Tax Compliance: Essential Guide for Businesses

Staying compliant with tax regulations isn’t just a legal obligation; it’s a cornerstone of trust and transparency. Each type demands attention and precision, from income and sales taxes to property and payroll taxes. Neglecting these can lead to heavy penalties and damage your reputation.

Staying compliant with tax regulations isn’t just a legal obligation; it’s a cornerstone of trust and transparency. Each type demands attention and precision, from income and sales taxes to property and payroll taxes. Neglecting these can lead to heavy penalties and damage your reputation.

This blog explores practical steps to ensure your business complies with the law and effortlessly navigates the complexities of tax compliance.

Contents

What is Tax Compliance?

Why is Tax Compliance Important?

Steps to Ensure Tax Compliance

Best Practices for Tax Compliance

Common Tax Compliance Challenges and Solutions

Wrapping Up

FAQ

What is Tax Compliance?

Tax compliance means following the tax laws and rules set by the government. This includes correctly reporting your income and expenses on tax forms, paying taxes on time, and following all tax-related legal requirements. Keeping up with tax compliance helps support public services and avoid fines and legal issues.

Why is Tax Compliance Important?

Following tax laws keeps businesses and individuals within the law and avoids legal troubles. Here are some reasons why you should stay tax-compliant.

Avoids Penalties and Fines: Non-compliance can result in hefty fines, interest on unpaid taxes, and even legal action, which can be financially devastating.

Enhances Business Reputation: Maintaining tax compliance builds trust with stakeholders, investors, and customers, reflecting a responsible and reliable business.

Facilitates Smooth Audits: Proper compliance makes the audit process more straightforward and less stressful, ensuring all records are accurate and up-to-date.

Improves Financial Management: Accurate tax reporting helps businesses better understand their financial health, leading to more informed decision-making and efficient financial planning.

Cash Flow Issues: Unexpected tax liabilities can disrupt cash flow, affecting business operations and financial stability.

Loss of Assets: In extreme cases, non-compliance can lead to asset seizures or forced liquidation to cover unpaid taxes.

Steps to Ensure Tax Compliance

Step 1: Understand Your Tax Obligations

Income Tax: This tax is levied on the income earned by individuals and businesses. Ensure accurate reporting of all income sources and allowable deductions.

Sales Tax: This tax is applied to selling goods and services. Businesses must collect and remit sales tax to the appropriate tax authorities.

Payroll Tax: This includes Social Security and Medicare taxes and federal and state unemployment taxes. Employers must withhold these taxes from employees' wages and pay their share.

Value Added Tax (VAT): This is a consumption tax levied at each stage of production or distribution of goods and services. Businesses must account for VAT on their sales and purchases.

Corporate Tax: This tax is levied on corporations' profits. Businesses must file corporate tax returns and pay taxes on their earnings.

Advance Tax: This income tax is paid in advance, based on estimated income. Businesses and individuals must pay advance tax to avoid interest on late payments.

Local Tax: Local governments impose taxes such as city or county taxes. They can include local income tax, business licenses, and other fees required for operating within a specific jurisdiction.

Step 2: Keep Accurate Financial Records

Accurate financial records will ease your tax preparation process. Keep all financial documents, such as receipts, invoices, and bank statements, well-organized and easily accessible.

Maintaining all your financial records manually is tedious and highly susceptible to errors. There is no point in having errors-filled records. Opt for SaasAnt Transactions, which allows you to automate error-free bulk import of your financial records into QuickBooks and Xero.

Just ensure that all financial transactions are recorded promptly and accurately. Use accounting software like QuickBooks or Xero to simplify this process.

Perform monthly reconciliations of your bank statements, credit card statements, and other financial accounts. This practice helps identify discrepancies early, ensuring your records are accurate and up-to-date. Applications like PayTraqer help you sync payment data into accounting software, simplifying reconciliation.

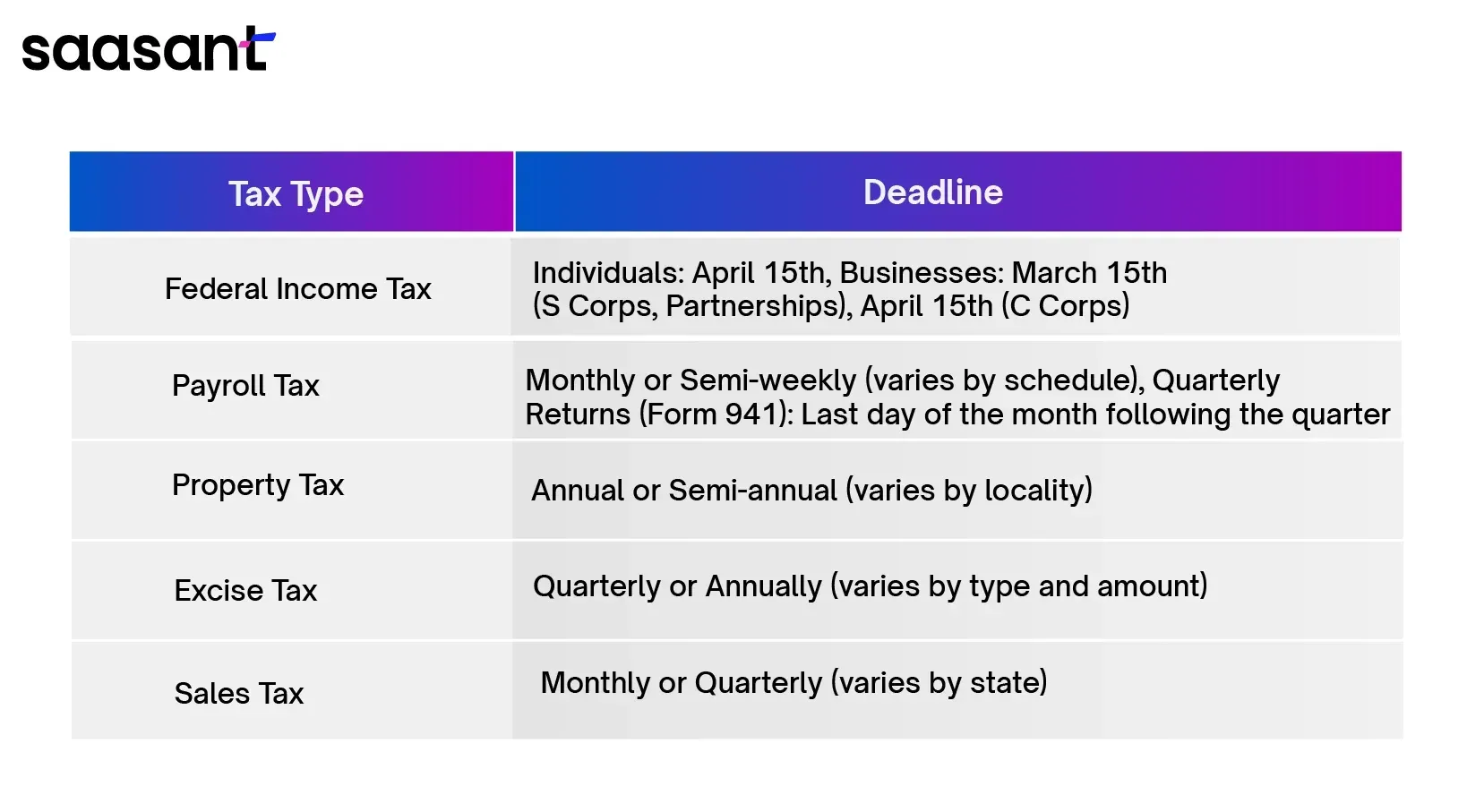

Step 3: File Taxes on Time

Step 4: Use Tax Compliance Software

Tax compliance software reduces the risk of human error, ensuring your tax filings are accurate and up-to-date. It automates complex calculations and tracks changes in tax laws, saving you time and reducing stress. It also helps store all your tax documents, receipts, and records in one place. This makes accessing and organizing your financial information easy, facilitating smoother audits and reviews.

Recommendations for Best Tax Compliance Software

ProConnect Tax by Intuit: Simplifies tax preparation with features like importing IRS transcripts, adjusting for new tax changes, and automating 1040 data entry. This streamlines client data management and enhances workflow efficiency. It can be integrated with QuickBooks.

Avalara AvaTax: Automates tax management by calculating transactional taxes across various jurisdictions and maintaining up-to-date tax tables. It also handles international duties, ensuring smooth cross-border transactions and eliminating manual entry. It can be integrated with QuickBooks.

QuickBooks and Xero: These tax compliance services assist by automatically categorizing expenses, generating tax reports, and integrating with tax software to streamline the filing process and ensure accuracy. They provide real-time tax updates and are ideal for small—to medium-sized businesses.

SaasAnt Transactions: For businesses handling large transactions, SaasAnt Transactions simplifies bulk data import and export, ensuring accuracy and compliance. It integrates well with QuickBooks, making it an excellent addition to your tax compliance toolkit.

Step 5: Regularly Review Tax Regulations

Tax regulations change from time to time, and you must stay informed. Here are a few tips to help you stay informed.

Utilise tax software that updates regularly to reflect the latest tax laws and regulations. This ensures that your tax filings are accurate and compliant.

Regularly check websites such as the IRS, state tax departments, and other relevant government agencies for the latest updates and announcements on tax regulations.

Sign up for newsletters from reputable sources, such as the IRS, state tax agencies, and professional accounting organisations, to receive tax laws and regulations updates.

Step 6: Consult with a Tax Professional

Tax professionals have specialized knowledge of tax laws and regulations, providing accurate advice tailored to your situation. They help ensure your tax returns are filed correctly, reducing the risk of errors that could lead to penalties or audits. They handle complex tax matters, freeing up your time to focus on running your business.

How to Find the Right Tax Professional:

Look for licensed and relevant-experienced certified professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs).

Ask for referrals from business associates, friends, or industry groups who have had positive experiences with tax professionals.

Check online reviews, ratings, and professional affiliations to gauge the reliability and reputation of the tax professional.

Meet with potential tax professionals to discuss your needs, their services, and their fees to ensure a good fit for your business.

Best Practices for Tax Compliance

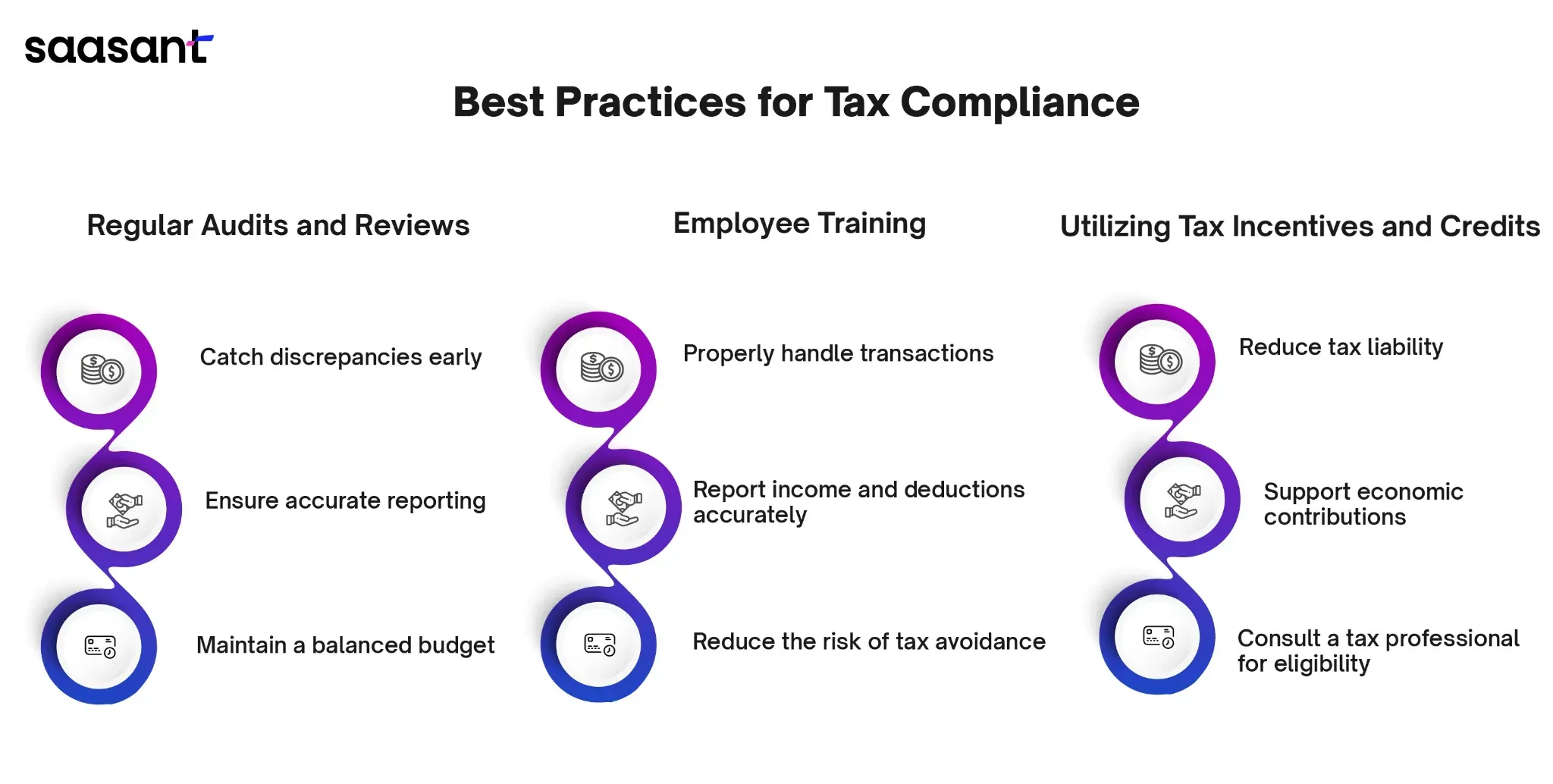

Regular Audits and Reviews

Conducting regular audits is a systematic review of your financials. This catches discrepancies early, ensures your goods and services are accurately reported, and keeps your balanced budget on track. Regular audits build trust and credibility with stakeholders, showing that your business is committed to transparency and accountability.

Employee Training

Training employees on tax compliance procedures ensure everyone knows how to handle financial transactions properly, report income, and manage deductions. It also reduces the risk of mistakes that could lead to tax avoidance allegations. When your staff is well-informed, they can help your business navigate the complex world of tax regulations, keeping you compliant and efficient.

Utilizing Tax Incentives and Credits

Why leave money on the table? Taking advantage of tax incentives and credits can significantly reduce your tax liability. These programs support businesses contributing to the economy through innovation, employment, and investment in goods and services. Understanding and utilizing these incentives can lead to a healthier bottom line and a more balanced budget. Consult with a tax professional to identify and apply for the incentives you qualify for.

Common Tax Compliance Challenges and Solutions

Keeping Up with Tax Law Changes

Tax laws constantly evolve, and staying informed is crucial for business tax compliance. To stay ahead of changes, regularly consult with your tax advisor, subscribe to industry newsletters, and attend seminars. This proactive approach helps prevent unintentional tax evasion and ensures your business adapts quickly to new regulations, protecting your tax revenue and keeping your operations smooth.

Dealing with Tax Audits

Tax audits can be daunting, but preparation is vital. Keep thorough records, document all transactions, and ensure accurate filings. When an audit notice arrives, consult with your tax professional immediately. They can guide you through the process, help you understand the auditor’s requests, and represent your interests. Proper preparation, stress reduction, and compliance can manage a tax audit effectively.

Wrapping Up

Staying on top of tax compliance is more than just a legal necessity; it’s vital to running a transparent and trustworthy business. Leverage tax compliance software like Avalara Avatax and ProConnect Tax, organize your financial data using QuickBooks and Xero for easy tax prep, and use SaasAnt Transactions to ensure accurate and efficient bulk data import. By following best practices and consulting with tax professionals, you can confidently navigate the complexities of tax regulations. Stay informed, stay compliant, and keep your business on the path to success.

FAQ

What is Tax Compliance?

Tax compliance refers to adhering to tax laws and regulations set by government authorities. This includes accurately reporting income, expenses, and other financial information, paying taxes on time, and maintaining proper documentation to ensure legal and financial accountability.

What are the penalties for non-compliance with tax laws?

Penalties include fines, interest on unpaid taxes, and potential jail time. Specific penalties can vary, such as a percentage of the unpaid tax amount, additional fees for late filing, and legal action for serious offenses.

How can small businesses ensure tax compliance?

Small businesses can ensure tax compliance by using accounting software like QuickBooks or Xero, keeping accurate records, filing taxes on time, staying updated on tax regulations, and using SaasAnt Transactions for error-free data import automation. Consulting a tax professional is also recommended.

What records should I keep for tax compliance?

For tax compliance, keep records of income, expenses, invoices, receipts, bank statements, payroll records, tax returns, and supporting documents. Using software like QuickBooks, Xero, or SaasAnt Transactions can help maintain organized records for accuracy.

How often should I review my tax compliance procedures?

Review your tax compliance procedures at least annually. Regular reviews, ideally quarterly, ensure that your business stays updated with tax laws, maintains accurate records, and promptly addresses compliance issues. Consulting a tax professional can provide additional assurance.

Can I handle tax compliance myself, or do I need a professional?

You can handle tax compliance using applications like ProConnect Tax and Avalara Avatax. However, for complex tax issues, consulting a tax professional is recommended to ensure compliance and optimize tax strategies.