Xero vs. Sage: Deciphering Cloud Accounting for Your Business

Imagine it's tax season, and you're drowning in a sea of receipts and invoices. Data entry takes hours, and chasing down missing paperwork adds to the stress. Believe it or not, a recent survey shows that 67% of accountants prefer cloud accounting over locally installed software options, and cloud software reduces labour costs by up to 50%. The world of finance has undergone a revolution; cloud accounting is here to streamline your finances and free you from the shackles of endless data entry.

Cloud accounting software, like industry leaders Xero and Sage Business Cloud (formerly Sage 50cloud), offers a game-changing approach to financial management. Unlike traditional desktop software, cloud-based solutions store your financial data securely on remote servers. This translates to a multitude of benefits for your business:

Contents

Understanding the Cloud Accounting Landscape (2024 Update): A Comprehensive Guide

Traditional On-Premise Software: A Familiar Yet Limited Approach

Cloud Accounting Solutions: Unleashing Flexibility and Accessibility

Sage 50 Migration: A Comprehensive Guide to Embracing Cloud Accounting

Feature Showdown: Xero vs Sage Business Cloud - A Deep Dive into Cloud Accounting Functionalities

Including the Competition: A Deep Dive into Cloud Accounting with QuickBooks Online in Focus

Unveiling the Price Tags: Xero vs Sage Business Cloud - A Deep Dive

Finding the Perfect Fit: Cloud vs. On-Premise Accounting Software (Choosing the Right Cloud Accounting Software)

FAQs

Mobility Unleashed: You are no longer chained to your desk! Cloud accounting empowers you to access your financial data from anywhere, anytime, and on any device with an internet connection. Imagine pulling up your real-time cash flow on your phone while travelling or checking key reports from your tablet during a client meeting. Cloud accounting gives you the freedom and flexibility to manage your finances on the go.

Fort Knox Security: Security is paramount when dealing with sensitive financial information. Cloud accounting platforms prioritise data security. Robust encryption protocols and user access controls protect your financial data from unauthorised access. In today's digital age, cloud providers often invest heavily in top-tier security measures, potentially exceeding what a small business could implement independently.

Collaboration Made Easy: Cloud accounting fosters a seamless partnerships between you, your colleagues, and your accountant. Team members can access and update financial information in real time, eliminating the need for email chains and version control issues. Sharing key financial reports with your accountant becomes effortless, streamlining the communication process and ensuring everyone is on the same page.

Navigating the expansive realm of cloud accounting solutions can feel overwhelming. Amidst many platforms vying for your attention, making the right choice becomes crucial for streamlined financial management. In this blog, we'll explore the essential considerations to help you select the ideal cloud accounting software tailored to your business's distinct needs, ensuring efficiency and effectiveness in managing your finances.

Understanding the Cloud Accounting Landscape (2024 Update): A Comprehensive Guide

In the ever-evolving world of business, efficient financial management is paramount. Choosing the right accounting software can significantly impact your workflow, economic insights, and overall success. This in-depth section delves into the two main software categories: traditional on-premise solutions and modern cloud-based systems. We'll explore their functionalities, limitations, and advantages to help you make an informed decision for your business.

Traditional On-Premise Software: A Familiar Yet Limited Approach

On-premise accounting software, exemplified by programs like Sage 50, is installed directly on your local computer or a dedicated server within your office. While offering a sense of familiarity for some users, this approach comes with inherent limitations that can hinder your business growth:

Restricted Accessibility: You can only access your financial data from the computer where the software is installed. This poses a significant challenge for remote work, team collaboration, and real-time financial oversight.

Manual Updates: Software updates require manual downloads and installations, disrupting workflow and potentially introducing compatibility issues.

Scalability Challenges: Scaling up or down to accommodate business growth can take time and effort. Adding more users often necessitates purchasing additional software licenses and potentially new hardware.

Potential Benefits of On-Premise Software

Sense of Data Control: Some business owners prefer storing their data locally on their servers. However, it's important to note that reputable cloud providers offer robust security measures that rival or surpass on-premise security implementations.

One-Time Purchase Option: On-premise software is a budget-friendly option for tiny businesses with limited accounting needs and a preference for a single upfront cost. However, ongoing IT maintenance expenses can erode those initial savings over time.

Disadvantages of On-Premise Software

High Upfront Costs: The initial investment can be significant, encompassing software licenses, hardware purchases, and potential server setup costs.

Ongoing IT Maintenance: Maintaining the software and hardware infrastructure requires dedicated IT staff or outsourced resources, leading to additional ongoing expenses.

Limited Collaboration and Accessibility: On-premise solutions hinder remote work and real-time collaboration among team members and external stakeholders.

Scalability Issues: Expanding or downsizing user access can be complex and costly, requiring additional licenses or hardware investments.

Cloud Accounting Solutions: Unleashing Flexibility and Accessibility

Cloud accounting software, exemplified by platforms like Xero and Sage Business Cloud, operates on remote servers accessed through a web browser or mobile app. This innovative approach offers a plethora of advantages that can empower your business:

Anytime, Anywhere Access: You can access your financial data from any device with an internet connection, fostering remote work, real-time collaboration, and improved financial oversight for stakeholders regardless of location.

Automatic Updates: Software updates are handled seamlessly by the provider, ensuring you always have the latest features, security patches, and regulatory compliance updates.

Scalability Made Easy: Adding or removing users as your business grows is a breeze. Cloud solutions are designed to scale effortlessly, eliminating the need for additional hardware investments or complex license management.

Advantages of Cloud Accounting Software

Lower Upfront Costs: Subscription-based pricing models offer a more affordable entry point than the upfront costs associated with on-premise software.

Reduced IT Burden: Cloud providers handle software updates, maintenance, and security, freeing your IT resources to focus on core business activities.

Enhanced Collaboration: Cloud-based solutions enable real-time collaboration among team members, accountants, and other stakeholders, regardless of location. This fosters better communication and transparency.

Scalability for Growth: As your business expands, you can easily add or remove users without incurring additional hardware costs. Cloud solutions scale with your needs.

Integration Potential: Many cloud accounting solutions integrate seamlessly with other business applications like CRM, inventory management, and payroll software. This provides a holistic view of your business operations and streamlines workflows.

Potential Considerations for Cloud Accounting Software

Reliable Internet Connection: While Internet connectivity is readily available in most areas, some businesses operating in remote locations with limited Internet access might encounter challenges. However, many cloud solutions offer offline functionality for basic data entry, with synchronisation occurring when a connection is re-established.

Data Security Concerns: Some business owners might have initial concerns about entrusting their financial data to a cloud provider. However, reputable cloud accounting providers invest heavily in robust security measures, including data encryption, access controls, and disaster recovery protocols. These measures can often exceed the security capabilities of on-premise solutions for small businesses.

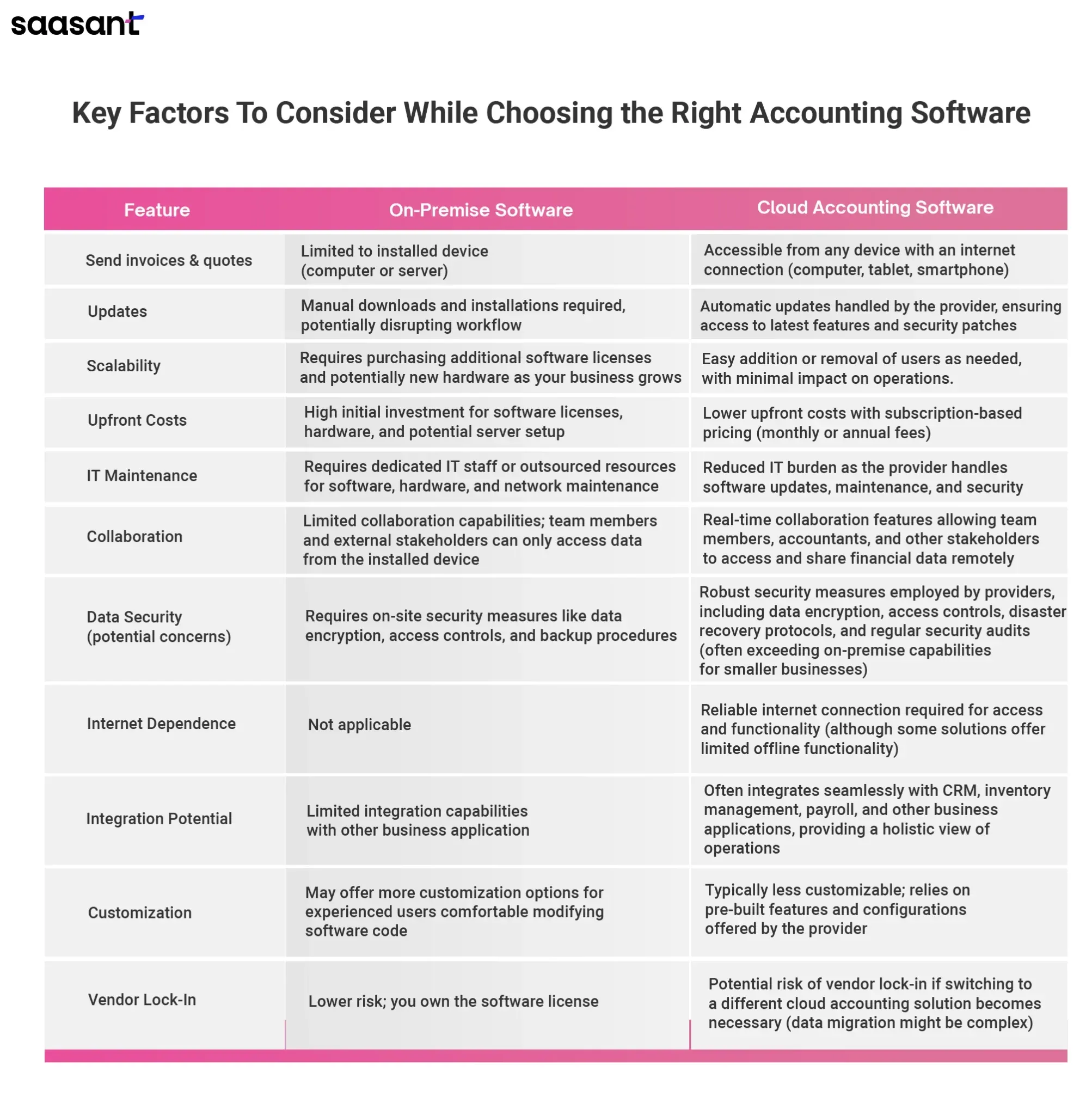

Choosing the Right Accounting Software: A Tailored Approach

The optimal accounting software choice hinges on your specific business needs and priorities. Here are some key factors to consider:

Additional Considerations

Data Ownership: With cloud accounting, you store your data on the provider's servers but retain ownership. Reputable providers offer clear data ownership clauses in their service agreements.

Disaster Recovery: Cloud providers typically have robust disaster recovery plans to ensure business continuity in case of unforeseen events. On-premise solutions require you to implement your own backup and recovery procedures.

Compliance: Depending on your business location and data type, ensure the cloud accounting software you choose adheres to relevant industry regulations and data privacy laws (e.g., GDPR, HIPAA).

Sage 50 Migration: A Comprehensive Guide to Embracing Cloud Accounting

The business world thrives on agility and innovation. For many, the once-reliable Sage 50, a desktop accounting software, might be hindering their ability to adapt. This comprehensive section delves into the signs that a Sage 50 migration to a cloud-based platform is necessary, explores the intricacies of the cloud accounting migration process, and helps you choose between Xero vs. Sage Business Cloud.

Unequivocal Signs You Need a Sage 50 Migration

Clinging to outdated software can stifle your business growth. Here are some undeniable signs that a Sage 50 migration is the strategic move:

Outdated Features: Cloud accounting platforms are constantly evolving, offering cutting-edge functionalities like:

Real-time data access: Monitor your financial health anytime, anywhere, with instant access to financial reports.

Mobile app integration: Manage invoices, track expenses, and approve payments on the go with user-friendly mobile apps.

Advanced reporting tools: Gain deeper insights into your finances with customisable dashboards and insightful data visualisations.

While dependable, Sage 50 might need more advanced features, hindering your ability to make data-driven decisions and adapt to ever-changing market trends.

Data Silos: Sage 50 operates on a desktop, creating data silos. Sharing and collaborating on financial data becomes cumbersome, hampering teamwork and hindering efficient workflows. Cloud accounting fosters a centralised hub accessible from any device with an internet connection. This facilitates seamless collaboration, improved communication, and real-time data visibility for all stakeholders.

Remote Work Limitations: The ability to work remotely is no longer a perk but a necessity. Sage 50's desktop-bound nature hinders remote access, hindering productivity for geographically dispersed teams. Cloud accounting empowers your team to work securely from anywhere, fostering flexibility and scalability.

Sage 50 Migration: A Streamlined Move for Your Accounting Software

Considering an upgrade or switch for your Sage 50 accounting software? A well-planned migration can boost efficiency and future-proof your financial systems. But before you hit the migration button, some key factors deserve your attention.

Here's a comprehensive guide to ensure a smooth Sage 50 migration, incorporating the latest SEO trends and best practices:

Pre-Migration Essentials: Prepare for a Flawless Transition

System Checkup: Can your current hardware handle the new Sage 50 version? Assess your infrastructure's capabilities to ensure optimal performance.

Compatibility Matters: Do your existing applications integrate seamlessly with the new Sage 50? Identify any compatibility issues and address them beforehand to avoid workflow disruptions.

Data Backup Fortress: Safeguard your financial data! Create a recent, secure backup of all critical Sage 50 files. This is your safety net in case of unexpected glitches during migration.

Employee Empowerment: How comfortable are your accounting staff with the new Sage 50 interface? Consider providing training or support materials to minimise the learning curve and maximise user adoption.

Downtime Dialogue: Talk to your IT team about potential downtime during the migration. Understanding the timeframe lets you plan strategically and minimise disruptions to daily operations.

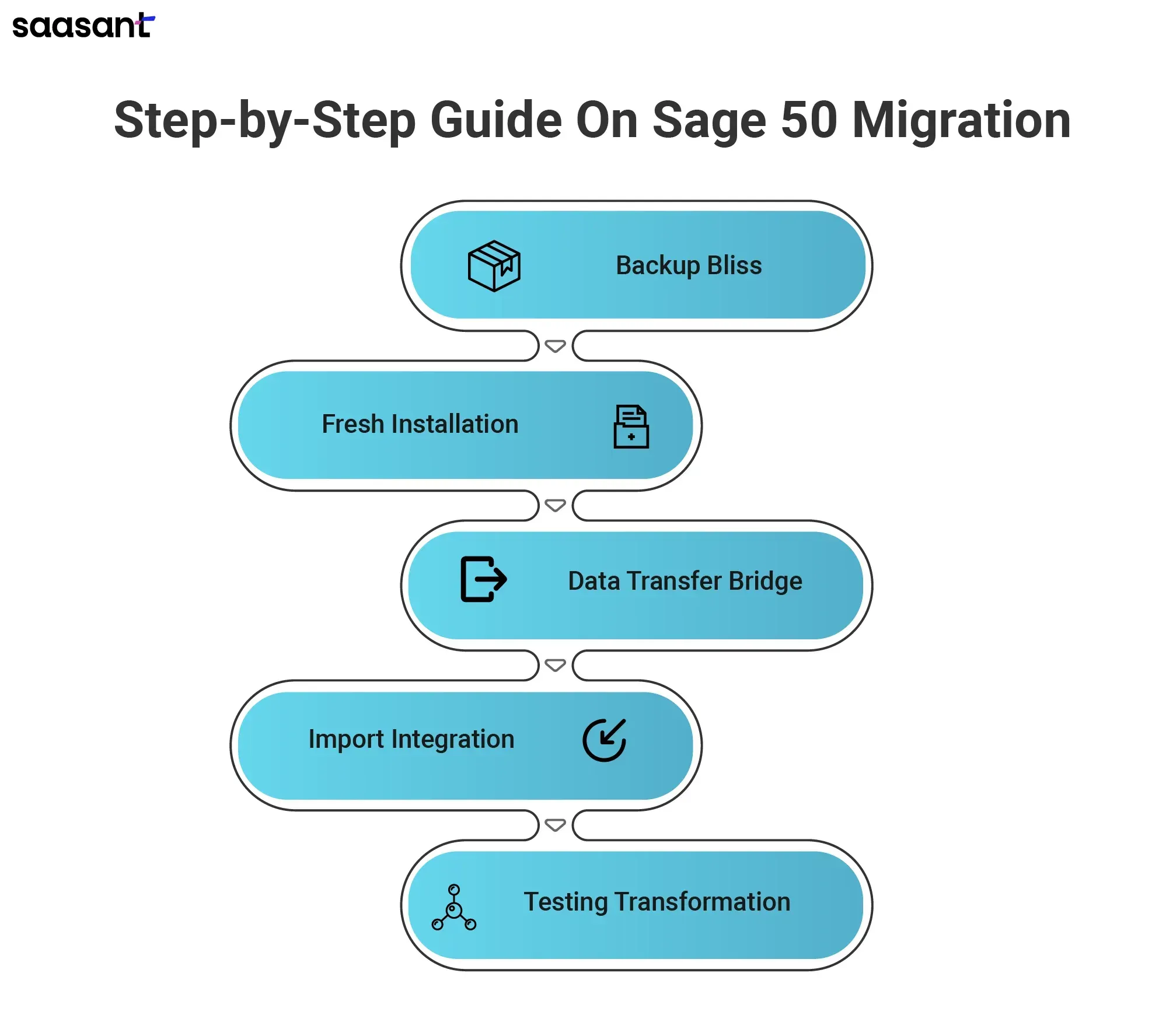

Step-by-Step Sage 50 Migration: A Seamless Journey

Backup Bliss: Create a comprehensive backup of your current Sage 50 data. This is non-negotiable!

Fresh Installation: Install the new Sage 50 version on your designated system. Have the installation file readily available to avoid delays.

Data Transfer Bridge: Connect the old and new systems. Export all necessary data from your current Sage 50 and save it in a format compatible with the latest version.

Import Integration: Launch your new Sage 50 and import the exported data using the designated tools or wizards. Double-check everything for accuracy and completeness.

Testing Transformation: Run reports, perform calculations, and verify balances. Ensure everything aligns with your previous setup for seamless financial management.

Note: Explore tutorials and guides related to the Sage 50 migration tool for additional insights and troubleshooting assistance.

By following these steps and considering these factors, your Sage 50 migration can be a smooth and successful. Remember, a well-executed migration can significantly enhance your accounting efficiency and empower your business for future growth.

Staff Retraining Needs and Available Resources

The user interface of cloud platforms differs from that of desktop software. However, both Xero and Sage Business Cloud boast intuitive interfaces and offer comprehensive training resources to ease the transition, including:

Tutorials: Access step-by-step guides and video tutorials that cover core functionalities and platform navigation.

Webinars: Attend live or pre-recorded webinars that delve deeper into specific features and answer common migration questions.

Support Documentation: Utilize comprehensive documentation libraries that provide detailed instructions and troubleshooting tips.

Proactive Measures for Staff Retraining

Internal Training: Appoint a ‘cloud champion’ within your team to guide colleagues through the transition and answer basic questions. This will foster peer-to-peer learning and reduce reliance on external resources.

External Support: Many accounting firms specialise in cloud accounting migration and can provide valuable training and implementation assistance. Consider partnering with such a firm to ensure a smooth and efficient migration process, especially for complex data sets or intricate workflows.

Choosing Xero vs Sage Business Cloud: A Smooth Transition from Sage 50

Migrating from Sage 50 requires selecting a new cloud accounting platform. Here's a detailed comparison of Xero and Sage Business Cloud to aid your decision:

Core Functionalities

Both platforms offer essential accounting features like invoicing, expense tracking, bank reconciliation, and reporting.

Xero: Xero excels in ease of use and scalability. Its intuitive interface and user-friendly design make it ideal for businesses of all sizes. Additionally, Xero boasts a vast app marketplace with integrations for a wide range of business applications.

Sage Business Cloud: Sage Business Cloud offers more in-depth inventory management functionalities, making it a strong contender for businesses with complex inventory needs.

Industry-Specific Considerations

If your business heavily relies on Sage 50 add-ons, investigate the integration capabilities of both platforms:

Xero: Xero boasts a vast app marketplace. This marketplace offers integrations for various industry-specific applications, potentially providing suitable alternatives to your existing Sage 50 add-ons.

Sage Business Cloud: Sage Business Cloud offers industry-specific solutions that might seamlessly integrate with your existing Sage 50 add-ons. This can be particularly beneficial if your add-ons cater to a niche industry and finding suitable alternatives in the Xero app marketplace proves challenging.

Additional Considerations for a Seamless Migration

Cost: Xero and Sage Business Cloud offer tiered subscription plans with varying pricing structures. Carefully evaluate your business needs and data volume to select the most cost-effective strategy.

Security: Cloud-based platforms prioritise data security. Ensure your chosen platform employs robust security measures like data encryption, two-factor authentication, and regular backups to safeguard your financial information.

Scalability: Consider your future growth projections. Choose a platform that can adapt and scale alongside your business needs. Xero and Sage Business Cloud offer scalable solutions for your business's evolution.

The Final Verdict: Embracing a Cloud-Based Future

A Sage 50 migration to a cloud accounting platform can unlock significant benefits for your business. By recognising the signs that necessitate a change, meticulously planning the migration process, and carefully choosing between Xero and Sage Business Cloud, you can ensure a smooth transition and embrace the future of cloud-based accounting.

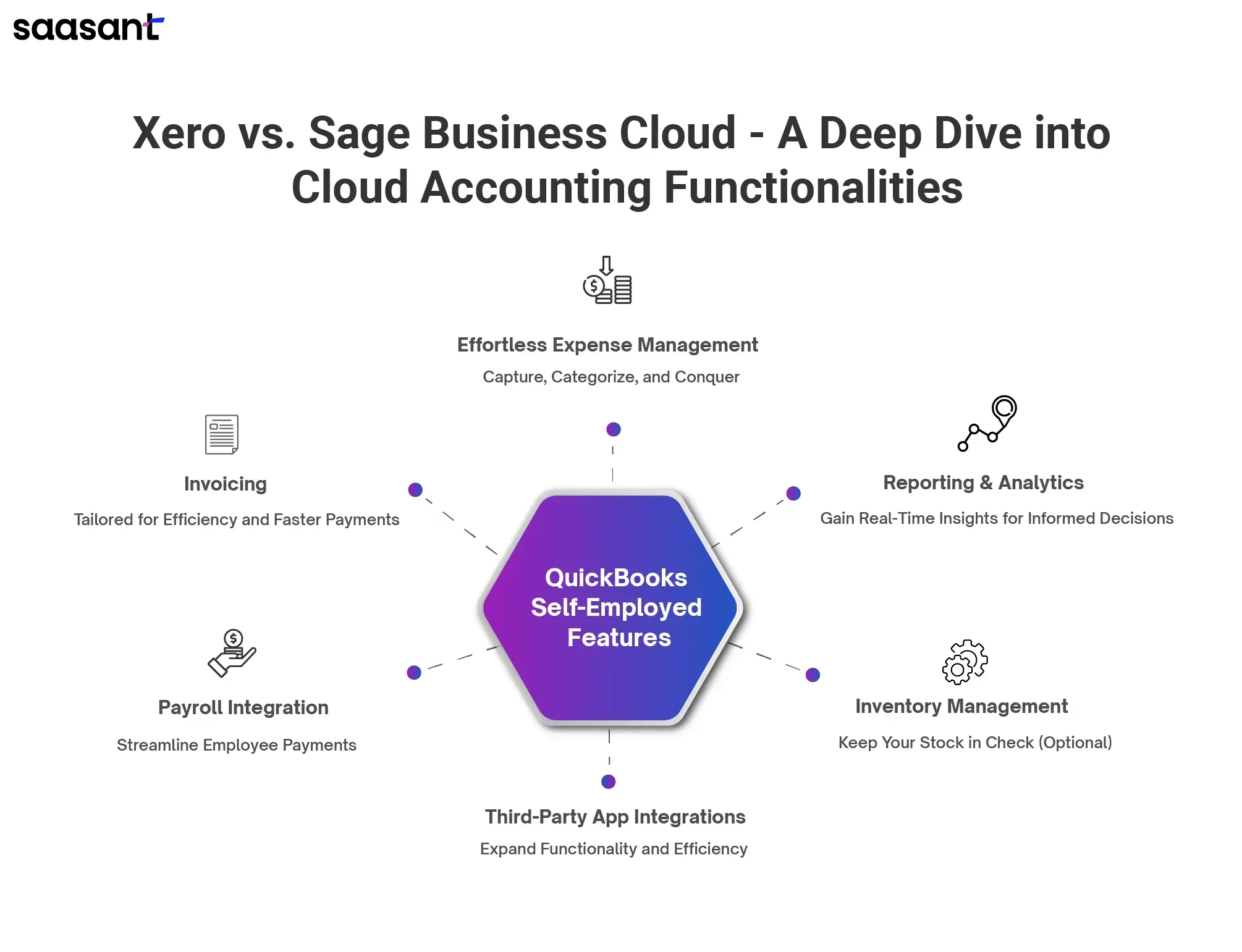

Feature Showdown: Xero vs Sage Business Cloud - A Deep Dive into Cloud Accounting Functionalities

Choosing the right cloud accounting software is crucial for modern businesses. This in-depth comparison analyses key functionalities of Xero and Sage Business Cloud to help you decide.

Invoicing: Tailored for Efficiency and Faster Payments

Customisation: Both Xero and Sage Business Cloud prioritise invoice customisation. You can design professional invoices reflecting your brand identity and incorporate crucial details like product descriptions, taxes, and payment terms.

Automation Streamlines Workflows: Xero takes a slight lead with its robust automation features. Schedule recurring invoices, set up automated payment reminders, and eliminate manual tasks that waste valuable time.

Seamless Payment Options: Both platforms integrate with popular payment gateways, allowing your customers the convenience of secure online payments via credit cards, debit cards, and other options.

Effortless Expense Management: Capture, Categorize, Conquer

Mobile Receipt Capture: Xero and Sage Business Cloud understand the importance of mobility. Capture receipts on the go using their mobile apps, streamlining expense tracking and eliminating the hassle of paper trails.

Intelligent Categorization: Automatic expense categorisation saves time and ensures accuracy. Define your own rules within both platforms, allowing them to categorise expenses based on vendor or expense type criteria.

Bank Integration for Effortless Reconciliation: Xero and Sage Business Cloud seamlessly connect with your bank statements. Transactions automatically import for effortless reconciliation, saving you the burden of manual data entry.

Reporting & Analytics: Gain Real-Time Insights for Informed Decisions

Customizable Dashboards at Your Fingertips: Xero and Sage Business Cloud empower you with customisable dashboards that display critical financial metrics. Monitor cash flow, track profitability, and gain valuable insights into your business health at a glance.

Real-Time Data, Real-Time Decisions: Both platforms provide up-to-date financial data, ensuring you always have the latest information. Make data-driven decisions confidently, knowing you have a clear picture of your financial performance.

Inventory Management: Keep Your Stock in Check (Optional)

Xero: For businesses with low-volume stock, Xero's higher tiers offer basic inventory management features, allowing you to track stock levels and generate basic reports.

Sage Business Cloud: This more robust solution is ideal for businesses with complex inventory needs. Manage stock control, generate purchase orders, and receive low-stock alerts to ensure you always have essential items.

Payroll Integration: Streamline Employee Payments

Both Xero and Sage Business Cloud integrate with various third-party payroll solutions. This streamlines payroll processing automates tax calculations, and ensures timely and accurate employee payments.

Third-Party App Integrations: Expand Functionality and Efficiency

Xero's Extensive Ecosystem: Xero boasts a broader range of third-party app integrations, including popular CRM (Customer Relationship Management) and productivity tools. Integrating seamlessly with these tools enhances your accounting experience.

Sage Business Cloud's Growing Integrations: While less vast than Xero's, Sage Business Cloud offers a growing selection of integrations, including CRM and business intelligence tools. Explore the available integrations to find the perfect fit for your business needs.

Switching from Sage to Xero? A Smooth Transition Awaits

Migrating from Sage to Xero doesn't have to be a headache. Here are some key aspects that ensure a smooth transition:

User-Friendly Interface: Both platforms prioritise a user-friendly interface and intuitive navigation. This minimises the learning curve, allowing you to become proficient quickly.

Robust Security Features: Both Xero and Sage Business Cloud prioritise the security of your financial data. Rest assured, your information is protected with robust security features.

Mobile Access for On-the-Go Management: Both platforms offer mobile apps which allow you to access your finances and manage critical tasks from anywhere, anytime.

Selecting the Perfect Fit for Your Business

Xero: Ideal for startups, small and medium businesses (SMBs), and accounting practices seeking a user-friendly platform with robust automation, real-time insights, and a vast app integration ecosystem. Xero empowers growth-oriented companies with the tools they need to scale efficiently.

Sage Business Cloud: Well-suited for freelancers, sole traders, and very small businesses with basic accounting needs. It offers a cost-effective solution and caters well to established businesses requiring robust inventory management functionalities.

Additional Considerations for Choosing the Right Cloud Accounting Software

Beyond the core functionalities explored above, here are some additional factors to consider when making your decision:

Scalability: If you anticipate significant growth in the future, consider a platform that can scale with your business needs. Xero's focus on automation and integrations makes it a strong option for scaling businesses.

Industry-Specific Features: Some industries may have specific accounting requirements. While both Xero and Sage Business Cloud offer general accounting tools, explore if either platform offers industry-specific features that cater to your unique needs.

Pricing: Xero and Sage Business Cloud offer tiered pricing plans with varying features. Carefully evaluate your budget and choose a plan that aligns with your needs without unnecessary costs. Consider free trials offered by both platforms to get hands-on experience before committing.

Customer Support: Reliable customer support is crucial if you encounter any issues. Research the quality and availability of customer support offered by each platform.

Including the Competition: A Deep Dive into Cloud Accounting with QuickBooks Online in Focus

Navigating the world of cloud accounting software can feel overwhelming. While Xero and Sage Business Cloud are prominent players, QuickBooks Online (QBO) deserves a closer look, especially for small businesses in the United States. This comprehensive analysis will delve into QBO's functionalities, compare it to its competitors, and guide you towards the perfect cloud accounting fit for your business.

QuickBooks Online: A US-Centric Powerhouse for Small Businesses

QuickBooks Online is a cloud-based accounting solution designed to simplify financial management for small businesses, particularly those in the United States. Its user-friendly interface and established reputation (as an extension of the popular QuickBooks Desktop software) make it a natural choice for entrepreneurs already familiar with the QuickBooks ecosystem.

Core Functionalities: A Side-by-Side Comparison with Xero and Sage Business Cloud

Choosing the right cloud accounting software requires understanding how each platform stacks up. Here's a detailed cloud accounting comparison focusing on core functionalities:

Invoicing and Billing: All three platforms (QBO, Xero, and Sage Business Cloud) allow you to create and send professional invoices, manage payments, and track outstanding customer invoices (AR). However, QuickBooks Online excels in seamlessly integrating with popular United States payment gateways like Stripe and PayPal, streamlining the payment collection process.

Expense Management: Capturing and categorising business expenses is crucial for tax purposes and financial control. All three platforms offer user-friendly features for expense tracking. However, QuickBooks Online boasts a user-friendly mobile app that lets you capture receipts and categorise expenses. This is a valuable feature for businesses with employees who frequently incur travel or entertainment expenses.

Inventory Management (if applicable): While Xero and Sage Business Cloud offer more advanced inventory features like multi-location tracking and barcode scanning, QuickBooks Online provides essential inventory management tools. This might be sufficient for service-based businesses or those with limited inventory needs. Xero or Sage Business Cloud might be better if you require more robust inventory management capabilities.

Reporting and Analytics: Gaining valuable financial insights is essential for informed decision-making. All three platforms offer a variety of reports that provide a clear picture of your financial health. QuickBooks Online shines in its report customisation options, allowing you to tailor reports to your specific needs. This can be particularly helpful for businesses with unique reporting requirements.

Integrations: Extending the functionality of your chosen platform is often necessary. All three integrate with various third-party applications, allowing you to connect your accounting software with your CRM, project management tools, or e-commerce platform. However, QuickBooks Online boasts the most extensive app marketplace specifically catering to the United States market. This vast selection allows you to find integrations seamlessly connecting with popular United States business tools.

Beyond the Features: Considerations for Choosing the Right Cloud Accounting Partner

While QuickBooks Online offers a compelling suite of features, the ideal cloud accounting solution depends on your business needs. Here are some key factors to consider when making your choice:

Industry: Certain industries might benefit from specialised features offered by specific platforms. For example, Xero's advanced inventory features might be more relevant if you're in a manufacturing or retail business.

Location: While QuickBooks Online excels in the United States market with its integrations and features, Xero offers a more global presence with multi-currency support and features tailored for international operations.

Team Size: As your business grows, your accounting needs will evolve. Consider whether the platform can scale with you. QuickBooks Online offers tiered plans for companies of various sizes.

Desired Level of Automation: Some platforms offer advanced automation features like automatic bill pay or bank reconciliations. Evaluate each platform's level of automation to see if it aligns with your needs.

The Final Step: Conduct a Thorough Cloud Accounting Comparison

Don't settle for the first platform you encounter. Most cloud accounting solutions offer free trials, including QuickBooks Online, Xero, and Sage Business Cloud. This hands-on experience allows you to assess the user interface, test functionalities, and see which platform best suits your workflow.

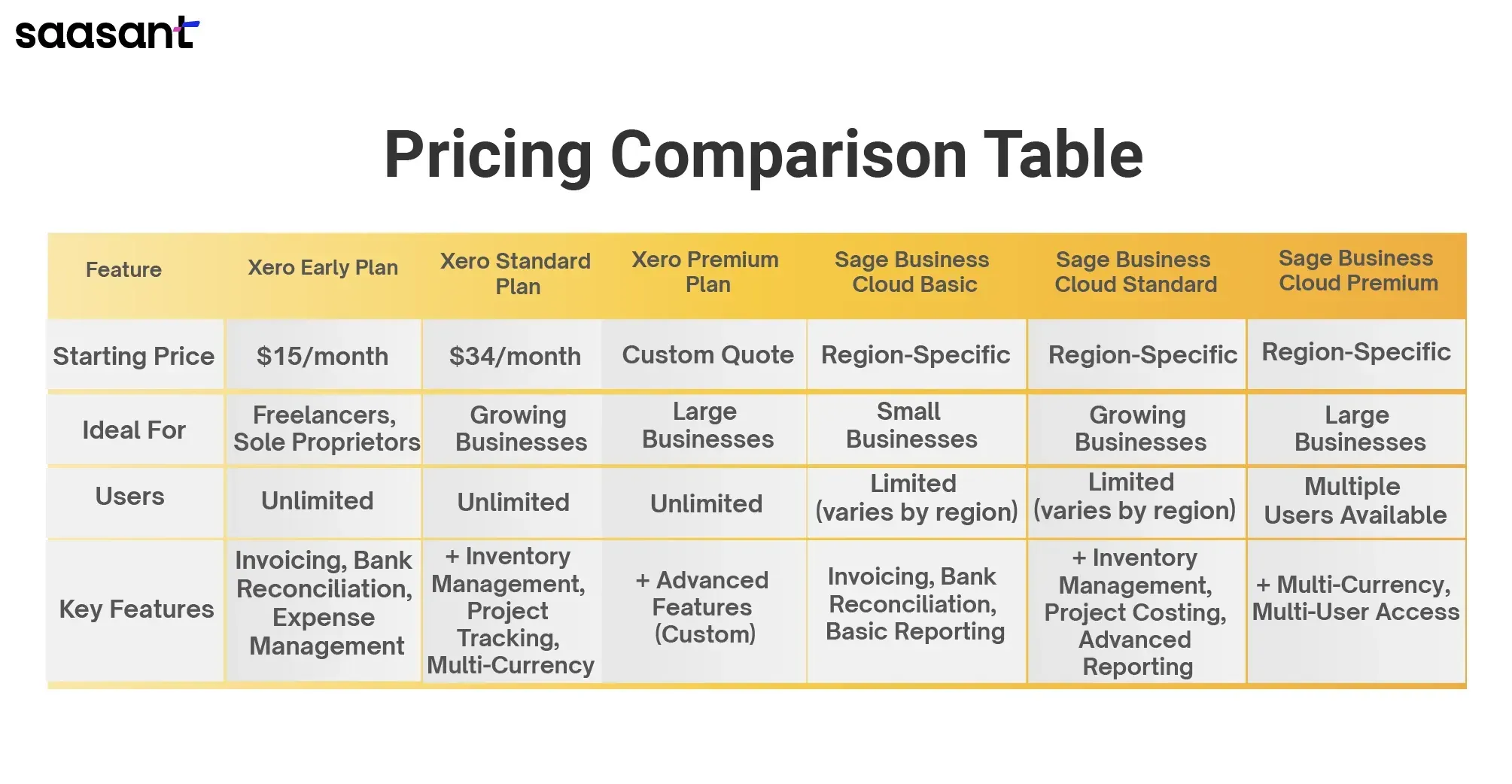

Unveiling the Price Tags: Xero vs Sage Business Cloud - A Deep Dive

Choosing the right cloud accounting software for your business can be daunting. Functionality is crucial, but so is budget. This comprehensive section delves into the pricing structures of Xero and Sage Business Cloud, equipping you with the knowledge to make an informed decision.

Transparent Pricing Breakdown

Xero Pricing

Xero boasts a clear and straightforward pricing structure with three main plans, all offering unlimited users:

Early Plan (Starting at $15/month): Ideal for freelancers and sole proprietors, this plan provides the essentials, such as invoicing, bank reconciliation, and expense management.

Standard Plan (Starting at $34/month): This plan caters to growing businesses, adding features like inventory management, project tracking, and multi-currency support.

Premium Plan (Custom Quote): The Premium Plan offers advanced functionalities such as multi-entity management and in-depth reporting for larger organisations with complex needs. You'll need to contact Xero for a custom quote.

Need help determining which Xero plan best suits your needs? Visit the official website to explore Xero’s comprehensive pricing breakdown.

Sage Business Cloud Pricing

Sage Business Cloud employs a region-specific pricing model. While exact pricing may vary depending on your location, they generally offer tiered plans similar to Xero. Here's a breakdown of their typical offerings:

Basic Plan: This includes core accounting features like invoicing, bank reconciliation, and basic reporting.

Standard Plan: This plan builds upon the Basic Plan by adding functionalities like inventory management, project costing, and more advanced reporting tools.

Premium Plan: The Premium Plan caters to larger businesses and offers advanced features like multi-currency support and multi-user access.

Considering Add-Ons and Long-Term Costs

The base price is just the tip of the iceberg. Both Xero and Sage Business Cloud offer extensive marketplaces with add-ons for specialised functionalities:

Payroll Integration: Streamline payroll processing for your employees.

CRM Integration: Enhance customer relationship management.

Advanced Reporting: Gain deeper insights into your business performance.

These add-ons can significantly inflate your overall cloud accounting costs. Carefully evaluate your needs and only choose add-ons that provide a clear return on investment.

User Licenses

Xero shines in this category by offering unlimited users on all plans. This can be a game-changer for businesses with multiple employees who need access to the accounting system. On the other hand, Sage Business Cloud often scales its pricing based on the number of users, which can be a cost consideration for businesses with a larger team.

Potential Hidden Fees

While both platforms strive for transparency, there can be hidden fees to watch out for:

Data Migration: Moving your data from your existing accounting system to the new platform might incur additional costs. Factor this into your overall budget when making your decision.

Choosing the Right Fit

By understanding Xero pricing, Sage Business Cloud pricing, the impact of add-ons, and user licenses, you're well-equipped to make an informed decision. Here are some key considerations:

Business Size: Xero's Early or Standard Plan might be sufficient if you're a freelancer or a small business. Sage Business Cloud's or Xero's plans could be better suited for larger firms.

Current Needs: Evaluate your current accounting needs. Do you need advanced features like multi-currency support or payroll integration? Choose a platform that offers the functionalities you require.

Future Growth: Consider your business's projected growth. Opt for a platform that can scale with your needs and avoid the hassle of switching software down the line.

By carefully weighing these factors, you can choose the cloud accounting solution that best fits your budget and empowers your business.

Finding the Perfect Fit: Cloud vs. On-Premise Accounting Software (Choosing the Right Cloud Accounting Software)

In today's dynamic business landscape, selecting the ideal accounting software is no longer a one-size-fits-all proposition. Choosing between cloud-based solutions like Xero and Sage Business Cloud or sticking with a familiar on-premise option like Sage 50 can be daunting. This section empowers you to make an informed decision by dissecting the strengths of each approach and outlining ideal use cases.

Sticking with Sage 50: When On-Premise Might Shine

While the cloud offers undeniable convenience and accessibility, on-premise software like Sage 50 maintains its relevance in specific scenarios:

Highly Complex Workflows: Businesses with intricate accounting processes or specialised data security requirements might find the granular control offered by on-premise software advantageous. For instance, a financial services firm with stringent regulatory compliance needs might necessitate Sage 50's in-house data management capabilities.

Industry-Specific Needs: Certain industries have unique accounting regulations or workflows. Sage 50 sometimes offers industry-specific modules that more directly address these needs. For example, a construction company might benefit from a Sage 50 module to streamline construction project costing and reporting (Sage 50 benefits).

However, it's crucial to consider the following drawbacks of on-premise solutions:

Ongoing Maintenance Costs: On-premise software requires ongoing IT support and infrastructure maintenance, which can translate to significant costs over time.

Limited Scalability: Scaling on-premise solutions often necessitates additional hardware or software licenses, hindering their ability to adapt to rapid business growth.

The Cloud Reigns Supreme: Ideal Use Cases for Cloud Accounting Software

Cloud-based accounting offers many benefits that can significantly enhance your business operations. Here's a breakdown of which platform might excel for your business type, considering factors like features, pricing, and scalability:

Xero

Benefits

User-friendly Interface: Xero boasts an intuitive interface that minimises training time and streamlines data entry, making it ideal for non-accountants.

Freelancer and Startup Friendly: The affordable pricing structure and focus on core accounting functionalities make Xero a perfect fit for freelancers, consultants, and startups.

Mobile App Powerhouse: Xero's robust mobile app allows you to manage your finances on the go, ensuring real-time access to crucial financial data.

App Ecosystem Integration: Xero integrates seamlessly with a vast ecosystem of business apps, allowing you to connect your accounting software with tools for CRM, inventory management, and more, fostering a truly connected business environment.

Ideal Use Cases

Freelancers and consultants who require a user-friendly platform for managing invoices and expenses.

Small businesses without dedicated accounting staff can leverage Xero's intuitive interface and core accounting functionalities to maintain financial health.

Businesses that require remote accessibility for geographically dispersed teams or owners who travel frequently benefit from Xero's mobile app capabilities.

Sage Business Cloud

Benefits

Robust Features: Sage Business Cloud caters to established businesses with complex accounting needs. Its strong features for inventory management, project costing, and advanced reporting provide a comprehensive financial management solution.

Scalability for Growth: Sage Business Cloud offers various subscription tiers, allowing businesses to scale their accounting software alongside their growth journey.

Multi-User Collaboration: Sage Business Cloud facilitates seamless collaboration among multiple users with role-based access controls, ensuring data security and streamlined financial management for larger teams.

Ideal Use Cases

Manufacturing companies with inventory management needs can leverage Sage Business Cloud's robust inventory tracking functionalities.

Sage Business Cloud's project costing features can benefit professional service firms with project-based work structures, enabling them to track profitability effectively.

Growing businesses seeking a scalable solution that can adapt to their evolving needs will find Sage Business Cloud's tiered subscription plans a valuable asset.

Wrap Up

The ever-evolving business landscape demands adaptability and agility. In this dynamic world, cloud accounting software has emerged as a game-changer, empowering businesses of all sizes to streamline financial processes, gain real-time financial insights, and achieve scalability for future growth.

We've explored the advantages of cloud-based solutions over traditional on-premise software, unpacked the critical functionalities of leading platforms like Xero, Sage Business Cloud, and QuickBooks Online, and provided a framework for making an informed decision tailored to your business needs.

The ideal cloud accounting partner should seamlessly integrate with your existing workflows and scale alongside your business aspirations. As you embark on your cloud accounting journey, consider these additional factors to refine your selection process:

Industry-Specific Features: Explore if a platform offers functionalities that cater to the unique requirements of your industry.

Global Compliance: For businesses operating internationally, ensure your chosen platform adheres to relevant international data privacy regulations.

Multilingual Support: Cater to a global audience by opting for a platform with multilingual support.

While selecting the perfect cloud accounting platform is a crucial first step, unlocking its potential hinges on automation. Consider integrating solutions like SaasAnt Transactions and PayTraQer alongside your chosen platform. SaasAnt Transactions automates data import and export tasks, eliminating manual data entry and ensuring accuracy across your accounting ecosystem. PayTraQer streamlines payment and sales data synchronisation between your e-commerce platforms, payment gateways, and cloud accounting software, saving you valuable time and effort.

Remember, a free trial is your best friend! Leverage the trial periods of most cloud accounting solutions to gain hands-on experience and assess which platform intuitively aligns with your accounting workflows and best facilitates informed financial decision-making.

By carefully considering the abovementioned factors, you can confidently select the perfect cloud accounting solution and leverage automation tools to unlock financial efficiency, empower your global business operations, and springboard towards a future of informed financial growth.

FAQs

What Is Cloud Accounting?

Cloud accounting refers to accounting software that resides on remote servers and can be accessed through a web browser or mobile app. This eliminates the need for desktop software installations and offers benefits like accessibility, automatic updates, and scalability.

What Are the Benefits of Cloud Accounting for Businesses?

Cloud accounting offers numerous advantages, including:

Accessibility: Access your financial data from anywhere with an internet connection.

Automatic Updates: Benefit from the latest features, security patches, and compliance updates.

Scalability: Easily add or remove users as your business grows.

Collaboration: Foster real-time collaboration among team members, accountants, and stakeholders.

Lower Costs: Typically lower upfront costs compared to traditional desktop software.

Reduced IT Burden: Cloud providers handle software updates, maintenance, and security.

Is Cloud Accounting Secure?

Reputable cloud accounting providers prioritise data security. They employ robust security measures like data encryption, access controls, and disaster recovery protocols, often exceeding the security capabilities of on-premise solutions for small businesses.

What Factors Should I Consider When Choosing Cloud Accounting Software?

Here are some key factors to consider:

Business Needs & Size: Evaluate your specific accounting needs and the size of your business.

Budget: Cloud accounting solutions offer tiered pricing plans. Choose a plan that aligns with your needs.

Ease of Use: Consider the platform's user-friendliness and how easy it is for your team to learn.

Features: Identify the features that are most important to your business, such as invoicing, expense tracking, inventory management, or reporting.

Integrations: Consider if the platform integrates with your existing business applications (CRM, payroll, etc.)

What Is the Difference between Xero and Sage Business Cloud?

Both Xero and Sage Business Cloud are popular cloud accounting platforms. Here's a quick comparison:

Xero: Known for its ease of use, scalability, and vast app marketplace integrations. Ideal for businesses of all sizes.

Sage Business Cloud: Offers robust inventory management functionalities, making it a good fit for businesses with complex inventory needs. It may also offer industry-specific solutions.

Should I Switch from Sage 50 to Cloud Accounting?

If you're using Sage 50 and experiencing limitations like restricted accessibility, manual updates, or data silos, migrating to a cloud accounting platform can significantly enhance your efficiency.

Is Quickbooks Online a Good Option for My Business?

QuickBooks Online is a strong contender for small businesses, particularly those in the United States. It offers a user-friendly interface, robust integrations with popular United States payment gateways and business tools, and features like expense tracking with mobile app capture.

How Does Quickbooks Online Compare to Xero and Sage Business Cloud?

All three platforms offer core accounting features like invoicing, expense tracking, and reporting. Here's a quick feature breakdown:

Invoicing: All three allow creating invoices, but QuickBooks Online excels in US payment gateway integrations.

Expense Management: All three offer options, but QuickBooks Online's mobile app simplifies on-the-go expense capture.

Inventory Management: Xero and Sage Business Cloud offer more advanced options, while QuickBooks Online provides basic inventory features.

Reporting & Integrations: All three offer reporting with customisation options. QuickBooks Online leads in customisation and boasts the most extensive US-based app integrations.

Do Cloud Accounting Solutions Offer Free Trials?

Yes, most cloud accounting solutions, including Xero, Sage Business Cloud, and QuickBooks Online, offer free trials. Utilise these trials to assess the platform's suitability for your business.