What Does a Bookkeeper Do: Roles, Responsibilities, and Skills Explained

A bookkeeper is essential for maintaining a business's financial stability and organization. Knowing their responsibilities helps companies to achieve accurate financial management and compliance with various regulations. This understanding is vital for any business's financial health and smooth operation.

A bookkeeper is essential for maintaining a business's financial stability and organization. Knowing their responsibilities helps companies to achieve accurate financial management and compliance with various regulations. This understanding is vital for any business's financial health and smooth operation.

Contents

Who is a Bookkeeper?

What are the Roles and Responsibilities of a Bookkeeper?

What are the Primary Skills for a Bookkeeper?

Bookkeeper vs. Accountant: What’s the Difference?

The Importance of a Bookkeeper in Business

How to Become a Bookkeeper?

Conclusion

FAQs

Who is a Bookkeeper?

A bookkeeper is a professional responsible for recording and managing a business's financial transactions, such as sales, purchases, payments, and receipts. They maintain the general ledger, reconcile accounts, and prepare financial statements. Their work ensures accurate financial records, aiding financial management and regulatory compliance.

By maintaining detailed records, bookkeepers provide crucial data that helps in budgeting, financial planning, and decision-making. Their work also supports compliance with financial regulations and prepares the groundwork for more complex accounting tasks, such as audits and tax filings.

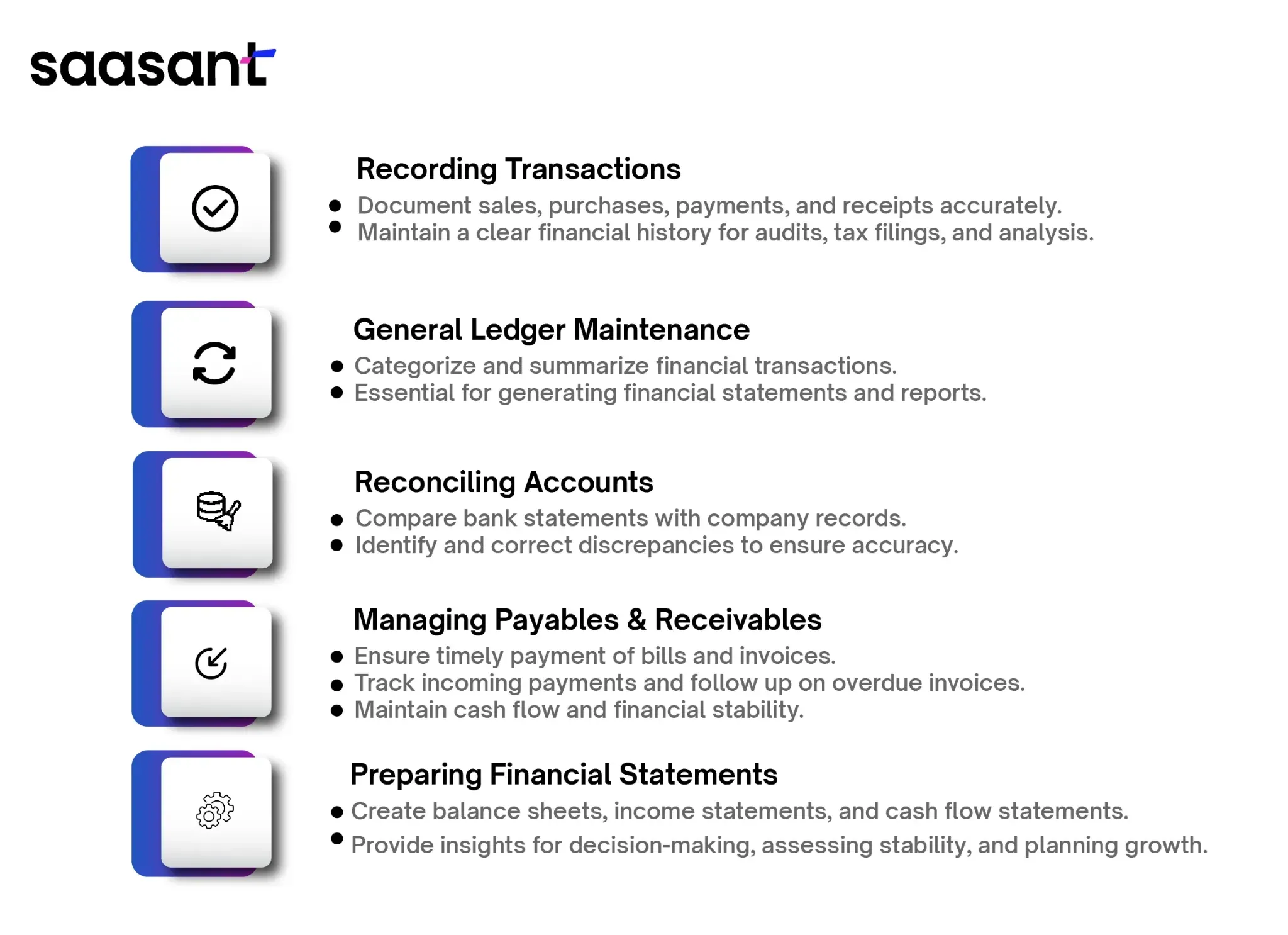

What are the Roles and Responsibilities of a Bookkeeper?

Bookkeepers are crucial in documenting all financial transactions, maintaining the general ledger, reconciling accounts, managing payables and receivables, and preparing financial statements. These tasks ensure the accuracy and clarity of a company's financial health, aiding in decision-making and regulatory compliance.

Recording Financial Transactions

Bookkeepers meticulously record all financial transactions, including sales, purchases, payments, and receipts. This process ensures that every financial activity, no matter how small, is documented accurately and promptly. Proper recording helps maintain a clear financial history, essential for audits, tax filings, and financial analysis.

Maintaining the General Ledger

Maintaining the general ledger involves categorizing and summarizing all financial transactions systematically. The general ledger is the backbone of a company’s financial records, providing a comprehensive overview of its financial activities. It includes detailed accounts for assets, liabilities, equity, revenues, and expenses, crucial for generating financial statements and reports.

Reconciling Accounts

Bookkeepers regularly reconcile bank statements with the company’s financial records to ensure consistency and accuracy. This reconciliation process helps identify and correct discrepancies, preventing potential financial errors and fraud. By comparing internal records with external statements, bookkeepers ensure the company’s reported financial position is precise.

Managing Accounts Payable and Receivable

Handling accounts payable involves ensuring that the company’s bills and invoices are paid on time, which helps maintain good relationships with suppliers and creditors. Managing accounts receivable includes tracking incoming customer payments, following up on overdue invoices, and ensuring the company receives the money it owes. Efficient management of these accounts is vital for maintaining cash flow and financial stability.

Preparing Financial Statements

Bookkeepers prepare essential financial statements such as balance sheets, income, and cash flow statements. These documents provide critical insights into the company’s financial health, performance, and liquidity. Management, investors, and regulatory agencies use financial statements to make informed decisions, assess financial stability, and plan for future growth.

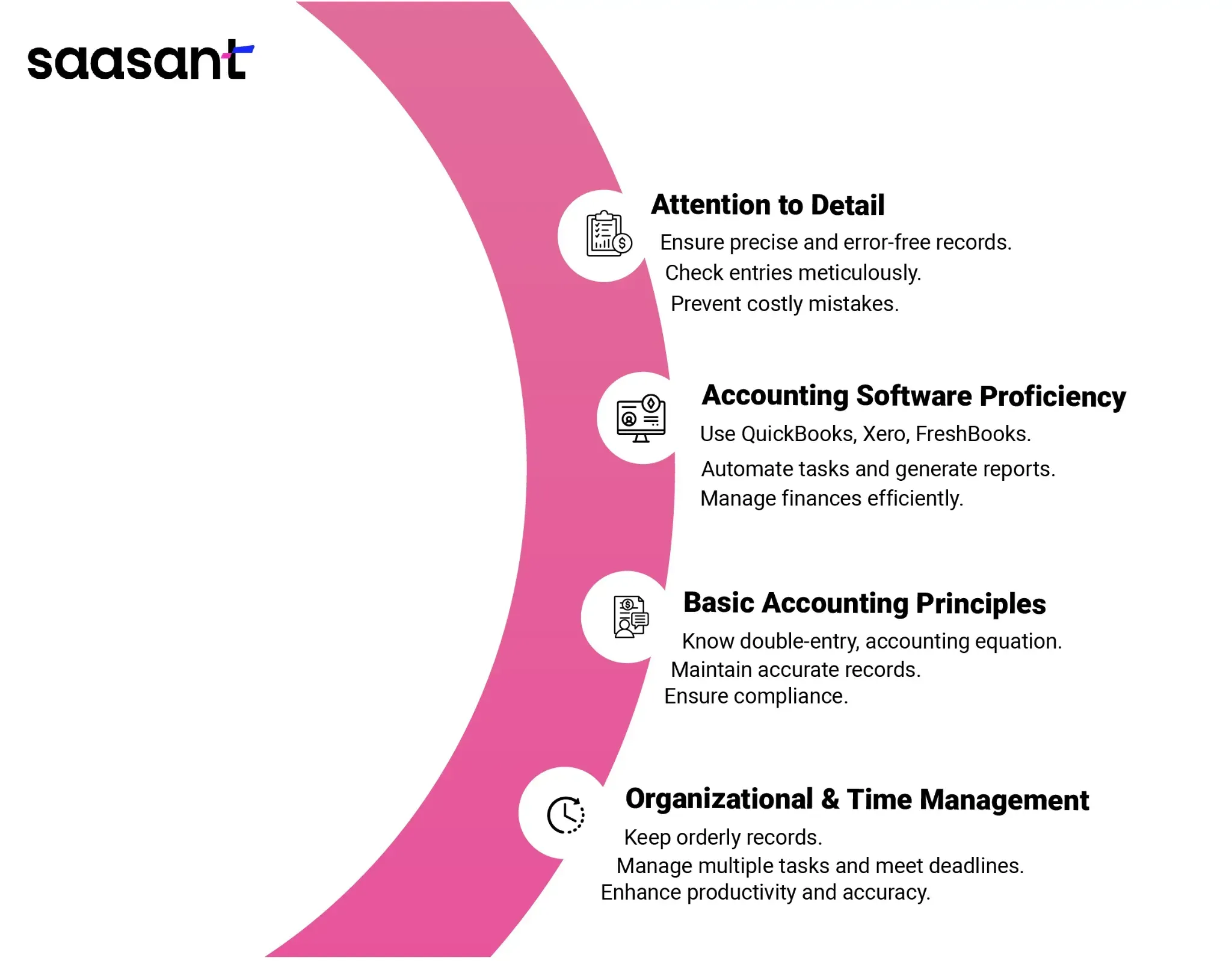

What are the Primary Skills for a Bookkeeper?

Effective bookkeeping requires attention to detail, proficiency in accounting software, an understanding of basic accounting principles, and strong organizational and time management skills. These competencies ensure accurate financial records, efficient financial management, and regulation compliance. Here's a deeper look into each of these essential skills.

Attention to Detail

Accuracy is paramount in bookkeeping. Bookkeepers must have a keen eye for detail to ensure all financial records are precise and error-free. This involves meticulously checking and double-checking entries, spotting discrepancies, and making necessary corrections. Attention to detail helps prevent costly mistakes and ensures that financial data is reliable for decision-making and compliance.

Proficiency in Accounting Software

Bookkeepers should be skilled in using accounting software like QuickBooks, Xero, or FreshBooks to manage financial records efficiently. Proficiency in these tools allows bookkeepers to automate routine tasks, generate reports quickly, and maintain accurate records. Familiarity with various software features, such as invoicing, payroll, and expense tracking, enhances a bookkeeper's ability to manage a company's finances effectively and saves time on manual processes.

Understanding of Basic Accounting Principles

A solid understanding of basic accounting principles is crucial for accurate financial record-keeping and compliance with financial regulations. Bookkeepers must know double-entry bookkeeping, debits and credits, and the accounting equation. This foundational knowledge ensures that financial transactions are recorded correctly and that financial statements accurately reflect the company's financial position.

Organizational and Time Management Skills

Bookkeepers must be highly organized and adept at managing their time to handle various tasks and meet deadlines effectively. Organizational skills involve maintaining orderly records, managing documents systematically, and keeping track of multiple financial activities. Time management skills are essential for prioritizing tasks, meeting deadlines for reports and filings, and ensuring that all financial operations run smoothly without delays. Efficient organization and time management contribute to the overall productivity and accuracy of the bookkeeping process.

Bookkeeper vs. Accountant: What’s the Difference?

While bookkeepers and accountants work with financial data, their roles differ significantly. Bookkeepers are responsible for handling day-to-day financial transactions and maintaining accurate record-keeping. This includes recording sales, purchases, payments, and receipts, ensuring that every financial activity is documented promptly and correctly. On the other hand, accountants focus on analyzing this financial data, preparing detailed financial statements, and handling tax returns. They offer strategic financial advice, helping businesses make informed decisions based on their financial status. Accountants also ensure compliance with financial regulations and may conduct audits to verify the accuracy of financial records.

The Importance of a Bookkeeper in Business

Bookkeepers are essential for maintaining accurate and up-to-date financial records, critical for informed decision-making, financial planning, and regulatory compliance. By meticulously recording all financial transactions, bookkeepers provide a clear and detailed financial history vital for audits, tax filings, and financial analysis.

Their work ensures business owners and managers have reliable data to make strategic decisions, such as budgeting, forecasting, and identifying cost-saving opportunities. Additionally, bookkeepers help ensure compliance with financial regulations by keeping thorough and precise records, reducing the risk of errors and potential legal issues. Overall, their contributions support a business's financial health and stability, enabling it to operate smoothly and grow sustainably.

How to Become a Bookkeeper?

Education and Certification Requirements

While formal education requirements for bookkeepers can vary, many professionals in this field hold an associate’s or bachelor’s degree in accounting, finance, or a related field. These educational programs provide foundational knowledge in accounting principles, financial reporting, and bookkeeping practices. Additionally, certification, such as becoming a Certified Bookkeeper (CB) through the American Institute of Professional Bookkeepers (AIPB) or obtaining the Certified Public Bookkeeper (CPB) designation from the National Association of Certified Public Bookkeepers (NACPB), can significantly enhance job prospects. These certifications demonstrate a bookkeeper’s expertise and commitment to the profession, often leading to better job opportunities and higher earning potential.

Gaining Experience

Gaining practical experience through internships or entry-level positions is invaluable for aspiring bookkeepers. Hands-on experience helps build essential skills, such as proficiency in accounting software, understanding real-world financial transactions, and familiarity with standard bookkeeping procedures. Working under the guidance of experienced bookkeepers or accountants provides practical insights that cannot be fully learned in a classroom setting. This experience strengthens a bookkeeper’s resume and builds confidence and competence in handling day-to-day financial tasks.

Continuous Learning and Professional Development

Ongoing education and professional development are vital for bookkeepers to keep up with the ever-changing landscape of accounting software, regulations, and best practices. This might include taking advanced courses in accounting, attending workshops and seminars, and participating in professional organizations. Staying current with technological advancements in accounting software, such as updates to QuickBooks, Xero, or other tools, ensures that bookkeepers can work efficiently and accurately. Additionally, understanding new regulations and compliance requirements is crucial for maintaining the integrity of financial records and avoiding legal issues. Continuous learning helps bookkeepers remain competitive in the job market and enhances their ability to provide high-quality services.

Conclusion

Bookkeepers play an integral role in maintaining a business's financial integrity. Their meticulous attention to detail, exceptional organizational skills, and comprehensive financial knowledge are crucial for accurate financial management. By diligently recording and managing financial transactions, bookkeepers ensure that a company's financial records are precise and up-to-date, providing a solid foundation for all financial activities. Their expertise in handling day-to-day financial tasks, such as reconciling accounts and managing payables and receivables, prevents errors and discrepancies that could lead to financial mismanagement. Hiring a qualified bookkeeper can significantly contribute to the success and stability of a business by supporting sound financial planning, regulatory compliance, and informed decision-making. A proficient bookkeeper helps maintain financial health, allowing business owners to focus on growth and strategic initiatives confidently.

FAQs

What does a bookkeeper do?

A bookkeeper records and manages all financial transactions, ensuring that financial records are accurate and up-to-date.

What are the duties of a bookkeeper?

Duties include recording financial transactions, maintaining the general ledger, reconciling accounts, managing accounts payable and receivable, and preparing financial statements.

What is the difference between a bookkeeper and an accountant?

Bookkeepers handle day-to-day financial record-keeping, while accountants analyze financial data, prepare tax returns, and provide strategic financial advice.

What qualifications do you need to be a bookkeeper?

Qualifications typically include an associate’s or bachelor’s degree in accounting or a related field, and certifications like Certified Bookkeeper (CB) can be beneficial.

Is bookkeeping a skill?

Yes, bookkeeping requires specific skills, including attention to detail, proficiency in accounting software, and a solid understanding of accounting principles.

How does a bookkeeper help a small business?

Bookkeepers help small businesses by maintaining accurate financial records, ensuring timely payments and collections, and providing critical financial insights for decision-making.

Can a bookkeeper prepare tax returns?

While some bookkeepers may prepare tax returns, this task is typically handled by accountants specializing in tax preparation and compliance.

What software do bookkeepers use?

Standard accounting software bookkeepers use includes QuickBooks, Xero, FreshBooks, and Sage.