in global commerce. However, for currency conversion transactions, PayPal adds a currency conversion spread to the exchange rate.

Also read:

Summary

We’ve navigated the intricate landscape of online payment processing, comparing the titans - Stripe and PayPal. Both platforms offer robust features, extensive support for international transactions, diverse payment options, and stringent security measures. However, they cater to different business needs. If you’re a business that handles various payment platforms and wants to automate the accounting processes, PayTraQer is a one-stop solution for e-commerce accounting automation concerning payment platforms. Stripe offers advanced customization, and PayPal focuses on simplicity. The choice between the two ultimately depends on your business requirements and preferences.

If you want to know more about Stripe safety, Read - Is Stripe Safe?

Frequently Asked Questions

Is Stripe better than PayPal?

In conclusion, Stripe is better for high sales volume and accepting multiple forms of payment. At the same time, PayPal may be a better choice for small businesses already using the platform for invoicing and payments.

Why is Stripe so popular?

Stripe is popular because of its ease of use, flexibility, extensive functionality, and affordable pricing. It is the fastest way for businesses to accept payments on their app or website with just one line of code.

Does Stripe have a monthly fee?

Stripe does not have a monthly fee. They offer pay-as-you-go pricing, so there are no setup, monthly, or hidden fees.

Is Stripe payment trustworthy?

Yes, Stripe payment is trustworthy because all transactions are SSL-protected, ensuring the secure transmission of information.

What are the transaction fees for Stripe and PayPal?

Both Stripe and PayPal charge a transaction fee of 2.9% + 30 cents for online transactions under $1 million in volume per year. Still, they may have different fees for other transaction types and additional charges. Consider these differences when choosing a payment processor.