The Ultimate Guide for Xero Accounting Software: Features, Benefits, Costs & How to Get Started

Xero has become a global leader in cloud accounting software, renowned for its user-friendly interface and powerful features designed for small and medium-sized businesses (SMBs). It simplifies essential financial tasks like invoicing, bank reconciliation, payroll, expense management, and reporting, providing real-time visibility into your business's financial health.

But is Xero right for your business? This comprehensive guide explores everything you need to know – from its core features and benefits to current costs, user feedback, and how it stacks up against alternatives – to help you make an informed decision.

Contents

What is Xero, and What does it do?

Key Features of Xero Accounting Software

How Xero Accounting Works (Getting Started)

Cost of Xero Accounting Software in Europe, Australia, and the UK

Advantages and Benefits of Using Xero

Understanding Xero's User Base & Reviews

Xero vs. Key Competitors (April 2025 Overview)

Is Xero Accounting Free?

Conclusion: Is Xero Right for You?

What is Xero, and What does it do?

Xero is a dynamic cloud-based accounting platform built specifically for the needs of SMBs. It provides a suite of tools to manage invoicing, bank reconciliation, inventory, purchasing, expenses, payroll (region-specific), reporting, and more. By automating tasks and offering real-time data access, Xero streamlines financial operations and empowers better business decisions.

Founded in New Zealand in 2006 by Rod Drury, Xero was born from the need for more accessible accounting software. It has since grown into a global platform serving millions, continually evolving through development, partnerships, and acquisitions to enhance its offerings for modern businesses operating online. Its cloud nature means you can access your financial data securely from anywhere with an internet connection, enabling flexibility and efficient collaboration.

Key Features of Xero Accounting Software

Xero packs a wide range of features designed to simplify accounting:

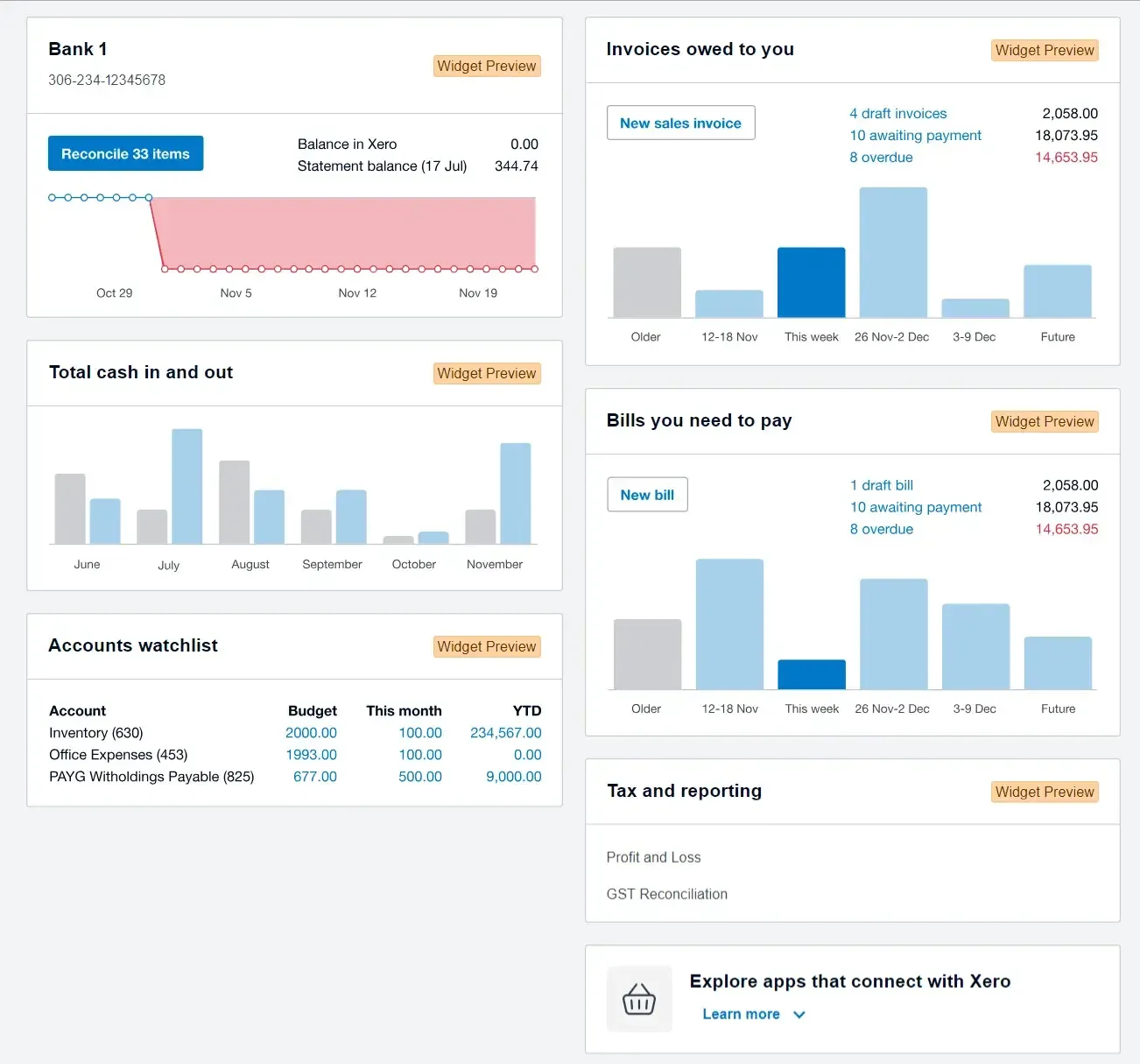

Intuitive Dashboard: Provides a clear, customizable overview of your key financial metrics, including bank balances, outstanding invoices, upcoming bills, cash flow snapshots, and more.

Invoicing and Accounts Receivable: Create professional, customized online invoices quickly. Set up automated payment reminders, accept online payments through integrations (like Stripe, PayPal, GoCardless), track invoice status, and manage customer statements efficiently. Multi-currency support is available on higher-tier plans.

Expense Management (Expenses): Track business spending easily. Capture receipts using Hubdoc (often included) or the Xero Expenses add-on/feature (inclusion varies by plan - verify current plan details). Manage employee expense claims and reimbursements.

Bills and Accounts Payable: Manage supplier bills, schedule payments, track what you owe, and gain a clear view of your accounts payable and cash outflow.

Bank Reconciliation: Connect directly to thousands of banks globally for automatic bank feeds. Xero suggests matches between bank transactions and your entries, making reconciliation faster and more accurate.

Payroll Management: (Region-specific features) Xero Payroll (often included with employee limits varying by plan - verify current plan details) helps automate calculations for pay, taxes (like PAYE, Superannuation), and compliance with local regulations in countries like Australia, New Zealand, and the UK.

Tax Handling and Compliance: Calculate and prepare tax returns like VAT (UK) or GST/BAS (Australia) directly within the software, often with options for direct digital filing to tax authorities (check regional capabilities).

Reporting: Access a wide range of real-time financial reports, including Profit & Loss, Balance Sheet, Cash Flow Statement, Aged Receivables/Payables, and more. Many reports are customizable.

Inventory Management: Basic inventory tracking (Xero Inventory) is often included for tracking stock levels, costs, and quantities. For more advanced needs, Xero Inventory Plus (XIP) or third-party app integrations are available.

Project Tracking (Xero Projects): Available usually on higher-tier plans or as an add-on (verify current plan details), allowing you to track time and costs against specific projects, monitor profitability, and invoice clients accordingly.

Multi-Currency Accounting: Handle transactions and reporting in multiple currencies (available on higher-tier plans), crucial for international businesses.

Integration & Xero App Store: Connect Xero to hundreds of other business apps via the Xero App Store for functions like CRM, point-of-sale, advanced inventory, job management, payment processing, reporting dashboards, and automation tools, creating streamlined workflows.

How Xero Accounting Works (Getting Started)

Setting up and using Xero involves a few key stages:

Sign Up & Setup:

Choose a subscription plan based on your business needs from the official Xero website for your region.

Enter your basic business information (name, industry, contact details).

Configure financial settings (financial year end, tax details like GST/VAT registration).

Set up your Chart of Accounts (Xero provides defaults you can customize).

Connect your business bank accounts and credit cards securely to enable automatic bank feeds.

Navigating the Interface:

Familiarize yourself with the main Dashboard for key financial snapshots.

Use the main navigation menu (typically including Business, Accounting, Payroll, Contacts, Reports) to access different functions.

Customize your dashboard to show the information most relevant to you.

Managing Day-to-Day Tasks:

Invoicing: Create and send invoices to customers. Track payments received.

Bills: Enter bills from suppliers. Schedule and record payments made.

Bank Reconciliation: Regularly match transactions from your bank feed to those entered in Xero to ensure accuracy.

Expense Claims: Record business expenses paid personally or via company card.

Utilizing Advanced Features:

Reporting: Regularly generate and review financial reports to understand business performance.

Budgeting: Use Xero's budget manager (if available on your plan) to set targets and track performance against them.

Inventory: Manage stock items, quantities, and values if applicable.

Tips for Efficient Use:

Reconcile Often: Reconcile bank accounts frequently (daily or weekly) to keep data current and catch discrepancies early.

Automate Where Possible: Use repeating invoices/bills, bank rules, and invoice reminders.

Explore Integrations: Leverage the Xero App Store to connect tools you already use or find new ones to streamline workflows.

Utilize Xero Central: Xero's official help center offers extensive guides, videos, and community forums.

Cost of Xero Accounting Software in Europe, Australia, and the UK

Pricing Models and Subscription Plans

Xero provides flexible pricing plans tailored to businesses in Europe, Australia, and the UK. Please note that regional promotions and currency differences can impact prices.

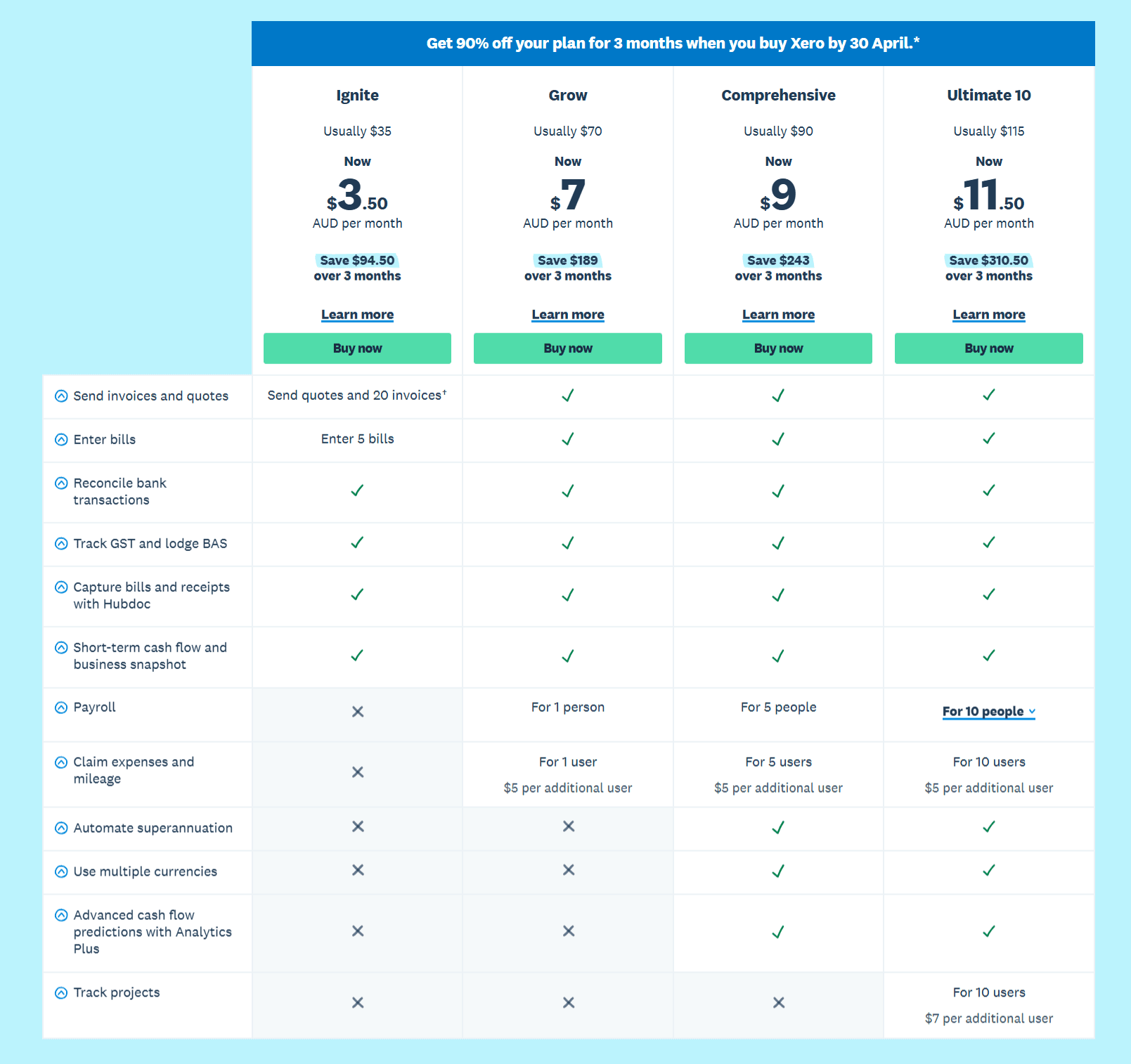

Xero Australia Pricing:

(Prices typically shown in AUD including GST)

Ignite Plan (~$35 AUD/month): Designed for sole traders or new businesses. Usually includes core accounting, bank reconciliation, Hubdoc, and integrated Payroll for 1 person. Limits may apply to number of bills/quotes previously, but trends suggest these might be easing (verify limits).

Grow Plan (~$70 AUD/month): For growing small businesses. Includes all Ignite features plus Payroll for more employees (e.g., up to 2), often includes integrated Expense Claims for 1 user.

Comprehensive Plan (~$90 AUD/month): For established businesses. Includes Grow features plus Payroll for more employees (e.g., up to 20), Multi-Currency support, potentially more users for Expense Claims.

Ultimate Plan (~$115 AUD/month): Advanced features. Includes Comprehensive features (Payroll often limited to 10 here, verify), integrated Xero Projects, and Analytics Plus for deeper cash flow insights.

Promotions: Xero Australia often offers discounts for new customers (e.g., % off for the first 3-6 months). Check the website for current offers.

Official Link: Visit https://www.xero.com/au/pricing/

Xero Pricing UK (Estimates as of April 2025) (Prices typically shown in GBP excluding VAT)

Starter Plan (~£16 GBP/month): Very basic plan, often with limits on invoices/bills (verify limits). Includes bank reconciliation, Hubdoc, VAT returns (MTD compliant).

Standard Plan (~£32 GBP/month): Most popular for small businesses. Unlimited invoices/bills, bulk reconciliation, CIS features often included.

Premium Plan (~£44 GBP/month): Adds Multi-Currency support. May include integrated Expense Claims (often for 1 user, verify details).

Ultimate Plan (~£59 GBP/month): Includes advanced features like Analytics Plus and Xero Projects (verify inclusion/limits). May have specific CIS submission add-ons.

Payroll: Usually an add-on in the UK, priced per employee per month (verify current pricing).

Promotions: Xero UK frequently offers discounts for new subscribers. Check the website.

Official Link: Visit https://www.xero.com/uk/pricing-plans/ \

Advantages and Benefits of Using Xero

Accessibility: Cloud-based access means you can manage finances anywhere, anytime, on any device.

Real-time Clarity: Dashboards and reports provide up-to-date financial insights for better decision-making.

Efficiency & Time Savings: Automation features (bank feeds, reconciliation, reminders, repeating transactions) significantly reduce manual data entry.

Scalability: Plans cater to businesses from freelancers to growing SMEs, with features like multi-currency supporting expansion.

Collaboration: Easily grant access to your accountant or bookkeeper for real-time collaboration.

Ecosystem & Integrations: The extensive Xero App Store allows you to connect Xero with other essential business tools, creating seamless workflows.

User-Friendly Interface: Widely praised for its intuitive design, making it easier for non-accountants to navigate.

Security & Compliance: Implements strong security measures and helps businesses stay compliant with regional tax regulations (like MTD in UK, STP in AU).

Support Resources: Access to Xero Central (help guides, courses), community forums, and official customer support.

Understanding Xero's User Base & Reviews

Xero serves a diverse range of businesses:

Size: From sole traders and freelancers to small and medium-sized enterprises (SMEs).

Industries: Widely used across retail, hospitality, professional services (agencies, consultants), construction/trades, technology, e-commerce, non-profits, and more.

User Feedback: Reviews on sites like G2, Capterra, and Trustpilot are generally positive. Users consistently praise:

Ease of use and intuitive interface.

Time-saving automation features, especially bank reconciliation.

Cloud accessibility and mobile app functionality.

The breadth of features available.

Common criticisms sometimes mention:

Customer support responsiveness or depth can vary.

Pricing can be higher than some competitors, especially for businesses needing only basic features or those requiring many add-ons (like UK Payroll).

Recommendation: Read current reviews on impartial platforms to get a feel for recent user experiences.

Xero vs. Key Competitors (April 2025 Overview)

Disclaimer: This is a high-level overview based on typical market positions as of April 2025. Pricing and features change constantly. Always conduct detailed comparisons based on current offerings and use free trials.

UK Market Snapshot (Estimates, GBP excl VAT):

Feature | Xero | QuickBooks Online (UK) | Sage Accounting | FreeAgent |

|---|---|---|---|---|

Starting Price | ~£16/mo | ~£10-£15/mo | ~£14/mo (Start) / ~£28 (Std) | ~£10/mo (Sole Trader) / ~£30 (Ltd Co) |

Target | SMBs | SMBs | SMBs (Start/Std) | Freelancers, Small Ltd Cos |

Key Diff. | Strong UI, Ecosystem, Payroll Add-on | Large user base, Payroll Add-on | Long UK history, Payroll Add-on | Simple, Free for NatWest/RBS |

Australia Market Snapshot (Estimates, AUD incl GST):

Feature | Xero | QuickBooks Online (AU) | MYOB Business |

|---|---|---|---|

Starting Price | ~$35/mo (Ignite) | ~$29/mo (Simple Start) | ~$34/mo (Lite) |

Target | SMBs | SMBs | SMBs |

Key Diff. | Strong UI, Ecosystem, Payroll Integrated | Global Brand, Payroll Add-on | Local focus, Payroll Add-on (Lite/Pro), Desktop option (AccountRight) |

General Considerations:

Xero: Strongest for usability, design, and its vast app marketplace. Good fit if you value user experience and integrations. Payroll integration in AU plans is a plus.

QuickBooks Online: Huge global user base, very feature-rich, often competitive on entry-level pricing. Payroll is typically an add-on.

Sage (Accounting/50): Long-standing reputation, particularly in the UK. Sage Accounting targets SMBs, Sage 50 (desktop-focused) offers more complex features for larger SMBs.

FreeAgent: Very simple, popular with UK freelancers/sole traders, especially if banking with NatWest/RBS/Ulster Bank (often free).

MYOB: Strong brand recognition in Australia/NZ. Offers both cloud (Business) and more powerful desktop/cloud hybrid (AccountRight) options.

Is Xero Accounting Free?

Free Trial: Yes, Xero typically offers a 30-day free trial allowing full access to test its features.

Permanently Free Plan: No, there is no permanently free version of Xero.

After Trial: You must subscribe to a paid plan to continue using Xero. Your trial data usually carries over seamlessly when you subscribe.

Conclusion: Is Xero Right for You?

Key Points Recap:

Xero is a powerful, user-friendly cloud accounting platform for SMBs.

It excels in usability, real-time data access, automation, and integrations via its App Store.

Features cover invoicing, bills, bank reconciliation, reporting, and region-specific payroll/tax compliance.

Pricing is tiered, making it scalable but potentially more costly than some alternatives for very basic needs.

User reviews are generally positive, praising ease of use, while some note occasional support or pricing concerns.

A 30-day free trial is available; no permanent free plan exists.

Is Xero the right choice?

Strong Fit For: Businesses prioritizing ease of use, real-time financial visibility, remote access, collaboration with advisors, and leveraging a wide range of app integrations. Ideal for businesses planning to scale.

Consider Alternatives If: You are extremely budget-sensitive with very simple needs (a competitor's basic plan might suffice), require highly specialized industry features not covered by Xero or its apps, or strongly prefer a desktop-only solution (though Xero's cloud nature is a key benefit).

Next Steps:

Utilize the Free Trial: Sign up for Xero's 30-day free trial on their website to get hands-on experience.

Evaluate Your Needs: Carefully assess which features are essential for your business now and in the near future to choose the right plan.

Check Official Pricing: Visit the official Xero website for your region to confirm current plan details, pricing, and promotions.

Explore Integrations: Browse the Xero App Store to see if your other critical business tools connect with Xero for streamlined workflows (e.g., payment gateways, CRM, inventory management, automation tools).

Overall, Xero remains a top-tier accounting solution for many SMBs globally. By evaluating its current offerings against your specific requirements, you can determine if it's the right platform to streamline your financial management and support your business growth.

Explore SaasAnt Transactions Xero Online on their website: Learn how to save time and reduce errors by automating data exchange.

Overall, Xero is a robust and adaptable accounting solution that is worth consideration for businesses seeking to streamline their financial management. Combined with SaasAnt, it can further enhance efficiency and data accuracy.