Why is PayPal Money on Hold? Reasons and Solutions

PayPal stands out as a widely used platform for its convenience and security. However, users often encounter a scenario: 'PayPal Money on Hold.' This situation can be confusing and challenging, especially when dealing with money.

This blog will walk you through how to get money off hold on PayPal, its reasons, how long it typically holds funds, and much more.

If you already use QuickBooks Online, you can connect PayPal and QuickBooks in just a few steps using PayTraQer. Instead of entering PayPal sales, fees, and refunds by hand, PayTraQer syncs them into QuickBooks for you so your books stay up to date.

Learn how to set this up in our step by step guide on integrating PayPal with QuickBooks Online using PayTraQer.

If you are already using PayPal for your business, you can start a free trial of PayTraQer, and see how automated PayPal to QuickBooks sync can save you hours each month.

Contents

Why is My PayPal Money on Hold?

How do you get money off hold on PayPal?

How To Release The Payment On Hold?

How do you avoid or speed up the hold process?

PayPal Money On Hold for Non-Sellers and 'Friends & Family' Payments

How to Deal with Disputes and High-Risk Transactions?

Conclusion

FAQs

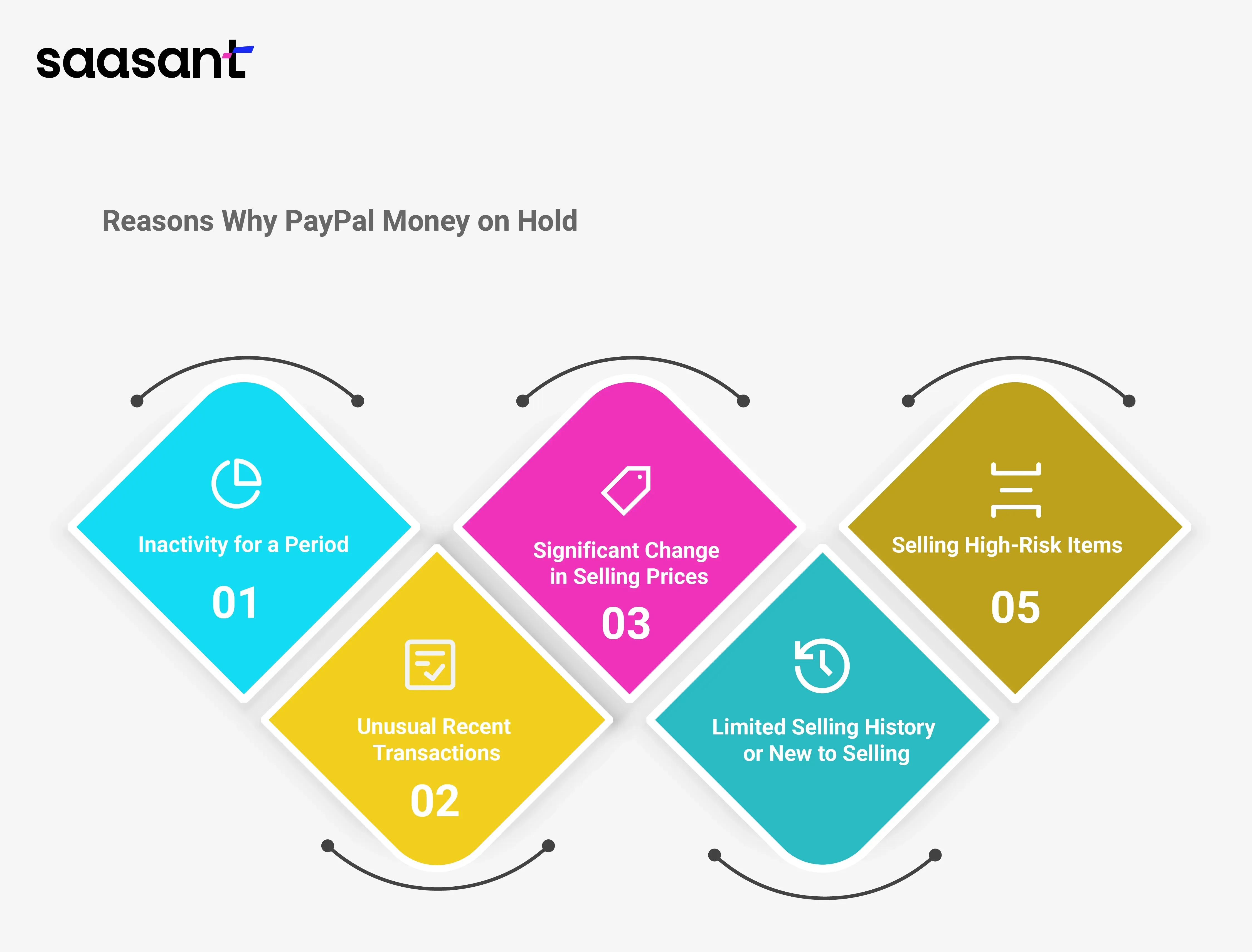

Why is My PayPal Money on Hold?

Inactivity for a Period

If you resume selling after inactivity, you may face service disruption temporarily. This precaution is to find suspicious activities and verify the legitimacy of transactions. Although this hold might occur unexpectedly, maintaining a positive selling history can help you reestablish your credibility as a seller.

Unusual Recent Transactions

Engaging in transactions out of your typical pattern, such as spending in a different country or unusual purchasing behaviors, can trigger a hold on your funds. This measure protects against potential fraud, particularly if the transactions don't align with your spending habits or payment activities. The hold aims to ensure the security of your account and verify your identity.

Significant Change in Selling Prices

If there's a notable shift in the pricing or type of products you sell, PayPal may hold your account to investigate any abnormal sales activities. A sudden increase in product prices or changes in items sold can put your PayPal money on hold.

Limited Selling History or New to Selling

For new sellers or those with a brief selling history, especially involving high-value items, PayPal may impose a hold as a precautionary measure. It is to ensure smooth transaction processes and manage potential risks.

Selling High-Risk Items

Selling products like tickets, consumer electronics, or gift cards is acceptable but may be a higher risk by PayPal. Other items like travel packages, computers, or event-related products might also attract scrutiny. In such cases, funds may be held for up to 21 days to confirm the legitimacy of the transactions. This approach enhances customer satisfaction and ensures a secure transaction for all parties involved.

How do you get money off hold on PayPal?

PayPal money holds can disrupt your cash flow, so it's crucial to have a streamlined system in place for tracking sales, fees, and refunds. It not only helps with reconciliation but also ensures financial stability.

Innovative solutions like integrating your PayPal account with accounting software like QuickBooks can significantly streamline this process. PayTraQer, for instance, links your PayPal with QuickBooks to track sales, fees, refunds, and taxes. Once connected, you can synchronize either individual or bulk PayPal transactions into QuickBooks.

This one-time setup records all your PayPal transactions as income and expenses, allowing for both automatic and manual syncing with QuickBooks. Proactively exploring such options can protect your finances and ensure smooth business operations.

Here are steps you can follow to get money off hold on PayPal:

If the hold is due to a recent sale, ship the item as soon as possible. Providing prompt service can get your money off hold on PayPal.

After shipping the item, enter the tracking information on PayPal. It lets PayPal track the shipment's progress and release funds within a day of the delivery confirmation.

If you're offering a service or digital goods and don't have a physical product to ship, update the order status on your PayPal account to 'Processed' or 'Completed,' and PayPal gets notified of the fulfillment of the transaction.

If the hold is due to a dispute or chargeback, work to resolve it. Respond promptly to any requests from PayPal for information about the transaction.

If you're a new seller, holds may be more common until you've established a history of successful, dispute-free transactions. Consistently providing exemplary service and delivering products as described will help build this history.

Good communication can encourage buyers to confirm receipt of the item or leave positive feedback, leading to PayPal releasing the hold earlier.

Understanding and complying with PayPal’s policies, such as the Acceptable Use Policy, can reduce the likelihood of holds.

If you believe the hold is an error or have complied with all the requirements and the hold persists, contact PayPal customer service for assistance. They can provide specific information about withheld funds and what additional steps you might need.

Sometimes, the only action is to wait. For instance, for new sellers, PayPal may hold funds for up to 21 days to ensure the transaction goes smoothly.

How To Release The Payment On Hold?

Sign in to your account to check if you can release your held payments. To release your eligible payments, you can take one of the following actions:

Add Tracking Information: If you're using one of the PayPal shipping carriers, adding tracking details can lead to the release of the hold. Typically, the hold is for 24 hours after the carrier confirms delivery to the buyer's address.

Update Order Status for Services or Intangible Items: If the hold is related to a service or an intangible item (like piano lessons or an e-book), updating the order status to 'Completed' can help. PayPal usually releases the hold seven days after you confirm the completion of the order.

Here's how to add tracking details or update an order status:

Go to the 'Activity' section of your account.

Locate the transaction you wish to update and select 'Get your money.' Choose the “Product” option to add tracking information or print a shipping label for physical products.

Select “Service or virtual product” for intangible items or services to change the order status. You can set the order status to 'Completed,' 'Pending,' or 'Cancelled.'

Once you have made your updates, click 'Submit.'

How do you avoid or speed up the hold process?

To avoid or speed up the process of funds released on PayPal, consider the following strategies:

Ensure your PayPal account is fully verified. It includes linking and confirming your bank account and credit card details. A verified account is often subject to fewer holds.

For physical goods, ship items quickly and upload the tracking information on PayPal. Using a shipping service that PayPal recognizes and updating the tracking information can lead to a quicker release of funds.

When listing items, provide clear, accurate descriptions and authentic images to reduce the chance of disputes and chargebacks. Misunderstandings about the product are a common reason for holds.

Maintain open and prompt communication with your customers. Responding swiftly to inquiries and addressing any concerns can help prevent disputes.

Communicate shipping times, costs, and methods. This transparency can reduce buyer anxiety and the likelihood of disputes due to shipping delays.

After fulfilling the service or delivery, update the order status on PayPal for services or intangible items.

If a dispute does occur, address it immediately. Resolving issues can lead to the release of funds sooner.

Keep detailed records of transactions, shipping information, and correspondence with buyers. It can be invaluable in case you need to dispute a hold.

If you're selling items considered high-risk (like electronics or gift cards), provide extra documentation and follow best practices to reassure both PayPal and the buyer.

Regularly checking your PayPal account can help you stay on top of any issues and address them promptly.

PayPal Money On Hold for Non-Sellers and 'Friends & Family' Payments

If you’re not a seller and your PayPal money is on hold, it could be due to several reasons:

Unusual account activity: It will be uncommon if you receive a payment from a friend or family member for the first time or after a long time. In that case, PayPal will put the payment on hold for up to 21 days.

Goods and Services Payment: If your friends sent you goods and services payment, to release the funds, you need to go inside each transaction’s details and click the ‘Add Tracking’ button, select an order status, and ask your friends to click “Confirm Receipt” on their end of the transaction.

Inactive Account: If your PayPal account has been inactive, PayPal might put your money on hold.

Receiving Large or Unusual Payments: If you receive a payment more significant than your usual transactions or from an unknown source, PayPal might place a hold on the funds. It is a security measure to prevent fraudulent activities.

Account Verification Issues: If your PayPal account needs to be fully verified or if there are issues with your account information, it may result in withheld funds. It could include incomplete personal details, unverified bank accounts, or credit cards.

How to Deal with Disputes and High-Risk Transactions?

Understanding how customer disputes and high-risk transactions impact your PayPal account is crucial for maintaining good standing and minimizing holds. Here’s a closer look at each issue:

Impact of Customer Disputes on Your PayPal Account

Customer disputes can significantly affect your PayPal account status and trigger fund holds often leading to PayPal money on hold. When a dispute is filed, PayPal may temporarily freeze the transaction amount until the issue is resolved to ensure there are sufficient funds to cover a potential refund.

Frequent disputes can lead to longer holds, increased scrutiny of transactions, and even limitations on your account. To avoid these all you have to do is:

Address disputes promptly and professionally, providing all necessary documentation to support your case.

Keep an open line of communication with the customer to try and resolve the issue amicably.

Have clear, easily accessible return and refund policies to reduce misunderstandings.

Suspicious Selling Patterns and High-Risk Items

PayPal monitors accounts for selling patterns and items that might pose higher risks of disputes or fraudulent activities. Suspicious patterns may include a sudden increase in transaction volume or selling high-risk items like electronics, gift cards, or other valuables. To handle this:

Avoid sudden, significant changes in your selling volume and types of products sold without notifying PayPal.

Provide clear, detailed descriptions and images of products to prevent misunderstandings and buyer dissatisfaction.

Conduct due diligence on buyer information, especially for high-value transactions, to prevent fraud.

Strategies to Manage Risks

Use tools and services that verify transaction legitimacy and secure buyer information.

Inform your customers about how transactions work, what they are getting, and your policies. This can build trust and reduce disputes.

Regularly check your PayPal account for any notices or required actions that can address potential issues proactively.

Conclusion

The 'PayPal Money on Hold' situation is a security measure implemented by PayPal to ensure the safety and trustworthiness of transactions on its platform. While these money holds can cause temporary inconvenience, it's important to remember that these holds are to protect all parties involved in a transaction.

In all cases, users are encouraged to contact PayPal's customer service for assistance and clarification. By understanding the causes and potential solutions for 'PayPal Money on Hold,' users can navigate the platform more effectively and confidently. Remember, patience and communication are vital in resolving these holds.

If you want to know more on how to verify PayPal, Read - How to Verify a PayPal Account?

FAQs

Why is My PayPal Money on Hold?

It takes time to develop a trustworthy selling profile as a new seller on PayPal or an established seller with a newly opened account.

If there's been a significant gap in your selling activities, re-establishing a positive reputation will take some time.

If several customers have raised issues or requested refunds, it's advisable to address these problems directly with your customers.

If there are notable changes in your selling behavior, such as a sudden increase in sales volume, a shift in the type of business, changes in average selling prices, or the kinds of items you're selling, this may result in a hold.

Selling higher-risk items, such as event tickets, consumer electronics, travel packages, and gift cards, might also lead to payment holds.

How do you get money off hold on PayPal?

To release funds on hold, fulfill the order promptly and upload tracking information if applicable. Update the order status to 'Completed' for service-based transactions in your PayPal account. Building a positive transaction history and responding quickly to disputes can help get money off hold on PayPal.

How Long is Money on Hold in PayPal?

Typically, PayPal may hold money for up to 21 days. However, the duration can be shorter if you provide shipment tracking details or update the order status, which can lead to the release of funds within 24 hours of delivery confirmation.

Why is My PayPal Money on Hold After Delivery?

Your money might still be on hold after delivery if PayPal is conducting a routine review, especially for newer accounts or unusual transactions. The hold can also continue if pending disputes or chargebacks are associated with the transaction. Communicate with PayPal support or the buyer if the hold persists unusually long after delivery.

How Can I Avoid PayPal Money Holds?

For sellers, maintaining a positive selling history, providing tracking information, and keeping open communication with buyers can help avoid holds. For non-sellers, understanding the nature of ‘Friends and Family’ payments and ensuring regular account activity can help mitigate holds.

How do I fix PayPal holding money?

You can fix PayPal holding money by following the given steps:

You can use one of the PayPal-approved shipping carriers, and PayPal will release the hold about 24 hours after the carrier confirms delivery to the buyer's address.

If the hold is for a service or an intangible item (like piano lessons or an e-book), make sure to update the order status accordingly.